Beruflich Dokumente

Kultur Dokumente

How To Use Infra Bonds

Hochgeladen von

vshrika210 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

63 Ansichten3 SeitenThis document discusses several ways for salaried individuals to save on taxes, including investing in infrastructure bonds under Section 80CCF, taking tax deductions on home loan principal and interest payments under Sections 80C and 24, using capital losses to offset gains, and claiming tax benefits from salary allowances like HRA and LTA. It recommends investing in infrastructure bonds before the March 31st deadline, maximizing tax deductions on home loans for self-occupied and rental properties, offsetting losses against gains, and utilizing HRA, LTA, and medical reimbursements to lower taxable income.

Originalbeschreibung:

How to use Infra Bonds

Originaltitel

How to Use Infra Bonds

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses several ways for salaried individuals to save on taxes, including investing in infrastructure bonds under Section 80CCF, taking tax deductions on home loan principal and interest payments under Sections 80C and 24, using capital losses to offset gains, and claiming tax benefits from salary allowances like HRA and LTA. It recommends investing in infrastructure bonds before the March 31st deadline, maximizing tax deductions on home loans for self-occupied and rental properties, offsetting losses against gains, and utilizing HRA, LTA, and medical reimbursements to lower taxable income.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

63 Ansichten3 SeitenHow To Use Infra Bonds

Hochgeladen von

vshrika21This document discusses several ways for salaried individuals to save on taxes, including investing in infrastructure bonds under Section 80CCF, taking tax deductions on home loan principal and interest payments under Sections 80C and 24, using capital losses to offset gains, and claiming tax benefits from salary allowances like HRA and LTA. It recommends investing in infrastructure bonds before the March 31st deadline, maximizing tax deductions on home loans for self-occupied and rental properties, offsetting losses against gains, and utilizing HRA, LTA, and medical reimbursements to lower taxable income.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

How To Use Infra Bonds, HRA, LTA, Home

Loan To Save Tax

It's that time of the year again! When everybody's in the holiday spirit, you might be taking a

family vacation to reward yourself after a long year's work, and let's not forget this is also tax-

saving time.

If you are a salaried individual, your company is probably going to ask for your investment

proofs for this year right about now. Most people stop at giving proof of their Section 80C

investments. But there are a few more things that you can consider. Let's see what these are.

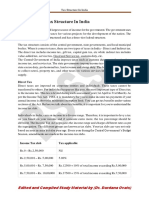

1. Infrastructure Bonds: Section 80CCF

You must have seen the hoardings lately. IDFC, IFCI and other companies are advertising

their infrastructure bonds, which give you tax relief under Section 80CCF and enable you to

in your own way, contribute towards building the infrastructure of the country.

Investments of up to Rs. 20,000 in these bonds qualifies for tax deduction.

These bonds are launched by companies including IDFC, L&T, IFCI, IIFCL and other

NBFCs classified as infrastructure companies.

If you are in the 30.90% tax bracket, then investing in an infrastructure bond will save you

up to Rs. 6,180 this year. With this tax amount saved, the yield on these bonds goes up

significantly. This is a definite consideration from a tax saving point of view. For more

details on which infrastructure bond to invest in, do have a look at our article on REC Infra

Bond - 80 CCF . You have until March 31st, 2011, to invest in any infrastructure bond, but

do note that the interest rate offered right now is quite attractive, and will most likely not get

any higher than it is right now, so don't wait.

2. Save tax through your home loan (Section 80C, Section 24)

If you have a home loan right now, you're probably feeling the pinch of the high interest

rates through your EMI. But, there's a beautiful silver lining to your home loan, and that's

how its helping you save on tax.

The laws of our country are such that if you have taken a home loan on a house that you are

living in i.e. a self occupied property, you are eligible for a Rs. 1 lakh deduction under

Section 80C on the principal repayment of your home loan, and a Rs. 1,50,000 deduction

under Section 24 of the interest repaid.

But, apart from this, if you have taken a home loan on a house that you have given out on

rent i.e. a let out property, then your tax benefits are much higher! You get the same

principal deduction as a self occupied property, but here your interest repaid is fully and

completely deductible! There is no limit on interest repaid on a let out property.

Make the most of either of these 2 situations and you can save a hefty amount of tax, which

you can promptly invest towards your retirement. For more information on this, do check out

our tutorial on Saving Tax through House Property.

3. Know how to use your short term capital gains loss

If you, like most investors, also trade in shares, and have made some losses this year, you

can set off these losses against any gains that you have made.

The divisions are as follows:

Short Term Capital Loss can be set off against Short Term Capital Gains, or Long Term

Capital Gains. Long Term Capital Loss can be set off only against Long Term Capital Gains.

So For example, if you have made a short term capital loss on direct equity, and made a gain

on Gold ETFs or even physical gold, or perhaps a gain made on property, you can set off the

losses against the gains. Please do speak with your CA for more details on this as the rules

are very specific, and save more tax this year.

4. How to save tax through salary allowances i.e. HRA, LTA, Medical Expenses

If you look at your salary slip, you will see certain amounts each month stats as HRA (House

Rent Allowance) and LTA (Leave Travel Allowance).

These sub divisions in your salary are there to help you save tax.

If you are living on rent, then you can claim HRA by showing your rent payment receipts.

Remember, the HRA rules allow you to claim only a certain amount of HRA which is the

least of the following:

a. Rent paid less 10% of your basic

b. 50% of your basic (if you live in a metro) or 40% if you live in a city other than a metro

c. Actual HRA received

This is an excellent way to save tax. So if you are living on rent, you must use it.

Similarly, your LTA allows you to save tax as well. If you have taken a holiday or plan to

take a holiday before March ends, you can claim your travel expenses (only travel, not stay

and food) within a limit as set by your employer and within certain rules as set by the

Government of India. For details on how to save tax using LTA, please see our tutorial on

How To Save Tax in your Salary.

Everybody has medical expenses and what's great is that you can use these regular medical

expenses to save tax. This depends on the salary structure decided by your company. Some

companies offer a reimbursement of medical expenses up to Rs. 15,000 per year. Others

include it as a part of your salary structure which you receive every month, and you can

present bills up to Rs. 15,000, which will be tax deductible under Section 17(2).

Next week, we will talk more about how to save tax, and see how forming an HUF can help you

to save tax as well. For now, do be sure to make use of the above mentioned points and submit

your investment proofs on time.

This note is authored by PersonalFN, a service brand of Quantum Information Services Pvt. Ltd.,

which has over 10 years of expertise in researching Mutual Funds and also provides unbiased

views on Mutual funds, Insurance, Gold and Fixed Income instruments in India. PersonalFN

provides premium mutual fund research and financial planning solutions to individuals. and also

powers research services for Quantum Equity Fund of Funds, a product of Quantum Mutual

Fund.

Das könnte Ihnen auch gefallen

- How to Save Tax with Sec 80C InvestmentsDokument4 SeitenHow to Save Tax with Sec 80C InvestmentsManu VermaNoch keine Bewertungen

- 8 ways to lower your tax billDokument6 Seiten8 ways to lower your tax billansplanetNoch keine Bewertungen

- Saving Income Tax - Understanding Section 80C DeductionsDokument6 SeitenSaving Income Tax - Understanding Section 80C DeductionsAbhishek JainNoch keine Bewertungen

- Interest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very SoonDokument3 SeitenInterest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very Soonanshushah_144850168Noch keine Bewertungen

- 10 Lesser Known Income Tax DeductionsDokument3 Seiten10 Lesser Known Income Tax DeductionsPrakash GuruswamiNoch keine Bewertungen

- Report on Corporate Tax Planning StrategiesDokument16 SeitenReport on Corporate Tax Planning StrategiesRutu Patel0% (1)

- Budget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaDokument79 SeitenBudget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaLukkana VaraprasadNoch keine Bewertungen

- Saving Income Tax - Understanding Section 80C DeductionsDokument4 SeitenSaving Income Tax - Understanding Section 80C DeductionsArun SinghNoch keine Bewertungen

- Income Tax Deductions From SalaryDokument34 SeitenIncome Tax Deductions From SalaryPaymaster Services100% (2)

- Create Wealth The Contrarian WayDokument3 SeitenCreate Wealth The Contrarian WaymayusawantNoch keine Bewertungen

- Tax PlaningDokument9 SeitenTax PlaningGaurav Singh JadaunNoch keine Bewertungen

- Tax Planning DefinitionDokument7 SeitenTax Planning DefinitionAlex MasonNoch keine Bewertungen

- Section 80C: List of Eligible Investments Are As FollowsDokument7 SeitenSection 80C: List of Eligible Investments Are As FollowsKachua SinghNoch keine Bewertungen

- Tax PlanningDokument3 SeitenTax Planningjoseph_gopu17919Noch keine Bewertungen

- Investment Alternatives For Tax Savings For Salaried EmployeesDokument10 SeitenInvestment Alternatives For Tax Savings For Salaried Employeessanjaymenon94Noch keine Bewertungen

- Income Tax ProjectDokument6 SeitenIncome Tax Projectdipmoip2210Noch keine Bewertungen

- Choice of Accounting SystemDokument4 SeitenChoice of Accounting SystemAnkush At Shiv ShaktiNoch keine Bewertungen

- The Stock Markets Have Reached Dizzying HeightsDokument6 SeitenThe Stock Markets Have Reached Dizzying HeightsAmber ManochaNoch keine Bewertungen

- Interest IncomeDokument4 SeitenInterest Incomenikhil khajuriaNoch keine Bewertungen

- Optimizing On TaxDokument2 SeitenOptimizing On TaxvijaysNoch keine Bewertungen

- Analysis of Tax05Dokument19 SeitenAnalysis of Tax05kharemixNoch keine Bewertungen

- NRI Saving GuideDokument4 SeitenNRI Saving GuidemeenaNoch keine Bewertungen

- How To Save Tax Legally With Income Tax Deductions From 80C To 80G?Dokument3 SeitenHow To Save Tax Legally With Income Tax Deductions From 80C To 80G?facedoneNoch keine Bewertungen

- Tax Planning Guide for Indian IndividualsDokument14 SeitenTax Planning Guide for Indian IndividualsArun JaiswalNoch keine Bewertungen

- Making The Best of Tax Saving OptionsDokument12 SeitenMaking The Best of Tax Saving Optionssumit_shindeNoch keine Bewertungen

- Chapter - 1Dokument62 SeitenChapter - 1neetuNoch keine Bewertungen

- 12 DTC PresentationDokument19 Seiten12 DTC PresentationPunit BhandariNoch keine Bewertungen

- Digital Assignment - 3: Submitted To: Submitted byDokument11 SeitenDigital Assignment - 3: Submitted To: Submitted byMonashreeNoch keine Bewertungen

- 5 Tax InstrumentsDokument3 Seiten5 Tax InstrumentsktsnlNoch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- How To Save Income Tax in IndiaDokument6 SeitenHow To Save Income Tax in IndiaSameerNoch keine Bewertungen

- Indian Tax Structure ExplainedDokument7 SeitenIndian Tax Structure ExplainedHarshita MarmatNoch keine Bewertungen

- Assignment 5: Legal Aspects of Business MS5210Dokument6 SeitenAssignment 5: Legal Aspects of Business MS5210karanNoch keine Bewertungen

- Assignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiDokument8 SeitenAssignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiNarasimha naidu ThotaNoch keine Bewertungen

- Tax EfficientDokument22 SeitenTax EfficientBrijesh NagarNoch keine Bewertungen

- Decoding Your Pay Slip: 1) Basic SalaryDokument3 SeitenDecoding Your Pay Slip: 1) Basic Salaryiamajay007Noch keine Bewertungen

- Taxguide 2007Dokument17 SeitenTaxguide 2007api-3724347Noch keine Bewertungen

- About The ExpertDokument7 SeitenAbout The ExpertAnurag RanbhorNoch keine Bewertungen

- How To Save TaxDokument3 SeitenHow To Save TaxVinu k mariaNoch keine Bewertungen

- Taxation Law Question Bank BALLBDokument49 SeitenTaxation Law Question Bank BALLBaazamrazamaqsoodiNoch keine Bewertungen

- Are Your Savings Flying Away?Dokument20 SeitenAre Your Savings Flying Away?livin2dieNoch keine Bewertungen

- Tax Planning Guide: Key Sections to Reduce Your Tax BurdenDokument14 SeitenTax Planning Guide: Key Sections to Reduce Your Tax BurdenRohitNoch keine Bewertungen

- Pay Less Tax,: Ways To LegallyDokument1 SeitePay Less Tax,: Ways To LegallyGauravNoch keine Bewertungen

- Pvt Ltd SavingsDokument5 SeitenPvt Ltd Savingstaxqoof1Noch keine Bewertungen

- 7 Reasons to Become an Income Investor: Financial Freedom, #214Von Everand7 Reasons to Become an Income Investor: Financial Freedom, #214Noch keine Bewertungen

- Advisorkhoj ICICI Prudential Mutual Fund ArticleDokument6 SeitenAdvisorkhoj ICICI Prudential Mutual Fund ArticleBIJAY KRISHNA DASNoch keine Bewertungen

- Basics of Personal FinanceDokument15 SeitenBasics of Personal FinanceAnjali TejaniNoch keine Bewertungen

- Real Estate Investing For Beginners: The Number 1 Guide For Cash Flowing Your Way To Financial Freedom Through The Rental Property MarketVon EverandReal Estate Investing For Beginners: The Number 1 Guide For Cash Flowing Your Way To Financial Freedom Through The Rental Property MarketNoch keine Bewertungen

- Impact On Direct Tax Code On Various Products: Tax Rules in IndiaDokument6 SeitenImpact On Direct Tax Code On Various Products: Tax Rules in IndiamerijannatNoch keine Bewertungen

- Changes in New Direct Tax Cod1Dokument10 SeitenChanges in New Direct Tax Cod1Somit ParNoch keine Bewertungen

- Capital GainDokument9 SeitenCapital Gainbarakkat72Noch keine Bewertungen

- Income Tax RulesDokument4 SeitenIncome Tax RulesvenkatanagachandraNoch keine Bewertungen

- Patna university IMPORTANT THEORY QUESTION TAXATION 2023Dokument49 SeitenPatna university IMPORTANT THEORY QUESTION TAXATION 2023satishksatish777Noch keine Bewertungen

- When You Are in The Highest Tax BracketDokument3 SeitenWhen You Are in The Highest Tax Bracketjaycee68Noch keine Bewertungen

- Santosh and Dipak PFP PresentationDokument8 SeitenSantosh and Dipak PFP PresentationKaira EventsNoch keine Bewertungen

- Thesis Tax AvoidanceDokument7 SeitenThesis Tax Avoidancepjrozhiig100% (2)

- Untangling NPS Taxation: Your ContributionsDokument8 SeitenUntangling NPS Taxation: Your ContributionsNItishNoch keine Bewertungen

- Lesson: Describing SAP HANA TechnologyDokument1 SeiteLesson: Describing SAP HANA Technologyvshrika21Noch keine Bewertungen

- Sap BPC 70sp00m OfficegdeDokument26 SeitenSap BPC 70sp00m Officegdegabrielsyst0% (1)

- Demo 1: Perform Bam Approval CustomizingDokument6 SeitenDemo 1: Perform Bam Approval Customizingvshrika21Noch keine Bewertungen

- Step by Step Procedures To Load Master Data (Attribute and Text) From FlatFile in BI 7.0Dokument15 SeitenStep by Step Procedures To Load Master Data (Attribute and Text) From FlatFile in BI 7.0raju221756_843567682Noch keine Bewertungen

- Sap BPC AdmnDokument34 SeitenSap BPC AdmnSamir KulkarniNoch keine Bewertungen

- Advanced Training Labs PDFDokument24 SeitenAdvanced Training Labs PDFvshrika21Noch keine Bewertungen

- SAP BPC QuestionsDokument160 SeitenSAP BPC Questionsvshrika21Noch keine Bewertungen

- Script Logic Sap BPC 7.5 NWDokument39 SeitenScript Logic Sap BPC 7.5 NWManoj DamleNoch keine Bewertungen

- SAP BPC QuestionsDokument6 SeitenSAP BPC QuestionsSuresh babuNoch keine Bewertungen

- Bach CharcteristicsDokument14 SeitenBach CharcteristicsSameer SamarthNoch keine Bewertungen

- Invst Banking CompaniesDokument4 SeitenInvst Banking Companiesvshrika21Noch keine Bewertungen

- Xcelsius Integration With MS-BPC 7 51Dokument29 SeitenXcelsius Integration With MS-BPC 7 51vshrika21Noch keine Bewertungen

- How To - Mass Import Security For BPC MSDokument22 SeitenHow To - Mass Import Security For BPC MSvshrika21Noch keine Bewertungen

- Yajurveda SandhyavandanamDokument46 SeitenYajurveda Sandhyavandanamkaustavchakravarthy85% (101)

- Financial Statement RatioDokument6 SeitenFinancial Statement Ratiovshrika21Noch keine Bewertungen

- Cost of CapitalDokument3 SeitenCost of Capitalvshrika21Noch keine Bewertungen

- Chapter 9 - The Capital Asset Pricing Model (CAPM)Dokument126 SeitenChapter 9 - The Capital Asset Pricing Model (CAPM)vshrika21Noch keine Bewertungen

- Risk Analysis Insurance PlanningDokument10 SeitenRisk Analysis Insurance PlanningAbhinav Mandlecha0% (1)

- Hoe To Select StockDokument8 SeitenHoe To Select StockPankaj KumarNoch keine Bewertungen

- Risk Analysis Insurance PlanningDokument10 SeitenRisk Analysis Insurance PlanningAbhinav Mandlecha0% (1)

- How To Perform Intercompany Elimination and Data Validation With SAP BPC 7.0 MSDokument14 SeitenHow To Perform Intercompany Elimination and Data Validation With SAP BPC 7.0 MSJamilNoch keine Bewertungen

- Advanced Financial Statements Analysis by Investopedia PDFDokument74 SeitenAdvanced Financial Statements Analysis by Investopedia PDFbijueNoch keine Bewertungen

- Capital BudgetingDokument7 SeitenCapital Budgetingvshrika21Noch keine Bewertungen

- LATAM AIRLINES GROUP S A 09-2012 (Inglés)Dokument172 SeitenLATAM AIRLINES GROUP S A 09-2012 (Inglés)chequeadoNoch keine Bewertungen

- Beta SecuritiesDokument5 SeitenBeta SecuritiesZSNoch keine Bewertungen

- José Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1Dokument8 SeitenJosé Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1karen hudes100% (1)

- Dep KeyDokument2 SeitenDep Keyanilkg53Noch keine Bewertungen

- Investor Summit Focus on Frontier MarketsDokument14 SeitenInvestor Summit Focus on Frontier Markets1124varNoch keine Bewertungen

- Financial Support StudyDokument101 SeitenFinancial Support Studypriyanka repalle100% (2)

- Mutual Fund Valuation and AccountingDokument72 SeitenMutual Fund Valuation and Accountingsiclsicl100% (1)

- Committee # 1. CII Code of Desirable Corporate Governance (1998)Dokument11 SeitenCommittee # 1. CII Code of Desirable Corporate Governance (1998)Vaidehi ShuklaNoch keine Bewertungen

- The Relationship Between Corporate Strategy and Capital StructureDokument2 SeitenThe Relationship Between Corporate Strategy and Capital StructureAnonymous DR0y6OXufA0% (1)

- Accounting Review and Tutorial Services in San Isidro, Nueva EcijaDokument8 SeitenAccounting Review and Tutorial Services in San Isidro, Nueva EcijaEiuol Nhoj Arraeugse100% (3)

- Startups ShabdkoshDokument89 SeitenStartups ShabdkoshRujuta Kulkarni0% (1)

- Preference SharesDokument1 SeitePreference SharesTiso Blackstar GroupNoch keine Bewertungen

- 91 SA Institutional Cautious Managed Fund Factsheet enDokument1 Seite91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNoch keine Bewertungen

- Ic Exam Review: VariableDokument122 SeitenIc Exam Review: VariableJL RangelNoch keine Bewertungen

- Optical Distortion, Inc. (A)Dokument8 SeitenOptical Distortion, Inc. (A)SergiNoch keine Bewertungen

- Training ReportDokument51 SeitenTraining ReportShikhar SethiNoch keine Bewertungen

- Formation of Joint Stock CompanyDokument5 SeitenFormation of Joint Stock CompanyHemchandra PatilNoch keine Bewertungen

- 3rd Periodical Exam - FABM1Dokument6 Seiten3rd Periodical Exam - FABM1Arven DulayNoch keine Bewertungen

- CA Final SFM Compiler Ver 6.0Dokument452 SeitenCA Final SFM Compiler Ver 6.0Accounts Primesoft100% (1)

- APC313 Assessment Brief January19Dokument3 SeitenAPC313 Assessment Brief January19Hoài Sơn VũNoch keine Bewertungen

- ABM - BF12 IIIb 8Dokument4 SeitenABM - BF12 IIIb 8Raffy Jade SalazarNoch keine Bewertungen

- Chapter 5 Discussion QuestionsDokument1 SeiteChapter 5 Discussion Questionscarmen yuNoch keine Bewertungen

- Financial Accounting 7th EditionDokument4 SeitenFinancial Accounting 7th Editiongilli1trNoch keine Bewertungen

- Click Here For Answers: ACC 400 Final ExamDokument4 SeitenClick Here For Answers: ACC 400 Final Examclickme12Noch keine Bewertungen

- SWIFT SR2021 MT BusinessHighlightsDokument13 SeitenSWIFT SR2021 MT BusinessHighlightsmelol40458Noch keine Bewertungen

- Secure Electronic TransactionDokument22 SeitenSecure Electronic TransactionRiddhi DesaiNoch keine Bewertungen

- Negotiable Instruments AIB PDFDokument488 SeitenNegotiable Instruments AIB PDFgomerpiles100% (2)

- Bibica - Default Risk AnalysisDokument2 SeitenBibica - Default Risk AnalysisThậpTamNguyệtNoch keine Bewertungen

- Managerial Accounting Reviewer PreFinalsxDokument10 SeitenManagerial Accounting Reviewer PreFinalsxGenelyn BalancarNoch keine Bewertungen

- SEC Revised Corporation Code 2019 QuestionsDokument12 SeitenSEC Revised Corporation Code 2019 QuestionsFrances Ann Nacar0% (1)