Beruflich Dokumente

Kultur Dokumente

Master of Business Administration: A Study On Ratio Analysis With Reference To Jocil Limited

Hochgeladen von

Sakhamuri Ram's0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

86 Ansichten97 Seiten1. The document is a project report submitted for a Master's degree in business administration on ratio analysis with reference to Jocil Limited.

2. It includes an acknowledgment section thanking various people for their guidance and assistance.

3. The project report will analyze the financial ratios of Jocil Limited to evaluate the company's performance and financial position.

Originalbeschreibung:

veerapo

Originaltitel

Veera

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1. The document is a project report submitted for a Master's degree in business administration on ratio analysis with reference to Jocil Limited.

2. It includes an acknowledgment section thanking various people for their guidance and assistance.

3. The project report will analyze the financial ratios of Jocil Limited to evaluate the company's performance and financial position.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

86 Ansichten97 SeitenMaster of Business Administration: A Study On Ratio Analysis With Reference To Jocil Limited

Hochgeladen von

Sakhamuri Ram's1. The document is a project report submitted for a Master's degree in business administration on ratio analysis with reference to Jocil Limited.

2. It includes an acknowledgment section thanking various people for their guidance and assistance.

3. The project report will analyze the financial ratios of Jocil Limited to evaluate the company's performance and financial position.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 97

1

A STUDY ON RATIO ANALYSIS WITH REFERENCE TO JOCIL LIMITED

A project report Submitted in partial fulfillment of the

Requirement for the award of degree Of

MASTER OF BUSINESS ADMINISTRATION

P.VEERLANKAIAH

Regd. No:Y13BU03069

Under the guidance of

Mrs. B.RATNAVALI

M.B.A.

TELLAKULA JALAYYA POLISETTY SOMUSUNDARAM COLLEGE

GUNTUR

DEPARTMENT OF BUSINESS ADMINISTRATION

T.J.P.S COLLEGE(P G COURSES)

GUNTUR

2

TELLAKULA JALAYYA POLISETTY SOMUSUNDARAM COLLEGE

GUNTUR

DEPARTMENT OF BUSINESS ADMINISTRATION

CERTIFICATE

This is to certify that is the bonafide record of the project entitled

A STUDY ON RATIO ANALYSIS WITH REFERENCE TO JOCIL LIMITED,

work done and submitted by MR.P.VEERLANKAIAH (Regd. No: Y13BU03069) in

Partial fulfillment of then requirements for the award of the degree of MASTER OF

BUSINESS ADMINISTRATION. It is a record of independent research work

undertaken by him, under my supervision and guidance during the academic year

2012-2014.

Head of the Department Project Guide

S. ANITHADEVI Mrs.B. RATNAVALI

MBA

3

ACKNOWLEDGEMENTS

It gives me immense pleasure to acknowledge all those who have extended their

helping hand in bringing out this project.

I owe my sincere thanks to Dr.C.ANIL KUMAR, Principal, T.J.P.S.

College (P.G. Courses), for granting me permission to do this project.

I thank Dr. G. SATYANARAYANA, Director and professor,

Department of Management Studies, for allocating me this project.

I feel happy to thank Dr.S.ANITHA DEVI, Head of the

Department, Department of Management Studies, for providing me her valuable

guidance and expertise in successful completion of this project.

I express my sincere gratitude to B.RATNAVLI for her kind

cooperation and guidance in completing my project work.

I express my deep sense of gratitude to MR.LAKSHMANA Asst

MANAGER , JOCIL LIMITED DOKIPARRU who has been my guide (external)

and helped me throughout the project.

Lastly, I thank all my family members & my friends for their valuable

support regarding the completion of my project work.

MR.P.VEERLANKAIAH

(Y13BU03069)

4

DECLARATION

I declare that this project entitled A STUDY ON RATIO ANALYSIS

OF WITH REFERENCE TO JOCIL LIMITE . It is an original and

Benefited work under taken by me in partial fulfillment of the requirement for the award

of degree of MASTER OF BUSINESS ADMINISTRATION which is submitted to

ACHARYA NAGARJUNA UNIVERSITY GUNTUR, under the guidance of

Miss. .RATNAVALI MBA It has not been copied from any earlier

reports. The empirical conclusions and findings of this report are based on this and the

information collected by me.

Place: GUNTUR

Date:

(P.VEERLANKAIAH)

(Y13BUO3O69)

5

TABLE OF CONTENTS

CHAPTER

NO

TITLE

PGNO

I

II

III

IV

V

INTRODUCTION

OBJECTIVES & METHODOLOGY

INDUSTRY PROFILE&COMPANY

PROFILE

RATIO ANALYSIS IN JOCIL LTD

SUMMARY,FINDINGS & SUGGESTIONS

BIBLIOGRAPHY

ANNEXURE

1-10

11-13

14-35

36-63

64-67

6

CHAPTER I

INTRODUCTION

7

INTRODUTION

Introduction

Finance is defined as the provision money at the time which is required even

enterprises whether big (or) small, needs finance to carry on its operations and to achieve its

target. Finance is life blood of any enterprises. Finance is one of the basic foundations of all

kinds of economic activities

FINANCIAL ANALYSIS:

The focus of financial analysis is on key figures in the financial statements and the

significant relationship that exists between them. The analysis of financial statements is a

process of evaluating the relationship between component parts of financial statements to

obtain a better understanding of the firms position and performance. The first task of the

financial analyst is to select the information relevant to the decision under consideration from

the total information contained in the financial statement. The final step interpretation and

drawing of inferences and conclusions in brief, financial analysis is the process of selection,

relation and evaluation.

Finance analysis is of immense use to a finance manager as it helps in carrying out

planning and control functions while preparing a functional plan for the company. Financial

manager must know the impact of financial decision on financial conditions and profitability

of the firm.

It concerned with the duties of the financial managers in the business firm. Financial

managers actively manages actively manage the financial affairs of any type of business

namely financial and non financial private and public large and small

Financial management divided in to three types

Investment decision

Finance decision

Dividend decision

8

MEANING OF FINANCIAL MANAGEMENT

Finance management is the entire gamut of managerial efforts devoted to

a management of finance and both its source of enterprise.

s c kuchhal _ finance management deals with procurement of funds

and their effective utilization in the business

Solomon _ finance management is concerned with the efficient use of

important economic resources, namely capital funds

9

IMPORTANCE OF FINANCIAL MANAGEMENT

The importance of finance management cannot be over emphasized it every organization

where funds are involved, sound financial management is necessary.

As coll in books has remarked, but production management and had sales management

have slain in hundreds, but fault finance management as slain in thousands.

Sound finance management is essential in both profit and non profit organizations .It helps in

monitoring the effective developments of funds in fixed assets and in working capital financial

management also helps in ascertaining how long the company would perform in feature. It helps in

indicating whether the firm will generate enough funds to meet it various obligations. It also helps in

profit planning, capital spending, measuring cost, controlling inventory accounts; receivables etc.

financial management essentially helps in optimizing the output from a given input in funds.

10

CHAPTER II

OBJECTIVES

&

METHODOLOGY

11

NEED FOR THE STUDY

Finance is a body of facts, principles and theories dealing with raising and using f

money by individuals, business and government. Financial management is that management

activity which is concerned with the planning and controlling of the firms financial

resources.

Financial reports like annual reports etc. we one of important resources of information

for judging the operational and financial performance of business. Ratio analysis is the basis

for scientific and quick decision making process. Ratios provide quick insight in to the

strengths and weakness of the firm.

Ratio analysis is a powerful tool of financial analysis. In financial analysis, a ratio is

used as a bench mark for evaluating the financial position and performance of a firm.

INTRODUTION OF RATIO ANALYSIS:

Financial ratios are useful to provide a snapshot of a companys financial statement.

Ratios are calculated from current year numbers and then are compared to previous year,

other companies, the industry, or even the economy to judge the performance of the

company. Ratio analysis is predominately used by proponents of fundamental analysis.

Financial ratios give out a detail report about with reference to firms performance

and financial situation. These are exercised to examine the trend and for comparing the firms

financial status with the other firms. Thus by such means, it will not be difficult to come

across the positional problems.

Ratio analysis is a tool of financial analysis. It is described as a relationship between

two or more things to evaluate the performance of a company. Traditional financial

statements provide absolute accounting figures that do not provide the financial position and

performance of a company.

12

MEANING OF RATIO ANALYSIS

Ratio analysis is a tool of financial analysis. It is described as a relationship between

two or more things to evaluate the performance of a company.

Traditional financial statements provide absolute accounting figures that do not

provide the financial position and performance of a company. Ratio analysis helps investors,

creditors, management and general public to evaluate the financial position of a company. It

is a numerical relationship between two variables. It depicts a quantified index for qualitative

judgments to the made about the companys performance.

Ratio analysis helps in comparing related information. Instead of absolute figures it

depicts data in relative figures. The figures can be expressed as a percentage or as ratios. The

ratio can be analyzed by following.

1. Trend

2. By inter-firm comparison

3. By comparing figures at a single point of time

4. By comparison with certain standards

Nature of ratio analysis

Ratio analysis is a powerful tool of financial analysis. A ratio is defined as the

indicated quotient of two mathematical expressions and as the relationship between two or

more things. In financial analysis, a ratio is used as a benchmark for evaluating the financial

position and performance of a firm. The absolute accounting figures reported in the financial

statements do not provide a meaning full understanding of the performance and financial

position of a firm. An accounting figure conveys meaning when it is related to some other

relevant information.

Ratios help to summarize large quantities of financial data and to make qualitative

judgment about the firms financial performance. The point to note is that a ratio reflecting a

13

quantitative relationship helps to forma qualitative judgment. Such is the nature of all

financial ratios.

Advantages of ratio analysis

Ratio analysis is very useful for financial statement analysis. The following

advantages are there to a company for analyzing its statements through the help of ratios.

1. It is easy to calculate and also easy to understand. Most of the ratios do not require

any specialized training and are understood by everybody because the formulae

used are simple.

2. Ratios help in evaluating a firms performance by measuring the current ratios with

those of the past.

3. Ratio analysis helps in making an assessment of the future. It determines the past

trends from financial statements.

4. Ratios are used for comparing the performance of one firm with another. It can also

be used for comparison with industry averages.

5. A company has to continuously analyze whether its liquidity position is satisfactory.

6. Ratio analysis assesses the operational efficiency of a company and is able to detect

the areas which require more attention.

7. Commercial organizations have the objectives running an enterprise successfully.

8. Ratio analysis follows internal and external standards. Internal standards are made

by comparing the firm own pas performance and relating it to current and future

planning.

9. The external standards are made when a companys performances is compared with

similar data of other companies or industry.

14

Limitations of ratio analysis

A ratio analysis is a useful tool in business. However, there are some standards.

However, these standards become problematic due to the following reasons.

Standards of comparison are difficult due to differences on the basis of valuation of

inventory of each company. Some companies value their inventory according to first in first

out method other companies may use the evaluation of average cost. There are differences in

technique of amortization of intangible assets like patents and goodwill in will bring a

difference in results.

Depreciation methods are often different. Some companies prefer straight line method

of depreciation because of its simple technique. Other companies use written down value

method. In India it is getting standardized towards written down value method.

TYPES OF RATIOS:

Liquidity ratios

Leverage ratio

Activity ratio

Profitability ratio

15

OBJECTIVES AND METHODOLOGY

Ratios help to summarizes large quantities of financial data and to make qualitative

judgment about the firms financial performance.

Objectives of the study:-

Objectives of the study is divided into primary and secondary objectives

Primary objective of the study is the to analyze financial performance of the

JOCIL limited.

In order to achieve the above objective and to make the study more purposeful, the secondary

objective of the study are as follows.

To measure the liquidity position of the company.

To find out the profitability of the organization.

To know the solvency position of the company

To compare the present performance of the company with that of the past years.

To evaluate the overall performance of JOCIL ltd. Through Ratio analysis.

To measure the financial risk through leverage ratios.

16

METHODS OF DATA COLLECTION

This evolution primarily requires factual information and so secondary data has

been used. the data collected from companies annual reports and financial results. A

part from these, interviews have been conducted with connected persons in relevant

departments of the company there information as also been used.

SECONDARY DATA

The secondary is collected from published annual reports of the company. Like profit

and loss account and balance sheets schedules. The data has been collected through

books, journals, and websites.

TOOLS OF FINANCIAL ANALYSIS:

Funds flow statement

Cash flow statement

Trend analysis

Ratio analysis

Comparative statement analysis

Common size statement analysis

17

IMPORTANCE OF THE STUDY

Financial analysis depends primarily on financial statements to diagnose financial

performance. It appears that are three principal reasons

To assess and evaluate the earning capacity of the firm

To find out the financial stability and soundness of the firm

To determine the possibility of the firm for future growth

To assess and evaluate the fixed assets, stock of the firm

FINANCIAL RATIO ANALYSIS

Financial ratios are useful measures to provide a snapshot of companies financial

position. A tool used by individual to conduct a quantitative analysis of information in a

companys financial statement. Ratios are calculated current year figures are then compared

to previous years other companies, the industry, or even the economy to judge the

performance of the company. The ratio analysis is predominately used by proponents of

fundamentals analysis. Financial ratios give out a detail report with reference to performance

and financial situations financial positions are exercise to examine the trend for comparing

the firms financial status with the other firms. Thus by such means, it will not be difficult to

come across the potential problem

ADVANTAGES OF RATIO ANALYSIS

Ratio analysis is an important age-old technique of financial analysis. The

following are some of advantage of ratio analysis.

1. Simplifies financial statements

It simplifies the comprehension of financial statements. ratios tell the whole story of

changes in the financial condition of business.

2. Facilities intra-firm comparison

It provides data for intra-firm comparison. Ratios highlight the associated with

successful and un successful firm. They also reveal strong firm weak firms. Overvalued and

undervalued firms.

18

3. Help in planning

It helps in planning and forecasting. Ratio can assist management, in its basic

functions of forecasting. Planning, co-ordination, control communication.

4. Make inter-firm comparison possible

Ratio analysis makes possible comparison of the performance of different divisions of

the firm. Ratios are helpful in deciding about there efficiency or otherwise in the past and

likely performance in future.

5. Help in investment decision

It helps in investment decision in the case of investors and lending decision in the

case of bankers etc..

19

Limitations of the study

Any study though it is widely acceptable and is of much use suffers from certain

limitations. The limitations of this study are as follows

Different companies use different accounting standards for inventory,

depreciation, etc... Therefore comparing their financial ratios can be misleading

financial statements analysis.

Ratio analysis is based on accounting not economic data

The study period is restricted to two months and a full

Fledged investigation can not be carried out in this Period

The analysis and interpretations done with the data available

The study is restricted to one tool of Financial Analysis i.e., ratio analysis

We confined the calculation of ratio only to limited number because of time constraint

20

CHAPTER III

INDUSTRY

&

COMPANY PROFILE

21

CHEMICAL INDUSTRY

The total volume of the chemical industry is us$ 25 billion fertilizers. It contributes

13% of GDP. It is one of fastest growing sectors of economy. Chemical industry in India is

fragmented and dispersed multi product and multi faceted chemicals sold directly to large

customers and through distribution channels distribution channels mostly consist of stockiest

and dealers spread all over India addressing small segments and retail market.

Major steps in the industry

Chemical industry is highly heterogeneous with following major sectors:

Petrochemicals

Inorganic chemicals

Organic chemicals

Fine and specialties

Agro chemicals

PETRO CHEMICALS

The major category in the chemicals

One of the fastest sectors at 13% p.a.

Major players are RELIANCE, IPCL, NOCIL, HALDIA, and GAIL

IN ORGANIC CHCHEMICALS

Us $ 2.5 billion industry

Covers basic products like caustic, chlorine, sulphuric acid etc.

Inorganic chemicals mostly used in detergents, glass, soaps, fertilizer, alkalis

Competition from imports is on rise.

22

ORGANIC CHEMICALS

1 billion dollar industry

Covers a wide range of chemicals

Units concentrated mostly in western India

FINE AND SPECIALITY CHEMICALS

Low volume, high price/margin chemicals.

Fragmented with large number of players.

Market around us $ 80 million p.a.

Major end user segment-textile, leather, paper, detergent, rubber, paints, polyester, oil

and gas etc..

AGRO CHEMICALS

In India a largest agriculture economy which is the major user. Average India

consumption is very low (1/20 of world average)

Market size 100000mt (in terms of technical grade)

US$800 million

Growth 10%p.a.

Consumption varies depending on crop and region

Cash crop like sugarcane, tobacco etc.. Is the major consumer of pesticides (above

60%)

Two types of products-

Technical-40nos Formulators-aove500nos

23

CHEMICAL INDUSTRY IN INDIA

India ranks 12

th

in the word for production of chemicals. Indias chemical industry

contributes about 3% to the nations GDP. The industry has a turnover of about US$ 30

billion, and accounts for about 14% in the general index of industrial production (IIP) and

17.5% in the manufacturing sector. It also accounts for about 13.14%of total exports and

8.9% of total imports of the country. The industry is mostly concentrated in western India,

which accounts for 45-50%^ of the total industry size.

OPPORTUNITIES

Success stories in dyes and agro-chemicals have boosted the confidence to take on

global competition.

The markets in developed countries are opening up and India can take advantage of

this, a large no. of products are going off patent.

India has the capacity for major value addition, being close to Middle East, this is a

relatively cheaper and abundant source for petrochemicals feedstock.

SWOT ANALYSIS OF CHEMICAL INDUSTRY IN INDIA

STRENGTH:

A diversified manufacturing base

Vibrant downstream industries in different segments competitive core industries

capability to produce world class end user products

Strong persons in some exports market segment

Large domestic market.

24

Raw material component sources with in the control.

Good R&D base and quality human resource

THREATS

Quantitative restrictions for imports have been removed already

Most of chemicals are now in the open general list (OGL) of import

Tariff level in India for most chemicals is significantly higher than in other countries

manufacturing the chemicals.

WEAKNESS

Cost of power: very high quality and poor quality of power

Cost of finance: chemical industry is high capital intensive, cost of finance in India

is very high

Infrastructure: theses facilities are not world class

Legacy of policy industrialization

Technology: low investment in R&D to be able to sell value-added product and

compete in developed countries is absent

Cost disadvantages: location disadvantages, such as extra transport cost raw materials

as well as finished products

Scale of production: plant size is not comparable to world scale operations

25

COMPETITIVE ADVANTAGE OF INDIA

Large resource of scientific and technical man power .

Large domestic market for various sector of chemicals.

Large cost line and abundant availability of salt.

SOAP INDUSTRY

The Rs.45 billion Indian soaps and detergents industry has been expiring low growth

and intense competition in urban areas. The physical market for detergents at about 2.7

million tones in one of the largest markets in the world. It categorized popular economy,

premium and super premium. In India, the per capita consumption of detergents is only 1.6

kg. Per annum as against over 16 kg. In Western Europe consumption soaps 1.4 kg which is

got from 93-94 report. In Taiwan 6.2kg. Thailand 32kg per annum. In Indonesia 2kg and in

Korea 7.3kg per annum per capital. Malaysia 3.7 kg per annum per capita, Japan 8.9 kg per

annum per capita.

The per capita consumption of toilet soap in India is at present whole fully low as

compared to many developing countries. The industry has made rapid progress after lifting of

the price control. The overall growth rate of the industry in the recent years has been in the

neighborhood of 15% per annum. .

The overall consumption of toilet soaps in the country has been increasing at the rate

6.7% and at more than 12% per annum in rural areas.

The soap market is divided into sub-popular and popular premium on the basis of

price and fatty matter. But for the purpose of market study, the market is categorized into

popular and premium. The popular segment constitutes about 87% while the premium soaps

make up the remaining 13%.

26

Segmentation of The Total Toilet Soaps:

Price range Soap Segment

Rs.6-8(for 75 grams) Sub-popular

Rs.8-12(for 75 grams) Popular

Rs.12+ (for 75 grams) Premium

Market Share of Premium, Popular, Sub Popular.

Segment Market Share(%) Growth Rate(%)

Premium

24 3

Popular 45 1

Sub- Popular 31 15

27

The above table shows the volume of growth rate of toilets soaps at different

segments. Premium, which is in the range of Rs.12 and above has price range between Rs.0.8

has 1% growth and sub-popular has a growth rate of 15% which is the range of between Rs.8-

12. Personal Wash market in India is very high. Everyone is using toilet

FATTY ACID INDUSTRY

Fatty Acids, as the name itself indicates, are in the organic acids derived from fats

and oils. Fats and oils are glycosides of Fatty Acids. Fatty acids are manufactured by

hydrolysis of fats and oils, which is popularly known as Fat Splitting. Glycerin is obtained as

a byproduct of the fatty acid. Fatty Acids are having diversified application in various fields

of industries like rubber manufacturing Industries, tries, plastic, cosmetics and

pharmaceuticals.

Fatty Acids are having diversified application in various fields of industries like

textile, type, plastic, surfactants, rubber, cosmetics, foods and pharmaceuticals both as it is

and as the derivatives. Present manufacture of Fatty Acids is dispersed all over the country

with units in various states.

PRESENT STATUS OF INDUSTRY

Production of fatty acid in India was insufficient Prior to the period of Second World

War.

Production on a small scale was initially started in the mid-forties that too with

obsolete equipment. The qualities of fatty acid coming out from these units are far from

desirable and recovery of Glycerin was inefficient. It is in 1953, the first high pressure Fat

splitting plant in our country went into stream in Bombay. It started production as a batch

operating Unit, which was soon converted to a semi-continuous one. The industry, which

started taking shape in the early fifties, was established on a firm

28

In the year 1954, the installed capacity of Fatty Acid plants was below 4500 tonnes

per annum. The annual production from the four operating Units at time was below 1000

tones per annum. Since then the fatty Acid Industry in India has made rapid progress during

the next two decades.

A BRIEF NOTE ON FATTY ACID INDUSTRY IN ANDHRA PRADESH

The fatty Acid industry is dependent on availability of the oils & oil seeds for

extraction and further processing, as Mutton Tallow is banned in India. The Industry found

that Rice Bran Oil (R .B. Oil) in one such source, which is cheaper than other oils. Thus,

most of the fatty Acid / Stearic Acid manufactures have chosen rice bran oil as their raw

material and the rice bran oils extraction units found placement near the raw Material source

i.e. Rice Bran even though the customers are well spread all over the Country.

The consumption pattern of Rice Bran Oil depends on the level of free Fatty Acid

Content available for industrial grade varies from time to time as the Rice Bran availability is

seasonal, having direct relation to the rice cropping and harvesting schedules.

Therefore, fluctuations are observed in the Rice Bran Oil prices, which are almost

fixed in their pattern. However, at times due to climate conditions and temperature variations,

the status of the Rice Bran oil changes form edible grade and vice-versa.

In India, as explained already Rice Bran Oil extraction is mostly available in the

major rice growing states of Andhra Pradesh and Punjab.

STEARIC ACID INDUSTRY:

+

In the Stearic acid different grades are produced with standard specification for

different industrial consumers.

The following are the different grades of Stearic acids consumed by different industries

in manufacturing their own Industrial products.

29

VARIOUS GRADES OF STEARIC ACIDS

JOTEX GRADE,

JOTEX SPECIAL GRADE

Used in drugs, Pharmaceuticals

Cosmetics, chemicals and plastics

JOSTRIC SPECIAL GRADE Chemicals, calcium carbonate

JOSTRIC GRADE Metal polish, Grease, Metallic Polish,PVC

Stabilizers and chemicals

JOCIL-9

Metal polish, Grease, Metallic polish PVC

stabilizers and chemicals

JOSTRIC-11 PVC

JOMEL Rubber, Cement and Paint,

RUBBER GRADE Rubber, Metallic polish

JOCIL Rubber, Metallic Polish, Grease.

30

COMSUMPTION PATTERN OF SREARIC IN DIFFERENT

INDUSTRIES

SI.NO

Rate

(%)

Name of the industry

Quantity

(M.T)

Industry

Share(%)

Growth

1 Rubber-type 13000 17 5

2 Rubber-Non tyre 12000 16 36

3 Stearates/Stabilizers 15000 24 7

4 PVC/polymers 9000 12 65

5 Cement paints 3000 4 69

6 Chemical auxiliaries 6000 8 5

7 Calcium carbonate 3000 4 8

8 Food/pharmacy 1000 1 30

9 Metal polishes 3000 4 5

10 Lubricants/greases 3000 4 8

11 Cosmetics 3000 4 30

12 Others 2000 3 5

31

PRESENT MARKET SHARE OF STEARIC ACID MANUFACTURES WISE

NAME OF THE

MANUFACTURER

QUANTITY

(MT)

MARKET

SHARE (%)

REGION

Godrej Soaps Ltd.,

VVF Limited

Jocil Limited

FFF Limited

Nahar Agro

Raj Agro

OCL & Thapar

Wipro Limited

Siris Agro Limited

Soda Agro Limited

Rayalaseema Alkalies Ltd.

Swastik & Oieo Chemicals

Imports

17000

9000

10000

6000

5000

5000

2000

2000

5000

2000

5000

7000

1000

22%

12%

13%

8%

7%

7%

3%

3%

7%

3%

7%

9%

1%

North

North

A.P

A.P

North

North

North

Karnataka

A.P

A.P

A.P

A.P

32

COMPANY PROFILE

The company was incorporated on 20

th

February, 1978 as per the certificate of

incorporation no.2260 granted by the register of companies, A.P., Hyderabad under the name

and style of ANDHRA PRADESH OIL AND CHEMICAL INDUSTRIES LIMITED. The

unit was promoted as public limited company in joint venture by the Andhra Pradesh

industrial development corporation limited, Hyderabad and jayalakshmi cotton and oil

products private limited; a company belongs to jayalakshmi group.

During the year 1982, the share stock of APIDC in the company has been reduced

consequently the name of the company has changed to JAYALAKSHMI OIL AND

CHEMICAL INDUSTRIES LIMITED on 12

th

April, 1982 as per the fresh certificate of

incorporation granted by the registrar of companies. Again during the year 1988, the major

share holding of the company has been acquired by the Andhra sugars limited, tanuku and the

company has become a subsidiary unit of the Andhra sugars limited effective from 27

th

October, 1988.

Later on to avail the benefit of the well noted brand name JOCIL limited

effectively from 17

th

September, 1992as per the fresh certificate of incorporation granted by

the registrar of companied, A.P. Hyderabad.

As such the present name of the company is

JOCIL LIMITED

33

LOCATION OF THE COMPANY

The company is located at Dokiparru in Medikonduru mandal of Guntur district in

the state of Andhra Pradesh. The area was declared as backward on by the government of

Andhra Pradesh. It is well connected by both road and rail only 45KM from Vijaywada, with

industrially located.

HISTORY OF THE COMPANY

A Public Limited Company incorporated in February 20, 1978 as Andhra Pradesh Oil

and Chemical Industries Ltd.

Listed in Madras and Hyderabad Stock Exchanges in India.

Renamed as Jayalakshmi Oil and Chemical Industries Limited in 1982.

Became a Subsidiary of the Andhra Sugars Ltd (ASL) on 27 October 1988.

ASL Group of companies have diversified interests in sugar, Chemicals such as

Caustic Soda, Acetic Acid, Industrial Alcohol, Sulfuric Acid, Aspirin etc., and also

Petrochemicals and Textiles at various location in Andhra Pradesh, India.

ASL is also the Sole Supplier of Rocket Fuel (UDMH) to ISRO.

Renamed once again as Jocil Limited in 1

st

September 1992.

25 years of experience in the field of manufacture of Stearic Acid Flakes, Fatty Acids,

Toilet Soap, Soap Noodles and Glycerin.

ISO 9001:2000 Certification by DNV in year 2004.

34

A 6 Mw Biomass Cogeneration Power Plant commissioned in 2001, to meet captive

requirements of Steam & Power.

Exports Surplus Power to APSPDCL (Public Utility Company).

Continuous unbroken dividend paying record since 1988-89.

Celebrated Silver Jubilee in the year 2004.

Stearic Acid Flakes are available in various grades for use in Pharmaceutical,

Cosmetics, Textiles, Paints, Plastics, Tires, Tread Rubber, Metal Polish and other

industries.

PROFILE OF JOCIL LIMITED:

Type of company - Large scale unit

Nature of company - Manufacturing

OWNERSHIP AND MANAGEMENT:

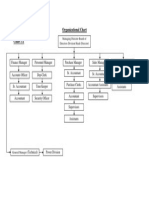

BOARD OF DIRECTORS

Dr. Mullapudi Harischandra Prasad Chairman

J. Murali Mohan, Managing managing Director

P. Narendranath Chowdary Director

M. Thimmaraja Director

Y. Narayanarao Chowdary Director

V. S. Raju Director

K. Srinivasa Rao Director

M. Gopalakrishna Director

Subbarao V. Tipirneni Director

35

SENIOR EXECUTIVE

Mr.p.kesavulu reddy president & secretary

BANKERS

Andhra bank Guntur

State bank of India Guntur

AUDITORS

Brahmmaiah & co Guntur

36

37

BOARD OF DIRECTORS

The board of directors of the company consists of 9 directors comparing of

promoter directors, additional director. The board of directors will meet once in three months

to review the working results, operations, financial and administrative matters and any other

policy matters of the company. The managing director being responsible to the board shall

appraise the board of directors about the progress of the company.

MANAGING DIRECTOR

The managing director is the chief executive of the organization and looks after the

day to day operations of the company. He is the top person in the hierarchical system of

organization. He does business operations with the assistance of all the departmental heads.

He is the pivotal of the organization.

PRESIDENT & SECRETARY

He is the in charge of administrative and finance departments.

He looks after all the matters relating to general administrative, secretarial, central

excise, purchases, account, store, personnel and all other matters relevant for smooth

operations of the company. He coordinates matters with all the departmental heads and takes

policy decisions in the absence of the managing director.

GENERAL MANAGER

He is the head of the production department. He looks after the fatty acid plant & glycerin

plant. He controls the overall production activities a term of engineers, supervisors and

helpers assist him.

38

SENIOR MANAGER-ELECTRICAL

He is the in charge of power house and responsible for all electrical installation in the

company. With the help of engineers, supervisors and electricians he looks after the matters

like power supply, operation of diesel generation sets etc...

MANAGER PRODUCTION (SOAP)

Production manager looks after the production of toilet soap and assisted by various

supervisory & other staff members.

ASST.MANAGER (ACCOUNTS)

Finance manager looks after all the works relating to audit books, commercial tax

matters and takes car4e of the accounting systems in the company. He will attend to the work

of income tax assessment orders given by the department. He will further attend to the work

of submission of working capital limits applications to the banks and submit to the banks the

required information with regard to sanction of working capital limits to the company.

The Company Policies are:

Quality

Consumer Safety

Health and Environment

39

STAFF AND WOEKERS PARTICULARS

Particulars No. of employees

1. Administration 31

2. Accounts 11

3. Marketing 5

4. Edp 3

5. Time office 7

6. Stores 13

7. Security 19

8. Transport 4

9. Production 14

10. Labour 19

11. Etp 6

12. Maintenance 4

13. Soap plant 139

14. Electrical 40

15. Power plant 102

16. Civil 6

17. Fatty acid plant 52

18. Hydrogenation plant 28

19. Flaker 6

20. Cell room 4

21. Oxygen plant 7

22. Dm plant 6

23. Fbc boiler 11

24. Workshop 49

TOTAL 586

40

OBJECTIVES OF JOCIL LIMITED

The main objective of company is to manufacture fatty acid and toilet soaps. The company

received letter of inter firm deferment of industrial development, ministry of industries,

government of India, Delhi. Enhanced the annual license capacity of fatty acids, glycerine

and fatty acids plant from 6205 M.T. per annum to 15510M.T. with effect from February

1991; this enhanced capacity came into operation. Later the company enhanced the capacity

came into operation. Later the company enhanced the capacity to 37500M.T. in March 1995.

Company Philosophy:

To conduct its operations- with Honesty, integrity and Transparency

To be the Market Leader in its Field of operation through Continual Improvement in

efficiency and Quality of Products and Services.

To have concern for Employees, Shareholders, Customers and Business Associates

alike.

To Serve Society through Industry.

To care for the Environment and the world in which we live.

MISSION OF JOCIL

JOCIL Ltd. Mission is to move up the levels of uncompromised customer care and to

e valued supplier of high quality products and services.

.

41

STRENGTHS OF JOCIL LTD

State of the art manufacturing capabilities

A team of professionals and experts

Wide distribution network

Market expertise

Consistent quality

Timely deliver.

FUNCTIONS OF JOCIL LTD

To produce, manufacture, refine, process import, sell and generally to deal in all

kinds of fatty acids and soaps and in connection there with the construction of

factories and workshop.

To fabricate manufacture and deal in all kinds of fatty acids plants.

To manufacture various kinds of soaps under contract basis for HLL.

The company organizes annual general body meeting where it submits all the four

quarterly reports regarding the actual performance with standard performance and

predicts the course of variances.

To receive, consider and adopt the profit & loss a/c for the year ended and prepares

balance sheet as at that date.

To declare dividends on equity shares.

42

INDUSTRIAL LICENCING

As the value of fixed assets envisaged in the project is less than Rs 3.3 crors the

industrial license is not required for setting of the project. The company has been registered

with directorate general technical development (DFTD),government of india,New delhi

bearing No :DGTD/HQ/D-S-S/C-26(N)/SE/79 with their latter dated 21-5-1979 and 31-3-

1990 for the manufacture of -

1. Processed Fatty Acid/Industrial Fatty Acids 9000

2. Glycerin 900

3. Toilet soaps 5000

Share Holders Pattern:-

31-03-2012

promoters 55.02%

(The Andhra Sugars Ltd, Holding

public 33.63%

Institution (ICICI &ISEC) 13.35%

Boolies corporate 1.30%

Face Value of Share Rs.10/- each

43

JOCIL LIMITED ACCOUNTING POLICIES

GENERAL

The accounts are prepared on historical cost convention and in accordance with

normally accepted accounting standards.

FIXED ASSETS

Fixed assets are stated at historical cost less accumulated depreciation

DEPRICIATION

Depreciation is provided on the written down value method at the rates and in the

manner specified in schedule XIV of companies act, 1956.`

INVESTMENTS

Long term investments are stated at cost and income there on is accounted for on

accrual. Provision towards decline in the value of long term investments is made only

when such decline is other than temporary.

Sales

Sales are of inclusive of excise duty, packing charges and sales tax.

RESEARCH AND DEVELOPMENT EXPENDITURE

Revenue expenditure is charged to profit & loss account and capital expenditure is

added to the cost of fixed assets in the year in which it is incurred.

44

RESEARCH AND DEVELOPMENT (R&D)

Specific areas in which R&D carried out by the company quality improvement of the

products and efficient use of utilities

Benefits derived as a result of above R&D. Improved product quality, quantity and

conservation of utilities.

Future plan of action utilization of various field resources as fuel in power plant

Enhancing capabilities through use of latest technology in fatty acid.

PERFORMANCE AND ACHEIVEMENTS OF JOCIL

1. Jocil leading manufacture of all kinds of fatty acids. This also manufacturesoaps.

2. Jocil supplies different grades of stearic acid and other fatty acids to other

manufacturing companies of pharmaceutical, chemicals,plastic etc.

3. Jocil supplies fatty acids to meet their specific requirement stearic acid,oleic acid

etc.

4. Jocil manufactures soaps on contract basis to HLL.

5. Jocil supplies soap noodles of mango brand to m/s Calcutta company.

6. Jocil production of quality goods is due to he following factors .

a) Usage of good quality raw materials like bran oils, coconut oils, cotton seed oils etc.

b) The processing and purification of fatty acids is done by using latest technology.

c) The technology and requirement of jocil has been imported from C.M.B.,Italy .

d) Maintence of quality control by experienced and committed operating personnel.

e) Toilet soaps and glycerin are manufactured as per BISC(formerly known as ISI )

standards.

f) It uses high quality chemicals for the purification and processing of fatty acids.

45

g) It maintains international standards in manufacturing two types products.

PRODUCTS OF JOCIL

Jocil has set up a modern plant for the manufacturing of fatty acids, toilet soaps and

refined glycerin. The major equipments were imported with lastest technology. The products

manufacture of international standards to suit different industrial users Jocil is manufacturing

two types products.

1.Industrial goods(chemical)

2.Consumers goods(soaps)

Fatty acids ,refined glycerin and fatty acids pitches fall under the category of

industrials goods where as soaps come under the category of consumer goods .

Fatty acids are manufactured from vegetable oils and fats .There are different types fatty

acids for different industrial applications .The following are the different kinds of fatty acids

which can be manufacture in JOCIL

1. Crude fatty acids of vegetable acids &fats.

2. Distilled fatty acids of vegetable acids &fats.

3. Hydrogenated fatty acids of vegetable acids &fats.

Out of the above type fatty acids. JOCIL is manufactured the following fatty acid

which is a major portion of their sale.

1. Stearic acid

2. Oleic acid

3. Distilled &hydrogenated fatty acids.

46

REFINED GLYCERIN

There varieties of refined glycerin are procedure namely.

1. Chemically pure grade (c.p)

2. Industrial white (w.h)

3. Pale straw

4.Glycerin is used in pharmaceuticals explosives, paints stroke ink, chemicals, tooth paste

etc.

OLEIC ACID

Only one variety of oleic acid namely commercial grade is manufactured by

JOCIL.It is used to in fertilizers, cutting oils, liquid soaps and other chemicals manufactures.

DISTILLED FATTY ACID

The fatty acids of different oils are tailor made products to suit different industrial users

specifications.

At present JOCIL is manufacturing distilled hydrogenated rice bran fatty acids,

distilled cotton seed oils fatty acids, distilled coconut fatty acids.

They plan to manufacture some varieties of fatty acids in future.

Distilled hydrogenated rice bran fatty acids and distilled plan oil fatty acids are also being

manufactured for consumption in soap plant for the manufacture of toilet soaps.

FATTY ACIDS PITCHES

Fatty acid pitches are obtained during distillation of crude fatty acids.

These products are supplied yo laundry soaps ,grease ,foundry chemical uses.

Raw Materials and Products:-

Raw Materials:

Rice Bran Oil

Rice Bran Acid Oil

Crude Palm Oil

47

Palm Fatty Acid Distillate

Palm Kemel Oil

Coconut Oil

Hydrogenated Rice Bran Oil

Neem

Products:

Fatty Acids

Stearic Acid

Distilled Rice Bran Fatty Acid

Hydrogenated Rice Bran Fatty Acids

Oleic Acid

Toilet Soap Noodles

Toilet Soaps

Refined Glycerin

Rice Bran Oil Pitch

Industrial Oxygen

Plants in Industry:-

Fat splitting plant

Fatty Acid Distillation

Fatty Acid Hydrogenation plant

Electrolyser

Cell Room

Oxygen Plant

Faker section

Sweet water Evaporation

Glycerin Distillation

D.M. water plant

Soap plant

Power plant

48

CASH MANAGEMENT IN JOCIL LIMITED

It is done by preparing a cash budget availing the information from the pay order

books, which will in turn, help to eliminate over keeping of cash. To reduce the delay of

clearing the cheques, JOCIL provides the facility of electronic fund transfer. The cash

management helps JOCIL limited to estimate the cash requirements and other day-to-day

payments. Jocil limited collected the money in the following two ways.

Concentration banking

Electronic funds transfer

1.CONCENTRATION BANKING

Concentration banking is a means of accelerating the flow of funds of the firm by

establishing strategic collection centers. Instead of a single collection centre located the

company had quarters multiple collection centers are established.

This system helps to the company to shorters the period between the times. Customers mail

their payments and the time the company has the use of funds .The company instructs its

customers in a particular geographic area to remit their payments the collection center in that

area. When the payments are received they are deposited in the collection centers or local

bankers. Surplus funds transferred from these local accounts to a concentration bank .

Generally the bank act as the collection centers. Jocil limited is having different centers for

collection i.e., banks accounts allover the country.

CURRENT ACCOUNT WITH ANDHRA BANK (LEAD BANK)

Name of the branch purpose

Main branch, guntur OCC A/c

49

CURRENT ACCOUNT WITH OTHER BANKS

Name of the bank

Address purpose

State bank of india

Main branch, Guntur OCC

State bank of Bikaner

operation

Khari baoli,Delhi Depot

Axis bank Naaz centre, Guntur Current A/c

CONTROL OF DISBURSEMENTS

We have already studied that along with the fastening of collection the management

of cash is also concerned with the control of disbursements.

The one and only procedure and followed by jocil limited for slowing of

disbursement is payment at the head office branch account. By doing so the cheque given to

out station paries will be out standing for sometime. The advantage of delays postal

activities deposition of cheques, encashment area utilized well by the company .Generally

the head office pays out station parties by demand draft and local parties with cheque.

MARKETABLE SECURITIES

Jocil limited I not holding any sort of marketable securities instead of investing in

marketable securities it is holding some field deposits which yield an interest amount

@10%p.a. if any need of cash is faced these deposits can be easily transferred to cash with a

cost of 1% of the amount.

The current account deposits shown in the table are those that are the credit balances

with the sales deposits accounts. These will instantly transfer to the main branch overdraft

account, the current will not yield any interest so this is transferred to the overdraft account

where there is debit balance .

By doing so the interest change on these balances by the bank can be decreased to some

extent.

50

Future out look

70 percent to 80 percent of the installed capacity of fatty acids is fully utilized in our country

and there is scope for 100% usage of the installed capacity.

A major reason behind this rate of consumption of Fatty Acid in India, compared to

developed countries is that they have not yet achieved that level of sophistication in demand

to utilize the versatile fatty acid derivatives. However, India is fast developing country and

auxiliary chemical industries are growing fast, where application of fatty acid derivatives are

very much a necessity.

Separation and purification of fat and oils is an important aspect of this fatty acid industry

and modern development in these lines have expanded the field of application of fatty acid to

industries like plastics, fibers, surfactants etc

SOAP MANUFACTURING

Different types of distilled fatty acids and hydrogenated fatty acids are mixed to

obtain desired quality to toilet soaps. Differed types are manufactured to satisfy different

types of users. Generally features of toilet soaps ate good lather, good perfume stability and

longer use.

51

Process of soap manufacturing

Saponification

Reaction with caustic soda

Neat soap

Spray drying (to reduce moisture to desired

level)

Soap noodles

Amalgamation (addition of color, perfume)

Mixing (homogenization)

Extrusion (taking to soap bar)

Soap bar

Stamping

packing

Finished soap

Fatty acids

52

TYPES OF RATIOS:

Liquidity ratios

Leverage ratio

Activity ratio

Profitability ratio

1. LIQUIDITY RATIO

Liquidity ratios analyses the short term solvency of a company. The reason for

calculating liquidity ratios is to find out if a firm has adequate funds to pay their current

requirements whenever they are due. If a firm is able to meet its short term obligations it

depicts its financial strength ad solvency. Creditors that supply short term loans are keen to

know the companys liquidity position. The liquidity ratio is required for an understanding in

preparing cash budgets and cash flow statements of a company

Current ratio

Quick ratio

Cash ratio

Current ratio:

A current asset consists of cash as well as the assets which can be converted into cash

within a year. The current assets that are included are marketable securities, debtors and

inventory. If there are any prepaid expenses they will be included as a part of current assets as

they are payments that the firm has already paid without any future liabilities in them.

Quick ratio:

The quick ratio is useful to depict and liquid current assets as a ratio of current

liabilities. it takes into account only those current assets which can be immediately converted

into cash without any loss in value.

53

Cash ratio:

Another test of liquidity in a company is through its cash ratio. Cash and marketable

securities are measured with the current liabilities.

2. LEVERAGE RATIOS

Leverage ratios indicate the debt paying ability of a company. There are two

types of debts in a company. These are short term and long term debts. Leverage ratios

calculate the proportion of debt in total financing of a company. It is useful for bankers and

creditors to find out the paying capacity of the company.

It is also useful for shareholders to find out the debt position of the

company and the return on total capital employed in the company. Leverage ratios examine

the long term solvency of the company.

Debt equity ratio:

Total debt ratio:

Proprietary ratio

Debt equity ratio:

This ratio is a measure of long term financial solvency of a company. It shows the

relationship between owners capital and borrowed capital.

54

Total debt ratio:

The total debt ratio can be calculated in different ways. One method is to calculate

the total debt divided by the total debt plus net worth of the shareholders. It depicts the lender

contribution for each rupee of the owners contribution.

Proprietary ratio:

The ratio throws light on the general financial strength of the company. It is also

regarded as a test of the soundness of the capital structure. Higher the ratio or share of

shareholders in the total capital of the company better is the long-term solvency position of

the company

3. ACTIVITY RATIO

The efficient management of assets helps in generating a good volume of sales. This

provides a good return to the owners and the creditors of a company. In ratio analysis

turnover ratios are used to evaluate the efficiency of the use of assets.

These turn over ratios are called activity ratios. They indicate the relationship

between sales and assets in a company. From these ratios a person can find out how quickly

the firm is able to convert is expressed either in percentages or number of times to depict the

result.

A higher turnover ratio will indicate that the resources are utilized efficiently. The

following activity ratios are commonly used to find out utility of the resources.

Debtors turnover ratio

Collection period ratio

Total assets turnover ratio

Fixed assets turnover ratio

Current assets turnover ratio

Working capital turnover ratio

55

Debtors turnover ratio

A firm has to extend its sales by selling goods on credit to customers. Cash sales are

very good for a company. But sales are limited because customers want some time interval to

make their payments.

To enhance the sales of a company there have to be sales made on credit. A

company has to be careful in selecting customers to whom credit can be extended.

Collection period ratio:

This ratio measures the efficiency of collecting the payments by the company.

The firm should have a good but firm credit policy. If it grants 15 days credit policy it should

be able to collect its funds from the debtors after the interval date.

Total assets turnover ratio:

The total assets ratio is calculated to get a view of the turnover of all the assets

resources in a company.

Fixed assets turnover ratio:

This ratio exclusively indicates the turnover of sales from net fixed assets.

Another turnover ratio between sales and current assets can also be calculated.

56

Current assets turnover ratio:

This ratio calculates the efficiency of current assets in comparison with sales of a

company.

Working capital turnover ratio:

This ratio measures the turnover of sales with working capital. Current liabilities are

reduced from the current assets the amount is called working capital.

4.PROFITABILITY RATIOS

Profitability ratios indicate the operating efficiency of a company by measuring

the revenues of a company. Profitability in a company is essential because a commercial

enterprise must sustain itself. However, social obligations, employees satisfaction,

shareholders, debtors and creditors interest have to be kept in mind while working towards

profit. To measure profitability the ratios can be calculated in relation to sales or investment.

Net profit margin ratio

Gross profit ratio

Net profit ratio:

Gross profit is measured by deducting the cost of good sold from the sales of a company.

However, in India gross profit is defined differently by organizations depending on the

interest of the organization. Profits can be calculated before tax or after taxes.

57

Gross profit ratio:

Gross profit ratio may be indicated to what extent the selling prices of goods per

unit may be reduced with out incurring losses on operations.

GROSS PROFIT RATIO = GROSS

PROFIT / NET SALES=100

Net profit ratio

This is used to measure the overall profitability and hence it very useful to

proprietors. The ratio is very useful as if the net profit is not sufficient, the firm shall not be

able to achieve a satisfactory return on its investment.

NET PROFIT RATIO = NET PROFIT / NET SALES*100

Operating profit ratio

This ratio expresses the relationship between operating profit and sales with the help of

the ratio one can judge the managerial efficiency which may not be reflected in net profit

ratio.

OPERATING PROFIT RATIO = OPERATING PROFIT /NET SALES*100

EARNING PER SHARE RATIO

Earning per share ratio helps in determine the market price of the equity share of

company. It helps in deciding whether equity share capital is being effectively used or not.

EARNING PER YIELD = EPS / MARKET VALUE PER SHARE*100

58

CHAPTER- IV

RATIO ANALYSIS IN

JOCIL LTD

59

DATA ANALYSIS AND INTERPRETATION

LIQUIDITY RATIO:-

Current ratio:-

Current ratios are a measure to find out the liquidity of the business of a company. It

is calculated in the following way.

Current ratio = currents assets/current liabilities

Current assets = debtors, cash, inventory, bills receivable, short term investments

Current liabilities = short term bank loan, creditors, bills payable, provisions, bank

overdraft.

Table-1.1

Year Current assets Current liabilities Ratio

2008-09 624866578 190479571 3.28

2009-10 854200067 30175603 2.83

2010-11 997737475 391631987 2.54

2011-12 1359287561 839692182 1.61

2012-13 1630346325 1012327536 1.61

60

CURRENT RATIO:

Interpretation:

The current ratio defined as the relationship between current assets and current

liabilities. As can be from the table 1.1 current ratio was 2.83 & 2.54 in 2008-2009, 2008-

2010 years respectively. It was decreased in the year 2009-10 to 2.54 from 2.83 and the

increased in the next year 2010-11 to 2.64 from 2.54 and not recovered in the years 2011-

12, 2012-2013 to 2.64 from 1.61.

The JOCIL limited it is maintaining the current ratio, which is more then ideal ratio

2:1 in all years.

0

0.5

1

1.5

2

2.5

3

3.5

2008-09 2009-10 2010-11 2011-12 2012-13

61

Quick ratio:-

Quick ratio should be 1:1 to indicate a satisfactory healthy financial condition of a

company. This test is considered to be better than the current ratio because it is able to assess

the liquidity of a company since it includes only quick conversion assets.

Quick ratio=current assets-stock/current liabilities

Quick assets=current assets-inventory

Table-1.2

Year Liquid assets Current liabilities Ratio

2008-09 485948545 190479571 2.55

2009-10 685232006 30175603 2.27

2010-11 828769414 391631987 2.11

2011-12 899469880 594510225 1.59

2012-13 1731751809 839692182 1.60

62

QUICK RATIO

Interpretation:

The standard norm of quick ratio is 1:1 the quick ratio of Jocil Ltd. was 2.51 in 2006-

07 and it was increased to 2.55 in the year 2007-08. it was 2.27, 2.11 & 1.51 in the year 2008-

09, 2010-2011 respectively. The company performance and maintain liquid in very high

level.

0

0.5

1

1.5

2

2.5

3

2008-09 2009-10 2010-11 2011-12 2012-13

63

Cash ratio:-

Absolute liquid ration is represented by cash and near cash item. It is a ratio of

absolute assets to current liabilities. In the computation of this ratio only the absolute liquid

assets are compared with the liquid liabilities.

Absolute liquid ratio =absolute liquid assets/current liabilities

Table-1.3

Year Absolute liquid assets Current liabilities Ratio

2008-09 64796749 190479571 0.34

2009-10 239149881 30175603 0.79

2010-11 103757796 59,45,10,225 0.75

2011-12 22265007 839692182 0.24

2012-13 56338144 1012327536 0.30

64

CASH RATIO

Interpretation:

A standard norm of 0.5:1 absolute liquid ratio is considered as an acceptable norm.

Hear the Jocil Ltd cash liquid ratio showed that 0.59,0.34, 0.79, 0.26, 0.075 in the year 2006-

07, 2007-08, 2008-09, 2009-10, 2010-11 but after it in

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

2008-09 2009-10 2010-11 2011-12 2012-13

65

LEVERAGE RATIO:-

Debt equity ratio:-

It measures the ratio of long term debt to share holders funds. Idle ratio usually

recommended is 2:1 as such if the debt is less than two times the equity. The logical

conclusion is that the financial structure of the concern is sound.

Debt equity ratio=long term debt /net worth

Table-2.1

Year Total debt Net worth Ratio

2008-09 60840461 886403369 0.03

2009-10 113086409 1048292529 0.06

2010-11 481661744 1201279603 0.40

2011-12 14752083 1274707156 0.01

2012-13 10788572 1358570216 0.03

66

DEBT EQUITY RATIO

Interpretation:

This ratio includes how much the company is leveraged (in debt) by comparing what

is owned. A high debt to equity ratio could indicate that the company may be over- leveraged

and should look for ways to reduce its debt.

How the Jocil Ltd debt equity ratio was highest in 2006-07 i.e., 0.42 and 2

nd

highest is

0.40 in 2010-11 and least ratio in 2007-08 i.e., 0.03. This ratio is showing a mixed trend.

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

2008-09 2009-10 2010-11 2011-12 2012-13

67

Total debt ratio:-

Debt ratio analysis is the long term solvency of a firm. It indicates the preparation of

the interest being debt in the capital structure.

Total debt ratio=total debt/capital employed

Table-2.2

Year Total debt Capital employed Ratio

2008-09 60840461 947243830 0.03

2009-10 113086409 1161378938 0.06

2010-11 481661744 1682941347 0.09

2011-12 14752083 1274707156 0.01

2012-13 10788572 1358570216 0.03

68

TOTAL DEBT RATIO

Interpretation:

The debt ratio is highest in the year of 2006-07 i.e., 0.29 and fall down in the year

2007-08 i.e., 0.03 and moves increased from year to year from 2007-08 to 2010-11.

0

0.02

0.04

0.06

0.08

0.1

2008-09 2009-10 2010-11 2011-12 2012-13

69

Proprietary ratio:-

The ratio throws light on the general financial strength of the company. It is also

regarded as a test of the soundness of the capital structure. Higher the ratio or share of

shareholders in the total capital of the company better is the long-term solvency position of

the company.

Proprietary ratio =net worth/total assets

Table-2.3

Year Net worth Total assets Ratio

2008-09 886403369 800206864 1.18

2009-10 1048292529 1650431451 0.70

2010-11 1201279603 959021319 1.25

2011-12 1274707156 223820856 0.56

2012-13 1358570216 2493929873 0.58

70

PROPRIETARY RATIO

Interpretation:

The proprietary ratio is the relationship between equity and total assets. The table

shows that the ratio in the year 2010-11 is high. The table shows ups and downs year on

year. It has one year upwards and another year it will decrease and again recovery his status.

From the above proprietary ratio of Jocil Ltd. It is clear that the company is

maintaining a mixed trend.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

2007-08 2008-09 2009-10 2010-11 2011-12 2012-13

71

ACTIVITY RATIO

Debtors turnover ratio:-

Debtors turnover ratio indicates the velocity of debt collection of a firm. In simple

words it indicates the number of times average debtors are tuned over during a year.

Debtors turnover ratio =sales/debtors

Table-3.1

DEBTORS TURNOVER RATIO

Year

Sales

Debtors

Ratio

2008-09 2141379194 228771563 9.36

2009-10 3235031620 355316081 9.10

2010-11 4186169010 438561908 9.54

2011-12 4301475544 468117277 9.18

2012-13 4534635784 531782979 8.52

72

DEBTORS TURNOVER RATIO

Interpretation:

The debtors turnover ratio was 9.54 in the year 2010-11 and it is highest. In the year

of 2006-07 and 2007-08 of 6.21 and 6.19. It was increased in the year 2008-09 i.e., 9.36 and

decreased in the year of 9.10 of 2009-10 and again recovered in the year 2010-11

i.e., from 9.10 to 9.54.

8

8.2

8.4

8.6

8.8

9

9.2

9.4

9.6

2008-09 2009-10 2010-11 2011-12 2012-13

73

Collection period ratio:-

It represents the average no. of days for which a firm has to wait before their

receivable is converted into measure the quality of debtors. Generally, the shorter the average

collection period the better is the quality of debtors.

Average collection period ratio=365/debtor turnover ratio

Table-3.2

Year 360 Debtors turn over ratio Ratio

2008-09 360 9.36 38.46

2009-10 360 9.10 39.56

2010-11 360 9.54 37.73

2011-12 360 9.18 39.21

2012-13 360 8.52 42.25

74

COLLECTION PERIOD RATIO

Interpretation:

The ratio of Jocil Ltd. was showing that 2006-07 the ratio was 57.97 later it was

increased to 58.15 due to increased in sales. But after the ratio was decreased in 2008-09 i.e.,

38.46 and least in the year of 2010-11 i.e., 37.73.

35

36

37

38

39

40

41

42

43

2007-08 2008-09 2009-10 2010-11 2011-12 2012-13

75

Total assets turnover ratio:-

The total assets ratio is calculated to get a view of the turnover of all the assets

resources in a company. The following formula is used to compute the ratio.

Total assets turnover ratio=sales/total assets

Table-3.3

Year Sales Total assets Ratio

2008-09 2141379194 800206864 2.67

2009-10 3235031620 1650431451 1.96

2010-11 4186169010 959021319 0.84

2011-12 4301475544 2238208567 1.92

2012-13 4534635784 2493929873 1.81

76

TOTAL ASSETS TURNOVER RATIO

Interpretation:

This ratio indicates how much sales generated when one rupee investment in total

assets i.e., fixed and current assets. For example the current year 2010-11 total assets turnover

ratio 0.84 implies that Jocil limited a sale of Rs.0.84 for one rupee investment in fixed and

current assets together.

0

0.5

1

1.5

2

2.5

3

2008-09 2009-10 2010-11 2011-12 2012-13

77

Fixed assets turnover ratio:-

This ratio exclusively indicates the turnover of sales from net fixed assets. Another

turnover ratio between sales and current assets can also be calculated.

Fixed assets turnover ratio=sales/fixed assets

Table-3.4

Year Sales Fixed assets Ratio

2008-09 2141379194 498450861 4.29

2009-10 3235031620 652693976 5.88

2010-11 4186169010 804045285 1.98

2011-12 4301475544 804252439 5.34

2012-13 4534635784 816571140 5.55

78

FIXED ASSETS TURNOVER RATIO

Interpretation

This ratio measures the relationship between sales and fixed assets. The fixed assets

turnover ratio was 1.98 in 2006-07 where it increased to 2.44 and 4.29 in 2007-08 and 2008-

09 years respectively. But later it is decreased to 2.44 and 1.98 in 2009-10 and 2010-11

respectively.

0

1

2

3

4

5

6

2008-09 2009-10 2010-11 2011-12 20112-13

79

Current assets turnover ratio:-

This ratio calculates the efficiency of current turnover ratio assets in comparison with

sales of a company.

Current assets turnover ratio=sales/current assets

Table-3.5

Year Sales Current assets Ratio

2008-09 2141379194 301756003 7.09

2009-10 3235031620 997737475 3.16

2010-11 4186169010 1574976034 2.65

2011-12 4301475544 1359287561 3.16

2012-13 4534635784 1630346325 2.78

80

CURRENT ASSECTS TURNOVER RATIO

Interpretation:

This ratio indicates how much sales generated when one rupee investment in total

current assets. For example the current year 2010-11 current assets turnover ratio 2.65

implies that that Jocil limited a sale of Rs.2.65 for one rupee investment in current assets.

0

1

2

3

4

5

6

7

8

2008-09 2009-10 2010-11 2011-12 2012-13

81

Working capital turnover ratio:-

This ratio measures the turnover of sales with working capital.

Working capital turnover ratio=sales/current assets-current liabilities

Table-3.6

Year Sales Working capital ratio ratio

2008-09 12141379194 552444064 3.87

2009-10 3235031620 606131790 5.33

2010-11 4186169010 980465809 4.26

2011-12 4301475544 818319599 5.25

2012-13 4534635784 835350799 5.42

82

WORKING CAPITAL TURNOVER RATIO

Interpretation:

It measures the relationship between working capital and the sales. The companys

working capital turnover ratio was 1.11 in 2006-07 where it increased to 1.56 in the next year

due to increased in sales and later it increased to 3.87 in the 2008-09. It remains increased

to5.33 in the 2009-10 and decreased in the year 2010-11 i.e., 4.26 here the ratio is showing a

mixed trend.

0

1

2

3

4

5

6

2008-09 2009-10 2010-11 2011-12 2012-13

83

PROFITABILITY RATIOS:-

Net profit ratio:-

The net profit is a good indicator of profitability as its takes into consideration all

these expenses including interest and taxes.

Net profit ratio=profit after tax/sales

Table-4.1

Year Profit after tax Sales Ratio

2008-09 96905513 1277135937 0.04

2009-10 213670150 2141379194 0.06

2010-11 194274652 32335031620 0.04

2011-12 125037026 4186169010 0.02

2012-13 146206069 4337557560 0.03

84

NET PROFIT RATIO

Interpretation:

This ratio measures the net profit in net sales or relationship between net profit and

net sales. The net profit ratio in the year 2006-2007 was 0.05% the ratio in the year 2007-08

was increased to 0.06%. Later it increased to 0.04% in 2008-09 and thereafter the ratio

increased to 0.06% and 0.04% in 2009-10, 2010-11 respectively.

0

0.01

0.02

0.03

0.04

0.05

0.06

2008-09 2009-10 2010-11 2011-12 2012-13

85

JOCIL LIMITED

BALANCE SHEET OF JOCIL LIMITED AS ON 31-03-2009

SCHEDULE

As on

31-03-2009

Sources of funds

Shareholders funds

Capital 4,44,10,500

Reserves & surplus 84,19,92,869

Loan funds:

Secured loans 2,82,41,585

Unsecured loans 3,25,98,876

Net Deferred tax liability 10,99,07,275

Total 1,05,71,51,105

Application of funds

Fixed assets:

Gross block 1,09,38,52,232

Less-depreciation 61,05,11,307

Net block 48,33,40,925

Capital work-in-progress 1,51,09,936

49,84,50,861

Investments 62,56,180

Current assets, loans & advances:

Inventories 16,89,68,061

Sundry debtors 22,87,71,563

Cash & bank balances 23,91,49,881

Other current assets 1,87,84,44

Loans & advances 21,54,32,118

85,42,00,067

Less: Current liabilities and provisions:

Current liabilities 11,79,36,595

Provisions 18,38,19,408

30,17,56,003

Net current assets 55,24,44,064

Total 1,05,71,51,105

86

JOCIL LIMITED

BALANCE SHEET OF JOCIL LIMITED AS ON 31-03-2010

SCHEDULE

As on

31-03-2010

Sources of funds

Shareholders funds

Capital 4,44,10,500

Reserves & surplus 1,00,38,82,029

Loan funds:

Secured loans 3,47,93,615

Unsecured loans 7,82,92,794

Deferred tax liability 10,74,56,953

Total 1,26,88,35,891

Application of funds

Fixed assets:

Gross block 1,21,00,02,136

Less-depreciation 65,94,27,245

Net block 55,05,74,891

Capital work-in-progress 6,28,35,018

Advance for capital goods 39,28,35,018

65,26,93,976

Investments 1,00,10,125

Current assets, loans & advances:

Inventories 29,76,92,856

Sundry debtors 35,53,16,081

Cash & bank balances 10,37,57,796

Other current assets 5,35,381

Loans & advances 24,04,35,361

99,77,37 475

Less: Current liabilities and provisions:

Current liabilities 15,22,85,441

Provisions 23,93,20,244

39,16,05,685

Net current assets 60,61,31,790

Total 1,26,,88,35,891

87

JOCIL LIMITED

BALANCE SHEET OF JOCIL LIMITED AS ON 31-03-2011

SCHEDULE

As on

31-03-2011

Sources of funds

Shareholders funds

Capital 4,44,10,500

Reserves & surplus 1,15,68,69,103

Loan funds:

Secured loans 24,95,10,370

Unsecured loans 23,21,51,374

Net Deferred tax liability 11,61,10,121

Total 1,79,90,51,468

Application of funds

Fixed assets:

Gross block 1,39,44,35,216

Less-depreciation 72,63,15,450

Net block 66,81,19,766

Capital work-in-progress 12,66,93,414

Advance for capital goods 9,23,21,05

80,40,45,285

Investments 1,45,40,374

Current assets, loans & advances:

Inventories 67,55,06,154

Sundry debtors 43,85,61,908

Cash & bank balances 4,46,15,362

Other current assets 79,310

Loans & advances 41,62,13,300

1,57,49,76,034

Less: Current liabilities and provisions:

Current liabilities 29,89,46,810

Provisions 29,55,63,415

59,45,10,225

Net current assets 98,04,65,809

Total 1,79,90,51,468

88

JOCIL LIMITED

BALANCE SHEET OF JOCIL LIMITED AS ON 31-03-2012

SCHEDULE

As on

31-03-2012

Sources of funds

Shareholders funds