Beruflich Dokumente

Kultur Dokumente

CSE and SEC Targets Local and Foreign Investors

Hochgeladen von

GayanChandrasekaraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CSE and SEC Targets Local and Foreign Investors

Hochgeladen von

GayanChandrasekaraCopyright:

Verfügbare Formate

PUBLIC

MediaRelease

14

th

July2014

Stock Market buoyant

CSE and SEC targets local and foreign investors Niroshan

Wijesundere

As the Sri Lankan economy takes an upward turn, with

economic growth being at 7.5 per-cent over the past four years,

macroeconomic indicators signal an ideal environment for investment,

with bank interest rates at an all-time low, the investment atmosphere

is idyllic for prudent and well informed investors.

It is important to understand the long term nature of

capital market investment and the cyclical flow that it follows. If

one looks at the indices right now, one is able to see the positive

growth trajectory of the market. The ASPI has crossed the 6600

point mark and the S&P SL20 was recently at the highest since its

launch, indicating that the stock market is now on an upward turn

based on valuations and fundamentals, CSEs Head of Market

Development Mr. Niroshan Wijesundere said.

Taking into account this ideal investment environment, the

Colombo Stock Exchange (CSE) along with the Securities and

Exchange Commission (SEC) and other stakeholders, have taken

strident steps to develop the capital market, with a new strategic direction adopted since

2012. Under the CSEs three year strategic plan and the SECs ten point plan, the CSE

has embarked on a steady phase of growth and these efforts are now coming into fruition.

The CSE and SEC has taken bold and innovative efforts to reach out to attract foreign

investors, make information more freely available and educate investors.

The past two years have seen a number of significant achievements:

The CSE in association with the SEC began a concentrated effort to attract

institutional and high net-worth investors from across the globe by projecting the CSE as

an attractive emerging market. Under the banner of the Invest Sri Lanka Investor

2012 Highest Net Foreign inflow Rs. 38,660. 7 Mn

2013 Highest capital raised through Debt IPOs Rs. 68, 262.3 Mn

2014

(J an to

J une)

Highest capital raised through equity IPOs

(since 2011)

Rs. 2,393.8 Mn

The Colombo stock

market offers good

value and i s now

consi der ed a

favori te market

among i nsti tuti onal

i nvestors looki ng to

i nvest i n fr onti er

markets.

PUBLIC

Forums were held in Mumbai, Dubai, Hong Kong, Singapore and London over the course

of 2013 and 2014.

Presentations were made by high-level government and financial sector

representatives, who made strong cases for investing in the Sri Lankan capital market,

during these investor forums. Since the beginning of these international forums, there has

been a steady stream of new foreign entrants to the market and renewed interest from

existing investors which has increased the foreign purchases and net foreign inflows.

By correlating the timing of our investor forums with the

inflows that have been generated from the respective countries where

these forums were held, we are able to directly see the constructive

nature of these forums for the Stock Market in Sri Lanka. Our

greatest success has certainly been from Singapore, we have

observed a net foreign inflow of Rs. 7,617.4 Mn in the first six

months of 2014, as opposed to a net foreign outflow of Rs. 2,054.4

Mn in 2013 (Graph 1) . In Hong Kong we saw a net foreign outflow

of Rs. 175 Mn in 2013 and a net foreign inflow of Rs. 1.7 Mn in

2014 (Graph 2), Mr. Wijesundere said.

Graph 1

Continued

Graph 2

(2,054.4)

7,617.4

(4,000.0)

(2,000.0)

2,000.0

4,000.0

6,000.0

8,000.0

10,000.0

2013 2014(JanJune)

Rs.Mn

NetForeignFlow(Rs.Mn)

Singapore

Our greatest success,

has certai nly been from

Si ngapore, we have

observed a net forei gn

i nflow of Rs. 7,617.4 Mn

i n the fi rst si x months of

2014, as opposed to a net

forei gn outflow of Rs.

2,054.4 Mn i n 2013.

4,019.5

2,150.9

6,337.5

Singapore

2013

2014(JanJune)

fromExisting

Investors

2014(JanJune)

fromNew

Investors

ForeignPurchases (Rs.Mn)

Singapore

4.4

12.9

HongKong

2013

2014(JanJune)

fromExisting

Investors

2014(JanJune)

fromNew

Investors

ForeignPurchases (Rs.Mn) Hong

Kong

(175.0)

1.7

(200.0)

(150.0)

(100.0)

(50.0)

50.0

2013 2014(JanJune)

Rs.Mn

NetForeignFlow(Rs.Mn)

HongKong

PUBLIC

Even in the case of the United Arab Emirates, where UAE markets were picking

up at the time of our conference; we were able to portray the Sri Lankan capital market as

an attractive investment avenue, which had growth potential. We have seen an

improvement from a net foreign outflow of Rs. 134.9 Mn in 2013 to a net foreign inflow

of Rs. 29.9 Mn in the first six months of 2014 (Graph 3). Since the event in Mumbai, we

have seen a net foreign flow from India improve from a net foreign outflow of Rs. 106.7

Mn in 2013 to a net foreign inflow of Rs. 30.8 Mn in 2013 (Graph 4), Mr. Wijesundere

said.

Graph 3

Graph 4

This joint effort between the CSE and the SEC has also resulted in a number of

new entrants to the market with 31 new accounts being opened from the locations where

the investor forums were held. Additionally purchases from the countries where investor

forums were held has increased significantly.

24.5

90.7

12.8

UAE

2013

2014(JanJune)

fromExisting

Investors

2014(JanJune)

fromNew

Investors

ForeignPurchases (Rs.Mn) UAE

(134.9)

29.9

(150.0)

(100.0)

(50.0)

50.0

2013 2014(JanJune)

Rs.Mn

NetForeignFlow(Rs.Mn)

UAE

67.3

47.3

11.8

India

2013

2014(JanJune)

fromExisting

Investors

ForeignPurchases (Rs.Mn) India

(106.7)

30.8

(150.0)

(100.0)

(50.0)

50.0

2013 2014(JanJune)

Rs.Mn

NetForeignFlow(Rs.Mn)

India

PUBLIC

These forums are a joint effort which brings together a number of the

stakeholders within the capital market, from brokers, to custodian banks and the market

regulator, their input has been vital to the success of the conferences and the positive

outcomes which they have yielded, Mr. Wijesundere added.

In the past months the CSE has launched a mobile application which provided

vital market information to users across the island and overseas, in all three languages.

The application allows uses to access, a market summary, ASPI and S&P SL20 graph

details, latest trades, announcements, price list, gainers and losers, details of listed

securities and a My Portfolio feature which is a personal watch list.

First launched for Android mobile devices, the

App is now also available for the iOS platform as well

and can be downloaded free of charge from Google Play

and the Apple iTunes store. Since its launch in December

2013 the Android App has had 4736 downloads, whereas

the iOS app, launched just last month has been

downloaded 568 times.

There is a perception among some that stock

market information is available only to a privileged few.

However the CSE is committed to ensure that everyone

has as much information as possible and is able to access

this information regardless of the size of their investment, their location or their language

of fluency. Therefore we take meticulous efforts to ensure information is available at

their fingertips and accessible on the go, Mr. Wijesundere stated.

The CSE is also making a conscious efforts to reach out to a younger more tech-

savvy audience that is interested in monitoring the capital market and keeping abreast of

the promotional activities being conducted therein. In order to provide timely updates to

this potential and existing investor bracket, the CSE launched a twitter handle

(@CSE_Media). Followers, that now number nearly 700, receive updates on

announcements, a market summary and information on CSE awareness building efforts,

amongst other stimulating updates.

In order to improve the financial literacy amongst

potential and existing investors and within this context our

Investor Education Team seeks to educate investors on the

fundamentals of investing, because it is knowledge of these

fundamentals that will assist them to make sound financial

decisions Mr. Wijesundere said.

He further pointed out that the CSE has been engaged in the task of educating

existing and potential investors over the last two years. We have a base of investors well

educated on the fundamentals of investment and this base will now be able to take full

advantage of the market that is posed to grow in the coming months.

The CSE i s commi tted

to ensure that ever yone

has as much

i nformati on as possi ble

and i s able to access thi s

i nformati on regardless

of the si ze of thei r

i nvestment, thei r

locati on or thei r

language of fluency.

There i s a need to

i mprove fi nanci al

li teracy

PUBLIC

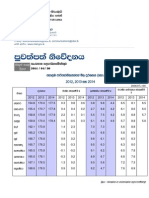

The Colombo Stock Exchange together with the Securities and Exchange

Commission of Sri Lanka is endeavoring to educate the general public, existing and

potential investors and students on the fundamentals of the capital market and investing

therein. The Investor Education Team of the CSEs Market Development division, in the

past six months have reached a large number of potential and existing investors (Table 1):

Description

Total

Noofevents NoofParticipants

Schools 150

8,627

University/Highereducation 29

1,564

InvestorAwareness(Direct

Approach) 173 10,151

InvestorAwareness(Other) 27

4,011

Exhibitions 6

4,834

InvestorEducationalWorkshops 8 318

ProfessionalWorkshops 17

1,061

Total 410 30,566

We identify specific segments and educate them on financial planning. Due to a

perceived risk of investing in the Stock Market some are disinclined to invest in the

capital market. Our aim is to portray the CSE as an alternative investment option, Mr.

Wijesundere said.

The CSE also conducts intensive, week long, Investor Education

Programmes for existing or potential investors, to give them an in-depth

understanding of the fundamentals of investing. These training workshops

equip attendees with the skills necessary for analyzing investment

opportunities, capital market processes, and benefits of investing in shares and

debt and analysis of listed company financial documents.

These workshops are attended by anyone from students to retired

professionals, who are seeking a thorough understanding of the market in

order to make prudent investment decisions. These workshops encourage

potential and existing investors to learn the basics of analyzing the financial

statements of a company and diversification of investment portfolios which

provide an advantageous return, Mr. Wijesundere stated.

With the improvement of market sentiments, investors must be

mindful to evaluate fundamentals and valuations and make informed investment

decisions. Furthermore they must consider research reports by brokers and seek the

advice of investment professionals, before making investment decisions, Mr.

Wijesundere said.

We i denti fy

speci fi c segments

and educate them

on fi nanci al

planni ng. Due to

a per cei ved r i sk of

i nvesti ng i n the

Stock Market

many are

di si ncli ned to

i nvest i n the

capi tal market.

Our ai m i s to

por tray the CSE

PUBLIC

AboutCSE

TheColomboStockExchange(CSE)operatestheonlysharemarketinSriLankaandis

responsibleforprovidingatransparentandregulatedenvironmentwherecompanies

andinvestorscancometogether.TheCSEisacompanythatislimitedbyguarantee

establishedundertheLawsofSriLanka.TheCSEislicensedbytheSecuritiesand

ExchangeCommissionofSriLanka(SEC)andisamutualexchangeconsistingof15

Membersand15TradingMembers.AllMembersandTradingMembersarelicensedby

theSECtooperateasStockbrokers.Formoreinformation,pleasevisit:www.cse.lk.

Formoreinformation:

NiroshanWijesundere

HeadofMarketDevelopment

ColomboStockExchange

Level4,WestBlock,

WorldTradeCenter,EchelonSquare,

Colombo01.

SriLanka.

Direct+94112356510

Mobile+94777819999

Fax+94112445279

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- External Sector Performance, June 2014Dokument8 SeitenExternal Sector Performance, June 2014GayanChandrasekaraNoch keine Bewertungen

- Maithripala Sirisena Election Manifesto SinhalaDokument35 SeitenMaithripala Sirisena Election Manifesto SinhalaGayanChandrasekara100% (1)

- Financial Sector Consolidation Update, August 2014Dokument2 SeitenFinancial Sector Consolidation Update, August 2014GayanChandrasekaraNoch keine Bewertungen

- Asian Alliance Insurance's National IFS Rating DowngradedDokument3 SeitenAsian Alliance Insurance's National IFS Rating DowngradedGayanChandrasekaraNoch keine Bewertungen

- JVP Writes Election CommissionerDokument3 SeitenJVP Writes Election CommissionerGayanChandrasekaraNoch keine Bewertungen

- CD SL Úÿ, S Mdßfnda - SL JHDMDRH National Movement of Electricity ConsumersDokument4 SeitenCD SL Úÿ, S Mdßfnda - SL JHDMDRH National Movement of Electricity ConsumersGayanChandrasekaraNoch keine Bewertungen

- External Sector Performance - May 2014Dokument7 SeitenExternal Sector Performance - May 2014GayanChandrasekaraNoch keine Bewertungen

- JVP Writes Election CommissionerDokument2 SeitenJVP Writes Election CommissionerGayanChandrasekaraNoch keine Bewertungen

- JVP Writes Election CommissionerDokument2 SeitenJVP Writes Election CommissionerGayanChandrasekaraNoch keine Bewertungen

- Central Bank Enters Into An Investment Agreement With Reserve Bank of IndiaDokument3 SeitenCentral Bank Enters Into An Investment Agreement With Reserve Bank of IndiaGayanChandrasekaraNoch keine Bewertungen

- Etheara API - Press Conference 2014.07.31Dokument3 SeitenEtheara API - Press Conference 2014.07.31GayanChandrasekaraNoch keine Bewertungen

- Sri Lanka Inflation Rises To 4.9 Percent in April 2014Dokument1 SeiteSri Lanka Inflation Rises To 4.9 Percent in April 2014GayanChandrasekaraNoch keine Bewertungen

- Press 20140620eDokument7 SeitenPress 20140620eRandora LkNoch keine Bewertungen

- USD 50mn Sri Lanka Development Bonds Oversubscribed by 4.8 TimesDokument1 SeiteUSD 50mn Sri Lanka Development Bonds Oversubscribed by 4.8 TimesGayanChandrasekaraNoch keine Bewertungen

- Sri Lanka "Less Indebted" in 2013 External Debt IndicatorsDokument2 SeitenSri Lanka "Less Indebted" in 2013 External Debt IndicatorsGayanChandrasekaraNoch keine Bewertungen

- Sri Lanka Economic Growth at 7.6-pct in 1Q 2014Dokument11 SeitenSri Lanka Economic Growth at 7.6-pct in 1Q 2014GayanChandrasekaraNoch keine Bewertungen

- A Clarification On Certain Media Reports On The External Debt StatisticsDokument3 SeitenA Clarification On Certain Media Reports On The External Debt StatisticsGayanChandrasekaraNoch keine Bewertungen

- CSE Annual Report 2013Dokument88 SeitenCSE Annual Report 2013GayanChandrasekaraNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Methodology SP Cse Sector and Industry Group IndicesDokument18 SeitenMethodology SP Cse Sector and Industry Group Indicescrappy blue angelNoch keine Bewertungen

- CG & Corp Failure-ScidirectDokument8 SeitenCG & Corp Failure-ScidirectindahmuliasariNoch keine Bewertungen

- News Bulletin - August 2013Dokument11 SeitenNews Bulletin - August 2013Randora LkNoch keine Bewertungen

- Peoples Merchant Annual Report 2010-11Dokument98 SeitenPeoples Merchant Annual Report 2010-11jkdjfaljdkjfkdsjfdNoch keine Bewertungen

- Bloomberg Confidential / Not For Distribution: Mnemonic Exchange Product In/out Current Fee Currency NotesDokument21 SeitenBloomberg Confidential / Not For Distribution: Mnemonic Exchange Product In/out Current Fee Currency Notessanjay guravNoch keine Bewertungen

- Bản Sao Của 230512 - TheSIS FINAL - NgoHoangLinhDokument106 SeitenBản Sao Của 230512 - TheSIS FINAL - NgoHoangLinhChâu Nguyễn Thị MinhNoch keine Bewertungen

- GayanDokument23 SeitenGayanijayathungaNoch keine Bewertungen

- External Resource Financing PDFDokument130 SeitenExternal Resource Financing PDFMhasibu Mhasibu100% (1)

- Anilana Annual Report 2015 PDFDokument94 SeitenAnilana Annual Report 2015 PDFChandima SrimaliNoch keine Bewertungen

- CT CLSA - Ceylon Tobacco Company (CTC) 4Q2020 Results Update - 19 March 2021Dokument8 SeitenCT CLSA - Ceylon Tobacco Company (CTC) 4Q2020 Results Update - 19 March 2021Imran ansariNoch keine Bewertungen

- Friday June 15, 2012Dokument61 SeitenFriday June 15, 2012colomboanalystNoch keine Bewertungen

- 01-A Brief Introduction To The Colombo Stock MarketDokument4 Seiten01-A Brief Introduction To The Colombo Stock Marketmuthuraja83Noch keine Bewertungen

- Factors Affecting Performance of Stock Market: Evidence From South Asian CountriesDokument15 SeitenFactors Affecting Performance of Stock Market: Evidence From South Asian CountriesAli MohammedNoch keine Bewertungen

- Economy of Sri LankaDokument24 SeitenEconomy of Sri LankaAman DecoraterNoch keine Bewertungen

- Report - Inefficiency in Operations of CSE, Sri LankaDokument9 SeitenReport - Inefficiency in Operations of CSE, Sri LankaDinesh ThevaranjanNoch keine Bewertungen

- LuckyDokument147 SeitenLuckyTharindu Chathuranga100% (1)

- New Hope Dawns in The Pearl of AsiaDokument2 SeitenNew Hope Dawns in The Pearl of AsiaMuath MubarakNoch keine Bewertungen

- Impact of Working Capital Management On Financial PerformanceDokument5 SeitenImpact of Working Capital Management On Financial PerformanceDhanushika SamarawickramaNoch keine Bewertungen

- KPMG Covid 19 Economic ImpactDokument30 SeitenKPMG Covid 19 Economic Impactsomapala88Noch keine Bewertungen

- JKH ArDokument324 SeitenJKH ArnizmiNoch keine Bewertungen

- Chrissworld Ipo ProsDokument71 SeitenChrissworld Ipo ProsjdNoch keine Bewertungen

- LOFC Documents - CSE Upload - 21511135431836783Dokument85 SeitenLOFC Documents - CSE Upload - 21511135431836783Ksijj OlajjaNoch keine Bewertungen

- External Sector Performance - July 2022Dokument13 SeitenExternal Sector Performance - July 2022Ada DeranaNoch keine Bewertungen

- Another Epic Lie of Colombo Stock ExchangeDokument2 SeitenAnother Epic Lie of Colombo Stock ExchangenotaNoch keine Bewertungen

- Singer Sri Lanka PLCDokument24 SeitenSinger Sri Lanka PLCSANDUN KAVINDANoch keine Bewertungen

- Factors Affecting The Initial Return of Initial PuDokument13 SeitenFactors Affecting The Initial Return of Initial PuReact EmotNoch keine Bewertungen

- External Sector Performance - December 2022Dokument13 SeitenExternal Sector Performance - December 2022Ada DeranaNoch keine Bewertungen

- CSE Equity Market Performance - One Year Equity Market PerformanceDokument2 SeitenCSE Equity Market Performance - One Year Equity Market PerformanceMudassir IjazNoch keine Bewertungen

- Prospectus CinsDokument70 SeitenProspectus CinsImran ansariNoch keine Bewertungen

- Jurnal Peristiwa Politik (Ramesh Dan Rajumesh - Huazhong University Tahun 2015)Dokument10 SeitenJurnal Peristiwa Politik (Ramesh Dan Rajumesh - Huazhong University Tahun 2015)pavita setyandaniNoch keine Bewertungen