Beruflich Dokumente

Kultur Dokumente

CRA Brochure Almaty Kazakhstan April 2014

Hochgeladen von

Farhad MadatovCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CRA Brochure Almaty Kazakhstan April 2014

Hochgeladen von

Farhad MadatovCopyright:

Verfügbare Formate

Certifed by Organized by

Delivery Type: Group Live | Pre-requisites: None | Level: Advanced | This Program is worth 35 NASBA CPE credits

21-25 April 2014

Almaty, Kazakhstan

GENERAL INFORMATION GENERAL INFORMATION

BENEFITS OF ATTENDING THIS HIGHLY

INTERACTIVE 5 DAY COURSE

Successful completion of this course makes you a CRA Certifed

Risk Analyst. You can use the designation CRA on your business

card and resume.

Up to 18 months membership to the IABFM professional body

Access to the IABFM network and body of information online

Preferred access to education centers in USA, UK, Europe, Asia,

Middle East and Latin America

Access to the IABFM journal published online Gold Embossed

Certifcate with your name and designation as MIABFM (Member of

the International Academy of Business Financial Management)

T: +971 4 447 5711 | F: +971 4 447 5710 | E: register@leoron.net | W: www.leoron.com 2

PROGRAM TIMINGS

Registration will begin at 08.00 on Day One. The program will com-

mence at 08.30 each day and continue until 16.30. There will be two

refreshment breaks and lunch at appropriate intervals.

IN-HOUSE

If interested to run this course in-house please contact Val Jusuf at

+971 4 447 5711 or e-mail: val@leoron.net

COURSE REQUIREMENTS AND CERTIFICATES

Delegates must meet the following criteria to be eligible to become

CRA:

Attendance delegates must attend all sessions of the course.

Delegates who miss more than two hours of the course sessions will

not be eligible to sit the course exam

Successful completion of the course assessment

After successfully passing the exam the Certifcates will be prepared

by the IABFM and will be directly posted to your company address.

Certifed Risk Analyst | 21-25 April 2014 | Almaty, Kazakhstan

John W. Dalle Molle Expert Trainer

Dr. John W. Dalle Molle is an inde-

pendent fnancial market consultant

specializing in measurement, ana-

lytics and quantitative modeling for

credit, energy, market, operational,

operations, and systemic risk man-

agement. Recently, Dr. Dalle Molle

has focused on credit, energy/com-

modity, and operations/operational

risk management and a developing

interest in healthcare risk manage-

ment. He has been involved in

model validation consulting projects

over the past few years with major Singaporean and Ma-

laysian banks. He has presented executive, educational, and

professional training programs, presentations, and seminars

in Africa, the Americas, Asia-Pacifc Region, South Asia, GCC

countries, the Middle East, and various Western and Eastern

European countries. His clients have includes several large

fnancial institutions and central banks. In the past, he has also

taught at a number of renowned universities in Asia, Europe,

and the Americas. Dr. Dalle Molle has also made several

professional presentations around the world in conferences

and exhibitions such as the IIR - Middle East - Credit Risk &

Receivables Management Conference in Dubai, the Futures

& Options World (FOW) in Singapore, the Quantitative

Methods in Finance (QMF) Conference in Sydney, and EU-

RORISK in Paris. He is also involved in developing and pre-

paring and writing various publications, working papers and

contributions for various highly respected journals, and he is

also working towards publishing several books on risk mea-

surement, modeling and management. Dr. Dalle Molle has

an interdisciplinary PhD in Management Science/Information

Systems with a focus on fnancial econometrics and statistical

modeling, a Masters of Arts in Mathematics, and a Masters

of Science in Petroleum Engineering, which are all from the

University of Texas at Austin, and a Bachelor of Science in

Chemical Engineering from University of Iowa.

BY ATTENDING THIS PRACTICAL AND

INFORMATIVE COURSE, YOU WILL BE ABLE TO:

1. Learn how to build a risk framework.

2. Gain insight into methods around risk /appetite & performance.

3. Build a risk system from the ground up without being a pro-

grammer.

4. Learn how to report risk to management & use risk numbers

in effective investment decision.

5. Learn best practice measurement approaches.

6. Look at different real life case studies which give you highly

practical information that can be applied in your company

WHO SHOULD ATTEND?

This program is suitable for many different types of risk analysts, man-

agers and audit staff. It covers the entire risk management landscape

drawing on different aspects of risk and delivers complex topics in an

easy to understand manner:

Corporate treasury Managers in banks & corporations

Risk Managers/Analysts

Finance Directors

Financial Controllers

Finance Managers

Accountants

Dealers

Market Risk Staff

Brokers

Internal Auditors

Plus anyone who is responsible for analyzing company fnancial risk and

dealing with the various risk exposures that may affect their organisation.

Certifed by

Leoron Professional Development

Institute JLT is registered with the National

Association of State Boards of Accountancy

(NASBA) as a sponsor of continuing profes-

sional education on the National Registry of

CPE Sponsors. State boards of accountancy

have fnal authority on the acceptance of individual courses for

CPE credit. Complaints regarding registered sponsors may be

submitted to the National Registry of CPE Sponsors through its

website: www.learningmarket.org.

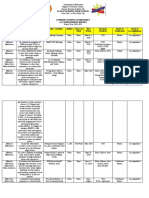

COURSE OUTLINE

DAY 3 Trading Risk

Session 1

Review different types of risk such as volatile commodity pric-

es and exposures from foreign exchange, learn how to hedge

these exposures with derivatives.

Session 2

Review option models that allow risk to be hedged cheaply

and in a controlled manner. Different examples will be given

from both vanilla and exotic option strategies.

Session 3

Use Real Options to price risk in volatile operating environ-

ments and gain insight into how to plan and control strategic

risk.

Session 4

Learn about processing environments and why they fail, look

at concepts such as Six Sigma but also learn how to reduce

failures in operating environments.

Session 5

Gain insight in a step to step manner for pricing, trading and

hedging risk. This is important because it shows how easy it is

to reduce proximity of exposure.

Session 6

Day fnished with discussions on accounting and reporting ex-

posure when it is hedged IAS 39.

T: +971 4 447 5711 | F: +971 4 447 5710 | E: register@leoron.net | W: www.leoron.com 3

DAY 1 Risk Management

Session 1

Overview of the ERM space, understand how this risk disci-

pline has evolved and the key players / regulators / Standards

boards in ERM practice.

Session 2

Framework elements and mapping session sets up an ap-

proach for capturing a frms processes and controls for risk

assessment.

Session 3

Risk Defnition and Scope are important aspects of an ERM

framework, we will look at industry accepted risk defnitions

and how to set policy in your frm.

Session 4

Understand the cause / effect of risks that frms face with

several case studies to highlight why ERM is important to a

business.

Session 5

Control Self Assessment process, learn step by step how to

build a Risk Control Self Assessment process for Operational

Risk.

Session 6

Complete set of case studies are given so that the workshop

builds its own maps and RDCA processes which can be taken

away by the class.

DAY 4 Credit Risk & Fraud

Session 1

Understand the aspects of Probability of Default, Exposure

at Default, Loss Given Default and how they apply to your

business.

Session 2

Learn how to score a client for their credit worthiness and

how credit scoring models are useful in calculating the poten-

tial exposure you have to your supply chain.

Session 3

Credit Collections and Contract Dispute management are

important to improve accounts receivable(s) in a frm, learn

best practice tips for improving collection ability of a frm.

Session 4

Review the drivers and outcomes of fraud, gain insight into

different types of fraud in a business and how it can be mea-

sured and controlled.

Session 5

Project feasibility understand the steps for reviewing con-

tracts or project opportunities and how to measure risk.

Session 6

Class carries out feasibility steps in an example.

DAY 5 Market risk & Portfolios

Session 1

Learn about measuring market risk volatility how to bench-

mark salesman and traders using different types of metrics

taking in Beta and Portable Alpha.

Session 2

Gain insight into the Greeks (Delta, Gamma, Theta, Vega) and

how they inform you about the risk in trades and how to use

them to make trading decisions.

Session 3

Look at Value at Risk and Component Value at Risk for a port-

folio of investments either internal to the frm or external to

the company. A spreadsheet model is given to participants.

Session 4

Understand OpVaR and how extreme value theory can be

used to dimension tail events and the cost from extreme

events to a business model.

Session 5

Review methods such as Monte Carlo and learn how to apply

it to your risk modelling exercises so that you are able to build

up a parametric perspective of loss.

Session 6

Open discussion on the fve day event, with a fnal Question

and Answer debate which ensure all concepts are bedded

down. The trainer is available for question and answering for

all participants after the workshop is complete.

DAY 2 Extending the model

Session 1

Scenario Analysis allows for impacts from a catastrophe to be

quantifed. The workshop will build a scenario analysis process

which can be used to measure tail risk.

Session 2

Learn about investment risk, the impacts of various aspects of

poor cash control, leverage and an introduction to volatility in

companies revenue streams.

Session 3

A set of case studies for both scenario analysis and company

structure are delivered to the class to explain how different

business models control risk.

Session 4

The capture and use of operational risk Loss data is an im-

portant requirement for regulated frms it also allows model-

ling teams to gain better insight into improving performance

in their business.

Session 5

Learn how to report risk at an enterprise level, review heat

maps and economic capital models which allow risk to be

priced into a frms operation.

Session 6

The instructor will fnish the day by building a risk reporting

database with the class, to show how easy it is to construct an

ERM system for reporting exposure.

Certifed Risk Analyst | 21-25 April 2014 | Almaty, Kazakhstan

1. Please Invoice my Company 2. Please charge my Credit Card

Visa Master Card

Card Number : __________________________________

CVC/CCV Number : _______________

Exp Date : _____ / _____ / ________

Name on card : __________________________________

Signature : __________________________________

BOOK EARLY

SAVE

US$ 400

COMPANY DETAILS

Company : ________________________________________________ Address : ________________________________________________

Post Code : ________________________________________________ Country : ________________________________________________

Tel : ________________________________________________ Fax : ________________________________________________

I have read and agreed to the following terms and conditions

DELEGATE DETAILS

1

Name : _____________________________

Job

title

: _____________________________ E-mail : _____________________________

Tel

: _____________________________

Fax

: _____________________________

Mob

: _____________________________

2

Name : _____________________________

Job

title

: _____________________________ E-mail : _____________________________

Tel

: _____________________________

Fax

: _____________________________

Mob

: _____________________________

3

Name : _____________________________

Job

title

: _____________________________ E-mail : _____________________________

Tel

: _____________________________

Fax

: _____________________________

Mob

: _____________________________

CRA

Signature: ___________________________

Group Discounts

3-4 Delegates 20%

5 Delegates 25%

*please note that all group discount

are given on the fnal price

+971 4 447 5711

+971 4 447 5711

register@leoron.net

www.leoron.com

4 Easy ways to Register

TERMS & CONDITIONS

1. Payment Terms

100% payment of the full amount upon receipt of the invoice.

2. Cancellation Policy

i. All cancellations must be done in writing.

ii. Full refund for cancellations will only be paid to a maximum of one week from the invoice date.

iii. 50% refund for cancellations will only be paid to a maximum of two weeks from the invoice date.

iv. No refund for cancellations done after 2 weeks from the invoice date. Substitute is always welcomed; if not possible a credit will be given which can be used for any of Leoron events up to 1 year.

3. Force Majeure: If the event is postponed, canceled or abandoned by reason of war, fre, storm, explosion, national emergency, labor dispute, strike, lock-out, civil, disturbance, actual or threatened violence by

any terrorist group, or any other cause not within the control of our organization, we shall be under no liability to Company for non-performance or delay in performance of obligations under this contract

or otherwise in respect of any actions, claims, losses (including consequential losses) costs or expenses whatsoever which may be brought against or suffered or incurred by Company, as the result of the

happening of any such events.

4. Complaint and Refund: For more information regarding administrative policies such as complaint and refund, please contact Val Jusuf, Head of Training at: Tel: +971 4 447 5711, Fax:+971 4 447 5710, e-mail:

val@leoron.net

5. Governing Law: This contract shall be governed by and construed in accordance with the Laws and Regulations of DMCCA.

Early Bird Discounts

Register before February 15, 2014...................... US$ 3590

Register before March 15, 2014........................... US$ 3790

Final Price.......................................................................... US$ 3990

CERTIFIED RISK ANALYST

21-25 April 2014 | Almaty, Kazakhstan

VENUE DETAILS

TBC

Tel:

Fax:

E-mail:

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Liquid Fertilizer PresentationDokument17 SeitenLiquid Fertilizer PresentationAnna RothNoch keine Bewertungen

- ST. LUKE'S MEDICAL CENTER EMPLOYEE'S FOUNDATION AFW v. NLRCDokument3 SeitenST. LUKE'S MEDICAL CENTER EMPLOYEE'S FOUNDATION AFW v. NLRCjodelle11Noch keine Bewertungen

- L-2 Single and Composite Heat TransferDokument44 SeitenL-2 Single and Composite Heat Transfer271758 ktr.chem.18Noch keine Bewertungen

- 2nd Comprehensive ExamDokument15 Seiten2nd Comprehensive ExamLoala SMDNoch keine Bewertungen

- La Paz National High SchoolDokument19 SeitenLa Paz National High SchoolBon Ivan FirmezaNoch keine Bewertungen

- Pipe Thickness CalculationDokument4 SeitenPipe Thickness CalculationHarryNoch keine Bewertungen

- Ducted Exhaust Ventilation Fans: Low Noise, High Performance Air and Moisture ExtractionDokument4 SeitenDucted Exhaust Ventilation Fans: Low Noise, High Performance Air and Moisture ExtractionNicolas BaquedanoNoch keine Bewertungen

- PQPDokument60 SeitenPQPlee100% (4)

- Parenting Styles and Social Interaction of Senior Secondary School Students in Imo State, NigeriaDokument10 SeitenParenting Styles and Social Interaction of Senior Secondary School Students in Imo State, NigeriaInternational Educational Applied Scientific Research Journal (IEASRJ)Noch keine Bewertungen

- English 10-1 Personal Response EssayDokument2 SeitenEnglish 10-1 Personal Response Essayapi-467840192Noch keine Bewertungen

- Adobeconstruct 19 NeubDokument34 SeitenAdobeconstruct 19 NeublailanuitNoch keine Bewertungen

- L-6th Sem (Eng Notes) Law Relating To Women and ChildDokument52 SeitenL-6th Sem (Eng Notes) Law Relating To Women and ChildCuriae corporate consultantsNoch keine Bewertungen

- Human Nutritional RequirementsDokument3 SeitenHuman Nutritional RequirementsAgnesMagadiaNoch keine Bewertungen

- Connection Manual: BNP-B2203D (ENG)Dokument122 SeitenConnection Manual: BNP-B2203D (ENG)Allison CarvalhoNoch keine Bewertungen

- Types of ProcurementDokument7 SeitenTypes of ProcurementrahulNoch keine Bewertungen

- Hello!: I Am Sir DeanDokument30 SeitenHello!: I Am Sir DeanDean MalaluanNoch keine Bewertungen

- Tibia Bone Segmentation in X-Ray Images - A Comparative AnalysisDokument8 SeitenTibia Bone Segmentation in X-Ray Images - A Comparative AnalysisSuzanaPetrovicNoch keine Bewertungen

- The Information Age CHAPTER 7 StsDokument7 SeitenThe Information Age CHAPTER 7 StsAngel FlordelizaNoch keine Bewertungen

- Electric Vehicle in IndonesiaDokument49 SeitenElectric Vehicle in IndonesiaGabriella Devina Tirta100% (1)

- Tutorials 2016Dokument54 SeitenTutorials 2016Mankush Jain100% (1)

- Jurnal Kasus Etikolegal Dalam Praktik KebidananDokument13 SeitenJurnal Kasus Etikolegal Dalam Praktik KebidananErni AnggieNoch keine Bewertungen

- Allowable Stresses of Typical ASME Materials - Stainless SteelDokument5 SeitenAllowable Stresses of Typical ASME Materials - Stainless SteelChanchal K SankaranNoch keine Bewertungen

- VEIKK A15PRO Instruction Manual 0714Dokument20 SeitenVEIKK A15PRO Instruction Manual 0714Corny777 UwUNoch keine Bewertungen

- Different Types of FermentationDokument26 SeitenDifferent Types of FermentationCats and DogNoch keine Bewertungen

- SOAP Progress NotesDokument11 SeitenSOAP Progress NotesShan SicatNoch keine Bewertungen

- I. External Analysis A. General Environment A. Economic DevelopmentsDokument17 SeitenI. External Analysis A. General Environment A. Economic DevelopmentsAndrea TaganginNoch keine Bewertungen

- JSA - Bolt TensioningDokument5 SeitenJSA - Bolt TensioningRaju KhalifaNoch keine Bewertungen

- Alcohol Consumption and Related Crime Incident in John Paul CollegeDokument17 SeitenAlcohol Consumption and Related Crime Incident in John Paul Collegejoy mesanaNoch keine Bewertungen

- LaserDokument12 SeitenLasercabe79Noch keine Bewertungen

- Heat Transfer Lab AssignmentDokument5 SeitenHeat Transfer Lab AssignmentChristyNoch keine Bewertungen