Beruflich Dokumente

Kultur Dokumente

A Commercial Bank

Hochgeladen von

nurulbibm0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten12 SeitenBank

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBank

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten12 SeitenA Commercial Bank

Hochgeladen von

nurulbibmBank

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 12

A commercial bank is a type of bank that provides services such as accepting deposits, making

business loans, and offering basic investment products.

Commercial bank can also refer to a bank or a division of a bank that mostly deals with deposits

and loans from corporations or large businesses, as opposed to individual members of the public

Definition of 'Commercial Bank'

A financial institution that provides services, such as accepting deposits, giving business loans and

auto loans, mortgage lending, and basic investment products like savings accounts and certificates of

deposit. The traditional commercial bank is a brick and mortar institution with tellers, safe deposit

boxes, vaults and ATMs. However, some commercial banks do not have any physical branches and

reuire consumers to complete all transactions by phone or !nternet. !n exchange, they generally pay

higher interest rates on investments and deposits, and charge lower fees.

15 main Functions of Commercial Banks

Nupur Singh

The commercial banks serve as the king pin of the financial system of the country. They render

many valuable services. The important functions of the Commercial banks can be explained with

the help of the following chart.

Primary Functions

The primary functions of the commercial banks include the following"

A. Acceptance of Deposits

1. Time Deposits:

These are deposits repayable after a certain fixed period. These deposits are not withdrawn able

by cheue, draft or by other means. !t includes the following.

(a) Fixed Deposits:

The deposits can be withdrawn only after expiry of certain period say # years, $ years or %&

years. The banker allows a higher rate of interest depending upon the amount and period of time.

'reviously the rates of interest payable on fixed deposits were determined by (eserve )ank.

'resently banks are permitted to offer interest as determined by each bank. However, banks are

not permitted to offer different interest rates to different customers for deposits of same maturity

period, except in the case of deposits of (s. %$ lakhs and above.

These days the banks accept deposits even for %$ days or one month etc. !n times of urgent need

for money, the bank allows premature closure of fixed deposits by paying interest at reduced

rate. *epositors can also avail of loans against +ixed *eposits. The +ixed *eposit (eceipt cannot

be transferred to other persons.

(b) ecurrin! Deposits:

!n recurring deposit, the customer opens an account and deposit a certain sum of money every

month. After a certain period, say % year or # years or $ years, the accumulated amount along

with interest is paid to the customer. !t is very helpful to the middle and poor sections of the

people. The interest paid on such deposits is generally on cumulative basis. This deposit system

is a useful mechanism for regular savers of money.

(c) Cas" Certificates:

Cash certificates are issued to the public for a longer period of time. !t attracts the people because

its maturity value is in multiples of the sum invested. !t is an attractive and high yielding

investment for those who can keep the funds for a long time.

!t is a very useful account for meeting future financial reuirements at the occasion of marriage,

education of children etc. Cash certificates are generally issued at discount to face value. !t

means a cash certificate of (s. %, &&,&&& payable after %& years can be purchased now, say for

(s. ,&,&&&.

#. Demand Deposits:

These are the deposits which may be withdrawn by the depositor at any time without previous

notice. !t is withdraw able by cheue-draft. !t includes the following"

(a) $a%in!s Deposits:

The savings deposit promotes thrift among people. The savings deposits can only be held by

individuals and non.profit institutions. The rate of interest paid on savings deposits is lower than

that of time deposits. The savings account holder gets the advantage of liuidity /as in current

a-c0 and small income in the form of interests.

)ut there are some restrictions on withdrawals. Corporate bodies and business firms are not

allowed to open 1) Accounts. 'resently interest on 1) Accounts is determined by ()!. !t is 2.$

per cent per annum. Co.operative banks are allowed to pay an extra &.$ per cent on its savings

bank deposits.

(b) Current Account Deposits:

These accounts are maintained by the people who need to have a liuid balance. Current account

offers high liuidity. 3o interest is paid on current deposits and there are no restrictions on

withdrawals from the current account.

These accounts are generally in the case of business firms, institutions and co.operative bodies.

3owadays, banks are designing and offering various investment schemes for deposit of money.

These schemes vary from bank to bank.

!t may be stated that the banks are currently working out with different innovative schemes for

deposits. 1uch deposit accounts offer better interest rate and at the same time withdraw able

facility also. These schemes are mostly offered by foreign banks. !n 41A, Current Accounts are

known as 5Checking Accounts5 as a cheue is euivalent to check in America.

B. Ad%ancin! of &oans

The commercial banks provide loans and advances in various forms. They are given below"

1. '%erdraft:

This facility is given to holders of current accounts only. This is an arrangement with the bankers

thereby the customer is allowed to draw money over and above the balance in his-her account.

This facility of overdrawing his account is generally pre.arranged with the bank up to a certain

limit.

!t is a short.term temporary fund facility from bank and the bank will charge interest over the

amount overdrawn. This facility is generally available to business firms and companies.

#. Cas" Credit:

Cash credit is a form of working capital credit given to the business firms. 4nder this

arrangement, the customer opens an account and the sanctioned amount is credited with that

account. The customer can operate that account within the sanctioned limit as and when reuired.

!t is made against security of goods, personal security etc. 6n the basis of operation, the period

of credit facility may be extended further. 6ne advantage under this method is that bank charges

interest only on the amount utili7ed and not on total amount sanctioned or credited to the

account.

(eserve )ank discourages this type of facility to business firms as it imposes an uncertainty on

money supply. Hence this method of lending is slowly phased out from banks and replaced by

loan accounts. Cash credit system is not in use in developed countries.

(. Discountin! of Bills:

*iscounting of )ills may be another form of bank credit. The bank may purchase inland and

foreign bills before these are due for payment by the drawer debtors, at discounted values, i.e.,

values a little lower than the face values.

The )anker5s discount is generally the interest on the full amount for the unexpired period of the

bill. The banks reserve the right of debiting the accounts of the customers in case the bills are

ultimately not paid, i.e., dishonored.

The bill passes to the )anker after endorsement. *iscounting of bills by banks provide

immediate finance to sellers of goods. This helps them to carry on their business. )anks can

discount only genuine commercial bills i.e., those drawn against sale of goods on Credit. )anks

will not discount Accommodation )ills.

). &oans and Ad%ances:

!t includes both demand and term loans, direct loans and advances given to all type of customers

mainly to businessmen and investors against personal security or goods of movable or

immovable in nature. The loan amount is paid in cash or by credit to customer account which the

customer can draw at any time.

The interest is charged for the full amount whether he withdraws the money from his account or

not. 1hort.term loans are granted to meet the working capital reuirements where as long.term

loans are granted to meet capital expenditure.

'reviously interest on loan was also regulated by ()!. Currently, banks can determine the rate

themselves. 8ach bank is, however reuired to fix a minimum rate known as 'rime 9ending (ate

/'9(0.

Classification of &oans and Ad%ances

9oans and advances given by bankers can be classified broadly into the following categories"

/i0 Advances which are given on the personal security of the debtor, and for which no tangible or

collateral security is taken: this type of advance is given either when the amount of the advance

is very small, or when the borrower is known to the )anker and the )anker has complete

confidence in him /Clean Advance0.

(ii) Advances which are covered by tangible or collateral security. !n this section of the study we

are concerned with this type of advance and with different types of securities which a )anker

may accept for such advances /1ecured Advance0.

(iii) Advances which are given against the personal security of the debtor but for which the

)anker also holds in addition the guarantee of one or more sureties. This type of advance is often

given by )anker to persons who are not known to them but whose surety is known to the )anker.

)ankers also often take the personal guarantee of the *irectors of a company to whom they agree

to advance a clean or unsecured loan.

/iv0 9oans are also given against the security of +ixed *eposit receipts.

*. +ousin! Finance:

3owadays the commercial banks are competing among themselves in providing housing finance

facilities to their customers. !t is mainly to increase the housing facilities in the country. 1tate

)ank of !ndia, !ndian )ank, Canara )ank, 'un;ab 3ational )ank, has formed housing

subsidiaries to provide housing finance.

The other banks are also providing housing finances to the public. <overnment of !ndia also

encourages banks to provide adeuate housing finance.

)orrowers of housing finance get tax exemption benefits on interest paid. +urther housing

finance up to (s. $ lakh is treated as priority sector advances for banks. The limit has been raised

to (s. %& lakhs per borrower in cities.

,. -ducational &oan $c"eme:

The (eserve )ank of !ndia, from August, %=== introduced a new 8ducational 9oan 1cheme for

students of full time graduate-post.graduate professional courses in private professional colleges.

4nder the scheme all public sector banks have been directed to provide educational loan up to

(s. %$,&&& for free seat and (s. $&,&&& for payment seat student at interest not more than %, per

cent per annum. This loan is on clean basis i.e., without calling for security.

This loan is available only for students whose annual family income does not exceed (s. %,

&&,&&&. The loan has to be repaid together with interest within five years from the date of

completion of the course. 1tudies in respect of the following sub;ects-areas are covered under the

scheme.

(a) Medical and dental course.

(b) 8ngineering course.

(c) Chemical Technology.

(d) Management courses like M)A.

(e) 9aw studies.

/f0 Computer 1cience and Applications.

This apart, some of the banks have other educational loan schemes against security etc., one can

check up the details with the banks.

.. &oans a!ainst $"ares/$ecurities:

Commercial banks provide loans against the security of shares-debentures of reputed companies.

9oans are usually given only up to $&> value /Market ?alue0 of the shares sub;ect to a

maximum amount permissible as per ()! directives. 'resently one can obtain a loan up to (s.%&

lakhs against the physical shares and up to (s. ,& lakhs against demateriali7ed shares.

0. &oans a!ainst $a%in!s Certificates:

)anks are also providing loans up to certain value of savings certificates like 3ational 1avings

Certificate, +ixed *eposit (eceipt, !ndira ?ikas 'atra, etc. The loan may be obtained for personal

or business purposes.

1. Consumer &oans and Ad%ances:

6ne of the important areas for bank financing in recent years is towards purchase of consumer

durables like T? sets, @ashing Machines, Micro 6ven, etc. )anks also provide liberal Car

finance.

These days banks are competing with one another to lend money for these purposes as default of

payment is not high in these areas as the borrowers are usually salaried persons having regular

incomeA +urther, bank5s interest rate is also higher. Hence, banks improve their profit through

such profitable loans.

12. $ecuriti3ation of &oans:

)anks are recently trying to securities a part of their part of loan portfolio and sell it to another

investor. 4nder this method, banks will convert their business loans into a security or a document

and sell it to some !nvestment or +und Manager for cash to enhance their liuidity position.

!t is a process of transferring credit risk from the banker to the buyer of securiti7ed loans. !t

involves a cost to the banker but it helps the bank to ensure proper recovery of loan. Accordingly,

securiti7ation is the process of changing an illiuid asset into a liuid asset.

11. 't"ers:

Commercial banks provide other types of advances such as venture capital advances, ;ewel

loans, etc.

%. 8ffective 6ctober %B, %==2 banks were free to determine their own prime lending rates /'9(s0

for credit limit over (s. , lakh. *ata relate to public sector banks.

,. The stipulation of minimum maturity period of term deposits was reduced from #& days to %$

days, effective April ,=, %==B. *ata relate to public sector banks.

#. The change in the )ank (ate was made effective from the close of business of respective dates

of change except April ,=, %==B.

2. 8ffective April ,=, %==B.

C. Credit Creation

Credit creation is one of the primary functions of commercial banks. @hen a bank sanctions a

loan to the customer, it does not give cash to him. )ut, a deposit account is opened in his name

and the amount is credited to his account. He can withdraw the money whenever he needs.

Thus, whenever a bank sanctions a loan it creates a deposit. !n this way the bank increases the

money supply of the economy. 1uch functions are known as credit creation.

$econdary Functions

The secondary functions of the banks consist of agency functions and general utility functions.

A. A!ency Functions

Agency functions include the following"

4i5 Collection of c"e6ues7 di%idends7 and interests:

As an agent the bank collects cheues, drafts, promissory notes, interest, dividends etc., on

behalf of its customers and credit the amounts to their accounts.

Customers may furnish their bank details to corporate where investment is made in shares,

debentures, etc. As and when dividend, interest, is due, the companies directly send the

warrants-cheues to the bank for credit to customer account.

(ii) Payment of rent7 insurance premiums:

The bank makes the payments such as rent, insurance premiums, subscriptions, on standing

instructions until further notice. Till the order is revoked, the bank will continue to make such

payments regularly by debiting the customer5s account.

(iii) Dealin! in forei!n exc"an!e:

As an agent the commercial banks purchase and sell foreign exchange as well for customers as

per ()! 8xchange Control (egulations.

(iv) Purc"ase and sale of securities:

Commercial banks undertake the purchase and sale of different securities such as shares,

debentures, bonds etc., on behalf of their customers. They run a separate 5'ortfolio Management

1cheme5 for their big customers.

(v) Act as trustee7 executor7 attorney7 etc:

The banks act as executors of @ill, trustees and attorneys. !t is safe to appoint a bank as a trustee

than to appoint an individual. Acting as attorneys of their customers, they receive payments and

sign transfer deeds of the properties of their customers.

(vi) Act as correspondent:

The commercial banks act as a correspondent of their customers. 1mall banks even get travel

tickets, book vehicles: receive letters etc. on behalf of the customers.

(vii) Preparations of 8ncome9Tax returns:

They prepare income.tax returns and provide advices on tax matters for their customers. +or this

purpose, they employ tax experts and make their services, available to their customers.

B. :eneral ;tility $er%ices

The <eneral utility services include the following"

(i) $afety &ocker facility:

1afekeeping of important documents, valuables like ;ewels are one of the oldest services

provided by commercial banks. 59ockers5 are small receptacles which are fitted in steel racks and

kept inside strong rooms known as vaults. These lockers are available on half.yearly or annual

rental basis.

The bank merely provides lockers and the key but the valuables are always under the control of

its users. Any customer cannot have access to vault.

6nly customers of safety lockers after entering into a register his name account number and time

can enter into the vault. )ecause the vault is holding important valuables of customers in lockers,

it is also known as 51trong (oom5.

(ii) Payment <ec"anism or <oney Transfer:

Transfer of funds is one of the important functions performed by commercial banks. Cheues

and credit cards are two important payment mechanisms through banks. *espite an increase in

financial transactions, banks are managing the transfer of funds process very efficiently.

Cheues are also cleared through the banking system. Correspondent banking is another method

of transferring funds over long distance, usually from one country to another. )anks, these days

employ computers to speed up money transfer and to reduce cost of transferring funds.

8lectronic Transfer of funds is also known as 5Cheueless banking5 where funds are transferred

through computers and sophisticated electronic system by using code words. They offer Mail

Transfer, Telegraphic Transfer /TT0 facility also.

4iii5 Tra%elers' c"e6ues:

Travelers Cheues are used by domestic travelers as well as by international travelers. However

the use of traveler5s cheues is more common by international travelers because of their safety

and convenience. These can be also termed as a modified form of traveler5s letter of credit.

A bank issuing travelers cheues usually have banking arrangement with many of the foreign

banks abroad, known as correspondent banks. The purchaser of traveler5s cheues can encase the

cheues from all the overseas banks with whom the issuing bank has such an arrangement.

Thus traveler5s cheues are not drawn on specific bank abroad. The cheues are issued in foreign

currency and in convenient denominations of ten, twenty, fifty, one hundred dollar, etc. The

signature of the buyer-traveler is written on the face of the cheues at the time of their purchase.

The cheues also provide blank space for the signature of the traveler to be signed at the time of

encashment of each cheue. A traveler has to sign in the blank space at the time of drawing

money and in the presence of the paying banker.

The paying banker will pay the money only when the signature of the traveler tallies with the

signature already available on the cheue.

A traveler should never sign the cheue except in the presence of paying banker and only when

the traveler desires to encash the cheue. 6therwise it may be misused. The cheues are also

accepted by hotels, restaurants, shops, airlines companies for respectable persons.

8ncashment of a traveler cheue abroad is tantamount to a foreign exchange transaction as it

involves conversion of domestic currency into a foreign currency.

@hen a traveller cheue is lost or stolen, the buyer of the cheues has to give a notice to the

issuing bank so that stop order can be issued against such lost-stolen cheues to the banks where

they are permitted to be encased.

!t is also difficult to the finder of the cheue to draw cash against it since the encasher has to sign

the cheue in the presence of the paying banker. 4nused travellers cheues can be surrendered to

the issuing bank and balance of cash obtained.

The issuing bank levies certain commission depending upon the number and value of travellers

cheues issued.

(iv) Circular =otes or Circular &etters of Credit:

4nder Circular 9etters of Credit, the customer-traveller negotiates the drafts with any of the

various branches to which they are addressed. Thus the traveller can obtain funds from many of

the branches of banks instead only from a particular branch. Circular 9etters of Credit are

therefore a more useful method for obtaining funds while travelling to many countries.

!t may be noted that travellers letter of credit are usually paid for in advance. !n other words, the

traveller first makes payments to the issuing bank before obtaining the Circular 3otes.

(v) 8ssue >Tra%ellers C"e6ues>:

)anks issue travellers cheues to help carry money safely while travelling within !ndia or

abroad. Thus, the customers can travel without fear, theft or loss of money.

(vi) &etters of Credit:

9etter of Credit is a payment document provided by the buyer5s banker in favour of seller. This

document guarantees payment to the seller upon production of document mentioned in the 9etter

of Credit evidencing dispatch of goods to the buyer.

The 9etter of Credit is an assurance of payment upon fulfilling conditions mentioned in the

9etter of Credit. The letter of credit is an important method of payment in international trade.

There are primarily 2 parties to a letter of credit.

The buyer or importer, the bank which issues the letter of credit, known as opening bank, the

person in whose favour the letter of credit is issued or opened /The seller or exporter, known as

5)eneficiary of 9etter of Credit50, and the credit receiving-advising bank.

The 9etter of Credit is generally advised-sent through the seller5s bank, known as 3egotiating or

Advising bank. This is done because the conditions mentioned in the 9etter of Credit are, in the

first instance: have to be verified by the 3egotiating )ank. !t is mostly used in international

trade.

(vii) Actin! as eferees:

The banks act as referees and supply information about the business transactions and financial

standing of their customers on enuiries made by third parties. This is done on the acceptance of

the customers and help to increase the business activity in general.

(viii) Pro%ides Trade 8nformation:

The commercial banks collect information on business and financial conditions etc., and make it

available to their customers to help plan their strategy. Trade information service is very useful

for those customers going for cross.border business. !t will help traders to know the exact

business conditions, payment rules and buyers5 financial status in other countries.

(ix) AT< facilities:

The banks today have ATM facilities. 4nder this system the customers can withdraw their money

easily and uickly and ,2 hours a day. This is also known as 5Any Time Money5. Customers

under this system can withdraw funds i.e., currency notes with a help of certain magnetic card

issued by the bank and similarly deposit cash-cheue for credit to account.

(x) Credit cards:

)anks have introduced credit card system. Credit cards enable a customer to purchase goods and

services from certain specified retail and service establishments up to a limit without making

immediate payment. !n other words, purchases can be made on credit basis on the strength of the

credit card.

The establishments like Hotels, 1hops, Airline Companies, (ailways etc., which sell the goods or

services on credit forward a monthly or fortnightly statements to the bank.

The amount is paid to these establishments by the bank. The bank subseuently collects the dues

from the customers by debit to their accounts. 4sually, the bank receives certain service charges

for every credit card issued. ?isa Card, )6) card are some examples of credit cards.

(xi) :ift C"e6ues:

The commercial banks offer <ift cheue facilities to the general public. These cheues received

a wider acceptance in !ndia. 4nder this system by paying euivalent amount one can buy gift

cheue for presentation on occasions like @edding, )irthday.

(xii) Acceptin! Bills:

6n behalf of their customers, the banks accept bills drawn by third parties on its customers. This

resembles the letter of credit. @hile banks accept bills, they provide a better security for payment

to seller of goods or drawer of bills.

(xiii) <erc"ant Bankin!:

The commercial banks provide valuable services through their merchant banking divisions or

through their subsidiaries to the traders. This is the function of underwriting of securities. They

underwrite a portion of the 'ublic issue of shares, *ebentures and )onds of Coint 1tock

Companies.

1uch underwriting ensures the expected minimum subscription and also convey to the investing

public about the uality of the company issuing the securities. Currently, this type of services can

be provided only by separate subsidiaries, known as Merchant )ankers as per 18)! regulations.

(xiv) Ad%ice on Financial <atters:

The commercial banks also give advice to their customers on financial matters particularly on

investment decisions such as expansion, diversification, new ventures, rising of funds etc.

(xv) Factorin! $er%ice:

Today the commercial banks provide factoring service to their customers. !t is very much helpful

in the development of trade and industry as immediate cash flow and administration of debtors5

accounts are taken care of by factors. This service is again provided only by a separate subsidiary

as per ()! regulations.

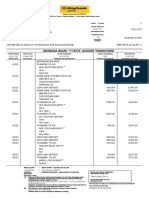

)alance sheet is a statement of assets and liabilities on a given date. !n !ndia, banks have to

publish their balance sheets according to the preformed i.e., 5+orm A5 given in the !!! schedule of

the )anking (egulation Act, %=2=. The study of the balance sheet along with its profit and loss

account reveals its financial soundness.

A customer has to carefully study these statements to choose his banks. The combined balance

sheet of all banks in the country reveals certain economic trends. A specimen of a )ank5s )alance

1heet is given at the end of this chapter.

%. Accepting deposits

,. <iving loans

#. 6verdraft

2. *iscounting of )ills of 8xchange

$. !nvestment of +unds

D. Agency +unctions

E. Miscellaneous +unctions

Das könnte Ihnen auch gefallen

- CV Shama 15 July 2012Dokument3 SeitenCV Shama 15 July 2012nurulbibmNoch keine Bewertungen

- Allu Arjun Biography FactsDokument3 SeitenAllu Arjun Biography FactsnurulbibmNoch keine Bewertungen

- Impulse CVDokument3 SeitenImpulse CVnurulbibmNoch keine Bewertungen

- Windows Serial KeyDokument2 SeitenWindows Serial KeynurulbibmNoch keine Bewertungen

- Arif CVDokument2 SeitenArif CVnurulbibmNoch keine Bewertungen

- Books ListDokument4 SeitenBooks ListnurulbibmNoch keine Bewertungen

- Impulse CVDokument3 SeitenImpulse CVnurulbibmNoch keine Bewertungen

- Bangladesh Commerce Bank Limited: Trade Division, Head Office, DhakaDokument5 SeitenBangladesh Commerce Bank Limited: Trade Division, Head Office, DhakanurulbibmNoch keine Bewertungen

- Bangladesh Commerce Bank Ltd. (BCBL) : Disclosure On Risk Based Capital (Basel II)Dokument7 SeitenBangladesh Commerce Bank Ltd. (BCBL) : Disclosure On Risk Based Capital (Basel II)nurulbibmNoch keine Bewertungen

- 19.padma Oil JuneDokument1 Seite19.padma Oil JunenurulbibmNoch keine Bewertungen

- AVON Inc.: Supernumerary Professor Associate ProfessorDokument1 SeiteAVON Inc.: Supernumerary Professor Associate ProfessornurulbibmNoch keine Bewertungen

- Bangladesh Commerce Bank Limited: Notice For Inviting TenderDokument1 SeiteBangladesh Commerce Bank Limited: Notice For Inviting TendernurulbibmNoch keine Bewertungen

- International Banking: Department of MBLDokument7 SeitenInternational Banking: Department of MBLnurulbibmNoch keine Bewertungen

- ImportDokument19 SeitenImportnurulbibmNoch keine Bewertungen

- Chapter - 01 Introductory Aspects: 1.1 Introduction of TopicDokument8 SeitenChapter - 01 Introductory Aspects: 1.1 Introduction of TopicnurulbibmNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Sagar SbiDokument75 SeitenSagar SbiSagar ChauhanNoch keine Bewertungen

- Commerce N Accts II (BLM) 21-22 (EM)Dokument44 SeitenCommerce N Accts II (BLM) 21-22 (EM)Anu BantyNoch keine Bewertungen

- Capstone Project: On Daily Cash Flow ManagementDokument11 SeitenCapstone Project: On Daily Cash Flow Managementloneheart007Noch keine Bewertungen

- Petition For Writ of Praecipe Against JudgeDokument12 SeitenPetition For Writ of Praecipe Against Judgetexrees100% (3)

- G.R. No. 50373. February 15, 1990. Manila Lighter Transportation, Inc., Petitioner, vs. Court OF Appeals AND China Banking CORPORATION, RespondentsDokument6 SeitenG.R. No. 50373. February 15, 1990. Manila Lighter Transportation, Inc., Petitioner, vs. Court OF Appeals AND China Banking CORPORATION, RespondentsJoannah SalamatNoch keine Bewertungen

- Internship Report On Foreign Remittance Activities of Janata Bank LimitedDokument46 SeitenInternship Report On Foreign Remittance Activities of Janata Bank LimitedTanvir SharifeeNoch keine Bewertungen

- Social Science Pre-Board Question Paper 2020-21Dokument9 SeitenSocial Science Pre-Board Question Paper 2020-21free fireNoch keine Bewertungen

- Bankers Notice of Accept PrestmDokument13 SeitenBankers Notice of Accept Prestmapi-374440888% (34)

- CMA Data in ExcelDokument7 SeitenCMA Data in ExcelVaishali MkNoch keine Bewertungen

- Creation of CreditDokument9 SeitenCreation of CreditRashmi Ranjan PanigrahiNoch keine Bewertungen

- MBBcurrent 564548147990 2022-12-31 PDFDokument10 SeitenMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNoch keine Bewertungen

- Cashand Cash Equivalents101Dokument38 SeitenCashand Cash Equivalents101Wynphap podiotanNoch keine Bewertungen

- GDS To MTS - SAPOST PDFDokument40 SeitenGDS To MTS - SAPOST PDFnani Kvpli100% (2)

- Banking - Alexander DyDokument240 SeitenBanking - Alexander DytynajoydelossantosNoch keine Bewertungen

- Money Minders Forge Your Future 2Dokument36 SeitenMoney Minders Forge Your Future 2api-576244922Noch keine Bewertungen

- UCSP Unit 12 Non State InstitutionsDokument53 SeitenUCSP Unit 12 Non State InstitutionsChaos blackNoch keine Bewertungen

- Balance Sheet..Dokument8 SeitenBalance Sheet..Sehar AsgharNoch keine Bewertungen

- Bank Secrecy Law (R.a. No. 1405)Dokument1 SeiteBank Secrecy Law (R.a. No. 1405)jancelmido1Noch keine Bewertungen

- ABHADokument30 SeitenABHANehal DarvadeNoch keine Bewertungen

- A Research Project Report: A Preference of Small Investors Towards Various InvestmentDokument87 SeitenA Research Project Report: A Preference of Small Investors Towards Various InvestmentMaster PrintersNoch keine Bewertungen

- Help Log Out: Memo: 112509FROM CHECKING 1306865902 Memo: WithdrawalDokument4 SeitenHelp Log Out: Memo: 112509FROM CHECKING 1306865902 Memo: Withdrawalsanond111Noch keine Bewertungen

- Organisation Structure of Axis BankDokument48 SeitenOrganisation Structure of Axis BankManmeet Matharu50% (6)

- Blueprint of Banking SectorDokument33 SeitenBlueprint of Banking SectorShrish Agrawal89% (9)

- Quaid-I-Azam University: (M.Phil/MS Programme Spring-2018)Dokument5 SeitenQuaid-I-Azam University: (M.Phil/MS Programme Spring-2018)yasirsshah261Noch keine Bewertungen

- How To Open An Account BDO Unibank, IncDokument1 SeiteHow To Open An Account BDO Unibank, IncKimay ArostiqueNoch keine Bewertungen

- Banking Law NitiDokument19 SeitenBanking Law NitiLekha AjgalleyNoch keine Bewertungen

- Role of Commercial Bank in The Economic Development of INDIADokument5 SeitenRole of Commercial Bank in The Economic Development of INDIAVaibhavRanjankar0% (1)

- 2022course Syllabus For Commercial Law ReviewDokument16 Seiten2022course Syllabus For Commercial Law Reviewfaye wongNoch keine Bewertungen

- Banking Laws SummaryDokument13 SeitenBanking Laws SummaryTwentyNoch keine Bewertungen

- Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred OnlyDokument1 SeiteTotal Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Onlysaurabhdabas7Noch keine Bewertungen