Beruflich Dokumente

Kultur Dokumente

Cag On Mumbai Airport PPP

Hochgeladen von

Manish Jaiswal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 Seitedf

Originaltitel

Cag on Mumbai Airport Ppp

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldendf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteCag On Mumbai Airport PPP

Hochgeladen von

Manish Jaiswaldf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Print This Page

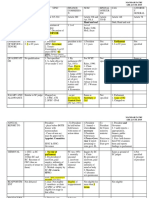

CAG pillories PPP model f or Mumbai airport

Comptroller and Auditor General (CAG) Friday pilloried the public-private partnership (PPP) model for the Mumbai airport,

saying risks had not been properly transferred to the private party as the project cost doubled and the funding gap was filled up

by passengers through development fee.

It also took the Civil Aviation Ministry to task for granting extensions to the project, which was delayed by four years, and not

penalising the private-led airport operator, Mumbai International Airport Limited (MIAL), for it.

"Examination in the audit indicated that risks had not been appropriately transferred to the concessionaire in the development

of the Chhatrapati Shivaji International Airport,

Mumbai," a report of the Comptroller and Auditor General, tabled in Parliament, said.

It said the project cost "more than doubled from Rs 5,826 crore to Rs 12,380 crore" but was restricted to Rs 11,647.46 crore till

March this year by the Airports Economic Regulatory Authority (AERA).

Though the project cost doubled, "the concessionaire did not appear to have faced financial vulnerability for the same, as the

funding gap was being largely absorbed by the passengers through levy of development fee (DF), though such levy was not in

the Operation, Management, Development Agreement (OMDA)," it said.

"No efforts were made to secure sources of financing for the project," it said. Observing that the project was delayed from 2010

to 2014 and there was "tardy progress" in mandatory capital projects, CAG said MIAL "had not been penalised" and the Civil

Aviation Ministry instead "approved extensions and agreed to reschedule the projects across different phases".

"As a result of the delay in project implementation, the terminal building is expected to be fully ready operationally, only by the

time the airport would have reached its design capacity," the official auditor said.

It also said the revenue share of state-run Airports Authority of India (AAI), which partners private infra firm GVK in MIAL, was

"set to decline with the outsourcing of activities as noticed in the case of domestic and international cargo activities and the

airport hotel project".

AAI received a gross revenue share from MIAL of over Rs 2,857 crore between 2006 and 2013. "The private partner, on other

hand, received gross revenues of Rs 4,526 crore during the same period on an investment of Rs 888 crore, without taking into

account other potential benefits that would accrue over time from commercial exploitation of land, CAG said.

Das könnte Ihnen auch gefallen

- Sukhoi For BengaluruDokument2 SeitenSukhoi For BengaluruManish JaiswalNoch keine Bewertungen

- Following Sanctions, Russia Turns To China For Defense and Aerospace Equipment - The DiplomatDokument1 SeiteFollowing Sanctions, Russia Turns To China For Defense and Aerospace Equipment - The DiplomatManish JaiswalNoch keine Bewertungen

- Coca ColaDokument116 SeitenCoca ColaBukhary Mohd0% (1)

- HAL To Study Feasibility of Setting Up Copter Unit at Goa - ParrikarDokument1 SeiteHAL To Study Feasibility of Setting Up Copter Unit at Goa - ParrikarManish JaiswalNoch keine Bewertungen

- COMAC Struggles To Juggle Between ARJ21 and C919Dokument1 SeiteCOMAC Struggles To Juggle Between ARJ21 and C919Manish JaiswalNoch keine Bewertungen

- Tata, Adani Among Firms in Fray For Four AirportsDokument1 SeiteTata, Adani Among Firms in Fray For Four AirportsManish JaiswalNoch keine Bewertungen

- FY - 2013-14 PipavavDokument120 SeitenFY - 2013-14 PipavavManish JaiswalNoch keine Bewertungen

- IGNOU Price CataleDokument36 SeitenIGNOU Price CataletuhionNoch keine Bewertungen

- DR Keshab Panda - LNT Tech ServicesDokument2 SeitenDR Keshab Panda - LNT Tech ServicesManish JaiswalNoch keine Bewertungen

- FIPB AgendaDokument3 SeitenFIPB AgendaManish JaiswalNoch keine Bewertungen

- Pipavav Financial ResultsDokument1 SeitePipavav Financial ResultsManish JaiswalNoch keine Bewertungen

- Boeing Setss Sights On Profit From Junked Jets - Business & Technology - The Seattle TimesDokument2 SeitenBoeing Setss Sights On Profit From Junked Jets - Business & Technology - The Seattle TimesManish JaiswalNoch keine Bewertungen

- Blogger - Broadsword - Post A CommentDokument4 SeitenBlogger - Broadsword - Post A CommentManish JaiswalNoch keine Bewertungen

- Defence Equipment Business Has Companies Interested Like Never Before - Print View - LivemintDokument3 SeitenDefence Equipment Business Has Companies Interested Like Never Before - Print View - LivemintManish JaiswalNoch keine Bewertungen

- Defence Minister To Start 8-10 Projects Each Year Under Make Policy - Secy DPDokument2 SeitenDefence Minister To Start 8-10 Projects Each Year Under Make Policy - Secy DPManish JaiswalNoch keine Bewertungen

- Airbus Confirms Bribery Probe of Defence UnitDokument1 SeiteAirbus Confirms Bribery Probe of Defence UnitManish JaiswalNoch keine Bewertungen

- HInudstan Cables Takeover by OFBDokument1 SeiteHInudstan Cables Takeover by OFBManish JaiswalNoch keine Bewertungen

- MAIT Appoints SR Vijay Shankar As Chairman of South ChapterDokument1 SeiteMAIT Appoints SR Vijay Shankar As Chairman of South ChapterManish JaiswalNoch keine Bewertungen

- Print - After Narendra Modi, Defence Ministry To Keep Media at Arm's LengthDokument2 SeitenPrint - After Narendra Modi, Defence Ministry To Keep Media at Arm's LengthManish JaiswalNoch keine Bewertungen

- Air India Opposes MOve To Abolish 5-20 RuleDokument1 SeiteAir India Opposes MOve To Abolish 5-20 RuleManish JaiswalNoch keine Bewertungen

- C130J and C17sdDokument1 SeiteC130J and C17sdManish JaiswalNoch keine Bewertungen

- US Biggest Arms Supplier To India in Last Three Years - Defence Ministry - The Economic TimesDokument1 SeiteUS Biggest Arms Supplier To India in Last Three Years - Defence Ministry - The Economic TimesManish JaiswalNoch keine Bewertungen

- INdustry Welcomes Avro Move of Defence MinistryDokument1 SeiteINdustry Welcomes Avro Move of Defence MinistryManish JaiswalNoch keine Bewertungen

- Rs 20000 Crore Defence Deal On The CardsDokument1 SeiteRs 20000 Crore Defence Deal On The CardsManish JaiswalNoch keine Bewertungen

- Boeing Setss Sights On Profit From Junked Jets - Business & Technology - The Seattle TimesDokument2 SeitenBoeing Setss Sights On Profit From Junked Jets - Business & Technology - The Seattle TimesManish JaiswalNoch keine Bewertungen

- Contractual Recruitment by Air India 'Violates' DGCA Norms - Business TodayDokument2 SeitenContractual Recruitment by Air India 'Violates' DGCA Norms - Business TodayManish JaiswalNoch keine Bewertungen

- C130J and C17sdDokument1 SeiteC130J and C17sdManish JaiswalNoch keine Bewertungen

- TAL-Requesting Custom Duty Waiver On Sukhoi PartsDokument2 SeitenTAL-Requesting Custom Duty Waiver On Sukhoi PartsManish JaiswalNoch keine Bewertungen

- Kamov To Create Ka-175asd Rotary UAV - IHS Jane's 360Dokument1 SeiteKamov To Create Ka-175asd Rotary UAV - IHS Jane's 360Manish JaiswalNoch keine Bewertungen

- Contractual Recruitment by Air India 'Violates' DGCA Norms - Business TodayDokument2 SeitenContractual Recruitment by Air India 'Violates' DGCA Norms - Business TodayManish JaiswalNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Telangana Economic Sector AR 2016-17 English Full ReportDokument88 SeitenTelangana Economic Sector AR 2016-17 English Full ReportSaakshi SarpotdarNoch keine Bewertungen

- Politics CLSA PDFDokument80 SeitenPolitics CLSA PDFAmit NadekarNoch keine Bewertungen

- Analysis of Public Administration Questions Paper 2000 2005 Vision IasDokument13 SeitenAnalysis of Public Administration Questions Paper 2000 2005 Vision IasFortune PubadNoch keine Bewertungen

- Sealed Cover Procedure - Supreme Court JudgmentDokument2 SeitenSealed Cover Procedure - Supreme Court JudgmentArun Kumar GuptaNoch keine Bewertungen

- Indian Admin Systems & ReformsDokument7 SeitenIndian Admin Systems & ReformsreadingthehinduNoch keine Bewertungen

- Handout 2.1.2 Audit of Govt. Comp. by CAGDokument6 SeitenHandout 2.1.2 Audit of Govt. Comp. by CAGNeel RahateNoch keine Bewertungen

- Coal Allocation ScamDokument6 SeitenCoal Allocation ScamAditiNoch keine Bewertungen

- Electoral Reforms in India Issues and ReformDokument15 SeitenElectoral Reforms in India Issues and ReformVipin YadavNoch keine Bewertungen

- Supreme Court urged to direct President on anti-corruption bills and CAG reportDokument18 SeitenSupreme Court urged to direct President on anti-corruption bills and CAG reportPuneet Upadhyay50% (2)

- Constitutional bodies oversightDokument3 SeitenConstitutional bodies oversightAkshayJhaNoch keine Bewertungen

- Civil Services Mentor June 2012 WWW - UpscportalDokument120 SeitenCivil Services Mentor June 2012 WWW - Upscportalsachi26Noch keine Bewertungen

- Public - Administration - Mains IGNOU BA MADokument19 SeitenPublic - Administration - Mains IGNOU BA MAjaytrips988150% (2)

- ODCPIOsDokument45 SeitenODCPIOsSdsambandamndam DamNoch keine Bewertungen

- A Tale of Two InquiriesDokument4 SeitenA Tale of Two InquiriesHarsha Vardhan Reddy AnnapareddyNoch keine Bewertungen

- CG-II Project On NJACDokument24 SeitenCG-II Project On NJACtanmayklNoch keine Bewertungen

- CAG's Duties and Powers ActDokument12 SeitenCAG's Duties and Powers Actsumit71sharmaNoch keine Bewertungen

- Constitutional BodiesDokument37 SeitenConstitutional BodiesNaga jyothiNoch keine Bewertungen

- 500 For RBI Grade and EPFO ExamsDokument72 Seiten500 For RBI Grade and EPFO ExamsmanideepNoch keine Bewertungen

- BM 75 Itemwise Agenda FinalDokument87 SeitenBM 75 Itemwise Agenda FinalMUNPL HRNoch keine Bewertungen

- The Evolution of FSSAIDokument43 SeitenThe Evolution of FSSAIMuthu GanesanNoch keine Bewertungen

- Laxmikant MCQs From CH 17 To 26 From Insight Test SeriesDokument24 SeitenLaxmikant MCQs From CH 17 To 26 From Insight Test SeriesVivek Singh100% (2)

- FulldayDokument191 SeitenFulldayPRASHANT KUMARNoch keine Bewertungen

- CAG Report - 25 of 2022 Vol. 1 (March, 2021)Dokument168 SeitenCAG Report - 25 of 2022 Vol. 1 (March, 2021)nidhidaveNoch keine Bewertungen

- UPSC, EC, CAG, and other key commissions comparedDokument5 SeitenUPSC, EC, CAG, and other key commissions comparedMonica ThakranNoch keine Bewertungen

- TO Indian Government Accounts and Audit: (Fifth Edition)Dokument347 SeitenTO Indian Government Accounts and Audit: (Fifth Edition)RananjaySinghNoch keine Bewertungen

- Polity 31Dokument31 SeitenPolity 31The SurgeonNoch keine Bewertungen

- 10 Subhra Ranjan PSIR Optional 2020 @UpscOptionalTestSeriesDokument20 Seiten10 Subhra Ranjan PSIR Optional 2020 @UpscOptionalTestSeriesRana RajNoch keine Bewertungen

- CA10Dokument5 SeitenCA10Abhishek ChaturvediNoch keine Bewertungen

- CAG Report 2012/2013 - TanzaniaDokument206 SeitenCAG Report 2012/2013 - TanzaniaMaria Sarungi-TsehaiNoch keine Bewertungen

- RBI Circular Import Goods ServicesDokument25 SeitenRBI Circular Import Goods Servicesgayanw1978Noch keine Bewertungen