Beruflich Dokumente

Kultur Dokumente

Bernanke Federal Reserve Monetary Policy

Hochgeladen von

zlemisch0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten3 SeitenFederal Reserve Monetary Policy

Principles of Micro Economics

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFederal Reserve Monetary Policy

Principles of Micro Economics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten3 SeitenBernanke Federal Reserve Monetary Policy

Hochgeladen von

zlemischFederal Reserve Monetary Policy

Principles of Micro Economics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Bernanke Lecture 2 Study Guide: The Federal Reserve after World War II

1. What are the two basic missions of a central bank?

1. Macroeconomic stability- use monetary policy to strive and aim for low and stable

inflation

2. Financial stability- central banks try to ensure that the nations financial system

functions properly; tries to prevent or mitigate financial panics or crises

2. How did the US finance WWII and what was the Feds role?

- Fed was pressed by the treasury to keep longer-term interest rates low to allow the government

debt accrued during the war to be financed more cheaply

3. How are low interest rates detrimental to an already strongly growing economy?

-Keeping interest rates low even as the economy was growing strongly risked economic

overheating and inflation

4. What is the Fed Treasury Accord of 1951?

-The Treasury agreed to end the arrangement and let the Fed set interest rates independently as

needed to achieve economic stability

-Fed has remained independent since 1951, conduction monetary policy to foster economic

stability without responding to short-term political pressures

5. Who said inflation is a thief in the night and if we dont act promptly and decisively we will

always be behind?

-William McC. Martin- Chairman of the Fed from 1951-1970

6. What is a Lean Against the Wind Monetary Policy?

-During most of the 1950s and earl 1960s, the Federal Reserve followed this policy that sought

to keep both inflation and economic growth reasonably stable

7. What was a big problem for the US in the 1960s and 70s?

-Starting in the mid-1960s, monetary policy was too easy

-This stance led to a surge in inflation and inflation expectations

-Inflation peaked at about 13%

-Exacerbating factors included: oil and food price shocks, fiscal policies that stretched economic

capacity

8. Who said inflation is always and everywhere a monetary phenomenon?

-Milton Friedman

9. What did Chairman Paul Volcker do in 1979 to subdue double-digit inflation on the US?

-He announced a dramatic break in the way that monetary policy would operate

-The new approach to monetary policy involved high interest rates (tight money_)to slow the

economy and fight inflation.

10. What is tight money or a tight monetary policy?

-The economic condition in which credit is difficult to secure and interest rates are high

11. Why was Mr. Volckers tight money policy considered costly?

-The high interest rates , which were necessary to bring down inflation, were having very

negative side effects on the economy and also caused a very sharp recession

12. Who was Chairman of the Fed during the period of The Great Moderation?

-Alan Greenspan (1987-2006)

13. What is a housing bubble?

-From the late 1990s until early 2006, house prices soared 130%

-Meanwhile, mortgage-lending standards deteriorated

-Rising house prices and weakening mortgage standards fed off each other: rising house prices

created an expectation that housing was a cant lost investment

-Lax underwriting and the availability of exotic mortgages drove up demand for housing, raising

prices further.

14. What is nonprime mortgage?

-As house prices rose, many lenders began to offer mortgages to less qualified borrowers, so-

called nonprime mortgages

-These mortgages required little or no down payment, and little or no documentation

15. What is sub-prime mortgage?

-Subprime mortgages were the lowest quality mortgages in terms of the credit of the borrows

16. What does it mean that a borrower has a negative equity in the home?

-Borrowers find themselves underwater, meaning that their mortgage, the amount of money

they owed, was greater than the value of their home

-Situation where the borrower in fact has negative wealth or negative equity in the home

17. What triggered the recent financial crisis?

-The decline in house prices and the mortgage losses were a trigger

-Weaknesses in the financial system that transformed what might otherwise have been a modest

recession into a much more severe crisis

-There were vulnerabilities in both the private sector of our financial system and also in the

public sector

18. What private sector and public sector vulnerabilities in the system turned the housing bust

into a financial crisis?

-Private sector:

-many borrowers and lenders took on too much debt, too much leverage because of 20

years of relatively calm economic and financial conditions, people became more

confident and willing to take on debt

-Financial contracts and transactions became more and more complex but the ability of

banks and other financial institutions to monitor and measure and manage those risks

was not keeping up

-Financial firms in a variety of contexts relied very heavily on short term funding like

commercial paper which can have a duration as short as one day or most of it is less than

90 days. They had very short-term liquid form of liability which was subject to runs in

the same way that deposits were subject to runs in the 19

th

century

-The use of exotic financial instruments, complex derivatives and so on

-Public sector:

-The financial regulatory structure had been changed a number of times and basically, It

was the same structure that had been created in the 1930s after the depression didnt

keep up with all kinds of changed in the structure of the financial system

- Many important financial firms that didnt really have any serious comprehensive

supervision by any financial regulator

-Fed made mistakes in supervision and regulation

-Didnt press hard enough on measuring risks

19. What were the four economic consequences of the crisis?

1. The stock market plunged

2. Very large decline in tech stocks

3. Home construction fell

4. Unemployment rose very sharply

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 10 Ideas For ConversationDokument116 Seiten10 Ideas For ConversationGreenLake36100% (1)

- Nursing Process Guide: St. Anthony's College Nursing DepartmentDokument10 SeitenNursing Process Guide: St. Anthony's College Nursing DepartmentAngie MandeoyaNoch keine Bewertungen

- Bibliografia Antenas y RadioDokument3 SeitenBibliografia Antenas y RadioJorge HerreraNoch keine Bewertungen

- Mobile DevGuide 13 - Gulde For Mobile DeveloperDokument258 SeitenMobile DevGuide 13 - Gulde For Mobile DevelopersmaliscribdNoch keine Bewertungen

- Bakery Interview QuestionsDokument15 SeitenBakery Interview QuestionsKrishna Chaudhary100% (2)

- Financial Management Full Notes at Mba FinanceDokument44 SeitenFinancial Management Full Notes at Mba FinanceBabasab Patil (Karrisatte)86% (7)

- Ingles V Eje 1 Week 2Dokument5 SeitenIngles V Eje 1 Week 2Cristhian Javier Torres PenaNoch keine Bewertungen

- Jee Mathmatic PaperDokument16 SeitenJee Mathmatic PaperDeepesh KumarNoch keine Bewertungen

- PSCI101 - Prelims ReviewerDokument3 SeitenPSCI101 - Prelims RevieweremmanuelcambaNoch keine Bewertungen

- Leaders Eat Last Key PointsDokument8 SeitenLeaders Eat Last Key Pointsfidoja100% (2)

- Article ReviewDokument3 SeitenArticle ReviewRAMADEVI A/P THANAGOPAL MoeNoch keine Bewertungen

- Influence of Brand Experience On CustomerDokument16 SeitenInfluence of Brand Experience On Customerarif adrianNoch keine Bewertungen

- Unit Test 9 BDokument1 SeiteUnit Test 9 BAnnaNoch keine Bewertungen

- EDDS StuttgartDokument21 SeitenEDDS Stuttgartdaniel.namendorfNoch keine Bewertungen

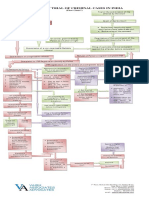

- Process of Trial of Criminal Cases in India (Flow Chart)Dokument1 SeiteProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Dokument7 SeitenAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Simple Future TenseDokument14 SeitenSimple Future TenseYupiyupsNoch keine Bewertungen

- SDS Jojoba Wax Beads 2860Dokument7 SeitenSDS Jojoba Wax Beads 2860swerNoch keine Bewertungen

- The Wilderness - Chennai TimesDokument1 SeiteThe Wilderness - Chennai TimesNaveenNoch keine Bewertungen

- Bill Vaskis ObitDokument1 SeiteBill Vaskis ObitSarah TorribioNoch keine Bewertungen

- USA V Meng Letter DPADokument3 SeitenUSA V Meng Letter DPAFile 411Noch keine Bewertungen

- OD2e L4 Reading Comprehension AKDokument5 SeitenOD2e L4 Reading Comprehension AKNadeen NabilNoch keine Bewertungen

- Hermle C42 ENDokument72 SeitenHermle C42 ENKiril AngelovNoch keine Bewertungen

- PETITION For Declaration of NullityDokument7 SeitenPETITION For Declaration of NullityKira Jorgio100% (3)

- Strategic Cost Management: Questions For Writing and DiscussionDokument44 SeitenStrategic Cost Management: Questions For Writing and Discussionmvlg26Noch keine Bewertungen

- Xeljanz Initiation ChecklistDokument8 SeitenXeljanz Initiation ChecklistRawan ZayedNoch keine Bewertungen

- FINAL Parent Handbook AitchisonDokument68 SeitenFINAL Parent Handbook AitchisonSaeed AhmedNoch keine Bewertungen

- Alternating Voltage and CurrentDokument41 SeitenAlternating Voltage and CurrentKARTHIK LNoch keine Bewertungen

- Rock Classification Gizmo WorksheetDokument4 SeitenRock Classification Gizmo WorksheetDiamond실비Noch keine Bewertungen

- Look 4 - Unit 4Dokument14 SeitenLook 4 - Unit 4Noura AdhamNoch keine Bewertungen