Beruflich Dokumente

Kultur Dokumente

Chord Technologies

Hochgeladen von

Helen1965Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chord Technologies

Hochgeladen von

Helen1965Copyright:

Verfügbare Formate

C

C

M

M

A

A

E

E

N

N

T

T

R

R

A

A

N

N

C

C

E

E

E

E

X

X

A

A

M

M

I

I

N

N

A

A

T

T

I

I

O

O

N

N

O

O

C

C

T

T

O

O

B

B

E

E

R

R

2

2

0

0

0

0

1

1

March 2002

October 2001 CMA Entrance Examination

Table of Contents

PAGE

OVERVIEW.............................................................................................................1

PART 1

GENERAL COMMENTS.......................................................................................4

PART 2

QUESTION

Backgrounder ........................................................................................5

Additional Information........................................................................24

MARKERS COMMENTS...................................................................................34

SUGGESTED SOLUTION* .................................................................................43

SUPPLEMENT OF FORMULAE AND TABLES**.......................................67

*The suggested solution to Part 2 is presented in a more comprehensive manner than would be expected of a

candidate writing under examination conditions and represents one of several possible approaches.

**This supplement is provided to all candidates with each part of the examination.

Ce document est galement disponible en franais.

Copyright 2001 The Society of Management Accountants of Canada.

The Society of Management Accountants of Canada Page 1

October 2001 CMA Entrance Examination Overview

Overview

Purpose

The purpose of the Entrance Examination is to ensure that candidates have a sound technical

foundation and to ensure that they have suitable integrative, judgmental, analytical, strategic

thinking, and written communication skills for entry into the CMA Strategic Leadership

Program.

Format, Duration and Type of Questions

The October 2001 CMA Entrance Examination consists of two parts, each of a 4-hour duration.

PART 1

Part 1 of the examination consists of 165 multiple-choice questions, grouped into 11 sections

according to the topic areas listed in the CMA Entrance Examination Syllabus.

PART 2

Part 2 of the examination consists of one integrated, complex case. Information relating to the

case was provided to candidates in two separate documents: a Backgrounder (provided to

candidates in advance) and the Additional Information (provided to candidates at the Part 2

examination).

Thus, in total, 50% of the Entrance Examination consists of a case and 50% consists of objective

(multiple-choice) questions.

Testing Objectives, Topic Emphasis and Syllabus Coverage

OVERALL

The October 2001 CMA Entrance Examination tests on the CMA Entrance Examination

Syllabus according to the cognitive skill level expectations reflected in Blooms Taxonomy of

Educational Objectives. The Category 1 and 2 syllabus topics are tested according to the

emphasis indicated in the syllabus. Approximately 2/3 of the content knowledge testing pertains

to Category 1 topics and the remaining 1/3 pertains to Category 2 topics.

Generally speaking, each of the 11 major topic areas in the two categories (Management

Accounting, Corporate Finance, Operations Management, Information Technology, Strategic

Management, International Business, Human Resources, Marketing, Financial Accounting,

Taxation, and Internal Control) are tested in roughly equal proportion. However, the topic areas

of Management Accounting, Information Technology, and Financial Accounting are tested to a

somewhat greater extent. Conversely, a relatively lower weighting is placed on some of the other

topic areas.

Category 1 and 2 topics are tested on both the cases and the objective questions on the

examination.

Page 2 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Overview

PART 1

The Part 1 testing objective is to evaluate the candidates content knowledge. Its focus is on the

first three cognitive levels in Blooms taxonomy, namely knowledge, comprehension and

application. It tests directly on each of the 11 syllabus areas specified above within the context of

165 multiple-choice questions. It should be noted that not all of the multiple-choice questions are

of equal value.

PART 2

The Part 2 testing objective is to evaluate the candidates higher order skills, i.e., judgement,

integration, analysis, strategic thinking and written communication. Its focus is on the last three

cognitive levels in Blooms taxonomy, namely analysis, synthesis, and evaluation.

In order to maximize the time available for candidates to demonstrate their higher order skills

and to facilitate their development of a well-reasoned, in-depth response to the case, candidates

were provided in advance with a Backgrounder on the company that was the focus of the case.

The Backgrounder contained extensive information about the company and its related industry so

that candidates could familiarize themselves with both in preparation for the strategic analysis

that they were asked to undertake during Part 2 of the examination.

On the Part 2 examination writing date, the Additional Information was provided to

candidates, which included additional information about the company and indicated what

candidates were required to do. Generally, the candidates task during Part 2 was to assess the

strategic options facing the company in light of its strengths and weaknesses, interpret and use

the financial and non-financial information provided in the Backgrounder and Additional

Information, and write a report to management, exhibiting appropriate written communication

skills, as to what the company should do.

While the Part 2 case includes content from many of the 11 syllabus topic areas, the focus is on

testing the higher order skills mentioned above rather than testing detailed content knowledge

which is the focus of Part 1. Thus, for the most part, content knowledge is tested indirectly on

Part 2 through an evaluation of how the information included in the case is used by candidates to

develop a report that demonstrates their higher order skills.

Evaluation

Candidates must pass both parts of the Entrance Examination individually in order to proceed to

the CMA Strategic Leadership Program. Candidates received an overall grade out of 100 for

each part of the examination, a score on a scale ranging from 100 to 400, an indication of

whether they had passed each part, and an indication of how they performed relative to other

candidates on each part of the examination in the form of deciles for each topic area (Part 1) and

each skill (Part 2) being tested. Candidates should note that there was no correction factor on the

multiple-choice questions.

The Society of Management Accountants of Canada Page 3

October 2001 CMA Entrance Examination Overview

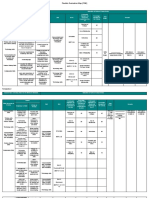

OCTOBER 2001 CMA ENTRANCE EXAMINATION CHARACTERISTICS

The following tables reflect the examinations major characteristics:

PART 1

Questions 1 to 165

Question Type multiple-choice

Number of Minutes 240

% Syllabus Coverage based on

relative value of the questions (not

based on the number of questions)

Category 1

Management Accounting

Corporate Finance

Operations Management

Information Technology

Strategic Management

International Business

Human Resources

Marketing

Category 2

Financial Accounting

Taxation

Internal Control

Total

24%

6%

6%

8%

6%

6%

6%

5%

67%

19%

9%

5%

33%

100%

PART 2

Question

Question Type integrated case

Number of Minutes 240

Syllabus Coverage Information relating to topics from most of the 11

major syllabus topic areas is included in the case.

Candidates are to use this information in developing

their written reports.

Page 4 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination General Comments

General Comments

October 2001

CMA Entrance Examination

Part 1

Part 1 of the October 2001 CMA Entrance Examination consisted of 165 multiple-choice

questions testing the eleven topic areas listed in the CMA Entrance Examination Syllabus. On

average, candidates answered 81 of the 165 questions correctly. The results for each topic area

were as follows:

Topic Area Number of Questions

Average Number

Correctly Answered

Management Accounting

37 18

Corporate Finance

11 5

Operations Management

11 6

Information Technology

14 7

Strategic Management

10 7

International Business

11 5.5

Human Resources

11 6

Marketing

9 5.5

Financial Accounting

29 11

Taxation

14 5

Internal Control

8 5

Total

165 81

It should be noted that the questions were not all valued equally. Those that had a plus sign (+) at

the beginning of the question were valued higher than the rest of the questions, and those with a

minus sign (-) were valued lower than the rest of the questions.

Generally, candidates performed fairly well on the questions testing material in the following

topic areas: strategic management, marketing, operations management, internal control and

human resources. The weakest areas of performance were on questions testing taxation, financial

accounting, and corporate finance. Performance on questions pertaining to management

accounting, information technology, and international business was average.

In the interests of improving the maintenance of a consistent passing standard over time, The

Society of Management Accountants of Canada has adopted equating methodology. This

involves the reuse of selected multiple-choice questions on future examinations. Consequently,

the actual multiple-choice questions used on the October 2001 CMA Entrance Examination are

not being provided. Practice multiple-choice questions are available in the June 2001 CMA

Entrance Examination and Solutions booklet and in Section F of the CMA Entrance Examination

Preparation Manual.

The Society of Management Accountants of Canada Page 5

October 2001 CMA Entrance Examination Part 2 - Backgrounder

The Societies of Management Accountants of Manitoba, New Brunswick, Newfoundland, Northwest Territories, Nova Scotia, Ontario, Prince

Edward Island, Saskatchewan and the Yukon, Certified Management Accountants Society of British Columbia, The Certified Management

Accountants of Alberta, Ordre des comptables en management accrdits du Qubec

October 2001

CMA Entrance Examination

Part 2

Backgrounder

The background information relating to the Part 2 case (Backgrounder) is provided to candidates

in advance of the Part 2 examination date. It contains information about the company in the case

and its related industry. Candidates are expected to familiarize themselves with this background

information in preparation for the strategic analysis that they will be asked to undertake during

Part 2 of the CMA Entrance Examination.

Candidates should note that they will not be allowed to bring any written material into the

examination writing center, including the advance copy of this Backgrounder. A new copy of

this Backgrounder, together with additional information about the company, will be provided at

the writing centre for Part 2 of the CMA Entrance Examination.

Candidates are reminded that no outside research is required and that the industry information

presented, which has been adapted for the purposes of this case, should be used in your analysis.

Page 6 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Chord Technologies Ltd.

Backgrounder

Company Background

Chord Technologies was a partnership owned by Franois Garneau and Jeff Chase that

represented the continuation of a sole proprietorship originally founded by Franois Garneau.

Garneau and Chase were good friends who first met at Technology College where they were

both in the architectural technology program. When Garneau graduated in 1994 (one year ahead

of Chase), he started his own business, which involved drafting blueprints for architects plus

some other drafting work for a metal cutting company. Although he was very proficient in his

work, he struggled to earn a living because the revenue from the drafting jobs was not substantial

and his clients would eventually find it more efficient to hire a full-time drafting technician.

Eventually, Garneau took a full-time drafting job in the cable industry, but he continued to do

some contract work at night.

Jeff Chase had been enrolled in the co-op program at the college. After he had successfully

completed his course requirements at the end of 1994, he still had one work term remaining to

complete his qualifications. He was fortunate to land a four-month assignment in Japan,

commencing in January 1995, where he was expected to train local technicians in the use of

computer-aided drafting (CAD) programs. (Both Chase and Garneau refer to themselves as

CAD jockeys.) These technicians would use the CAD programs to draft plans for new houses

for the company that employed them. Chase conducted his training in English, but while he was

in Japan he learned the basics of conversational Japanese.

The management of the Japanese company the technicians were working for were quite

impressed with Chases ability as a CAD jockey and with his creativeness. In fact, they offered

him a five-year contract to stay in Japan, provided that the appropriate administrative red tape

could be overcome. As it turned out, this could not be accomplished and Chase had to

respectfully decline. However, the possibility of Chase doing design work for them from Canada

was discussed.

After Chase returned from Japan in early May 1995, he and Garneau did some work for the

Japanese company on a limited basis. Garneau continued to work full-time in the cable industry

while Chase looked for full-time employment of his own. Their hope was that the work for the

Japanese company would eventually develop into something more substantial so that they could

devote all of their energies to their yet-to-be established partnership. Unfortunately, a variety of

problems arose related to the Japanese contract work, primarily involving getting approvals and

payments. The frustrations of dealing with this company caused Chase to give up his pursuit of

more substantial Japanese contract work.

The Society of Management Accountants of Canada Page 7

October 2001 CMA Entrance Examination Part 2 - Backgrounder

In June 1995, Chase was offered a drafting position with a cable company operating in several

countries, including Canada, with its head office in San Francisco, California. After working in

its Toronto office for the remainder of 1995, Chase accepted a transfer to the San Francisco

office in January 1996. This presented Chase with a variety of opportunities to meet people in

the cable industry, including representatives of several companies involved in upgrading a

variety of existing cable networks. This gave him a potential contact network for the future.

Chase soon realized that his career advancement ambitions would not be realized with his current

employer, so he decided to return to Canada in the fall of 1996. Through his cable contact

network, he soon obtained some contracts to draft survey maps required in cable upgrading.

Fortunately, this work offered sufficient revenue to enable Chase and Garneau to take the big

step to commit to their own partnership full-time, and Chord Technologies was formed on

January 1, 1997. Since that time, Chords customers were primarily in the cable industry.

Initially, Chord Technologies operated out of Garneaus residence, located in a suburb of a major

Canadian city. As the need to hire additional contract technicians became obvious, Chord leased

a facility in the city. While this location suited both Chase and Garneau, Chord could have

operated from any location with reasonable access to an airport and an international courier

service.

Over its first two years of operations, Chord expanded significantly. By December 31, 1998,

Garneau and Chase had 16 CAD jockeys, two project managers and a director of quality control

working part-time under contract for them. Chase and Garneau were very busy during this

growth phase, handling all the management functions as well as drafting survey maps. At the

suggestion of their tax accountant, they agreed to consider incorporating their partnership and

hiring full-time employees.

The Communications Technologies Industry

Overview

In broad terms, the communications technologies industry covers all technologies involved in

communicating over distances through wire, radio, optical or electromagnetic means. These

include cable, satellite, microwave and wireless transmissions of signals for television, Internet

and telephone communications. The industry is dominated by large, national and international

corporate players, including AT&T, AOL/Time Warner, the Bell series of companies and Cox

Communications. These companies are all involved in a variety of activities, but were initially

involved in mass communications in one way or another. However, there is a second tier of

support entities that provide services to these mega companies, as they require. Chord is one of

these service providers. Upon its inception, Chord limited its activities to the cable transmission

sector of the industry.

Page 8 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

The level of activity in the cable sector is determined by the health of the overall

communications technologies industry. The cable industry tends to grow both by expanding

coverage into new neighbourhoods and other areas not previously served, and by technology

upgrades. When resources become scarce or overburdened, it is usually the upgrading of existing

delivery systems that is cut back. This is to be expected since existing systems are already

producing revenue, although not always at optimal levels, while new neighbourhoods and areas

that do not yet have cable systems are not as yet producing any revenue, so they are given

priority.

In the television sector, cable companies are in direct competition with satellite and wireless

television transmission suppliers. In the Internet sector, cable companies primarily compete with

telephone companies, although satellite and wireless transmission companies have recently

started to supply Internet access. The bases of competition in the cable industry are speed and

quantity (i.e., variety) of product, since all competitors purport to have excellent reliability and

service. Of course, from a customer point of view, reliability and service remain major factors

and they tend not to be at the same level with each competitor. A description and comparison of

the competing technologies in the television and Internet sectors is provided in Exhibit A.

In recent years, there has been a substantial move towards consolidation in the industry, with the

major companies attempting to increase their size and market share primarily by the acquisition

of smaller competitors.

Chord Technologies

Planning and Budgeting

In the first two years of operation, Chord Technologies main focus was on producing a top

quality product, i.e., survey maps. The partners hoped to achieve a reputation for competence in

the industry in order to acquire additional contracts. This would allow Garneau and Chase to

further leverage their income by contracting competent CAD jockeys to assist in the drafting

work. This approach served them well, as Chord received interest in their work from potential

clients in Des Moines, Denver, Chicago and Atlanta. In addition, although they have not yet

performed any survey work in Canada, they have received some local inquiries.

As the volume of work increased, it became necessary for the company to implement project and

cash flow budgeting. Chase undertook this duty as part of the accounting function. The project

budgeting is quite straightforward, since it primarily involves estimating revenue on a per mile

basis, as specified in the related contract, then estimating the direct costs of performing the work.

Overhead, with the exception of necessary computer hardware and software upgrades and

systems maintenance, is mainly fixed. The company currently has enough leased space to

accommodate up to 30 CAD jockeys and 6 project managers comfortably.

The Society of Management Accountants of Canada Page 9

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Operations

The upgrading of existing cable television systems first involves surveying the existing cables

and equipment, and drafting the initial survey maps of this equipment. Once a system is

surveyed, it is then redesigned to allow it to carry more channels and additional services. When

the redesigning is completed, the reconstruction of the cable system is undertaken and an effort is

made to sign up subscribers to take advantage of the enhanced products. Chords specific role in

this process is the drafting of the survey maps. This process is described further in Exhibit B.

Up to the end of December 1998, Chords operations were primarily focused on drafting detailed

survey maps for cable systems upgrades for a single client, a large telecommunications company

in the United States. Initially, these projects were limited to the West Coast of the United States,

but have now expanded to include Florida and Illinois. Chase and Garneau, initially, also

performed some hourly rate drafting work to supplement the operation. Any work that they have

undertaken outside of the survey mapping function has been handled on an ad hoc basis. There

has been very little of this.

During 1997 and 1998, Chord continually upgraded its computer capacity and workstation

efficiency. To facilitate supervisory and quality control activities, the company has implemented

a local area network and has made broad use of passwords for security purposes. Since the

companys main product is computer generated, Chord uses sophisticated equipment and

procedures. Also, as a security precaution, daily back-up copies are produced for off-site storage.

Most of Chords work continued to be in the United States during 1997 and 1998 despite the

increasing respect the company developed on both sides of the border. Because of the value of

the Canadian dollar relative to the American dollar, Chord has been able to submit contract

offers at the low end of the anticipated bid range while still allowing for a reasonable profit

margin. This has provided Chord with a significant competitive advantage over U.S. companies

interested in bidding on the same jobs. To date, Chord has not found that it has been competing

against other Canadian companies for this work.

Although each market, typically consisting of a group of cities and towns, tends to have a

different price range, the competing firms usually have a good idea of the acceptable bid range.

In practice, more contracts are awarded on the basis of satisfactory working relationships than by

open tender.

Organizational Structure

During 1997 and 1998, Chords management committee consisted of Chase and Garneau, who

were also the chief executive officer (CEO) and chief operating officer (COO), respectively (see

Exhibit C). The main qualifications and roles of the members of Chords management team were

as follows:

Page 10 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Jeff Chase, Chief Executive Officer

Chase is a qualified architectural technician and has developed leading edge skills in the area of

applied computer-aided drafting. He has also developed the ability to assist with the installation

of AutoCAD systems and to train operators for these systems. In addition to actually doing some

of the survey mapping as necessary, Chase has been responsible for rectifying any computer

problems as well as any necessary computer programming or customization, and the accounting

function.

Chase has a functional ability in conversational Japanese and, in addition to his considerable

technical skills, he has an innate creative gift for original design with respect to both computer

programming and the design of physical objects such as buildings and furniture. However, Chase

is generally not well suited to being an employee of a company other than his own. While he is

not rebellious, he typically moves quite quickly to the head of the class and then becomes

frustrated with the more limited skills, in his view, of those who remain senior to him. This can

be problematic, as senior management beyond the level of his immediate supervisor are usually

not inclined to disturb the overall morale of their organization to keep Chase happy, particularly

as it is not uncommon for many other employees to be better qualified, at least on paper.

Franois Garneau, Chief Operating Officer

Garneau is also a qualified architectural technician and a competent CAD jockey. He is fluently

bilingual (French and English) and has family and business contacts in Montreal. He also has

some design experience from his days assisting with metal cutting designs. Garneau has been

responsible for human resource management, business planning and the quality control function

for the company, and, like Chase, he has participated in the survey mapping process as needed.

Garneaus personality is in sharp contrast to that of Chase. While he works hard and is willing to

do whatever is needed, he is a lot more relaxed about life in general and provides another useful

perspective when Chase proposes a new idea. While Garneau is quite capable in his own right,

he is comfortable as, essentially, the number two executive and actually prefers to react to

situations that arise rather than create.

Linda Morton, Quality Control Manager

Morton, who at the age of 31 is a couple of years older than the partners, holds a Bachelor of

Commerce degree as well as a certificate in architectural technology. In July 1998, she decided

to work under contract for Chord on a part-time basis as a means of getting back into the

workforce after starting and raising a family for the previous four years. She quickly regained

whatever skills she may have lost and was clearly a special talent. She soon started taking on

jobs from other clients. Since the standard fee for contracted CAD jockeys is rather modest and

tends to stay within a fairly narrow range, Chase and Garneau decided to create a new function

for Morton at a higher fee in the hopes of convincing her to accept a long-term contract. She

agreed to only a one-year contract as the quality control manager on a part-time basis. The

quality control function seemed to be a natural fit for her, as she performed this role well.

The Society of Management Accountants of Canada Page 11

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Accounting Information Systems

Chords internal accounting records have been maintained using commonly available

spreadsheet software. The process is as follows: Chase enters all the cheques and receipts, then

the payments are posted to the appropriate spreadsheet expense column and totals are computed

for the fiscal period, which is also the calendar year. Since the company works almost

exclusively for customers in the United States, no GST is billed on these accounts (i.e., exports

are zero-rated for GST purposes). A memo record of GST paid out is maintained in the

spreadsheet, and applications for refunds of GST input tax credits in excess of GST collected are

submitted on a quarterly basis. If there is any work billed in Canada in a particular quarter, the

related GST is duly reported, thereby reducing the refund requested. When the GST refund is

received, it is recorded as a reduction to overhead expenses.

At year end, lists are made of any outstanding bills and any unpaid invoices to provide the basis

for calculating accounts payable and accounts receivable. The accountant who is contracted to

prepare Chords income taxes then makes the necessary entries to expense the outstanding bills,

report the unpaid invoices as revenue and record the related accounts payable and receivable.

As of December 31, 1998, Chord did not have any employees, as Linda Morton, the CAD

jockeys and the project managers were all independent contractors who had clients other than

Chord. The partnership simply filed T4A forms showing the amounts paid as other income. It is

expected that when Chord becomes a corporation and hires full-time employees, a regular

payroll routine using a well-known small business software package will be established. It is also

expected that the same software package will be used for recording the regular accounting

transactions of the corporation. The software in question would integrate the payroll function

with the general ledger function and, should it become desirable at some time in the future, the

project accounting module could be used to track work in process as well as prepare project

estimates and budgets.

Considering the dollar volume of business conducted by Chord, it actually has very few cash

transactions. This is a function of the size of its typical contracts and the relatively small number

of input components involved with the production of the survey maps.

Marketing

During the first two years of operation, Chords marketing activities consisted almost entirely of

using the personal contacts developed by Chase while he was in California. Once Chord received

its first large contract, the partners focus was on generating cash flow and becoming profitable

rather than on extensive marketing.

Human Resources

The main function performed by the contracted workers is the drafting of survey maps. For a

slightly higher fee, the project manager function includes the responsibility of coordinating the

various sub-map segments of a particular project in addition to performing regular drafting

duties. When hiring contractors, Garneau looks for people with superior CAD skills and gives

Page 12 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

preference to those with an architectural background. He also has a preference for people who

are willing to learn new concepts, though this is a more difficult attribute to discern.

The initial term of a contract for a new CAD jockey is three months. For those who demonstrate

excellent skills, Chord offers a longer-term contract for a $2 per hour increase in rate. Prior to

1998, Chord had no trouble in attracting the quality and quantity of people that it sought,

although expectations regarding their ability were not always met. In 1998, it became more

difficult for Chord to find a sufficient number of qualified contractors and some of the regular

contractors decided to leave Chord in favor of other businesses, either as contractors or as

employees. For the most part, Chase and Garneau believed that these problems were industry

wide and were caused by a combination of a growing economy, particularly in the hi-tech

industries, and a shortage of qualified people in the work force.

Diversification Strategy

Chase and Garneau were well aware of the risks of depending primarily on one large client. To

address this situation, in 1998, they decided to consider pursuing a number of possibilities with a

view to providing some diversification to their activities. One of the options that they were

considering was to provide architectural design services locally for some friends who have a

successful residential housing construction company.

Another option being considered was a merger proposal received from CCC Ltd. (see Exhibit D).

Although Chase and Garneau viewed the initial proposal to be unappealing in terms of its

immediate returns and their share of ownership, they made a counter offer. While the partners

were not expecting a quick, positive response to all the terms of their counter offer without some

negotiation, they were interested in seriously exploring a variation on this proposal as a means of

broadening their market and the services they could offer.

Furthermore, with the background and training that Garneau and Chase possess, in addition to

their acknowledged superior drafting skills, they could provide drafting services to almost any

industry at the requisite level. Chase, in particular, was interested in pursuing the various

diversification opportunities, as he had a tendency to become bored easily and was always

looking for new approaches, better methods and new challenges. Although Chord was still a

relatively new company and despite the fact that he did not have enough hours in the day as it

was, Chase was anxious to try his hand at other projects.

In contrast to Chase, Garneau was much more comfortable with dealing with details and with

operating in a repetitive comfort zone. This did not mean that he was in any way opposed to

potential diversification opportunities, or even to putting in the extra effort to try to develop

additional services and markets while handling his share of the day-to-day operations. It simply

meant that he was less prone to requiring change to provide him with job satisfaction.

The two partners together provided a good psychological balance. Chase provided the impetus

for the need to consider what is new and what might be possible, while Garneau provided the

sounding board for new ideas and made sure that Chords philosophy did not become change

for the sake of change, but rather, change if the change will improve, or has an upside potential

to improve, the status quo.

The Society of Management Accountants of Canada Page 13

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Financial Management

In 1997 and 1998, the major revenue source for Chord was survey map drafting. The contracts

for this work, currently limited to U.S. customers, were written in terms of dollars per mile.

There was also a built-in premium for each apartment building on a particular map. Industry

practice is to pay an additional US$1 over and above the per mile rate for each apartment

building. These financial details are built into the contracts by general provision, but are not

numerically specified because the exact number of apartment buildings is not known at the time

that the contract is signed.

The rate charged per mile varies from US$100 to US$150, depending on the area and on the

customer. On specific contracts, Chord knows the actual revenue rate. However, for the purposes

of annual projections, an average expected revenue per mile of US$120 (Cdn$180) is used. See

Exhibit E for a summary of probable billing rates Chord expects to charge for its services.

Although there is additional compensation for apartment buildings, they are always losing

propositions, since the additional compensation is never sufficient relative to the additional time

required to do the survey mapping. Thus, the mapping is most profitable for areas where the

population density is fairly low and the style of dwelling is detached housing. The most time

consuming (and, therefore, least profitable) mapping involves areas that are high density and

multiple dwelling in nature.

For purposes of estimating costs and revenues for a particular job, Chord uses the mileage rate

stipulated in the contract, ignoring any bonus for multiple-unit buildings, and an average

mapping time of four hours per mile. Direct labour costs are estimated at $16 per hour for

drafting, plus an estimated $5 per mile for quality control. Chase and Garneau were aware that

labour costs would increase by about 10%, to cover employment expenses other than the direct

hourly wage rate, as a result of replacing contractors with full-time employees once the business

is incorporated. However, given the volume of work and the margin per unit, they did not see

any problem in absorbing these increased costs.

All other costs were treated as period costs. A condensed summary of operating results for 1997

and 1998 is provided in Exhibit F.

Page 14 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Exhibit A

Comparison of Technologies For Television and Internet

Digital Versus Analogue Television

Since 1953, the television industry in North America has followed the standard set by the

National Television Standards Committee (NTSC). This standard has specified analogue

transmission, which is the sending of television signals in the form of a constantly variable wave

(i.e., this is done by varying the voltage in an electrical signal). The video and audio signals of a

television program are transmitted simultaneously on separate high frequency radio waves,

which create a band, or channel. Each television station (or channel) has been assigned a

6-megahertz (MHz) slice of the radio spectrum for their transmissions, called a bandwidth. (A

hertz is a measure of frequency equal to one cycle per second, and a bandwidth corresponds to

the difference between the lowest and highest frequency signal that can be carried by a channel.)

Each high frequency wave is transmitted from point to point in a straight line to antennas,

satellite dishes or receivers in one of three ways: through terrestrial transmission (e.g., broadcast

through the air from transmission towers to antennas), through satellite transmission, or through

cable transmission.

In the 1990s, some television stations began to adopt digital television (DTV), which is the

transmission of television signals using digital rather than conventional analogue methods.

Digital transmission consists of an electronic pulse which has only two possible states (i.e., it is

either on or off, or it is positive or negative). Each pulse is represented by a one or a zero, known

as a bit. Both digital and analogue signals are transmitted in the same basic ways and have the

same range, but because a digital signal does not fluctuate, a digital transmission is more precise

than an analogue transmission, and much more digital data can be transmitted in the same

bandwidth.

In November 1997, Industry Canada agreed to adopt the North American DTV standard set by

the Advanced Television Systems Committee (ATSC). The ATSC standard includes 18 DTV

display formats separated into two categories: High-Definition Television (HDTV) and

Standard-Definition Television (SDTV). The main difference between the two formats is the

resolution (i.e., number of picture elements called pixels) that can be displayed on the television.

Each pixel is a single dot of light on the television screen, and the higher the number of pixels on

the screen, the sharper the picture will be. The highest quality format (HDTV) can display a

widescreen picture which has a width-to-height ratio of 16:9 (compared with a 4:3 ratio on a

conventional television set) and which is up to 900% sharper than traditional analogue television.

The advantage of SDTV is that a television station can broadcast up to 6 SDTV channels using

the same bandwidth as is required for a single HDTV or analog TV channel.

The Society of Management Accountants of Canada Page 15

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Some of the advantages of DTV over analogue TV include the following:

Superior clarity and depth of image, elimination of snow or ghosting, and exceptionally

vivid colours with no bleeding of colours at the edges.

Smaller bandwidth for a given image resolution.

Compatibility with computers and the Internet.

Superior audio quality (i.e., the ATSC standard specifies Dolby Digital for audio).

Interactivity (i.e., the ability to interact with the television program that is being broadcast,

such as downloading a recipe from a favorite cooking show).

DTV is currently being adopted by North American television stations and it is expected that

most will have adopted it by 2010. Like analogue signals, digital signals can be sent through

terrestrial transmission, satellite transmission or cable transmission. Although the signals will be

transmitted in DTV, viewers will be able to continue using their conventional analogue television

sets by connecting a digital-to-analogue converter to the television. This converter will receive

the digital signal and reformat it so that it can be displayed on an analogue television.

Cable Television

Origins:

In the 1950s, there were few television stations in North America and their signals could only be

received by antenna that had a clear line of sight from the stations broadcasting towers.

People living in remote areas, especially mountainous areas, could not receive the television

transmission. To solve this problem, remote communities began to erect receiving antennas that

were strategically placed and ran cables to carry the signals from the antennas directly to the

television sets in the local households. This allowed a greater proportion of the population to

enjoy television viewing. Because the signal from an antenna became weaker as it traveled

through the length of the cable, amplifiers had to be inserted at regular intervals to boost the

strength of the signal. Unfortunately, the amplifiers added noise and distortion to the signal,

resulting in a low quality picture. It took a couple of decades to solve the amplifier problems.

Advances in Technology:

The early cable companies started to utilize microwave transmitting and receiving towers to

capture signals from distant stations. This made it possible for cable customers to enjoy a greater

variety of channel choices and its popularity began to grow. Households that previously used

aerial antennas on their roofs began to switch to cable. These households also appreciated the

fact that they could easily and inexpensively equip more than one television set in more than one

room with cable service by simply using a splitter or installing additional cable outlets. This

allowed different household members to watch different channels at the same time.

In the 1970s, cable providers began transmitting signals to telecommunication satellites in

geosynchronous orbit around the earth, and they began to offer pay-per-view channels, which

further increased the popularity of cable television. By the 1980s, coaxial cable was being

replaced with fiber-optic cable. The main advantage of fiber-optic cable was that it did not suffer

the same signal loss as coaxial cable, which greatly reduced the need for amplifiers in the

system. This resulted in dramatic improvements in signal quality and system reliability. The

popularity of cable grew to such an extent that by the mid 1990s, around 95% of households in

Page 16 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Canada were wired for cable television service and about 75% of these households subscribed to

cable television.

As the number of channels grew, the bandwidth of cable systems also increased. By the 1980s,

most cable installations operated with 450 to 550 MHz of capacity, with a downstream

bandwidth capable of carrying the equivalent of up to 65 analogue channels. Today, some cable

systems are capable of carrying the equivalent of more than 110 analogue channels. With the

introduction of DTV, cable companies will be able to transmit many new channels to their

customers. For example, in addition to their regular cable channel packages, cable companies

could offer customers up to 40 digital music channels, 5 movie network channels, NFL Sunday

Ticket, NHL Centre Ice, and many pay-per-view channels. However, to take advantage of the

opportunities presented by digital technology, the cable systems require major upgrading. Also,

subscribers are required to purchase or rent a digital receiver box with digital to analogue

conversion capabilities for each television set that they wish to use for viewing digital channels.

Satellite and Wireless Television

Satellite and wireless television are simply alternative ways of delivering multi-channel

television. Todays most widespread method is cable television. Unlike cable television,

however, satellite television requires that you purchase or rent a dish antenna and a receiver. The

dish receives signals from a satellite orbiting the earth, and the receiver converts those signals

into the programming you will watch on your television. In Canada, the two major satellite

companies are Bell ExpressVu and Star Choice.

Wireless television uses multipoint distribution systems technology whereby the provider

collects television signals using numerous satellite dishes, transports the collected signals to

transmission sites via high capacity fiber optic cable, converts the signals to microwaves and

then transmits the microwave signals to the customers homes. Like satellite television, wireless

television requires you to purchase or rent a dish antenna and a receiver. In Canada, wireless

service is offered by Look TV.

Unlike cable television, satellite and wireless television requires line of sight technology. This

simply means that the dish antenna needs a clear view of the satellite or microwave transmitter to

receive the signals. Therefore, a prospective buyer is required to undergo a site evaluation before

purchasing to ensure that there are no obstructions in the neighborhood that would block the

signal.

In the early 1980s, the size and cost of satellite dishes were prohibitive for the individual viewer;

therefore, they were used mainly by cable companies to receive a large variety of channels and

then transmit them to their subscribers. As the cost of satellite dishes decreased, viewers began to

choose a direct-to-home satellite system instead of cable service because, after making the initial

capital investment in hardware, viewers could tune into any channel that was transmitted by

satellite for free, whereas the local cable company offered a limited number of channels for an

ever-increasing monthly fee. However, the satellite industry faced a setback in 1986 as

broadcasters began to scramble their signals, forcing viewers to pay for special decoding

receivers. In the mid 1990s, the satellite industry began to grow again, mainly because they could

take advantage of digital technology faster and easier than the cable companies. Today, about

one in twenty households in North America has a satellite dish antenna.

The Society of Management Accountants of Canada Page 17

October 2001 CMA Entrance Examination Part 2 - Backgrounder

With satellite and wireless television, a symptom called rain fade is a common problem. This

occurs when there is a heavy rain, which can result in the obstruction of the signals or even a

blackout of service. If the dish antenna is installed improperly, these outages are even more

likely to occur. Also, an accumulation of snow and ice during the winter months can reduce the

quality of the reception. Another disadvantage is that you cannot watch multiple channels on

different television sets without purchasing or renting additional receivers. With cable television,

no additional receivers are required to view analogue television channels on different televisions.

Internet

Originally, Internet access was available to the public only through telephone lines. In the 1990s,

cable companies began offering Internet services to their subscribers utilizing their cable lines.

Despite having cable lines already in place, cable companies are required to make substantial

investments in equipment and software to build the end-to-end IP networking infrastructures

necessary to support the high-speed Internet service. This includes items such as modems,

routers, servers, security systems and network management tools.

Competition between the cable and telephone companies has been intense. The telephone

companies, who use dedicated lines, claim that telephone lines are both faster and more secure

than cable because the subscribers connection is not shared. Conversely, the cable companies

claim that cable is faster than telephone lines.

In reality, either service can be faster or slower than the other depending on the situation, and the

security risk attached to using cable is minimal. For example, cable may operate more slowly as

more people use the system. Similarly, telephone lines may operate more slowly the further away

the subscribers computer is from the central office. It can be said, however, that at peak

performance, cable Internet service is slightly faster than the high-speed service which is

available through telephone lines.

What is best in any given location depends on availability, price and the reliability of the

competing suppliers. Potential users are well advised to also research speed at various times of

the day if this is important to them, as this may vary, both in terms of a single supplier and

among competing technologies.

Page 18 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Exhibit B

Chord Technologies

Procedures In Developing and Delivering Drafting Projects

The Overall Steps:

1. Acquiring the drafting contract.

2. Obtaining basic municipal maps of the area covered by the contract, along with the data

from the survey of the existing equipment (see item i below).

3. Drafting the appropriate survey maps (see items ii to vi below).

4. Carrying out a quality control review of the maps.

5. E-mailing the completed product to the customer.

6. Expediting the delivery of hard copies of the maps to the customer.

7. Receiving customer approval of the completed work.

8. Invoicing for the completed work and receiving payment.

Additional Detail Related to Steps 2) and 3) Above:

Note: Chord would be involved in all three drafting processes (ii, iv, and vi below) as a

contractor for the cable provider. Chord uses AutoCAD drafting software to produce all of its

drawings. This software is among the most widely used CAD packages available. Chord has

customized the software in such a way that better quality drawings can be produced in less time

than with the standard software package. The customization also provides for more consistency

among drafting technicians. This reduces the time needed to perform the quality control process.

i) Surveying

Surveying is the process of collecting all of the current field information, such as the location of

all houses, apartment buildings, schools, churches, office buildings, cables, aerial and

underground structures, cable systems equipment (amplifiers, splitters, taps, etc.), distances,

accurate street names, addresses and other relevant information. This survey is a local on-the-

ground walk around. When the data accumulation is complete, the data is run through a quality

control process (QCP) to ensure its accuracy, and is then sent for drafting to Chord.

The Society of Management Accountants of Canada Page 19

October 2001 CMA Entrance Examination Part 2 - Backgrounder

ii) Drafting of Survey Information

This process involves drafting the data collected in step 2) using a computer-aided drafting

system and then running the survey drawings through a QCP to ensure that they reflect the field

data. The information is then sent to the cable providers designers.

ii) Design

This process involves taking all of the existing survey information and redesigning the cable

system to meet the new requirements. The new requirements may involve the addition of new

channels, digital cable service, or Internet over cable service. When the redesign is completed,

the information is returned to Chord.

iii) Drafting of Design Information

The existing survey drawings are now modified, using the redesign information, to create

construction drawings. The modified drawings are run through the QCP to ensure their accuracy,

and then forwarded to the construction division of the cable provider.

iv) Construction

The construction drawings are used as the basis for constructing the new cable system in the

field. The appropriate new equipment is installed and tested. Sometimes the newly constructed

system will vary slightly from the construction drawings due to field conditions. Any changes

are hand drafted on As Built drawings in the field. This information is then sent back to Chord.

v) Drafting of As-Built Information

The construction drawings are updated based on the As-Built information provided by the

construction division. They are run through the QCP to ensure accuracy, and are then stored,

both digitally and on paper, for future reference.

Page 20 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Exhibit C

Chord Technologies

Organization Chart

December 31, 1998

Management Committee

Jeff Chase (CEO) Franois Garneau (COO)

Accounting Operations

Data Processing Project Managers

Quality Control

(Linda Morton)

Computer Systems, CAD jockeys

Design and Maintenance

Business Planning

Customer Relations

The Society of Management Accountants of Canada Page 21

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Exhibit D

Chord Technologies

Merger Proposal From CCC Ltd.

November 28, 1998

The Company

XPL Ltd. (XPL) is an inactive subsidiary of Cable Construction of Canada Ltd. (CCC). CCC has

a thriving business in the construction aspect of cable installation. It has tried to develop its own

drafting and design operation twice in the past, but has been unsuccessful.

The Proposal

XPL would purchase the assets of Chord for $400,000 in cash plus 34% of the outstanding

shares of XPL. In addition, both Chase and Garneau would be employed as executives of XPL at

annual salaries of $120,000 each, with a minimum 5-year term, conditional on annual sales being

maintained at no less than $1,000,000. CCC expects to provide a minimum of $1,000,000 in

revenue to XPL through its construction customers. CCC will also ensure that there is sufficient

cash flow available, i.e., up to 75% of any outstanding receivables. XPL will pay an annual

dividend of not less than 50% of its after-tax income (the tax rate will be approximately 40%).

The Analysis

It appears that XPL would basically be using cash collected from Chords current

receivables to finance the $400,000 of upfront money it needs to pay for Chords assets.

Without the merger, Chase and Garneau have projected that they will net $200,000 each

in 1999 from Chords operations.

Based on the data projected by CCC as well as Chase and Garneaus own knowledge of

direct costs, their most favourable calculations indicate that XPLs 1999 net after-tax

income would be about $400,000. Therefore, Chase & Garneaus share of any dividend

would be about $68,000 (i.e., .5 x 34% x $400,000). This would give each of them a

salary of $120,000 and a dividend of $34,000 for the year.

The Discussion

Chase and Garneau would not be averse to taking an early gain on their company if it provided

enough of a nest egg to provide some security. However, to receive the cash equivalent of their

current receivables plus a job with a five-year harness for substantially less money than they

expect to make by retaining their business was not very attractive.

Page 22 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Backgrounder

The Counter Offer

After reflecting on the proposal, Chase and Garneau decided that the offer was quite

unsatisfactory from their perspective, but if CCC seriously wanted to merge XPL with Chord,

they would make the following counter offer:

$1,000,000 in cash plus 50% of the shares of XPL.

Executive positions at XPL, at an annual salary of $150,000 each, with a two-year guarantee.

Positions on the board of directors for both of them.

Option to sell their shares in XPL to CCC for $1,000,000 after two years, payment terms

open to negotiation before closing.

Chase and Garneau were willing to negotiate somewhat from this position, but they wanted to

establish some realism in the discussions which they felt was lacking to this point.

The Society of Management Accountants of Canada Page 23

October 2001 CMA Entrance Examination Part 2 - Backgrounder

Exhibit E

Chord Technologies

Probable Billing Rates

Type of Service

Architectural drafting

Cable systems survey mapping

Billing Rate in Canadian Currency

$30 to $35 per hour

$150 to $225 per mile

or $93 to $140 per kilometre

Exhibit F

Chord Technologies

Condensed Operating Results

For the Years Ending December 31

1998 1997

Revenue from survey maps

Other revenue

Contract expenses

Income before partners taxes

$900,000

10,000

315,000

468,000

$580,000

32,000

160,000

340,000

Page 24 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Additional Information

The Societies of Management Accountants of Manitoba, New Brunswick, Newfoundland, Northwest Territories, Nova Scotia, Ontario,

Prince Edward Island, Saskatchewan and the Yukon, Certified Management Accountants Society of British Columbia,

The Certified Management Accountants of Alberta, Ordre des comptables en management accrdits du Qubec

October 2001

CMA Entrance Examination

Part 2

(Time Allowed: 4 hours)

Notes:

i) Candidates must not identify themselves in answering any question.

ii) This examination has a total of 8 pages and consists of one question. Ensure that you

have a complete examination question paper before starting to answer the question.

iii) All answers must be written on official answer sheets. Work done on the question paper

or on the Backgrounder will NOT be marked.

iv) Included in the examination envelope is a supplement consisting of formulae and tables.

It is a standard supplement that may be useful for answering the question on this paper.

v) Part 2 consists of one case question, which you are to answer in the four hours allotted.

vi) Examination answer sheets must NOT BE REMOVED from the examination

writing centre. All used and unused answer sheets and working papers must be sealed in

the examination envelope and submitted to the presiding officer before you leave the

examination room.

The Society of Management Accountants of Canada Page 25

October 2001 CMA Entrance Examination Part 2 - Additional Information

Chord Technologies Ltd.

Additional Information

Historical Update

Effective with its fiscal year commencing January 1, 2000, Chord was incorporated and was

renamed Chord Technologies Ltd. The two founding partners were issued 1,000,000 common

shares each in return for $1,000 each in cash. The incorporated entity recorded the capital assets

at their tax values, which were approximately equal to their net fair values at the time. The only

other items transferred to the corporation were some cash, the accounts receivable, the accounts

payable and some nominal amount of supplies and prepaid expenses. The net difference (i.e.,

value of transferred assets less transferred liabilities less $2,000 share equity) was credited

equally to Chase and Garneau and recorded as a liability in the Due to shareholders account.

For tax purposes, a Section 85 rollover was filed to establish that this was essentially a sale to

oneself.

On January 1, 2000, Chord Technologies, the partnership, ceased to function as an active

business and its federal business number was cancelled. With the agreement of its existing

customers, all of Chords contracts were continued under the new corporate name. As planned,

the new corporation ceased to use contract workers and instead hired full-time employees at the

same rate per hour as before. Although some of the previously contracted workers agreed to sign

on as employees, including Linda Morton, many declined the offer and Chord had to hire and

train new staff.

During 1999 and the first part of 2000, Chord continued to obtain significant contracts from U.S.

cable companies to prepare survey maps. In fact, for the first quarter of 2000, billings had topped

$475,000 and Chord had contracts in hand for an additional $1,425,000 to be completed by year

end. Expectations were that revenues would easily top $2,000,000 for the year, provided that

competent staff could be found to produce the volume of work required. Unfortunately, the

turnover of CAD jockeys was beginning to become a problem, primarily because of the lack of

any visible career path that Chord could offer.

The pressure to maintain production and keep pace with the mounting volume of administrative

concerns, combined with the prospects of a substantial increase in profits, led Chase and Garneau

to hire a receptionist-bookkeeper and to increase the number of CAD jockey positions to 26 in

early 2000. A third project manager position was also established.

Due to the much higher level of activity, there had been no progress made in terms of resolving

the issue of the companys dependency on the cable sector. Consequently, Chords resources had

been increasingly tied up in accounts receivable and work in process, causing Chords working

capital requirements to frequently exceed its line of credit. Additionally, CCC Ltd. had not

responded to Chords counter offer and Chord had not pursued the issue further.

Page 26 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Additional Information

The April 2000 Board of Directors Meeting

Both Chase and Garneau had been working long hours on various aspects of the business and,

despite its apparent success, there was a sense that things were somewhat out of control. Among

other things, the time demands of staff recruiting and training were taking a heavy toll.

Competition for techies was intensifying and recruiting was becoming more difficult. In

addition, Chase and Garneau were not very satisfied with the level of administrative support they

were receiving.

Linda Morton, however, continued to perform very well and Carol Milan, one of the CAD

jockeys, had become a natural leader in the office. Carol was often the first one that others on her

team would turn to if they were having a problem. Chase, in particular, wanted to ensure that

Chord fully utilized her talents and retained her interest.

In light of the above, the following decisions were made at the April 2000 board of directors

meeting:

As a staff retention measure, it was decided to give all permanent technical staff a 20%

increase in their hourly rates.

Linda Morton would be promoted to the new position of office manager and relieved of her

quality control responsibilities.

Carol Milan would be promoted to the quality control manager and would also be used to

assist with the training of new CAD jockeys.

The Remainder of 2000

During the last three quarters of 2000, the following occured at Chord Technologies Ltd.:

Morton and Milan settled into their new positions and did a good job. However, Morton

expressed a desire for greater participation at the decision-making level.

The contract work continued at a steady pace, but there were signs of a leveling off of

activity in the industry, particularly in the cable upgrading sector, as the impact of the costs

of amalgamation began to be felt. Chords main customer advised Chord not to be concerned,

as it would be continuing cable upgrading and would require 700 miles per month of survey

mapping in 2001. While this would represent a small decrease relative to current levels, it

could easily be handled through attrition at the production level. If necessary, the project

managers could be reduced by one or their hands on requirement could be increased.

Receivables continued to be outstanding for significant periods of time, preventing Chord

from accumulating any significant cash reserves.

Chase and Garneau turned down another proposed merger.

The Society of Management Accountants of Canada Page 27

October 2001 CMA Entrance Examination Part 2 - Additional Information

2001

In January 2001, Chord was advised by its main U.S. customer that there would be a temporary

cutback in the upgrading of cable systems. Its head office declared that there would be a 25%

budget reduction across the board for the next six months. The impact on Chords contracts was

that average mapping requirements would drop to about 500 miles per month. The customer

contact assured Chase, however, that this was only temporary, and that regular volumes should

resume at the end of the six-month period.

Notwithstanding the above, Chase requested payment from the customer of the US$609,600 in

billings currently outstanding, and his contact promised to look into the matter. Subsequently, the

contact advised Chase that the outstanding invoices had either not been received or had been

misplaced, and requested Chase to re-invoice them. Chase did so shortly thereafter.

Chase and Garneau discussed the implications of the unforeseen reduction in survey mapping

business at the January 2001 board of directors meeting. Although no reduction in revenues can

be received in a positive way, they saw this temporary downturn as an opportunity to perform

staff reviews and ensure that quality had not slipped during the recent busy period. Chase also

noted that this volume reduction would allow him to ensure that all the proper year-end

procedures were carried out. By coincidence, Chord was two CAD jockeys below what it ideally

needed for its workload previous to receiving this news. Not surprisingly, they decided not to fill

these positions in the short term.

The following other issues were raised at the board meeting:

Chase expressed an increasing concern regarding collection of receivables, a situation that

was putting serious pressure on funding the regular payroll.

Garneau suggested that they should look more seriously at prospects for diversification.

Chase agreed; however, no definite plans were made in this regard.

In August 2001, Chords main U.S. customer advised them that, as a result of the company

having had its credit rating reduced by Dun and Bradstreet recently, its head office had put a

temporary hold on all new cable upgrade projects, with a few very specific exceptions. It was

expected that it would take the company between twelve and eighteen months to reestablish its

desired working capital position. Chase was advised by his contact at the company that Chords

share of the limited work available would be only 50 miles per month. In a related matter, Chase

thanked his contact for his recent efforts in getting some of Chords invoices paid, but pointed

out that payments were still substantially in arrears. His contact agreed to do what he could, but

blamed the problem on head office. Nevertheless, he assured Chase that payment would be

forthcoming shortly.

Page 28 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Additional Information

Possible Options

Diversification

With the decrease in the survey mapping business, Chord could more vigorously pursue other

CAD applications, such as some of those services Chase and Garneau have provided or

experimented with in the past. These include the following:

1. Architectural design and drawings for residential housing.

2. Drafting support for architects.

3. Program installation, setup and training for CAD software.

4. Customization of CAD software.

5. Industrial design production drawings.

6. Corporate logo and web-site design.

7. Aerial photography survey map drafting.

For items 3 and 4, Chase would currently be required to do the work. For items 1 and 6, Chase or

Garneau could fulfill the work requirements, though Chase is more inclined to the creative side

than Garneau. For items 2, 5 and 7, any qualified CAD jockey could handle the work with

minimal supervision. (See Appendix 1 for probable billing rates.)

Acquisition

Chord has an opportunity to acquire a small CAD service bureau located close to Chord. This

company, known as Computer Design Services Inc. (CDSI), currently specializes in providing

CAD jockeys for short-term or replacement assignments. It also has the ability to design web-

sites and carry out other CAD applications. The company continues to be reasonably successful.

In what is known to be a low margin business, CDSIs most recent three-year history is as

follows:

2000 1999 1998

Gross revenue $4,360,000 $4,010,000 $3,650,000

Income before owners salaries and income taxes 434,000 388,000 365,000

Net income 120,000 120,000 90,000

Retained earnings 220,000 190,000 160,000

Indications are that CDSIs shares could be acquired for $852,000, with $402,000 payable upon

closing and $150,000 per year for the next three years. All three of its shareholders would be

equally happy to either leave CDSI or continue on a salary basis. In the latter case, two of the

three, Ella Nehrik, an MBA in human resource management, and Carl Ho, an architectural

technologist, would be willing to lend their after-tax share proceeds back to the business on a

renewable term basis at an interest rate of prime plus 1%, on the condition that Chase and

Garneau would provide a personal guarantee.

The Society of Management Accountants of Canada Page 29

October 2001 CMA Entrance Examination Part 2 - Additional Information

Employment

Chase and Garneau are both easily employable. In fact, both have had job offers in the recent

past that they could still accept. In Garneaus case, the offer is from an uncle in another province

who is a partner in a well-respected firm of architects. This experience could lead to several

possibilities in the future. First, a service bureau for providing CAD services to architects could

be started, if pricing could be kept competitive. Second, contacts in the cable industry in that

province could be made. Third, this experience could provide invaluable information and leads

with a view to opening a Chord office in a major city in that province at some future time.

Alternatively, Garneau could also find employment locally.

Chase has two existing offers, one from a local firm entailing a twelve-month consulting and

training assignment that would allow him to stay on the cutting edge of CAD technology and

further develop his instructing skills. Presumably, Garneau could also benefit from Chases

experience by eventually offering consulting and training services in French as well as in

English. Chases second offer is from his residential construction friends to establish and manage

an architectural design department for them.

Other

a) Chase and Garneau could simply wind-up Chord and go their own ways for now as far as

business is concerned. Perhaps they could resume working together at a later time.

b) Chord could suspend operations until business picks up in the cable upgrade industry.

c) Chord could be sold, albeit at a very sacrificial price, perhaps to Linda Morton and Carol

Milan.

d) Chase has again been offered a contract to go to Japan. This contract would be for a

maximum of three years. Chase would be paid the equivalent of US$200,000 annually

and he would be entitled to renew or cancel the contract on 30 days notice on either

anniversary date. If his wife of six months remained in Canada, his annual living costs in

Japan would be in the neighbourhood of US$120,000, including income taxes. If he takes

his wife, who would not be employable in Japan, his annual living costs would increase

to US$160,000.

In October 2001, Chase and Garneau decided to solicit the services of a consultant, Gerry Parker,

to assist them in sorting out their options.

Preliminary Research Findings

In preparation for his assignment, Parker undertook some preliminary research and discovered

the following:

Although the list of employment options above was prepared as objectively as possible, the

shareholders of Chord have certain personal priorities. Jeff Chase, whose wife has just started

a job in the marketing department of a large automobile manufacturer, would see going to

Japan at this particular time as a measure of last resort. Indeed, he would prefer to be able to

function from his present location. Garneau, who is currently unattached, would see working

Page 30 The Society of Management Accountants of Canada

October 2001 CMA Entrance Examination Part 2 - Additional Information

for his uncle as either a last resort or a short-term solution. He would prefer a solution that

includes the continuance of Chord and its recovery as a creative, profitable company.

Although Chase is, perhaps, less sentimental about Chord, he also sees it as a viable and

desirable option. He, too, would prefer a solution that includes the rehabilitation of Chord.

Both Chase and Garneau continue to believe that they can do well together with their

complementary abilities.

A case could be made for having all of the survey work done by the CAD jockeys while

Chase and Garneau pursue more challenging and profitable activities more in line with their

unique and valuable talents, an observation that both have made from time to time.

The operations of Chord have actually been very basic in its short existence. This is probably

a good thing, since both Chase and Garneau have been handling areas of the operations for

which they have only minimal training and experience.

Until the end of 1999, the accounting function consisted of keeping the minimum amount of