Beruflich Dokumente

Kultur Dokumente

Service Tax Notification No.08/2014 Dated 11th July, 2014

Hochgeladen von

stephin k j0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten3 SeitenService Tax Notification No.08/2014 "Seeks to amend notification No. 26/2012- Service Tax, dated 20th June, 2012, so as to make necessary amendments in the specified entries prescribing taxable portion and the conditions for availing the exemption therein." Dated 11th July, 2014

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenService Tax Notification No.08/2014 "Seeks to amend notification No. 26/2012- Service Tax, dated 20th June, 2012, so as to make necessary amendments in the specified entries prescribing taxable portion and the conditions for availing the exemption therein." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten3 SeitenService Tax Notification No.08/2014 Dated 11th July, 2014

Hochgeladen von

stephin k jService Tax Notification No.08/2014 "Seeks to amend notification No. 26/2012- Service Tax, dated 20th June, 2012, so as to make necessary amendments in the specified entries prescribing taxable portion and the conditions for availing the exemption therein." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

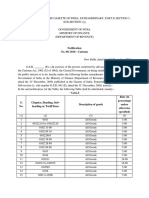

TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification

No. 08/2014 - Service Tax

New Delhi, the 11

th

July, 2014

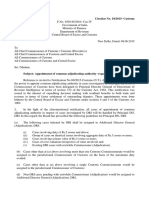

G.S.R....(E)- In exercise of the powers conferred by sub-section (1) of section 93 of

the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is

necessary in the public interest so to do, hereby makes the following further amendments in

the notification of the Government of India in the Ministry of Finance (Department of

Revenue), No.26/2012-Service Tax, dated the 20th June, 2012, published in the Gazette of

India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 468 (E), dated

the 20th June, 2012, namely:-

1. In the said notification, in the TABLE,-

(i) against serial number 7, in column (4), after the words has not been taken,

the words by the service provider shall be inserted;

(ii) in serial number 8, for the entry in column (4), the following entry shall be

substituted, namely:-

CENVAT credit on inputs, capital goods and input services, used for

providing the taxable service, has not been taken under the provisions of the

CENVAT Credit Rules, 2004.;

(iii) in serial number 9,-

(a) in column (2), for the words any motor vehicle designed to carry

passengers, the words motorcab shall be substituted with effect from the 1

st

day of October, 2014;

(b) for the entry in column (4), the following entry shall be substituted

with effect from the 1

st

day of October, 2014, namely:-

(i) CENVAT credit on inputs and capital goods, used for providing the

taxable service, has not been taken under the provisions of the CENVAT

Credit Rules, 2004;

(ii) CENVAT credit on input service of renting of motorcab has been taken

under the provisions of the CENVAT Credit Rules, 2004, in the following

manner:

(a) Full CENVAT credit of such input service received from a person

who is paying service tax on forty percent of the value; or

(b) Up to forty percent CENVAT credit of such input service received

from a person who is paying service tax on full value;

(iii) CENVAT credit on input services other than those specified in (ii)

above, has not been taken under the provisions of the CENVAT Credit

Rules, 2004.;

(iv) after serial number 9 and the entries relating thereto, the following serial

number and entries shall be inserted, namely:-

9A Transport of passengers, with or

without accompanied

belongings, by a contract

carriage other than motorcab.

40 CENVAT credit on inputs,

capital goods and input

services, used for providing the

taxable service, has not been

taken under the provisions of

the CENVAT Credit Rules,

2004.;

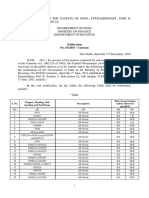

(v) in the serial number 9A, so inserted, for the entry in the column (2), the

following entry shall be substituted with effect from such date as the Central

Government may notify for omission of the words radio taxis in the section

66D(o)(vi) of the Finance Act 1994, namely:-

Transport of passengers, with or without accompanied belongings, by-

a. a contract carriage other than motorcab.

b. a radio taxi.;

(vi) in the serial number 10, for the existing entry in column (3), the entry 40

shall be substituted with effect from the 1

st

day of October, 2014;

(vii) against serial number 11, in column (4), for the words input services,

wherever occurring, the words input services other than the input service of a tour

operator shall be substituted with effect from the 1

st

day of October, 2014.

2. Save as otherwise provided in this notification, the amendments shall come into force

on the 11

th

day of July, 2014.

[F.No. 334/15/2014 - TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note.- The principal notification was published in the Gazette of India, Extraordinary, vide

notification No. 26/2012 - Service Tax, dated 20th June, 2012, vide number G.S.R. 468 (E),

dated the 20th June, 2012 and was last amended by notification No.9/2013- Service Tax,

dated the 8

th

May, 2013 vide G.S.R. 296 (E), dated the 8

th

May, 2013.

Das könnte Ihnen auch gefallen

- Customs Circular No.05/2015 Dated 9th February, 2016Dokument21 SeitenCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNoch keine Bewertungen

- Customs Circular No.03/2015 Dated 3rd February, 2016Dokument4 SeitenCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNoch keine Bewertungen

- Customs Circular No. 28/2015 Dated 23rd October, 2015Dokument3 SeitenCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNoch keine Bewertungen

- Customs Circular No.04/2015 Dated 9th February, 2016Dokument5 SeitenCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNoch keine Bewertungen

- Customs Circular No. 27/2015 Dated 23rd October, 2015Dokument13 SeitenCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNoch keine Bewertungen

- Customs Circular No. 25/2015 Dated 15th October, 2015Dokument10 SeitenCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNoch keine Bewertungen

- Customs Circular No. 20/2015 Dated 31st July 2015Dokument15 SeitenCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNoch keine Bewertungen

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Dokument60 SeitenCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNoch keine Bewertungen

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Dokument26 SeitenCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNoch keine Bewertungen

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Dokument34 SeitenCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Dokument15 SeitenDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNoch keine Bewertungen

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Dokument2 SeitenCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNoch keine Bewertungen

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Dokument22 SeitenCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNoch keine Bewertungen

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Dokument5 SeitenCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNoch keine Bewertungen

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Dokument38 SeitenCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNoch keine Bewertungen

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Dokument1 SeiteDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNoch keine Bewertungen

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Dokument3 SeitenCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNoch keine Bewertungen

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Dokument3 SeitenDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Assignment of CopyrightDokument2 SeitenAssignment of CopyrightpravinsankalpNoch keine Bewertungen

- NISCE, Alyssa Angela R. 12081000 - G06 Legal Writing Assignment #1Dokument5 SeitenNISCE, Alyssa Angela R. 12081000 - G06 Legal Writing Assignment #1Ally NisceNoch keine Bewertungen

- Egyptian Dies, 15 Injured As Fire Breaks Out in 4-Storey BuildingDokument1 SeiteEgyptian Dies, 15 Injured As Fire Breaks Out in 4-Storey BuildingNasreen FalaahNoch keine Bewertungen

- Competition AssignmentDokument16 SeitenCompetition AssignmentAshwina NamtaNoch keine Bewertungen

- Thermodynamics Syllabus FinalDokument4 SeitenThermodynamics Syllabus FinalVpr NaturalsNoch keine Bewertungen

- G.R. Nos. 136066-67 February 4, 2003 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, BINAD SY CHUA, Accused-AppellantDokument90 SeitenG.R. Nos. 136066-67 February 4, 2003 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, BINAD SY CHUA, Accused-AppellantHartel BuyuccanNoch keine Bewertungen

- Attaining Behavioural ControlDokument7 SeitenAttaining Behavioural ControlAarohi SinghNoch keine Bewertungen

- Information Privacy Law Aspen Casebook Series 6th Edition Ebook PDFDokument62 SeitenInformation Privacy Law Aspen Casebook Series 6th Edition Ebook PDFlevi.stanley500100% (48)

- 01CA1S01Dokument6 Seiten01CA1S01Joel AlcantaraNoch keine Bewertungen

- Chapter 3: The Partnership Section E: Fiduciary Duties 2. Codification of Fiduciary Duty and Contractual WaiverDokument1 SeiteChapter 3: The Partnership Section E: Fiduciary Duties 2. Codification of Fiduciary Duty and Contractual WaiverkraftroundedNoch keine Bewertungen

- Unified Audit StrategyDokument8 SeitenUnified Audit StrategyvangieNoch keine Bewertungen

- Case Study On Property Agency FraudDokument2 SeitenCase Study On Property Agency Fraudmuqm5001Noch keine Bewertungen

- Warant of ArrestDokument6 SeitenWarant of ArrestJoseph InoviaNoch keine Bewertungen

- A&D Bedrooms V Michael PDFDokument5 SeitenA&D Bedrooms V Michael PDFTony GallacherNoch keine Bewertungen

- Petition For Writ of Certiorari in Woods v. State of FloridaDokument23 SeitenPetition For Writ of Certiorari in Woods v. State of FloridaReba Kennedy100% (2)

- MSC Circ 1084 Hot Work PrinciplesDokument2 SeitenMSC Circ 1084 Hot Work PrinciplesThurdsuk NoinijNoch keine Bewertungen

- Differential EquationDokument9 SeitenDifferential EquationPvr SarveshNoch keine Bewertungen

- Faculty of Law: Jamia Millia IslamiaDokument21 SeitenFaculty of Law: Jamia Millia IslamiaFaisal HassanNoch keine Bewertungen

- Miami Beach Police - Haneef Jamal Young Arrest FormDokument2 SeitenMiami Beach Police - Haneef Jamal Young Arrest FormRandom Pixels blogNoch keine Bewertungen

- Bully WorkDokument280 SeitenBully WorkRoberta CavaNoch keine Bewertungen

- LG ReviewerDokument68 SeitenLG Reviewercmv mendozaNoch keine Bewertungen

- Agency - EDokument25 SeitenAgency - EvalkyriorNoch keine Bewertungen

- Assured Shorthold Tenancy Agreement: CBBJJFGJJJHHHGGDokument5 SeitenAssured Shorthold Tenancy Agreement: CBBJJFGJJJHHHGGJan TanaseNoch keine Bewertungen

- Handball: Basic RulesDokument7 SeitenHandball: Basic Ruleskomplease100% (1)

- JCT Cimar 2016Dokument41 SeitenJCT Cimar 2016Jery Hasinanda HutagalungNoch keine Bewertungen

- Banking and Insurance Law Assignment by Anubhav SinghDokument5 SeitenBanking and Insurance Law Assignment by Anubhav Singhrieya dadhichiNoch keine Bewertungen

- Mathematical Modelling. MA - Maths PreviousDokument223 SeitenMathematical Modelling. MA - Maths Previousgyanendra tiwariNoch keine Bewertungen

- Indeterminate Sentence Law When ApplicableDokument4 SeitenIndeterminate Sentence Law When ApplicableFlorielle GlennNoch keine Bewertungen

- Partnership Deed FinalDokument4 SeitenPartnership Deed FinalNikhil MaanNoch keine Bewertungen