Beruflich Dokumente

Kultur Dokumente

Chapter 7 Investments

Hochgeladen von

Rizia Feh EustaquioCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 7 Investments

Hochgeladen von

Rizia Feh EustaquioCopyright:

Verfügbare Formate

Chapter 7 Investments

Investments assets not directly identified with the central revenue producing activities of the

enterprise but are acquired for any of the following:

1) Earn a return on idle cash balance

2) Establish long-term relationship with suppliers and customers

3) Exercise significant influence/ control over another entity

4) Accumulate funds for future use

5) Capital appreciation

6) Future protection

Investments include:

- Investment in securities (equity / debt securities)

- Fund for long term use (plant expansion fund, equipment acquisition fund, stock

redemption fund and sinking fund)

- Investment property and cash surrender value of life insurance policies

INVESTMENTS in SECURITIES

Security interest/share in a debt/equity of another entity that is represented in a financial instrument

and is one that is being dealt in capital markets.

Equity Securities represent ownership in company/rights to acquire ownership interest at an agreed

upon/determinable price.

- Preference shares (Preferred stock)

- Ordinary shares (Common stock)

- Share warrants/Stock rights

- Call options

- Put options

Debt Securities instruments representing a creditor relationship with an enterprise

Typically have the following characteristics:

1. Maturity value

2. Periodic interest payments at fixed/variable interest rate

3. Maturity date

- Government securities (Philippine treasury bills and warrants)

- Corporate bonds

- Convertible debt and commercial paper

Substance rather than its legal form govern whether an instrument is an equity or debt

security

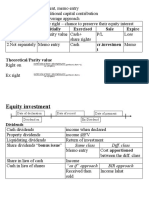

20% 50%

Less than 20% 20% - 50% More than 50%

INVESTMENTS in EQUITY SECURITIES

Share capital (capital stock) of other companies may be purchased by an enterprise for no. of reasons:

1. Temporary placements of excess cash and held primarily for sale in the near term to

generate income on short-term price fluctuations.

2. Obtain long term customer/supplier/ creditor relationship to secure

operating/financing arrangements with these companies.

3. Exercise significant influence or even control over the operating policies of another

entity

Convertible debt and redeemable preference shares equity securities

The extent of ownership in common stock by an investor in an investee determines the

accounting treatment for equity securities

Classification of Equity Securities

Financial Assets @ FVPL

(Trading Securities)

AFS

- Investor does not have significant

influence over the investee co.

Investment in Associate

-

- - Power to participate

- - Investor has significant

influence over the investee co.

Investment in Subsidiaries

- Power to govern

- Investor has control over the

investee co.

Available for Sale Securities

Initial recognition:

purchase price + transaction cost

Transaction subsequent to initial recognition:

Share split reduction in the par/stated value of share capital accompanied by a proportionate increase

in the no. of shares outstanding

- Does not affect equity of shareholder in the issuing corporation nor its total SHE

- No formal entry needed (memo entry only indicating change in no. of shares)

Dividends corporate distributions to its shareholders proportionate to the nos. of shares held by the

latter

a) Cash dividends

- Recognized as income/receivable

3 significant dates:

1. Declaration date BOD declares distribution of dividends

2. Record date Co. draw a list naming the shareholders who are entitled to dividends

3. Payment date dividends are distributed to shareholders

Declaration date Record date

- Shares sell dividends-on

- Market price of a share includes amount of dividend

After Record date

- Shares sell ex-dividend

- Market price does not include the amount of dividend

b) Bonus Issue/Share Dividend

- Increases no. of shares held by each shareholder without any change in the total SHE/net assets of

distributing corporation

- Memo entry only

- Merely adjust the carrying value/ share held by the investor

If the bonus issue is in the form of another class of share capital, a part of the carrying value of the

original investment will be transferred to the new shares received in another class. The allocation

based on the relative FMV.

c) Property Dividends

- Dividends distributable in the form of the investees NCA

- Recorded as Dividend revenue at the assets FMV

Stock rights

Pre-emptive right right of shareholder to maintain his proportionate ownership in the co.

Share warrant - certificate that evidence a shareholders pre-emptive right

3 significant dates:

1. Declaration/Announcement of warrants Date

2. Issuance Date

3. Expiration Date

Declaration date Issuance date

- Share and right cannot be separately bought/sold (selling rights-on)

Issuance Declaration date Expiration

- Shares and rights may be bought/sold separately (selling ex-rights)

Share warrant received by the investor qualifies as a derivate as defined by PAS

39:

1. The value of the warrant depends on the movement of the value of the issuing

corporations share capital.

2. It requires no investment for the holder, as the same is received as a result of the

original shares held by the investor.

3. The warrant is settled at a future date through exercise by the holder or through

expiration.

o Rule on measurement of derivates shall apply to stock rights

measured at Fair Value except for those derivates that are linked to

equity securities whose fair value cannot be reliably measured.

o Derivates are classified as Financial Assets at FVPL.

Theoretical Market Value of Stock Rights

- May be use as initial measurement basis in the absence of an actual market value of the stock

right at the ___ of distribution

Ex -rights

TMV =

Rights-on

TMV =

Presentation and Measurement in SFP:

- Non-current asset measured at Fair Market Value

- Only charge in Market Value recognized as other comprehensive income outside of P/L in SCI

- Market adjustment AFS if debit addition to AFS balance

if credit deduction

- Net Unrealized Gain/Loss on AFS cumulative bal part of SHE forming part of reserves

credit addition, debit deduction

Disposal of AFS:

Net selling price recorded cost of securities - amount of Realized Gain/Loss

- Balance in both market adjustment and net unrealized gain and losses account pertaining to the

securities sold are eliminated

- SP > Cost of AFS

Cash (Net SP)

Gain on Sale of AFS

AFS

- Prior to sale CV (FMV as of end of last b/s date) > Cost (entry for elimination of Unrealized G/L)

Net Unrealized G/L on AFS

Market Adjustment AFS

Exception to the rule on measurement at Fair Value:

AFS without active market are measured, after initial recognition at cost.

Impairment of AFS:

Entity shall asses at each reporting date whether there is any objective evidence that a financial asset is

impaired.

Objective evidence that there is impairment in AFS includes observable data that come to the

attention of the holder of the securities about the following events:

a) Significant financial difficulty of the issuer.

b) Disappearance of an active market for the securities because of financial difficulties of the issuer of

the securities.

c) Significant changes that adversely affect the technological, economic or legal environment in

which the issuer operates.

d) Prolonged decline in the fair value of the securities.

Amount of any previous decline in market value of the securities that has been recognized

directly in equity (balance of Net Unrealized G/L on AFS) shall be removed from equity

and shall be recognized in P/L/

Market Adjustment AFS

Net Unrealized G/L on AFS

original cost current fair value any impairment loss previously recognized

Reversal of Impairment:

Market Adjustment AFS

Unrealized Gain/Loss on AFS

Trading Securities

Initial recognition:

purchase price = FMV at date of acquisition

transaction cost directly attributable to acquisition = expense

Dividends, Share Split and Stock rights on Trading Securities

Similar procedures applied when dividends and share splits relate too TS.

However when stock rights are received on shares classified as Financial Assets at FVPL, there is no need

to value the stock rights separately.

Presentation and Measurement in SFP:

- Current asset measured at Fair Value

- Financial Asset at FVPL

- Any change in the Fair value reported as Gain/Loss in P/L section of SCI

- Unrealized Gains/Losses on TS if credit balance part of income from continuing operation

in P/L section of SCI

Disposal of TS:

Net SP CV of securities

Purchased in prior period CV = Market value at the end of most recent b/s date

Purchased in same year of disposal CV = Initial amount recorded

Investment in Associate

- Shares of stock give the investor significant influence over the investee, the investee is called associate

Existence of significant influence evidenced in 1 or more of the following ways:

a) Representation in BOD/ equivalent governing body of the investee

b) Participation in policy making processes, including participation in decision about dividends/other

distributions

c) Material transactions between the investor and investee

d) Interchange of managerial personnel

e) Provision of essential technical info.

Judgment is frequently required in determining whether an investment of 20% or more results in

significance influence.

- Accounted for using equity method when not held exclusively for disposal within 12 mos. from

acquisition date

Initially recorded at cost

Investments CV increased by investors proportionate share of earnings

Investments CV decreased by investors proportionate share of losses and dividends declared by

investee

Presentation in FS:

Investment in Associate

- Non-current Asset

- Separate line item

Share in Profit in Associate

- Separate line item on SCI in P/L section

Other Issues:

Difference in Reporting Dates

- Maximum difference for the 2 entities reporting date is 3 mos.

Difference in Accounting Policies

- Investors FS shall be prepared using uniform accounting policies for like transactions and events

in similar circumstances

Associate has Preference shares

- When the associate has Outstanding P/S, the measurement of the investors share of profit from

associate shall be based on the associates profit after making adjustments for the dividends on

preference shares.

- If it has outstanding cumulative P/S, the profit shall be adjusted by deducting the required

current preference dividends whether/ or not declared.

- If it has an outstanding non-cumulative P/S, the associates profit shall be reduced by the amount

of preference dividends declared during the period.

INVESTMENTS in DEBT SECURITIES

Financial instruments issued by a company and typically have the following characteristics:

a) Maturity Value (MV)

b) Interest rate that specifies the periodic interest payments

c) Maturity Date

Ex. Bond certificates certificates of indebtedness issued by a corporation/government agency

guaranteeing payment of a principal amount at a specified future date plus periodic interest.

- May sell at a price different from the face value of the instruments

Bonds Market Value

- Result of an interaction of variety of forces such as the current interest rates, expected future

interest rates and stated rate of interest on the investment.

Rate of interest

Stated on bond

= Rate of return desired by investors

(effective, yield/market rate)

will sell at face value

Stated rate > Market rate will pay more than face value

(bond premium)

Stated rate < Market rate purchaser will pay less than

face value (bond discount)

Bond Price Computation/Present Value

1)

Present Value of Maturity Value (Face Value x PVF )

+ Present Value of Interest Payment (Interest per period x PVAF)

Total Present Value/ Bond Price

PVF =

PVAF =

()

2) Bond Price = Face Value Discount/+Premium

Discount/Premium = Difference in interest rates x Face Value x PVAF

Classification of Debt Securities

1) Trading Securities (Financial Assets at FVPL)

2) AFS

3) HTM

Held to Maturity

- Non derivative financial assets with fixed/determinable payments and fixed maturity that the entity

has positive intention and ability to hold to maturity other than those that the entity upon initial

recognition designates as at Fair Value through P/L or as AFS.

- Positive intent to hold the securities until maturity date

- Ability to hold the until maturity date

Entity shall not classify an investment as HTM if the entity has during the current financial

year, sold/reclassified more than an insignificant amount of HTM investments before

maturity except:

a) The sale/reclassification is so close to maturity that changes in market interest rate would not have

significant effects on the instruments fair value.

b) The sale occurs after the entity has collected substantially all of the financial assets original

principal through scheduled payments, or the sale is attributable to an isolated event that is

beyond the entitys control, is non-recurring and could not have been reasonably anticipated by

the entity.

Initial recognition:

purchase price + transaction cost

- Periodically amortize the difference between COI and its face value over the term of debt instruments

Amortization gradually adjust the original cost of the instrument, such that on maturity date,

its carrying value equals its face value

PAS 39 requires the use of effective interest method for the amortization of

discount/premium on HTM

Interest income during

interest period

= CV of instrument x Actual interest rate/ Effective

interest rate/ Yield

- Bonds purchased at more/less than face value premium/discount not shown separately but included as

part of COI/netted against investment cost

If the bond year does not coincide with accounting period, the amortization of

premium/discount must be updated at each reporting date.

If bond investment is purchased between interest payment dates, buyer should pay, in

addition to the purchase price of the bonds, amount of accrued interest from the last

interest payment date.

Disposal of HTM

Sold before maturity, investor shall update the amount of premium/discount amortization. Amortization

should be taken up until date of sale up to date the CV of investment sold.

Gain/Loss sale of investment

- P/L (other operating income/expense)

When an enterprise sells more than an insignificant amount of HTM before maturity date,

the ability of the company to hold any securities until maturity is tainted. Any remaining

HTM shall be reclassified as AFS. In addition, the enterprise cannot designate during the

current financial year and the next 2 years, any acquired debt securities as HTM.

However the following sale of HTM will not taint the enterprises ability to hold the

securities as HTM.

a) Sale of HTM that is so close to maturity or financial assets call date (for example, less than 3

mos. before maturity date) that changes in the market rate of interest would not have a

significant effect on the financial assets fair value

b) Sale that occurs after the entity has collected substantially all of the financial assets original

principal through scheduled payments/prepayments.

c) Sale that is attributable to an isolated event that is beyond the entitys control is non-recurring

and could not have been reasonably anticipated.

Impairment of HTM

- Recorded either directly crediting HTM or using allowance account

Asset CV (amortized cost)

- PV of estimated future cash flows

discounted at the financial assets original

effective interest rate at initial recognition

Impairment Loss

- Amount of loss shall be recognized in P/L

If in subsequent period, the amount of impairment loss is recovered and the recovery can

be related objectively to an event occurring after the impairment was recognized, the

previously recovered impairment loss shall be reserved either directly or by adjusting the

allowance method.

The reversal shall not result in a carrying amount that exceeds what the amortized cost

could have been had the impairment loss not been recognized at the date the impairment

is reversed.

HTM (Allowance)

Recovery in Market Value of HTM

Financial Assets at FVPL

Initial recognition:

purchase price = FMV at date of acquisition

transaction cost directly attributable to acquisition = expense

Interest income instruments stated interest rate

- Adjusted to market value at b/s date

- Change in Market Value taken to P/L

Available For Sale

Initial recognition:

purchase price + transaction cost

- Similar to HTM any discount (net of transaction cost) or premium (inclusive of transaction cost

incurred upon initial recognition) are amortized using effective interest method

At each reporting date, debt securities classified as AFS are measured at Fair value, with

change in faire value taken to comprehensive income.

Cumulative credit balance in Unrealized Gains/Losses on AFS account is presented as

component of SHE

Disposal of AFS:

- Any premium/discount shall be updated up to date of sale

selling price amortized cost = gain/loss on sale

- Same with derecognition of AFS equity security the accounts market adjustment (if used) and

unrealized gain/loss on AFS carried in the equity shall be cancelled.

Impairment of AFS:

- Cumulative loss that had been recognized directly in equity shall be removed from equity and

recognized in P/L

- Market value after impairment shall be replaced cost of the securities

- The accounting procedures same as its equity securities.

If in a subsequent period, the fair value increases and the increase can be objectives related

to an event occurring after the impairment loss was recognized in profit/loss, the

impairment loss shall be reversed with the amount of reversal recognized in P/L

The amount of reversal taken to profit/loss shall not bring the amortized cost of the

securities to that amount had no impairment loss been previously recorded.

BIFURCATING A COMPUND FINANCIAL INSTRUMENT

Compound Financial Instrument one that possesses a debt and equity characteristics

Ex. Bonds with non-detachable share warrants

Convertible bonds

- Those that would be exchanged with the issuing entitys O/S at the option of the bondholders

Bifurcation the process of splitting the purchase price of a compound financial instrument into equity

and debt component

Equity component (share warrant/____) - derivative recognized at fair value

Debt component purchase price fair value of derivative

Das könnte Ihnen auch gefallen

- Intermediate Acc NotesDokument24 SeitenIntermediate Acc Notesyurineo losisNoch keine Bewertungen

- FAR 2 Discussion Material - Shareholders' Equity PDFDokument4 SeitenFAR 2 Discussion Material - Shareholders' Equity PDFAisah ReemNoch keine Bewertungen

- Presentation5 - Audit of InvestmentsDokument20 SeitenPresentation5 - Audit of InvestmentsRoseanne Dela CruzNoch keine Bewertungen

- InvestmentsDokument13 SeitenInvestmentsCorinne GohocNoch keine Bewertungen

- FAR 4307 Investment in Equity SecuritiesDokument3 SeitenFAR 4307 Investment in Equity SecuritiesATHALIAH LUNA MERCADEJASNoch keine Bewertungen

- State Street:-: Information Classification: Limited AccessDokument8 SeitenState Street:-: Information Classification: Limited AccessOmkar DeshmukhNoch keine Bewertungen

- Audit of Stockholder’s Equity, Share Based Payment & Book ValueDokument6 SeitenAudit of Stockholder’s Equity, Share Based Payment & Book ValueJessalyn DaneNoch keine Bewertungen

- IND As SummaryDokument41 SeitenIND As SummaryAishwarya RajeshNoch keine Bewertungen

- FAR-4207 (Investment in Equity Securities)Dokument3 SeitenFAR-4207 (Investment in Equity Securities)Jhonmel Christian AmoNoch keine Bewertungen

- SBR - Chapter 4Dokument6 SeitenSBR - Chapter 4Jason KumarNoch keine Bewertungen

- Chapter 3Dokument12 SeitenChapter 3spambryan888Noch keine Bewertungen

- Module 21-Shareholders-EquityDokument12 SeitenModule 21-Shareholders-EquityJehPoy100% (1)

- Financial Asset at Fair ValueDokument38 SeitenFinancial Asset at Fair ValueShiela Marie SolisNoch keine Bewertungen

- Farap 4505Dokument7 SeitenFarap 4505Marya NvlzNoch keine Bewertungen

- Reviewer in Intermediate Accounting IDokument9 SeitenReviewer in Intermediate Accounting ICzarhiena SantiagoNoch keine Bewertungen

- Transition To PFRS (The Beginning of The Earliest Period For Which Entity Presents Full Comparative InformationDokument8 SeitenTransition To PFRS (The Beginning of The Earliest Period For Which Entity Presents Full Comparative InformationMary Joy Morales BuquiranNoch keine Bewertungen

- 14 Shareholders' EquityDokument10 Seiten14 Shareholders' Equityrandomlungs121223Noch keine Bewertungen

- IntangiblesDokument7 SeitenIntangiblesWertdie stanNoch keine Bewertungen

- Date of Transition To PFRS (The Beginning of The Earliest Period For Which Entity Presents FullDokument20 SeitenDate of Transition To PFRS (The Beginning of The Earliest Period For Which Entity Presents FullMary Joy Morales BuquiranNoch keine Bewertungen

- 161 15 PAS 28 Investment in AssociateDokument2 Seiten161 15 PAS 28 Investment in AssociateRegina Gregoria SalasNoch keine Bewertungen

- Earnings 11-17 Shares 18-27 Earnings 31-33 Shares 34-38 Dilutive Potential Ordinary Shares 39-62 43-47 48-50 51-56 57-60 61 62Dokument20 SeitenEarnings 11-17 Shares 18-27 Earnings 31-33 Shares 34-38 Dilutive Potential Ordinary Shares 39-62 43-47 48-50 51-56 57-60 61 62Gemini_0804Noch keine Bewertungen

- Classroom Notes 6390 and 6391Dokument2 SeitenClassroom Notes 6390 and 6391Mary Grace Galleon-Yang OmacNoch keine Bewertungen

- Financial Accounting 2 SummaryDokument10 SeitenFinancial Accounting 2 SummaryChoong Xin WeiNoch keine Bewertungen

- THE COMPLETE INVESTMENT BANKING COURSE GlossaryDokument6 SeitenTHE COMPLETE INVESTMENT BANKING COURSE GlossaryYahya AçafNoch keine Bewertungen

- 08 InvestmentquestfinalDokument13 Seiten08 InvestmentquestfinalAnonymous l13WpzNoch keine Bewertungen

- Sources of Finance (Equity)Dokument10 SeitenSources of Finance (Equity)Dayaan ANoch keine Bewertungen

- Actrev2 - InvestmentsDokument19 SeitenActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Exam NotesDokument7 SeitenExam NotesAmit VadiNoch keine Bewertungen

- Shareholders EquityDokument4 SeitenShareholders EquityfoxtrotNoch keine Bewertungen

- Potential Equity Shares - Financial Instruments Entitle Its Holder The Right To Acquire Equity Shares Ex: Convertible Debentures, Convertible Preference Shares, Options, Warrants EtcDokument5 SeitenPotential Equity Shares - Financial Instruments Entitle Its Holder The Right To Acquire Equity Shares Ex: Convertible Debentures, Convertible Preference Shares, Options, Warrants EtcD Suresh BabuNoch keine Bewertungen

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Dokument8 SeitenIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloNoch keine Bewertungen

- FIN2004 A+ CheatsheetDokument79 SeitenFIN2004 A+ CheatsheetXinyuZhangNoch keine Bewertungen

- Ias - 33Dokument4 SeitenIas - 33Asad TahirNoch keine Bewertungen

- CFAS-PFRS-9-PAS-28Dokument31 SeitenCFAS-PFRS-9-PAS-28quintanamarfrancisNoch keine Bewertungen

- Corporation BasicsDokument14 SeitenCorporation BasicsWonde BiruNoch keine Bewertungen

- Equity Capital Common and Preffered StockDokument23 SeitenEquity Capital Common and Preffered StockNicole LasiNoch keine Bewertungen

- Ias-33 EpsDokument59 SeitenIas-33 Epssyed asim shahNoch keine Bewertungen

- Unit IV InvestmentsDokument16 SeitenUnit IV InvestmentsJonnacel TañadaNoch keine Bewertungen

- Financial Instruments - Session 2 Jan 7Dokument56 SeitenFinancial Instruments - Session 2 Jan 7Sagar 'Oman' TilakrajNoch keine Bewertungen

- FAR 4218 Shareholders Equity Retained Earnings PDFDokument11 SeitenFAR 4218 Shareholders Equity Retained Earnings PDFSherri BonquinNoch keine Bewertungen

- 19 - Us Gaap Vs Indian GaapDokument5 Seiten19 - Us Gaap Vs Indian GaapDeepti SinghNoch keine Bewertungen

- FARMOD23 Earnings Per Share ForprintDokument10 SeitenFARMOD23 Earnings Per Share Forprintcarl patNoch keine Bewertungen

- CHAPTER 2 Statement of Financial PositionDokument4 SeitenCHAPTER 2 Statement of Financial PositionGee LacabaNoch keine Bewertungen

- FARAP 4406A Investment in Equity SecuritiesDokument8 SeitenFARAP 4406A Investment in Equity SecuritiesLei PangilinanNoch keine Bewertungen

- BOSCOMDokument18 SeitenBOSCOMArah Opalec100% (1)

- IAS33Dokument24 SeitenIAS33Elizabeth MarlitaNoch keine Bewertungen

- Exam NotesDokument9 SeitenExam NotesEven JayNoch keine Bewertungen

- CH 07Dokument23 SeitenCH 07mehdiNoch keine Bewertungen

- Capital Market Concepts ExplainedDokument8 SeitenCapital Market Concepts ExplainedShubham NathNoch keine Bewertungen

- SMEs - ASSETS measurement and accountingDokument21 SeitenSMEs - ASSETS measurement and accountingToni Rose Hernandez LualhatiNoch keine Bewertungen

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Dokument8 SeitenInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNoch keine Bewertungen

- Finance Glossary: Study. Learn. ShareDokument9 SeitenFinance Glossary: Study. Learn. ShareAditya RatnamNoch keine Bewertungen

- Sources of Finance: Equity vs DebtDokument30 SeitenSources of Finance: Equity vs DebtSajal KhatriNoch keine Bewertungen

- IA-final NotesDokument5 SeitenIA-final NotesRocel B. LigayaNoch keine Bewertungen

- Tagamabja-Cfas Activity Set 2FDokument10 SeitenTagamabja-Cfas Activity Set 2FBerlyn Joy TagamaNoch keine Bewertungen

- Corpration Chapter FiveDokument19 SeitenCorpration Chapter Fiveseneshaw tibebuNoch keine Bewertungen

- Introduction To Primary MarketDokument4 SeitenIntroduction To Primary Marketkrusha64Noch keine Bewertungen

- Equity Securities MarketDokument23 SeitenEquity Securities MarketILOVE MATURED FANSNoch keine Bewertungen

- Unit-1: Investment SettingDokument61 SeitenUnit-1: Investment SettingKarthika NathanNoch keine Bewertungen

- Corpo 2Dokument3 SeitenCorpo 2Rizia Feh EustaquioNoch keine Bewertungen

- T:TR"T FF!.",' (.? : (.: at T N?NF, :L FRDokument2 SeitenT:TR"T FF!.",' (.? : (.: at T N?NF, :L FRRizia Feh EustaquioNoch keine Bewertungen

- T) Ah, 6f/Nt E/ R Tus - Ils: L, Ton S) NoeDokument17 SeitenT) Ah, 6f/Nt E/ R Tus - Ils: L, Ton S) NoeRizia Feh EustaquioNoch keine Bewertungen

- Finman OverviewDokument5 SeitenFinman OverviewRizia Feh EustaquioNoch keine Bewertungen

- CAPM Stock ValuationDokument11 SeitenCAPM Stock ValuationRizia Feh EustaquioNoch keine Bewertungen

- A - La-R1 - R: Pl20 Pl2) BalaneDokument12 SeitenA - La-R1 - R: Pl20 Pl2) BalaneRizia Feh EustaquioNoch keine Bewertungen

- 1A9Dokument8 Seiten1A9Rizia Feh EustaquioNoch keine Bewertungen

- Analysis of FSDokument4 SeitenAnalysis of FSRizia Feh EustaquioNoch keine Bewertungen

- Analysis and Interpretation of FSDokument5 SeitenAnalysis and Interpretation of FSRizia Feh EustaquioNoch keine Bewertungen

- ObligationDokument4 SeitenObligationRizia Feh EustaquioNoch keine Bewertungen

- Liabilities QuizDokument13 SeitenLiabilities QuizRizia Feh Eustaquio100% (1)

- Nature and EffectsDokument6 SeitenNature and EffectsRizia Feh EustaquioNoch keine Bewertungen

- Different Kinds of Obligations and Their Legal EffectsDokument11 SeitenDifferent Kinds of Obligations and Their Legal EffectsRizia Feh Eustaquio100% (1)

- Current LiabilitiesDokument1 SeiteCurrent LiabilitiesRizia Feh EustaquioNoch keine Bewertungen

- MODES OF EXTINGUISHING OBLIGATIONSDokument6 SeitenMODES OF EXTINGUISHING OBLIGATIONSRizia Feh Eustaquio82% (34)

- Nature and Effects of ObligationsDokument5 SeitenNature and Effects of ObligationsRizia Feh EustaquioNoch keine Bewertungen

- MODES OF EXTINGUISHING OBLIGATIONSDokument6 SeitenMODES OF EXTINGUISHING OBLIGATIONSRizia Feh Eustaquio82% (34)

- Business LawDokument19 SeitenBusiness LawRizia Feh Eustaquio100% (2)

- Donors Tax Theory ExplainedDokument5 SeitenDonors Tax Theory ExplainedJoey Acierda BumagatNoch keine Bewertungen

- Business Law and Taxation ReviewerDokument5 SeitenBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- The Pinoy Financial Planning Guide - Book 1Dokument23 SeitenThe Pinoy Financial Planning Guide - Book 1Jose ContrerasNoch keine Bewertungen

- Tentative Personal Finance CalendarDokument3 SeitenTentative Personal Finance Calendars516680Noch keine Bewertungen

- Installment Sales Accounting ExampleDokument3 SeitenInstallment Sales Accounting ExampleMohib HaqueNoch keine Bewertungen

- Sales (UST)Dokument51 SeitenSales (UST)Rizia Feh Eustaquio100% (1)

- Corporation Law USTDokument66 SeitenCorporation Law USTiammaan214100% (1)

- Nature and Effects of ObligationsDokument5 SeitenNature and Effects of ObligationsRizia Feh EustaquioNoch keine Bewertungen

- Agency (UST)Dokument15 SeitenAgency (UST)Rizia Feh EustaquioNoch keine Bewertungen

- Current LiabilitiesDokument1 SeiteCurrent LiabilitiesRizia Feh EustaquioNoch keine Bewertungen

- The Law On ObligationsDokument3 SeitenThe Law On ObligationsRizia Feh EustaquioNoch keine Bewertungen

- MODES OF EXTINGUISHING OBLIGATIONSDokument6 SeitenMODES OF EXTINGUISHING OBLIGATIONSRizia Feh Eustaquio82% (34)

- Long Term Finance SourcesDokument14 SeitenLong Term Finance Sourcesabayomi abayomiNoch keine Bewertungen

- Chapter 17 Flashcards - QuizletDokument34 SeitenChapter 17 Flashcards - QuizletAlucard77777Noch keine Bewertungen

- Swift Foods, Inc. Operations and Financial OverviewDokument10 SeitenSwift Foods, Inc. Operations and Financial OverviewMydel AvelinoNoch keine Bewertungen

- Impact of Dividend Policy On Shareholders' Value - An Empirical Analysis of Indian FirmsDokument25 SeitenImpact of Dividend Policy On Shareholders' Value - An Empirical Analysis of Indian Firmssujata.kapoorNoch keine Bewertungen

- HLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, MalaysiaDokument8 SeitenHLA Beyond Cancer Plan: Wong Evis No 674 Pt4898 Wakaf Delima Wakaf Bharu 16250 Wakaf Bharu Kelantan, MalaysianadiaNoch keine Bewertungen

- Equities Crossing Barriers 09jun10Dokument42 SeitenEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- Chapter 17 End of Chapter Question AnswersDokument6 SeitenChapter 17 End of Chapter Question AnswersMuhammad DanialNoch keine Bewertungen

- Effect of Dividend Policy on Financial Performance of Consumer Goods FirmsDokument9 SeitenEffect of Dividend Policy on Financial Performance of Consumer Goods FirmsTanvir ChowdhuryNoch keine Bewertungen

- Guide of Audit in InvestmentsDokument21 SeitenGuide of Audit in InvestmentsNicco OrtizNoch keine Bewertungen

- ESSAYDokument6 SeitenESSAYSimonNoch keine Bewertungen

- Annual Report 2012-13 OF RUBY TEXTILEDokument71 SeitenAnnual Report 2012-13 OF RUBY TEXTILERNoch keine Bewertungen

- What is Financial Management? Meaning & ObjectivesDokument12 SeitenWhat is Financial Management? Meaning & ObjectivesJasin ThajNoch keine Bewertungen

- Tutorial Letter 102/3/2014: Financial Accounting For Companies FAC2601Dokument57 SeitenTutorial Letter 102/3/2014: Financial Accounting For Companies FAC2601Phebieon MukwenhaNoch keine Bewertungen

- Sinergi dan Transformasi untuk Pertumbuhan BerkelanjutanDokument447 SeitenSinergi dan Transformasi untuk Pertumbuhan BerkelanjutanNimas PandanwangiNoch keine Bewertungen

- Ch 4 Solutions GuideDokument24 SeitenCh 4 Solutions GuideJane Ming0% (1)

- Analyze Bartlett Company's Financial StatementsDokument46 SeitenAnalyze Bartlett Company's Financial StatementsMustakim Bin Aziz 1610534630Noch keine Bewertungen

- UntitledDokument27 SeitenUntitledSartoriNoch keine Bewertungen

- Spring 2016 SUA Document No 1Dokument6 SeitenSpring 2016 SUA Document No 1Esther Dorce0% (2)

- UAS PA 2020-2021 Ganjil - JawabanDokument27 SeitenUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNoch keine Bewertungen

- Sample AssignmentDokument31 SeitenSample Assignmentits2kool50% (2)

- MCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDokument2 SeitenMCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDhawal RajNoch keine Bewertungen

- Dividend Theories and Empirical Evidence ExplainedDokument11 SeitenDividend Theories and Empirical Evidence ExplainedAamir KhanNoch keine Bewertungen

- Income Tax 1 - Seatwork Signabon-MalaoDokument16 SeitenIncome Tax 1 - Seatwork Signabon-MalaoLarry Fritz SignabonNoch keine Bewertungen

- Client equity and F&O trades with realized profitsDokument34 SeitenClient equity and F&O trades with realized profitsraghav guptaNoch keine Bewertungen

- US Internal Revenue Service: Irb00-06Dokument134 SeitenUS Internal Revenue Service: Irb00-06IRSNoch keine Bewertungen

- GR 51765 Rep Planters Bank Vs Enrique AganaDokument4 SeitenGR 51765 Rep Planters Bank Vs Enrique AganaNesrene Emy LlenoNoch keine Bewertungen

- Corporate Finance MCQDokument11 SeitenCorporate Finance MCQsinghsanjNoch keine Bewertungen

- Financial Statement AnalysisDokument38 SeitenFinancial Statement AnalysisRoyal HikariNoch keine Bewertungen

- Sy CH - 5Dokument8 SeitenSy CH - 5Rafayeat Hasan MehediNoch keine Bewertungen

- Wiley MCQDokument44 SeitenWiley MCQMuhammadKhalidNoch keine Bewertungen

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfVon EverandProduct-Led Growth: How to Build a Product That Sells ItselfBewertung: 5 von 5 Sternen5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Von EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Bewertung: 4.5 von 5 Sternen4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthVon EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNoch keine Bewertungen

- Note Brokering for Profit: Your Complete Work At Home Success ManualVon EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNoch keine Bewertungen

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionVon EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionBewertung: 5 von 5 Sternen5/5 (1)