Beruflich Dokumente

Kultur Dokumente

Bata India LTD

Hochgeladen von

Srikanth MallyaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bata India LTD

Hochgeladen von

Srikanth MallyaCopyright:

Verfügbare Formate

1 Literature Review of BATA

2

Literature Review OF BATA

Submitted by :

Abhishek Mohapatra

Apuroop Pullabhatla

Russel DSouza

Srikanth Mallya

2 Literature Review of BATA

01 Early history of BATA and its evolution over time.

02 Initial positioning and subsequent repositioning.

03 Advertising, sales promotion and segmentation strategy followed by

the BATA.

04 Analysis of product and generic competition to the BATA.

05 Strategies adopted over time by BATA to tackle competition or

prime market expansion.

06 Distribution strategy followed by the BATA.

07 Summary regarding the future directions for BATA.

3 Literature Review of BATA

1. History and Evolution of Bata:

Bata India is the largest retailer and leading manufacturer of footwear in India and is a part of

the Bata Shoe Organization. The parent company Bata was founded by three siblings; Tom

Baa, his brother Antonn and his sister Anna with a small inheritance in the town of Zlin,

Czechoslovakia on August 24, 1894. Initially known as Bata Shoe Company, it was one of the

worlds first shoe manufacturers; a team of stitchers and shoemakers creating footwear not

only for friends and local residents, but also for distant retail merchants.

4 Literature Review of BATA

1.1.Key Events:

1905: Tom Baa introduced mechanized production techniques that allowed the Bata

Shoe Company to become one of the first mass producers of shoes in Europe.

1914: The company had a significant development due to military orders.

1928: The companys head factory in Zlin was expanded as demand for the inexpensive

shoes grew rapidly.

1931: Bata Shoe Organization setup factories in Germany, England, The Netherlands,

Poland, France, Austria, Romania, Sweden, Switzerland, Egypt, Belgium, Finland,

Luxembourg, Hungary, Italy, Indonesia, Singapore and India.

1932: Tom Baa died in a plane crash and control of the company was passed to his

half-brother, Jan, and his son, Thomas John Bata.

1939: Due to the outbreak of World War II Thomas Jan Bata decided to move Bata

Shoe Organization to Canada established the Bata Shoe Company of Canada

By 1950: Bata was positioned as the worlds leading footwear exporter. From its new

base in Canada, the company gradually rebuilt itself, expanding into new markets

throughout Asia, the Middle East, Africa and Latin America.

In 1970s, 80s and 90s: Bata continued to grow through its new, innovative strategies

guided by Batas founding principles which focused on customers, marketing and

employees.

.

Today, Bata has a retail presence in over 70 countries across five continents, with a million

customers per day. It employs more than 40,000 people in its 5,000 retail stores, manages 27

5 Literature Review of BATA

production facilities. It is estimated that since the day it was founded over 120 years ago, Bata

has sold more than 14 billion pairs of shoes which is more than the number of human feet that

have walked the earth!

The acting headquarters of Bata Shoe Organization is located in Lausanne, Switzerland. There

are 3 main Business Units: Bata Europe, based in Italy; Bata Emerging Market (Asia Pacific,

Africa and Latin America), based in Singapore, and Bata Protective (worldwide B2B

operations), based in the Netherlands.

1.2.BATA INDIA LTD

Bata is a name that needs no introduction to Indians. Incorporated as Bata Shoe Company

Private Limited in 1931, Bata India is the largest retailer and leading manufacturer of footwear

in India and is a part of the Bata Shoe Organization.

In 1932, an experimental shoe production plant was built in Konnagar, West Bengal with 75

Czechoslovak experts. Jan Antonin Bata then built an industrial manufacturing city called

Batanagar in South 24 Paraganas District in West Bengal in 1934, as well as other factories in

Digha near Patna, and elsewhere it India, employing more than 7,000 people. Later Batanagar

became one of the bigger suburban towns near Kolkata. The Company went public in 1973

when it changed its name to Bata India Limited. In 1993, it became the first manufacturing

facility in the Indian shoe industry to receive the ISO: 9001 certification.

6 Literature Review of BATA

1.2.1.Bata India today:

It is one of the largest footwear manufacturers in India and sells a wide range of canvas, rubber,

leather, and plastic footwear. Its retail network of over 1500 stores gives it a reach that no other

footwear company can match in India. The stores are present in good locations and can be

found in all the metros, mini-metros and towns. The Company also operates a large non retail

distribution network through its urban wholesale division and caters to millions of customers

through over 30,000 dealers. It has 26 Wholesale depots, serving more than 500 wholesalers.

The company has a licensed capacity of 628 lakh pairs per annum spread across its five

manufacturing units at Batanagar (Kolkata), Faridabad (Haryana), Bataganj (Bihar), Peenya

(near Bangalore), and Hosur (Tamil Nadu). The company has two tanneries - one at Batanagar

and the other at Mokameghat (Bihar). The latter is the second largest in Asia. In total, Bata

India employs more than 12000 people.

Bata sells over 60 million pairs of shoes every year. South India is a major market for Bata,

from where it earns around 40% of its revenue. The company is the market leader in South,

with 16% share of the organized footwear market. Of the overall revenue, it derives nearly 85%

through retail networks, 14% from non-retail channels (dealers/institutional/industrial sales)

and remaining 1% through exports. Thus, the domestic market is the mainstay as far as revenues

are concerned.

Bata India is today traded on the Kolkata and Bombay Stock Exchanges. It has also consistently

outperformed the Sensex and broader Nifty year after year. For the first time in its history, Bata

Bata House Gurgaon and Bata India Factory at Batanagar

7 Literature Review of BATA

India's Turnover crossed the coveted mark of Rs. 20,000 Million for the financial year 2013 by

achieving a total turnover of Rs.20, 984.1 Million. It also recorded a Net Profit of Rs.1, 907.4

Million for the year 2013.

2. Initial positioning and subsequent repositioning

Bata India was primarily known as a manufacturing company and it comes with a baggage of

being an old-school, no-frills footwear maker and retailer. It has traditionally positioned itself

as providing product lines catering to the middle class segment of the society. Bata was in a

way successful in positioning itself as a brand having stores with products to meet the needs of

almost all members of the family, since it had product ranges for children, men, women etc.

Bata enjoyed an almost monopolistic position in the organized footwear market in India until

late 1980's. Its simple, yet iconic, brown leather sandals and blue-and-white rubber slippers

were instantly recognizable and also are still recognized. Bata was the choice for everyone in

the family. Whether it was shoes for the monsoon, school shoes, formal wear or even comfort

wear for the elderly, the brand had something for every member in the Indian household. The

brand Bata was household name then and was the first choice footwear of the Indian middle

class.

But with time, Bata India had to come in line with the changed retailing landscape with the

arrival of malls and big retail chains. It also had to shed its image as a low-cost functional

footwear brand that appeals to the 40-plus age group. Bata started gradually losing its position

as market leader in the 1990's when its profit margins reduced drastically. Bata has suffered

due to an un-favorable impression of a perception drag and has been unable to connect with the

youth. This was due to a number of factors like

(a) Crowded store formats;

(b) Subdued store staff,

(c) Lack of presence in the media, etc.

2.1. Repositioning:

After three straight years of losses, Bata started to script a turnaround story from 2005. Marcelo

Villagran took over Bata Indias operations in 2005 and he brought about many changes in the

8 Literature Review of BATA

company that have led to a turnaround. He is credited as being the man who brought back Bata

India from the brink of bankruptcy.

The focus was on revamping retail large format stores were opened and existing ones re-

modelled. Sandwiched between luxury brands from the top and mass market offerings at the

bottom, Bata had to leverage its considerable equity. The erstwhile Bata stores had a very

congested layout and the display of all SKUs was at times either not possible or not accessible.

However, with the revamping of stores, the company has now improved the design and layout

to make more products visible and available for touch and feel to the consumer. The company

has also extended the store timing by two hours (from the earlier 10 am 7 pm to 10 am 9

pm). The company has also decided to keep stores open on Sundays. This led to higher footfalls

and, therefore, improved inventory turnover. A drastic cut in employee headcount and

outsourcing labor-intensive operations helped in pruning costs. As part of the restructuring plan

set out by Mr Villagran, Bata opened 718 stores, closed down 524 and remodeled 296 stores

during CY05-12. The new stores opened were decided in a phased manner and designed

according to the target audience that it catered to.

The company now categorizes stores as: 1. Metro 2. Metro & Mini metro and 3. Smaller towns.

Based on this classification, it decides the store layout, product profile and location based on

that. While stores in metros are air-conditioned and stock more premium and fashion brands,

the metro and mini-metro stores are non-air-conditioned and stock products catering to the

aspirational upper middle class consumers. Similarly, in small towns, the stores are non-air-

conditioned and stock economy and mid-range products meant for mass markets.

In its strategic pursuit, Bata India continues to open approx. 100 new retail stores every year

across India and shut down or relocate unviable stores. Most of the new stores are of large

format having space of more than 3,000 sq. ft. and delicately designed to display each category

of footwear and accessories. These large format stores are designed to provide an excellent

ambience and delightful shopping experience to the customers.

Bata has also overhauled its merchandise strategy. It literally threw out its entire low-margin

inventory in 2005. They fixed a certain operating margin and have decided not to sell any shoes

whose margins are below that margin. And the efforts appear to be paying off as Bata is the

9 Literature Review of BATA

market leader with over 16% share in the organized footwear segment. The company now plans

to increase the average store size to 5000 sq ft.

Bata India Ltd has witnessed constant growth over the past few years, which endorses its strong

understanding of the consumer needs and lifestyle. The footwear collection has vastly improved

over the years and many contemporary and fashionable designs of footwear have been

launched. The new designs have helped Bata to constantly increase its customer base while

meeting the changing lifestyle needs of the loyal customers. The manufacturing facilities of

Bata have also been upgraded with introduction of improved quality, better technology and

materials for producing footwear with a trendier look and comfort to meet the ever-changing

market requirements.

An exclusive range of ladies footwear and a variety of products for the kids and children were

launched, which have been well accepted by the customers. Bata continues to be the market

leader in Men's formal footwear, with Ambassador, Comfit, Moccasino - all brands recording

a high growth. In ladies segment, Marie Claire and Sundrop brands of footwear have recorded

a good growth. The footwear range for the children - Bubblegummer and Angry Birds

continued to be the most favourite brands in India. Other popular brands like Power, North Star,

Scholl and Weinbrenner - all have registered growth in volume in the year 2013.

Hush Puppies and Footin are two specific brands introduced by Bata India targeting the

younger consumers and the fashion conscious crowd.

2.1.1. HUSH PUPPIES

Bata India's premium Brand - Hush Puppies has been expanding in line with the overall retail

expansion program and continues to open exclusive stores and shop-in-shop stores in premium

departmental stores. At the end of year 2013, Hush Puppies had 34 exclusive stores and 37

shop-in-shops.

10 Literature Review of BATA

2.1.2. FOOTIN:

Bata India's new retail concept - FOOTIN offers

a new range of footwear focusing on affordable

fashion and trendy styles. In FOOTIN stores,

customers can get fashionable, young looking and

affordable footwear presented through a high-

density display concept. It is one of the new

business models with a different approach to

improve volume growth of the company. Since

2012, Bata has opened 8 new FOOTIN stores

across India, with range of footwear for both

men and women focusing on fashionable and

trendy styles at an affordable price.

2.1.3. NON RETAIL

Bata India's Industrial division is now recognized as the leading supplier in the safety footwear

market. The product range has been refreshed by launching new molds as well as new PU-

Rubber soles collection. The customer service function has been strengthened to provide

immediate response to the queries raised by the industrial buyers.

11 Literature Review of BATA

The strategy to focus on segments like defence, canteens, education, corporate, etc. has been

fruitful for Bata India and resulted in achieving good market penetration. A new range for the

healthcare segment has been launched with specialized footwear to be used in hospitals for

Doctors, Nurses, front office staff, maintenance team, etc.

2.1.4. E-COMMERCE

Bata India generated a volume growth of almost 100% in online business during the year 2013

as compared to the previous year 2012. Its E-Commerce business reached approx. 750 cities

across India with its shipments. In order to attract more e-customers, new partnerships have

been entered into by tying up with leading on-line players e.g., Flipkart, Jabong, E-bay,

HomeShop18, Myntra, Rediff, Indiatimes, etc. As a part of the strategy, Cash on Delivery

service was launched for the end customer to facilitate the shopping ease. The Companys

website www.bata.in has experienced a tremendous growth in traffic of approx. 2.5 Million

visitors.

3. Advertising, sales promotion and segmentation strategy followed by the

BATA.

BATA India has traditionally spent less than 1 percent of its total revenue on advertising. This

is far less than their competitors who spend anywhere between 5 and 10% of their revenue on

advertising.

12 Literature Review of BATA

Location location location- is a mantra for retail success. BATA has banked on building its

retail store presence in middle of bustling bazaars in rural and urban areas and near urban

suburban train stations. Coupling the location with VFM (Value for Money) shoes for the entire

family has helped Bata sustain itself for three quarters of a century. The target segment for the

brand used to be the lower and middle income segment of the population.

Like any other retail brand in the business, BATA too holds sales promotions at specific time

periods in the year. These sales promotions are advertised through different mediums:

Outreach media Print Media Electronic Media Online Media

Bata was the first business to

place large advertising signs

at its own points of sale

Advertisement in

magazines &

newspaper

Promotion through

TV ads, Eg: Spring

Summer 2014

Facebook fan

club page of Bata

India has

2,66,430 likes.

3.1. Sales Promotion Strategy:

3.1.1. Price promotion: Price promotion refers to price discounting. It is done by two ways,

namely

DISCOUNTS: A discount on the normal selling price of the product. For example Bata a family

footwear brand with showrooms all over the city, is offering discounts ranging up to 50% on

shoes, sandals, chappals, ladies footwear, kids footwear and mens footwear. This offer is

available at all Bata footwear showrooms across the country.

END OF SEASON SALE: Bata often has End of Season sale which helps in boosting up the

sales figure.

13 Literature Review of BATA

3.1.2. Sales at point of purchase:

Another feature of their sales promotion strategy is their point of purchase products. Products

like Dr Scholls foot cream, Knee Pain Relief Orthotic, etc are displayed over the cash counter

so as to encourage customers to make an immediate purchase.

3.1.3. Consumer promotions:

The tool already in use by BATA India group is Bata Gift Vouchers. The design of the

vouchers need to be complementary to the theme used for advertising so as to reinforce the

image of the brand.

These gift vouchers have the following features:

Convenient denominations

6 month validity

Redeemable on all BATA products.

Acceptable at over 1500 Bata stores across India.

3.1.4. 99 Magic formula: The psychological factor of prices ending with 99 gives the

consumer a feeling of a good bargain price as against a cheap prize. Bata India have

cleverly managed to use this strategy to their advantage.

(An old Advertisement of Bata)

14 Literature Review of BATA

3.2. Bata Sub-brand Segmentation based on Indian Income Groups:

Upper Middle Class

Lower Middle Class

Low Income Group

4. Analysis of product and generic competition to the brand.

When we think of BATA, the first thing that strikes us is its INDIANNESS. According to

the HR manager BATA, it is the mass appeal that drives a customer to a BATA store. This is

largely because BATA offers the masses products and gifts in every possible price range they

can think of. The brand identity and position of BATA has been carefully crafted and

painstakingly embedded as a value proposition in the minds of consumers for generations. It

certainly promises a lot of value by virtue of consistent quality and positive word-of-mouth.

According to Mr. Anjanay Shrivastav (HR manager), most of the people in India don't even

know that BATA is not an India based brand. An example of mass appeal is also seen in the

fact that the school shoes category is synonymous with BATA.

The total revamp that BATA got as a brand in 2005 is aimed at targeting audiences in every

income group. And hence, the brand came up with products targeting the youth, corporate

executives, working women, sports enthusiasts and children. Prior to this strategy, BATA was

considered to be the Parle-G of the footwear industry, mass producing shoes and sandals of

the same type and features for all kinds of target audiences. Hence the new strategy was a huge

15 Literature Review of BATA

development from its previously rigid and old-fashioned brand image. As part of their new

strategy, the new brands that came about were: NorthStar(youth), Marie Claire(women),

Bubblegummers(kids), Weinbrenner(Men) etc. However, one fundamental strategy that BATA

did not execute was the effective promotion of these brands in terms of their advertising. These

new brands did not have separate identities of their own and hence did not succeed in creating

images of their own.

4.1. BCG Matrix of BATA:

BCG Matrix describes the companys Portfolio analysis with respect to its Market share and

current market growth rate. Due to the competition from local brands of unorganized retail and

presence of low cost emerging brands like Paragon, Relaxo, Khadims, Sreeleathers etc. Bata is

losing its market growth though it has high relative market share. With incomes growing, Bata

needs to understand how consumer aspirations change and find ways to meet the changing

needs. So, in the coming years, Bata needs to focus on consumer insights, innovation,

renovation as well as improved value chain management for a good performance.

16 Literature Review of BATA

4.2. Generic competition to the brand

Indias per capita shoe consumption or the number of footwear (shoes, chappals, sandals) worn

by an individual has gone up from 1.4 shoes a year in 2004 to 2.2 shoes per year in 2010,

according to data from the commerce ministry, While in absolute percentage terms this might

not seem like a lot, in a country of a population of one billion people, the fact that in six years

people have gone from consuming 1.4 shoes a year to 2.2 shoes a year is a big change, said

Suman Roy Burman, president, Khadims, a Kolkata-based manufacturer and retailer. The

average shoe consumption in developed countries is about five per person per year.

8,155.07

2,376.24

666.61

553.8

392.52

328.18

2,065.17

1,211.83

56.99

485.04

318.7

707.35

190.74

65.64

7.08

13.21 8.64 43.37

0.00

1,000.00

2,000.00

3,000.00

4,000.00

5,000.00

6,000.00

7,000.00

8,000.00

9,000.00

BATA India Relaxo Footwear Sreeleathers Liberty Shoes Bhartiya Inner Mirza

International

Comparision with Other Brands

Market Capital (Rs. In Cr) Sales (Rs in Cr) Net Profit (Rs. In Cr)

17 Literature Review of BATA

In order to devise a competitive strategy for BATA, we need to analyze Porters Five Forces

Model. The model analyses the different aspects of attractiveness and competitiveness of the

market.

Bargaining power of customers:

High

The potential customers for footwear

industries can be broadly classified into two

categories-

Price sensitive customers who have a

huge bargaining power owing to the

presence of low cost brands and local

products.

High end customers who prefer to buy

discounted and high sale products from

retail outlets or through online

shopping like Jabong, Myntra, Yebhi

etc.

Bargaining power of suppliers:

Low

Shoes are made of leather, rubber and

nylon etc. The materials could be

classified as commodities, where the

manufacturing process adds the value.

For this reason supplier have limited

bargaining power over buyers.

Threat of new entrants:

Low

As this company has established its

name in billion hearts, customers are

keen to go for well-known brand;

hence the prospects of a new entrant in

the market are significantly reduced.

New entrants like Sreeleather, Relaxo

are constantly challenging Bata in low

cost segment for last 5-10 years.

Threat of substitute products:

High

As customers are often ready to switch

brands and try out different products of

the competitors in their search for the

best possible deal in terms of price,

quality of service etc, the threat of

substitute products of Khadims,

Liberty, Paragon etc is high.

Intensity of competitive rivalry:

High

Rivalry is more intense as there are lots

of equally-sized competitors in India

e.g- Liberty, Khadims etc.

Aggressive growth strategy of other

brands with low switching cost rivalry

is more intense in footwear industries.

4.2.1. Porters Five Forces Model

18 Literature Review of BATA

Product

Development and

Diversification

Market

Development

Better Quality at

Low Cost

Customer Care

Initiatives

5. Strategies adopted over time by the brand to tackle competition or prime

market expansion.

To tackle competition and expand the market share Bata is adopting strategies over time e.g.

aggressive retail expansion, promotion of its brands, contemporary styling, and quality control

and strengthening its human resources. As far as growth strategies and competencies of Bata

are concerned in Prime market expansion, they can be categorized as:

5.1.Product Development and Diversification:

Bata has been holding a unique place in the heart of Indians for more than 75 years. Bata

Products have been designed as per various functional needs e.g. sports, casual footwear,

formal-semi and formal. From contemporary to fashion shoes, sports to outdoors, Kids to teens,

Bata today stands for trendy, colorful & youthful footwear destination offering shoes &

accessories for the entire family. With more than 1500 designs to choose from, the design

inspirations are upscale international at affordable price. Bata today design, source & market

many international footwear brands such as Hush Puppies, Naturalizer, Marie Claire, Sundrops,

Dr.Scholl's, Power, Weinbrenner and many others. The name Bata is not limited in footwear

industries, but Bata is also trying to excel in the arena of other propositions like- Umbrellas,

Belts, Bags and Sunglasses etc.

In line with our growth strategy of expanding our consumer base,

we are now adding a layer to our brand proposition the aspirational

layer while continuing to retain our core competence. Key additions

are being made to the catalogue with the introduction of new line of

umbrellas under the name Bata & I. These will be in vibrant colours

aimed at attracting the youth. Also plans to offer bags, belts and

sunglasses.

Sumit Kumar

Bata India Vice-President (Marketing and Customer Services)

19 Literature Review of BATA

5.2. Market Development:

The customer value proposition is substantial as Bata offers value for money along with the

trust which its customers have because of the established Bata brand. In terms of access,

functionality and selection options it always fulfils its promises of being a family outlet where

each member of the family can buy something. To increase the contribution from women and

children's footwear segments, Bata increased the display area for both segments across all

stores, complimented by launching newer trendy designs under brands like Marie Claire, Hush

Puppies, North Star etc.

Bata had made its presence in all corners of the country to introduce its current products into

new market segments- thereby accessibility to everyone becomes possible for the customers.

Bata derives nearly 85 per cent of revenue through retail networks, 14 per cent from non-retail

channels (dealers/institutional/industrial sales) and balance 1 per cent through exports. About

80-90 per cent of the retail revenue is from Tier I and II cities, presenting a huge opportunity

to tap rural and semi-urban markets, which are mainly serviced through dealer networks. Bata

has been present in towns with a population of 500,000 and above and plans to expand to 400

plus cities, with a population of more than 100,000, to improve presence in Tier III and rural

markets through the wholesale division

20 Literature Review of BATA

5.3. Better Quality at Low Cost:

Retail footwear segment in Indian is very price sensitive and has been steadily growing over

the years. Major part of the demand is met by brands like Bata and Liberty. While international

brands largely dominate the higher end of the spectrum, the lower end of the market is

dominated by home-grown players as well as unorganized players.

5. 4. Customer Care Initiatives:

During the year 2013-14, Bata has further strengthened its customer care division. Effective

and satisfactory customer service continued to delight the customers at various points, i.e.,

starting at retail stores, during the sale interaction, post sales services at Customer Help Desk

and obtaining feedback from the customers. A new initiative - Passion to Serve program has

been adopted for the sales personnel which entitles them to periodic promotions. An exclusive

Customer Help Desk has been in place to assist the customer and to locate stores, inform

product availability, process online orders and to acknowledge all their valuable feedback. On

the Digital Space, through Facebook, Bata has entered into over 100,000 customers' personal

space and acquired more than 250,000 Likes on Bata Facebook page.

21 Literature Review of BATA

6. Distribution strategy followed by the BATA:

6.1. Wholesale Channel Classification

6.1.1. Dealers

Family stores located in major cities. Some of the stores are air-conditioned. Products consist

of medium to high priced shoes for the whole family. These shops deal in local brands and

unbranded shoes from small manufacturers.

6.1.2. DSP - Dealer Support Program

Independent dealers who buy 100% of their assortment from Bata depots. A product mix of low

to medium priced shoes for the whole family. DSP customers are allowed to use red and white

square check signboard as per established policy.

6.1.3. Wholesalers

Shoe traders who buy merchandise to resell to traditional dealers located in rural areas and

street markets of major cities/towns. They keep inventory for replacement and sell on credit or

cash basis. Their focus is on volume products, some of them sell to institutions.

6.1.4. Industrial / Institutional

Large industries and private or public institutions who need to buy footwear for their own

workers can approach Wholesale division for their requirements.

22 Literature Review of BATA

6.1.5. Department Store

Big multilevel modern and full service stores located in major metro cities. Selection of medium

to high priced shoes for men, women & children. The collection comprises products with local

and International brands. Full air-conditioned environment.

6. 2. Retail Store profile classification

With the shrinking of the world into a small global village, Indian consumers now aspire for

international taste and style. Bata has more than 1500 retail outlets in India and they aspire to

start 100 new outlets every year. To make things easier for the consumer Bata India has

introduced the concept of store classification and sub divided it into Flagship, City, Family and

Bazar stores.

6.2.1. Flagship

In metro cities. High class location. Fashionable products. Imported and International brands,

air-conditioned, luxurious and cozy atmosphere with comprehensive mobile display units with

new arrivals.

6.2.2. City

In Metros and semi Metros. High and commercial locations, shoeline catering to the needs of

fashion-oriented middle and high income group consumers. Air-conditioned store with panel

display and mobile display unit for brand promotion with new arrivals.

6.2.3. Family

High Traffic commercial location in major and boom towns. Medium to high priced basic

footwear, Non-air conditioned store with total commercial look, mass display, standard panel

and stooping rods.

6.2.4. Bazar

High traffic non-commercial location as destination store and small existing stores in thickly

populated and saturated markets. Basic and volume selling lines for low and medium segments

including liquidation and sub- standard clearance.

6.3. Exports

BIL (Bata India Limited) exports around 3 million pairs of shoes and other footwear annually,

primarily to Western Europe, Middle-East and Far-East markets. Majority of the export is

Canvas shoes under leading private labels to customers in the United Kingdom and France.

Men's leather shoes are sold to established retailers in Europe, Middle-East and Far-East.

BIL's most modern leather shoe Factory is located in Hosur (Tamilnadu) and is geared to make

23 Literature Review of BATA

international quality footwear for export. This Factory is comparable to the best anywhere in

the world with high degree of flexibility and is fully equipped to manufacture Men's, Ladies'

and Children's cemented and Moccasin shoes and other footwear.

7. Summary regarding the future directions for the brand:

Bata is on an aggressive expansion drive. The company wants to move to large format

stores, 50-percent of which will be set up in malls. In an effort to draw a younger

clientele, Bata also plans to add 20-30 'foot-in' stores every year from 2014.

Bata board is considering a proposal to start franchisee operations this year in smaller

cities where setting up company-owned outlets may not be viable. Meanwhile, its online

sales are growing at 200% year on year.

And to keep up their current 15- 20-percent growth momentum, Bata will also invest

Rs 80 crore this year, largely on modernizing and increasing production at their 3

factories in Kolkata, Bangalore and Pune.

Indian Finance Minister Arun Jaitley has announced in the Union Budget 2014-15 a cut

in the excise duty on footwear from 12 percent to 6 percent as a result of which a 10

percent surge in footwear stocks has been listed on BSE. According to Rajeev

Gopalakrishnan, managing director, Bata India Ltd, the middle class and lower middle

class, who make up close to 70% of the market, buy shoes below Rs.1,000 a pair; nearly

half of this segment buys shoes between Rs.500-Rs.1,000 a pair. Hence Bata is

continued to focus on improvement in customer service, addition of new products

ranges, training of employees, consolidation of manufacturing processes and

restructuring of non-retail sales division.

Bata has also rolled out new plans to connect with the youth of the country. It rolled

out its first commercial in years on March 14, 2014. This way the brand could to reach

out to consumers, highlight its offerings and build a fresh connection with the youth.

The brief is to contemporize the brand, showcase its aspirational and trendy products

and reach the evolving consumer; all centered around its Spring Summer' 14 collection.

With a peppy jingle, youthful imagery of flirtatious footsies and visuals full of colour

and life the plan is to attract eyeballs.

24 Literature Review of BATA

Always ahead in new designs, new features, new products. A relentless search will

continue for better quality and pursuit of excellence. Bata aims to provide new shoes

for its customers at every step of their lives, every week.

Bata will remain a household name to the people of India. Making footwear for the

family with a chain of ultra-modern retail outlets all around the country and bringing in

new trends and designs to suit the needs of the trendy and the traditional. Today, Bata

has repositioned itself as a marketing-driven company with emphasis on quality service

and production.

25 Literature Review of BATA

WEBLIOGRAPHY:

bata.in/0/pdf/Bata-India-Annual-2013.pdf

www.bata.com/our-history/

en.wikipedia.org/wiki/Bata_Shoes

http://articles.economictimes.indiatimes.com/2014-03-

12/news/48154356_1_indian-brand-bata-brand-positioning

http://www.bataindia.com/corporate.htm

http://www.moneycontrol.com/news_html_files/broker_report/2014/A

pr-190414-06190414.pdf

http://www.scribd.com

http://www.business-standard.com/article/companies/footwear-

industry-expands-steps-into-non-metro-mkts-111122000042_1.html

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Official Attachment ReportDokument27 SeitenOfficial Attachment ReporttawandaNoch keine Bewertungen

- Brandeo Marketing Calendar Template 2012 - 0Dokument12 SeitenBrandeo Marketing Calendar Template 2012 - 0Brevis77Noch keine Bewertungen

- Final Report of Pakistan State OilDokument18 SeitenFinal Report of Pakistan State OilZia UllahNoch keine Bewertungen

- Ch4 Recording Transactions and Balancing The Ledgers v6Dokument13 SeitenCh4 Recording Transactions and Balancing The Ledgers v6Soputivong NhemNoch keine Bewertungen

- Ford Fusion Engine 2 7l Ecoboost 238kw 324ps Repair ManualDokument22 SeitenFord Fusion Engine 2 7l Ecoboost 238kw 324ps Repair Manualkimberlyweaver020888cwq100% (58)

- Alphaex Capital Candlestick Pattern Cheat SheetDokument5 SeitenAlphaex Capital Candlestick Pattern Cheat SheetMuraliSankar Mahalingam100% (1)

- Screen (HTS) - WINPro 200 DocumentationDokument83 SeitenScreen (HTS) - WINPro 200 DocumentationBob ClarksonNoch keine Bewertungen

- Preparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsDokument25 SeitenPreparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsarunvisNoch keine Bewertungen

- Reformulation of Financial StatementsDokument30 SeitenReformulation of Financial StatementsKatty MothaNoch keine Bewertungen

- MGT 263 Assignment 1Dokument8 SeitenMGT 263 Assignment 1Aysha Muhammad ShahzadNoch keine Bewertungen

- Organisational CultureDokument26 SeitenOrganisational CultureAditi Basnet100% (1)

- Indian OilDokument71 SeitenIndian OilArif Khan50% (2)

- CORPORATE FINANCE Test 3Dokument6 SeitenCORPORATE FINANCE Test 3AnanditaKarNoch keine Bewertungen

- Assignment On Case 1.1 and Case 1.2: Submitted ToDokument4 SeitenAssignment On Case 1.1 and Case 1.2: Submitted ToEhsan AbirNoch keine Bewertungen

- Britannia Milk Marketing Strategies of Britannia Milk ProducDokument66 SeitenBritannia Milk Marketing Strategies of Britannia Milk ProducRohit YadavNoch keine Bewertungen

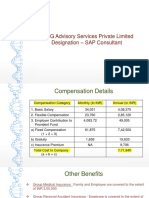

- KPMG Advisory Services Private Limited Designation - SAP ConsultantDokument8 SeitenKPMG Advisory Services Private Limited Designation - SAP ConsultantDhanad AmberkarNoch keine Bewertungen

- Afar 2 Module CH 13Dokument12 SeitenAfar 2 Module CH 13Ella Mae TuratoNoch keine Bewertungen

- How To Calculate Your Hourly RateDokument3 SeitenHow To Calculate Your Hourly RateERIC GARCHITORENANoch keine Bewertungen

- GDPR V ISO 27001 Mapping TableDokument12 SeitenGDPR V ISO 27001 Mapping Tablemr KNoch keine Bewertungen

- Ahs Org OrgchartDokument2 SeitenAhs Org OrgchartДрагослав БјелицаNoch keine Bewertungen

- CVP Excel Exercise UpdatedDokument6 SeitenCVP Excel Exercise Updatedyyshu11Noch keine Bewertungen

- Sales GST 31Dokument1 SeiteSales GST 31ashish.asati1Noch keine Bewertungen

- K04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFDokument106 SeitenK04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFinfosahay100% (1)

- For Sample MCQ ISCADokument19 SeitenFor Sample MCQ ISCAsaraNoch keine Bewertungen

- PRODUCT DIFFRENTIATION Vs MARKET SEGMENTATIONDokument3 SeitenPRODUCT DIFFRENTIATION Vs MARKET SEGMENTATIONRikatsuiii chuchutNoch keine Bewertungen

- Heart Rules of Sales TaxDokument4 SeitenHeart Rules of Sales Taxbroken GMDNoch keine Bewertungen

- JOHANSSON - ChapDokument38 SeitenJOHANSSON - Chaplow profileNoch keine Bewertungen

- Advanced Returns Management 2Dokument27 SeitenAdvanced Returns Management 2Ranjeet Ashokrao UlheNoch keine Bewertungen

- Harvest StrategyDokument3 SeitenHarvest StrategyAkash NelsonNoch keine Bewertungen

- Systemize Your BusinessDokument27 SeitenSystemize Your BusinessvlaseNoch keine Bewertungen