Beruflich Dokumente

Kultur Dokumente

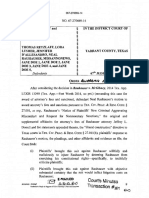

Lynn Thomas Bankruptcy 2

Hochgeladen von

Breitbart Unmasked100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

410 Ansichten3 SeitenDocuments on Lynn Thomas's bankruptcy.

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenDocuments on Lynn Thomas's bankruptcy.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

410 Ansichten3 SeitenLynn Thomas Bankruptcy 2

Hochgeladen von

Breitbart UnmaskedDocuments on Lynn Thomas's bankruptcy.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

B22A (Official Form 22 A) (Chapter 7) (04/10)

(Check the box as directed in Parts I, III, and VI of this statement)

The presumption arises.

The presumption does not arise.

According to the calculations required by this statement:

In re: ___________________________________

Case Number: ____________________________

Debtor(s)

(If known)

Stephen Thomas and Lynn Thomas

X

The presumption is temporarily inapplicable.

CHAPTER 7 - STATEMENT OF CURRENT MONTHLY INCOME

AND MEANS-TEST CALCULATION

In addition to Schedules I and J, this statement must be completed by every individual Chapter 7 debtor, whether or not filing jointly,

whose debts are primarily consumer debts. Joint debtors may complete one statement only.

Part I. - EXCLUSION FOR DISABLED VETERANS AND NON-CONSUMER DEBTORS

If you are a disabled veteran described in the Veteran's Declaration in this Part I, (1) check the box at the beginning of the

Veteran's Declarations, (2) check the "Presumption does not arise" box at the top of this statement, and (3) complete the

verification in Part VIII. Do not complete any of the remaining parts of this statement.

Veteran's Declaration. By checking this box, I declare under penalty of perjury that I am a disabled veteran (as defined

in 38 U.S.C. 374 (1)) whose indebtedness occured primarily during a period in which I was on active duty (as defined in 10

U.S.C. 101(d)(1)) or while I was performing a homeland defense activity (as defined in 32 U.S.C. 901(1)).

1A

1B

If your debts are not primarily consumer debts, check the box below and complete the verification in Part VIII. Do not complete

any of the remaining parts of this statement.

Declaration of non-consumer debts. By checking this box, I declare that my debts are not primarily consumer debts.

1C

Reservists and National Guard Members; active duty or homeland devense activity. Members of a reserve component of the

Armed Forces and members of the National Guard who were called to active duty (as defined in 10 U.S.C. 101(d)(1)) after

September 11, 2001, for a period of at least 90 days, or who have performed homeland defense activity (as defined in 32 U.S.C.

901(1)) for a period of at least 90 days, are excluded from all forms of means testing during the time of active duty or homeland

defense activity and for 540 days thereafter (the "exclusion period"). If you qualify for this temporary exclusion, (1) check the

appropriate boxes and complete any required information in the Declaration of Reservists and National Guard Members below,

(2) check the box for "The presumption is temporarily inapplicable" at the top of this statement, and (3) complete the verification

in Part VIII. During your exclusion period you are not required to complete the balance of this form, but you must complete the

form no alter than 14 days after the date on which you exclusion period ends, unless the time for filing a motion raising the

means test presumption expires in your case before your exclusion period ends.

Declaration of Reservists and National Guard Members. By checking this box and making the appropriate entries below, I

declare that I am eligible for a temporary exclusion from means testing because, as a member of a reserve component of the

Armed Forces or National Guard

a. I was called to active duty after September 11, 2001, for a period of at least 90 days and

I remain on active duty /or/

I was released from active duty on , which is less than 540 days before this

bankruptcy case was filed;

OR

b. I am performing homeland defense activity for a period of at least 90 days /or/

I performed homeland defense activity for a period of at least 90 days, terminating on

, which is less than 540 days before this bankruptcy case was filed.

PFG Record # 586622 Page 1 of 3

Case 13-34690 Doc 7 Filed 08/30/13 Entered 08/30/13 12:31:40 Desc Main

Document Page 1 of 3

B22A (Official Form 22 A) (Chapter 7) (04/10)

Part II. - CALCULATION OF MONTHLY INCOME FOR 707(b)(7) EXCLUSION

\

2

Marital/filing status. Check the box that applies and complete the balance of this part of this statement as directed.

a. Unmarried. Complete only Column A (Debtors Income) for Lines 3-11.

b. Married, not filing jointly, with declaration of separate households. By checking this box, debtor declares under

penalty of perjury: My spouse and I are legally separated under applicable non-bankruptcy law or my spouse and I

are living apart other than for the purpose of evading the requirements of 707(b)(2)(A) of the Bankruptcy Code.

Complete only Column A (Debtors Income) for Lines 3-11.

c. Married, not filing jointly, without the declaration of separate households set out in Line 2.b above. Complete both

Column A (Debtors Income) and Column B (Spouses Income) for Lines 3-11.

d. Married, filing jointly. Complete both Column A (Debtors Income) and Column B (Spouses Income) for

Lines 3-11.

All figures must reflect average monthly income received from all sources, derived during

the six calendar months prior to filing the bankruptcy case, ending on the last day of the

month before the filing. If the amount of monthly income varied during the six months, you

must divide the six-month total by six, and enter the result on the appropriate line.

Column A

Debtor's

Income

Column B

Spouse's

Income

X

3

Gross wages, salary, tips, bonuses, overtime, commissions. $ 0 $ 0

4

Income from the operation of a business, profession or farm. Subtract Line b from Line a

and enter the difference in the appropriate column(s) of Line 4. If you operate more than one

business, profession or farm, enter aggregate numbers and provide details on an attachment.

Do not enter a number less than zero. Do not include any part of the business expenses

entered on Line b as a deduction in Part V.

a.

Gross Receipts

b. Ordinary and necessary operating expenses

c. Business income

$ 60.00

$ 0

$ 60.00

5

Rent and other real property income. Subtract Line b from Line a and enter the difference in

the appropriate column(s) of Line 5. Do not enter a number less than zero. Do not include any

part of the operating expenses entered on Line b as a deduction in Part V.

a. Gross Receipts

Ordinary and necessary operating expenses

Rent and other real property income

b.

c.

$ 0

$ 0

$ 0

Interest, Dividends and Royalties. 6 $ 0 $ 0

7 Pension & Retirement Income. $ 0 $ 0

8

Any amounts paid by another person or entity, on a regular basis, for the household

expenses of the debtor or the debtors dependents, including child support paid for

that purpose. Do not include alimony or separate maintenance payments or amounts paid

by your spouse if Column B is completed.

0.00 0.00

9

Unemployment compensation. Enter the amount in the appropriate column(s) of Line 9.

However, if you contend that unemployment compensation received by you or your spouse

was a benefit under the Social Security Act, do not list the amount of such compensation in

Column A or B, but instead state the amount in the space below:

$ 0 $ 0

PFG Record # 586622 Page 2 of 3

Case 13-34690 Doc 7 Filed 08/30/13 Entered 08/30/13 12:31:40 Desc Main

Document Page 2 of 3

B22A (Official Form 22 A) (Chapter 7) (04/10)

10

Income from all other sources. Specify source and amount. If necessary, list additional

sources on a separate page. Do not include alimony or separate maintenance payments

paid by your spouse if Column B is completed, but include all other payments of

alimony or separate maintenance. Do not include any benefits received under the Social

Security Act or payments received as a victim of a war crime, crime against humanity, or as

a victim of international or domestic terrorism.

a.

b.

Parents Contribution

Total and enter on Line 10

$1,000.00

$ 0

11

Subtotal of Current Monthly Income for 707(b)(7). Add Lines 3 thru 10 in Column A,

and, if Column B is completed, add Lines 3 through 10 in Column B. Enter the total(s).

$ 1,060.00 $ 0

12

Total of Current Monthly Income for 707 (b)(7). If Column B has been completed, add Line

11, Column A to Line 11, Column B and enter the total. If Column B has not been completed,

enter the amount from Line 11 Column A.

$ 1,060.00

Part III - Application of 707(b)(7) Exclusion

13

Annualized Current Monthly Income for 707(b)(7). Multiply the amount from Line

12 by the number 12 and enter the result.

$ 12,720.00

14

Applicable Median Family Income. Enter the median family income by state and

household size.

a. State of Residence: ____________ b. Debtor's Household Size: __________

IL 2

$ 59,861.00

15

Application of Section 707(b)(7). Check the applicable box and proceed as directed.

The amount on Line 13 is less than or equal to the amount on Line 14. Check the box for The presumption does not

arise at the top of page 1 of this statement, and complete Part VIII; do not complete Parts IV, V, VI or VII.

The amount on Line 13 is more than the amount on Line 14. Complete the remaining parts of this statement.

X

I declare under penalty of perjury that the information provided in this statment is true and correct.

Dated: 08/27/2013

Dated: 08/27/2013

/s/ Stephen Thomas

/s/ Lynn Thomas

Stephen Thomas

Lynn Thomas

X Date & Sign

X Date & Sign

Part VIII: VERIFICATION 57

*Amount subject to adjustment on 4/01/16, and every three years thereafter with respect to cases commenced on or after the date of adjustment

PFG Record # 586622 Page 3 of 3

Case 13-34690 Doc 7 Filed 08/30/13 Entered 08/30/13 12:31:40 Desc Main

Document Page 3 of 3

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Aaron Walker Cert PetitionDokument17 SeitenAaron Walker Cert PetitionBreitbart UnmaskedNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Walker Vs Kimberlin AppealDokument21 SeitenWalker Vs Kimberlin AppealBreitbart UnmaskedNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Lynn Thomas BankruptcyDokument41 SeitenLynn Thomas BankruptcyBreitbart UnmaskedNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Pundit Syndication, LLC ForefeitedDokument1 SeitePundit Syndication, LLC ForefeitedBreitbart UnmaskedNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Order Awarding Attorney's Fees & SanctionsDokument8 SeitenOrder Awarding Attorney's Fees & SanctionsBreitbart UnmaskedNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- NBC Fundraising LetterDokument1 SeiteNBC Fundraising LetterBreitbart UnmaskedNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Judge Hazel's Letter Order 07/27/15Dokument5 SeitenJudge Hazel's Letter Order 07/27/15PaulKrendlerNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hoge v. Kimberlin Motion To QuashDokument5 SeitenHoge v. Kimberlin Motion To QuashBreitbart UnmaskedNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Case 8:13-cv-03059-GJH Document 302-2 Filed 08/31/15 Page 1 of 3Dokument3 SeitenCase 8:13-cv-03059-GJH Document 302-2 Filed 08/31/15 Page 1 of 3Breitbart UnmaskedNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- ECF 296 RedactedDokument20 SeitenECF 296 Redactedhimself2462Noch keine Bewertungen

- Pundit Syndication ForfeitureDokument1 SeitePundit Syndication ForfeitureBreitbart UnmaskedNoch keine Bewertungen

- Abdulrahman Alharbi's Suit Against Glenn BeckDokument6 SeitenAbdulrahman Alharbi's Suit Against Glenn BeckBreitbart UnmaskedNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Akbar's DMCA Counter Notice To SchmalfeldtDokument4 SeitenAkbar's DMCA Counter Notice To SchmalfeldtBreitbart UnmaskedNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Vice & Victory ForefeitureDokument1 SeiteVice & Victory ForefeitureBreitbart UnmaskedNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Judge Grimm's Letter Order in The Kimberlin v. NBC Et Al Federal SuiitDokument7 SeitenJudge Grimm's Letter Order in The Kimberlin v. NBC Et Al Federal SuiitBill SchmalfeldtNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- NBC ForfeitedDokument1 SeiteNBC ForfeitedBreitbart UnmaskedNoch keine Bewertungen

- 2011 Institute For Individualism IRS 990Dokument22 Seiten2011 Institute For Individualism IRS 990Breitbart UnmaskedNoch keine Bewertungen

- Pundit Syndication, LLC ForefeitedDokument1 SeitePundit Syndication, LLC ForefeitedBreitbart UnmaskedNoch keine Bewertungen

- 2012 Institute For Individualism IRS 990Dokument12 Seiten2012 Institute For Individualism IRS 990Breitbart UnmaskedNoch keine Bewertungen

- Kimberlin Amended RICO Suit Fed Final LinksDokument51 SeitenKimberlin Amended RICO Suit Fed Final LinksBreitbart UnmaskedNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- NRA LetterDokument2 SeitenNRA LetterBreitbart UnmaskedNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Kimberlin RICO SuitDokument48 SeitenKimberlin RICO SuitBreitbart UnmaskedNoch keine Bewertungen

- Hagel Press Release and LetterDokument3 SeitenHagel Press Release and LetterBreitbart UnmaskedNoch keine Bewertungen

- Halligan Concerns Talker 6.6.11 (Revised)Dokument6 SeitenHalligan Concerns Talker 6.6.11 (Revised)Breitbart UnmaskedNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Letter To POTUS Re. Hagel Nom - V4Dokument2 SeitenLetter To POTUS Re. Hagel Nom - V4Breitbart UnmaskedNoch keine Bewertungen

- The War On Women': Does It Exist, and If So, What Is Its Nature?Dokument1 SeiteThe War On Women': Does It Exist, and If So, What Is Its Nature?Breitbart UnmaskedNoch keine Bewertungen

- GOA LetterDokument2 SeitenGOA LetterBreitbart UnmaskedNoch keine Bewertungen

- Regina McCarthy NomineeAlert 2013Dokument2 SeitenRegina McCarthy NomineeAlert 2013Breitbart UnmaskedNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- RNC Spring Meeting Letter PDFDokument3 SeitenRNC Spring Meeting Letter PDFAdil KhanNoch keine Bewertungen

- Egypte Food Drink SurveyDokument71 SeitenEgypte Food Drink SurveysaadabdallaNoch keine Bewertungen

- Chapter 5 Internal Enviroment Analysis PDFDokument31 SeitenChapter 5 Internal Enviroment Analysis PDFsithandokuhleNoch keine Bewertungen

- CSAT Sample PaperDokument3 SeitenCSAT Sample PaperRehmat KaurNoch keine Bewertungen

- ASEAN Sustainable Urbanisation Strategy ASUSDokument248 SeitenASEAN Sustainable Urbanisation Strategy ASUStakuya_eekNoch keine Bewertungen

- Why Renting Is Better Than BuyingDokument4 SeitenWhy Renting Is Better Than BuyingMonali MathurNoch keine Bewertungen

- Foreign Exchange Arithmetic WorksheetDokument4 SeitenForeign Exchange Arithmetic WorksheetViresh YadavNoch keine Bewertungen

- Niti Aayog PDFDokument4 SeitenNiti Aayog PDFUppamjot Singh100% (1)

- Contemporary 1Dokument16 SeitenContemporary 1Lingayo, Deseree C.Noch keine Bewertungen

- Fire in A Bangladesh Garment FactoryDokument6 SeitenFire in A Bangladesh Garment FactoryRaquelNoch keine Bewertungen

- Sop Finaldraft RaghavbangadDokument3 SeitenSop Finaldraft RaghavbangadraghavNoch keine Bewertungen

- Specialization Project Report FinalDokument49 SeitenSpecialization Project Report FinalANCHURI NANDININoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Accenture IT Strategy Transformation ServicesDokument6 SeitenAccenture IT Strategy Transformation Serviceserusfid100% (1)

- Concentrate Business Vs Bottling BusinessDokument3 SeitenConcentrate Business Vs Bottling BusinessShivani BansalNoch keine Bewertungen

- Standard Notes To Form No. 3CD (Revised 2019) CleanDokument8 SeitenStandard Notes To Form No. 3CD (Revised 2019) CleanRahul LaddhaNoch keine Bewertungen

- GR12 Business Finance Module 3-4Dokument8 SeitenGR12 Business Finance Module 3-4Jean Diane JoveloNoch keine Bewertungen

- Vascon Engineers - Kotak PCG PDFDokument7 SeitenVascon Engineers - Kotak PCG PDFdarshanmadeNoch keine Bewertungen

- The Business Group and The IndustryDokument10 SeitenThe Business Group and The IndustryApoorva PattnaikNoch keine Bewertungen

- Peta 4TH QTR Business-Simulation-Final-042522Dokument4 SeitenPeta 4TH QTR Business-Simulation-Final-042522Kevin GuinsisanaNoch keine Bewertungen

- Debtors Ageing AnalysisDokument1 SeiteDebtors Ageing AnalysisMehul BhanushaliNoch keine Bewertungen

- TLE 5 EntrepDokument10 SeitenTLE 5 EntrepFrance PilapilNoch keine Bewertungen

- Solution: International Inance SsignmentDokument7 SeitenSolution: International Inance SsignmentJamshidNoch keine Bewertungen

- Roundtable FeedbackDokument59 SeitenRoundtable FeedbackVarun SoodNoch keine Bewertungen

- Heizer 10Dokument45 SeitenHeizer 10anushanNoch keine Bewertungen

- Columbus Custom Carpentry HR IssuesDokument5 SeitenColumbus Custom Carpentry HR IssuesWendy Aden SaputraNoch keine Bewertungen

- Topic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Dokument5 SeitenTopic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Mijwad AhmedNoch keine Bewertungen

- VRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisDokument5 SeitenVRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisKaran VasheeNoch keine Bewertungen

- CSR Activities of Coca ColaDokument19 SeitenCSR Activities of Coca ColaAjay Raj Singh94% (16)

- Merchant and Investment BankingDokument22 SeitenMerchant and Investment BankingAashiNoch keine Bewertungen

- HRD StrategiesDokument25 SeitenHRD Strategiesrohitharit95% (21)

- Costing Theory & Formulas & ShortcutsDokument58 SeitenCosting Theory & Formulas & ShortcutsSaibhumi100% (1)

- Why We Die: The New Science of Aging and the Quest for ImmortalityVon EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeVon EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeNoch keine Bewertungen

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansVon EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansBewertung: 4 von 5 Sternen4/5 (17)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessVon EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (327)

- Roxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingVon EverandRoxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingBewertung: 5 von 5 Sternen5/5 (5)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenVon EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenBewertung: 3.5 von 5 Sternen3.5/5 (36)

- Roxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingVon EverandRoxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingBewertung: 3.5 von 5 Sternen3.5/5 (33)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryVon EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryBewertung: 3.5 von 5 Sternen3.5/5 (2)