Beruflich Dokumente

Kultur Dokumente

How to trade bullish flag patterns

Hochgeladen von

sudeshjhaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How to trade bullish flag patterns

Hochgeladen von

sudeshjhaCopyright:

Verfügbare Formate

http://www.dailyfx.

com/forex/education/trading_tips/trend_of_the_day/2012/02/21/How_t

o_Trade_Bullish_Flag_atterns.html

F!"#$: How to Trade Bullish Flag atterns

By Jeremy Wagner, Head Forex Trading Instructor

21 February 2012 19:20 GMT

There are many different patterns that traders follow to help time entries and exits. The flag pattern is one that tends to ath my interest when ! find it

beause they an pro"ide explosi"e mo"es. The #$%&#% appears to be in the middle of a potential bull flag pattern. Today' we will loo( at how to identify

higher probability trading opportunities off the bull flag pattern.

The flag pattern is fairly simple with )ust three omponents.

1. The flag pole

2. The flag

3. # strong up trend

First identify an instrument in a strong up trend *flag pole+. Through the duration of this uptrend' e"entually pries need to rest and onsolidate those gains.

This prie onsolidation beomes the ,flag- of the pattern. The flag portion of the pattern tends to be a gently downward sloping prie hannel.

#dditionally' this onsolidation will retrae a small portion of the pre"ious up trend. !f the retraement beomes deeper than .0/' it may not be a flag pattern.

!deally' we-ll see the retraement be less than 01/. 2ine this is a ontinuation pattern' we loo( for pries to brea( higher with a length e3ual to the si4e of the

flag pole.

(Created using FXCMs Marketscope !" c#arts$

For the past 0 months' traders ha"e been buying ris( through ommodities' the sto( mar(et' and ris( based urrenies. #s a result' the #ustralian %ollar has

performed well against most other urrenies beause it offers a higher interest rate of return. 2o we ha"e a fundamental ba( drop for additional strength in

the #ustralian %ollar. Today' we will math the #$% against the &anadian %ollar.

The #$%5&#% is no stranger to the flag pattern. 6a( in 7tober 2011' we saw this pair form and omplete a flag pattern as the #ustralian %ollar pushed higher

in on)untion with the sto( mar(et bouning higher.

(Created using FXCMs Marketscope !" c#arts$

8ere is a piture of the ompleted pattern. The pre"ious uptrend *flag pole+ is noted in green. 9ries onsolidated in a gently down ward sloping prie hannel.

This hannel retraed only 01/ of the pre"ious up mo"e. To trade the flag' you an time an entry at the lower end of the prie hannel or wait for a brea( up

abo"e the upper hannel. :oo( to ta(e profits by pro)eting the length of the flag pole at the bottom of the flag *orange dotted line+.

(Created using FXCMs Marketscope !" c#arts$

!f we fast forward to today' the #$%5&#% ontinues its marh higher. 9ries are urrently onsolidating sideways in a gently down ward sloping prie hannel.

Therefore' we ha"e an opportunity to enter into a trade with at least a 1:2 ris( to reward ratio.

:oo( for an entry near the bottom of the bla( prie hannel as support to go long. 9lae a stop loss )ust below the swing low. 2o that means an entry near

1.0;0< with a stop near 1.0.90. 7ne pries reah the top of the bla( hannel' loo( to mo"e the stop loss to brea( e"en. !f this pattern holds up' the

#$%5&#% ross rate ould mo"e to 1.10.

How to Trade &ymmetrical Triangles

By Wa%ker &ng%and, Forex Trading Instructor

20 2eptember 2011 11:19 GMT

!dentifying symmetrial triangle patterns an beome an asset to a trader in any mar(et. To ta(e ad"antage of the pattern' first we must be able to identify it.

# symmetrial triangle is simply defined as a tehnial pattern forming a triangle from a desending resistane line and an asending line of support.

These lines of support and resistane an be found by onneting the wi(s of andles on your hart. 7n the =$>5$2% two hour harts below' resistane is

defined by onneting the 2eptember ;th high at 1.?21. with the 2eptember 1.th high of 1.090;. 2upport is deri"ed by onneting the 2eptember 11th low at

1.0?9? and the 2eptember 19th low of 1.0.1..

(Created using FXCMs Marketscope !" c#arts$

7ne a symmetrial triangle is found' our two trading options beome lear. The first is to trade prie' as it ontinues to range' inside of the triangle. !n our

example we would loo( for the =$>5$2% to ad"ane towards our resistane line urrently residing near the 1.0100 prie handle. :imits should be plaed at

support near 1.0;00. 2tops should be plaed abo"e our resistane line at 1.01.0' reating a fa"orable ris( reward ratio.

(Created using FXCMs Marketscope !" c#arts$

7ption two for trading' is to wait for the =$>5$2% symmetrial triangle to brea(. # brea(out ours when prie would breah our support and resistane lines

reated with our onneted highs and lows. =ntry-s to 6$@ should be plaed abo"e resistane at 1.01.0 and =ntry-s to 2=:: below support at 1.0..0. 2tops

should be plaed between urrent support and resistane at 1.0<00' with limits loo(ing for new highs and lows for a minimum 1:2 ris( reward ratio.

>egardless of your opinion' understanding symmetrial triangles an assist us in our trading deisions. !dentifying support and resistane is the (ey. 7ne these

le"els are found we are free to implement the strategy of our hoosing by setting our entry-s' stops and limit orders appropriately. For additional researh on

tehnial analysis' ! would suggest the following resoures.

In our last lesson we learned about the fag and pennant chart patterns, how to identify

them on a chart, and when the pattern is a bullish or bearish sign. In this lesson we are

going to learn how to identify entry and exit points for potential trades after spotting

these patterns on a chart.

As we learned in our last lesson when you spot a fag pattern in an uptrend this is a bullish

sign as the market consolidation which forms the fag is seen as a pause before a

resumption of the original uptrend. As this is the case when traders spot these patterns on

a chart they will commonly look to enter a buy position. The entry point which they will

commonly use to enter the long position is the breakpoint of the upper line of the fag

which is resistance. The target for the trade is then calculated by measuring the distance

between the start of the up move and the highest point on the fag and then projecting

that upwards. The stop is then placed just below the bottom support line of the fag.

Example of the Bull Flag Trading Strategy:

The strategy is exactly the same for the bull pennant, with one exception. hen trading

the bull pennant the stop loss is placed just below the bottom trend line, in line with the

closest trough.

Example of the Bull Pennant Trading Strategy:

hen you spot a fag pattern in a downtrend it is a bearish sign as the market

consolidation which forms the pattern is seen as a pause before a continuation of the

original downtrend. As this is the case when traders spot this pattern on a chart they will

commonly look to enter a short position. The entry point that is normally used when

trading this strategy is to sell on a break below the bottom support line. The target is then

calculated by measuring the distance between the start of the down move and the lowest

point on the fag and then projecting that downwards. The stop is then placed just above

the upper resistance line of the fag.

Example of the Bear Flag Trading Strategy:

The strategy is exactly the same for a bear pennant, with one exception. hen trading the

bear pennant the stop loss is placed just above the upper trend line, in line with the

closest peak.

Example of the Bear Pennant Trading Strategy:

!o that completes this lesson. "ou should now have a good understanding of the strategies

used to trade fag and pennant patterns as well as how to identify these patterns on a

chart. In our next lesson we are going to look at the triangle chart pattern and how to spot

this on a chart so we can look at ways to trade that continuation pattern. !o we hope to

see you in that lesson.

For more information on this pattern, read Encyclopedia of Chart Patterns, Second Edition, pictured on the right, pages 335 to

34. !hat chapter gi"es a complete re"ie# of the chart pattern, including tour, identification guidelines, focus on failures,

performance statistics, trading tactics, and sample trade. $elo# is %ust a sli"er of the information contained in the &oo'.

Flags appear as small rectangles usually tilted against the pre"ailing price trend and mounted at the end of a flagpole. (f you don)t ha"e

a straight*line price run +the flagpole,, then you don)t ha"e a flag. !he &est performing flags ha"e a long, near "ertical flagpole.

(mportant -esults

(dentification .uidelines

!rading !ips

E/ample

See 0lso

!#o (deal Flag Patterns

Important Bull Market Results* for Flags

1"erall performance ran' for &rea'outs2 3ot applica&le

$rea' e"en failure rate for up4do#n &rea'outs2 456 25

0"erage rise4decline2 2356 175

!hro#&ac'4pull&ac' rate2 4356 475

Percentage meeting price target for up4do#n &rea'outs2 7456 485

!he a&o"e num&ers are &ased on hundreds of perfect trades. See the

glossary for definitions.

9 !he performance results for flags are &ased on the short*term price

s#ing, not the change from the &rea'out to the ultimate high or lo# as

in most other chart patterns.

Flag Identification Guidelines

Characteristic Discussion

Price trend Can &e any direction leading to the chart pattern.

Shape :oo's li'e a small rectangle often tilted against the pre"ailing price trend.

!rend lines Prices mo"e &et#een t#o parallel, or near parallel, trendlines.

3 #ee's Flags are short, less than 3 #ee's long. Patterns longer than that are rectangles or channels.

Flagpole !he flagpole #hich leads to the flag should &e unusually steep and last se"eral days.

;olume trend <o#n#ard trend 815 of the time.

$rea'out =p#ard 545 of the time.

Flag Trading Tips

Trading Tactic Explanation

>easure rule

Compute the height from the start of the price s#ing +point 0 in the measure rule figure to the

right, to the end of the price s#ing +$, and then multiply it &y the a&o"e ?percentage meeting

price target.@ 0dd it +up#ard &rea'outs, to the &ottom of the flag +C, or su&tract it +do#n#ard

&rea'outs, from the top of the flag +C, to get the target +<,.

Aalf staff

!he a"erage mo"e from the trend start to the top of the flag is 225 in 15 days. !he mo"e from

the flag lo# to the trend end is 235 and ta'es 1 days. !he half staff figure to the right sho#s

an e/ample, #ith the flag mid#ay through the trend +mo"e 0 eBuals $,.

Flag tilt

Performance suffers #hen the flag slopes in the direction of the pre"ailing price trend. !he

flag tilt figure to the right sho#s an e/ample of price tilting up#ard in a rising price trend.

Flat &ase

(f the flag appears a&o"e +up#ard &rea'outs, or &elo# +do#n#ard &rea'outs, a flat &ase then

e/pect the mo"e to &e a large one.

!ight flags

0 tight flag performs &etter than a loose one. 0 loose flag is one in #hich price meanders,

po'es outside the trendline &oundary, contains #hite space, or loo's %agged. !he tight ". loose

figure to the right sho#s an e/ample.

Cearly middle

=p#ard &rea'outs perform &est #ithin a third of the yearly high. <o#n#ard &rea'outs do &est

#ithin a third of the yearly lo#.

!hro#&ac's and

pull&ac's

!hro#&ac's and pull&ac's hurt post &rea'out performance.

!he >easure -ule

Aalf Staff

Flag !ilt

!ight ".

:oose

** !homas $ul'o#s'i

Flag Example

!he a&o"e figure sho#s an e/ample of a flag chart pattern. !he price s#ing leading to the flag &egins at 0 and ends at the top of the

flagpole, $. 0 short flag sho#s for a fe# days and then an up#ard &rea'out ta'es price higher.

http244###.%anarps.com4&log4inde/.php42D1D41D4trading*flag*patterns*the*easy*#ay4

Trading Flag Patterns the Easy Way

osted on !cto'er 1() 2010 'y *an +rps, Traders, Tool'ox

-n our prior Blog post on Trading Flag Patterns) we co.ered the characteristics of flag patterns) how to detect and trade flag patterns

using the +rps Flag indicator) and showed you that a confirmed 'rea/out of a flag pattern is an excellent trade setup. +s in many

things) 0timing is e.erything1 in trading too. 2ocating flag patterns) 'rea/outs) and 0putting on the trade1 can 'e tedious wor/) often

re3uiring perfect timing. -n this follow4up Blog we are going to show you how to o.ercome these o'stacles in effecti.ely trading flag

pattern 'rea/outs using two additional tools: the scanning .ersion of the +rps Flag indicator and our new automated Flag strategy.

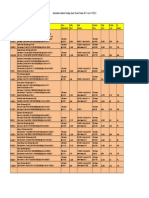

The Arps Flag Scanner

The most efficient way to locate flag patterns and 'rea/outs is to use a scanner) containing a list of your fa.orite trading sym'ols or

any e3uity and futures list you wish to screen) along with a flag scanning tool. !ur uni3ue and proprietary scanning .ersion of the

+rps Flag -ndicator) designed exclusi.ely for the Trade&tation "adarscreen5 and 6ulticharts5 scanners) pro.ides four columns of

color4coded information) as descri'ed 'elow and depicted in the screen shot that follows) for each sym'ol in which the +rps Flag

indicator has identified a flag pattern. 7ells are color4coded 8reen for Bull Flags and "ed for Bear Flags.

Column 1- Bars Ago

This scanning cell) uni3ue to *an +rps9 Traders9 Tool'ox) displays a running count of the num'er of 'ars since the occurrence of the

flag pattern.

Column 2- Breakout Price

This column displays the price the stoc/ must reach to confirm a 'rea/out of the flag pattern.

Column - Target

This column displays the price at which the rofit Target will 'e achie.ed for the current flag pattern. The price will match the user4

controlled input settings for the chart indicator on the si:e of flags and profita'ility targets you wish to trade.

Column !- " to T#T

This column displays in percentage terms where current price is in relation to the distance from the 'rea/out price to the target

price. The ercent to Target column) 0; T! T8T1) will 'e 'lan/ until a 'rea/out has occurred. +t the 'rea/out price the ; T! T8T

cell will show 0;. <hen price reaches the target) the ; T! T8T cell will show 100;. -f price is half way to the target from the

'rea/out price) for example) the cell will display =0;.

Below is an example of the +rps Flag &canner indicator in action as installed on Trade&tation9s "adarscreen5 platform. To loo/ for

the most recent flag patterns) we dou'le clic/ on the header of the 0Bars +go1 column and the sym'ol list is then sorted with the most

recently4occurring flag patterns at the top. For a daily time frame) 001 Bars +go indicates that a flag pattern has formed today) 011

Bars +go would indicate a flag pattern formed yesterday) and so on. &imilarly) if you were to format the &ym'ol column to display =4

minute data) 001 Bars +go would indicate the current =4minute 'ar and 011 Bars +go would indicate that the flag pattern was

identified on the pre.ious =4minute 'ar.

The colors of the cells are user4defined. For our example) magenta will signify the detection of a Bear flag pattern and light green will

signify the detection of a Bull flag pattern. +fter a flag is detected) a price 'rea/ through the 'rea/out price le.el will turn the flag

cells for that sym'ol to dar/ green to signify a Bull Flag 'rea/out and red to signify a Bear Flag 'rea/out.

$o% to Scan &or Flag Patterns using the Arps Flag Scanner

+s mentioned a'o.e) 'y dou'le4clic/ing on the column header 0Bars +go1) the scanner will sort the most recently detected flag

patterns to the top of the list in descending order) starting with those detected in the current 'ar) 'ar 001. >sing a lin/ed chart

window with the +rps Flag chart indicator applied) we then clic/ on any sym'ol of interest in the scanner &ym'ol column for further

analysis. -n the screenshot 'elow) we clic/ed on the sym'ol +?) +utomatic ?ata rocessing) which formed a Bull flag pattern

yesterday) 1 'ar ago on our daily chart. <e can continue scanning other sym'ols) set a Brea/out +lert on this sym'ol or acti.ate the

+rps Flag &trategy to enter a trade automatically in the e.ent a 'rea/out occurs.

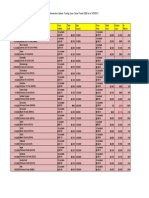

"ecent flag 'rea/outs that still offer excellent entry points are always of interest) so we scroll down and clic/ on a well /nown stoc/)

7isco) which had a Bull flag 'rea/out yesterday and the closing price is only 1; to the rofit Target. -n the lin/ed chart window

'elow) we see that 7isco is 'rea/ing out of a congestion area) or 'ase 'uilding period) and that the pre.ious 'ull flag @ust 'arely fell

short of the rofit Target. The flag has also nicely held all retracements. Based on the chart characteristics) this is a good trade

candidate.

The +rps Flag &canner) in addition to scanning for the most recent flag patterns and flag 'rea/out signals) is useful in trac/ing the

progression and maturity of flag pattern 'rea/outs. -n some cases) li/e with any strong continuation trend) you will want to

participate in a 'rea/out after the early stage. Below the lin/ed window in our scanner highlights the sym'ol 6!) +ltria 7orporation)

that had a Bull flag 'rea/out A 'ars) or A days ago) on our daily time frame and is 2B; to the Target. <ith the smooth upward trend

of this stoc/ and room to go to achie.e 100; of the Target) this is a good 0@ump on 'oard1 candidate.

To inspire confidence to trade flag 'rea/outs) you can also sort on 'rea/outs closest to the rofit Target. Below is a 'eautiful chart of

#?) #nterprise roducts artners) as price stretches as if drawn 'y a magnet to the Target line.

Taking a Position %ith the Arps Flag Strategy

"ather than ha.ing to wait and watch the screen for a Brea/out +lert and enter the trade manually) we can acti.ate the +rps Flag

strategy in a new chart window on any flag pattern we are interested in trading if a Brea/out occurs.

For a Bull flag pattern) the strategy upon acti.ation enters three orders: a Buy &top at the Brea/out rice) a &ell 2imit !rder at the

rofit Target rice) and a trailing stop using the +rps Trender.

Below is a chart of the Flag &trategy applied to sym'ol) 7!) 7onoco hillips.

'nputs

The Flag &trategy has se.eral -nputs that are user4controlled) so that you can customi:e the strategy to your specific trading style and

ris/ tolerance.

1. The +rps Trender is used as a trailing stop to protect against unaccepta'le losses and to protect profit. The user can ad@ust the

sensiti.ity settings to increase/decrease the 0'reathing room1 of the stop.

2. The rofit Target default setting is set at 100; of the length of the Flagpole. &ome 'rea/outs go on to exceed the normal rofit

Target and some fail to reach it. The user can ad@ust the rofit Target to less than 100; or more than 100; of the flagpole length)

such as 120;.

+n input is pro.ided for you to ad@ust the rofit Target to less than 100; or more than 100; of the flagpole length) such as 120;)

entered as 1.2 in the -nput cell.

(. -f) after an entry) the price 'rea/s 'ac/ into the flag) it will exit on an automatic stop on the other side of the flag.

C. -f) 'efore price reaches the profit target) a new flag in the same direction is detected) the new flag will 'e ignored unless the

&trategy roperties input is set to allow more than one trade in the same direction. -f) howe.er) a 'rea/out of a flag pointing in the

opposite direction is detected while in a position) the strategy will re.erse position.

-n conclusion) to trade flag patterns the easy and efficient way) you will need three indicators: the +rps Bull and Bear Flag chart

indicators) the +rps Flag &canning tool) and the +rps Flag &trategy. <e ha.e com'ined these tools in a new +rps Flag toolset. For a

limited time we are offering the +rps Flag toolset) a DA00 .alue) for only DCAE. 7lic/ H#"# to go directly to the online product page.

For 3uestions) please send an email to infoF@anarps.com.

>ntil our next post)

Best)

*an +rps9 Traders9 Tool'ox

?-&72!&>"#

*an +rps9 Traders9 Tool'ox is not an in.estment ad.isory ser.ice) nor a registered in.estment ad.isor or 'ro/er4dealer and does not purport to tell

or suggest which securities customers should 'uy or sell for themsel.es. 7ustomers should always chec/ with their licensed financial ad.isor and

their tax ad.isor to determine the suita'ility of any in.estment.

-t should not 'e assumed that the methods) techni3ues) or indicators presented in these products will 'e profita'le or that they will not result in

losses. ast results are not necessarily indicati.e of future results. #xamples presented in this letter are for educational purposes only. These set4

ups are not solicitations of any order to 'uy or sell. The author and affiliates assume no responsi'ility for your trading results. There is a high

degree of ris/ in trading.

Das könnte Ihnen auch gefallen

- The Encyclopedia Of Technical Market Indicators, Second EditionVon EverandThe Encyclopedia Of Technical Market Indicators, Second EditionBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Technical analysis and online trading - Indicators and Oscillators in ExcelVon EverandTechnical analysis and online trading - Indicators and Oscillators in ExcelBewertung: 4 von 5 Sternen4/5 (1)

- Wouldn't You Like to Know Where the Stock Market is Heading?Von EverandWouldn't You Like to Know Where the Stock Market is Heading?Noch keine Bewertungen

- The Master Swing Trader: Tools and Techniques to Profit from Outstanding Short-Term Trading OpportunitiesVon EverandThe Master Swing Trader: Tools and Techniques to Profit from Outstanding Short-Term Trading OpportunitiesBewertung: 4 von 5 Sternen4/5 (16)

- Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationVon EverandPring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationNoch keine Bewertungen

- The Master Swing Trader Toolkit: The Market Survival GuideVon EverandThe Master Swing Trader Toolkit: The Market Survival GuideNoch keine Bewertungen

- Candlestick Charting Explained Workbook: Step-by-Step Exercises and Tests to Help You Master Candlestick ChartingVon EverandCandlestick Charting Explained Workbook: Step-by-Step Exercises and Tests to Help You Master Candlestick ChartingBewertung: 5 von 5 Sternen5/5 (4)

- The Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersVon EverandThe Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersBewertung: 1 von 5 Sternen1/5 (1)

- Candlestick Charting Explained:Timeless Techniques for Trading Stocks and Futures: Timeless Techniques for Trading stocks and SuturesVon EverandCandlestick Charting Explained:Timeless Techniques for Trading Stocks and Futures: Timeless Techniques for Trading stocks and SuturesBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Trading Triangles: How to trade and profit from triangle patterns right now!Von EverandTrading Triangles: How to trade and profit from triangle patterns right now!Bewertung: 4 von 5 Sternen4/5 (8)

- High-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingVon EverandHigh-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingBewertung: 4 von 5 Sternen4/5 (1)

- All About Technical Analysis: The Easy Way to Get StartedVon EverandAll About Technical Analysis: The Easy Way to Get StartedBewertung: 4.5 von 5 Sternen4.5/5 (10)

- Multiple Time Frame Analysis for Beginner TradersVon EverandMultiple Time Frame Analysis for Beginner TradersBewertung: 1 von 5 Sternen1/5 (1)

- The Illustrated Guide to Technical Analysis Signals and PhrasesVon EverandThe Illustrated Guide to Technical Analysis Signals and PhrasesNoch keine Bewertungen

- Maverick Trading: PROVEN STRATEGIES FOR GENERATING GREATER PROFITS FROM THE AWARD-WINNING TEAM AT MAVERICK TRADINGVon EverandMaverick Trading: PROVEN STRATEGIES FOR GENERATING GREATER PROFITS FROM THE AWARD-WINNING TEAM AT MAVERICK TRADINGNoch keine Bewertungen

- 5 Chart PatternsDokument11 Seiten5 Chart Patternsac4scrn DC67% (3)

- The Complete Guide to Using Candlestick Charting How to Earn High Rates of Return-SafelyVon EverandThe Complete Guide to Using Candlestick Charting How to Earn High Rates of Return-SafelyBewertung: 2.5 von 5 Sternen2.5/5 (2)

- Trading With Flag PatternsDokument58 SeitenTrading With Flag PatternsNam Chun Tsang50% (2)

- Winning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingVon EverandWinning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Day Trading with a Simple Supply and Demand StrategyVon EverandDay Trading with a Simple Supply and Demand StrategyNoch keine Bewertungen

- High Profit Price Action Trading for BeginnersVon EverandHigh Profit Price Action Trading for BeginnersBewertung: 2.5 von 5 Sternen2.5/5 (4)

- Trading Options: Using Technical Analysis to Design Winning TradesVon EverandTrading Options: Using Technical Analysis to Design Winning TradesNoch keine Bewertungen

- Bible of Supply & Demand Trading for complete BeginnersVon EverandBible of Supply & Demand Trading for complete BeginnersBewertung: 1 von 5 Sternen1/5 (2)

- Tradingstrategyguides All Strategies Forex Strategies Indicator Strategies Indicators 0 CommentsDokument5 SeitenTradingstrategyguides All Strategies Forex Strategies Indicator Strategies Indicators 0 CommentsLucaNoch keine Bewertungen

- Trend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingVon EverandTrend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingBewertung: 5 von 5 Sternen5/5 (1)

- Tradacc Pattern-CheatsheetDokument1 SeiteTradacc Pattern-CheatsheetGabrielNoch keine Bewertungen

- Options Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)Von EverandOptions Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)Noch keine Bewertungen

- Swing Trading: The Ultimate Guide to Making Fast Money 1 Hour a DayVon EverandSwing Trading: The Ultimate Guide to Making Fast Money 1 Hour a DayNoch keine Bewertungen

- Pervert Trading: Advanced Candlestick AnalysisVon EverandPervert Trading: Advanced Candlestick AnalysisBewertung: 2 von 5 Sternen2/5 (1)

- Tools and Tactics for the Master Day Trader (PB)Von EverandTools and Tactics for the Master Day Trader (PB)Bewertung: 4 von 5 Sternen4/5 (6)

- An easy approach to japanese candlesticks: The introductory guide to candlestick trading and to the most effective strategies of Technical AnalysisVon EverandAn easy approach to japanese candlesticks: The introductory guide to candlestick trading and to the most effective strategies of Technical AnalysisBewertung: 3 von 5 Sternen3/5 (5)

- Trade Secrets: Powerful Strategies for Volatile MarketsVon EverandTrade Secrets: Powerful Strategies for Volatile MarketsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Advanced Charting Techniques for High Probability Trading: The Most Accurate And Predictive Charting Method Ever CreatedVon EverandAdvanced Charting Techniques for High Probability Trading: The Most Accurate And Predictive Charting Method Ever CreatedBewertung: 3 von 5 Sternen3/5 (7)

- Trading Plans Made Simple: A Beginner's Guide to Planning for Trading SuccessVon EverandTrading Plans Made Simple: A Beginner's Guide to Planning for Trading SuccessNoch keine Bewertungen

- SWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)Von EverandSWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)Noch keine Bewertungen

- High Probability Day Trading with Supply & Demand: Forex and Futures Newbie Day Trader Series Book, #4Von EverandHigh Probability Day Trading with Supply & Demand: Forex and Futures Newbie Day Trader Series Book, #4Bewertung: 3 von 5 Sternen3/5 (14)

- Candlestick and Pivot Point Trading Triggers: Setups for Stock, Forex, and Futures MarketsVon EverandCandlestick and Pivot Point Trading Triggers: Setups for Stock, Forex, and Futures MarketsNoch keine Bewertungen

- Understanding Classic Chart PatternsDokument50 SeitenUnderstanding Classic Chart PatternsChartSniper67% (3)

- Supply & Demand Trading Bible for Day Trading BeginnersVon EverandSupply & Demand Trading Bible for Day Trading BeginnersBewertung: 3.5 von 5 Sternen3.5/5 (6)

- Two Roads Diverged: Trading DivergencesVon EverandTwo Roads Diverged: Trading DivergencesBewertung: 4 von 5 Sternen4/5 (23)

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsVon EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsBewertung: 1 von 5 Sternen1/5 (1)

- Bamm Candlesticks 5-3-14Dokument53 SeitenBamm Candlesticks 5-3-14sudeshjhaNoch keine Bewertungen

- MOT2008 2011final 1Dokument25 SeitenMOT2008 2011final 1sudeshjhaNoch keine Bewertungen

- 6 Ways To Gen Income Using Options - Fpwl14Dokument11 Seiten6 Ways To Gen Income Using Options - Fpwl14Anamaria SuciuNoch keine Bewertungen

- 07-Combining Rsi With Rsi PDFDokument5 Seiten07-Combining Rsi With Rsi PDFsudeshjhaNoch keine Bewertungen

- Commodities Info GlobalDokument12 SeitenCommodities Info GlobalsudeshjhaNoch keine Bewertungen

- MOT 2011 WeeklyFinal-1Dokument2 SeitenMOT 2011 WeeklyFinal-1sudeshjhaNoch keine Bewertungen

- Momentum Options Trading Results 2011Dokument7 SeitenMomentum Options Trading Results 2011sudeshjhaNoch keine Bewertungen

- 5 Chart Patterns To KnowDokument15 Seiten5 Chart Patterns To KnowsudeshjhaNoch keine Bewertungen

- Momentum Options Trading Open Closed Trades 2009 As of 1/25/2012Dokument12 SeitenMomentum Options Trading Open Closed Trades 2009 As of 1/25/2012sudeshjhaNoch keine Bewertungen

- Commodities Info AgriDokument26 SeitenCommodities Info AgrisudeshjhaNoch keine Bewertungen

- Bharat Sanchar Nigam Limited: (Regulation)Dokument4 SeitenBharat Sanchar Nigam Limited: (Regulation)sudeshjhaNoch keine Bewertungen

- Compost PDFDokument4 SeitenCompost PDFsudeshjhaNoch keine Bewertungen

- SP-90 Soluble Humate Powder Optimizes Plant NutritionDokument1 SeiteSP-90 Soluble Humate Powder Optimizes Plant NutritionsudeshjhaNoch keine Bewertungen

- Organic - Nature's Essence SEP 10-Lb - ColorDokument1 SeiteOrganic - Nature's Essence SEP 10-Lb - ColorsudeshjhaNoch keine Bewertungen

- Humates How They WorkDokument5 SeitenHumates How They WorksudeshjhaNoch keine Bewertungen

- 3 Marketing Management TasksDokument3 Seiten3 Marketing Management TasksGanga K.C.Noch keine Bewertungen

- Birla Pacific Medspa Ltd.Dokument338 SeitenBirla Pacific Medspa Ltd.adhavvikasNoch keine Bewertungen

- Sri Lanka's Central Bank Intervenes in Seylan Bank CrisisDokument1 SeiteSri Lanka's Central Bank Intervenes in Seylan Bank CrisisPradeepa DharmawardanaNoch keine Bewertungen

- Ch10 HW SolutionsDokument43 SeitenCh10 HW Solutionsgilli1trNoch keine Bewertungen

- F7.1 Chap 11 - Financial Instruments 2Dokument35 SeitenF7.1 Chap 11 - Financial Instruments 2NapolnzoNoch keine Bewertungen

- JD - Country Manager - VietnamDokument3 SeitenJD - Country Manager - VietnamLê Tuyết NhiNoch keine Bewertungen

- CT DummiesDokument52 SeitenCT DummiesZac Van88% (8)

- Asset Liability Management in BanksDokument47 SeitenAsset Liability Management in BanksHeema Nimbeni100% (3)

- Chapters 10 14Dokument72 SeitenChapters 10 14Aqsa Jawed KhatriNoch keine Bewertungen

- COA Unit 2 Issue of Shares - ProblemsDokument3 SeitenCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNoch keine Bewertungen

- Introduction To Forex Trading PDFDokument25 SeitenIntroduction To Forex Trading PDFEdy Engl100% (1)

- UntitledDokument4 SeitenUntitledRudra PrakashNoch keine Bewertungen

- TD GIC PlusDokument2 SeitenTD GIC PlusSalimah ArabNoch keine Bewertungen

- FINANCIAL DERIVATIVES Unit - 1Dokument18 SeitenFINANCIAL DERIVATIVES Unit - 1Neehasultana ShaikNoch keine Bewertungen

- Solved The Following Selected Information Is Available For Two Competitors NikeDokument1 SeiteSolved The Following Selected Information Is Available For Two Competitors NikeAnbu jaromiaNoch keine Bewertungen

- Sahara ScamDokument12 SeitenSahara ScamManu Gupta100% (1)

- Finnifty Sum ChartDokument5 SeitenFinnifty Sum ChartchinnaNoch keine Bewertungen

- Security Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskDokument4 SeitenSecurity Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskEdwin HauwertNoch keine Bewertungen

- How To Make Money Trading The: Ichimoku SystemDokument12 SeitenHow To Make Money Trading The: Ichimoku SystemYatharth DassNoch keine Bewertungen

- Disclosure Rules A. Article Vii - Disclosure RulesDokument2 SeitenDisclosure Rules A. Article Vii - Disclosure RulesGenelle SorianoNoch keine Bewertungen

- Derivatives QuizDokument5 SeitenDerivatives QuizAllyssa Kassandra Luces0% (1)

- Public Company and Private Company by Prof. ReyazuddinDokument6 SeitenPublic Company and Private Company by Prof. ReyazuddinSiddhesh BhosleNoch keine Bewertungen

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDokument13 SeitenVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNoch keine Bewertungen

- Cash and Cash Equivalents Basic ProblemsDokument6 SeitenCash and Cash Equivalents Basic ProblemshellokittysaranghaeNoch keine Bewertungen

- VALUE CHAIN ANALYSISDokument8 SeitenVALUE CHAIN ANALYSISAnna FossiNoch keine Bewertungen

- Ep Module II Ns June 2021Dokument89 SeitenEp Module II Ns June 2021Sarmishtha JanaNoch keine Bewertungen

- Introduction To CAPM - TranscriptDokument2 SeitenIntroduction To CAPM - TranscriptRobert ClarkNoch keine Bewertungen

- Herens Holdco Term Loan B Amendment Adds SFr621MDokument2 SeitenHerens Holdco Term Loan B Amendment Adds SFr621MOthman Alaoui Mdaghri BenNoch keine Bewertungen

- Relative Momentum Index PDFDokument7 SeitenRelative Momentum Index PDFalexmorenoasuarNoch keine Bewertungen

- LN01 - Smart3075419 - 13 - FI - C07 - Analyzing Common StocksDokument62 SeitenLN01 - Smart3075419 - 13 - FI - C07 - Analyzing Common StocksNhung HồngNoch keine Bewertungen