Beruflich Dokumente

Kultur Dokumente

Four Principles of Budget Process Reform

Hochgeladen von

Princeakhtar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten5 SeitenThis document discusses principles for reforming the federal budget process in the United States. It proposes that the budget process should:

1) Cap overall federal spending at a set level to restrain growth, similar to how families budget.

2) Require the annual budget to present the full picture of future obligations, like businesses do with long-term liabilities.

3) Involve the President throughout the budget process, rather than just at the end, to facilitate earlier agreement on budget resolutions.

4) Include strong enforcement of any budget restraints that are adopted.

Originalbeschreibung:

Originaltitel

Budget

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses principles for reforming the federal budget process in the United States. It proposes that the budget process should:

1) Cap overall federal spending at a set level to restrain growth, similar to how families budget.

2) Require the annual budget to present the full picture of future obligations, like businesses do with long-term liabilities.

3) Involve the President throughout the budget process, rather than just at the end, to facilitate earlier agreement on budget resolutions.

4) Include strong enforcement of any budget restraints that are adopted.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten5 SeitenFour Principles of Budget Process Reform

Hochgeladen von

PrinceakhtarThis document discusses principles for reforming the federal budget process in the United States. It proposes that the budget process should:

1) Cap overall federal spending at a set level to restrain growth, similar to how families budget.

2) Require the annual budget to present the full picture of future obligations, like businesses do with long-term liabilities.

3) Involve the President throughout the budget process, rather than just at the end, to facilitate earlier agreement on budget resolutions.

4) Include strong enforcement of any budget restraints that are adopted.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

BUDGET

Definition:A budget is a description of a financial plan. It is a list

of estimates of revenues to and expenditures by an agent for a stated

period of time. ormally a budget describes a period in t!e future not

t!e past.

Bac"grounder #$%&' on Federal Budget

April () *++&

,our -rinciples of Budget -rocess .eform

.estraining runa/ay federal spending /ill re0uire difficult decisions by

la/ma"ers. 1a/ma"ers /!o are /illing to ta"e a toug! stand need a budget

process t!at !elps) rat!er t!an !inders t!em) and t!at is not stac"ed in

favor of excessive spending.

Unfortunately) 2ongress remains saddled /it! an outdated budget process

t!at /as created in $3%&44/!en t!e federal budget /as only one4t!ird of

its current si5e. A 6+4year4old budget process t!at !as been punc!ed

full of !oles by successive 2ongresses cannot ade0uately address t!e

nation7s current budgetary c!allenges.

1a/ma"ers are /or"ing to repair t!e federal budget process. 8et) budget

process reform can easily become bogged do/n in tec!nicalities)

obscuring t!e big picture. Any positive budget reforms s!ould reflect

four general principles:

-rinciple #$: 9verall :pending :!ould Be 2apped at a :et 1evel

,amilies understand spending caps. Every year) millions of families sit

do/n at t!eir "itc!en tables and evaluate !o/ muc! t!ey can afford to

spend. A family7s /is! list almost al/ays exceeds /!at it can afford;

t!erefore) t!e family must prioriti5e in order to remain underneat! t!e

cap. :etting limits is never easy: <o/ever) responsible budgeting "eeps

t!ese families solvent in t!e long run.

T!e federal government does not cap spending. 1a/ma"ers can simply add

up t!e cost of t!eir preferred programs and pass legislation to fund

t!em. =andatory programs44/!ic! no/ comprise t/o4t!irds of all federal

spending44gro/ eac! year /it!out any cap or oversig!t. Discretionary

programs gro/ /it! only slig!t constraints imposed by t!e annual budget

resolutions. >it!out real federal spending caps) la/ma"ers often avoid

difficult trade4offs and spending gro/s beyond /!at taxpayers can

afford. ot surprisingly) mandatory spending is gro/ing % percent

annually. Abandoning enforced caps on discretionary spending !as

resulted in double4digit gro/t! in annual discretionary spending.

T!ere are several options available to cap spending. =ulti4year caps on

discretionary spending succeeded in t!e $33+s) /!en t!ey /ere enforced

and considered politically realistic. 1a/ma"ers could set annual

spending cap levels every fe/ years or determine t!em by a formula) suc!

as inflation plus population gro/t!. 1in"ing spending increases to

budget deficits or to t!e gross domestic product is more difficult

because economic gro/t! and tax revenues can fluctuate rapidly.

Additionally) t!ose limits /ould re0uire t!e deepest spending cuts

during recessions and allo/ large spending !i"es during booms.

2aps could /or" for mandatory programs as /ell. In t!e $33+s) t!ese

programs /ere sub?ected to -A8G9 rules t!at limited only t!e creation of

ne/ entitlements44and did not!ing to limit t!e calamitous spending

increases pro?ected in t!e current :ocial :ecurity and =edicare

baselines. >it! mandatory spending pro?ected to double in $+ years and

over/!elm t!e rest of t!e budget) current mandatory programs can no

longer be left off t!e table. Effective caps s!ould apply to all federal

spending44/!et!er mandatory or discretionary) current or proposed.

1a/ma"ers could create separate levels for mandatory and discretionary

spending) utili5ing distinct levels or gro/t! formulas.1

Alternatively) t!ey could set a single @omnicap@ t!at applies to all

federal spending. An omnicap /ould !ave t!e advantage of allo/ing trade4

offs bet/een mandatory and discretionary spending44t!us promoting

flexibility and simplicity.

-rinciple #*: T!e Annual Budget :!ould -resent a ,ull -icture of

,uture 9bligations

,amilies also understand t!e costs of long4term financial commitments.

T!ey can 0uic"ly calculate !o/ muc! t!ey o/e on t!eir mortgage) car) and

ot!er long4term obligations) and /!en t!ose obligations /ill be fully

paid. Importantly) families cannot commit to ne/ financial obligations

/it!out demonstrating t!at t!ey can pay for t!em. ,or example) potential

!omeo/ners must ma"e a substantial do/n payment and s!o/ t!at t!ey can

afford t!e mont!ly payments.

Businesses operate under similar fiscal constraints. A business is

re0uired to disclose t!e si5e and scope of its obligations on financial

statements so t!at s!are!olders) oversig!t entities) and potential

investors can understand t!e true nature of its financial condition and

can ma"e informed decisions. It must report all long4term obligations)

including liabilities associated /it! pension and retirement !ealt! care

plans44similar in nature to :ocial :ecurity and =edicare44/!ile a

measure of t!eir gro/t! is counted against t!e business7s bottom line.

>!ile measuring t!ese types of liabilities is muc! more difficult t!an

reporting t!e liability on a contract or mortgage) excluding t!is

information from financial reports can grossly misrepresent a business7s

financial viability and lead to poor decisions by management and boards.

Including t!e best estimate of suc! liabilities44and t!eir annual impact

on t!e bottom line44is superior to implying t!at no obligation exists by

excluding suc! calculations because t!ey are imprecise and difficult to

estimate.2 In t!is /ay) every business is re0uired to pay today in

order to fulfill its obligations for tomorro/.

T!e federal government is under no suc! constraints. T!e federal budget

does not include any measure of t!e federal government7s future

obligations and t!us misinforms citi5ens about t!e true fiscal burden

facing t!e nation. T!is omission allo/s policyma"ers to ignore t!e need

for fiscal planning and reforms. 1a/ma"ers can commit to a massive

financial entitlement Asuc! as t!e =edicare drug benefitB /it! no do/n

payment) no set mont!ly payments) and no standard @credit c!ec"@ to

determine /!ic! commitments are affordable. T!e entire open4ended

spending spree is placed on a credit card /it! no spending limit)

relying on blind fait!44rat!er t!an annual planning44t!at future

generations /ill pay t!e balance.

A positive first step /ould be to include a measure of all future

obligations in t!e federal budget) ?ust as businesses are re0uired to

do. T!is /ould contain a brea"do/n of contractual liabilities) suc! as

debt) and social insurance liabilities) suc! as =edicare and :ocial

:ecurity. If budgets began including t!ese measures) policyma"ers /ould

no longer be able to ignore t!ese liabilities and could begin budgeting

for t!eir costs and initiate t!e reforms necessary to "eep t!ese

financial commitments manageable.

-rinciple #6: T!e -resident :!ould Be Involved T!roug!out t!e

Budget -rocess

If t/o parties are expected to negotiate a detailed agreement on a

complex sub?ect /it!in a nine4mont! period) separating t!em until t!e

end of t!e nint! mont! ma"es little sense. It ma"es even less sense for

one side to spend a great deal of time /or"ing out t!e smallest details

of its offer /it!out first !aving forged t!e basic structure of an

agreement /it! t!e ot!er side. 8et) 2ongress and t!e -resident currently

use t!is met!od to /rite t!e federal budget.

T!e -resident begins t!e process in ,ebruary by presenting !is proposed

budget as an opening offer. 2ongress t!en spends up to eig!t mont!s

preparing its counteroffer in t!e form of $6 detailed) annual

appropriations bills. At t!at point44/it! t!e deadline for completion

0uic"ly approac!ing44t!e -resident7s options are limited to eit!er

signing or vetoing eac! appropriations bill.

>it!out any agreed4upon budgetary frame/or") t!ese last4minute

negotiations over t!e details of !undreds of programs become extremely

difficult. T!e inevitable results are rus!ed compromises t!at are

completed /ell past t!e fiscal year deadline. In fact) t!e past t/o

federal budgets /ere completed four mont!s late44one4t!ird into t!e year

t!at t!ey /ere designed to fund.

An increasingly popular solution /ould be to move from a concurrent

budget resolution A/!ic! does not involve t!e -residentB to a ?oint

budget resolution A/!ic! /ould be signed into la/ by t!e -residentB. By

/or"ing out differences early in t!e process and enacting a binding la/)

contentious debates on t!e si5e of government /ould be settled in

=arc!44rat!er t!an in 9ctober) /!en delays ris" government s!utdo/ns.

T!e appropriations debate /ould be limited to t!e composition of federal

spending) and disagreements /ould be far easier to resolve if spending

limits /ere already fixed by la/.

Issues remain regarding !o/ to move t!e budget process for/ard /!en

2ongress and t!e -resident are unable to agree on a budget blueprint.

9ne idea is to re0uire a superma?ority to pass spending bills t!at are

introduced under an unsigned budget resolution. T!at /ould provide

ade0uate pressure on 2ongress and t!e >!ite <ouse to settle t!eir

differences.

Anot!er /ay to bring t!e -resident into t!e process /ould be to re0uire

congressional votes to bloc" rescissions. -residential rescission

re0uests) /!ic! cancel previously appropriated budget aut!ority)

currently re0uire bot! <ouse and :enate approval to ta"e effect. T!us)

2ongress can bloc" a rescission by simply refusing to vote on it.

.e0uiring =embers of 2ongress to vote do/n t!e rescissions t!ey oppose

/ould be a positive reform. .escission proposals not voted do/n by at

least one !ouse of 2ongress /it!in &C days /ould go for/ard. :upporters

of 0uestionable spending could no longer avoid going on t!e public

record /it! t!eir position.

-rinciple #&: Budget Decisions :!ould Include :trong Enforcement.

Budget restraints /it!out strong enforcement are paper tigers.

.estraints are intended to force 2ongress to ma"e some uncomfortable

trade4offs in order to preserve t!e nation7s long4term economic !ealt!.

<o/ever) =embers of 2ongress typically ta"e t!e easy pat! of see"ing

loop!oles t!at bypass restraints) t!us avoiding difficult c!oices.

2onse0uently) rules are only strong as t!eir /ea"est lin".

,or example) t!e discretionary spending caps of t!e $33+s did not apply

to emergency spending. -redictably) la/ma"ers began classifying regular

annual spending as @emergency@ spending in order to bypass t!e caps.

2ongress s!ould budget sufficiently for regular @emergencies@ /!ile

assuring t!at t!e necessary escape !atc! for unforeseen) catastrop!ic

emergencies is not abused. =odest reform options include altering t!e

definition of emergency spending and re0uiring t!e -resident to agree to

an emergency designation. A more ambitious reform /ould re0uire

la/ma"ers to set aside a pre4determined portion of t!e budget for

emergencies and re0uire a superma?ority vote to spend beyond t!at fund.

T!e budget resolution7s spending ceilings are also /ea"ly enforced. In

t!e <ouse of .epresentatives) passing a spending bill t!at exceeds t!e

spending ceiling re0uires only a simple ma?ority44/!ic! is no more of a

!urdle t!an any ot!er spending bill must clear. T!is renders t!e budget

resolution7s spending ceilings meaningless in t!e <ouse of

.epresentatives. T!e :enate is slig!tly better) re0uiring a t!ree4fift!s

vote to violate t!e budget resolution.3 .eal enforcement) !o/ever) may

re0uire closer to a t/o4t!irds vote. ,urt!ermore) if la/ma"ers convert

t!e concurrent budget resolution into a ?oint budget resolution)

exceeding spending limits /ould also re0uire >!ite <ouse approval.

:uc! reforms /ould promote better planning and coordination /it!in t!e

constraints of t!e budget caps and annual budget resolution.

2onclusion

T!e federal government currently spends over D*+)+++ per !ouse!old. T!at

cost is pro?ected to begin rising s!arply over t!e next $+ years) /!en

retiring baby boomers begin receiving :ocial :ecurity and =edicare

benefits. 1a/ma"ers can avert painful tax increases only if t!ey ma"e

t!e difficult decision to limit federal spending. T!e current budget

process) /!ic! is designed to maximi5e federal spending) is t!e /rong

tool for t!at ?ob. T!e four principles listed above represent positive

budget reform consistent /it! sound planning) responsible spending) and

lo/ taxes.

Das könnte Ihnen auch gefallen

- Sample Post Negotiation Report 2Dokument21 SeitenSample Post Negotiation Report 2Tiancheng Huang0% (2)

- SBCTF Finalreport PDFDokument31 SeitenSBCTF Finalreport PDFHunter CapableNoch keine Bewertungen

- Research Paper On Federal BudgetDokument8 SeitenResearch Paper On Federal Budgetgz7vxzyz100% (1)

- Accounting Policies and Procedures Manual Budgetary ControlDokument25 SeitenAccounting Policies and Procedures Manual Budgetary ControlMuhammad AyubNoch keine Bewertungen

- Summers 12-15-08 MemoDokument57 SeitenSummers 12-15-08 MemochenjiayuhNoch keine Bewertungen

- Brighton I360 PlansDokument18 SeitenBrighton I360 PlanspeterjtrumanNoch keine Bewertungen

- Budget PreparationDokument3 SeitenBudget Preparationspaw1108Noch keine Bewertungen

- Local Government Management Guide - Understanding The Budget ProcessDokument33 SeitenLocal Government Management Guide - Understanding The Budget Processziyaz119420Noch keine Bewertungen

- Influencing The Budget During The Formulation StageDokument11 SeitenInfluencing The Budget During The Formulation StageAhmed EssalhiNoch keine Bewertungen

- Testimony DHEProcess May 2006Dokument11 SeitenTestimony DHEProcess May 2006Committee For a Responsible Federal BudgetNoch keine Bewertungen

- Chapter 2Dokument17 SeitenChapter 2Haaromsaa Taayyee TolasaaNoch keine Bewertungen

- The Various Objectives of Government Budget Are: 1. Reallocation of ResourcesDokument23 SeitenThe Various Objectives of Government Budget Are: 1. Reallocation of ResourcesSantosh ChhetriNoch keine Bewertungen

- Chapter 2Dokument12 SeitenChapter 2Yitera SisayNoch keine Bewertungen

- Rivlin Testimony9212011Dokument5 SeitenRivlin Testimony9212011Committee For a Responsible Federal BudgetNoch keine Bewertungen

- EC Fiscal Policy Quiz ANSWERSDokument5 SeitenEC Fiscal Policy Quiz ANSWERSRashid HussainNoch keine Bewertungen

- Sept27.2014no Re-Enacted Budget As House Approves On 2nd Reading P2.606 T Budget For 2015Dokument4 SeitenSept27.2014no Re-Enacted Budget As House Approves On 2nd Reading P2.606 T Budget For 2015pribhor2Noch keine Bewertungen

- DeficitReduction PrintDokument35 SeitenDeficitReduction PrintPeggy W SatterfieldNoch keine Bewertungen

- Debt Limit Memo BanksDokument2 SeitenDebt Limit Memo BanksFox NewsNoch keine Bewertungen

- The Budget Act at Forty: Time For Budget Process ReformDokument25 SeitenThe Budget Act at Forty: Time For Budget Process ReformMercatus Center at George Mason UniversityNoch keine Bewertungen

- Ortgaging: UR UtureDokument5 SeitenOrtgaging: UR UturereasonorgNoch keine Bewertungen

- World Bank Debt Management: Questions and AnswersDokument20 SeitenWorld Bank Debt Management: Questions and Answersk_Dashy8465Noch keine Bewertungen

- Management of Inter-Government and Other Fund Transfers - 01Dokument36 SeitenManagement of Inter-Government and Other Fund Transfers - 01DB BañasNoch keine Bewertungen

- Eyes On The Horizon: Multi-Year Budgeting and Its Role in The Federal Budget ProcessDokument14 SeitenEyes On The Horizon: Multi-Year Budgeting and Its Role in The Federal Budget ProcessCommittee For a Responsible Federal BudgetNoch keine Bewertungen

- FRBM Act 2003 Related - StudentsDokument5 SeitenFRBM Act 2003 Related - StudentsKamran AliNoch keine Bewertungen

- Fifth Five Year PlanDokument4 SeitenFifth Five Year PlanApollo Institute of Hospital AdministrationNoch keine Bewertungen

- Institutional IssuesDokument29 SeitenInstitutional IssuesJojit Domingo Dela Cruz - SinghNoch keine Bewertungen

- Public Budgets: ProcessDokument3 SeitenPublic Budgets: ProcessCatherin NataliaNoch keine Bewertungen

- Budget Process-PlcpdDokument35 SeitenBudget Process-Plcpdtom villarinNoch keine Bewertungen

- Budjet Estimate, Performance BudjetDokument28 SeitenBudjet Estimate, Performance BudjetYashoda SatputeNoch keine Bewertungen

- What We Hope To See From Super CommitteeDokument18 SeitenWhat We Hope To See From Super CommitteeCommittee For a Responsible Federal BudgetNoch keine Bewertungen

- PUBLIC FINANCE Midterm 01 3Dokument4 SeitenPUBLIC FINANCE Midterm 01 3ocampojohnoliver1901182Noch keine Bewertungen

- Must Read BOPDokument22 SeitenMust Read BOPAnushkaa DattaNoch keine Bewertungen

- Critically Assess The Problems of Budget Implementation in NigeriaDokument5 SeitenCritically Assess The Problems of Budget Implementation in NigeriaOketa Daniel83% (6)

- Introduction To The Federal Budget ProcessDokument9 SeitenIntroduction To The Federal Budget ProcessDulguun BaasandavaaNoch keine Bewertungen

- Philippine Budget ProcessDokument44 SeitenPhilippine Budget Processfrancis ralph valdezNoch keine Bewertungen

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Von EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Noch keine Bewertungen

- Hope To See From Super CommitteeDokument19 SeitenHope To See From Super CommitteeCommittee For a Responsible Federal BudgetNoch keine Bewertungen

- Fifth Five Year PlanDokument3 SeitenFifth Five Year PlanNavaneeth KrishnanNoch keine Bewertungen

- GovAcc HO No. 2 - The Philippine Budget CycleDokument9 SeitenGovAcc HO No. 2 - The Philippine Budget Cyclebobo kaNoch keine Bewertungen

- Budget Deficit ThesisDokument5 SeitenBudget Deficit ThesisErica Thompson100% (1)

- Setting The Right Course in The Next Budget AgreementDokument30 SeitenSetting The Right Course in The Next Budget AgreementCenter for American ProgressNoch keine Bewertungen

- The Role of Accounting in National DevelopmentDokument14 SeitenThe Role of Accounting in National DevelopmentPushpa BaruaNoch keine Bewertungen

- PNG Budget Manual: Government of Papua New GuineaDokument32 SeitenPNG Budget Manual: Government of Papua New GuineaALEWA CEDRICNoch keine Bewertungen

- DeficitReduction ScreenDokument46 SeitenDeficitReduction ScreenPeggy W SatterfieldNoch keine Bewertungen

- Assignment OquaDokument7 SeitenAssignment OquaOqua 'Fynebuoy' EtimNoch keine Bewertungen

- Budget LegislationDokument3 SeitenBudget LegislationMitch Flores AlbisoNoch keine Bewertungen

- Lecture Notes: Chapter 14: The Budget Balance, The National Debt, and InvestmentDokument14 SeitenLecture Notes: Chapter 14: The Budget Balance, The National Debt, and InvestmentNatia TsikvadzeNoch keine Bewertungen

- Presidents Budget FY05Dokument9 SeitenPresidents Budget FY05Committee For a Responsible Federal BudgetNoch keine Bewertungen

- HOMEWORKDokument4 SeitenHOMEWORKcyralizmalaluanNoch keine Bewertungen

- Chapter 4Dokument6 SeitenChapter 4Yitera SisayNoch keine Bewertungen

- The Budget Process & The Philippine CongressDokument5 SeitenThe Budget Process & The Philippine CongressSimon WolfNoch keine Bewertungen

- Essentials of The Budget Process of The State GovernmentDokument28 SeitenEssentials of The Budget Process of The State GovernmentbermazerNoch keine Bewertungen

- Reflection PaperDokument5 SeitenReflection PaperJoice RuzolNoch keine Bewertungen

- Chen Et Al 2009 Ch1-The Craft of BudgetingDokument28 SeitenChen Et Al 2009 Ch1-The Craft of BudgetingReza BayuajiNoch keine Bewertungen

- HBCTestimony Mac Guineas September 2008Dokument9 SeitenHBCTestimony Mac Guineas September 2008Committee For a Responsible Federal BudgetNoch keine Bewertungen

- Diagnosis and Treatment of Puerto Rico's Fiscal Crisis - VsenateDokument7 SeitenDiagnosis and Treatment of Puerto Rico's Fiscal Crisis - VsenateAlfonso A. Orona AmiliviaNoch keine Bewertungen

- Hidden Spending: The Politics of Federal Credit ProgramsVon EverandHidden Spending: The Politics of Federal Credit ProgramsNoch keine Bewertungen

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentVon EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentBewertung: 1 von 5 Sternen1/5 (1)

- The United States Government Shutdowns and Emergency Declarations: Facts to RememberVon EverandThe United States Government Shutdowns and Emergency Declarations: Facts to RememberNoch keine Bewertungen

- Low & High Context Culture (Adnan)Dokument5 SeitenLow & High Context Culture (Adnan)PrinceakhtarNoch keine Bewertungen

- Latin AmericaDokument21 SeitenLatin AmericaPrinceakhtarNoch keine Bewertungen

- Mahmood Textile MillsDokument118 SeitenMahmood Textile MillsPrinceakhtarNoch keine Bewertungen

- Harms of GlobalizationDokument13 SeitenHarms of GlobalizationPrinceakhtarNoch keine Bewertungen

- Tax PresentationDokument21 SeitenTax PresentationSumeet TamrakarNoch keine Bewertungen

- Public RevenueDokument17 SeitenPublic RevenueNamrata More100% (1)

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Business and Transfer Taxation Quiz Assignment #2 AY 2021-2022Dokument4 SeitenColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Business and Transfer Taxation Quiz Assignment #2 AY 2021-2022Ervin Jay ManuelNoch keine Bewertungen

- GST ChallanDokument1 SeiteGST Challanrajender kumarNoch keine Bewertungen

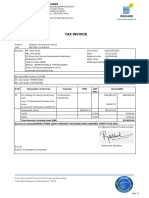

- Total Amount Due: Tax InvoiceDokument2 SeitenTotal Amount Due: Tax InvoiceHikmat RahimovNoch keine Bewertungen

- Invoice 1Dokument1 SeiteInvoice 1Birdhi ChandNoch keine Bewertungen

- Payslip March 2023Dokument1 SeitePayslip March 2023kaushalNoch keine Bewertungen

- Direct TaxesDokument7 SeitenDirect Taxessebastian mlingwaNoch keine Bewertungen

- Shivani Jain: Work Experience SkillsDokument1 SeiteShivani Jain: Work Experience SkillsThe Cultural CommitteeNoch keine Bewertungen

- One Two Three MagicDokument1 SeiteOne Two Three Magickelle brassartNoch keine Bewertungen

- Shashank GuptaDokument2 SeitenShashank GuptaThe Cultural CommitteeNoch keine Bewertungen

- Concept of Income TaxDokument28 SeitenConcept of Income TaxLau AngelNoch keine Bewertungen

- Basis PeriodDokument11 SeitenBasis PeriodLyana InaniNoch keine Bewertungen

- Dof-Train With TrabahoDokument56 SeitenDof-Train With TrabahoMariver LlorenteNoch keine Bewertungen

- Downloadfile 30 PDFDokument114 SeitenDownloadfile 30 PDFYianniAnd Sophia0% (1)

- InvoiceDokument1 SeiteInvoicealok singhNoch keine Bewertungen

- EXFO FTB-8510G Packet Blazer 10G Ethernet TestmodulDokument2 SeitenEXFO FTB-8510G Packet Blazer 10G Ethernet TestmodulPhilip SiefkeNoch keine Bewertungen

- Annex C RR 11-2018Dokument1 SeiteAnnex C RR 11-2018KB WorldNoch keine Bewertungen

- Adobe Scan 14 Feb 2024Dokument2 SeitenAdobe Scan 14 Feb 2024anusha.veldandiNoch keine Bewertungen

- 11th BPS Arrears Income Tax Relief 89 1 RajManglamDokument8 Seiten11th BPS Arrears Income Tax Relief 89 1 RajManglamShubhamGuptaNoch keine Bewertungen

- Income and Business Taxation: GradeDokument9 SeitenIncome and Business Taxation: GradeTinny Casana100% (1)

- 2018-19 - Part B - 1Dokument4 Seiten2018-19 - Part B - 1Shivam DixitNoch keine Bewertungen

- EXCEL INC TAX FinalDokument2 SeitenEXCEL INC TAX FinalLysss EpssssNoch keine Bewertungen

- Public Finance PolyDokument65 SeitenPublic Finance PolyNeelabh KumarNoch keine Bewertungen

- Vaidehi Kishori Vikas Telugu PamphletDokument2 SeitenVaidehi Kishori Vikas Telugu PamphletSevaBharathiTelanganaNoch keine Bewertungen

- Preferential Taxation - Double Taxation AgreementDokument3 SeitenPreferential Taxation - Double Taxation AgreementKezNoch keine Bewertungen

- 202212-Tax Return Transcript-DARA-104758594023Dokument7 Seiten202212-Tax Return Transcript-DARA-104758594023tironatirona455Noch keine Bewertungen

- Tax Case ListDokument3 SeitenTax Case ListSham GaerlanNoch keine Bewertungen

- Government Without Any Expectation of Direct Return in Benefit ". Ability To Pay. Taxed in The Same Way Without Any DiscriminationDokument42 SeitenGovernment Without Any Expectation of Direct Return in Benefit ". Ability To Pay. Taxed in The Same Way Without Any DiscriminationyebegashetNoch keine Bewertungen

- (Cpar2016) Tax-8002 (Individual Taxpayer)Dokument10 Seiten(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNoch keine Bewertungen