Beruflich Dokumente

Kultur Dokumente

CIR vs. Philamlife tax refund prescription period

Hochgeladen von

BreAmber0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

192 Ansichten2 SeitenThis case involves determining the start date of the two-year prescriptive period for claiming tax refunds for corporations that file income tax returns on a quarterly basis. The court ruled that:

1) For corporations filing quarterly, the two-year period begins from the date the final adjustment return is filed, not the date of each quarterly payment.

2) Until the final adjustment return is submitted, the quarterly payments are only partial payments and it cannot be determined if a refund is due.

3) For this case, the two-year period began on April 15, 1984 when the final adjustment return was filed, and the claim for refund was submitted within this period so it was

Originalbeschreibung:

Tax

Originaltitel

CIR vs Philamlife

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis case involves determining the start date of the two-year prescriptive period for claiming tax refunds for corporations that file income tax returns on a quarterly basis. The court ruled that:

1) For corporations filing quarterly, the two-year period begins from the date the final adjustment return is filed, not the date of each quarterly payment.

2) Until the final adjustment return is submitted, the quarterly payments are only partial payments and it cannot be determined if a refund is due.

3) For this case, the two-year period began on April 15, 1984 when the final adjustment return was filed, and the claim for refund was submitted within this period so it was

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

192 Ansichten2 SeitenCIR vs. Philamlife tax refund prescription period

Hochgeladen von

BreAmberThis case involves determining the start date of the two-year prescriptive period for claiming tax refunds for corporations that file income tax returns on a quarterly basis. The court ruled that:

1) For corporations filing quarterly, the two-year period begins from the date the final adjustment return is filed, not the date of each quarterly payment.

2) Until the final adjustment return is submitted, the quarterly payments are only partial payments and it cannot be determined if a refund is due.

3) For this case, the two-year period began on April 15, 1984 when the final adjustment return was filed, and the claim for refund was submitted within this period so it was

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

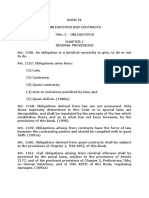

CIR vs. Philamlife (G.R. No.

105208 May 29, 1995)

FAC!"

On May 30, 1983, private respondent Philamlife, For its Third Quarter of 1983, declared a net taa!le income of

P",#1#,$%1&00 and a ta due of P%08,'$'&00& (fter creditin) the amount of P3,899,#"#&00 it declared a

refunda!le amount of P3,1#8,0$1&00&

For its Fourth and *nal +uarter endin) ,ecem!er 31, private respondent su-ered a loss and there!y had no

income ta lia!ility&

.n the return for that +uarter, it declared a refund of P3,991,8'1&00 representin) the *rst and second +uarterly

payments/ P"1#,%'"&00 as 0ithholdin) taes on rental income for 1983 and P133,08'&00 representin) 198"

income ta refund applied as 1983 ta credit&

.n 198', private respondent a)ain su-ered a loss and declared no income ta lia!ility& 1o0ever, it applied as ta

credit for 198', the amount of P3,991,8'1&00 representin) its 198" and 1983 overpaid income taes and the

amount of P"#0,8$%&00 as 0ithholdin) ta on rental income for 198'&

On 2eptem!er "$, 198', private respondent *led a claim for its 198" income ta refund of P133,08'&00&

On 3ovem!er "", 198', it *led a petition for revie0 0ith the 4ourt of Ta (ppeals 0ith respect to its 198" claim

for refund& On ,ecem!er 1$, 198#, it *led another claim for refund On 5anuary ", 198$, private respondent *led a

petition for revie0 0ith the 4T(, doc6eted as 4T( 4ase 3o& '018 re)ardin) its 1983 and 198' claims for refund in

the a!ove7stated amount& 8ater, it amended its petition !y limitin) its claim for refund to only P3,8#8,%#%&00

.229:/ .n a case such as this, 0here a corporate tapayer remits;pays to the <.= ta 0ithheld on income for the *rst

+uarter !ut 0hose !usiness operations actually resulted in a loss for that year, as re>ected in the 4orporate Final

(d?ustment =eturn su!se+uently *led 0ith the <.=, should not the runnin) of the prescriptive period commence

from the remittance;payment at the end of the *rst +uarter of the ta 0ithheldinstead of from the *lin) of the Final

(d?ustment =eturn@

1:8,/

The issue in this case is the rec6onin) date of the t0o7year prescriptive period provided in 2ection "30 of

the 3ational .nternal =evenue 4ode Aformerly 2ection "9"B 0hich states that/ =ecovery of ta erroneously

or ille)ally collected& C 3o suit or proceedin) shall !e maintained in any court for the recovery of any

national internal revenue ta hereafter alle)ed to have !een erroneously or ille)ally assessed or collected,

or of any penalty claimed to have !een collected 0ithout authority, or of any sum alle)ed to have !een

ecessive or in any manner 0ron)fully collected, until a claim for refund or credit has !een duly *led 0ith

the 4ommissionerD !ut such suit or proceedin) may !e maintained, 0hether or not such ta, penalty, or

sum has !een paid under protest or duress&

.n any case, no such suit or proceedin) shall !e !e)un after the epiration of t0o years from the date

of payment of the ta or penalty re)ardless of any supervenin) cause that may arise after

payment/Provided, however, That the 4ommissioner may, even 0ithout a 0ritten claim therefor, refund or

credit any ta, 0here on the face of the return upon 0hich payment 0as made, such payment appears

clearly to have !een erroneously paid&

Forfeiture of refund& C ( refund chec6 or 0arrant issued in accordance 0ith the pertinent provisions of

this 4ode 0hich shall remain unclaimed or uncashed 0ithin *ve A#B years from the date the said 0arrant or

chec6 0as mailed or delivered shall !e forfeited in favor of the )overnment and the amount thereof shall

revert to the Eeneral Fund&

2ection "9" Ano0 2ection "30B stipulates that the t0o7year prescriptive period to claim refunds should !e

counted from date of payment of the ta sou)ht to !e refunded& Fhen applied to ta payers *lin) income

ta returns on a +uarterly !asis, the date of payment mentioned in 2ection "9" Ano0 2ection "30B must !e

deemed to !e +uali*ed !y 2ections $8 and $9 of the present Ta 4ode

.t may !e o!served that althou)h +uarterly taes due are re+uired to !e paid 0ithin sity days from the

close of each +uarter, the fact that the amount shall !e deducted from the ta due for the succeedin)

+uarter sho0s that until a *nal ad?ustment return shall have !een *led, the taes paid in the precedin)

+uarters are merely partial taes due from a corporation& 3either amount can serve as the *nal *)ure to

+uantity 0hat is due the )overnment nor 0hat should !e refunded to the corporation&

This interpretation may !e )leaned from the last para)raph of 2ection $9 of the Ta 4ode 0hich provides

that the refunda!le amount, in case a refund is due a corporation, is that amount 0hich is sho0n on its

*nal ad?ustment return and not on its +uarterly returns&

Therefore, 0hen private respondent paid P3,"'$,1'1&00 on May 30, 1983, it 0ould not have !een a!le to

ascertain on that date, that the said amount 0as refunda!le& The same applies 0ith co)ency to the

payment of P39$,8%'&00 on (u)ust "9, 1983&

4learly, #he $%es&%i$#ive $e%io' of #(o yea%s sho)l' &omme*&e #o %)* o*ly f%om #he #ime #ha#

#he %ef)*' is as&e%#ai*e', (hi&h &a* o*ly +e 'e#e%mi*e' af#e% a ,*al a'-)s#me*# %e#)%* is

a&&om$lishe'. I* #he $%ese*# &ase, #his 'a#e is A$%il 1., 198/, a*' #(o yea%s f%om #his 'a#e

(o)l' +e A$%il 1., 198.. The record sho0s that the claim for refund 0as *led on ,ecem!er 10, 198#

and the petition for revie0 0as !rou)ht !efore the 4T( on 5anuary ", 198$& <oth dates are 0ithin the t0o7

year re)lementary period& Private respondent !ein) a corporation, 2ection "9" Ano0 2ection "30B cannot

serve as the sole !asis for determinin) the t0o7year prescriptive period for refunds& (s 0e have earlier said

in the TMX Sales case, 2ections $8, $9, and %0 on Quarterly 4orporate .ncome Ta Payment and 2ection

3"1 should !e considered in con?unction 0ith it&

Moreover, even if the t0o7year period had already lapsed, the same is not ?urisdictional

and may !e

suspended for reasons of e+uity and other special circumstances&

Das könnte Ihnen auch gefallen

- Cir vs. PhilamlifeDokument2 SeitenCir vs. PhilamlifeAnny YanongNoch keine Bewertungen

- Philamlife V Cta Case DigestDokument2 SeitenPhilamlife V Cta Case DigestAnonymous BvmMuBSwNoch keine Bewertungen

- BPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentDokument2 SeitenBPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentJP Murao IIINoch keine Bewertungen

- Bpi V. Cir G.R. No. 174942Dokument1 SeiteBpi V. Cir G.R. No. 174942dasfghkjlNoch keine Bewertungen

- Atlas Mining VAT Refund CaseDokument35 SeitenAtlas Mining VAT Refund CaseDaley CatugdaNoch keine Bewertungen

- G.R. No. L-68252Dokument4 SeitenG.R. No. L-68252Klein Carlo100% (1)

- Liquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119Dokument3 SeitenLiquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119brendamanganaanNoch keine Bewertungen

- CIR v. Benguet Corp Ruling on Retroactive Application of VAT RulingDokument1 SeiteCIR v. Benguet Corp Ruling on Retroactive Application of VAT RulingAgnes GamboaNoch keine Bewertungen

- G.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueDokument1 SeiteG.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueEdmerson Prix Sanchez CalpitoNoch keine Bewertungen

- PILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.Dokument2 SeitenPILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.lexxNoch keine Bewertungen

- CIR Vs BinalbaganDokument2 SeitenCIR Vs BinalbaganjohnkyleNoch keine Bewertungen

- CIR vs. Raul Gonzales (Digest)Dokument2 SeitenCIR vs. Raul Gonzales (Digest)Bam Bathan100% (1)

- Consolidated Mines V CIR DigestDokument2 SeitenConsolidated Mines V CIR Digestcookbooks&lawbooksNoch keine Bewertungen

- Cir vs. Metro Super Rama DigestDokument3 SeitenCir vs. Metro Super Rama DigestClavel TuasonNoch keine Bewertungen

- Collector V Goodrich DigestDokument2 SeitenCollector V Goodrich DigestmbNoch keine Bewertungen

- CIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRDokument3 SeitenCIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRAila Amp100% (1)

- 1 CIR Vs Standard CharteredDokument2 Seiten1 CIR Vs Standard CharteredChris AlgaNoch keine Bewertungen

- CIR v. CitytrustDokument2 SeitenCIR v. Citytrustpawchan02Noch keine Bewertungen

- Estate Not Liable for Property Taxes Before RepurchaseDokument1 SeiteEstate Not Liable for Property Taxes Before RepurchaseMACNoch keine Bewertungen

- CIR vs Philam Life Prescription RefundDokument1 SeiteCIR vs Philam Life Prescription RefundRaquel Doquenia100% (1)

- Cir Vs PNB DigestDokument3 SeitenCir Vs PNB DigestKaye Almeida100% (1)

- CIR vs. American RubberDokument2 SeitenCIR vs. American RubberMarife MinorNoch keine Bewertungen

- CIR vs. Embroidery & Garments Industries PhilsDokument5 SeitenCIR vs. Embroidery & Garments Industries PhilsEmil BautistaNoch keine Bewertungen

- CIR vs. Metro Star Superama, G.R. No. 185371, December 8, 2010Dokument3 SeitenCIR vs. Metro Star Superama, G.R. No. 185371, December 8, 2010Mich LopezNoch keine Bewertungen

- Lascona Land Co., Inc. v. CIRDokument2 SeitenLascona Land Co., Inc. v. CIRAron Lobo100% (1)

- My Digest - CIR vs. Pascor Realty, GR 128315Dokument4 SeitenMy Digest - CIR vs. Pascor Realty, GR 128315Guiller MagsumbolNoch keine Bewertungen

- Donor - Christian and Missionary Alliance Donee - Petitioner Both Are Religious CorporationsDokument3 SeitenDonor - Christian and Missionary Alliance Donee - Petitioner Both Are Religious CorporationsRobelle RizonNoch keine Bewertungen

- Bpi V Cir DigestDokument3 SeitenBpi V Cir DigestkathrynmaydevezaNoch keine Bewertungen

- Cir V AcostaDokument2 SeitenCir V AcostaJennilyn TugelidaNoch keine Bewertungen

- Abakada Guro Vs ErmitaDokument1 SeiteAbakada Guro Vs Ermitaapril75Noch keine Bewertungen

- Cir v. Wyeth SuacoDokument1 SeiteCir v. Wyeth SuacoJames Estrada CastroNoch keine Bewertungen

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Dokument1 SeiteCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNoch keine Bewertungen

- CIR Vs Toledo Power CompanyDokument1 SeiteCIR Vs Toledo Power CompanyMilcah MagpantayNoch keine Bewertungen

- Spouses Tan Vs BanteguiDokument2 SeitenSpouses Tan Vs BanteguiPaul EsparagozaNoch keine Bewertungen

- Gibbs vs. CIR and CTA rules on prescription of tax claimsDokument2 SeitenGibbs vs. CIR and CTA rules on prescription of tax claimsIrish Asilo PinedaNoch keine Bewertungen

- University of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioDokument3 SeitenUniversity of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioSophiaFrancescaEspinosaNoch keine Bewertungen

- Commissioner vs Fireman's FundDokument2 SeitenCommissioner vs Fireman's FundjulyenfortunatoNoch keine Bewertungen

- Philippine Bank of Communications Vs Commissioner of Internal RevenueDokument2 SeitenPhilippine Bank of Communications Vs Commissioner of Internal RevenueNFNL100% (1)

- BPI vs. TrinidadDokument3 SeitenBPI vs. TrinidadKM MacNoch keine Bewertungen

- CIR v. Vda de PrietoDokument3 SeitenCIR v. Vda de Prietoevelyn b t.Noch keine Bewertungen

- Digests For TaxDokument12 SeitenDigests For TaxFender BoyangNoch keine Bewertungen

- Manila Tax Ordinance Ruled Invalid for Failing Publication RequirementDokument2 SeitenManila Tax Ordinance Ruled Invalid for Failing Publication RequirementRyan Acosta100% (3)

- Villanueva V City of IloiloDokument1 SeiteVillanueva V City of IloiloEllaine Virayo100% (1)

- Philippine Match Co vs. City of CebuDokument4 SeitenPhilippine Match Co vs. City of CebuKC ToraynoNoch keine Bewertungen

- 157 CIR V Meralco GAMDokument2 Seiten157 CIR V Meralco GAMGreghvon MatolNoch keine Bewertungen

- Kepco Philippines Corporation Vs. CIR VAT Refund CaseDokument4 SeitenKepco Philippines Corporation Vs. CIR VAT Refund CaseWhere Did Macky GallegoNoch keine Bewertungen

- 14d G.R. No. L-18330 July 31, 1963 de Borja Vs GellaDokument2 Seiten14d G.R. No. L-18330 July 31, 1963 de Borja Vs GellarodolfoverdidajrNoch keine Bewertungen

- Bpi vs. Cir, GR No. 139736Dokument11 SeitenBpi vs. Cir, GR No. 139736Ronz RoganNoch keine Bewertungen

- ExxonMobil Petroleum Philippine Branch vs. CIR Tax Refund RulingDokument1 SeiteExxonMobil Petroleum Philippine Branch vs. CIR Tax Refund RulingDino BacomoNoch keine Bewertungen

- Dorado - Medicard Philippines, Inc. vs. CirDokument4 SeitenDorado - Medicard Philippines, Inc. vs. CirNoel Christopher G. BellezaNoch keine Bewertungen

- 5 - CIR vs. Hon. Raul M. GonzalezDokument6 Seiten5 - CIR vs. Hon. Raul M. GonzalezJaye Querubin-FernandezNoch keine Bewertungen

- Corre Vs Tan CorreDokument2 SeitenCorre Vs Tan CorreLean Manuel ParagasNoch keine Bewertungen

- Shell Corporation Vs Vano DigestDokument2 SeitenShell Corporation Vs Vano Digestminri721Noch keine Bewertungen

- Supreme Court upholds prosecution of tax evasion caseDokument2 SeitenSupreme Court upholds prosecution of tax evasion caseJD BallosNoch keine Bewertungen

- 143.CIR Vs Stanley (Phils.)Dokument8 Seiten143.CIR Vs Stanley (Phils.)Clyde KitongNoch keine Bewertungen

- Case No.19 - Waldman Publishing Corporation and Playmore Inc., Publishers vs. Landoll, Inc.Dokument2 SeitenCase No.19 - Waldman Publishing Corporation and Playmore Inc., Publishers vs. Landoll, Inc.juliNoch keine Bewertungen

- Conflicts - Chap 2 and 12 FINALDokument19 SeitenConflicts - Chap 2 and 12 FINALFranz GarciaNoch keine Bewertungen

- Cir V Itogon-Suyoc MinESDokument2 SeitenCir V Itogon-Suyoc MinESkeloNoch keine Bewertungen

- Jardine Davies Insurance Brokers vs. AliposaDokument2 SeitenJardine Davies Insurance Brokers vs. AliposaCarlota Nicolas Villaroman100% (1)

- RR 12 - 99 DigestDokument5 SeitenRR 12 - 99 DigestrodolfoverdidajrNoch keine Bewertungen

- Good GovernanceDokument22 SeitenGood GovernanceBreAmberNoch keine Bewertungen

- Title V Trust (1440-1457)Dokument3 SeitenTitle V Trust (1440-1457)BreAmberNoch keine Bewertungen

- Sec Memo No. 9, s2011Dokument1 SeiteSec Memo No. 9, s2011Cesareo Antonio Singzon Jr.Noch keine Bewertungen

- Corpo - Title IIIDokument4 SeitenCorpo - Title IIIBreAmberNoch keine Bewertungen

- Title IX Partnership (1767-1867)Dokument34 SeitenTitle IX Partnership (1767-1867)BreAmberNoch keine Bewertungen

- Title XIII Aleatory Contracts (2010-2027)Dokument3 SeitenTitle XIII Aleatory Contracts (2010-2027)BreAmberNoch keine Bewertungen

- Pledge and Mortgage Contract RequirementsDokument9 SeitenPledge and Mortgage Contract RequirementsBreAmberNoch keine Bewertungen

- GR 107383 Nizurtado Vs SandiganbayanDokument9 SeitenGR 107383 Nizurtado Vs SandiganbayanBreAmberNoch keine Bewertungen

- Title XVIII Damages (2195-2235)Dokument8 SeitenTitle XVIII Damages (2195-2235)BreAmberNoch keine Bewertungen

- Title XII Deposit (1962-2009)Dokument8 SeitenTitle XII Deposit (1962-2009)BreAmber100% (1)

- Title XIX Concurrence and Preference of Credits (2236-2270)Dokument10 SeitenTitle XIX Concurrence and Preference of Credits (2236-2270)BreAmberNoch keine Bewertungen

- Estoppel under Philippine lawDokument2 SeitenEstoppel under Philippine lawBreAmber100% (1)

- Title XV Guaranty (2047-2084)Dokument7 SeitenTitle XV Guaranty (2047-2084)BreAmberNoch keine Bewertungen

- Title XIV Compromises and Arbitrations (2028-2046)Dokument3 SeitenTitle XIV Compromises and Arbitrations (2028-2046)BreAmberNoch keine Bewertungen

- Title XI Loan (1933-1961)Dokument5 SeitenTitle XI Loan (1933-1961)BreAmberNoch keine Bewertungen

- Title VIII Lease (1642-1766)Dokument21 SeitenTitle VIII Lease (1642-1766)BreAmberNoch keine Bewertungen

- Family Code (Executive Order No 209)Dokument53 SeitenFamily Code (Executive Order No 209)BreAmberNoch keine Bewertungen

- Title VII Barter or Exchange (1638-1641)Dokument1 SeiteTitle VII Barter or Exchange (1638-1641)BreAmberNoch keine Bewertungen

- Nego Syllabus Week 03 v97-2003 2010-12-08Dokument1 SeiteNego Syllabus Week 03 v97-2003 2010-12-08BreAmberNoch keine Bewertungen

- 130714Dokument8 Seiten130714BreAmberNoch keine Bewertungen

- Title II Contracts (1305-1422)Dokument19 SeitenTitle II Contracts (1305-1422)BreAmber33% (3)

- Title III Natural Obligations (1423-1430)Dokument2 SeitenTitle III Natural Obligations (1423-1430)BreAmberNoch keine Bewertungen

- Title I Obligations (1156 - 1304)Dokument26 SeitenTitle I Obligations (1156 - 1304)BreAmberNoch keine Bewertungen

- Law 108: Negotiable Instruments CasesDokument15 SeitenLaw 108: Negotiable Instruments CasesBreAmberNoch keine Bewertungen

- Digest Env 430Dokument25 SeitenDigest Env 430BreAmberNoch keine Bewertungen

- Full Env 430Dokument59 SeitenFull Env 430BreAmberNoch keine Bewertungen

- Insurance law case digest interpretationDokument28 SeitenInsurance law case digest interpretationBernadette Quitoriano67% (3)

- Annex N.tax - HassleDokument4 SeitenAnnex N.tax - HassleBreAmberNoch keine Bewertungen

- Concealment: Insurance Law Case Digests SY 2010-2011Dokument1 SeiteConcealment: Insurance Law Case Digests SY 2010-2011BreAmberNoch keine Bewertungen

- Tax Digest2003Dokument11 SeitenTax Digest2003BreAmberNoch keine Bewertungen

- TQM 2 MARKSDokument12 SeitenTQM 2 MARKSMARIYAPPANNoch keine Bewertungen

- Homework Solutions For Chapter 8Dokument6 SeitenHomework Solutions For Chapter 8api-234237296Noch keine Bewertungen

- EDMU 520 Phonics Lesson ObservationDokument6 SeitenEDMU 520 Phonics Lesson ObservationElisa FloresNoch keine Bewertungen

- Vaishali Ancient City Archaeological SiteDokument31 SeitenVaishali Ancient City Archaeological SiteVipul RajputNoch keine Bewertungen

- Impact On Modern TechnologyDokument2 SeitenImpact On Modern TechnologyNasrullah Khan AbidNoch keine Bewertungen

- Alice Hoffman - Green AngelDokument24 SeitenAlice Hoffman - Green AngelHristiyana Yotova71% (14)

- Pope Francis' Call to Protect Human Dignity and the EnvironmentDokument5 SeitenPope Francis' Call to Protect Human Dignity and the EnvironmentJulie Ann BorneoNoch keine Bewertungen

- What Is Six Sigma: Everything You Need To Know About It: by Pankaj KumarDokument16 SeitenWhat Is Six Sigma: Everything You Need To Know About It: by Pankaj KumarSuman DewanNoch keine Bewertungen

- Holliday - 2006 - Native-Speakerism - ELT JournalDokument3 SeitenHolliday - 2006 - Native-Speakerism - ELT JournalBob HowesNoch keine Bewertungen

- Ebook Torrance (Dalam Stanberg) - 1-200 PDFDokument200 SeitenEbook Torrance (Dalam Stanberg) - 1-200 PDFNisrina NurfajriantiNoch keine Bewertungen

- Highly Effective College StudentsDokument8 SeitenHighly Effective College StudentsPhoenix Kylix0% (1)

- FluteDokument3 SeitenFlutepatrickduka123100% (1)

- Perceptiual - Cognitive SkillDokument17 SeitenPerceptiual - Cognitive SkillGeovani AkbarNoch keine Bewertungen

- Opening RitualDokument17 SeitenOpening RitualTracy CrockettNoch keine Bewertungen

- Ageli Software DevelopmentDokument112 SeitenAgeli Software DevelopmentRyan Adrian100% (2)

- Enuma Elish LitChartDokument20 SeitenEnuma Elish LitChartsugarntea24Noch keine Bewertungen

- Life Strategy 101: How To Live Live by Vision, Work With Purpose, and Achieve More SuccessDokument31 SeitenLife Strategy 101: How To Live Live by Vision, Work With Purpose, and Achieve More SuccessMichelle Casto100% (2)

- VV Siddipet Merit ListDokument81 SeitenVV Siddipet Merit ListSubashNoch keine Bewertungen

- Class 6 - The Banyan TreeDokument5 SeitenClass 6 - The Banyan Tree7A04Aditya MayankNoch keine Bewertungen

- Phonology BibliogrDokument6 SeitenPhonology BibliogrSnapeSnapeNoch keine Bewertungen

- Capital StructureDokument59 SeitenCapital StructureRajendra MeenaNoch keine Bewertungen

- Affidavit of DesistanceDokument6 SeitenAffidavit of Desistancesalasvictor319Noch keine Bewertungen

- De Sagun, Leila Camille A. BSN3Y1-1B NCMB312-LEC Course Task #4 Burn InjuriesDokument2 SeitenDe Sagun, Leila Camille A. BSN3Y1-1B NCMB312-LEC Course Task #4 Burn InjuriesCarl Santos50% (2)

- SPE-21639-MSDokument8 SeitenSPE-21639-MSehsanNoch keine Bewertungen

- Lecture 22 NDokument6 SeitenLecture 22 Ncau toanNoch keine Bewertungen

- Lesson PlanDokument8 SeitenLesson PlanNunette SenilloNoch keine Bewertungen

- VajroliDokument3 SeitenVajroliJithu BayiNoch keine Bewertungen

- Alpha To Omega PPT (David & Krishna)Dokument11 SeitenAlpha To Omega PPT (David & Krishna)gsdrfwpfd2Noch keine Bewertungen

- Draft Resolution 1.1 SPECPOL LUMUN 2013Dokument8 SeitenDraft Resolution 1.1 SPECPOL LUMUN 2013Hamza Hashim100% (1)

- Peta I Think Fizik t4Dokument18 SeitenPeta I Think Fizik t4Yk TayNoch keine Bewertungen