Beruflich Dokumente

Kultur Dokumente

7.11.14 Syncora Bankruptcy Appeal

Hochgeladen von

WDET 101.9 FM0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

148 Ansichten3 SeitenU.S. District Judge Bernard Friedman denied bond insurer Syncora's request to have casino tax revenue released and not protected/frozen in the city's bankruptcy case.

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenU.S. District Judge Bernard Friedman denied bond insurer Syncora's request to have casino tax revenue released and not protected/frozen in the city's bankruptcy case.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

148 Ansichten3 Seiten7.11.14 Syncora Bankruptcy Appeal

Hochgeladen von

WDET 101.9 FMU.S. District Judge Bernard Friedman denied bond insurer Syncora's request to have casino tax revenue released and not protected/frozen in the city's bankruptcy case.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DISTRICT

SYNCORA GUARANTEE INC.

and SYNCORA CAPITAL

ASSURANCE INC.,

Civil Action No. 13-CV-14305

Appellants, HON. BERNARD A. FRIEDMAN

Bankr. No. 13-53846

v. HON. STEVEN W. RHODES

CITY OF DETROIT, MICHIGAN,

Appellee.

_____________________________/

OPINION AND ORDER AFFIRMING THE BANKRUPTCY COURTS

AUGUST 28, 2013, ORDER

I. Introduction

Syncora Guarantee Inc. and Syncora Capital Assurance Inc. (Syncora) appeal from an

August 28, 2013, order of the bankruptcy court, which determined that certain casino tax revenues

are property of the bankruptcy estate and, therefore, subject to the automatic stay provided in 11

U.S.C. 362(a)(3). Syncora filed a brief in support of the appeal [docket entry 3]. The City of

Detroit (the City) filed a brief in response [docket entry 5] and Syncora filed a reply [docket entry

6].

In granting Syncoras petition for a writ of mandamus, the Sixth Circuit Court of Appeals

ordered this Court to vacate the stay it had earlier imposed in this case [docket entry 7] and decide

the merits of the appeal. See In Re Syncora Guar. Inc., No. 14-1719, 2014 U.S. App. LEXIS 12557

(6th Cir. J ul. 2, 2014). Since the Court has now had the opportunity to independently review the

factual record, and finds that the Sixth Circuits opinion accurately recites the underlying facts, the

-1-

Court will adopt the summary of the factual record as it appears in the Sixth Circuits opinion. See

id. at *2-8.

II. Standard of Review

The Court has appellate jurisdiction pursuant to 28 U.S.C. 158 and reviews a bankruptcy

courts factual findings for clear error and its conclusions of law de novo. See In re Cook, 457 F.3d

561, 565 (6th Cir. 2006); In re Musilli, 398 B.R. 447, 452-53 (E.D. Mich. 2008). Because the facts

of the case are undisputed, and Syncora merely challenges the bankruptcy courts legal conclusions,

the Court reviews those conclusions de novo.

III. Analysis

On appeal, Syncora contends that the casino tax revenues are not the property of the

bankruptcy estate because the lockbox procedure, whereby the City deposited its swap obligation

payments into one third-party custodial account in exchange for the release of the casino tax

revenues deposited into another such account, is akin to an escrow arrangement that merely

endowed the City with a contingent right to receive the deposited revenues. Syncora also maintains

that the casino tax revenues are exempt from the automatic stay pursuant to 11 U.S.C. 922(d).

With respect to the first argument, the bankruptcy court properly determined that the

lockbox mechanism does not constitute an escrow arrangement. Under New York law,

1

one of

the essential characteristics of an escrow arrangement is that [t]he incidents of ownership remain in

the person depositing the property into escrow until the conditions of the escrow agreement are

fulfilled. 55 NY J urisprudence 2d, Escrows 9 (citing 99 Commercial Street, Inc. v. Goldberg, 811

F. Supp. 900, 906 (S.D.N.Y. 1993). That is simply not the case here. The collateral agreement

required the casinos to deposit the tax revenues into the general receipts subaccount and there is

1

The parties agree that the rights and obligations arising under the collateral agreement are

governed by New York law. See R-1, Ex. 6 14.10(a).

-2-

nothing in the agreement indicating that the casinos, thereafter, retained any form of ownership

interest in those revenues. See R-1, Ex. 6 5.1.

Regarding the second argument, the bankruptcy court correctly held that the automatic stay

exemption found in 11 U.S.C. 922(d) is inapplicable. Section 922(d) provides that the filing of a

chapter 9 municipal bankruptcy petition does not operate as a stay of application of pledged special

revenues . . . to payment of indebtedness secured by such revenues. Assuming, without deciding,

that Syncora possesses the requisite standing to invoke section 922(d) (which the Court strongly

doubts), the statute has no bearing on the use of the casino tax revenues to secure the Citys swap

obligation payments. This is because one of the main purposes of section 922(d) is to ensure the

protection in chapter 9 cases of a pledge of special revenues under revenue bonds, 6 Collier on

Bankruptcy 922.05[1] (Alan N. Resnick & Henry J . Sommer eds., 16th ed.), and the Citys swap

obligation was not a form of indebtedness issued to either the swap counterparties or the swap

insurer, Syncora.

Accordingly,

IT IS ORDERED that the stay imposed in this matter is hereby vacated.

IT IS FURTHER ORDERED that the bankruptcy courts August 28, 2013, order is affirmed.

Dated: J uly 11, 2014 S/ Bernard A. Friedman

Detroit, Michigan BERNARD A. FRIEDMAN

SENIOR UNITED STATES DISTRICT J UDGE

-3-

Das könnte Ihnen auch gefallen

- Detroit Food Metrics ReportDokument42 SeitenDetroit Food Metrics ReportWDET 101.9 FM100% (6)

- Gretchen Whitmer DJC Interview TranscriptDokument15 SeitenGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNoch keine Bewertungen

- Deliver/ Note NumberDokument15 SeitenDeliver/ Note Numberleaderwithin100% (1)

- Mbia/assured Guaranty Complaint Re GO Unsecured Status in Detroit Bankruptcy Case PDFDokument31 SeitenMbia/assured Guaranty Complaint Re GO Unsecured Status in Detroit Bankruptcy Case PDFChris HerzecaNoch keine Bewertungen

- Eumulgin CO 40Dokument3 SeitenEumulgin CO 40lissethNoch keine Bewertungen

- The Role of Marketing Strategy in Determining Consumer Purchasing BehaviourDokument80 SeitenThe Role of Marketing Strategy in Determining Consumer Purchasing BehaviourSourav Mandal100% (2)

- Design of Goods and ServicesDokument6 SeitenDesign of Goods and Serviceschubel100% (2)

- Citicorp (Usa), Inc. and Southeast Bank, N.A. v. Davidson Lumber Company, Florida Steel Corp., 718 F.2d 1030, 11th Cir. (1983)Dokument5 SeitenCiticorp (Usa), Inc. and Southeast Bank, N.A. v. Davidson Lumber Company, Florida Steel Corp., 718 F.2d 1030, 11th Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- In Re H & H Beverage Distributors v. Department of Revenue of the Commonwealth of Pennsylvania. Appeal of Commonwealth of Pennsylvania, Pennsylvania Department of Revenue, 850 F.2d 165, 3rd Cir. (1988)Dokument9 SeitenIn Re H & H Beverage Distributors v. Department of Revenue of the Commonwealth of Pennsylvania. Appeal of Commonwealth of Pennsylvania, Pennsylvania Department of Revenue, 850 F.2d 165, 3rd Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- EVALUATE THE ASSIGNMENTS SAYS THE SUPREME COURT - Carl Piazza v. Citimortgage - Supreme Court "Mediation, Directs Dist. Ct. To Evaluate AssignmentsDokument4 SeitenEVALUATE THE ASSIGNMENTS SAYS THE SUPREME COURT - Carl Piazza v. Citimortgage - Supreme Court "Mediation, Directs Dist. Ct. To Evaluate Assignments83jjmackNoch keine Bewertungen

- U.S. Atttorney Seeks Over $1.6 Million in Fines From WestchesterDokument38 SeitenU.S. Atttorney Seeks Over $1.6 Million in Fines From WestchestertauchterlonieDVNoch keine Bewertungen

- Filed: Patrick FisherDokument17 SeitenFiled: Patrick FisherScribd Government DocsNoch keine Bewertungen

- Attorneys For Secured Creditor, Capital One, NADokument9 SeitenAttorneys For Secured Creditor, Capital One, NAChapter 11 DocketsNoch keine Bewertungen

- In Re Burden, Wilfred, H., A/K/A Burden, Wilfred, H., JR., T/a Burden's Janitorial Service & Supply Company v. The United States of America, 917 F.2d 115, 3rd Cir. (1990)Dokument14 SeitenIn Re Burden, Wilfred, H., A/K/A Burden, Wilfred, H., JR., T/a Burden's Janitorial Service & Supply Company v. The United States of America, 917 F.2d 115, 3rd Cir. (1990)Scribd Government DocsNoch keine Bewertungen

- Holmes v. Securities Investor Protection Corporation, 503 U.S. 258 (1992)Dokument27 SeitenHolmes v. Securities Investor Protection Corporation, 503 U.S. 258 (1992)Scribd Government DocsNoch keine Bewertungen

- 84 A - GaronDokument6 Seiten84 A - GaronBibi JumpolNoch keine Bewertungen

- David Braka, Ivor Braka, Murray Braka, Moises Braka, Isaac Braka, Percy N. Scherr, Lisa Bogart and Susan Bogart v. Bancomer, S.N.C., 762 F.2d 222, 2d Cir. (1985)Dokument6 SeitenDavid Braka, Ivor Braka, Murray Braka, Moises Braka, Isaac Braka, Percy N. Scherr, Lisa Bogart and Susan Bogart v. Bancomer, S.N.C., 762 F.2d 222, 2d Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- Gordon R. and Sharon L. Flygare, Debtors-Appellants v. Judith A. Boulden, 709 F.2d 1344, 10th Cir. (1983)Dokument6 SeitenGordon R. and Sharon L. Flygare, Debtors-Appellants v. Judith A. Boulden, 709 F.2d 1344, 10th Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- 8 169968-2014-Federal Builders Inc. v. FoundationDokument10 Seiten8 169968-2014-Federal Builders Inc. v. FoundationSarah C.Noch keine Bewertungen

- Not PrecedentialDokument11 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Objection of New Jersey Department of TreasuryDokument5 SeitenObjection of New Jersey Department of TreasuryDealBookNoch keine Bewertungen

- Juris Remaining CasesDokument15 SeitenJuris Remaining CasesApureelRoseNoch keine Bewertungen

- Marriott vs. Eden RocDokument6 SeitenMarriott vs. Eden Rocs2888m100% (1)

- China Banking Corporation vs. Commissioner of Internal RevenueDokument5 SeitenChina Banking Corporation vs. Commissioner of Internal RevenueNash LedesmaNoch keine Bewertungen

- 37 Collier bankr.cas.2d 713, Bankr. L. Rep. P 77,290 Lamar A. McCartney v. Integra National Bank North, Successor to McDowell National Bank Gary J. Gaertner, U.S. Trustee, 106 F.3d 506, 3rd Cir. (1997)Dokument12 Seiten37 Collier bankr.cas.2d 713, Bankr. L. Rep. P 77,290 Lamar A. McCartney v. Integra National Bank North, Successor to McDowell National Bank Gary J. Gaertner, U.S. Trustee, 106 F.3d 506, 3rd Cir. (1997)Scribd Government DocsNoch keine Bewertungen

- Tila AugustinDokument4 SeitenTila AugustinTA WebsterNoch keine Bewertungen

- #Credittransactionscase-Commonwealth Vs RCBC-CANDELARIADokument16 Seiten#Credittransactionscase-Commonwealth Vs RCBC-CANDELARIAKê MilanNoch keine Bewertungen

- 131918-1989-Servicewide Specialists Inc. v. Intermediate20210424-12-1qrg1efDokument11 Seiten131918-1989-Servicewide Specialists Inc. v. Intermediate20210424-12-1qrg1efboy abundaNoch keine Bewertungen

- Microsoft Corporation v. Bristol Technology, Inc., 250 F.3d 152, 2d Cir. (2001)Dokument5 SeitenMicrosoft Corporation v. Bristol Technology, Inc., 250 F.3d 152, 2d Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Guaranty and Suretyship CasesDokument23 SeitenGuaranty and Suretyship CasesPrincess Ayoma100% (1)

- GR 166058 April 2007Dokument11 SeitenGR 166058 April 2007Jocelyn Desiar NuevoNoch keine Bewertungen

- Robinson Bank Corporation V GalonoDokument6 SeitenRobinson Bank Corporation V GalonoFroilanVFaurilloNoch keine Bewertungen

- Petitioner Respondent: Second DivisionDokument9 SeitenPetitioner Respondent: Second DivisionPreciousGanNoch keine Bewertungen

- US Trustee Objection To Las Vegas Monorail BankruptcyDokument17 SeitenUS Trustee Objection To Las Vegas Monorail BankruptcyToohoolNoch keine Bewertungen

- S9uprtmt QI:ourt: 3republic Toe BilippinesDokument14 SeitenS9uprtmt QI:ourt: 3republic Toe BilippinesMonocrete Construction Philippines, Inc.Noch keine Bewertungen

- G.R. No. 130886Dokument6 SeitenG.R. No. 130886Julian DubaNoch keine Bewertungen

- Jay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Dokument13 SeitenJay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Scribd Government DocsNoch keine Bewertungen

- Credtrans Finals CasesDokument114 SeitenCredtrans Finals Cases001nooneNoch keine Bewertungen

- G.R. No. 195064 January 15, 2014 NARI K. GIDWANI, Petitioner, People of The Philippines, RespondentDokument6 SeitenG.R. No. 195064 January 15, 2014 NARI K. GIDWANI, Petitioner, People of The Philippines, RespondentShari ThompsonNoch keine Bewertungen

- Tcherepnin v. Knight, 389 U.S. 332 (1967)Dokument12 SeitenTcherepnin v. Knight, 389 U.S. 332 (1967)Scribd Government DocsNoch keine Bewertungen

- 2016-03-21 - MTD Unconsionable ContractDokument9 Seiten2016-03-21 - MTD Unconsionable ContractA. CampbellNoch keine Bewertungen

- Insurance Full CasesDokument65 SeitenInsurance Full CasesAR ReburianoNoch keine Bewertungen

- In Re: Montgomery Ward Holding Corp. Debtor Centerpoint Properties v. Montgomery Ward Holding Corp, 268 F.3d 205, 3rd Cir. (2001)Dokument13 SeitenIn Re: Montgomery Ward Holding Corp. Debtor Centerpoint Properties v. Montgomery Ward Holding Corp, 268 F.3d 205, 3rd Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Homelink (Private) Limited V Maputseni (4 of 2022) (2022) ZWSC 4 (18 January 2022)Dokument15 SeitenHomelink (Private) Limited V Maputseni (4 of 2022) (2022) ZWSC 4 (18 January 2022)toga22Noch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument5 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- United States of America On Behalf of Its Agency Internal Revenue Service v. William H. Norton, Carrie W. Norton, F/k/a Carrie A. Woodward, 717 F.2d 767, 3rd Cir. (1983)Dokument11 SeitenUnited States of America On Behalf of Its Agency Internal Revenue Service v. William H. Norton, Carrie W. Norton, F/k/a Carrie A. Woodward, 717 F.2d 767, 3rd Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- Country Bankers Insurance CorporationDokument11 SeitenCountry Bankers Insurance CorporationolofuzyatotzNoch keine Bewertungen

- The First National Bank of Chicago v. Commissioner of Internal Revenue, 546 F.2d 759, 1st Cir. (1977)Dokument9 SeitenThe First National Bank of Chicago v. Commissioner of Internal Revenue, 546 F.2d 759, 1st Cir. (1977)Scribd Government DocsNoch keine Bewertungen

- Initial Decision in SEC Enforcement Action Against Former Stanford Group Company Executive Jay ComeauxDokument6 SeitenInitial Decision in SEC Enforcement Action Against Former Stanford Group Company Executive Jay ComeauxStanford Victims CoalitionNoch keine Bewertungen

- Elon Musk Motion To StayDokument15 SeitenElon Musk Motion To StayGMG EditorialNoch keine Bewertungen

- Defendants and Counterclaim-Plaintiffs' Motion To Stay Pending Closing of The TransactionDokument15 SeitenDefendants and Counterclaim-Plaintiffs' Motion To Stay Pending Closing of The TransactionTechCrunch0% (2)

- First National Bank of Chicago v. United States, 792 F.2d 954, 1st Cir. (1986)Dokument4 SeitenFirst National Bank of Chicago v. United States, 792 F.2d 954, 1st Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, First CircuitDokument5 SeitenUnited States Court of Appeals, First CircuitScribd Government DocsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument4 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- 2nd Circ SECDokument17 Seiten2nd Circ SECDanRivoliNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument4 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- 19 Asia Production v. Pano - LTDokument9 Seiten19 Asia Production v. Pano - LTLoren Bea TulalianNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument33 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Ontario Inc. v. City of Stratford, No. OLT-22-002455 (Ont. Land Trib. Jan. 11, 2024)Dokument64 SeitenOntario Inc. v. City of Stratford, No. OLT-22-002455 (Ont. Land Trib. Jan. 11, 2024)RHTNoch keine Bewertungen

- MBTC Vs ChiokDokument3 SeitenMBTC Vs ChiokNath AntonioNoch keine Bewertungen

- Protective v. Dignity, 171 F.3d 52, 1st Cir. (1999)Dokument9 SeitenProtective v. Dignity, 171 F.3d 52, 1st Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- 34 Collier Bankr - Cas.2d 328, Bankr. L. Rep. P 76,635 in Re Steve A. Buckner, Debtor. Farmers Home Administration v. Steve A. Buckner, 66 F.3d 263, 10th Cir. (1995)Dokument4 Seiten34 Collier Bankr - Cas.2d 328, Bankr. L. Rep. P 76,635 in Re Steve A. Buckner, Debtor. Farmers Home Administration v. Steve A. Buckner, 66 F.3d 263, 10th Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- 120666-2004-Commonwealth Insurance Corp. v. Court Of20180417-1159-1bm24hr PDFDokument6 Seiten120666-2004-Commonwealth Insurance Corp. v. Court Of20180417-1159-1bm24hr PDFAntoinette Janellie TejadaNoch keine Bewertungen

- Civil CodeDokument51 SeitenCivil CodemynameislianeNoch keine Bewertungen

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1972.Von EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1972.Noch keine Bewertungen

- California Supreme Court Petition: S173448 – Denied Without OpinionVon EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionBewertung: 4 von 5 Sternen4/5 (1)

- Greens RecipeDokument2 SeitenGreens RecipeWDET 101.9 FMNoch keine Bewertungen

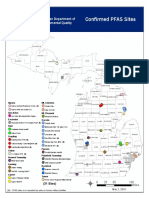

- PFAS in Drinking WaterDokument2 SeitenPFAS in Drinking WaterWDET 101.9 FMNoch keine Bewertungen

- Detroit Census MapDokument1 SeiteDetroit Census MapWDET 101.9 FMNoch keine Bewertungen

- Residential Road Program Introduction 2019Dokument6 SeitenResidential Road Program Introduction 2019WDET 101.9 FMNoch keine Bewertungen

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDokument1 SeiteInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNoch keine Bewertungen

- IRS Tax Reform Basics For Individuals 2018Dokument14 SeitenIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNoch keine Bewertungen

- WDET's Preschool BallotDokument1 SeiteWDET's Preschool BallotWDET 101.9 FMNoch keine Bewertungen

- HUD False ClaimsDokument3 SeitenHUD False ClaimsWDET 101.9 FMNoch keine Bewertungen

- Black GarlicDokument2 SeitenBlack GarlicWDET 101.9 FMNoch keine Bewertungen

- Boil Water Advisory FAQDokument5 SeitenBoil Water Advisory FAQWDET 101.9 FMNoch keine Bewertungen

- MDEQ PFAS Contaminated SitesDokument1 SeiteMDEQ PFAS Contaminated SitesWDET 101.9 FMNoch keine Bewertungen

- GST 4.26.2018Dokument44 SeitenGST 4.26.2018WDET 101.9 FMNoch keine Bewertungen

- Combined Detroit Audit Exec Summary 551188 7Dokument27 SeitenCombined Detroit Audit Exec Summary 551188 7WDET 101.9 FMNoch keine Bewertungen

- (PC) Introduction To Accelerators Included With Success Plans - Presentation PDFDokument23 Seiten(PC) Introduction To Accelerators Included With Success Plans - Presentation PDFharshNoch keine Bewertungen

- Math11 Q3Wk7a FABM1Dokument6 SeitenMath11 Q3Wk7a FABM1Marlyn LotivioNoch keine Bewertungen

- Module-1 Chapter-4: HR Planning & RecruitingDokument43 SeitenModule-1 Chapter-4: HR Planning & Recruitingmehul75% (4)

- Service & Rate GUIDE 2020: ThailandDokument23 SeitenService & Rate GUIDE 2020: ThailandTeravut SuwansawaipholNoch keine Bewertungen

- BM Module 1 CommissionsDokument15 SeitenBM Module 1 CommissionsHp laptop sorianoNoch keine Bewertungen

- Brand Dossier: Dove SoapDokument23 SeitenBrand Dossier: Dove SoapNYRA SINGHNoch keine Bewertungen

- Project 2 - Recommendation ReportDokument3 SeitenProject 2 - Recommendation ReportHiba KassabNoch keine Bewertungen

- Assignment #2 - EMI and The CT Scanner Group CDokument2 SeitenAssignment #2 - EMI and The CT Scanner Group Cmohsen bukNoch keine Bewertungen

- Shweta Prakash PDFDokument79 SeitenShweta Prakash PDFdona biswasNoch keine Bewertungen

- As - Unit 5 UPDATED For May 2024 - Syllabus UpdatedDokument36 SeitenAs - Unit 5 UPDATED For May 2024 - Syllabus UpdatedfahadkhanthegreatNoch keine Bewertungen

- CRM in Samsung TVDokument16 SeitenCRM in Samsung TVkabita singhNoch keine Bewertungen

- Problems For Algorithm DevelopmentDokument3 SeitenProblems For Algorithm DevelopmentNathaniel CorderoNoch keine Bewertungen

- The Nature of The Firm SummariesDokument3 SeitenThe Nature of The Firm Summariesnitins_89Noch keine Bewertungen

- The Product Strategy Playbook by ProductPlan PDFDokument32 SeitenThe Product Strategy Playbook by ProductPlan PDFWilliam O OkolotuNoch keine Bewertungen

- RIYA Calling Data Open Pool April 2022Dokument1.086 SeitenRIYA Calling Data Open Pool April 2022priti palNoch keine Bewertungen

- EYGDS India Candidate Information SheetDokument27 SeitenEYGDS India Candidate Information SheetChahat PuriNoch keine Bewertungen

- Ratios Analysis Abhinav Srivastava CT1 FMand PDokument7 SeitenRatios Analysis Abhinav Srivastava CT1 FMand PAbhinav srivastavaNoch keine Bewertungen

- EABD MCQs DIMRDokument37 SeitenEABD MCQs DIMRAkshada BidkarNoch keine Bewertungen

- KK Krishna Prajapati 2019 NewDokument4 SeitenKK Krishna Prajapati 2019 Newkrishna prajapatiNoch keine Bewertungen

- ISFDirectory2020ONLINE 4Dokument276 SeitenISFDirectory2020ONLINE 4Marc ThomasNoch keine Bewertungen

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Dokument8 SeitenAllama Iqbal Open University, Islamabad (Department of Business Administration)apovtigrtNoch keine Bewertungen

- Consumer Behavior Quiz (01-16-21)Dokument3 SeitenConsumer Behavior Quiz (01-16-21)litNoch keine Bewertungen

- Barco Projection Systems Case StudyDokument1 SeiteBarco Projection Systems Case StudyHammad AqdasNoch keine Bewertungen

- Iprospect DigitalPerformanceReport Q12019 PDFDokument27 SeitenIprospect DigitalPerformanceReport Q12019 PDFtheghostinthepostNoch keine Bewertungen

- General Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyDokument2 SeitenGeneral Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyRegine BaterisnaNoch keine Bewertungen

- Inventory - Gross Profit - Retail MethodDokument6 SeitenInventory - Gross Profit - Retail MethodaleywaleyNoch keine Bewertungen