Beruflich Dokumente

Kultur Dokumente

Non-Rep Benefit Summary

Hochgeladen von

Roger Brewington BeyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Non-Rep Benefit Summary

Hochgeladen von

Roger Brewington BeyCopyright:

Verfügbare Formate

BENEFIT SUMMARY FOR WMATA NON-REPRESENTED EMPLOYEES

Program

Provisions

Paid Time Off

Vacation

Holidays

Sick Leave

0 - 3 years service, 13 days per year

3 -15 years service, 21 days per year

15+ years service, 27 days per year

10 per year (plus Inauguration Day every four years)

13 days per year

Insurance

Medical

Dental

Life

Options: Cigna OAP

Kaiser HMO

UnitedHealthcare (UHC) HMO

Benefit Level: Hospitalization - 100% (PPO out of network - 80%)

Doctor Visits - 100% after copay

(PPO out of network 80%)

Prescriptions - 100% after copay

(PPO out of network 80%)

Coverage provided for physicals and vision

Employee Cost Per Pay Period: Cigna Kaiser UHC

Employee Only $57.22 $43.48 $37.01

Employee + 1 $110.75 $86.96 $80.69

Family $175.58 $126.09 $92.54

Delta Dental POS

Benefit Level: Preventive - 100%

Basic - 75%

Major - 50%

Orthodontia - 50% (children only)

Employee Cost Per Pay Period:

Employee Only $ 7.24

Employee + 1 $13.95

Family $22.07

Basic: Benefit amount equals 1.5 times salary, cost paid

by the company ($30,000 minimum)

Optional: Employees may purchase supplemental coverage

up to 4 times salary (and $100,000 for spouse) at

group rates, in 5 year age brackets; employees

may also purchase accidental death and

dismemberment coverage up to 4 times salary at a

cost of $0.03 per $1,000 of coverage; employees

may also purchase $10,000 for children at a cost of

$1.00 per month to cover all eligible children

Page 1

7/1/2013

BENEFIT SUMMARY FOR WMATA NON-REPRESENTED EMPLOYEES (contd.)

Program

Provisions

Long-Term

Disability

Benefit Level: 60% of salary (waiting period - 3 months)

Cost: Shared 50/50 by company and employee

Retirement

457 Deferred

Compensation Plan

401(a) Defined

Contribution

Retirement Plan

(Applies to

employees hired

after 1/1/1999 only,

employees hired

before 1/1/1999

participate in the

WMATA

Retirement Plan)

In calendar year 2013, employees may contribute up to $17,500 or

100% of includible compensation, whichever is less, on a pre-tax

basis

Employee directs investment (many options are available); earnings

are not taxed until withdrawal

All contributions are made by the company

Basic contribution: 4% of pay

Additional contributions: If employee contributes 3% or

more to the 457 Plan, company

contributes an additional 3% to

the basic 4%, for a total of 7% per

pay

(Company only contributes 3% to

401(a) Plan in pay periods when

employee contributes 3% to 457

Plan)

Vesting period: 3 years

Employee directs investment (many options are available); earnings

are not taxed until withdrawal

Note: This is intended as only a brief summary of the benefit plans offered to WMATA

Non-represented employees. Complete descriptions are provided in the plan

document and company policies. In the case of any discrepancies, the provisions

of these documents prevail.

For further information, please call the Benefits office at (202) 962-1076.

Page 2

7/1/2013

Das könnte Ihnen auch gefallen

- Chapter 12 Employee BenefitsDokument8 SeitenChapter 12 Employee Benefitsroyalroy_313027733Noch keine Bewertungen

- HRM - Benefits and ServicesDokument39 SeitenHRM - Benefits and ServicesJuli Gupta0% (1)

- 8Z9N0K0001V0Dokument3 Seiten8Z9N0K0001V0Vanessa Graves FosterNoch keine Bewertungen

- POWERGRID PresentationDokument31 SeitenPOWERGRID Presentationskaushik21Noch keine Bewertungen

- 2015 Ast Corporation Benefits SummaryDokument4 Seiten2015 Ast Corporation Benefits SummarySam GobNoch keine Bewertungen

- 2023 India Benefits Overview PDFDokument2 Seiten2023 India Benefits Overview PDFRajesh KrishnaNoch keine Bewertungen

- 2009 Compensation & Benefits Survey QuestionnaireDokument18 Seiten2009 Compensation & Benefits Survey QuestionnaireearendilvorondoNoch keine Bewertungen

- HRM - Chap 10Dokument24 SeitenHRM - Chap 10mqasim sheikh5Noch keine Bewertungen

- Policy Terms and Conditions FAQDokument5 SeitenPolicy Terms and Conditions FAQRahul SaswadkarNoch keine Bewertungen

- Kpit BenefitsDokument12 SeitenKpit BenefitsRAHUL DAM100% (1)

- Benefit Summary IndiaDokument5 SeitenBenefit Summary IndiaMohd Asim AftabNoch keine Bewertungen

- ESI ACT, 1948 (Team 3)Dokument19 SeitenESI ACT, 1948 (Team 3)Rahul RaoNoch keine Bewertungen

- PAY MODEL OF COMPENSATION HandoutDokument12 SeitenPAY MODEL OF COMPENSATION HandoutJustinnMaeArmentaNoch keine Bewertungen

- Esi Act, 1948Dokument21 SeitenEsi Act, 1948sandeep sureshNoch keine Bewertungen

- 2016 Benefit Changes (Non-Barganing Unit)Dokument18 Seiten2016 Benefit Changes (Non-Barganing Unit)Blaine RiceNoch keine Bewertungen

- Benefits-Summary-Philippines NewDokument4 SeitenBenefits-Summary-Philippines Newgen genNoch keine Bewertungen

- P. No.: 508 Department: ProductionDokument6 SeitenP. No.: 508 Department: ProductionMuhammad Hamza NaveedNoch keine Bewertungen

- Brochure (PRU@Work)Dokument36 SeitenBrochure (PRU@Work)aviro259156Noch keine Bewertungen

- Benefits at A Glance 2018Dokument2 SeitenBenefits at A Glance 2018JeffNoch keine Bewertungen

- Chapter 13 - The Benefits OptionsDokument39 SeitenChapter 13 - The Benefits OptionsAnonymous Io54FfF0SNoch keine Bewertungen

- Benefits Summary YahDokument3 SeitenBenefits Summary YahJohn NixonNoch keine Bewertungen

- Flexi Medical Plan BrochureDokument28 SeitenFlexi Medical Plan BrochurewoodksdNoch keine Bewertungen

- Upcoming HR Program Changes - Part Time Employees - EN PDFDokument4 SeitenUpcoming HR Program Changes - Part Time Employees - EN PDFjsource2007Noch keine Bewertungen

- The Employee's State Insurance Act 1948Dokument37 SeitenThe Employee's State Insurance Act 1948Sanjeev Prasad67% (3)

- Tracy Buckler ContractDokument11 SeitenTracy Buckler ContractcbcSudburyNoch keine Bewertungen

- Benefits Summary PhilippinesDokument2 SeitenBenefits Summary PhilippinesPidz GarciaNoch keine Bewertungen

- Information-Benefits: Services Information Announcement What's NewDokument3 SeitenInformation-Benefits: Services Information Announcement What's NewYash ChoudharyNoch keine Bewertungen

- Benefits and ServicesDokument26 SeitenBenefits and ServicesSushmit ShettyNoch keine Bewertungen

- Uploads/Presentations/184/Mr. M S SureshDokument10 SeitenUploads/Presentations/184/Mr. M S Sureshjitu031Noch keine Bewertungen

- VINCENT A ROCCHI - TheGuardianLifeInsuranceCompany - Fall2011Dokument30 SeitenVINCENT A ROCCHI - TheGuardianLifeInsuranceCompany - Fall2011studentATtempleNoch keine Bewertungen

- Fundamentals of Human Resource Management: Ninth EditionDokument30 SeitenFundamentals of Human Resource Management: Ninth Editionkingshukb100% (1)

- Benefits Summary PhilippinesDokument2 SeitenBenefits Summary PhilippinesZner NivlekNoch keine Bewertungen

- Full Time Benefit Summary Eff.07.01Dokument2 SeitenFull Time Benefit Summary Eff.07.01jlaikenNoch keine Bewertungen

- Week 2 Payroll PDFDokument8 SeitenWeek 2 Payroll PDFVassish DassagneNoch keine Bewertungen

- Cafeteria Benefits HomeworkDokument2 SeitenCafeteria Benefits Homeworkalexandra fultonNoch keine Bewertungen

- Ba 211-Module 22-ReportDokument46 SeitenBa 211-Module 22-ReportAlma AgnasNoch keine Bewertungen

- The Employees' Provident Fund OrganizationDokument6 SeitenThe Employees' Provident Fund OrganizationAjay TiwariNoch keine Bewertungen

- Submitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashDokument20 SeitenSubmitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashPriyanshuChauhanNoch keine Bewertungen

- Phil Health: Pag-IBIGDokument2 SeitenPhil Health: Pag-IBIGNEDIE OFFICIALNoch keine Bewertungen

- ESI SchemeDokument87 SeitenESI Schemeharitha kunderuNoch keine Bewertungen

- Features At-A-Glance : 205-206, C-Wing, Crystal Plaza, New Link Road, Sample Report For Demonstration Purpose OnlyDokument3 SeitenFeatures At-A-Glance : 205-206, C-Wing, Crystal Plaza, New Link Road, Sample Report For Demonstration Purpose OnlySubhodeep NandiNoch keine Bewertungen

- Lecture 3 - The Employee's State Insurance Act, 1948Dokument8 SeitenLecture 3 - The Employee's State Insurance Act, 1948rishapNoch keine Bewertungen

- Components of CompensationDokument4 SeitenComponents of CompensationAnil Kumar SinghNoch keine Bewertungen

- Labour Laws 10Dokument11 SeitenLabour Laws 10dskrishnaNoch keine Bewertungen

- Compensation Benefits in The PhilippinesDokument3 SeitenCompensation Benefits in The PhilippinesWynona PinlacNoch keine Bewertungen

- Employee Benefits PresentationDokument22 SeitenEmployee Benefits PresentationDesniar PetuaNoch keine Bewertungen

- BenefitsDokument2 SeitenBenefitsryukenNoch keine Bewertungen

- On "Employee's State Insurance Act 1948" of India.Dokument20 SeitenOn "Employee's State Insurance Act 1948" of India.Anshu Shekhar SinghNoch keine Bewertungen

- 1.11 The ESI Act, 1948Dokument34 Seiten1.11 The ESI Act, 1948Palak DawarNoch keine Bewertungen

- Group Savings - Linked Insurance SchemesDokument5 SeitenGroup Savings - Linked Insurance SchemesMayank VermaNoch keine Bewertungen

- Extended Family Health Insurance Policy 2015 - 16Dokument6 SeitenExtended Family Health Insurance Policy 2015 - 16GracefulldudeNoch keine Bewertungen

- 7 Benefits and Services LectureDokument21 Seiten7 Benefits and Services LectureNitesh JainNoch keine Bewertungen

- Gabriel F Stellar - Rmi 3501 - CompleteDokument30 SeitenGabriel F Stellar - Rmi 3501 - CompletestudentATtempleNoch keine Bewertungen

- Payroll It Is The Total Amount That Has Been Paid Out To Employees For TheDokument4 SeitenPayroll It Is The Total Amount That Has Been Paid Out To Employees For TheKate Andrea MillanNoch keine Bewertungen

- Benefits and Services Faculty: Muzdalifa AnzumDokument32 SeitenBenefits and Services Faculty: Muzdalifa AnzumDiptta Roy ChowdhuryNoch keine Bewertungen

- Mr. Rahul & Family: Features At-A-GlanceDokument4 SeitenMr. Rahul & Family: Features At-A-GlanceRahul DandageNoch keine Bewertungen

- Group Saving Linked Insurance SchemeDokument14 SeitenGroup Saving Linked Insurance SchemeSam DavidNoch keine Bewertungen

- Tuscarora+roots an+historical+report+regarding+the+relation+of+the+Hatteras+Tuscarora+tribe+of+Robeson+County,+North+Carolina...Dokument187 SeitenTuscarora+roots an+historical+report+regarding+the+relation+of+the+Hatteras+Tuscarora+tribe+of+Robeson+County,+North+Carolina...Roger Brewington BeyNoch keine Bewertungen

- Apostolic New Life Church v. DominquezDokument9 SeitenApostolic New Life Church v. DominquezRoger Brewington BeyNoch keine Bewertungen

- DR - Michael Heiser - The Divine Council of The Elohim and The Gods of The BibleDokument100 SeitenDR - Michael Heiser - The Divine Council of The Elohim and The Gods of The BibleRoger Brewington BeyNoch keine Bewertungen

- ShabuwaDokument86 SeitenShabuwaRoger Brewington BeyNoch keine Bewertungen

- Speciale Translated From GermanDokument108 SeitenSpeciale Translated From GermanRoger Brewington BeyNoch keine Bewertungen

- Academic Self-Concept and Academic Achievement of African AmericaDokument117 SeitenAcademic Self-Concept and Academic Achievement of African AmericaRoger Brewington BeyNoch keine Bewertungen

- Way El Tells On HimselfDokument13 SeitenWay El Tells On HimselfRoger Brewington BeyNoch keine Bewertungen

- Invoking The Seven Worlds LibreDokument39 SeitenInvoking The Seven Worlds LibreRoger Brewington BeyNoch keine Bewertungen

- How To Build A Great Sermon: Listening GuideDokument3 SeitenHow To Build A Great Sermon: Listening GuideRoger Brewington BeyNoch keine Bewertungen

- Bowen AHS JRER LibreDokument54 SeitenBowen AHS JRER LibreRoger Brewington BeyNoch keine Bewertungen

- European Oil Product SpecsDokument73 SeitenEuropean Oil Product SpecsRoger Brewington BeyNoch keine Bewertungen

- Bon Bo MeditationDokument66 SeitenBon Bo MeditationRoger Brewington Bey100% (2)

- 100th Year AnniversaryDokument1 Seite100th Year AnniversaryRoger Brewington BeyNoch keine Bewertungen

- Egungun ChantsDokument2 SeitenEgungun ChantsRoger Brewington Bey100% (5)

- Marcus Garvey Lesson Plan1Dokument10 SeitenMarcus Garvey Lesson Plan1Roger Brewington BeyNoch keine Bewertungen

- Chief Executive Officer, President, or General Manager: Roles and ResponsibilitiesDokument8 SeitenChief Executive Officer, President, or General Manager: Roles and ResponsibilitiesRoger Brewington BeyNoch keine Bewertungen

- Chicago Daily Defender (Big Weekend Edition) (1966-1973) Jul 13, 1968Dokument2 SeitenChicago Daily Defender (Big Weekend Edition) (1966-1973) Jul 13, 1968Roger Brewington BeyNoch keine Bewertungen

- Odu Verses Are Different From Oosh To IfaDokument29 SeitenOdu Verses Are Different From Oosh To IfaRoger Brewington Bey100% (2)

- Intro To Kabbalah by PapusDokument4 SeitenIntro To Kabbalah by PapusRoger Brewington BeyNoch keine Bewertungen

- Underhill Vs FernandezDokument1 SeiteUnderhill Vs FernandezAlyk CalionNoch keine Bewertungen

- Supplementary Aggrement SGPDokument2 SeitenSupplementary Aggrement SGPParth MaldeNoch keine Bewertungen

- Legal Mirror - V1 - I2 PDFDokument296 SeitenLegal Mirror - V1 - I2 PDFRahul SharmaNoch keine Bewertungen

- Case Digest of Dy Vs CaDokument5 SeitenCase Digest of Dy Vs CaAnonymous uMI5BmNoch keine Bewertungen

- Association of Salem-Keizer Education Support Professionals: Agreement With DistrictDokument2 SeitenAssociation of Salem-Keizer Education Support Professionals: Agreement With DistrictStatesman JournalNoch keine Bewertungen

- Certificates of Non Citizen NationalityDokument9 SeitenCertificates of Non Citizen NationalitySpiritually Gifted100% (2)

- François DuvalierDokument11 SeitenFrançois DuvalierthiegoNoch keine Bewertungen

- 2020 BRIGADA ESKWELA and OPLAN BALIK ESKWELA PROGRAM PDFDokument2 Seiten2020 BRIGADA ESKWELA and OPLAN BALIK ESKWELA PROGRAM PDFHazel Dela PeñaNoch keine Bewertungen

- Strunk Bar Complaint Against Adam Bennett SchiffDokument9 SeitenStrunk Bar Complaint Against Adam Bennett Schiffkris strunk100% (3)

- 4 PP V TuniacoDokument2 Seiten4 PP V TuniacoshezeharadeyahoocomNoch keine Bewertungen

- 11 Cangco V Manila RailroadDokument3 Seiten11 Cangco V Manila RailroadluigimanzanaresNoch keine Bewertungen

- Corpo Finals ReviewerDokument3 SeitenCorpo Finals ReviewerlawdiscipleNoch keine Bewertungen

- Exclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andDokument19 SeitenExclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andPOOJA AGARWALNoch keine Bewertungen

- 143581-1967-Lua Kian v. Manila Railroad Co PDFDokument4 Seiten143581-1967-Lua Kian v. Manila Railroad Co PDFAmberChanNoch keine Bewertungen

- Indian Constitution-Federal or Unitary: FederalismDokument3 SeitenIndian Constitution-Federal or Unitary: FederalismthaslimNoch keine Bewertungen

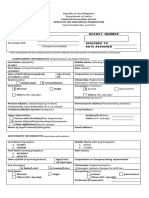

- To Be Accomplished by The Office: Republic of The Philippines Department of JusticeDokument2 SeitenTo Be Accomplished by The Office: Republic of The Philippines Department of JusticeKrystal Rain AgustinNoch keine Bewertungen

- 4.C Lanuzo Vs PingDokument1 Seite4.C Lanuzo Vs PingElaine ChescaNoch keine Bewertungen

- The Rise of Extra-Legal RemediesDokument3 SeitenThe Rise of Extra-Legal Remediesem corderoNoch keine Bewertungen

- Barangay Full Disclosure Monitoring Form NoDokument1 SeiteBarangay Full Disclosure Monitoring Form NoOmar Dizon100% (1)

- People Vs Michael Bokinco and Renante Col GR 187536 Aug. 10, 2011Dokument11 SeitenPeople Vs Michael Bokinco and Renante Col GR 187536 Aug. 10, 2011Leo FelicildaNoch keine Bewertungen

- Notice of Set Down (Unopposed Roll)Dokument11 SeitenNotice of Set Down (Unopposed Roll)Methembe MbamboNoch keine Bewertungen

- Ana Silvia Velasquez Castellon, A205 016 240 (BIA Nov. 2, 2017)Dokument3 SeitenAna Silvia Velasquez Castellon, A205 016 240 (BIA Nov. 2, 2017)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- G.R. No. 192898 January 31, 2011Dokument8 SeitenG.R. No. 192898 January 31, 2011Chelsey Arabelle Perez100% (1)

- Thakur GA Thematic Debate On UN in GG PDFDokument10 SeitenThakur GA Thematic Debate On UN in GG PDFbilling100% (1)

- Legal SeparationDokument12 SeitenLegal SeparationBenitez Gherold100% (1)

- Kyc PDFDokument9 SeitenKyc PDFOnn InternationalNoch keine Bewertungen

- Pmap & EcopDokument27 SeitenPmap & EcopRoseNTolentinoNoch keine Bewertungen

- Employee Handbook SampleDokument20 SeitenEmployee Handbook SampleejoghenetaNoch keine Bewertungen

- IT Act ChecklistDokument10 SeitenIT Act ChecklistPawan Kumar Laddha50% (4)

- Eduarte vs. Court of Appeals, 253 SCRA 391, February 09, 1996Dokument15 SeitenEduarte vs. Court of Appeals, 253 SCRA 391, February 09, 1996Kath ONoch keine Bewertungen