Beruflich Dokumente

Kultur Dokumente

Investor Presentation Handout Post Q4 FY14 Results

Hochgeladen von

Ritesh Kumar PatroCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investor Presentation Handout Post Q4 FY14 Results

Hochgeladen von

Ritesh Kumar PatroCopyright:

Verfügbare Formate

M&M Investor Presentation Handout

1

The following presentations is a compilation of individual presentations

made by

-Mr. V. S. Parthasarathy, Chief Financial Officer, Group CIO, EVP Group M&A,

Member of the Group Executive Board

-Mr. P. N. Shah, Chief Executive, Automotive Sector

-Mr. Rajesh Jejurikar, Chief Executive, Farm Equipment Sector

at Annual Analyst Meet held on 30

th

May, 2014

2

Theme

Green shoots

Hope

Performance amidst adversity

Standalone Financials

Consolidated Financials

Zero Trauma in Turbulence

Consistent Strong Financial Metrics

Value Creation

Milestone & Achievement

3

4

GDP Currency

2013 2012 2013 2012

Brazil 1.93 1.83 2.36 2.05

Russia 1.3 3.4 32.9 30.56

India 4.5 6.7 61.89 54.79

China 7.7 7.9 6.06 6.23

5

World economy outlook

2014 2015

World Output 3.6 3.9

USA 2.8 3.0

Euro Area 1.2 1.5

Brazil 1.8 2.7

Russia 1.3 2.3

India 5.4 6.4

China 7.5 7.3

Source: IMF world economic outlook April 2014

Recovery Strengthens, Remains Uneven

6

Stability in Indian environment

Exports showing traction

Rupee stable to strong

Rural economy as a driver

7

Glimmer of Hopes

Policy actions on FDI / Investments / GST etc. will it be fast tracked?

Financing Cost will reduce

Thrust on Infrastructure Investments

With emergence of stability, estimates of GDP (5.4%) may be bettered

The Return of Optimism

8

9

Mahindra

Tower

10

Mahindra

Tower

...in 10 business sectors...

Mahindra Partners (Steel,

Retail, Trade, Logistics, Boats,

Energy, Media)

Defence Systems

Automotive

Aftermarket

Financial Services

Hospitality

Systech

Information Technology

Real Estate

Farm Equipment

11

12

Life Insurance Corporation of India

First State Investments

Golboot Holdings Ltd (Goldman Sachs)

J P Morgan Group

Dodge & Cox

Capital Group

ICICI Prudential Life Insurance Ltd

Government of Singapore

Abu Dhabi Investment Authority

GIC, India

Top 10 Shareholders with > 1%

Shareholding Patternas on 31

st

March 2014

Promoter

and

Promoter

Group

25.3%

FII / NRI /

GDR

45.6%

Insurance

Cos.

14.3%

FI / MF /

Banks

1.5%

Individuals

13.3%

13

Industry Growth

Auto Industry in downward spiral

FY 14 FY 13 FY 12

Passenger Vehicle -6.1% 1.3% 4.7%

CVs -20.2% -2.0% 18.2%

3 Wheelers -10.9% 4.9% -2.4%

Industry (Excl. 2 Wheelers) -9.5% 1.7% 6.2%

Sharpest fall

since 1976

14

To stand against all adversity is the most sacred moment

of existence

15

Strong Growth Trajectory

Gross Revenue & Other Income

PAT

2,068

2,687

2,997

3,634

3,905

FY10 FY11 FY12 FY13 FY14

M&M + MVML (Standalone)

20,735

26,201

35,005

43,655 43,256

FY10 FY11 FY12 FY13 FY14

EBITDA

2,965

3,621

4,150

5,329

5,248

FY10 FY11 FY12 FY13 FY14

16

Strong Growth Trajectory

Gross Revenue & Other Income

PAT after MI

2,479

3,080 3,127

4,099

4,667

FY10 FY11 FY12 FY13 FY14

Consolidated Accounts

33,790

39,864

63,358

74,361

78,736

FY10 FY11 FY12 FY13 FY14

EBITDA

5,015

5,449

6,245

7,449

7,843

FY10 FY11 FY12 FY13 FY14

17

Generating robust EPS growth

Note: Adjusted for Bonus & Stock-split

2.7

2.2

3.1

7.5

11.5

19.0

22.6

23.1

15.9

38.0

46.6

51.0

61.6

66.2

2001 2004 2007 2010 2014

18

Our businesses are leaders in

their industries

19

XUV 5OO Quanto Xylo Scorpio

Thar Bolero Verito

Rexton

In UV Segment, Q4

Market Share @ 43.3%

20

21

22

Mahindra Holidays &

Resorts India Limited

23

24

25

26

Financials Snapshots

27

Mahindra Trucks & Buses

(MTBL)

De-merger Rationale

Operational efficiency

Financial benefits

Quarterly Performance M&M + MVML Snapshot

Total Income

EBIDTA

PAT 976

1,400

10,137

Q4 FY 14 Q4 FY 13

10,085

1,435

963

1.3%

2.4%

0.5%

Without MTBL

Merger

OPM 13.98% 14.38%

28

Quarterly Performance M&M + MVML Snapshot

Total Income

EBIDTA

PAT 976

1,400

10,137

Q4 FY 14 Q4 FY 13

10,085

1,435

963

1.3%

2.4%

0.5%

0.5%

26.1%

2.4%

Without MTBL

Merger

OPM 13.98% 14.38%

968

1,060

10,322

Q4 FY 14

With MTBL

10.38%

29

Yearly Performance M&M + MVML Snapshot

Total Income

EBIDTA

PAT 3,913

5,588

39,297

FY 14 FY 13

38,926

5,329

3,634

7.7%

4.9%

1.0%

Without MTBL

Merger

OPM 14.47% 13.89%

30

Yearly Performance M&M + MVML Snapshot

Total Income

EBIDTA

PAT 3,913

5,588

39,297

FY 14 FY 13

38,926

5,329

3,634

7.4%

1.5%

1.4%

Without MTBL

Merger

OPM 14.47% 13.89%

3,905

5,248

39,482

FY 14

With MTBL

13.52%

31

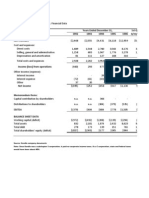

Performance Indicators

Particulars F 2014 F 2013

OPM (%) 13.52 13.89

ROCE (%) 22.16 26.77

Interest Coverage Ratio (x) 14.91 16.08

Debt / Service Ratio (x) 5.67 6.63

EPS (Basic) (Rs.) 66.15 61.63

Book Value (Rs.) 293.26 254.85

32

33 Copyright 2013 Mahindra & Mahindra Ltd. All rights reserved. 33

F-2014

Consolidated Result

Rs. 5,154 crs

Rs. 4,129 crs

25%

Financial Highlights

Total income

Rs. 78,736 crs

Rs. 74,361 crs

6%

M&M Consolidated FY 14 vs. FY 13

Rs. 7,843 crs

Rs. 7,449 crs

5%

EBIDTA

PAT before MI

34

Rs crs

Subsidiary Company Results

# includes share in profits of Associates

F 2014 F 2013

% Inc/

(Dec)

Net Revenue 40,249 35,813 9%

PAT before MI # 1,457 754 93%

PAT after MI # 972 596 63%

35

Listed companies continues to perform

F14 Rs.954 crs

F13 Rs.927 crs

F14 Rs 101 crs

F13 Rs 141 crs

F14 Rs.3,029 crs

F13 Rs.1,956 crs

F14 Rs.87 crs

F13 Rs.91 crs

36

Other unlisted companies growing in strength..

Last 5 years PAT. CAGR

Mahindra Rural Housing Finance 92%

Mahindra Insurance 40%

Mahindra South Africa 80%

Mahindra Engineering Service 11%

Mahindra World City Jaipur 32%

37

2281

2878 2934

3563

0

500

1000

1500

2000

2500

3000

3500

4000

2010 2011 2012 2013

Q1 CY 14 Performance

Revenue 14.5%

Operating loss reduced by 95.5% and

a net current profit of 10.7 billion won

SYMC continues upward journey

Revenue Billion won

38

Consolidated Segment Report

39

41798

44875

35000

37000

39000

41000

43000

45000

47000

2330

2358

1000

1500

2000

2500

13825

16884

10000

11000

12000

13000

14000

15000

16000

17000

18000

1828

2480

1000

1500

2000

2500

3000

Farm Equipment

4117

5306

3000

4000

5000

6000

1284

1461

500

1000

1500

2000

Segment Revenue

Segment Result

Automotive

FY13 FY14

FY13 FY14

Financial Service

FY13 FY14

FY13 FY14

FY13 FY14 FY13

FY14

7% 22%

29%

1% 36% 14%

40

727

817

500

1000

141

121

50

100

150

754

722

200

500

800

243

161

100

200

300

IDS

1423

1298

500

1000

1500

88

95

50

70

90

110

Hospitality

FY13 FY14 FY13 FY14

Steel Trading

FY13

FY14

FY13 FY14 FY13 FY14 FY13

FY14

12%

-4% -9%

-15% -34% 8%

Segment Revenue

Segment Result

41

2851

3208

2000

2500

3000

3500

-295

-502

100

200

300

400

500

600

Others

FY13 FY14

FY13 FY14

-70%

13%

Segment Revenue

Segment Result

42

Segment Revenue

Segment Result

-44

-27

10

40

70

100

4994

3812

2000

3000

4000

5000

6000

Systech

FY13 FY14

FY13 FY14

-24%

40%

222

30

-50

0

50

100

150

200

250

FY13 FY14

1494

292

200

500

800

1100

1400

IT Services

FY13 FY14

-80%

-86%

43

Segment Revenue

Segment Result

-50

0

50

100

150

200

250

-44

-27

10

40

70

100

1494

292

200

500

800

1100

1400

4994

3812

2000

3000

4000

5000

6000

Systech

FY14

FY14

IT Services

FY13

FY13

FY14 FY13

FY13

FY14

-24% -80%

40% -86%

14608

19123

12000

14000

16000

18000

20000

4994

5169

3000

3500

4000

4500

5000

5500

FY14

-44

-34

10

110

Systech

FY13

FY13 FY14

2702

3692

2300

2800

3300

3800

IT Services

FY13

FY14

FY13

FY14

4%

23% 37%

31%

44

Zero Trauma in Turbulence

Achieving Zero Trauma

45

30.9

28.1

23.3

24.7 23.6

25.5

20.3

15.7

17.6

17.2

10

15

20

25

30

35

40

2010 2011 2012 2013 2014

M&M + MVML M&M Consolidated

Healthy ROE

46

0.28

0.32

0.37

0.30 0.45

0.01

0.09

0.17

0.19

0.09

0.41

0.43

0.51 0.51

0.70

(0.25)

(0.05)

0.15

0.35

0.55

0.75

2014 2013 2012 2011 2010

M&M + MVML M&M + MVML (Net) M&M Consolidated

minimal leverage despite huge investments

Debt Equity Ratio

47

India Ratings

& Research

A Fitch Group Company

Top notch Credit Rating.

48

0.45

0.32

0.37

0.30

0.28

F 2010 F 2011 F 2012 F 2013 F 2014

DE Ratio

M&M + MVML

1.12

0.82

0.98

0.76

0.83

F 2010 F 2011 F 2012 F 2013 F 2014

Gearing Multiple

M&M + MVML

Robust Financial Risk Profile

49

50

51

Unlocking Shareholders Value Since 2005

Corporate Actions

Bonus Issue FY 2005

1:1

Stock Split FY 2011 1:2

Original Investment Cost Vs. CMP

31

st

March 2014 31

st

March 2013

Cost Market Value Cost

Market

Value

Listed Companies

Subsidiaries 2,735 15,029 2,994 11,090

Associates 651 11,178 649 6,592

Total 3,386 26,207 3,644 17,683

Rs crs

52

Recent

Value

Unlocking

53

Merger of MES with Tech Mahindra @ swap Ratio of 12:5

M&Ms investment value of Rs. 60 crs in MES is valued at Rs. 633 crs

Mahindra Engineering

Services (MES)

54

Mahindra Logistic

(MLL)

Divestment in MLL : Stake sale + PE Infusion

Investment of Rs. 200 crore for a significant minority stake from Kedaara

Capital.

55

Mahindra CIE Deal

Mahindra CIE Deal

Per Share CMP

Investment in Mahindra CIE Rs. 81 Rs. 106.7

Investment in CIE Spain 6 9.19

56

3.8

9.8

46.7

0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 40.00 45.00 50.00

Gold

Sensex

M&M

Last 5 years

5.1

2.3

1.4

Note: Adjusted for Bonus & Stock-split

Ex Dividend price

Last 11 years

39.5

7.3

3.8

Last 21 years

As at 31

st

March 2014

Delivering consistent, long term value

$/Oz

57

IT 6x

40x

7x

4x

No.1 in Auto

Enhancing shareholders value best among all

Last 11 years

Banking

36x

Mfg. 27x

Pharma

45x

58

Global Leadership Framework

Leadership

Global Presence

Financial Returns

Innovation

59

Global Leadership Framework

Leadership

Global Presence

Financial Returns

Innovation

60

Finance and Accounts Milestones

50 Years Unsecured

NCD with bullet

payment

CIE

Strategic

Alliance

61

Clean sweep for M&M Group with Eight awards at the Fourth Annual CFO 100 Awards 2014

Finance and Accounts Awards

62

"No stars gleam as brightly as those which

glisten in the polar sky. No water tastes so

sweet as that which springs amid the desert

sand. And no faith is so precious as that which

lives and triumphs through adversity

- Charles H Spurgeon

63

Automotive Sector

64

Year of Prolonged Industry Slowdown

Industry down 9.6% (excl. 2W)

PU & 2W : only segments with growth

MHCV : lowest since F09

PV : lowest since F10

65

The Year that was Auto Industry

-14.0%

-6.9% -8.5% -9.6%

-20%

-10%

0%

10%

20%

30%

40%

1

9

7

4

-

7

5

1

9

7

5

-

7

6

1

9

7

6

-

7

7

1

9

7

7

-

7

8

1

9

7

8

-

7

9

1

9

7

9

-

8

0

1

9

8

0

-

8

1

1

9

8

1

-

8

2

1

9

8

2

-

8

3

1

9

8

3

-

8

4

1

9

8

4

-

8

5

1

9

8

5

-

8

6

1

9

8

6

-

8

7

1

9

8

7

-

8

8

1

9

8

8

-

8

9

1

9

8

9

-

9

0

1

9

9

0

-

9

1

1

9

9

1

-

9

2

1

9

9

2

-

9

3

1

9

9

3

-

9

4

1

9

9

4

-

9

5

1

9

9

5

-

9

6

1

9

9

6

-

9

7

1

9

9

7

-

9

8

1

9

9

8

-

9

9

1

9

9

9

-

0

0

2

0

0

0

-

0

1

2

0

0

1

-

0

2

2

0

0

2

-

0

3

2

0

0

3

-

0

4

2

0

0

4

-

0

5

2

0

0

5

-

0

6

2

0

0

6

-

0

7

2

0

0

7

-

0

8

2

0

0

8

-

0

9

2

0

0

9

-

1

0

2

0

1

0

-

1

1

2

0

1

1

-

1

2

2

0

1

2

-

1

3

2

0

1

3

-

1

4

Indian Auto Industry (excluding 2W)

Worst since 1976

Source: SIAM

66

The Year that was Auto Industry

Auto (total) and Personal Vehicle Industry

273

315

364

554

526

F10 F11 F12 F13 F14

Utility Vehicles Sales 000s

1,528

1,973 2,031

1,895

1,786

F10 F11 F12 F13 F14

Passenger Car Sales 000s

3996

3613

F13 F14

Auto Industry Sales (excld. 2W) 000s

Source: SIAM 67

The Year that was Auto Industry

Commercial Vehicle Industry

76

82

110

190 193

F10 F11 F12 F13 F14

LCV 2 to 3.5 T Sales 000s

137

191

251 247

167

F10 F11 F12 F13 F14

LCV < 2T Sales 000s

245

323

349

268

200

F10 F11 F12 F13 F14

MHCVs Sales 000s

440

526

513

538

480

F10 F11 F12 F13 F14

3W Sales 000s

Source: SIAM 68

26%

55%

51%

F

1

2

-

Q

1

F

1

2

-

Q

2

F

1

2

-

Q

3

F

1

2

-

Q

4

F

1

3

-

Q

1

F

1

3

-

Q

2

F

1

3

-

Q

3

F

1

3

-

Q

4

F

1

4

-

Q

1

F

1

4

-

Q

2

F

1

4

-

Q

3

F

1

4

-

Q

4

Increased MNC focus on UV Space

33%

34%

56%

58%

58%

39%

14%

21%

F

1

1

-

Q

1

F

1

1

-

Q

2

F

1

1

-

Q

3

F

1

1

-

Q

4

F

1

2

-

Q

1

F

1

2

-

Q

2

F

1

2

-

Q

3

F

1

2

-

Q

4

F

1

3

-

Q

1

F

1

3

-

Q

2

F

1

3

-

Q

3

F

1

3

-

Q

4

F

1

4

-

Q

1

F

1

4

-

Q

2

F

1

4

-

Q

3

F

1

4

-

Q

4

UV1: <4400mm, UV2: 4400 4700mm

Share of UV1 & UV 2

Change in Dynamics in UV segment

UV1% of Total UV

UV2 % of Total UV

UV % of PV

Share of MNCs in the UV segment

Source: SIAM

69

5.8%

7.5%

8.6%

9.2%

9.3%

18.5%

Company 4

Company 2

Company 3

Company 1

Industry

M&M

Commercial Vehicles

CAGR F04-14

Among top 5 manufacturers

F04-F14: M&M vs Industry

3.6%

9.6%

10.7%

11.3%

13.9%

20.0%

Company 4

Company 3

Industry

Company 2

M&M

Company 1

Passenger Vehicles

CAGR F04-14

Among top 5 manufacturers

Source: SIAM

M&M among the growth leaders over a decade

70

F14 F14

Actual Actual

UV Total 525,942 -5.0% 219,421 -16.9% 41.7% 47.7%

Cars (Verito) 346,524 31.1% 9,734 -36.6% 2.8% 5.8%

MPV Total 190,844 -19.6% 25,189 -19.9% 13.2% 13.2%

LCV < 2T 166,974 -32.5% 29,223 -26.8% 17.5% 16.1%

2T > LCV < 3.5T 192,911 1.3% 123,175 19.7% 63.9% 54.0%

3W Total 479,634 -10.9% 62,614 -4.4% 13.1% 12.2%

AD (Dom.) Total 1,902,829 -6.3% 469,356 -9.6% 24.7% 25.5%

LCV > 3.5 T Total 72,226 -16.7% 5,876 -34.2% 8.1% 10.3%

MHCV (Goods) 88,123 -24.2% 2,285 -23.2% 2.6% 2.6%

AS (Dom.) Total 2,063,178 -7.7% 477,517 -10.1% 23.1% 23.8%

Non Participating Segments - 0.0% - 0.0% 0.0% 0.0%

MHCV Passenger 38,709 -17.5%

MCV Goods 73,795 -30.1%

Cars (Excl. Super Compact) 1,440,375 -10.5%

AS (Dom.) Total 3,616,057 -9.5% 477,517 -10.1% 13.2% 13.3%

Segment

Industry M&M M&M Mkt. Share

Growth Growth CY PY

F14 Domestic Market Performance

71

Bolero No.1 SUV 8 years in a row

5

th

highest selling Passenger Vehicle

in India

Crosses 100,000 mark 3 years in a

row

72

Undisputed King in Pickup segment

Bolero Pick-up and BMT sells

staggering 120,000+

Y-o-Y growth >25%

Market Share of 64%

73

The Trimurti continues to Outperform

Sells 279000+ in FY 14. Y-o-Y growth at 5.6%

74

UV and Pick-Up Market Performance

Consistent Gain in PU Share

47.8%

46.0%

39.9%

38.2%

43.2%

30%

32%

34%

36%

38%

40%

42%

44%

46%

48%

50%

Q4 F13 Q1 F14 Q2 F14 Q3 F14 Q4 F14

UV Mkt. Share

50.4%

58.0%

58.8%

65.8%

72.2%

30%

35%

40%

45%

50%

55%

60%

65%

70%

75%

Q4 F13 Q1 F14 Q2 F14 Q3 F14 Q4 F14

Pik-Up Mkt. Share

41.7%

(F14)

63.9%

(F14)

75

13,025 13,229

10,957

12,242

14,521

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Q4 F13 Q1 F14 Q2 F14 Q3 F14 Q4 F14

Scorpio Volume

10,380

5,774

6,429

7,879

9,925

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Q4 F13 Q1 F14 Q2 F14 Q3 F14 Q4 F14

XUV Volume

Scorpio Gaining & XUV recovery

Scorpio posts highest volumes since launch

76

Market F14

Nepal + Bangladesh 87.1%

Peru 77%

Tunisia 69%

F14 Exports Performance

18,19

0

12,83

0

H1 F13 H1 F14

H1 F14

Growth Markets

14,26

6

16,82

9

H2 F13 H2 F14

H2 F14

Recovery in H2

32,45

6

29,65

9

F13 F14

F14

18%

29%

9%

77

F14 Performance Trucks & Buses

Weak performance due to prolonged Industry slowdown

116,18

9

88,123

F13 F14

HCV Industry

2,977

2,285

F13 F14

HCV M&M

80,816

67,834

F13 F14

LCV (Load+Pass) Industry

8,925

5,876

F13 F14

LCV (Load+Pass) M&M

78

Product Launches

Verito Vibe Bolero Pick Up Refresh

Bolero Maxi Truck Plus Xylo H Series

79

Among the leaders in Customer Satisfaction

JD Power CSI 2013

Highest ever score. Rank 4

Most improved brand over last 3 years Highest ever score. Rank 3

JD Power SSI 2013

Source: JD Power

80

All round improvement in Product quality

140

161

200

110

117 117

163

62

Scorpio Xylo Bolero Verito

J.D. Power IQS Score - 2013

2012 2013

Improvement more than 20% across Product range

Better

81

Strengthening Brand in India

Live Young, Live Free campaign 13 Mn+ FB fans, largest auto community on Facebook in

India

INRC SUV Champion of 2014 winning 4 out of 5 rounds

Indias first and only Off-Road Training Academy at

Igatpuri

82

Building brand in International markets

Top 6 Diesel Pickup Brands in Chile

Most improved SUV brand in South Africa

Scorpio Pikup: Best Budget Bakkie in South Africa

Strong brand equity in SAARC markets

277,000+ Facebook fans

83

Creating buzz at the 12

th

Delhi AutoExpo

AutoSHIFT technology in Quanto Hybrid XUV

Electric Sports Car - Halo 84

1200+ Primary Showrooms, 1500+ Secondary Showrooms

1400+ Primary Workshops, 1000+ Secondary Workshops

Enhanced Reach

Covering

70%+

Districts

Leveraging Technology & Innovation across every touch points

85

Strengthened position in the heartlands of India

Rural contributing to 24% of total sales

Shift of focus from District to Tehsils

Focusing on special target groups like Grape & Onion farmers in

Nashik, fishermen in Kerala etc.

Extensive tie-ups with Mahindra Finance, PSU Banks, RRBs & NBFCs

Leveraging synergy with Farm Sector and 1100+ Mahindra Finance

outlets

86

Super XUV 500 wins 12

th

edition of

Desert Storm

National Energy Conservation Award

ADs Nasik Plant bagged the Elite Excellence

Kaizen Award by CII.

Mahindra e2o wins the Green Car

of the Year Award at the Top Gear

Malayalam Awards

Awards & Accolades

8 Abbys won for Mahindra Autos Digital

Work

CII ITC Sustainability Award

Driven by Gaurav Gill, the Super XUV500 dominated the Indian National Rally Championship

(INRC) by being the fastest vehicle in 4 out of 5 INRC rallies.

Mahindra e2o was conferred the S.M.A.R.T Award at the Overdrive CNBC TV18 Awards

recently

XUV500 wins buzzy brand award at the Pitch Brands 50 awards 2013

Mahindra Automotive Sector wins the Dun & Bradstreet Corporate Award

87

F14 Financials Overview (AD+MVML)

26,489

24,434

F13 F14

Segment Revenue (crs)

3,118

2,770

F13 F14

Segment Result (crs)

(11.2)%

88

F14 Financials Overview AD+MVML+MTB

26,489

24,633

F13 F14

Segment Revenue (crs)

3,118

2,346

F13 F14

Segment Result (crs)

(11.2)%

F13 figures are AD+MVML

F14 figures are AD+MVML+MTB

89

May 2013

Mahindra Farm Equipment

Mahindra Farm Equipment

90

77312

64515

79217

146261

135970

245849

240195

215377

176404

226867

264271

318293

302241

303921

400203

480377

535210

525970

633656

(F73-F82)

CAGR:

14.7%

(F86-F92)

CAGR: 12%

CAGR:

10.4%

(F94-F00)

CAGR: 13.6%

(F04-F14)

Domestic Industry: Robust Growth

91

Domestic Industry: F14

In tractors

10 year CAGR: 13.6 %

527384

633656

F13 F14

20.2%

92

Increase in MSP

Good monsoon

Labor shortage

Availability of finance

Growth Drivers

93

No. 1 Tractor Company in

the World*

*M&M Ltd. is the largest tractor

company in the world by volume

94

Mahindra completes 31

years of Domestic Market

Leadership

95

Mahindra Domestic Volumes: F14

Volumes in tractors

Market Share grew by 0.5% to reach 40.6%

212555

258339

F13 F14

21.5%

96

Mahindra Exports Volumes: F14

Volumes in tractors

12289

10364

F13 F14

-15.7%

Inclusive of CKD nos. in F14

97

International Operations: F14

98

Implements Business: F14

120

232

F13 F14

Revenue in Crs

8,545

F13 F14

Rotary Tiller Volumes

93%

95%

16, 688

99

Customer Centricity

Product portfolio

Quality focus

Macro-micro marketing strategy

Operational excellence: Manufacturing, Cost

Drivers of Success

100

Operational Excellence:

Manufacturing

Zaheerabads

smooth ramp up

101

Financial Performance: F14

Rs. Cr.

11,990

14,334

F13 F14

19.6 %

Segment Revenue

Rs. Cr.

1858

2453

F13 F14

32 %

Segment Result

15.5%

17.1%

F13 F14

1.6 % points

Segment Result %

102

Stability in Volatility

0.6%

31.7%

20.0%

11.4%

-1.5%

20.2%

25.1%

46.9%

21.7%

10.1%

-4.7%

21.5%

11.0%

18.9%

17.5%

15.7% 15.5%

17.1%

F09 F10 F11 F12 F13 F14

Ind Grwth

FES Grwth

PBIT %

103

F15 Industry Outlook

104

Copyright 2012 Mahindra & Mahindra Ltd. All rights reserved. 105

Micro Irrigation

(EPC Industri

ltd.)

Fresh Produce

(Mahindra

Shubhlabh

Services ltd.)

Grapes

Banana

Apple

Citrus

Mahindra Univeg ltd.

Crop Care

Seeds

Seed Potato

Samriddhi

Drip & Sprinklers

Agri Pumps

Greenhouse

Agri Inputs &

Advisory

(M&M ltd.)

6X revenue in last 3 years

106

Disclaimer

Mahindra & Mahindra herein referred to as M&M, and its subsidiary companies provide a wide array of presentations and reports, with the contributions of various professionals.

These presentations and reports are for informational purposes and private circulation only and do not constitute an offer to buy or sell any securities mentioned therein. They do

not purport to be a complete description of the markets conditions or developments referred to in the material. While utmost care has been taken in preparing the above, we claim

no responsibility for their accuracy. We shall not be liable for any direct or indirect losses arising from the use thereof and the viewers are requested to use the information

contained herein at their own risk. These presentations and reports should not be reproduced, re-circulated, published in any media, website or otherwise, in any form or manner,

in part or as a whole, without the express consent in writing of M&M or its subsidiaries. Any unauthorized use, disclosure or public dissemination of information contained herein is

prohibited. Unless specifically noted, M&M or any of its subsidiary companies is not responsible for the content of these presentations and/or the opinions of the presenters.

Individual situations and local practices and standards may vary, so viewers and others utilizing information contained within a presentation are free to adopt differing standards

and approaches as they see fit. You may not repackage or sell the presentation. Products and names mentioned in materials or presentations are the property of their respective

owners and the mention of them does not constitute an endorsement by M&M or its subsidiary companies. Information contained in a presentation hosted or promoted by M&M is

provided as is without warranty of any kind, either expressed or implied, including any warranty of merchantability or fitness for a particular purpose. M&M or its subsidiary

companies assume no liability or responsibility for the contents of a presentation or the opinions expressed by the presenters. All expressions of opinion are subject to change

without notice.

Copyright 2012 Mahindra & Mahindra Ltd. All rights reserved.

Thank you

Visit us at www.mahindra.com

107

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Jeankeat TreatiseDokument96 SeitenJeankeat Treatisereadit777100% (9)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 5 - Corporate Governance AmendedDokument24 Seiten5 - Corporate Governance AmendednurhoneyzNoch keine Bewertungen

- AgileDokument2 SeitenAgileRitesh Kumar PatroNoch keine Bewertungen

- Business IntelligenceDokument2 SeitenBusiness IntelligenceRitesh Kumar PatroNoch keine Bewertungen

- Indian Depository ReceiptDokument9 SeitenIndian Depository ReceiptRitesh Kumar PatroNoch keine Bewertungen

- Kotakbank ChartDokument1 SeiteKotakbank ChartRitesh Kumar PatroNoch keine Bewertungen

- Value Research Online: The Calculations Are Based On Sips Made On The 1St of Every MonthDokument2 SeitenValue Research Online: The Calculations Are Based On Sips Made On The 1St of Every MonthRitesh Kumar PatroNoch keine Bewertungen

- Education Loan Amortization Table: Month EMI Amount (RS) Interest Amount (RS) Principal Reduction (RS) Balance Due (RS)Dokument4 SeitenEducation Loan Amortization Table: Month EMI Amount (RS) Interest Amount (RS) Principal Reduction (RS) Balance Due (RS)Ritesh Kumar PatroNoch keine Bewertungen

- Mnutes of Meeting - 1Dokument3 SeitenMnutes of Meeting - 1Ritesh Kumar PatroNoch keine Bewertungen

- Layout of HospitalDokument11 SeitenLayout of HospitalRitesh Kumar PatroNoch keine Bewertungen

- Urban Housing PresentationDokument27 SeitenUrban Housing PresentationRitesh Kumar Patro0% (1)

- Ritesh ResumeDokument2 SeitenRitesh ResumeRitesh Kumar PatroNoch keine Bewertungen

- Roles and Responsibilities of Central ManagementDokument13 SeitenRoles and Responsibilities of Central ManagementManmohanNoch keine Bewertungen

- Accounts ProjectDokument33 SeitenAccounts Projectaradhana chauhanNoch keine Bewertungen

- Imron Sahid NugrohoDokument7 SeitenImron Sahid NugrohoAnanda LukmanNoch keine Bewertungen

- Arcelor Undervaluation CaseDokument19 SeitenArcelor Undervaluation CaseJerry K Floater100% (1)

- Jetblue's Case Study by P.rai87@gmailDokument25 SeitenJetblue's Case Study by P.rai87@gmailPRAVEEN RAI67% (3)

- Millicon InternationalDokument18 SeitenMillicon InternationalDanielZambranoNoch keine Bewertungen

- Port Folio Number 2007 MASDokument8 SeitenPort Folio Number 2007 MASSasa LuNoch keine Bewertungen

- Costs of An Initial Public Offering-Grant ThorntonDokument7 SeitenCosts of An Initial Public Offering-Grant ThorntonSS CORPORATE SERVICESNoch keine Bewertungen

- Eight Best CandlesDokument4 SeitenEight Best CandlesJonathan DominguezNoch keine Bewertungen

- BO2 Case Digests 021212Dokument8 SeitenBO2 Case Digests 021212kumag2Noch keine Bewertungen

- 12 Entrepreneurship SP 1Dokument15 Seiten12 Entrepreneurship SP 1Ashish GangwalNoch keine Bewertungen

- STB Ar2015 en 1 PDFDokument272 SeitenSTB Ar2015 en 1 PDFHòa Trần VănNoch keine Bewertungen

- KKR Investor UpdateDokument8 SeitenKKR Investor Updatepucci23Noch keine Bewertungen

- TUI UniversityDokument9 SeitenTUI UniversityChris NailonNoch keine Bewertungen

- Pocket Money Course Material-MarathiDokument81 SeitenPocket Money Course Material-MarathiAbhieshek P GodhaNoch keine Bewertungen

- Analysis - Why Investing in PSUs Is A Good Idea - MoneycontrolDokument2 SeitenAnalysis - Why Investing in PSUs Is A Good Idea - Moneycontrollaloo01Noch keine Bewertungen

- No. 3 Mercantile Bar 2017Dokument2 SeitenNo. 3 Mercantile Bar 2017Venice SantibanezNoch keine Bewertungen

- Management Management Management ManagementDokument94 SeitenManagement Management Management Managementalizah khadarooNoch keine Bewertungen

- The Corporation Code ReviewerDokument28 SeitenThe Corporation Code Reviewernoorlaw100% (4)

- 2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Dokument69 Seiten2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Roze JustinNoch keine Bewertungen

- SelectedGlobalStocks - February 1 2017Dokument5 SeitenSelectedGlobalStocks - February 1 2017Tiso Blackstar GroupNoch keine Bewertungen

- Reliance Infrastructure 091113 01Dokument4 SeitenReliance Infrastructure 091113 01Vishakha KhannaNoch keine Bewertungen

- Case Study Barclays FinalDokument13 SeitenCase Study Barclays FinalShalini Senglo RajaNoch keine Bewertungen

- Barbeque Nation Hospitality Limited DRHP CompressedDokument515 SeitenBarbeque Nation Hospitality Limited DRHP Compressedsiddhant kohliNoch keine Bewertungen

- Ments Questions Corp-LawDokument7 SeitenMents Questions Corp-LawIan Ray PaglinawanNoch keine Bewertungen

- Intermediate Financial Accounting Part 1b by Zeus Millan Compress - CompressDokument174 SeitenIntermediate Financial Accounting Part 1b by Zeus Millan Compress - CompresswalsondevNoch keine Bewertungen

- Exhibit 1 Kendle International Inc. Financial Data Years Ended December 31Dokument12 SeitenExhibit 1 Kendle International Inc. Financial Data Years Ended December 31Kito Minying ChenNoch keine Bewertungen

- Session 2 - Board Effectiveness v1 - Chris RazookDokument29 SeitenSession 2 - Board Effectiveness v1 - Chris RazookEra HRNoch keine Bewertungen