Beruflich Dokumente

Kultur Dokumente

Link Legal Budget Newsflash 2014-15

Hochgeladen von

legallyindia0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

2K Ansichten24 SeitenBudget 2014-15 indirect tax analysis by Link Legal

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBudget 2014-15 indirect tax analysis by Link Legal

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

2K Ansichten24 SeitenLink Legal Budget Newsflash 2014-15

Hochgeladen von

legallyindiaBudget 2014-15 indirect tax analysis by Link Legal

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 24

Uni on Budget 2014

A snapshot of Indirect tax proposals

New Delhi|| Mumbai || Hyderabad || Bangalore || Chennai

LINK LEGAL

India Law Services

The last few years have been quite challenging for the global economies and the Indian

economy has not remained insulated from the impact. After achieving unprecedented

growth of over 9% for three successive years between the financial years 2005-06 and

2007-08 and partially recovering from the global financial crisis of 2008-09, various

external and internal factors have impeded the growth of the economy, which has

witnessed slowdown in several key sectors.

What has been worrisome is that the slowdown has been broad-based, resulting in a

burgeoning fiscal deficit, declining tax collections and poor investor sentiment. At the

same time the country has been facing a double digit inflation leading to high prices

amidst sluggish demand.

In the above backdrop, the Finance Minister has presented the first Budget for the new

Government, amidst the expectancy that the Government will take concrete steps to

address the above problems as well as control the fiscal deficit and improve tax collections

while introducing a fresh wave of economic and tax reforms.

We have analysed the key indirect tax proposals contained in the Union Budget and also

studied its impact on certain key sectors of the economy.

Preface

2

LINK LEGAL

INDIA LAW SERVICES

LINK LEGAL

INDIA LAW SERVICES

Section I

Key Indirect tax proposals

Rate of Service tax remains unchanged at 12.36%.

New services brought under the Service tax net by amending the Negative list from

a date to be notified:

Sale of time or space for advertising in all media except print media (Newspapers and

books), which remains under the Negative list.

Services provided by Radio Taxis. The tax would be levied at an abated value of 40%

(subject to non-availment of Cenvat credit).

Services made taxable with immediate effect by withdrawing the exemption from

Service tax:

Services for transport of passengers through a Air-conditioned contract carriages such as

buses etc. Tax would be levied at an abated value of 40%.

Services provided by a clinical research organization by way of technical testing or analysis

of newly developed drugs, vaccines and herbal remedies on human participants.

Following services exempted with immediate effect:

Transport of organic manure by vessel, rail or road.

Loading, unloading, packing, storage or warehousing, transport by vessel, rail or road of

cotton, ginned or baled.

Specialized financial services received by RBI from outside India in relation to management

of foreign exchange reserves.

Services provided by Indian tour operators to foreign tourists in relation to a tour wholly

conducted outside India

Streamlining of certain exemptions with immediate effect:

Following services provided to an educational institution providing education services have

been exempted:

Transportation of students, faculty and staff;

Catering including mid-day meals;

Security, cleaning, house-keeping services in such institutions; and,

Services relating to admission, conduct of examination by the institution.

Concept of Auxiliary education services has been done away with, and exemption earlier

available for renting of immovable property to an educational institution is withdrawn.

Services to Government or local authority in relation to water supply, public health,

sanitation, solid waste management, slum improvement / upgradation etc. remain

exempted. However, exemption does not extend to services ancillary to such activities such

as drawing, design and consultancy etc.

Service Tax

4

LINK LEGAL

INDIA LAW SERVICES

Procedural simplifications for claiming Service tax exemptions for Special

Economic Zones (SEZ) effective 11 July 2014:

Central Excise Officer to issue authorization Form A-2 for claiming exemption, within 15

days from receiving Form A-1.

Exemption available from the date on which list of eligible services is endorsed by the

authorised SEZ officer in Form A-1, provided it is furnished to the Central Excise Officer

within 15 days of endorsement.

If the Form is submitted later, exemption would be available from the date of submission.

Exemption available during pendency of Form A-2, subject to furnishing of authorization

issued by the Central Excise officer to the service provider within 3 months from provision of

service.

Requirement of furnishing Service tax registration number dispensed with for the services

taxable under the reverse charge.

For the purpose of the above exemption, a service shall be treated as exclusively used for

SEZ operations, if the same is received by a SEZ Unit / Developer, invoice is in the name of

such SEZ Unit / Developer, and the service is used exclusively for furtherance of authorized

operations in the SEZ.

Amendment in the provisions relating to payment of Service tax on abated values

effective 1 October 2014:

For works contract excluding contracts for execution of original works, where a service

provider opts to pay Service tax on abated value, the tax shall be paid on an abated value of

70%.

Services in relation to transport of goods by vessel shall be levied to Service tax on an abated

value of 50% , instead of 40%.

Cenvat credit allowed for input services of rent-a-cab services, if used for the same line of

business. Full credit shall be allowed to the recipient if service provider has paid Service tax

after claiming the prescribed abatements. In case the service provider has paid Service tax

on full value, credit would be restricted to 40% of tax paid by the service provider.

Tour operators allowed Cenvat credit of the input services received from another tour

operator.

Service Tax

5

LINK LEGAL

INDIA LAW SERVICES

For services relating to renting of Motor Vehicles, both service provider and

recipient liable to pay Service tax of 50% each with effect from 1 October 2014

(where the service provider does not claim abatement in the value for paying

Service tax).

Point of Taxation Rules, 2011 amended with effect from 1 October 2014 to provide

that point of taxation in respect of reverse charge will be the date of payment or

three months from the date of invoice, whichever occurs earlier.

Place of Provision of Services Rules, 2012 (PPS Rules) have been amended with

effect from 1 October 2014 as follows:

Definition of the term intermediary amended to bring in its ambit an intermediary of goods,

i.e., a commission or consignment agent.

Therefore, services of a commission / consignment agent shall be taxable if the service

provider is located in the taxable territory.

In case of temporary imports of goods for undertaking repairs on them, it would suffice for

exclusion from performance based criteria for determination of place of provision, if the said

goods are exported after repairs without being put to use in the taxable territory.

Provisions for prescribing conditions in this regard have been done away with.

Services of hiring of vessels (except yacht) and aircraft shall be covered by the general Rule,

i.e., the location of the service recipient shall be the place of provision of services.

Service Tax

6

LINK LEGAL

INDIA LAW SERVICES

Other procedural amendments:

Effective 11 July 2014:

E-payment of Service tax made mandatory with effect from 1 October 2014.

For services provided by a Director to a body corporate and a Recovery agent to a

banking company or financial institution or NBFC the recipient of services shall be

liable to pay entire Service tax.

Effective 1 October 2014:

Amendments made to revise the provision relating to imposition of interest on

delayed payment of Service tax (earlier levied @18%), in the following manner:

From a date to be notified after enactment of Finance Bill:

Rules to be prescribed for determination of rate of exchange for calculation of taxable

value

Time bound adjudication to be undertaken within 6/12 months for Notices issued for

recovery of Service tax.

Powers withdrawn for waiver of 50% penalty under Section 78(1) of the Finance Act,

1994 in case of non-levy / short levy or short-payment of Service tax on account of

suppression of facts or wilful misstatement but details of transactions are available in

the records.

Amendments proposed to authorise any Central Excise Officer to carry out search and

seizure proceedings.

Section 87 of the Finance Act, 1994 is proposed to be amended to enable recoveries of

dues of a predecessor from the assets purchased by the successor as currently

provided under the Central Excise laws.

Section 83 of the Finance Act, 1994 is proposed to be amended to prescribe that an

explanation to a Notification or special order within a year of issuance for clarifying

the scope or applicability shall have effect from the date of issuance of such

Notification or Order.

Service Tax

7

LINK LEGAL

INDIA LAW SERVICES

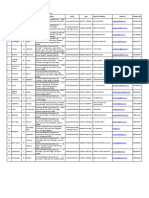

Extent of delay Rate of interest (per annum)

Upto 6 months 18%

6 months to 1 year 18% for first 6 months, plus 24% for delay

beyond 6 months

More than 1 year 18% for first 6 months, plus 24% for

second 6 months, plus 30% beyond 1 year.

Tari ff Changes

Rate of BCD for all types of Coal (Coking, Steam, Anthracite, Metallurgical etc)

increased from NIL to uniform rate of 2.5%. Rate of CVD reduced to 2% for all

types of coal except Steam coal for which CVD at the rate of 1% applies.

Rate of BCD on Dolomite and Limestone for metallurgical use reduced from 19% to

2.5%.

Rate of BCD on Naphthalene and Coal tar pitch reduced from 10% to 5%.

BCD on Petroleum products such as Propane, Saturated Acyclic hydrocarbons,

Ethylene, Propylene, Butadiene etc reduced from 10% to uniform rate of 2.5%.

Import of certain goods such as Crude glycerin, stearic acid, oleic acid etc., used in

manufacture of soap exempted from BCD.

BCD on all machinery for setting up a project for generation of Compressed bio-gas

(Bio CNG) using non-conventional materials to attract a flat rate of 5%.

Specific Exemption/ Concession extended to Solar Energy sector as follows:

BCD on Flat copper wire for use in manufacture of solar photovoltaic cells or modules

reduced from 5% to Nil.

BCD on all items of machinery for use in solar energy production reduced to flat rate of 5%.

SAD exempted on good imported for use in Solar Energy Production.

Import of goods for use in manufacture of solar photovoltaic cells exempted from BCD.

Specific Exemption/ Concession extended to Wind Energy sector as follows:

BCD on Forged Steel rings for manufacture of special bearings for use in Wind operated

electricity generators reduced from 10% to 5%.

SAD exempted on Parts and raw material required for the use in the manufacture of wind

operated electricity generator.

SAD exempted on PVC sheet and ribbon for use in manufacture of Sheet cord.

Export duty on calcined and non calcined Bauxite enhanced from 10% to 20%.

8

LINK LEGAL

INDIA LAW SERVICES

Customs duty

BCD on Vessels and other structures brought in India for breaking up reduced from

5% to 2.5%.

Rate of BCD on import of CRT tubes for color televisions reduced to Nil.

BCD on LCD & LED TV panels of below 19 inches reduced from 10% to Nil.

Import of specified inputs for manufacture of LCD or LED TV from 10%/ 7.5% to

Nil.

SAD exempted Inputs or components for use in manufacture of personal computer

(Laptop or Desktop) including tablet computers subject to actual user condition.

Education and Senior Higher Education Cess levied on certain electronic products

such as Line telephone sets, Electronic Sound or Visual Signal Apparatus, Printed

circuits, Recorded Media, Electrical machines apparatus and instrument apparatus

for chemical analysis.

BCD on import of E-Readers reduced from 7.5% to Nil.

BCD on Flat rolled products of Alloy steel/ stainless steel reduced from 10% to 7.5%.

Rate of BCD on Cut & Polished Gem stones, Diamonds (which include semi

processed, half cut or broken) and non industrial diamonds increased from Nil/2%

to uniform rate of 2.5%.

Sponsoring Authority in respect of Project Import benefits for Metro Rail or

Monorail Project for urban public transport notified to be State Government

instead of Ministry of Urban Development.

Director (Electrical) to certify exempted imports for Delhi MRTS project instead of

Director (Rolling Stock, Electrical and Signaling).

9

LINK LEGAL

INDIA LAW SERVICES

Customs duty

Road construction machinery imported duty free can be sold within 5 years of

importation subject to payment of Customs duty on depreciated value and that

individual constituents of the consortium whose names appear in the contract can

import goods without payment of duty

The requirement of certification by the Ministry of Road Transport (or NHAI) for

availing of Customs duty exemption on specified goods required for construction of

roads is being dispensed with.

It stands clarified that exemption from BCD and CVD on goods imported for use in

manufacture of aircrafts for the Ministry of Defence is available to all materials in

any form and articles subject to the overall condition that they conform to

aeronautical specification accompanied with certificate of development.

Procedural changes

Filing of Bill of Entry prior to Import Report permitted for imports through land

route. Also, the date for determination of rate of duty for tariff valuation deemed to

be on the date of arrival of vehicle through which import is made.

Customs Duty on mineral oils including petroleum and natural gas extracted or

produced in the continental shelf or the exclusive economic zone of India not to be

recovered for the period prior to 7

th

February 2002, irrespective of any judgment,

decree or order of any judicial body. The pending suits to be dropped. However, no

refund available of Customs duty already paid in respect of mineral oils.

Safeguard duty imposed on goods imported by SEZ and EOUs cleared as such in

Domestic Tariff Area (DTA), or used in manufacture of goods cleared into DTA.

10

LINK LEGAL

INDIA LAW SERVICES

Customs duty

Tari ff changes

Excise duty on Branded petrol reduced from Rs 7.5 per litre to Rs 2.35 per litre.

Excise duty on inputs for manufacture of Solar Photo-voltaic cells reduced from

12.36% to Nil.

Excise duty exempted on Solar tempered glass for use in manufacture of solar

photovoltaic cells or modules, solar power generating equipment or systems and flat

late solar collectors.

Excise duty on all items of machinery for use in solar energy production reduced to flat

rate of 5%.

Excise duty exempted on parts consumed within the factory of production for

manufacture of goods used for manufacture for non renewable power generation

through Solar, Wind, Industrial and Urban waste conversion and Ocean Thermal

Energy.

Rate of Clean Energy Cess levied on Coal, lignite and Peat is increased from Rs 50 per

tonne to Rs 100 per tonne.

Excise Duty on all machinery for setting up a project for generation of Compressed

bio-gas (Bio CNG) using non-conventional materials to attract a flat rate of 5%.

Excise duty on recorded Smart Cards increased to 12.36% instead of 2.06% (without

Cenvat credit) and 6.18% (with Cenvat credit).

It is clarified that exemption from Education cess and Secondary and higher

Education cess is applicable only in respect of clean energy cess leviable on coal and

not in respect of excise duty leviable on coal.

An additional duty of excise is being levied at the rate of 5% ad valorem on aerated

waters containing added sugar.

11

LINK LEGAL

INDIA LAW SERVICES

Excise duty

Excise duty on cigarettes is being increased by 72% for cigarettes of length not

exceeding 65mm and by 11% to 21% for cigarettes of other lengths.

Basic Excise Duty is being increased from 12% to 16% on pan masala, from 50% to

55% on unmanufactured tobacco and from 60% to 70% on jarda scented tobacco,

gutkha and chewing tobacco.

It has been clarified that Rail locomotives covered under the heading 8601 to 8606

(except 8604) attract 6% of excise duty with Cenvat benefit.

Director (Electrical) to certify exempted goods for supply to Delhi MRTS project

instead of Director (Rolling Stock, Electrical and Signaling).

Education cess and Senior higher education cess exempted on supply of manufactured

goods from EHTP / EOU / STP to DTA.

It is clarified that all goods falling under any Chapter supplied against International

competitive Bidding (ICB) are fully exempt from Excise duty in case such goods are

exempted from the duties of Customs leviable under the Customs tariff Act 1975.

12

LINK LEGAL

INDIA LAW SERVICES

Excise duty

Procedural changes

Effective after the enactment of Finance Bill

The Third Schedule to the Central Excise Act, 1944 to be allied with goods liable to for

assessment based on Retail Sale Price.

Supreme Court to also adjudicate upon appeals which involve determination of taxability or

excisability of goods for the purpose of assessment.

Assessee and specified authorities required to submit information return containing details of

payment of tax, sale purchase of goods etc. to prescribed authority/ agency. (This provision

is also extended to the Service tax laws)

The Central Excise Valuation Rules 2000 is amended with immediate effect to provide

that in cases where excisable goods are sold at a price below the manufacturing cost

and profit and there is no additional consideration flowing from the buyer to the

assessee directly or from a third person on behalf of the buyer, value for the

assessment of duty shall be deemed to be the transaction value.

E-payment of Excise duty is being made mandatory with effect from 1 October 2014

for all assessees subject to certain exceptions

Sub-rule (3A) of Rule 8 is being substituted to provide that in case of default in

payment of duty, the assessee shall on his own pay a penalty of 1% per month on the

amount of duty not paid for each month or part thereof.

13

LINK LEGAL

INDIA LAW SERVICES

Excise duty

Procedural changes appli cable to Servi ce tax / Exci se / Customs

The name of Customs and Central Excise Settlement Commission changed to

Customs Central Excise and Service Tax Settlement Commission in line with

amendment in 2012 for inclusion of Service Tax matters in the scope of Settlement

Commission.

It is clarified that if the concealment of particulars of Duty liability relates to any

such concealment made from the Officer of Customs and not from Settlement

Commission, would disentitle the applicant from filing second application in any

other matter.

Pre-Deposit mandated for all appeals or stay applications filed after commencement

of Finance Act, 2014 as follows:

At the rate of 7.5% of the duty demanded or penalty imposed or both for filing appeal with

Commissioner (Appeals) or the Tribunal at the first stage; and,

At the rate of 10 % of the duty demanded or penalty imposed or both for filing second stage

appeal before Tribunal.

The amount of pre-deposit payable would be subject to ceiling of Rs 10 crores.

The Scheme of Advance Ruling is extended to Resident Private Limited companies

with immediate effect.

Procedural changes common for Central Exci se and Customs

Liquefied petroleum products such as Propane, Butane, LPG, imported by IOCL,

HPCL or BPCL for supply to Domestic Consumers and Non Domestic Exempted

Category Customers exempted from levy of Excise / Customs duties retrospectively

with effect from 08.02.2013.

Goods imported / supplied for execution of projects financed by UN or an specified

International Organization under exemption from Excise / Customs duties (under

the relevant Notifications) before 1 March 2008 can now be transferred to a new

project, re-exported without payment of duty (for imported goods), or cleared after

payment of specified duties calculated on a depreciated value obtained by straight

line method of depreciation.

CESTAT at its discretion may refuse the admission of Appeals involving demands of

less than Rs. 200,000 (the present limit was Rs. 50,000).

14

LINK LEGAL

INDIA LAW SERVICES

Common changes

The term Place of Removal has been defined under the Cenvat Credit Rules, 2004

(Credit Rules) in terms of Section 4 of the Central Excise Act, 1944.

With effect from 1 September 2014, an assessee shall not avail Cenvat credit on

inputs after expiry of 6 months from the date of issuance of invoice / challan / Bill

of entry, as the case may be. .

Cenvat credit of tax paid under reverse charge mechanism would be available only

after payment of Service tax.

In case the payment to a service provider/manufacturer for the value of taxable

services and Service tax as indicated in the invoice is not made within 3 months

from the date of the invoice, the assessee would be required to pay an amount equal

to Cenvat credit availed on such invoice.

The credit may be reclaimed, once the payment has been released to the service

provider / manufacturer.

Cenvat credit reversed on account of non-receipt of export proceeds within the

specified / extended period can be claimed back if such export proceeds are received

within one year after the expiry of such specified or extended period.

Transfer of Cenvat credit by large tax payer units from one unit to another has been

disallowed with effect from 10 July 2014.

However, the credit accumulated upto 10 July 2014 can be transferred in the

manner specified .

Cenvat Credit

15

LINK LEGAL

INDIA LAW SERVICES

In his budget speech, the Finance Minister has stated as follows with regard to GST

implementation

The debate whether to introduce a Goods and Services Tax (GST) must end.

Some States have been apprehensive about surrendering their taxation jurisdiction; others

want to be adequately compensated. The matter has been discussed with the States both

individually and collectively.

It is hoped to find a solution in the course of this year and approve the legislative scheme

which enables the introduction of GST.

This will streamline the tax administration, avoid harassment of the business and result in

higher revenue collection both for the Centre and the States.

Economic survey tabled prior to the Budget, states that implementation of a Central

GST (CGST) could be the first step towards GST. Once CGST is implemented, and

IT systems for CGST has worked, estimation risk will be lower and it will be easier

to move towards GST.

Though no specific time frame has been prescribed in the Budget, it appears that by

the end of the current Financial Year, the country may have a clear road-map

towards GST implementation.

However, as per the indications provided in the Economic Survey, we may initially

have a partial roll-out in the form of Central GST.

GST

16

LINK LEGAL

INDIA LAW SERVICES

17

LINK LEGAL

INDIA LAW SERVICES

Section II

Impact on key Sectors

Power

Non-renewable

Proposal to provide for a uniform rate of BCD for all types of coals may reduce

litigation but would entail adverse financial impact on the Power sector, which is

already reeling under cost pressures, would be adverse.

However, clarity on ICB projects as regards the extension of benefits to sub-

contractor would be somewhat helpful in mitigating the costs of such projects.

Further, the initiative of introducing ultra modern super critical coal based thermal

power technology should pave way for a cleaner and more efficient thermal power

in future.

One looks forward to Foreign Trade Policy for some additional incentive for this

sector.

Renewable

A major thrust on harnessing the natural sources of power such as solar power and

wind energy is apparent from proposals regarding incentivizing the inputs used for

manufacture of Solar power and Energy equipments. It has been proposed that

ultra mega solar power projects would be established in Rajasthan, Gujarat,

Tamilnadu, Laddakh and J&K with an expense of Rs 500 Crore .Implementation of

Green Energy Corridor Project is also proposed to be implemented.

It is a welcome move given the power crisis prevalent in the country and vast scope

for generating power at low cost through this technology.

Extension of Income tax holiday under Section 80 IA may give a boost to the sector in the

short-run.

18

LINK LEGAL

INDIA LAW SERVICES

Energy

Oi l & Gas

The reduction of Excise duty on certain petroleum products may help the refining

sector in the short run. However, there are no amendments In the Budget for the

upstream or downstream sector. No incentives/ amendments for LNG projects is

somewhat surprising, considering the deficient energy situation of the country,

19

LINK LEGAL

INDIA LAW SERVICES

Energy

Road

The proposed investment of Rs 37,880 crores in NHAI and state roads and

proposal to construct 8000 kms of roads is a serious endeavor on part of the

Government to develop what the FM called as an artery of communication in the

country. The development on this front is long overdue and would require a

devoted and concerted effort on part of the government to make good its promises.

However, no Indirect tax concessions have been forthcoming for the sector which is

somewhat disappointing. Some concessions, especially on Service tax, would have

reduced the costs pertaining to such projects.

Rai lways

There are no specific proposals or budget allocation in respect of Railways sector.

This is not in line with the aggressive stance of Government reflected in Union Rail

Budget which promised to transform the face of Railways in India.

The concerned state Government is now designated to be Sponsoring Authority for

Metro / Monoral projects instead of Ministry if Urban Development. This step may

lead to procedural complexities given the magnitude of Metro / Monorail projects

and its expanse of its operation / procurement across states.

Ai rports

It has been announced that scheme of development of new airports in Tier I and II

would be launched for implementation through Airport Authority in India or PPPs.

However, there is no budget allocation for Airports or a clear roadmap in the

Budget. Further, there are no Indirect tax concession forthcoming for this sector.

Transportation

20

LINK LEGAL

INDIA LAW SERVICES

Port & Shi ppi ng

The budget proposal to introduce sixteen new port projects and allocation of Rs

11,635 crores would lead to for the development of waterways as a mode of cost

effective transportation and connectivity. Outer Harbour Project in Tuticorin for

Phase I. SEZs would also be set up in Kandla and JNPT.

No Indirect tax incentives for Port sector has been announced. Considering that

Service tax is a major cost in setting up of ports, some scheme to mitigate the costs

may have been welcome.

Transportation

21

LINK LEGAL

INDIA LAW SERVICES

The increase in rate of Service tax on Works Contract for repair and maintenance or

re-conditioning or restoration or servicing of any goods from 60% to 70% would be

detrimental to Construction and Real Estate Sector.

However, procedural simplifications for claiming Service tax exemptions for SEZ

may be a key benefit to these sectors.

Given that there are no other significant changes announced for these sectors, many

expectations remain to be fulfilled.

Construction &

Real Estate

22

LINK LEGAL

INDIA LAW SERVICES

Exemption of SAD on personal computers including laptops and tablets would

reduce the price of the same, thus increasing its affordability and reach to common

masses.

Further, the decrease in rates of BCD on parts of LCD, LED would increase its

accessibility to poorer sections of the society, as has been mentioned by FM in his

speech as well.

However, imposition of Education Cess and Secondary and Higher Secondary Cess

on specified IT goods would be a dampener for the already struggling IT industry,

even though being a minor change in taxes.

23

LINK LEGAL

INDIA LAW SERVICES

Technology

Thank You

New Delhi|| Mumbai || Hyderabad || Bangalore || Chennai

LINK LEGAL

India Law Services

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Environmental AuditingDokument37 SeitenEnvironmental AuditingParth Shah100% (1)

- Nigeria Descalzi PresentationDokument25 SeitenNigeria Descalzi PresentationLawrence Mbah100% (2)

- WP No. 69 of 2015 - Deepak Khosla vs. Khaitan & Co - Debar From PracticeDokument308 SeitenWP No. 69 of 2015 - Deepak Khosla vs. Khaitan & Co - Debar From Practicelegallyindia100% (1)

- CLAT PetitionDokument56 SeitenCLAT PetitionlegallyindiaNoch keine Bewertungen

- Data Sheet 6320 AisDokument139 SeitenData Sheet 6320 Aisshahramkh59Noch keine Bewertungen

- Jay Sayta Writ Petition GamingDokument23 SeitenJay Sayta Writ Petition Gaminglegallyindia100% (2)

- TP 03Dokument13 SeitenTP 03Walid Ben HuseinNoch keine Bewertungen

- Hydraulic Power Unit Cum Control Panel: Sheet No. 1 of 1Dokument1 SeiteHydraulic Power Unit Cum Control Panel: Sheet No. 1 of 1rakeshsundaramurthyNoch keine Bewertungen

- Our Brand Story - Shardul Amarchand Mangaldas CoDokument2 SeitenOur Brand Story - Shardul Amarchand Mangaldas ColegallyindiaNoch keine Bewertungen

- Cannabis PILDokument84 SeitenCannabis PILlegallyindiaNoch keine Bewertungen

- Case StudiesDokument5 SeitenCase StudiesAdoree Ramos0% (1)

- M2 Energy Efficiency Regulations - IMO TTT Course Presentation Final1Dokument121 SeitenM2 Energy Efficiency Regulations - IMO TTT Course Presentation Final1Khan Sharif RaihanNoch keine Bewertungen

- Clat Writ AnnexuresDokument17 SeitenClat Writ AnnexureslegallyindiaNoch keine Bewertungen

- List of Dubious Answers by Rajneesh SinghDokument15 SeitenList of Dubious Answers by Rajneesh SinghlegallyindiaNoch keine Bewertungen

- Clat Merged Merit List 2015Dokument748 SeitenClat Merged Merit List 2015legallyindia33% (3)

- Jayalalitha - HC JudgementDokument919 SeitenJayalalitha - HC JudgementJasmine TurnerNoch keine Bewertungen

- BCI Letter To Legally IndiaDokument6 SeitenBCI Letter To Legally IndialegallyindiaNoch keine Bewertungen

- Salman Khan's Trial Court JudgmentDokument240 SeitenSalman Khan's Trial Court Judgmentgulshankolte100% (2)

- Bar Council of India (BCI) Minutes On The All India Bar Exam in 2012Dokument38 SeitenBar Council of India (BCI) Minutes On The All India Bar Exam in 2012legallyindiaNoch keine Bewertungen

- The Section 66A JudgmentDokument122 SeitenThe Section 66A JudgmentThe Indian Express100% (1)

- Justice Manjunath Speech, Via The HinduDokument32 SeitenJustice Manjunath Speech, Via The HindulegallyindiaNoch keine Bewertungen

- Anti AIB Draft PILDokument11 SeitenAnti AIB Draft PILlegallyindia100% (1)

- Gov't Counter Greenpeace / Priya PillaiDokument25 SeitenGov't Counter Greenpeace / Priya Pillailegallyindia100% (1)

- Khaitan Letter To Calcutta CJ Vs Deepak KhoslaDokument9 SeitenKhaitan Letter To Calcutta CJ Vs Deepak KhoslalegallyindiaNoch keine Bewertungen

- Teesta Setalvad SLPDokument14 SeitenTeesta Setalvad SLPlegallyindiaNoch keine Bewertungen

- Final Written Submissions in Priya Pillai (Greenpeace)Dokument9 SeitenFinal Written Submissions in Priya Pillai (Greenpeace)legallyindiaNoch keine Bewertungen

- Bombay High Court Anticipatory Bail OrderDokument7 SeitenBombay High Court Anticipatory Bail OrderlegallyindiaNoch keine Bewertungen

- Teesta Setalvad Affidavit in RejoinderDokument5 SeitenTeesta Setalvad Affidavit in RejoinderlegallyindiaNoch keine Bewertungen

- Amended Bar Council of India (BCI) Certificate and Place of Practice Verification Rules 2015Dokument15 SeitenAmended Bar Council of India (BCI) Certificate and Place of Practice Verification Rules 2015legallyindiaNoch keine Bewertungen

- BCCI Supreme Court JudgmentDokument138 SeitenBCCI Supreme Court JudgmentlegallyindiaNoch keine Bewertungen

- Deepak Khosla - Sanjeev Sachdeva OrderDokument118 SeitenDeepak Khosla - Sanjeev Sachdeva OrderlegallyindiaNoch keine Bewertungen

- Angela Logomasini - Plastic Bag Bans Are Bad For The Environment - WebMemoDokument5 SeitenAngela Logomasini - Plastic Bag Bans Are Bad For The Environment - WebMemoCompetitive Enterprise InstituteNoch keine Bewertungen

- High-Voltage Transformer Bushing Assessment Is Critical - T&D WorldDokument11 SeitenHigh-Voltage Transformer Bushing Assessment Is Critical - T&D WorldwasimwalayatNoch keine Bewertungen

- Chapter 11 IndustryDokument10 SeitenChapter 11 Industryapi-261258709100% (1)

- Doing Business in Japan: 2013 Country Commercial Guide For U.S. CompaniesDokument138 SeitenDoing Business in Japan: 2013 Country Commercial Guide For U.S. CompaniesMelih AltıntaşNoch keine Bewertungen

- 8194MA Baltec Proposal For PT Truba Jurong Eng 1 X V64.3A Rev4Dokument3 Seiten8194MA Baltec Proposal For PT Truba Jurong Eng 1 X V64.3A Rev4Mitha SyauzieNoch keine Bewertungen

- Large Reliability Survey Installations,: of of Industrial and CommercialDokument12 SeitenLarge Reliability Survey Installations,: of of Industrial and CommercialHussein Razaq100% (1)

- Flow Diagram SymbolsDokument5 SeitenFlow Diagram SymbolshussainNoch keine Bewertungen

- JAF TerraCarb Base Media - Jaf Media CenterDokument2 SeitenJAF TerraCarb Base Media - Jaf Media CenterMICAH JEDAHNoch keine Bewertungen

- NEC 2015 ReportDokument20 SeitenNEC 2015 ReportNew Economy CoalitionNoch keine Bewertungen

- TR 05 07e 120402 PDFDokument0 SeitenTR 05 07e 120402 PDFFlores JesusNoch keine Bewertungen

- Problems: S.T. 6x 6x 2x S.TDokument4 SeitenProblems: S.T. 6x 6x 2x S.TJARED DARREN ONGNoch keine Bewertungen

- Chotu KoolDokument4 SeitenChotu KoolharshmarooNoch keine Bewertungen

- REC GST Registration Details25072017 PDFDokument1 SeiteREC GST Registration Details25072017 PDFJagadamba RealtorNoch keine Bewertungen

- 70.06 - Vortex 1500 SystemDokument3 Seiten70.06 - Vortex 1500 SystemBrandon TrocNoch keine Bewertungen

- Resume ZahidDokument7 SeitenResume ZahidEngr Irfan AkhtarNoch keine Bewertungen

- 4.1.9. Sektor Energetyczny W Polsce. Profil Sektorowy EN PDFDokument7 Seiten4.1.9. Sektor Energetyczny W Polsce. Profil Sektorowy EN PDFShubham KaklijNoch keine Bewertungen

- Turbines and ExpandersDokument8 SeitenTurbines and ExpandersMusa KaleemNoch keine Bewertungen

- Manual de Servicio LK-C090BC00Dokument35 SeitenManual de Servicio LK-C090BC00jose antonio100% (1)

- Hemant NirmalkarDokument4 SeitenHemant NirmalkarkrunalNoch keine Bewertungen

- Welspun Group Corporate PresentationDokument39 SeitenWelspun Group Corporate PresentationAli SuhailNoch keine Bewertungen

- Yb 009Dokument27 SeitenYb 009harshNoch keine Bewertungen

- 2017MY Hyundai All Models Warranty Handbook PDFDokument49 Seiten2017MY Hyundai All Models Warranty Handbook PDFNguyen PhanNoch keine Bewertungen