Beruflich Dokumente

Kultur Dokumente

The Case - Cashing On The Branded Generics Market in India

Hochgeladen von

Rahul Pratap SinghOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Case - Cashing On The Branded Generics Market in India

Hochgeladen von

Rahul Pratap SinghCopyright:

Verfügbare Formate

Industry Institute

Partnership Cell

inassociationwith

presents

Lupin Case study ChaLLenge

Cashing on the branded generics market in India

Anil Gupta, chairman of Inheim Limited, the holding company of Berger Inheim, was overlooking the

BKC road traffic from his cabin located in Bandra Kurla Complex. The traffic was highly unusual for a

weekday, so were the thoughts passing through his mind. He stared at the quarterly performance report

indicating the stagnant market in US and the scope for growth to be minimal. Albeit, the competitors

seem to be raking profits from Emerging Markets (EM) but Berger Inheims profits seems to be sub-

optimal in-spite of being the 3rd largest player in the Indian Market, which contributes a major share of

EM. Gupta was curious to know whats happening in the US market so he called Lucas, COO in US.

Highly entrenched market US

US has one of the most sophisticated healthcare system in the world. The healthcare system is highly

intertwined with insurance sector thereby making the MNCs operating in the healthcare industry,

specifically in the pharmaceutical, to be cordial with insurance companies. The insurance companies

decide the repayment for the medicine bills based on the drug used on a case basis leading to the choice of

drugs being prescribed or consumed (Exhibit 1). The market growth seems to be around 1-2%, the precise

reason behind companies hesitant to invest multi-million dollars in research for new drugs as there would

be not be much of significant difference from the existing drugs. When a new drug provides only a subtle

difference in the cure/care from the existing, insurance companies dont choose to refund for such a drug.

The indictment seems to be clear, unless there is any disruptive innovation, growth and profits would

suffer in the medium term for US market. Lucas informed of the modus operandi and high opportunity

being tapped by their competitors in EM.

Where the growth is? - The Indian Market

Indian Pharmaceutical Industry is one of the fastest growing in the world. It is ranked third in the world in

terms of volume and is 13

th

largest in terms of value.

Domestic Scenario

Major factors driving the growth in the domestic pharmaceutical market are the fast rising per capita

income of the domestic consumers, the advancement in the medical facilities, increasing prevalence of

chronic diseases in India and the increase in the health insurance coverage. Another major aspect

contributing to the growth is the fact that the patents of major branded drugs across the world are expiring

in the next couple of years, particularly in the US market.

Patents

Before 2005, the regulatory system in India focused only on process patents. Indian pharmaceutical

companies thrived during the process patent regime. They would re-engineer products of global innovator

companies, which were unavailable in India, and launch them in the country as generics, as India did not

recognize the product patents. In this manner, Indian companies gained process chemistry skills, but did

not focus on R&D for new drug discovery.

In January 2005, India complied with the World Trade Organization (WTO) to follow the product patent

regime [sale of re-engineered products (for drugs patented after 1995) is restricted]. However, enterprises,

which had made significant investments and were producing and marketing the concerned product prior

to January 1, 2005 and which continue to manufacture the product covered by the patent on the date of

grant of the patent, are protected, and the patentee cannot institute infringement suits against them, but

would be entitled to reasonable royalty.

Branded Generics in the Indian Market

The post patent era had brought in two major changes in the market. First, the reach of patented products

had come down drastically due to distribution issues. Earlier, 40 companies used to sell the same product

under different brand names but now the restrictions withhold. This lead to the second change in the

market, MNCs started manufacturing patented drugs, which were consumed in large volumes and price

de-controlled, with a slight change in the chemical formula but addressing the same therapy, thereby

applying patent for that drug and enabling better penetration.

Branded generics is said to explode in the Indian market during the forthcoming years. In order to cash in

on the branded generics market, MNCs developed a business model (Exhibit 2) where they can extend

their reach till the last mile through a channel partner. The model was based on selling the same product

through different brand names for different channel partners thereby accounting for their respective sales

and made sure that their channel partners sell at the same price thereby not undercutting any other

channel.

Diabetes market, known for Branded generics, has four MNCs competing for the share with their own

patented drug. They are MSD, Nova-Iris, Berger Inheim and Zeneca in which the Berger Inheim and

Zeneca were late entrants to the market. Their drugs are Sitagliptin, Vildagliptin, Linagliptin, and

Saxagliptin respectively. Since each of them had incurred significant investments for manufacturing the

drug, they had a pseudo agreement, not to spoil the market by waging price wars which is detrimental to

every player and toed the same line with their channel partners (Exhibit 3).

Undercut Name of the game

Glenmart, a local drug manufacturing company in India, wanted to cash in on the huge diabetes market in

India. They came up with a drug similar to that of the competitors (Sitaglyptin) and priced it at two-

thirds of the market price (Rs. 18 / day of therapy). The cartel operating in the diabetes drug market didnt

expect this coming as they had patents. They dragged Glenmart to court but to their surprise Government

backed Glenmart in-spite of the infringement, for the greater good i.e. making diabetic drugs available at

cheaper prices, for a country known to become the diabetic capital of the world in the near future (Exhibit

4).

Its just a matter of time within which the whole market would be taken away by Glenmart. For MSD and

Novartis, the branded generic glyptin has already provided more than expected returns after break-even

whereas for Zeneca and Berger Inheim their investment cost is yet to be recovered (Exhibit 5).

Suppose you were to be the CEO at Berger Inheim, what would be your Strategy in order to at least

recover the investment costs of the glyptin product line?

Checklist for drug

insurance

Exhibit 1 Healthcare System for Pharmaceuticals in US

Exhibit 2 Business Model

Drug Manufacturers Drug Name Channel Partners Brands Sold

MSD Sitaglyptin Sun-pharma, Abbott Januvia, Estavel, Zomelis

Nova Iris Vildaglyptin USV, Emcure Galvus, Jalra, Vyfov

Berger Inheim Linaglyptin - Trajenta

Zeneca Saxaglyptin - Onglyza

Sells in the market as

Estavel

Channel Partner

Channel Partner

Sitaglyptin MSD

Sells directly in the

market as Januvia

USV

XYZ

Sells in the market as

Zomelis

Either Insurance

pays or patient

pays Out of

pocket

Information

Availability

Information of drugs

enlisted for repayment

Influences to

approve the drug

for insurance

repayment

Seeks help

for a

disease or

therapy

Patient

Pharmacy

Doctor

Prescribes

medicine

Drug

Manufactures

Insurance

Company

Exhibit 3 Diabetes therapy

Drug Manufacturers Cost / Day of therapy (Rs.)

MSD 28

Nova Iris 29

Berger Inheim 29

Zeneca 28

*Cost/Day of Therapy is overall price paid by a patient for a day inclusive of the dosages per day

Exhibit 4 Diabetic Population in the World

Exhibit 5

Drug Manufacturers Drug Name

Investment Cost

(Rs. Crores)

Sold For

( In Years)

MSD Sitaglyptin 15 8

Nova Iris Vildaglyptin 20 7.5

Berger Inheim Linaglyptin 20 3

Zeneca Saxaglyptin 18 3.5

25%

17%

7%

4%

3%

3%

2%

2%

2%

2%

1%

1%

31%

Diabetic Population (CountryWise)

China

India

United States of America

Brazil

Russian Federation

Mexico

Indonesia

Egypt

Japan

Pakistan

Bangladesh

Germany

Others

Das könnte Ihnen auch gefallen

- Factors Affecting the Sales of Independent Drugstores (A Historical Perspective)Von EverandFactors Affecting the Sales of Independent Drugstores (A Historical Perspective)Noch keine Bewertungen

- Compilation Global Pharma Industry PrintDokument16 SeitenCompilation Global Pharma Industry PrintRasool AsifNoch keine Bewertungen

- Pestal Analysis of Pharmaceutical IndustryDokument12 SeitenPestal Analysis of Pharmaceutical IndustrynaviguguNoch keine Bewertungen

- Beyond The Patent CliffDokument2 SeitenBeyond The Patent CliffPriyamvada ChouhanNoch keine Bewertungen

- Strategy AssignmentDokument12 SeitenStrategy AssignmentGarry StephenNoch keine Bewertungen

- indian Pharmaceutical Industry:-: 1) Introduction: - HistoryDokument13 Seitenindian Pharmaceutical Industry:-: 1) Introduction: - HistoryPRASH43Noch keine Bewertungen

- The Indian Pharmaceutical Industry Is Highly FragmentedDokument3 SeitenThe Indian Pharmaceutical Industry Is Highly FragmentedSanchit SawhneyNoch keine Bewertungen

- Porter Five Forces and Industry Analysis - Indian Pharma SectorDokument7 SeitenPorter Five Forces and Industry Analysis - Indian Pharma SectorMohit Chhabra100% (1)

- Final Assignment PDFDokument21 SeitenFinal Assignment PDFsuruchi100% (1)

- A Review of MarketingDokument9 SeitenA Review of Marketingrahuly12Noch keine Bewertungen

- P.E.S.T. AnalysisDokument9 SeitenP.E.S.T. AnalysisaaravaroraNoch keine Bewertungen

- Branded Versus Generic Version 1 August 2013Dokument21 SeitenBranded Versus Generic Version 1 August 2013Bhumika AggarwalNoch keine Bewertungen

- Pharmaceutical Industry-IIM Lucknow-Team LDokument8 SeitenPharmaceutical Industry-IIM Lucknow-Team LGaurav MittalNoch keine Bewertungen

- WackhardDokument72 SeitenWackhardAbuzar AhmadNoch keine Bewertungen

- Industry Report Final Pharmaceuticals Group 4 Section CDokument21 SeitenIndustry Report Final Pharmaceuticals Group 4 Section Crabbi sodhiNoch keine Bewertungen

- Challenges and Opportunities in the Indian Pharmaceutical IndustryDokument9 SeitenChallenges and Opportunities in the Indian Pharmaceutical IndustrySaurav TimilsinaNoch keine Bewertungen

- Generics Life and Money Saving A ReviewDokument5 SeitenGenerics Life and Money Saving A ReviewEditor IJTSRDNoch keine Bewertungen

- Newtech Advant Business Plan9 PDFDokument38 SeitenNewtech Advant Business Plan9 PDFdanookyereNoch keine Bewertungen

- Introduction To The IndustryDokument21 SeitenIntroduction To The IndustrySmeet JasoliyaNoch keine Bewertungen

- Aurobindo Pharma's expansion over 20 yearsDokument7 SeitenAurobindo Pharma's expansion over 20 yearsitsvijay100% (1)

- Strategy of Pharmacitical IndustryDokument3 SeitenStrategy of Pharmacitical IndustrysukeshNoch keine Bewertungen

- Indian Pharma Sector Set for Growth Despite Looming Patent CliffDokument60 SeitenIndian Pharma Sector Set for Growth Despite Looming Patent CliffAbhi SuriNoch keine Bewertungen

- Pharma Industry: Vipul Murarka Vibhuti SharmaDokument37 SeitenPharma Industry: Vipul Murarka Vibhuti SharmaVipul MurarkaNoch keine Bewertungen

- Indian Pharmaceutical IndustryDokument119 SeitenIndian Pharmaceutical IndustryMohammed Yunus100% (1)

- Summer Internship Project (Pharma)Dokument8 SeitenSummer Internship Project (Pharma)Sadiya ZaveriNoch keine Bewertungen

- Novartis - From GSK To Novartis, Pharma MNCs Are Struggling To Grow in India. What's The Diagnosis - The Economic TimesDokument14 SeitenNovartis - From GSK To Novartis, Pharma MNCs Are Struggling To Grow in India. What's The Diagnosis - The Economic TimesChetan Ashok BagulNoch keine Bewertungen

- Why Is Pharma Industry So ProfitableDokument2 SeitenWhy Is Pharma Industry So Profitablerohan_m67% (3)

- 5 Pre Amendment Patent Act 1970Dokument2 Seiten5 Pre Amendment Patent Act 1970Ashish UpadhyayaNoch keine Bewertungen

- Indian Pharma Industry OverviewDokument83 SeitenIndian Pharma Industry OverviewSrinivasan ThangathirupathyNoch keine Bewertungen

- Strategic ManagementDokument8 SeitenStrategic ManagementAlbert Katabarwa100% (1)

- Project 2Dokument11 SeitenProject 2RuDyNoch keine Bewertungen

- Anand Winter Tranning ReportDokument45 SeitenAnand Winter Tranning ReportAnand Narayn DubeyNoch keine Bewertungen

- Group6 - Industry Analysis ReportDokument10 SeitenGroup6 - Industry Analysis ReportNidhi AshokNoch keine Bewertungen

- Cipla Limited Report on Indian Pharmaceutical IndustryDokument9 SeitenCipla Limited Report on Indian Pharmaceutical IndustryAshish GondaneNoch keine Bewertungen

- RANBAXYDokument76 SeitenRANBAXYRickyMartynNoch keine Bewertungen

- Focus Finance - ER Report - PfizerDokument12 SeitenFocus Finance - ER Report - PfizerVinay SohalNoch keine Bewertungen

- Branded GenericsDokument38 SeitenBranded Generics陳建宇Noch keine Bewertungen

- Overview of The IndustryDokument5 SeitenOverview of The IndustryAvinash SinghalNoch keine Bewertungen

- Indian Pharma Industry: SWOT Analysis: Opportunity, Threat)Dokument3 SeitenIndian Pharma Industry: SWOT Analysis: Opportunity, Threat)amit48Noch keine Bewertungen

- Pharmaceutical SectorDokument2 SeitenPharmaceutical Sectorvishwa thakkerNoch keine Bewertungen

- Pharmaceutical Industry: A Close LookDokument8 SeitenPharmaceutical Industry: A Close LookVikramSubramanianNoch keine Bewertungen

- Pharmaceutical Marketing Strategy of Pharmaceutical IndustryDokument98 SeitenPharmaceutical Marketing Strategy of Pharmaceutical IndustryRajendra Singh ChauhanNoch keine Bewertungen

- "Branded" Generic Drugsc: C CCCC CCCDokument16 Seiten"Branded" Generic Drugsc: C CCCC CCCliyakath_ashrafNoch keine Bewertungen

- Equity Master Report 2015-16Dokument3 SeitenEquity Master Report 2015-16Aalokek KumarNoch keine Bewertungen

- Background Details of Pharma SectorDokument12 SeitenBackground Details of Pharma SectorArjun SanghviNoch keine Bewertungen

- Pest Analysis of Pharma IndustryDokument10 SeitenPest Analysis of Pharma IndustryNirmal75% (4)

- Villar Assignment-Case StudyDokument3 SeitenVillar Assignment-Case StudyAra VillarNoch keine Bewertungen

- The Study On To Identify The Effectiveness of Product Promotion by Sangrose Laboratories Pvt. LTDDokument76 SeitenThe Study On To Identify The Effectiveness of Product Promotion by Sangrose Laboratories Pvt. LTDAmeen MtNoch keine Bewertungen

- Unilab Case Study-Libre PDFDokument27 SeitenUnilab Case Study-Libre PDFShane RealinoNoch keine Bewertungen

- Pharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaDokument9 SeitenPharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaGurudas RaghuramNoch keine Bewertungen

- Novartis International AGDokument2 SeitenNovartis International AGAshish NirmalNoch keine Bewertungen

- Healthcare Investing: Profiting from the New World of Pharma, Biotech, and Health Care ServicesVon EverandHealthcare Investing: Profiting from the New World of Pharma, Biotech, and Health Care ServicesNoch keine Bewertungen

- Legal Issues Journal 7(2): Legal Issues Journal, #9Von EverandLegal Issues Journal 7(2): Legal Issues Journal, #9Noch keine Bewertungen

- Leading Pharmaceutical Innovation: How to Win the Life Science RaceVon EverandLeading Pharmaceutical Innovation: How to Win the Life Science RaceNoch keine Bewertungen

- The Future of Drug Discovery: Who Decides Which Diseases to Treat?Von EverandThe Future of Drug Discovery: Who Decides Which Diseases to Treat?Noch keine Bewertungen

- Current Good Manufacturing Practices (cGMP) for Pharmaceutical ProductsVon EverandCurrent Good Manufacturing Practices (cGMP) for Pharmaceutical ProductsNoch keine Bewertungen

- Strategic Marketing for Specialty Medicines: A Practical ApproachVon EverandStrategic Marketing for Specialty Medicines: A Practical ApproachNoch keine Bewertungen

- Nikola Tesla's Vision of Wireless WarfareDokument30 SeitenNikola Tesla's Vision of Wireless WarfareRahul Pratap SinghNoch keine Bewertungen

- 360 Degree Series: Back Panel HeadingDokument2 Seiten360 Degree Series: Back Panel HeadingRahul Pratap SinghNoch keine Bewertungen

- In Retail Sector Report 2013Dokument6 SeitenIn Retail Sector Report 2013Rahul Pratap SinghNoch keine Bewertungen

- Marketing MangementDokument4 SeitenMarketing MangementRahul Pratap SinghNoch keine Bewertungen

- L293D Motor Driver DatasheetDokument14 SeitenL293D Motor Driver DatasheetAnkit Daftery100% (3)

- Consumer Behaviour: Group ProjectDokument5 SeitenConsumer Behaviour: Group ProjectAanchal MahajanNoch keine Bewertungen

- Canada's Health Care SystemDokument11 SeitenCanada's Health Care SystemHuffy27100% (2)

- Đề cương ôn tập tiếng anh 9Dokument28 SeitenĐề cương ôn tập tiếng anh 9Nguyễn HoaNoch keine Bewertungen

- Maximizing Oredrive Development at Khoemacau MineDokument54 SeitenMaximizing Oredrive Development at Khoemacau MineModisa SibungaNoch keine Bewertungen

- Position paper-MUNUCCLE 2022: Refugees) Des États !Dokument2 SeitenPosition paper-MUNUCCLE 2022: Refugees) Des États !matNoch keine Bewertungen

- Tutorial 7: Electromagnetic Induction MARCH 2015: Phy 150 (Electricity and Magnetism)Dokument3 SeitenTutorial 7: Electromagnetic Induction MARCH 2015: Phy 150 (Electricity and Magnetism)NOR SYAZLIANA ROS AZAHARNoch keine Bewertungen

- AAR Maintenance 001Dokument3 SeitenAAR Maintenance 001prakash reddyNoch keine Bewertungen

- Cell City ProjectDokument8 SeitenCell City ProjectDaisy beNoch keine Bewertungen

- Universal Basic IncomeDokument31 SeitenUniversal Basic IncomeumairahmedbaigNoch keine Bewertungen

- Manual Masina de Spalat Slim SamsungDokument1.020 SeitenManual Masina de Spalat Slim SamsungPerfectreviewNoch keine Bewertungen

- Module A Specimen Questions January2020 PDFDokument5 SeitenModule A Specimen Questions January2020 PDFShashi Bhusan SinghNoch keine Bewertungen

- TDS Versimax HD4 15W40Dokument1 SeiteTDS Versimax HD4 15W40Amaraa DNoch keine Bewertungen

- Acc101Q7CE 5 3pp187 188 1Dokument3 SeitenAcc101Q7CE 5 3pp187 188 1Haries Vi Traboc MicolobNoch keine Bewertungen

- CERADokument10 SeitenCERAKeren Margarette AlcantaraNoch keine Bewertungen

- Bs8161 - Chemistry Laboratory Syllabus: Course ObjectivesDokument47 SeitenBs8161 - Chemistry Laboratory Syllabus: Course ObjectiveslevisNoch keine Bewertungen

- Alternate Mekton Zeta Weapon CreationDokument7 SeitenAlternate Mekton Zeta Weapon CreationJavi BuenoNoch keine Bewertungen

- A Sample of The Completed Essential Principles Conformity Checklist MD CCLDokument12 SeitenA Sample of The Completed Essential Principles Conformity Checklist MD CCLAyman Ali100% (1)

- Executive Order 000Dokument2 SeitenExecutive Order 000Randell ManjarresNoch keine Bewertungen

- Test Report OD63mm PN12.5 PE100Dokument6 SeitenTest Report OD63mm PN12.5 PE100Im ChinithNoch keine Bewertungen

- Treatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Dokument5 SeitenTreatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Victoria LeahNoch keine Bewertungen

- Fugro - Method Statement - For Geotechnical InvestigationDokument4 SeitenFugro - Method Statement - For Geotechnical Investigationsindalisindi100% (1)

- Genetics ProblemsDokument50 SeitenGenetics ProblemsTasneem SweedanNoch keine Bewertungen

- Interface GSKTMTRLBRCHR A4 Int 4webDokument7 SeitenInterface GSKTMTRLBRCHR A4 Int 4webROGERIO GUILHERME DE OLIVEIRA MARQUESNoch keine Bewertungen

- Rreinforcement Pad Leak Test ProcedureDokument5 SeitenRreinforcement Pad Leak Test ProcedureAmin Thabet100% (2)

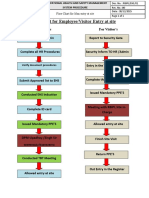

- fLOW CHART FOR WORKER'S ENTRYDokument2 SeitenfLOW CHART FOR WORKER'S ENTRYshamshad ahamedNoch keine Bewertungen

- Job Satisfaction RRLDokument39 SeitenJob Satisfaction RRLMarie Tiffany100% (1)

- Iso 28000Dokument11 SeitenIso 28000Aida FatmawatiNoch keine Bewertungen

- High-pressure dryers for PET bottle production and industrial applicationsDokument3 SeitenHigh-pressure dryers for PET bottle production and industrial applicationsAnonymous 6VCG1YRdNoch keine Bewertungen

- Practical Examination Marking Guideline Grade 12 Physical Science 2019 PDFDokument5 SeitenPractical Examination Marking Guideline Grade 12 Physical Science 2019 PDFWonder Bee Nzama100% (1)

- Insects, Stings and BitesDokument5 SeitenInsects, Stings and BitesHans Alfonso ThioritzNoch keine Bewertungen