Beruflich Dokumente

Kultur Dokumente

Income Tax Benefits U - S 80E

Hochgeladen von

Kalyan Chakravarthy TripuraneniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax Benefits U - S 80E

Hochgeladen von

Kalyan Chakravarthy TripuraneniCopyright:

Verfügbare Formate

u/s 80E of The Income Tax Act 1961

Only interest paid on an educational loan is allowed as deduction u/s. 80E of The Income Tax

Act, 1961, out of his/her income chargeable to tax i.e. Deduction will be allowed only when actual

interest is paid.

Loan should be taken by individual for pursuing higher education of self, spouse or his /her

childrens. Hence parents are also eligible to claim deduction of interest paid by them on

loan taken for their childrens education. (See Note 1)

Loan should be taken from approved financial institution(See Note 2) or from institution

established for charitable purposes and approved by the prescribed authority under clause (23C) of

section 10 or an institution referred to in clause (a) of sub-section (2) of section 80G.

Loan should be for full-time studies for any graduate or postgraduate course in engineering,

medicine, management or for post-graduate course in applied sciences or pure sciences including

mathematics and statistics; [From A.Y. 2010-11 see Note 3]

Deduction is allowed for a continuous period of eight years, starting with initial assessment year in

which the assessee starts paying the interest on the loan or until the interest is paid in full

whichever is earlier.

Notes: -

1) An Individual is also entitled to claim deduction u/s. 80 C of The Income Tax Act, 1961 upto

Rs. 1,00,000 in the year of payment in respect of as tuition fees (excluding any payment towards any

development fees or donation or payment of similar nature), whether at the time of admission or

thereafter,(a) to any university, college, school or other educational institution situated within India;

(b) for the purpose of full-time education of self, spouse or his /her childrens;

2) financial institution means a banking company to which the Banking Regulation Act, 1949 (10

of 1949) applies (including any bank or banking institution referred to in section 51 of that Act); or

any other financial institution which the Central Government may, by notification in the Official

Gazette, specify in this behalf

3) Definition of Higher education is proposed to be substituted by making a amendment as per

Finance (No. 2) Bill 2009. After the amendment Higher education would means any course of study

pursued after passing the Senior Secondary Examination or its equivalent from any school, board or

university recognised by the Central Government or State Government or local authority or by any

other authority authorised by the Central Government or State Government or local authority to do

so.

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Implementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLDokument21 SeitenImplementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLNikitaPrabhu0% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Basic Graphics TermsDokument90 SeitenBasic Graphics TermsKalyan Chakravarthy TripuraneniNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Western Formal For WomenDokument6 SeitenWestern Formal For WomenKalyan Chakravarthy TripuraneniNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- AsDokument6 SeitenAsKalyan Chakravarthy TripuraneniNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Implementation of Fast Fourier Transform (FFT) Using VHDLDokument71 SeitenImplementation of Fast Fourier Transform (FFT) Using VHDLCutie93% (30)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- How To Create Adobe PDF Files For Print and Press Acrobat 6 (PDF 1.5) VersionDokument81 SeitenHow To Create Adobe PDF Files For Print and Press Acrobat 6 (PDF 1.5) VersiongrpepinNoch keine Bewertungen

- Webcast Ipcc P 1 AccountingDokument17 SeitenWebcast Ipcc P 1 AccountingKalyan Chakravarthy TripuraneniNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- IPCC Report On Science of Climate Change FAQsDokument35 SeitenIPCC Report On Science of Climate Change FAQsCu UleNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Best practices for producing high quality PDF filesDokument8 SeitenBest practices for producing high quality PDF filesSyed ShahNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Design Collection (M.Sc. (FT) - 402)Dokument1 SeiteDesign Collection (M.Sc. (FT) - 402)Kalyan Chakravarthy TripuraneniNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Greenhouse Effect and Global WarmingDokument7 SeitenGreenhouse Effect and Global WarmingRajat BansalNoch keine Bewertungen

- Global Warming and Its Impacts On Climate of IndiaDokument13 SeitenGlobal Warming and Its Impacts On Climate of IndiaDeepak RajNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Design Collection (M.Sc. (FT) - 402)Dokument1 SeiteDesign Collection (M.Sc. (FT) - 402)Kalyan Chakravarthy TripuraneniNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- MSCFTDokument23 SeitenMSCFTKalyan Chakravarthy TripuraneniNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Implementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLDokument21 SeitenImplementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLNikitaPrabhu0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Implementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLDokument21 SeitenImplementation of Fast Fourier Transform (FFT) On FPGA Using Verilog HDLNikitaPrabhu0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Canterbury TravelsDokument5 SeitenCanterbury TravelsRahul SinghNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Answers - Quiz 01 (15 Feb 2014)Dokument2 SeitenAnswers - Quiz 01 (15 Feb 2014)Adnan JawedNoch keine Bewertungen

- Texas Budget MemoDokument1 SeiteTexas Budget MemoTexas WatchdogNoch keine Bewertungen

- IRS Publication 962Dokument2 SeitenIRS Publication 962Francis Wolfgang UrbanNoch keine Bewertungen

- The Women of Anna NagarDokument1 SeiteThe Women of Anna NagarAanchal MehtaNoch keine Bewertungen

- Form 27A Monthly ReturnDokument6 SeitenForm 27A Monthly Returnrgsr2008Noch keine Bewertungen

- Questionnaire: A Study On Job Satisfaction of Employees at Pushpanjali Hospital, AgraDokument3 SeitenQuestionnaire: A Study On Job Satisfaction of Employees at Pushpanjali Hospital, AgraDeepti JainNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Socio-Economic Impact of Business Establishments in Balagtas, Batangas City To The Community: Inputs To Business Plan DevelopmentDokument8 SeitenSocio-Economic Impact of Business Establishments in Balagtas, Batangas City To The Community: Inputs To Business Plan DevelopmentAsia Pacific Journal of Multidisciplinary ResearchNoch keine Bewertungen

- BUS13401n14099 10 09Dokument2 SeitenBUS13401n14099 10 09jc199707Noch keine Bewertungen

- Economic Growth Theories and True Development ModelDokument21 SeitenEconomic Growth Theories and True Development ModelnaveedNoch keine Bewertungen

- Chapter 2 Reward System ExplainedDokument17 SeitenChapter 2 Reward System Explainedunnu123Noch keine Bewertungen

- Crisis of Good Governance in PakistanDokument2 SeitenCrisis of Good Governance in Pakistanraheel44100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- HelpHomelessDokument2 SeitenHelpHomelessali bettaniNoch keine Bewertungen

- FinanceDokument5 SeitenFinanceOnemustika SeahayaNoch keine Bewertungen

- Putting People First For Organizational SuccessDokument1 SeitePutting People First For Organizational SuccessFerdous Mahmud ShaonNoch keine Bewertungen

- Mid Sem Notes FINA2222Dokument1 SeiteMid Sem Notes FINA2222zdoug1Noch keine Bewertungen

- Understanding Employee AttritionDokument2 SeitenUnderstanding Employee Attritionchhaya23Noch keine Bewertungen

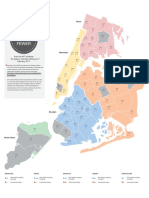

- A Map of NYC DHS Shelter Locations As of July 2022Dokument1 SeiteA Map of NYC DHS Shelter Locations As of July 2022Jeanmarie EvellyNoch keine Bewertungen

- Compensation Benefits Test MCQs ExcelDokument2 SeitenCompensation Benefits Test MCQs ExcelAli ArainNoch keine Bewertungen

- Bus conductor lifestyle studyDokument12 SeitenBus conductor lifestyle studyHosnain ShahinNoch keine Bewertungen

- Soneri Bank Limited Balance SheetDokument3 SeitenSoneri Bank Limited Balance SheetSaad Ur RehmanNoch keine Bewertungen

- ECON 204 - Presentation 1Dokument11 SeitenECON 204 - Presentation 1Ha Hoang Anh NguyenNoch keine Bewertungen

- Broadway 4D Theaters Financial AnalysisDokument16 SeitenBroadway 4D Theaters Financial AnalysisJoshua ChuaNoch keine Bewertungen

- A Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaDokument10 SeitenA Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaBen SteigmannNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Caf Ngo ProfileDokument10 SeitenCaf Ngo ProfileBild Andhra PradeshNoch keine Bewertungen

- Toy World, Inc - Projected Balance Sheet and Income StatementDokument4 SeitenToy World, Inc - Projected Balance Sheet and Income StatementMartin Perrone0% (1)

- Diamond ChemicalsDokument3 SeitenDiamond ChemicalsJohn RiveraNoch keine Bewertungen

- 2012 Term 4 H2 Economics Revision - Week 4 Essay QuestionsDokument1 Seite2012 Term 4 H2 Economics Revision - Week 4 Essay QuestionsRyan ZamoraNoch keine Bewertungen

- Fundamentals of Political EconomyDokument208 SeitenFundamentals of Political Economypsyops008Noch keine Bewertungen

- Under Armour Inc NYSE UA Financials Balance SheetDokument6 SeitenUnder Armour Inc NYSE UA Financials Balance SheetCindyGNoch keine Bewertungen

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesVon EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesBewertung: 3 von 5 Sternen3/5 (3)