Beruflich Dokumente

Kultur Dokumente

Peter Low - The Northern Pacific Panic of 1901

Hochgeladen von

Adrian Kachmar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

509 Ansichten4 SeitenAn article on the Northern Pacific Panic of 1901, by Peter Low. Published in the Museum of American Finance's newsletter in the Winter of 2010.

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAn article on the Northern Pacific Panic of 1901, by Peter Low. Published in the Museum of American Finance's newsletter in the Winter of 2010.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

509 Ansichten4 SeitenPeter Low - The Northern Pacific Panic of 1901

Hochgeladen von

Adrian KachmarAn article on the Northern Pacific Panic of 1901, by Peter Low. Published in the Museum of American Finance's newsletter in the Winter of 2010.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

13 www.moaf.

org Financial History ~ Winter 2010

By Peter Low

On May 10, 2007 while appearing

on The Charlie Rose Show, War-

ren Buffett mentioned that during the

many seminars he conducted with

MBA students from various schools

very few had ever heard of the North-

ern Pacic Panic of 1901. Ironically,

the airing of this segment took place

106 years, almost to the day, of the

culmination of that fascinating epi-

sode in American nancial history

which involved a number of Gilded

Age business titans and pitted JP Mor-

gan and James J. Hill against Edward

H. Harriman and Jacob Schiff.

In early March of 1901, Mor-

gan organized the merger of Carnegie

Steel, Federal Steel, American Steel

& Wire, and a number of smaller

Above: The Rush to Buy Northern Pacic,

Thursday, May 9, published in Harpers

Weekly, May 18, 1901.

steel, wire and tube producers to form

United States Steel, the rst billion-

dollar corporation. The company was

initially capitalized at $1.4 billion and

Andrew Carnegies share of $226 mil-

lion, in ve percent bonds, made him

the richest man in the world.

Later that month Morgan and Hill

bought control of the Chicago, Burling-

ton, and Quincy Railroad for the joint

account of Hills Great Northern and

Northern Pacic Railroads. The CBQ

was strategically important because it

provided an entry into Chicago which

Hills systems, and Harrimans Union

Pacic, lacked. Since Harrimans line

reached no farther east than Omaha,

and Hills no farther than St. Paul and

Duluth, ownership of the CBQ also

represented a connection for a pos-

sible transcontinental railroad.

Harriman and his investment

banker, Jacob Schiff, the senior part-

ner of Kuhn, Loeb & Company, asked

Hill and Morgan for a one-third inter-

est but was rebuffed. Harrimans reply

was, very well it is a hostile act and

you must take the consequences.

Harriman then decided that to attain

possession of the CBQ, he would

attempt to purchase control of the

Northern Pacic Railroad.

Edward Henry Harriman began his

business career as a trader, speculator

and market operator. His interest

in railroads was engendered by his

marriage into the prominent north-

M

u

s

e

u

m

o

f

A

m

e

r

i

c

a

n

F

i

n

a

n

c

e

14 Financial History ~ Winter 2010 www.moaf.org

ern New York State Averell family

who controlled the Ogdensburg Bank

and the local Ogdensburg and Lake

Champlain Railroad. Brilliant in his

understanding of railway operations

and audacious in his business strate-

gies, he eventually gained majority

interests in the Illinois Central and the

Southern Pacic railroads as well as

in the Union Pacic, which he reorga-

nized out of bankruptcy.

Harriman was described by Kuhn,

Loeb partner Otto Kahn as a man

who would attend group meetings at

which 10 or 12 men sat around a table

with him a large majority opposed

to the measures he would propose.

Yet I know of hardly an instance of

any importance where his views did

not prevail nally, and, what is more,

generally by unanimous vote. In Har-

rimans own words, he told Kahn, all

the opportunity I ever ask is to be one

among 15 men around a table.

In addition to the support of Kuhn,

Loeb, he was backed by the Union

Pacic Treasury and National City

Bank which, as a repository of mil-

lions of dollars of Standard Oil cash,

had a particularly close relationship

with the Rockefellers.

In early and mid-April, Harriman

began to accumulate Northern Pacic

common and preferred shares in the

open market. Morgan, unaware of

Harrimans bold tactics, left the United

States for a vacation at Aix-les-Bains,

France. His partners were so unin-

formed that as NP continued to rise in

price, they actually sold about 23,000

shares of the partnerships holdings

and an additional 35,000 shares for

customers and afliates, thus unwit-

tingly aiding Harriman in his quest

for control.

By late April, numerous specula-

tors assumed that the run-up in the

shares of many railroads was due to

the McKinley bull market and to the

consolidation of the CBQ with NP.

James Hill, however, became alarmed

with the pace of trading in NP and

decided to make a speedy rail trip

from Seattle to New York City, arriv-

ing on Friday, May 3. He immediately

visited the Kuhn, Loeb ofce where

Schiff explained that the Harriman

Group had invested a total of $80

million and owned 420,000 shares

of NPs 750,000 preferred issue and

370,000 shares of its 800,000 com-

mon. Although these combined posi-

tions constituted a majority of all the

NP stock outstanding, Harriman was

40,000 shares shy of a controlling

interest of the common.

Hill was originally from Ontario,

Canada but he settled in St. Paul, Min-

nesota at the age of 18. Blind in the

right eye from a childhood bow and

arrow accident, he was known as the

Little Giant because of his short stat-

ure and huge ambition. Later that day

he visited JP Morgan and Company

and while combing through records,

discovered to his delight that NP

directors had the right to retire the

preferred issue on January 1, 1902.

Therefore, 51 percent ownership of

the common was crucial.

The following day, Saturday, May

4, Harriman instructed Kuhn, Loeb

to buy an additional 40,000 shares of

common (the NYSE conducted Sat-

urday trading sessions from 10 am to

12 pm until 1952). Schiff was in Syna-

gogue observing the Jewish Sabbath

and when found by one of his part-

ners, he instructed that the order not

be lled and indicated that he would

take personal responsibility for the

decision. The historical record gener-

ally assumes that Schiff was observant

and would not conduct business on the

Sabbath. However, Jean Strouse, in

her biography of JP Morgan, offers the

possibility that Schiff did not want to

further antagonize the powerful House

of Morgan. In any event, no portion of

the order was executed.

In addition, Morgan partner Rob-

ert Bacon wired his senior partner

in France for permission to purchase

150,000 shares of common, and the

reply which reached Bacon on Mon-

day, May 6, ordered him to buy at

any price. Frenzied trading ensued,

and that day NP closed up 17 points

at 127 .

By Tuesday, May 7, it became clear

that the stock was cornered. Many

speculators, unaware of the behind-

the-scenes struggle for control, saw the

price increase as an opportunity to sell

short, thus attempting to prot from

a possible decline. As a result, about

100,000 more shares were sold than

had been printed. In addition, under

the then existing rules of the NYSE, a

Northern Pacic Railroad Company stock certicate issued to E.H. Harriman & Co. in 1885.

C

o

u

r

t

e

s

y

o

f

P

e

t

e

r

L

o

w

15 www.moaf.org Financial History ~ Winter 2010

seller had the obligation to deliver sold

shares by 2:15 pm the following day.

As Bernard Baruch, the famous

speculator and advisor to presidents,

relates in his autobiography, neither

side intended to set off a short squeeze,

and as a result Al Stern, of Herzfeld &

Stern, was sent to the NYSE Floor

that Tuesday, after the 3 pm closing

bell, as a Kuhn, Loeb emissary to lend

stock to panicked short sellers. NP

had already nished the session at 143

after touching 149 earlier in the day,

but brokers had not yet left the trad-

ing post. As Stern entered the crowd

he inquired, Who wants to borrow

Northern Pacic? I have a block to

lend. Baruch, who was a NYSE

Member, and therefore, an eyewitness

to the pandemonium that followed,

explains that the desperate bro-

kers rushed at Stern. Struggling to get

near enough to him to shout their bids,

they kicked over stock tickers. Strong

brokers thrust aside the weak ones.

Hands were waving and trembling

in the air. Continuing his narrative,

Baruch describes the frantic brokers

as acting like thirst-crazed men

battling for water, with the biggest,

strongest and loudest faring best.

Stern nally broke away after he had

no more stock to lend.

The next day, Wednesday, May

8, the hysteria continued, and as NP

advanced in price other stocks were

being sold in panic at considerable dis-

counts. Many speculators were facing

catastrophic losses and nancial ruin.

Baruch further explains that dur-

ing that era many traders and brokers

often assembled after hours at the

Waldorf Astoria Hotel, which was

on the site where the Empire State

Building now stands. He describes the

scene that Wednesday evening, one

look inside the Waldorf that night

was enough to bring home [the] truth

of how little we differ from animals

after all. From a palace the Waldorf

had been transformed into the den

of frightened men at bay It was, in

short, a mob swayed by all the unrea-

sonable fears, impulses and passions

that play on mobs.

The headline in the New York Her-

ald on Thursday, May 9, read, Giants

of Wall Street in Fierce Battle for

Mastery, Precipitate Crash That Brings

Ruin to Horde of Pygmies. That

morning, Northern Pacic opened up

10 points at $170 and by 11 am it was

selling at $400. Around noon, the price

hit $700 and at about 2 pm there was

a transaction of 300 shares at $1,000.

Then, a few minutes before the 2:15

pm settlement deadline Al Stern again

visited the Floor accompanied by JP

Morgans representative, Eddie Nor-

ton of Street and Norton. The men

announced that neither Kuhn, Loeb

nor JP Morgan would enforce delivery

of NP shares purchased the day before.

The crisis was over and NP sold off to

$300 although it eventually closed at

$325, up 165 points for the day. Later

that afternoon, both investment banks

announced that they would provide

stock to short sellers at the reasonable

price of $150.

As for Baruchs personal trading

during the panic, he reports that on

Monday morning, May 6, he was con-

sidering an NP arbitrage opportunity

between the New York and London

markets and shared his thoughts with

Talbot Taylor, a reliable and well-

connected colleague. Taylor, whos

father-in-law, James Keene, was han-

dling the NP buy order for JP Morgan

& Company, admonished Baruch to

Be careful and dont be short of this

stock. What I buy today must be deliv-

ered now. Stock bought in London

will not do. Taylor then informed

his friend, in strict condence, about

the covert struggle for control. Privy

to extremely sensitive information and

sworn to secrecy, Baruch decided to

avoid trading in NP and chose an

alternative strategy. Anticipating a

corner, he sensed that the rest of the

market might collapse as shares of

other companies would have to be

sold to raise money to support losing

short positions. He shorted various

leading issues from the general list and

referring to Wednesday, May 8, indi-

cates that when stocks were dumped

I bought My net prot that day was

more than I made on any other one

day before or after.

The two sides of this nancial tug

of war eventually made peace, and in

November of 1901 the Northern Secu-

rities Company was formed to hold

the Northern Pacic, Great Northern

and CBQ railroads. Its board of direc-

tors included three JP Morgan part-

ners along with James J. Hill, Edward

H. Harriman, Jacob Schiff and John

D. Rockefellers brother, William.

However, previously on September 6,

President William McKinley, who had

a friendly bias toward Morgans eco-

nomic interests, was shot by an anar-

chist at the Pan-American Exposition

in Buffalo, New York. He died eight

days later and Theodore Roosevelt,

whose viewpoint toward trusts and

large business combinations was more

skeptical, became President. In Febru-

ary 1902, Northern Securities was

sued by the Roosevelt Administration

under the Sherman Antitrust Act of

1890. It was dissolved in 1904 by

order of the Supreme Court.

Bernard M. Baruch

continued on page 38

38 Financial History ~ Winter 2010 www.moaf.org

The Great Debate

continued from page 31

The Panic of 1826

continued from page 19

The Northern Pacic Panic of 1901

continued from page 15

threat of losing everything was a gov-

ernor to greed.

By the end of the 18th century, two

very different viewpoints on specula-

tion had been demarcated, and a battle

waged between a class that lived off its

land and a risk-taking class intoxi-

cated by the paper wealth of a concen-

trated banking system. This latter

group championed by Hamil-

ton was so at odds with the coun-

trys agrarian ideals that it reinforced

Jeffersons fear that New York was

inhabited by nothing more than a

bunch of English-sympathizing stock

jobbers who dressed like, spoke like,

and wished to be the English he so

detested. Put another way, the notion

that it was un-American to play in the

nancial game is nearly as old as the

country itself. The battle among the

founding fathers foreshadowed how

economic blame would be distributed

for the next 230 years. FH

Robert Sloan is the managing partner

of S3 Partners, LLC, a New York and

London-based balance sheet manager

for top hedge funds globally, which

he founded in 2003. He is the author

of the book, Dont Blame the Shorts:

Why Short Sellers are Always Blamed

for Market Crashes and How History

is Repeating Itself (McGraw-Hill/Fall

2009). In addition, Bob serves as a

member of the board for MF Global

Ltd., the worlds largest exchange

traded derivatives broker.

Sources

Chernow, Ron. Alexander Hamilton. New

York: Penguin Group, 2005.

Fleming, Thomas. Wall Streets First

Collapse. American Heritage, July 20,

2009.

In 1970, the Great Northern,

Northern Pacic, CBQ and the Spo-

kane, Portland, and Seattle Railway

merged to form the Burlington North-

ern Railroad. The merger was allowed

in spite of a challenge by the highest

court, essentially reversing the 1904

ruling. On December 31, 1996, Bur-

lington Northern merged with the

Atchison, Topeka, and Santa Fe Rail-

way to form the BNSF.

In his 2008 Annual Letter to share-

holders, Warren Buffett reported that

Berkshire Hathaway Inc. owned at

least 20 percent of the Burlington

Northern Santa Fe Corporation. On

November 3, 2009, he announced that

in a $44 billion transaction Berkshire

would acquire the entire railroad. In

his statement to the press, Buffett

explained that he viewed the purchase

as an investment in the economic

future of the United States. FH

Peter Low is Chairman of the Gris-

wold Company, Inc. He was previ-

ously an independent Member of the

New York Stock Exchange for more

than 40 years.

Sources

Allen, Frederick Lewis. The Great Pierpont

Morgan. New York: Harper Brothers,

1949.

Baruch, Bernard. Baruch: My Own Story.

New York: Holt Rinehart and Win-

ston, 1957.

Chernow, Ron. The House of Morgan. New

York: Atlantic Monthly Press, 1990.

Grant, James. Bernard M. Baruch: The

Adventures of a Wall Street Legend.

New York: Simon and Schuster, 1983.

Josephson, Matthew. The Robber Barons.

New York: Harcourt, Brace, 1934.

Kahn, Otto. Of Many Things. New York:

Boni & Liveright, 1926.

Klein, Maury. The Life and Legend of

E.H. Harriman. Chapel Hill: University

of North Carolina Press, 2000.

Sobel, Robert. Panic on Wall Street. Lon-

don: The Macmillan Company, 1968.

Strouse, Jean. Morgan American Financier.

New York: Random House, 1999.

Thomas, Dana. The Plungers and the Pea-

cocks. New York: William Morrow &

Company, 1967.

enacted or amended in response to

historical nancial crises; the current

crisis will almost certainly produce a

new round of legal changes. FH

Notes

1. This rm was chartered in 1812 as

The President, Directors and Com-

pany of the City Bank of New York.

In 1865, it converted to The National

City Bank of New York.

Eric Hilt is Associate Professor of

Economics at Wellesley College and

Research Associate at the National

Bureau of Economic Research. His

work focuses on the history of Ameri-

can business organizations and their

governance, and on the role of legal

institutions in shaping economic and

nancial development.

Das könnte Ihnen auch gefallen

- A Brief History of Panics and Their Periodical Occurrence in the United StatesVon EverandA Brief History of Panics and Their Periodical Occurrence in the United StatesNoch keine Bewertungen

- Wide Moat Investing - CFA Cleveland May 2016Dokument40 SeitenWide Moat Investing - CFA Cleveland May 2016Jeff TargaryaenNoch keine Bewertungen

- Klarman Yield PigDokument2 SeitenKlarman Yield Pigalexg6Noch keine Bewertungen

- Hayman Bass 20081017Dokument3 SeitenHayman Bass 20081017dylan555100% (1)

- Austrian Economics & InvestingDokument20 SeitenAustrian Economics & InvestingRaj KumarNoch keine Bewertungen

- Decision-Making For Investors: Theory, Practice, and PitfallsDokument20 SeitenDecision-Making For Investors: Theory, Practice, and PitfallsGaurav JainNoch keine Bewertungen

- Keynes Investment LessonsDokument5 SeitenKeynes Investment LessonskwongNoch keine Bewertungen

- Amitabh Singhvi L MOI Interview L JUNE-2011Dokument6 SeitenAmitabh Singhvi L MOI Interview L JUNE-2011Wayne GonsalvesNoch keine Bewertungen

- Aquamarine Fund PresentationDokument25 SeitenAquamarine Fund PresentationVijay MalikNoch keine Bewertungen

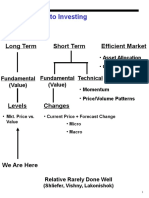

- Approaches To Investing: Long Term Short Term Efficient MarketDokument71 SeitenApproaches To Investing: Long Term Short Term Efficient MarketPeter WarmeNoch keine Bewertungen

- Investing classics & business biographiesDokument2 SeitenInvesting classics & business biographiesdanawhite2Noch keine Bewertungen

- Tobin - Commercial Banks As Creators of MoneyDokument12 SeitenTobin - Commercial Banks As Creators of MoneyJung ZorndikeNoch keine Bewertungen

- Lisa Rapuano Finding Your Way Along The Many Paths of ValueDokument29 SeitenLisa Rapuano Finding Your Way Along The Many Paths of ValueValueWalk100% (1)

- Stephen Hawking and The Prophets of A Scientific AgeDokument17 SeitenStephen Hawking and The Prophets of A Scientific Agebhav2501100% (1)

- Bob Robotti - Navigating Deep WatersDokument35 SeitenBob Robotti - Navigating Deep WatersCanadianValueNoch keine Bewertungen

- Graham - Doddsville - Issue 40 - v19 PDFDokument61 SeitenGraham - Doddsville - Issue 40 - v19 PDFRofiq 4 NugrohoNoch keine Bewertungen

- Tiananmen Square To Wall Street - ArticleDokument3 SeitenTiananmen Square To Wall Street - ArticleGabe FarajollahNoch keine Bewertungen

- Boyar's Intrinsic Value Research Forgotten FourtyDokument49 SeitenBoyar's Intrinsic Value Research Forgotten FourtyValueWalk100% (1)

- Guru Focus Interview With Arnold VandenbergDokument16 SeitenGuru Focus Interview With Arnold VandenbergVu Latticework Poet100% (2)

- Transcription of David Tepper's 2007 Presentation to Carnegie Mellon Undergraduate StudentsDokument7 SeitenTranscription of David Tepper's 2007 Presentation to Carnegie Mellon Undergraduate StudentsPattyPattersonNoch keine Bewertungen

- Mahony - Soros S SecretsDokument2 SeitenMahony - Soros S SecretssimvanonNoch keine Bewertungen

- Warren Buffett's Case Study in Mid-Continent Tabulating CompanyDokument19 SeitenWarren Buffett's Case Study in Mid-Continent Tabulating CompanyAhmad DamasantoNoch keine Bewertungen

- Dylan Grice - GoodbyeDokument7 SeitenDylan Grice - Goodbyevineet_bmNoch keine Bewertungen

- AVM Ranger Returns 29.1% in 2016Dokument6 SeitenAVM Ranger Returns 29.1% in 2016ChrisNoch keine Bewertungen

- Murray Stahl Discusses Value Investing Approach and Top Stock IdeasDokument10 SeitenMurray Stahl Discusses Value Investing Approach and Top Stock IdeaskdwcapitalNoch keine Bewertungen

- Graham Doddsville Issue 24Dokument61 SeitenGraham Doddsville Issue 24CanadianValueNoch keine Bewertungen

- Max Heine Forbes March 29 1982Dokument2 SeitenMax Heine Forbes March 29 1982jkusnan3341100% (2)

- George Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFDokument88 SeitenGeorge Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFJoao Alves Monteiro NetoNoch keine Bewertungen

- Aquamarine - 2013Dokument84 SeitenAquamarine - 2013sb86Noch keine Bewertungen

- Ed Thorp - A Mathematician on Wall StreetDokument3 SeitenEd Thorp - A Mathematician on Wall StreetgjangNoch keine Bewertungen

- Graham Doddsville Issue 31 0Dokument37 SeitenGraham Doddsville Issue 31 0marketfolly.comNoch keine Bewertungen

- The Boom of 2021Dokument4 SeitenThe Boom of 2021Jeff McGinnNoch keine Bewertungen

- Hedge Papers No.6: Daniel LoebDokument21 SeitenHedge Papers No.6: Daniel LoebHedge Clippers100% (1)

- Who's A Pretty Boy Then? or Beauty Contests, Rationality and Greater FoolsDokument16 SeitenWho's A Pretty Boy Then? or Beauty Contests, Rationality and Greater FoolsOld School ValueNoch keine Bewertungen

- Graham and Doddsville - Issue 9 - Spring 2010Dokument33 SeitenGraham and Doddsville - Issue 9 - Spring 2010g4nz0Noch keine Bewertungen

- HBR Article Explains Increasing Returns and Two Worlds of BusinessDokument11 SeitenHBR Article Explains Increasing Returns and Two Worlds of BusinessLuis Gonzalo Trigo SotoNoch keine Bewertungen

- Edition 1Dokument2 SeitenEdition 1Angelia ThomasNoch keine Bewertungen

- Daily Journal Meeting Detailed Notes From Charlie MungerDokument29 SeitenDaily Journal Meeting Detailed Notes From Charlie MungerGary Ribe100% (1)

- How Open Societies Can Stabilize CapitalismDokument5 SeitenHow Open Societies Can Stabilize CapitalismShaun FantauzzoNoch keine Bewertungen

- Thomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Dokument34 SeitenThomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Hedge Fund ConversationsNoch keine Bewertungen

- ONE-WAY POCKETS: The Book of Books on Wall Street SpeculationVon EverandONE-WAY POCKETS: The Book of Books on Wall Street SpeculationNoch keine Bewertungen

- Seasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingVon EverandSeasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingNoch keine Bewertungen

- 8th Annual New York: Value Investing CongressDokument46 Seiten8th Annual New York: Value Investing CongressVALUEWALK LLCNoch keine Bewertungen

- Debunkery (Review and Analysis of Fisher and Hoffmans' Book)Von EverandDebunkery (Review and Analysis of Fisher and Hoffmans' Book)Noch keine Bewertungen

- Popular Delusions Issue December 2019 PDFDokument16 SeitenPopular Delusions Issue December 2019 PDFfx2009Noch keine Bewertungen

- Graham & Doddsville - Issue 15 - Spring 2012Dokument64 SeitenGraham & Doddsville - Issue 15 - Spring 2012Filipe DurandNoch keine Bewertungen

- Marcato Capital 4Q14 Letter To InvestorsDokument38 SeitenMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- Summary of Marc Levinson's The Great A&P And The Struggle For Small Business In AmericaVon EverandSummary of Marc Levinson's The Great A&P And The Struggle For Small Business In AmericaNoch keine Bewertungen

- High Conviction Barrons Talks With RiverParkWedgewood Fund Portfolio Manager David RolfeDokument3 SeitenHigh Conviction Barrons Talks With RiverParkWedgewood Fund Portfolio Manager David RolfebernhardfNoch keine Bewertungen

- Benjamin Graham's Impact on the Financial Analysis ProfessionDokument1 SeiteBenjamin Graham's Impact on the Financial Analysis Professionpjs15Noch keine Bewertungen

- The Successful InvestorDokument12 SeitenThe Successful InvestorRahul Ohri100% (1)

- Distressed Debt InvestingDokument5 SeitenDistressed Debt Investingjt322Noch keine Bewertungen

- From The Bronx To Wall Street: My Fifty Years in Finance and PhilanthropyVon EverandFrom The Bronx To Wall Street: My Fifty Years in Finance and PhilanthropyNoch keine Bewertungen

- Brian Spector Leaving Baupost Letter - Business InsiderDokument4 SeitenBrian Spector Leaving Baupost Letter - Business InsiderHedge Fund ConversationsNoch keine Bewertungen

- Grant's Interest Rate Observer X-Mas IssueDokument27 SeitenGrant's Interest Rate Observer X-Mas IssueCanadianValueNoch keine Bewertungen

- Distressed Debt Investing: Seth KlarmanDokument5 SeitenDistressed Debt Investing: Seth Klarmanjt322Noch keine Bewertungen

- Siegal CAPEDokument10 SeitenSiegal CAPEJeffrey WilliamsNoch keine Bewertungen

- CLR 2 Review of SpitznagelDokument8 SeitenCLR 2 Review of SpitznagelAnonymous HtDbszqtNoch keine Bewertungen

- Short Selling: Strategies, Risks, and RewardsVon EverandShort Selling: Strategies, Risks, and RewardsBewertung: 4.5 von 5 Sternen4.5/5 (2)

- 1987 Washington Post Article On Lou SimpsonDokument4 Seiten1987 Washington Post Article On Lou SimpsonAdrian KachmarNoch keine Bewertungen

- 2013.03 - NYSSA - Pres by Insurance Info Inst PDFDokument168 Seiten2013.03 - NYSSA - Pres by Insurance Info Inst PDFAdrian KachmarNoch keine Bewertungen

- 2007.01.22 - VF Corp - Mackey McDonald WSJ InterviewDokument5 Seiten2007.01.22 - VF Corp - Mackey McDonald WSJ InterviewAdrian KachmarNoch keine Bewertungen

- 2011 - 16 Minetta Lane Sales BrochureDokument20 Seiten2011 - 16 Minetta Lane Sales BrochureAdrian KachmarNoch keine Bewertungen

- KYC checklist for filling formDokument35 SeitenKYC checklist for filling formAjay Kumar MattupalliNoch keine Bewertungen

- Interim Report On Devolved GovernmentDokument341 SeitenInterim Report On Devolved GovernmentSpartacus OwinoNoch keine Bewertungen

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Dokument30 SeitenEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- AnnualReport 2016-17Dokument232 SeitenAnnualReport 2016-17arunNoch keine Bewertungen

- Assignment PDFDokument31 SeitenAssignment PDFjjNoch keine Bewertungen

- Paper Accountingandcultureandmarket Zarzeski 1996.Dokument20 SeitenPaper Accountingandcultureandmarket Zarzeski 1996.SorayaNoch keine Bewertungen

- RFBT-04: LAW ON Credit Transactions: - T R S ADokument10 SeitenRFBT-04: LAW ON Credit Transactions: - T R S AAdan Nada100% (1)

- Republic of Austria Investor Information PDFDokument48 SeitenRepublic of Austria Investor Information PDFMi JpNoch keine Bewertungen

- KPMG Nppa New Payments Platform Minimising Payments FraudDokument16 SeitenKPMG Nppa New Payments Platform Minimising Payments FrauddavemacbrainNoch keine Bewertungen

- Analysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezosDokument37 SeitenAnalysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezostineNoch keine Bewertungen

- Rothschild in Japan: Expert Advisory Services and Landmark DealsDokument4 SeitenRothschild in Japan: Expert Advisory Services and Landmark DealsTiago PinheiroNoch keine Bewertungen

- SPT PPH BDN 2009 English OrtaxDokument29 SeitenSPT PPH BDN 2009 English OrtaxCoba SajaNoch keine Bewertungen

- Income StatementsDokument23 SeitenIncome StatementsJuan FrivaldoNoch keine Bewertungen

- Risk Management Options and DerivativesDokument13 SeitenRisk Management Options and DerivativesAbdu0% (1)

- Barrons 3.8Dokument3 SeitenBarrons 3.8alireza shahinNoch keine Bewertungen

- Chapter 4 Assignment Recording TransactionsDokument6 SeitenChapter 4 Assignment Recording TransactionsjepsyutNoch keine Bewertungen

- SyllabusDokument45 SeitenSyllabusPrachi PNoch keine Bewertungen

- A Project Report On TaxationDokument71 SeitenA Project Report On TaxationHveeeeNoch keine Bewertungen

- EquityDokument29 SeitenEquityThuy Linh DoNoch keine Bewertungen

- Booklet 2Dokument127 SeitenBooklet 2alok pandeyNoch keine Bewertungen

- The Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going ForwardDokument10 SeitenThe Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going Forwardgreenam 14Noch keine Bewertungen

- Investment Decision MakingDokument16 SeitenInvestment Decision MakingDhruvNoch keine Bewertungen

- Multinational Capital BudgetingDokument20 SeitenMultinational Capital BudgetingBibiNoch keine Bewertungen

- International Taxation of Hybrid EntitiesDokument11 SeitenInternational Taxation of Hybrid EntitiesNilormi MukherjeeNoch keine Bewertungen

- TCCB Revision - ProblemsDokument4 SeitenTCCB Revision - ProblemsDiễm Quỳnh 1292 Vũ ĐặngNoch keine Bewertungen

- Accounts - Past Years Que CompilationDokument393 SeitenAccounts - Past Years Que CompilationSavya SachiNoch keine Bewertungen

- SBI Focused Equity Fund (1) 09162022Dokument4 SeitenSBI Focused Equity Fund (1) 09162022chandana kumarNoch keine Bewertungen

- Day 3 PDFDokument14 SeitenDay 3 PDFDinesh GadkariNoch keine Bewertungen

- Case Study Currency SwapsDokument2 SeitenCase Study Currency SwapsSourav Maity100% (2)

- 2014 Tax TablesDokument1 Seite2014 Tax Tableszimbo2Noch keine Bewertungen