Beruflich Dokumente

Kultur Dokumente

Dynamics and Distributions of Logistics - Supply Chain Management

Hochgeladen von

sirfanalizaidiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dynamics and Distributions of Logistics - Supply Chain Management

Hochgeladen von

sirfanalizaidiCopyright:

Verfügbare Formate

1

2

AGENDA

Incoterms 2010

Foreign Exchange

Payment Methods

Letters of Credit at Financing Tools

Medium-Term Financing for Foreign Buyers

Export Credit Insurance

Examples and War Stories

Q & A

3

Pricing/Shipping Terms

Known as Incoterms 2010

Published by:

ICC Publishing Corporation

156 Fifth Avenue

New York, New York 10010

(212) 206-1150

Website: http://www.iccwbo.org

A set of international rules, initially formulated in 1936 by

the International Chamber of Commerce (ICC) to define

& interpret a standard set of pricing/shipping terms for

international trade.

Know the Rules

4

Incoterms 2010

Rules for Any Mode or Modes of Transport

EXW = Ex Works

FCA = Free Carrier

CPT = Carriage Paid To

CIP = Carriage & Insurance Paid To

DAT = Delivered At Terminal

DAP = Delivered At Place

DDP = Delivered Duty Paid

Rules for Sea and Inland Waterway Transport

FAS = Free Alongside Ship

FOB = Free On Board

CFR = Cost & Freight

CIF = Cost, Insurance & Freight

5

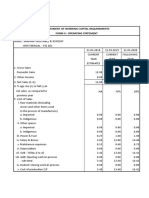

Inco term

2010

Export-

Customs

declaration

Carriage to

port of

export

Unloading

of truck in

port of

export

Loading

charges in

port of

export

Carriage

(Sea

Freight/Air

Freight) to

port of

import

Unloading

charges in

port of

import

Loading on

truck in

port of

import

Carriage to

place of

destination

Insurance

Import

customs

clearance

Import

taxes

EXW Buyer Buyer Buyer Buyer Buyer Buyer Buyer Buyer Buyer Buyer

FCA Seller Buyer Buyer Buyer Buyer Buyer Buyer Buyer Buyer Buyer

FAS Seller Seller Seller Buyer Buyer Buyer Buyer Buyer Buyer Buyer

FOB Seller Seller Seller Seller Buyer Buyer Buyer Buyer Buyer Buyer

CFR Seller Seller Seller Seller Seller Seller Buyer Buyer Buyer Buyer

CIF Seller Seller Seller Seller Seller Seller Buyer Buyer Seller Buyer Buyer

CPT Seller Seller Seller Seller Seller Seller Seller Seller Buyer Buyer

CIP Seller Seller Seller Seller Seller Seller Seller Seller Seller Buyer Buyer

DAT Seller Seller Seller Seller Seller Seller Seller Seller Buyer Buyer

DAP Seller Seller Seller Seller Seller Seller Seller Seller Buyer Buyer

DDP Seller Seller Seller Seller Seller Seller Seller Seller Seller Seller

Allocations of costs buyer/seller according to

Inco terms 2010

2

6

Foreign Exchange

There is foreign exchange risk to someone in every

international transaction even those payable in U.S.

dollars

Four Basic Risks

- Fluctuation risk

- Transaction risk cash flow risk

- Economic risk operating risk vs. competitors

- Translation risk accounting risk

You must quantify and manage this risk

Banks have tools and expertise to help you mitigate

these risks

7

Foreign Exchange

Common Uses of Foreign Exchange

Transactions used to make or receive

payments in another currency

Precautionary hedges to protect against

unexpected changes in exchange rates

Speculative positions to profit from

expected changes in exchange rates

Foreign investments to buy and sell

foreign assets

8

There is a mismatch between

Buyer and Seller Goals

When do YOU want to get paid?

When do Buyers want to pay?

Now!

Later!

PAYMENT METHODS

9

Payment Methods: 4 Methods

Buyer (Importer) Perspective

Open Account

Documentary Collection

Letter of Credit

Cash In Advance

Seller (Exporter) Perspective

Cash In Advance

Letter of Credit

Documentary Collection

Open Account

Buyer & Seller have Reversed Priorities!

Lowest

Risk

Highest

Risk

Best

Cash

Flow

Worst

Cash

Flow

3

10

Choice of Methods

(What Determines?)

Buyer-Seller Relationship

Buyers credit standing

Competition

Uniqueness of the product (custom made?)

Country conditions (political, economic)

Cash flow considerations

Transaction costs

Other

11

Payment Methods: 4 Methods

Cash in Advance

Documentary Collection

Terms

Favor

Seller

Terms

Favor

Buyer

Letter of Credit

Open Account

12

Risk Evaluation and Mitigation

High Risk Cash-in-Advance or Confirmed LC

Moderate Risk Advised or Confirmed LC

Low Risk Documentary Collection (at sight)

Very Low Risk: Documentary Collection (Time) or, Open

Account (possibly with Credit Insurance)

Lowest Risk Open Account on extended terms

Make Decisions to Mitigate the Risks

Consider ALL risks, not just credit risks

13

Cash In Advance

Buyer Pays

Wire Transfer

Check

Draft

Credit Card

Seller Ships

No risk for seller except order cancellation

Foreign Import Regulations may prohibit

Hard sell to buyer

Consider the type of payment (Wire Transfer Best)

Requires little to no credit understanding of the buyer

4

14

Open Account

Seller Ships

Buyer Pays

Wire Transfer

Check

Draft

Credit Card

Ship it and hope you get paid

Foreign import regulations may prohibit

Full Country & Buyer Credit Risk

Consider payment type (wire transfer best)

Requires extensive knowledge of the buyer

(underwriting, trade references, excellent reputation)

15

Letters of Credit

A versatile tool for closing the gap

that exists between buyers and

sellers.

16

Letters of Credit

Definition:

- An undertaking issued by a bank for the account of the

applicant (buyer) to pay to the beneficiary (seller) the

value of the letter of credit, provided that the terms and

conditions evidenced by documents presented, are

complied with

In other words:

- A letter of credit substitutes a banks creditworthiness,

which is generally well known or easily ascertainable for

that of its customer, which may not be as well known

17

Letters of Credit

Two Common Types

Documentary / Commercial

Active payment instrument

Active financing tool

Standby

Passive payment instrument

Passive financing tool

Performance

Financial

Trade-Related

5

18

Independence Principle

Importer (Buyer)

Buyer has an

obligation to the

Issuing Bank to pay

upon claim for

payment

Issuing Bank has the obligation to the Exporter

to pay if he has complied with all the terms and

conditions in the L/C

Exporter and Importer

have a sales contract

between them which

supports the

underlying transaction

Issuing Bank Exporter (Seller)

Separate

Contracts

Advising/

Confirming bank

19

Sales Contract

(Issuing Bank) (Advising Bank)

Sight LC Transaction Flow

Buyer (Applicant)

Seller (Beneficiary)

22

Application

Foreign BANK PNC Bank

44

LC Advised

33

LC Issued

11

Importer

(Buyer)

Issuing

Bank

Exporter

(Seller)

Advising/

Confirming bank

20

Shipment

Documents

Payment Claim

Buyer pays

BEFORE receipt

of goods

Sight LC Transaction Flow

5

$

Buyer

Seller

(Applicant)

Foreign BANK PNC Bank

8

7

$

8

6 $ 8

21

Time LC Transaction Flow

Shipment

Payment Documents

Payment

At

Maturity

5

$

Buyer

Seller

(Applicant)

Foreign BANK PNC Bank

8

$

8

6 $ 8 Documents

6 Documents

Acceptance

7

6

6

Advised Letters of Credit

Beneficiary:

Bears credit risk of the issuing bank

Bears full country risk of the transaction

Responsible for ensuring compliance with Pro Forma

Advising Bank:

Responsibility limited to authentication

Has no payment obligation

Advocate for beneficiary

23

Role of the Advising Bank

Verify the authenticity of the Letter of Credit, thereby

protecting the beneficiary from fraud

Advocate for the beneficiary

No conflict of interest

Other benefits of using your bank

Commitment to Customer Service

Relationship Pricing

Consistency in Processing

If you want more protection the next step is to consider

having the letter of credit confirmed

Confirmed Letters of Credit

Eliminates issuing bank country and commercial risk

If the issuing banks letter of credit is confirmed, the

confirming bank substitutes its own creditworthiness for

that of the issuing banks and takes on all duties and

responsibilities of an issuing bank

Must be requested by issuing bank to confirm credit

If the issuing bank is not deemed creditworthy, or if there

are country risk issues a bank may refuse to add

confirmation

Confirmed Letters of Credit

Confirmation eliminates:

Commercial credit risk of issuing bank

Country risk of issuing bank

Confirmed credit means payment obligation moves to

the confirming bank and its country

However:

Confirmation is location specific

Verify country of confirming bank

Confirmation by branch or subsidiary of issuing bank

May shift country risk

May not shift commercial

7

26

Payment Method: Letter of Credit

Set it up right!

1. Irrevocable

2. Issue Date, Expiry Date &

Location

3. Issuing Bank/Advising Bank

4. Importer/Exporter

5. Value & Currency

6. Description of Goods/Services

7. Required Documents

8. Payment Terms

9. Incoterms

10. Port-To-Port Info

11. UCP 600

12. LC Fees - Who Pays?

13. Latest Ship Date

14. Presentation Date

15. Partial Shipments (Y/N)

16. Transshipments (Y/N)

17. Paying Bank

18. Drawee Bank

19. Reimbursing Bank

20. Confirming Bank

20 Points of Negotiation in Structuring your LC

27

Reducing Cost and

Accelerating Payment

Set up the LC correctly negotiating all points

Check with your bank on S.W.I.F.T arrangements

prior to LC opening

Avoid discrepancies

Use LC template

Get copy of LC application before issuance

Have the LC confirmed/payable at PNC Bank

In some cases, discount

Consult with PNC Bank

28

What to do When the LC Arrives

Read the letter of credit very carefully

Ensure you can comply with the terms (all 20+ points)

Send copy of LC to freight forwarder

Ask about anything you dont understand

If incorrect, reject the LC immediately

If necessary, request the buyer amend the Letter of

Credit

29

The Letter of Credit as a

Financing Tool

The protections afforded both parties in a letter of

credit transaction provide each additional benefits

as well

One of these is the ability to use the credit already

evidenced by the letter of credit itself to lower

Trade Cycle cash flow financing costs for both

Buyer and Seller

8

30

Documentary Collections

Disguised open account transactions

Less secure than letters of credit

More secure than open account

Benefits

Dont encumber buyers line of credit

Very inexpensive

Effective if properly structured

Use of correct Incoterms

Role of banks and freight forwarders

31

Shipment

Buyer pays BEFORE receipt of goods

Sight Collection (D/P)

2

Documents 2

Documents 3

4

$

4 $ 4 $

Documents

4

Foreign BANK PNC Bank

Buyer Seller

Buy/Sell

Agreement

1

32

Buyer pays AFTER receipt of goods

Time Collection (D/A)

Documents 2

Documents 3

6

$

6 $

6 $

Documents

5

Foreign BANK PNC Bank

Payment at Maturity

5 Acceptance

Buyer Seller

Shipment

2

Buy/Sell

Agreement

1

33

Documentary Collection

Transaction Flow

Seller ships

Seller presents documents to National City

National City sends documents to a correspondent

Correspondent bank releases documents against:

Payment (if Documents against Payment D/P)

Acceptance (if Documents against Acceptance D/A)

Note: D/A terms represent more risk to the seller.

Correspondent wires funds to National City

National City pays seller

9

34

Payment Method Variations

CIA Variation

50% in advance, balance with order

100% upon shipment

LC Variation

Transfer

Assignment

Financing

Open Account Variation

Insured

Performance guaranty (Standby LC)

35

Medium-Term Financing

PNC is largest provider of Medium-term (typically up to 5 years)

Financing to Foreign Buyers of Capital Goods under Eximbanks

Buyer Finance Program

Financed amount is the lesser of 85% of the sales contract or 100%

of the U.S. content of the sales contract

Up to 30% of related local costs in the foreign country may be

eligible for financing

Repayment is through semi-annual installments of P & I

Interest floating or fixed each six months

Eximbank fees may be financed as part of the credit

Seller is paid out when shipment documentation is presented to

PNC Bank; PNC receives payment directly from foreign buyer

Program is at no cost to Seller; PNC needs introduction to Foreign

Buyer from Seller

36

Export Credit Insurance

Covers the risk of buyer nonpayment for commercial risks (e.g.

bankruptcy) and certain political risks (e.g. war or the inconvertibility

of currency) from qualified foreign buyers

Does NOT cover product quality/service disputes

Provides 90-95% commercial, 95-100% political coverage against

buyer payment defaults

Premiums are only paid on actual shipments

Available through the U.S. Eximbank and other private insurers

Can improve cash flow by allowing you to include insured foreign

receivables in your borrowing base by assigning the policy to a

commercial bank

For Eximbank coverage, minimum 50% U.S. content required

Use an insurance broker!!!!

37

Examples and War Stories

Trust Gone Awry on a Documentary Collection

When the credit markets freeze up

If it sounds too good to be true, it probably is

In general, Possibly trust, but verify

10

Bill of Lading or blading for short, it is a

document signed by or on behalf of the master

of a carrying vessel, certifying that the goods

have been received on board in good order for

transportation and delivery as specified in the

document.

Consignee

the buyers name

to order in the consignee space, and the

name and address of the agent underneath

to order, then the agent can endorse the

bill of lading to the buyer.

Functions:

First, it serves as a receipt for goods signed

by the shipping company (carrier) and given

to the shipper (consignor);

Second, its evidence of a contract of

carriage between the carrier and the

consignor;

Third, it conveys a document of title because

the legal owner of the bill of lading is the

owner of the goods it covers.

Process

The shipper fills in the form and sends it to the ship, then the officer of

the shipping company checks the goods and signs the Bill. The shipping

company sends the Bill of Lading to the exporter or his bank. These

negotiable Bills of Lading are used for payment. They are passed on to

the buyer or the exporters agents in the importing country. Then the Bills

of Lading together with other shipping documents are presented to the

shipping company when the ships arrives. The shipping company

compares the negotiable Bills of lading with their copy on the ship. Then

the buyer can obtain the goods from the ship.

11

Different types

clean Bill of Lading()

foul or clause Bill of Lading()

__ if defects are unavoidable, what to do

shipped in apparent good order and

condition . It is issued when the good do

not show any defects on their exteriors at

the time of loading at the port of shipment.

This type is favored by the buyer and the

banks

If detects are found on the exteriors of

the goods, or the shipping company

does not agree to any of the statements

in the B/L, the bill will be marked as

unclean, foul, or packages in

damaged condition.

Different types

straight Bill of Lading

blank (open, bearer) Bill of Lading)

order Bill of Lading)

Straight bill of lading has a designated consignee. Under the bill only the named

consignee at the destination is entitled to take delivery of the cargo. As it is not

transferable, it is not commonly used in international trade and normally applies to

high-value shipments or goods for special purposes.

It means that there is no definite consignee of the goods.

There usually appear in the box of consignee words like

To bearer. Anyone who holds the bill is entitled to the

goods the bill represents. No endorsement is needed for

the transfer of the blank bill. Due to the exceedingly high

risk involved, this bill is rarely used.

It is widely used in international trade. It means that

the goods are consigned or destined to the order of a

named person. In the box of consignee, to order, to

order of shipper, or to order of the consignee is

marked. It can be transferred only after endorsement

is made.

Different types

on-board Bill of Lading

received-for-shipment Bill of Lading

direct Bill of Lading

transshipment Bill of Lading

It is issued by the shipping company after the goods are

actually shipped on board the designated vessel. Most bill of

lading forms are preprinted as shipped bill.

It means the goods are shipped from the port of

loading direct to the port of destination without

involving transshipment.

Different types :

through Bill of Lading

combined transport B/L

long form Bill of Lading

short form Bill of Lading

It is sometimes necessary to employ two or more carriers to get the goods

to their final destination. Usually the first carrier will sign the bill of lading.

Combined transport B/L is ideal for container movements. It differs from

through B/L in that combined transport is operated by only one carrier.

Long term B/L is more detailed with shipping

contract clause printed on the back of the

page.

12

Different types

air waybill

A receipt for goods and a record of the existence of a contract of carriage

railway consignment note

liner waybill

charter-party bill of lading

The air waybill is the consignment note used for the carriage of goods

by air. It is basically a receipt of the goods for the dispatch and

evidence of the contract of carriage between the carrier and the

consignor.

Consignment note for rail transport serves as the

contract of carriage between the railway and consignor,

evidencing the receipt of the goods and the date of

acceptance for carriage for carrier. Unlike B/L, it is not a

document of title and is not transferable or negotiable.

Modes of International Cargo Transport

Sea/Ocean Transport

Rail Transport

Air Transport

Road Transport

Inland Waterway Transport

Container Transport

International Multimodal Transport

Parcel Post Transport

Carriage of goods can take place by

sea, rail, air, road, inland waterway, parcel post,

containers and multimodal transport

Sea transport (ocean transport)

Kinds of Vessels:

general cargo vessels

Oil tankers

Container vessels

Oil/Bulk/Ore (OBO) vessels

Ro/Ro vessels

LASH (lighter Aboard Ship)

Refrigerated ship

Timber ship

Commercial Vessel

Liner

Tramp

Freight

W = weight ton

M = measurement ton

Ad Val =price and value

W/M = weight ton or measurement ton

subject to the higher rate

W/M or Ad Val

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Time Sheet For Teaching Assistant, Research Assistant & Executive AssistantDokument1 SeiteTime Sheet For Teaching Assistant, Research Assistant & Executive AssistantsirfanalizaidiNoch keine Bewertungen

- Order to Cash Life Cycle ExplainedDokument34 SeitenOrder to Cash Life Cycle ExplainedGaurav SrivastavaNoch keine Bewertungen

- The Usury Law (De Leon)Dokument9 SeitenThe Usury Law (De Leon)Martin EspinosaNoch keine Bewertungen

- Capital Structure: Overview of The Financing DecisionDokument68 SeitenCapital Structure: Overview of The Financing DecisionHay JirenyaaNoch keine Bewertungen

- How money laundering risks affect countries and financial institutionsDokument42 SeitenHow money laundering risks affect countries and financial institutionsAbidRazaca88% (16)

- NISM V A Sample 500 QuestionsDokument36 SeitenNISM V A Sample 500 Questionsbenzene4a182% (34)

- Finacle Menu OptionsDokument7 SeitenFinacle Menu OptionsNiki Lohani100% (2)

- UniLever Foods Project CharterDokument15 SeitenUniLever Foods Project ChartersirfanalizaidiNoch keine Bewertungen

- Student Records - MBA ProjectDokument4 SeitenStudent Records - MBA ProjectsirfanalizaidiNoch keine Bewertungen

- Student Records - MBA ProjectDokument4 SeitenStudent Records - MBA ProjectsirfanalizaidiNoch keine Bewertungen

- Syed Hasan Ali - MBA FinanceDokument2 SeitenSyed Hasan Ali - MBA FinancesirfanalizaidiNoch keine Bewertungen

- What Are The Products of Steel Division?Dokument2 SeitenWhat Are The Products of Steel Division?sirfanalizaidiNoch keine Bewertungen

- MBA Graduate Profile - Syed Irfan Ali ZaidiDokument1 SeiteMBA Graduate Profile - Syed Irfan Ali ZaidisirfanalizaidiNoch keine Bewertungen

- Contact Directory with 18 Contacts & DetailsDokument14 SeitenContact Directory with 18 Contacts & DetailssirfanalizaidiNoch keine Bewertungen

- Revo car re-launch project planDokument6 SeitenRevo car re-launch project plansirfanalizaidiNoch keine Bewertungen

- Revo's Re-Launch: Terms of ReferenceDokument14 SeitenRevo's Re-Launch: Terms of ReferencesirfanalizaidiNoch keine Bewertungen

- Future of Mutual Funds in PakistanDokument26 SeitenFuture of Mutual Funds in PakistansirfanalizaidiNoch keine Bewertungen

- MBA Graduate Profile - Syed Irfan Ali ZaidiDokument1 SeiteMBA Graduate Profile - Syed Irfan Ali ZaidisirfanalizaidiNoch keine Bewertungen

- Contact Directory with 18 Contacts & DetailsDokument14 SeitenContact Directory with 18 Contacts & DetailssirfanalizaidiNoch keine Bewertungen

- Introduction To The Project - Shan Single Pack SKU (Repositioning)Dokument5 SeitenIntroduction To The Project - Shan Single Pack SKU (Repositioning)sirfanalizaidiNoch keine Bewertungen

- MBA Project Handbook - FinalDokument22 SeitenMBA Project Handbook - FinalsirfanalizaidiNoch keine Bewertungen

- MBA - Institute of Business Administration, Karachi Graduating Year: Spring 2015Dokument1 SeiteMBA - Institute of Business Administration, Karachi Graduating Year: Spring 2015sirfanalizaidiNoch keine Bewertungen

- Market Potential Analysis of Neutraceutical IndustryDokument6 SeitenMarket Potential Analysis of Neutraceutical Industrysirfanalizaidi100% (1)

- Hospital Waste TOR - DraftDokument13 SeitenHospital Waste TOR - DraftsirfanalizaidiNoch keine Bewertungen

- Syed Hasan Ali - MBA FinanceDokument2 SeitenSyed Hasan Ali - MBA FinancesirfanalizaidiNoch keine Bewertungen

- MBA Project Handbook - FinalDokument22 SeitenMBA Project Handbook - FinalsirfanalizaidiNoch keine Bewertungen

- Final Mba Project Report Final VersionDokument199 SeitenFinal Mba Project Report Final VersionsirfanalizaidiNoch keine Bewertungen

- Group Profile For MBA ProjectDokument1 SeiteGroup Profile For MBA ProjectsirfanalizaidiNoch keine Bewertungen

- Spring 2015: MBA - Institute of Business Administration, Karachi Graduating YearDokument1 SeiteSpring 2015: MBA - Institute of Business Administration, Karachi Graduating YearsirfanalizaidiNoch keine Bewertungen

- AFDMDokument9 SeitenAFDMsirfanalizaidiNoch keine Bewertungen

- Introduction To The Project - Shan Single Pack SKU (Repositioning)Dokument4 SeitenIntroduction To The Project - Shan Single Pack SKU (Repositioning)sirfanalizaidiNoch keine Bewertungen

- Final Mba Project Report Final VersionDokument199 SeitenFinal Mba Project Report Final VersionsirfanalizaidiNoch keine Bewertungen

- Syed Hasan Ali - MBA FinanceDokument2 SeitenSyed Hasan Ali - MBA FinancesirfanalizaidiNoch keine Bewertungen

- ABL AMC ConfirmationDokument4 SeitenABL AMC ConfirmationsirfanalizaidiNoch keine Bewertungen

- ABL AMC ConfirmationDokument4 SeitenABL AMC ConfirmationsirfanalizaidiNoch keine Bewertungen

- Syed Hasan Ali - MBA FinanceDokument1 SeiteSyed Hasan Ali - MBA FinancesirfanalizaidiNoch keine Bewertungen

- Abhishek Kumar Department of Management Studies Kumaun University, NainitalDokument69 SeitenAbhishek Kumar Department of Management Studies Kumaun University, NainitalAarav AroraNoch keine Bewertungen

- Foreign Exchange Transaction Against RupiahDokument5 SeitenForeign Exchange Transaction Against RupiahErick MulijadiNoch keine Bewertungen

- PDFDokument2 SeitenPDFRubab ShaikhNoch keine Bewertungen

- Bank of Punjab: Internship Report ONDokument7 SeitenBank of Punjab: Internship Report ONMuhammad FarhanNoch keine Bewertungen

- United Malayan Banking Corporation Berhad VDokument4 SeitenUnited Malayan Banking Corporation Berhad VaishahNoch keine Bewertungen

- Intercontinental Bank Debunks Akingbola's Claims - 101010Dokument2 SeitenIntercontinental Bank Debunks Akingbola's Claims - 101010ProshareNoch keine Bewertungen

- Application For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1Dokument3 SeitenApplication For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1shobsundar1Noch keine Bewertungen

- Bank Payment Declaration - For Mt103 SwiftDokument1 SeiteBank Payment Declaration - For Mt103 Swiftshahil_4uNoch keine Bewertungen

- Cost sheet for 2-3BHK luxury apartments in Brigade Buena VistaDokument1 SeiteCost sheet for 2-3BHK luxury apartments in Brigade Buena VistapriyankarghoshNoch keine Bewertungen

- Habib Bank Limited (HBL) : HBL Was The First Commercial Bank To Be Established in Pakistan in 1947Dokument7 SeitenHabib Bank Limited (HBL) : HBL Was The First Commercial Bank To Be Established in Pakistan in 1947Muhammad ShakeelNoch keine Bewertungen

- Operation Management in State Bank of IndiaDokument82 SeitenOperation Management in State Bank of IndiaMayapati MishraNoch keine Bewertungen

- Frbny Annual2006Dokument66 SeitenFrbny Annual2006atilabNoch keine Bewertungen

- SSB Online Extension-RKUM11407230018Dokument1 SeiteSSB Online Extension-RKUM11407230018simphiwe matheNoch keine Bewertungen

- Assessment of Working Capital Requirements Form Ii: Operating StatementDokument12 SeitenAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNoch keine Bewertungen

- CPBM Gen AnsDokument118 SeitenCPBM Gen Ansmadhu pNoch keine Bewertungen

- MCCP LeafDokument2 SeitenMCCP LeafManish GoelNoch keine Bewertungen

- CPT Mock Test Paper ReviewDokument40 SeitenCPT Mock Test Paper ReviewbaburamNoch keine Bewertungen

- Citigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup ComplaintDokument82 SeitenCitigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup Complaint83jjmackNoch keine Bewertungen

- Percents 20 NotesDokument12 SeitenPercents 20 Notesapi-234882812Noch keine Bewertungen

- SET Secure Electronic Transaction GuideDokument12 SeitenSET Secure Electronic Transaction GuidePraveen BhardwajNoch keine Bewertungen

- NIGERIA – DANIEL (LAGOS)/0485/001 conditional offerDokument2 SeitenNIGERIA – DANIEL (LAGOS)/0485/001 conditional offersihajNoch keine Bewertungen

- ICICI Bank ACQUISITION WITH BANK OF RAJASTHANDokument6 SeitenICICI Bank ACQUISITION WITH BANK OF RAJASTHANPrayagraj PradhanNoch keine Bewertungen

- Barclays 2007Dokument79 SeitenBarclays 2007Cetty RotondoNoch keine Bewertungen

- UTI - Systematic Investment Plan (SIP) New Editable Application FormDokument4 SeitenUTI - Systematic Investment Plan (SIP) New Editable Application FormAnilmohan SreedharanNoch keine Bewertungen