Beruflich Dokumente

Kultur Dokumente

IFM Notes Full Rudramurthy Sir

Hochgeladen von

Sachin PatilOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IFM Notes Full Rudramurthy Sir

Hochgeladen von

Sachin PatilCopyright:

Verfügbare Formate

Rudramurthy B.

V

CRASH COURSE FOR IFM AND

PROJECT FINANCE WILL BE HELD

FROM 25

TH

MAY TO 31

ST

MAY

2011.

TIMINGS: 5 to !".

FEES: R#.1$500%& !'( #)*+',t.

CO-ERAGE. ALL PRACTICAL

AREAS.

GROUP DISCOUNT A-AILABLE

FOR SAME COLLEGE STUDENTS:

L/"/t'0 #'1t#222 M13' 4o) 10"/##/o5# 1t

t6' '1(7/'#t 1# 8' t13' o574 1 B1t,6. Fo(

R'9/#t(1t/o5 150 :)(t6'( 0't1/7# 4o) ,15

,o5t1,t M(.S191( ; <=5>20530 O(

<535>22<5.

1

Rudramurthy B.V

INTERNATIONAL FINANCIAL MANAGEMENT

BASICS

Extends the area of operations to outside the geographical boundaries of the

domestic country.

Generally, Domestic orporates face !ith only business and financial ris"s

only.

#ultinational ompanies are exposed to currency ris".

?UOTES:

$here are t!o types of %uotes&

1. Direct %uotes.

'. (ndirect %uotes.

D/(',t ?)ot': )ne unit of foreign currency expressed in so many units of home

currency.

E*& 1+ , (-R ./.

10 , (-R 1/.

12g of 3ugar , (-R 14.

1BG , (-R 4/,///.

I50/(',t ?)ot': )ne unit of home currency expressed in so many units of foreign

currency. 516D%7

E*& 1(-R , + /./'4

1(-R , 8 /./1.9

1(-R , 3 /./::1

1(-R , BG /.////4

E@,'!t/o5#:

ertain urrencies are al!ays ;uoted for 1//units instead of 1unit.

E*& <apanese =en.

3outh 2orean >on

(ndonesian Rupiah

C1)t/o5:

?ll o@er the !orld, direct ;uotes are follo!ed, except in A2 and Euro countries !here

indirect ;uotes are follo!ed.

B/0 R1t': (t is the Buying rate of the ?uthoriBed dealer i.e. the 3elling rate for the

customer.

'

Rudramurthy B.V

O::'( R1t': (t is the 3elling rate of the ?uthoriBed dealer i.e. the Buying rate for the

customer.

S!('10: (t is the difference bet!een )ffer rate and Bid Rate.

S!('10: AI5 BC D 3pread in Rs C 1//

)ffer Rate

Co"!)t1t/o5 o: /50/(',t E)ot' :o( 1 t8o 814 0/(',t E)ot':

Bid rate of (ndirect %uote , 1 .

)ffer rate of Direct %uote

)ffer rate of (ndirect %uote , 1 .

Bid rate of Direct %uote

C(o## R1t'#:

?uthoriBed dealers may ha@e ;uotation only for some popularly traded foreign

currencies. (f a customer needs a ;uotation for a currency other than these currencies,

R)33 R?$E3 are used.

PROBLEM:

1. 3uppose R# plans to in@est in #artin ltd, a British corporation that is currently

selling for 84/ per share. R# has +1,1',4// to in@est at current exchange rate of

+'.'4618

a7 Do! many shares can R# purchaseE

b7 >hat is his net return if the price of #artin ltd at the end of the year is :/8 and

the exchange rate at that time is +'.//618

So7)t/o5

a7

R# has +11'4// to in@est , + 11'4// , 4//// 8

'.'4

R# can purchase , 4/// , 1/// shares

4/

b7

Dis return in pounds !ould be 1/// C :/ 8 , ://// 8

Dis return in dollars !ould be ://// C ' , +1'////

Return in F 50ounds7 , ://// G 4//// , '/ F

4////

Return in F 5Dollars7 , 1'//// G 11'4// , :.:1 F

11'4//

$his change in percentage is due to ARRE-= R(32

9

Rudramurthy B.V

Hactors influencing apital Budgeting

1. Estimated cash out flo!

'. Estimated future cash inflo!

9. Estimated life of the proIect

.. Discounting factor 5Ris" adIusted rate7

4. 3pot rate and expected for!ard rate

:. Ris" free rate in home country an foreign country

$here are t!o approaches to e@aluate international capital budgeting

a7 Dome currency approach

b7 Horeign currency approach

P(o*7'"

'. (ndian 0harma ltd an (ndian based foreign #- is e@aluating an o@erseas

in@estment proposal, (ndia 0harma ltd exporter of pharmaceutical products is

considering to build a plant in Anited 3tates the proIect !ill entail an initial outlay

of + 1// million and it is expected to gi@e the follo!ing cash flo! o@er its life of .

years

=ears ash Hlo! 5in million +7

1 9/

' ./

9 4/

. :/

$he current spot exchange rate is Rs .46+ the ris" free rate of interest in (ndia is 11

F and in A3 it is : F. (ndia 0harma re;uires a rupee return of 14 F on the abo@e

proIect. alculate the -0V under both home currency and foreign currency

approach.

So7)t/o5

a7 Dome currency approach

alculation of expected for!ard rate according to (nternational Hischer effect

t

3

t

, 3

/

1 J r

hc

1 J r

fc

>here 3

t

, for!ard rate for year t

3

/

, spot rate

r

hc

, ris" free rate in the home country

r

fc

, ris" free rate in the foreign country

t , time period

3

1

, .4 1 J /.11 , .1.1'

1 J /./:

3

'

, .4 1 J /.11

'

, .K.94

1 J /./:

.

Rudramurthy B.V

3

9

, .4 1 J /.11

9

, 41.:1

1 J /./:

3

.

, .4 1 J /.11

.

, 4..11

1 J /./:

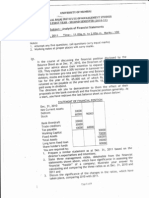

C17,)71t/o5 o: NP-

=ear ash Hlo! 5in

million +7

ER ash Hlo! 5in

million Rs7

DH L 14F DH

/ 51//7 .4.// 5.4//7 1.//// 5.4//7

1 9/ .1.1' 1.19.:/ /.M:K: 1''K.''

' ./ .K.94 1K1..// /.14:1 1.K'.:9

9 4/ 41.:1 '4M9.4/ /.:414 1:KM.:K

. :/ 4..11 9'.:.:/ /.411M 1M4:.'4

=F1F.F0 1FF>.F<

3ince -0V is positi@e, the abo@e foreign proIect shall be accepted

b7 Horeign currency approach

51 J ris" adIusted rupee rate7 , 51 J R

f

rupee rate7 C 51 J ris" premium7

51 J /.147 , 51 J /.117 51 J r

p

7

51 J r

p

7 , 1.1461.11 , 1./9:

r

p

, 9.: F

51 J ris" adIusted dollar rate7 , 51 J R

f

dollar rate7 C 51 J ris" premium7

51 J ris" adIusted dollar rate7 , 51 J /./:7 C 51 J /./9:7

51 J ris" adIusted dollar rate7 , 1./KM1:

ris" adIusted dollar rate , K.M F

alculation of -0V

=ears ash Hlo! in million + DH L K.M F DH

/ 51//7 1 N1//

1 9/ /.K1/1 '1.9''.

' ./ /.M'K4 99.11M.

9 4/ /.144. 91.111.

. :/ /.:MM/ .1.'M/'

3<.552=

9K.4'.. C .4 , 1FF<.>

4

Rudramurthy B.V

Dome currency approach

1. alculation of Expected Hor!ard rate 5ERH7 using international Hischer effect

'. on@ert cash flo!s in foreign currency to local currency using spot rate and

ERH

9. alculate present @alue of cash flo!s in local currency 5Ris" adIusted local

country rate i.e. DH7

.. E@aluate the proIect by calculating its -0V, if -0V is positi@e accept or reIect

the proposal

Horeign currency approach

1. alculation of Ris" premium rate

'. alculation of ris" adIusted foreign country rate

9. alculation of cash flo! using ris" adIusted foreign country rate and

discounting factor

.. E@aluate the proposal using -0V

P(o*7'"

9. Barret orporation presently has no existing business in Hrance but is considering

the establishment of a subsidiary there. $he follo!ing information is gi@en to

assess this proIect

$he initial in@estment re;uired is HH :/ million. $he existing spot rate is + /.'/O

the initial in@estment in dollars is + 1' million. (n addition to HH :/ million

initial in@estment on plant and e;uipment, HH 1/ million is needed for !or"ing

capital and !ill be borro!ed by the subsidiary from Hrench ban". $he Hrench

subsidiary of Barret !ill pay interest only on the loan each year at an interest of

1/F.

$he loan principal is to be paid in 1/ years

$he proIect !ill be terminated at the end of year 9, !hen subsidiary !ill be sold.

$he price, demand, and @ariable cost of the product in Hrance are as follo!s&

=ear 0rice 5HH7 Demand Variable ost 5HH7

1 :// .//// '4

' :4/ 4//// 9/

9 1// ://// ./

$he fixed costs are estimated to be HH 4 million per year.

$he exchange rate of the Hrench Hranc is expected to be + /.'' at the end of year

1, +/.'4 at the end of year ' and + /.'M at the end of year 9.

$he Hrench go@ernment !ill impose a !ithholding tax of 1/ F on earnings

remitted by the subsidiary. $he A.3 go@ernment !ill allo! a tax credit on

remitted earnings and !ill not impose any additional taxes.

:

Rudramurthy B.V

?ll cash flo!s recei@ed by the subsidiary are to be sent to the parent at the end

of each year. $he subsidiary !ill use its !or"ing capital to support ongoing

operations.

$he plant and e;uipment are depreciated o@er 1/ years, using straightNline

depreciation method. 3ince the plant and e;uipment are initially @alued at HH :/

million, the annual depreciation expense is HH : million.

(n three years, the subsidiary is to be sold. Barret plans to let the ac;uiring firm

assume the existing Hrench loan. $he !or"ing capital !ill not be li;uidated, but

!ill be used by the ac;uiring firm

$he re;uired rate of return on this proIect is 14 F.

a7 Determine the net present @alue of this proIect. 3hould Barret accept this

proIectE

b7 ?ssume that Barret o. pro@ides the additional funds for !or"ing capital

so that the loan from the Hrench go@ernment is not necessary.

c7 >ould the -0V of this proIect from the parentPs perspecti@e be more

sensiti@e to exchange rate mo@ements if the subsidiary used Hrench

financing to co@er the !or"ing capitalE Explain

d7 ?ssume Barret o. uses the original proposed financing arrangement and

that funds are bloc"ed until the subsidiary is sold. $he funds to be remitted

are rein@ested at a rate of M F 5after taxes7 until the end of year 9. Do! is

the proIectPs -0V affectedE

e7 ?ssume that Barret o. decided to implement the proIect, using the

original proposed financing arrangementO also assume that after one year, a

Hrench firm offers Barret o. a price of + 9/ million after taxes for the

subsidiary, and that Barret o. original forecasts for years ' and 9 ha@e not

changed. 3hould Barret o. di@est the subsidiaryE Explain

So7)t/o5

a7

$o find cash flo! transferred to parent co

HH in million

P1(t/,)71(# 1 2 3

3ales

N Variable ost

'.

1

9'.4

1.4

.'

'..

Co5t(/*)t/o5

N Hixed ost

23

4

31

4

3<.>

4

EBITD

N Depreciation

1

:

2>

:

3=.>

:

EBIT 1:t'( D'!(',/1t/o5

N (nterest

12

1

20

1

2.>

1

EBT A1:t'( /5t'('#t 150 0'!(',/1t/o5C 11 1< 2F.>

1

Rudramurthy B.V

N tax N N N

EAT

J depreciation

11

:

1<

:

2F.>

:

EATBD

J 3al@age @alue 5:/ G 5:C977

1F

N

25

N

33.>

.'

C1#6 :7o8 t(15#:'(1*7' to !1('5t ,o

N !ithholding tax

1F

1.1

25

'.4

F5.>

1.4:

C1#6 :7o8 t(15#:'(('0 to !1('5t ,o 15.3 22.5 >.0=

alculation of -0V

=ears ash flo! 5in

million HH 7

Exchange rate ash flo! 5in

million dollar7

DH L 14 F DH

/ 5:/7 /.'/ 51'7 1.//// 51'7

1 14.9 /.'' 9.9:: /.M:K: '.K'1/

' ''.4 /.'4 4.:'4 /.14:1 ..'499

9 :M./. /.'M 1K./41' /.:414 1'.4':4

F.F0>F

$he abo@e proIect shall be accepted since -0V is positi@e

b7

$o find cash flo! transferred to parent co

HH in million

P1(t/,)71(# 1 2 3

EBIT 1:t'( D'!(',/1t/o5

N (nterest

12

N

20

N

2.>

N

EBT A1:t'( /5t'('#t 150 0'!(',/1t/o5C

N tax

12

N

20

N

2.>

N

EAT

J depreciation

12

:

20

:

2.>

:

EATBD

J 3al@age @alue 5:/ G 5:C977

1

N

2>

N

3=.>

.'

C1#6 :7o8 t(15#:'(1*7' to !1('5t ,o

N !ithholding tax

1

1.M

2>

'.:

F>.>

1.::

C1#6 :7o8 t(15#:'(('0 to !1('5t ,o 1>.2 23.= >.<=

alculation of -0V

=ears ash flo! 5in

million HH 7

Exchange rate ash flo! 5in

million dollar7

DH L 14 F DH

/ 51/7 /.'/ 51.7 1.//// 51.7

1 1:.' /.'' 9.4:. /.M:K: 9./KK1

' '9.. /.'4 4.M4 /.14:1 ...'9.

9 :M.K. /.'M 1K.9/9' /.:414 1'.:K''

>.21=F

$he abo@e proIect shall be accepted since -0V is positi@e

c7 (f Barret orporation funds the !or"ing capital re;uirement of its subsidiary,

then it is exposed to Hrench Hranc 1/ million, !here as if the subsidiary

finances its !or"ing capital from Hrench Ban" then Barret orporation is

M

Rudramurthy B.V

exposed to a total capital of HH :/ million. $hus to minimiBe currency ris" it is

ad@isable to borro! !or"ing capital re;uired from Hrench Ban". Digher the

exposure higher is the ris" and @isa @ersa.

d7

HH in million

P1(t/,)71(# 1 2 3

C1#6 :7o8 t(15#:'(1*7' to !1('5t ,o 1F 25 F5.>

J interest recei@ed at the end of year '

J interest recei@ed at the end of year 9

1.9:

1..:M

N

'

N

N

C1#6 F7o8 1<.3 2F F5.>

alculation of -0V

=ears ash flo! 5in

million HH 7

Exchange rate ash flo! 5in

million dollar7

DH L 14 F DH

/ 5:/7 /.'/ 51'7 1.//// 51'7

1 1K.M9 /.'' ..9:': /.M:K: 9.1K9:

' '1.// /.'4 :.14 /.14:1 4.1/./

9 14.:/ /.'M '1.1:M /.:414 19.K1M9

10.15

-ote& N Hor calculating interest time @alue of money is ignored

e7

P1(t/,)71(#

C1#6 F7o8AFFC

N !ithholding tax L 1/ F

1F

1.1

C1#6 F7o8 1:t'( WT 15.3

C1#6 F7o8 1:t'( WT /5 Do771( A15.3 G 0.22C

J 3al@age Value

3.3>>

9/

ash Hlo! in Dollar

D/#,o)5t'0 ,1#6 /5:7o8 ADF ; 15 BC

A33.3>> G0. ><>C

99.9::

2<.015

N Discounted cash outflo! 1'

NP- 11./14

(t is better to sell the subsidiary at the end of year 1 as higher -0V of +11./14

million is achie@ed under this situation.

.. =es corporation expects to recei@e cash di@idend from a Hrench Ioint @enture o@er

the coming 9 years. $he first di@idend is expected to be paid on 9161'6/' and is

expected to be Q 1'//// the di@idend is then expected to gro! 1/ F per year o@er

the follo!ing ' years, the current exchange rate is +/.K1M/6Q the !eighted a@erage

cost of capital for =es corporation is 1' F.

a7 >hat is present @alue of expected Euro di@idend stream if the Euro is

expected to appreciate . F per annum against dollarE

b7 >hat is the present @alue of expected Euro di@idend stream if the Euro !ere to

depreciate at the rate of 9 F per annum against dollarE

K

Rudramurthy B.V

So7)t/o5

a7 alculation of 0V of di@idends

=ears / 1 ' 9

Expected di@idend N 1'//// 1K'/// M11'//

>?) or DH L 1' F 1 /.MK'K /.1K1' /.111M

Expected return 5increase

by . F e@ery year7 /.K1M/ /.K4.1 /.KK'K 1./9':

0resent @alue of di@idends N :191.K :':K// :./99. 10<3

b7 alculation of 0V of di@idends

=ears / 1 ' 9

Expected di@idend N 1'//// 1K'/// M11'//

>?) or DH L 1' F 1 /.MK'K /.1K1' /.111M

Expected return 5decrease

by 9 F e@ery year7 /.K1M/ /.MK/4 /.M:91 /.M91M

0resent @alue of di@idends N 41'.9K 4.494/ 41K4.9 1>3F332

4. * orporation presently has no existing business in -e! Realand but is

considering the establishment of a subsidiary there. $he follo!ing information is

gi@en to assess this proIect

$he initial in@estment re;uired is + 4/ million in -R dollars. $he existing spot

rate is /.4/ A3D6 1 -RDO the initial in@estment in A3D is + '4 million. (n

addition to 4/ million -RD initial in@estments on plant and e;uipments '/

million -RD is needed for !or"ing capital and !ill be borro!ed by the

subsidiary from -R ban". $he -R subsidiary of * !ill pay interest only on the

loan each year at an interest of 1.F.

$he loan principal is to be paid in 1/ years

$he proIect !ill be terminated at the end of year 9, !hen subsidiary !ill be sold.

$he price, demand, and @ariable cost of the product in -R are as follo!s&

=ear 0rice 5-RD7 Demand Variable ost 5-RD7

1 4// .//// 9/

' 411 4//// 94

9 49/ ://// ./

$he fixed costs are estimated to be : million -RD per year.

$he exchange rates of the -RD is expected to be + /.4' at the end of year 1,

+/.4. at the end of year ' and + /.4: at the end of year 9.

$he -R go@ernment !ill impose an income tax of 9/ F on income in addition it

!ill impose a !ithholding tax of 1/ F on earnings remitted by the subsidiary.

$he A.3 go@ernment !ill allo! a tax credit on remitted earnings and !ill not

impose any additional taxes.

1/

Rudramurthy B.V

?ll cash flo!s recei@ed by the subsidiary are to be sent to the parent at the end

of each year. $he subsidiary !ill use its !or"ing capital to support ongoing

operations.

$he plant and e;uipment are depreciated o@er 1/ years, using straightNline

depreciation method. 3ince the plant and e;uipment are initially @alued at 4/

million -RD, the annual depreciation expense is 4 million -RD.

(n three years, the subsidiary is to be sold. * plans to let the ac;uiring firm

assume the existing -R loan. $he !or"ing capital !ill not be li;uidated, but !ill

be used by the ac;uiring firm. >hen it sells the subsidiary * corporation

expected to recei@e 4' million -RD after subtracting capital gain tax, assume

that this amount is not subIected to a !ithholding tax

* corporation re;uires '/ F R)( on this proIect

a7 Determine the net present @alue of this proIect. 3hould * orp. accept this

proIectE

b7 ?ssume that * orp. is also considering an alternati@e financing

arrangement in !hich the parent !ould in@est an additional + 1/ million to

co@er !or"ing capital re;uired so that subsidiary !ould a@oid the -R ban"

loan. (f this arrangement is used the selling price of the subsidiary after

subtracting any capital gains tax is expected to be 1M million -RD higher.

(s this alternati@e financing arrangement more feasible for the parent than

original proposalE

c7 Hrom the parentPs perspecti@e !ould the -0V of this proIect be more

sensiti@e to exchange rate mo@ements. (f the subsidiary uses -R financing

to co@er the !or"ing capital or if the parent in@ests more of its o!n funds

to co@er the !or"ing capital explain.

d7 ?ssume * orp. uses the original proposed financing arrangement and

that funds are bloc"ed until the subsidiary is sold. $he funds to be remitted

are rein@ested at a rate of : F 5after taxes7 until the end of year 9. Do! is

the proIectPs -0V affectedE

e7 >hat is the brea"Ne@en sal@age @alue of this proIect if * orp. uses

original financing proposal and funds are not bloc"edE

f7 ?ssume that * orp. decided to implement the proIect, using the original

proposed financing arrangementO also assume that after one year a -R firm

offers * orp. a price of + '1 million after taxes for the subsidiary, and

that * orp. original forecasts for years ' and 9 ha@e not changed. 3hould

* orp. di@est the subsidiaryE Explain

11

Rudramurthy B.V

So7)t/o5

a7

$o find cash flo! transferred to parent co

-RD in million

P1(t/,)71(# 1 2 3

3ales

N Variable ost

'/./

1.'

'4.44

1.14

91.M

'..

Co5t(/*)t/o5

N Hixed ost

1.

:

23.

:

2<.=

:

EBITD

N Depreciation

12.

4

1F.

4

23.=

4

EBIT 1:t'( D'!(',/1t/o5

N (nterest

F.

'.M

12.

'.M

1.=

'.M

EBT A1:t'( /5t'('#t 150 0'!(',/1t/o5C

N tax

5

1.4

10

9

15.>

..:M

EAT

J depreciation

3.5

4

F

4

10.<2

4

EATBD

N !ithholding tax

.5

/.M4

12

1.'

15.<2

1.4K

EATBD 1:t'( W/t66o70/59 t1@

J 3al@age @alue

F.>5

N

10.

N

1=.33

4'

C1#6 :7o8 t(15#:'(('0 to !1('5t ,o F.>5 10. >>.33

alculation of -0V

=ears ash flo! 5in

million -RD 7

Exchange rate ash flo! 5in

million dollar7

DH L '/ F DH

/ 54/7 /.4/ 5'47 1.//// 5'47

1 1.:4 /.4' 9.K1M /.M999 9.914/

' 1/.M/ /.4. 4.M9' /.:K.. ../4//

9 ::.99 /.4: 91.1..M /.41M1 '1..K4M

3.>0

$he abo@e proIect shall be accepted since -0V is positi@e

b7

$o find cash flo! transferred to parent co

-RD in million

P1(t/,)71(# 1 2 3

EBIT 1:t'( D'!(',/1t/o5

N (nterest

F.

N

12.

N

1.=

N

EBT A1:t'( /5t'('#t 150 0'!(',/1t/o5C

N tax

F.

'.9.

12.

9.M.

1.=

4.4'

EAT

J depreciation

5.=>

4

.<>

4

12.

4

EATBD

N !ithholding tax

10.=>

1./4

13.<>

1..

1F.

1.M

EATBD 1:t'( W/t66o70/59 t1@

J 3al@age @alue

<.=1

N

12.5>

N

1>.0

1/

C1#6 :7o8 t(15#:'(('0 to !1('5t ,o <.=1 12.5> >.0

1'

Rudramurthy B.V

alculation of -0V

=ears ash flo! 5in

million HH 7

Exchange rate ash flo! 5in

million dollar7

DH L '/ F DH

/ 51/7 /.4/ 5947 1.//// 5947

1 K..1 /.4' ..MK9' /.M:K: ../111

' 1'.4: /.4. :.1M'. /.14:1 ..11//

9 M:./M /.4: .M.'/.M /.:414 '1.MK:9

1.>=

$he abo@e proIect shall be accepted since -0V is positi@e the original proposal is

more feasible as -0V of original proposal is higher compared to ne! proposal.

c7 (f * orp. funds the !or"ing capital re;uirement of its subsidiary, then it is

exposed to -RD 1/ million, !here as if the subsidiary finances its !or"ing

capital from -R Ban" then * orp. is exposed to a total capital of -RD 4/

million. $hus to minimiBe currency ris" it is ad@isable to borro! !or"ing

capital re;uired from -R Ban". Digher the exposure higher is the ris" and

@isa @ersa.

d7

-RD in million

P1(t/,)71(# 1 2 3

C1#6 :7o8 t(15#:'(1*7' to !1('5t ,o 10.=> 13.<> F.

J interest recei@ed at the end of year '

J interest recei@ed at the end of year 9

/.:'1:

/.::49

N

/.M.

N

N

C1#6 F7o8 11.F53 1=. F.

alculation of -0V

=ears ash flo! 5in

million -RD 7

Exchange rate ash flo! 5in

million dollar7

DH L 14 F DH

/ 54/7 /.4/ 5'47 1.//// 5'47

1 11.14 /.4' :.11 /.M999 4./K11

' 1..M/ /.4. 1.KK' /.:K.. 4.44//

9 M1.MM /.4: .K.'1'M /.41M1 'M..1K:

1=.1213

-ote& N Hor calculating interest time @alue of money is ignored

e7

=ears ash flo! 5in

million -RD 7

Exchange rate ash flo! 5in

million dollar7

DH L 14 F DH

/ 54/7 /.4/ 5'47 1.//// 5'47

1 1.:4 /.4' :.11 /.M999 4./K11

' 1/.M/ /.4. 1.KK' /.:K.. 4.44//

9 1=.33 H S- 0.5> 30.=>= 0.5FF 1F.>350

0

By re@erse method !e get 51..99 J 3V7 C /.4: , 9/..:.M

$herefore S- D =0.0F

19

Rudramurthy B.V

f7

P1(t/,)71(#

C1#6 F7o8AFFC

N !ithholding tax L 1/ F

10.=>

1./4

C1#6 F7o8 1:t'( WT <.=1

C1#6 F7o8 1:t'( WT /5 Do771( A<.=1 G 0.52C

J 3al@age Value

=.<

'1

ash Hlo! in Dollar

D/#,o)5t'0 ,1#6 /5:7o8 ADF ; 15 BC A31.<

G 0. 333C

91.MK

2>.5

N Discounted cash outflo! '4

NP- 1.5FF

(t is better not sell the subsidiary at the end of year 1 -0V of +1.411 million is

achie@ed under this situation !hich is less than the actual -0V of + 9.M:/M million.

A0+)#t'0 NP-

(n this -0V method all cash flo!s are discounted at !eighted a@erage cost of

capital and it is assumed that uncertainty is in@ol@ed in different cash flo! schemes

are same.

?dIusted -0V method pro@ides the flexibility of adopting the different

discount factors for different cash flo! schemes. Digher the uncertainty in@ol@ed

from a cash flo! scheme, higher is the discount factor and @ice @ersa.

P(o*7'"

:. ? 1/ million A3D is in@ested in $hailand for a period of 4 years. (t is financed by

4/ F debt and 4/ F e;uity, normally the cost of debt !ould be 1' F for proIect of

this type in $hailand, the !orld ban" is ho!e@er !illing to lend us 4 million A3D

at a subsidiBed rate of 1/ F. $he proIect is expected to generate 9 million A3D

operating cash flo! e@ery year for a period of 4 years and the marginal tax rate is

./ F.alculate adIusted -0V for the abo@e proIect assuming discount rate of

1..:F.

So7)t/o5

ash Hlo! 3cheme 1&

)perating cash flo! 9 million e@ery year to be discounted at the rate of 1..: F.

ash Hlo! 3cheme '& 3a@ings in interest

-ormal debt rate applicable in $hailand is 1' F, rate paid for debt borro!ed

from >orld Ban" is 1/ F therefore sa@ings in interest rate is ' F.

3a@ings in interest , 4 million C ' F , /.1 million

$he abo@e sa@ings in interest should be discounted at the general debt capital

rate of 1' F

ash Hlo! 3cheme 9& $ax benefit on account of payment of interest

Debt capital borro!ed from >orld Ban" 4 million, rate of interest 1/ F

?nnual interest , 4 million C1/ F , /.4 million

$ax benefit , ?nnual interest C tax rate

, /.4 million C ./ F , /.' million

1.

Rudramurthy B.V

alculation of ?dIusted -0V

$ype of ash Hlo! ash Hlo!

5+ in million7

0eriod Discount

Rate

?nnuity

Discount rate

DH

)perating ash

Hlo!

9 1N4 1..: F 9.9M.1 1/.14'9

3a@ings in interest /.1 1N4 1' F 9.:/4 /.9:/4

$ax benefit /.' 1N4 1' F 9.:/4 /.1'1

11.23=

S D( , 11.'9. million

N S D) , 1/ million

?-0V , 1.'9. million

$he abo@e proIect shall be accepted since ?-0V is positi@e

1. limited an (ndian manufacturer of high ;uality sports goods and related

e;uipment, the company is planning to increase its exports in the coming years as

a part of its strategy it is thin"ing of establishing a subsidiary in Hrance that could

manufacture and sell goods locally. $he management has as"ed @arious

departments of the company to supply all rele@ant information for multinational

capital budgeting analysis, the rele@ant information is gi@en belo!

(n@estment& N $he total initial in@estment to finance plant and e;uipment is

estimated at '/ million Hrench Hranc that !ill be in@ested by the parent. >or"ing

capital re;uirements estimated at HH 1/ million !ill be borro!ed by subsidiary

from a local financing institution at an interest rate of M F per annum, the

principal !ill be paid at the end of 4

th

year !hen the proIect is terminated !hile

the interest payments are it be paid by the subsidiary annually.

Depreciation& N $he Hrench go@ernment !ill allo! the company to depreciate the

plant and e;uipment using straightNline method, the depreciation expense sill be

HH . million per year the li@e of the proIect is excepted to be 4 years. $he forecast

price and sales schedule for the next 4 years are as gi@en belo!

=ear 0rice6unit 3ales in Hrance

1 HH :// 4////

' HH :// 4////

9 HH :4/ M////

. HH ::/ 1/////

4 HH :M/ 1'////

$he @ariable cost are HH ''/6unit in year 1 and in year ' it is expected to rise to

HH 9//6unit and remain constant for years 9, . and 4. $he fixed costs other then

depreciation are expected to be HH 1.4 million6year.

Exchange Rate& N $he spot exchange rate of the Hrench Hranc is Rs :.: the

forecasted exchange rate for all future period is Rs :.M

Remittance& N ?ll profits after tax realiBed are to be transferred to the parent at the

end of each year. $he Hrench go@ernment plans to impose no restrictions on the

remittance of cash flo!s but !ill impose a 4 F !ithholding tax on funds remitted

by subsidiary to the parent as mentioned earlier.

14

Rudramurthy B.V

Hrench go@ernment taxes on income earned by subsidiary& N $he (ndian

go@ernment !ill allo! a tax credit on taxes paid in Hrance, the company re;uires a

1/ F return on this proIect.

?d@ise the (ndian company regarding the financial @iability of the proposal,

should the proIect be setup in Hrance or not.

?dditional onsiderations

1. ?ssume that all funds are bloc"ed until the end of 4

th

year this funds can be

rein@ested locally to yield : F annually after taxes, sho! the calculations

and comment on the result.

'. ?ssume the follo!ing exchange rate scenario and recalculate your results

?lternati@e 1

=ear Exchange Rate

1 :.M/

' :.K/

9 :.K4

. 1.//

4 1./4

?lternati@e '

=ear Exchange Rate

1 :.44

' :.4/

9 :../

. :.9M

4 :.94

So7)t/o5

alculation of cash flo! to parent company

P1(t/,)71(# 1 2 3 = 5

3ales

N Variable ost

9/

11

9/

11

4'

'.

::

9/

M1.:

9:

Co5t(/*)t/o5

N Hixed ost

1<

1.4

1<

1.4

2

1.4

3>

1.4

=5.>

1.4

EBITD

N Depreciation

1F.5

.

1F.5

.

2>.5

.

3=.5

.

==.1

.

EBIT

N (nterest 51/ C M F7

13.5

/.M

13.5

/.M

22.5

/.M

30.5

/.M

=0.1

/.M

EBT

N $ax

12.F

N

12.F

N

21.F

N

2<.F

N

3<.3

N

EAT

J Depreciation

12.F

.

12.F

.

21.F

.

2<.F

.

3<.3

.

EATBD

J >or"ing apital

N Repayment of loan

N >ithholding $ax

1>.F

N

N

/.M.

1>.F

N

N

/.M.

25.F

N

N

1.'K

33.F

N

N

1.:K

=3.3

1/

1/

'.11

C1#6 F7o8

T(15#:'(('0 to

!1('5t ,o"!154

15.> 15.> 2=.=1 32.01 =1.13

1:

Rudramurthy B.V

alculation of -0V

=ears ash Hlo!

5HH in

million7

Exchange

Rate

ash Hlo!

5Rs in

million7

DH L1/F DH

/ 5'/7 :.: 519'7 1 519'7

1 14.M: :.M 1/1.M4 /.K/K1 KM./.

' 14.M: :.M 1/1.M4 /.M':. MK.19

9 '...1 :.M 1:..:9 /.1419 1'9.:K

. 9'./1 :.M '11.:1 /.:M9/ 1.M.:1

4 .1.19 :.M '1K.:M /.:'/K 119.::

502.22

3ince -0V is positi@e, accept the proIect

?dditional consideration

a7

(nterest for 1

st

year , 1:.1 C 51./:7

.

, '1./M

(nterest for '

nd

year , 1:.1 C 51./:7

9

, 1K.MK

(nterest for 9

rd

year , '4.1 C 51./:7

'

, 'M.MM

(nterest for .

th

year , 99.1 C 51./:7

1

, 94.1'

(nterest for 4

th

year , .9.9 C 51./:7

/

, .9.9/

alculation of -0V

=ears ash Hlo!

5HH in

million7

Exchange

Rate

ash Hlo!

5Rs in

million7

DH L1/F DH

/ 5'/7 :.: 519'7 1 519'7

1 '1./M :.M 1.9.9. /.K/K1 19/.91

' 1K.MK :.M 194.'4 /.M':. 111.1M

9 'M.MM :.M 1K:.9M /.1419 1.1.44

. 94.1' :.M '.'.K/ /.:M9/ 1:4.K/

4 .9.9/ :.M 'K.... /.:'/K 1M'.M'

>0>.3>

b7 ?lternati@e 1

alculation of -0V

=ears ash Hlo!

5HH in

million7

Exchange

Rate

ash Hlo!

5Rs in

million7

DH L1/F DH

/ 5'/7 :.:/ 519'7 1 519'7

1 14.M: :.M/ 1/1.M4 /.K/K1 KM./.

' 14.M: :.K/ 1/K..9 /.M':. K/...

9 '..'1 :.K4 1:K.:4 /.1419 1'1..:

. 9'./1 1.// ''../1 /.:M9/ 149./.

4 .1.19 1./4 'MK.K1 /.:'/K 1M/./4

51F.03

11

Rudramurthy B.V

?lternati@e '

alculation of -0V

=ears ash Hlo!

5HH in

million7

Exchange

Rate

ash Hlo!

5Rs in

million7

DH L1/F DH

/ 5'/7 :.:/ 519'7 1 519'7

1 14.M: :.44 1/9.MM /.K/K1 K....

' 14.M: :.4/ 1/9./K /.M':. M4.'/

9 '..'1 :../ 14:.'' /.1419 111.91

. 9'./1 :.9M '/..'' /.:M9/ 19K..K

4 .1.19 :.94 ':1.1M /.:'/K 1:'.11

=>>.>F

1M

Rudramurthy B.V

PARITY CONDITIONS IN INTERNATIONAL FINANCE AND

CURRENCY FORECASTING

#eaning of arbitrage& N (t is simultaneous purchase and sale of the same assets or

commodities on different mar"ets to profit from price discrepancies.

Ta! of one price& N (n competiti@e mar"ets characteriBed by numerous buyers and

sellers, ha@ing lo! cost access to information exchange adIusted prices of identical

tradable goods and financial assets must be !ithin transition costs of e;uality

!orld!ide.

(nternational arbitrageurs !ho follo! the principle of UBuy lo! and sell highV

enforce the abo@e rule of la! of one price.

Hor!ard 0remium and Discount& N ? foreign currency is said to be at premium if

for!ard rate expressed is terms of home currency is greater than spot rate or else it is

said to be at discount.

?nnualiBed F of for!ard , HR G 3R C 9:/ .

0remium or Discount 3R Hor!ard contract period in days

$he follo!ing fi@e economic relationships arise due to the pre@alence of Ula! or one

priceV and international arbitraging opportunities.

1. 0ARD?3E 0)>ER 0?R($= 50007

'. H(3DER EHHE$ 5HE7

9. (-$ER-?$()-?T H(3DER EHHE$ 5(HE7

.. (-$ERE3$ R?$E 0?R($=5(R07

4. H)R>?RD R?$E3 ?3 A-B(?3ED 0RED($)R3 )H HA$ARE 30)$

R?$E3 5AH3R7

(f inflation in A3 is expected to exceed inflation in (ndia by ' F for the

coming year then the A3 dollar should decline in @alue by ' F relati@e to Rupee by

the same rate, the one year A3D for!ard should sell at a ' F discount relati@e to the

(ndian Rupees. 3imilarly, 1Nyear interest rates in A3 should be about ' F higher than

oneNyear interest rates on securities of comparable ris" in (ndia.

1K

Rudramurthy B.V

PURCHASING POWER PARITY IPPPJ

(f international arbitrage enforces the la! of one price, then the exchange rate

bet!een the home currency and domestic goods must be e;ual to the exchange rate

bet!een home currency and foreign goods.

(n other !ords, one unit of home currency should ha@e the same purchasing

po!er !orld!ide. Ex& N (f a pen costs Rs 4/ in (ndia and the same model pen costs +1

in A3, then exchange rate shall be +1 , Rs 4/.

Hor same purchasing po!er to remain constant !orld !ide, the foreign

exchange rate must change approximately the same as difference bet!een the

domestic and foreign rates of inflation.

3!edish economist WGusta@ asselP first stated purchasing po!er parity in a

rigorous manner in 1K1M. De used it as the basis for recommending a ne! set of

official exchange rates at the end of >orld >ar X.

0urchasing po!er parity in its absolute @ersion states that price le@els should

be same !orld !ide !hen expressed in common currency. ? unit of home currency

should ha@e the same purchasing po!er !orld!ide. $his theory is application of la!

of one price to national price le@els or else arbitrage opportunities !ould exist.

Do!e@er, absolute 000 ignores the effects of transportation costs, tariffs ;uotas and

other restrictions and product differentiations in free trade.

$he relati@e @ersion of 000 states that the exchange rate bet!een the home

currency and foreign currency !ill adIust to reflect changes in the price le@els of t!o

countries. Ex& N (f inflation in (ndia is 4 F and in A3 is 'F then the rupee @alue of the

A3D must rise by about 9 F to e;ualiBe the Rupee price of goods in both the

countries.

(f i

h

and i

f

are inflations of home country and foreign country respecti@ely, e

/

is

home currency @alue of 1 unit of foreign currency at the beginning of the period and e

t

is the spot exchange rate in period t, then

e

t

,

51 J i

h

7

t

e

/

51 J i

f

7

t

e

t

,

e

/

51 J i

h

7

t

51 J i

f

7

t

$he @alue of e

t

represents 000 rate.

-ote& N the abo@e formula !or"s for direct ;uote. (n case of indirect ;uote the formula

shall be

e

t

,

e

/

51 J i

f

7

t

51 J i

h

7

t

'/

Rudramurthy B.V

Ex& N $he A3 5hc7 and 3!itBerland 5fc7 are running annual inflation rates of 4 F and

9 F respecti@ely and the spot rate is 3Hr 1 , +/.14 then calculate the 000 rate after

1,' and 9 years

e

t

, e

/

51 J i

h

7

t

51 J i

f

7

t

e

1

, /.14 51 J /./4 7

1

, +/.1:.:

51 J /./97

1

e

'

, /.14 51 J /./4 7

'

, +/.11K.

51 J /./97

'

e

9

, /.14 51 J /./4 7

9

, +/.1K.4

51 J /./97

9

$hus according to 000 the exchange rate change during a period should be

e;ual to the inflation differential for the same timeNperiod. (n effect, 000 says that

currencies !ith high rates of inflation should de@alue relati@e to currencies !ith lo!er

rate of inflation.

(nflation change of ' F more in A3 should result in de@aluation of A3D by ' F.

$herefore e

1

, + /.14 C 1/' F , + /.1:4

0oint W?P on the parity line is an e;uilibrium point !herein 9 F change in inflation is

offset by 9 F appreciation in foreign currency, !hereas 0oint WBP is at dise;uilibrium

since 9 F change in inflation is offset Iust by 1 F appreciation in foreign currency.

R'17 E@,6159' (1t': &

$he real exchange rate is the nominal exchange rate adIusted for changes in

the relati@e purchasing po!er of each currency since some base period

Y

t

, e

t

C 0

f

0

h

'1

Rudramurthy B.V

By indexing these price le@els to 1// as of the base period their ratio reflects

the change in the relati@e purchasing po!er of these currencies since time /. (ncrease

in foreign price le@el and foreign currency depreciation ha@e offsetting effects on the

real exchange rate and similarly home price le@el increases and foreign currency

appreciation offset each other.

?n alternati@e !ay to represent the real exchange rate is to directly reflects the

change in relati@e purchasing po!ers of these currencies by adIusting the nominal

exchange rate for inflation in both countries since time / 5base period7.

Y

t

, e

t

C 51 J i

h

7

t

51 J i

f

7

t

-ote& N e

t

shall be in direct ;uote.

Empirical E@idence& N

$he strictest @ersion of 000, that all goods and financial assets obey the la! of

one price is demonstrably false. $he ris" and costs of shipping goods internationally

as !ell as go@ernment erected barriers to trade and capital flo!s, are at times high

enough to cause exchange adIusted prices to systematically differ bet!een countries.

$he general conclusion from empirical study of 000 is that theory holds up

!ell in long run, but not as !ell o@er shorter timeNperiods. $hus in long run the real

exchange rate tends to re@ert to its predicted @alue of e

/

. $hat is if Y

t

Z e

/

, then the real

exchange rate should fall o@er time to!ards e

/

. >here as if Y

t

[ e

/

the real exchange

rate should rise o@er time to!ards e

/

.

THE FISHER EFFECT: AK NIR D K ELPECTED INFLATIONC

$he real interest rate shall be adIustable to reflect expected inflation to obtain

the nominal interest rate. ?ccording to Hisher effect the interest rate5r7 is made of t!o

components

a7 Real interest rate 5a7

b7 Expected inflation rate 5i7

$herefore

51 J -ominal interest rate7 , 51 J real interest rate7 51 J expected inflation rate7

51 J r7 , 51 J a7 51 J i7

51 J r7 , 1 J a J i J ai

( D 1 H / H 1/

Do!e@er often approximated WrP is calculated as e;ual to Wa J iP.

Ex& (f re;uired real interest rate is 9 F and expected inflation rate is 1/ F. alculate

the nominal interest rate

51 J r7 , 51 J a7 51 J i7

51 J r7 , 51 J /./97 51 J /.1/7

51 J r7 , 1.199

r , /.199 or 19.9 F

?lternati@ely

r , a J i J ai

r , /./9 J /.1/ J 5/./97 5/.1/7 , /.199 or 19.9 F

''

Rudramurthy B.V

?ccording to HE the lender should not only be compensated for interest 59 F7 but also

for depreciation in principal @alue by 51/.9 F7 for passage of time

U?ccording to generaliBed @ersion of HE the real returns are e;ualiBed across

the countries through arbitrageV i.e. a

h

, a

f

. (f expected real returns !ere higher in one

currency than the other, capital !ould flo! from the second to the first currency.

(n an e;uilibrium !ith no go@ernment interference, the nominal interest rate

differential !ill approximately e;ual the anticipated inflation differential bet!een the

t!o currencies.

r

h

G r

f

, i

h

G i

f

\ -(R , \ (nflation

>here r

h

and r

f

represents nominal interest rate at home country and foreign

country respecti@ely, i

h

and i

f

represents inflation at home country and foreign country

respecti@ely.

(n other !ords, according to HE,

51 J r

h

7

t

, 51 J i

h

7

t

51 J r

f

7

t

51 J i

f

7

t

THE INTERNATIONAL FISHER EFFECT IIFEJ

(t is the combination of 0urchasing po!er parity 50007 and generaliBed Hisher

Effect 5HE7 !hich gi@es !ay to (nternational Hisher Effect 5(EH7

?ccording to 000

\ ER , \ (R

e

t

,

51 J i

h

7

t

]]]]]]]]]]517

e

/

51 J i

f

7

t

'9

Rudramurthy B.V

?ccording to HE

51 J -(R7 , 51 J R(R7 51 J (R7

51 J r7 , 51 J a7 51 J i7

$herefore \ -(R , \ Expected (nflation rate

51 J r

h

7

t

, 51 J i

h

7

t

]]]]]]]]5'7

51 J r

f

7

t

51 J i

f

7

t

E;uation 1 and ' gi@es

e

t

,

51 J r

h

7

t

e

/

51 J r

f

7

t

i.e. \ ER , \ -(R

$herefore

e

t

, e

/

51 J r

h

7

t

51 J r

f

7

t

?ccording to (HE, the interest rate differential bet!een any t!o countries is an

unbiased predictor of the future change in spot exchange rate. Dence currency !ith

higher interest rates !ill depreciate and those !ith lo! interest rates !ill appreciate.

0oint W?P on parity line is at e;uilibrium !hereas point WBP outside the parity

line is not at e;uilibrium.

'.

Rudramurthy B.V

INTEREST RATE PARITY THEORY IIRPJ

?ccording to (R0 theory, the interest differential should be e;ual to the

for!ard differential i.e. the currency of the country !ith a lo!er interest rate should

be at a for!ard premium in terms of the currency of the country !ith higher interest

rate. (f the abo@e condition is satisfied, the for!ard rate is said to be at interest rate

parity and e;uilibrium pre@ails in money mar"et.

o@ered (nterest Differential&

(nterest parity ensures that the return on a hedged or co@ered foreign

in@estment !ill Iust e;ual the domestic interest rate on in@estment of identical ris" or

else it gi@es rise to co@ered interest arbitrage. $he process of co@ered interest

arbitrage continues until interest parity holds, unless there is go@ernment interference.

THE RELATIONSHIP BETWEEN THE FORWARD RATE AND FUTURE

SPOT RATE

?n unbiased nature of for!ard rate is that the for!ard rate should reflect the

expected future spot rate on the date of settlement of the for!ard contract.

H

t

, ^

t

>here H

t

, for!ard rate at timeWtP.

^t , expected future spot rate

E;uilibrium is achie@ed only !hen the for!ard differential e;uals the

expected change in the exchange rate.

'4

Rudramurthy B.V

PARITY CONDITIONS

(. 0ARD?3(-G 0)>ER 0?R($= _000`

\ ER , \ (R

e

t

,

51 J i

h

7

t

e

/

51 J i

f

7

t

e

t

,

e

/

51 J i

h

7

t

51 J i

f

7

t

((. H(3DER EHHE$ _HE`

\ -(R , \ Expected (nflation rate

51 J -(R7 , 51 J R(R7 51 J (R7

51 J r7 , 51 J a7 51 J i7

51 J r7 , 1 J a J i J ai

( D 1 H / H 1/

(((. (-$ER-?$()-?T H(3DER EHHE$ _(HE`

\ ER , \ -(R

':

Rudramurthy B.V

e

t

, 51 J r

h

7

t

e

/

51 J r

f

7

t

e

t

, e

/

51 J r

h

7

t

51 J r

f

7

t

(V. (-$ERE3$ R?$E 0?R($= _(R0`

Hor!ard rate differential , (nterest differential

H

t

, 51 J r

h

7

t

e

/

51 J r

f

7

t

V. A-B(?3ED H)R>?RD R?$E3 _AHR`

H

t

, ^

t

Ht G e

/

, ^

t

Ge

/

e

/

e

/

P(o*7'"#

1. Gi@en the follo!ing date calculate any arbitrage possibility is a@ailable

3pot rate& Rs .'.//1/ , + 1

: months for!ard rate& Rs .'.M/'/ , +1

?nnualiBed interest rate on : months dollar , M F

?nnualiBed interest rate on : months Rupees , 1' F

So7)t/o5

C17,)71t/o5 o: :o(81(0 0/::'('5t/17#

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, .'.M/'/ G .'.//1/ C 9:/

.'.//1/ 1M/

, 9.M1.' F

C17,)71t/o5 o: /5t'('#t 0/::'('5t/17#

(nterest differential , ?nnualiBed (nterest rate in (ndia G ?nnualiBed interest rate in A3

(nterest differential , 1' F N M F , .F

3ince interest differential is grater than for!ard rate differential an arbitrager shall

prefer in@estment in that country !here interest rate is higher. $hus, in@estment shall

be done in (ndia and funds shall be borro!ed from A3.

'1

Rudramurthy B.V

C17,)71t/o5 o: 1(*/t(19' !(o:/t

(t is assumed that + 1///// is borro!ed from A3 ban" at the rate of M F 0.a.

on@ert + 1///// into Rupees using spot rate of + 1 , Rs .'.//1/

$herefore + 1///// , 1///// C .'.//1/ , R# =200100

(n@est the abo@e sum in (ndia at the rate of 1' F 0.a. for : months

(nterest amount after : months , .'//1// C 1' F C :61' , Rs '4'//:

$otal amount at maturity , .'//1// J '4'//: , R# ==5210>

on@ert the abo@e Rupees to dollars

..4'1/: , + 1/./1:

.'.M/'/

Toan amount to be refund along !ith interest , 1///// J 51///// C /./M C :61'7

, +1/.///

?rbitrage profit , +1/./1: N +1/./// , +1:

?rbitrage profit 5F7 , 1: . C 1// , 0.01> B

1/////

'. Gi@en the follo!ing date calculate any arbitrage possibility is a@ailable

3pot rate& + 1 , Rs ...//9/

: months for!ard rate& +1 , Rs .4.//1/

?nnualiBed interest rate on : months Rupees , 1' F

?nnualiBed interest rate on : months Dollars , M F

So7)t/o5

C17,)71t/o5 o: :o(81(0 0/::'('5t/17#

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, .4.//1/ G ...//9/ C 9:/

...//9/ 1M/

, ..49: F

C17,)71t/o5 o: /5t'('#t 0/::'('5t/17#

(nterest differential , ?nnualiBed (nterest rate in (ndia G ?nnualiBed interest rate in A3

(nterest differential , 1' F N M F , .F

3ince for!ard rate differential is grater than interest differential, in@est in that

countryPs currency !hich is expected to appreciate. Dere in this case borro! in (ndia

and in@est in A3.

C17,)71t/o5 o: 1(*/t(19' !(o:/t

(t is assumed that Rs 1///// is borro!ed from (ndian ban" at the rate of 1' F 0.a.

on@ert Rs 1///// into Dollars using spot rate of + 1 , Rs ...//9/

$herefore + 1///// , 1///// a ...//9/ , M 22F3

'M

Rudramurthy B.V

(n@est the abo@e sum in A3 at the rate of M F 0.a. for : months

(nterest amount after : months , ''19 C M F C :61' , + K/.K'

$otal amount at maturity , ''19 J K/.K' , M 23>3.<2

on@ert the abo@e Dollars to Rupees

'9:9.K' C .4.//1/ , Rs 1/:91K

Toan amount to be refund along !ith interest , 1///// J 51///// C /.1' C :61'7

, Rs1/:///

?rbitrage profit , Rs1/:91K G Rs1/:/// , Rs 91K

?rbitrage profit 5F7 , 91K . C 1// , /.91K F

1/////

9. Gi@en the follo!ing date calculate any arbitrage possibility is a@ailable

3pot rate& b : , + 1 5b , Hrench Hranc7

: months for!ard rate& b :.//'/ , +1

?nnualiBed interest rate on : months A3D , 4 F

?nnualiBed interest rate on : months HHR , M F

So7)t/o5

C17,)71t/o5 o: :o(81(0 0/::'('5t/17#

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, :.//'/ G :.//// C 9:/

:.//// 1M/

, /./:1 F

C17,)71t/o5 o: /5t'('#t 0/::'('5t/17#

(nterest differential , ?nnualiBed (nterest rate in Hrance G ?nnualiBed interest rate in A3

(nterest differential , M F N 4 F , 9F

3ince interest differential is grater than for!ard rate differential an arbitrager shall

prefer in@estment in that country !here interest rate is higher. $hus, in@estment shall

be done in Hrance and funds shall be borro!ed from A3.

C17,)71t/o5 o: 1(*/t(19' !(o:/t

(t is assumed that + 1///// is borro!ed from A3 Ban" at the rate of 4 F 0.a.

on@ert + 1///// into Hrench Hranc using spot rate of + 1 , b :

$herefore + 1///// , 1///// C : , N >00000

(n@est the abo@e sum in Hrance at the rate of M F 0.a. for : months

(nterest amount after : months , :///// C M F C :61' , b './//

$otal amount at maturity , :///// J './// , N >2=000

on@ert the abo@e Hrench Hranc to Dollars

:'./// C :.//' , + 1/9K:4

'K

Rudramurthy B.V

Toan amount to be refund along !ith interest , 1///// J 51///// C /./4 C :61'7

, +1/'4//

?rbitrage profit , +1/9K:4 G +1/'4// , +1.:4.9.

?rbitrage profit 5F7 , 1.:4.9. . C 1// , 1..:4 F

1/////

.. ?ssume the buying rate for D# 5Dutch #ar"7 spot in -e! =or" is + /../

a7 >hat !ould you expect the price of A3D to be in GermanyE

b7 (f the dollar to be ;uoted in Germany at D# '.: ho! is the mar"et supposed

to reactE

So7)t/o5

a7 $he price of A3D in Germany is expected to be 51a/..7 , '.4 D#6+

b7 3ince dollar is cheaper in -e! =or", Buy dollar at the rate of '.4 D#6+ in

-e! =or" and sell the same in Germany at the rate of '.: D#6+ thus ma"ing

an arbitrage profit of D# /.16+.

4. =ou ha@e called your foreign exchange trader and as"ed for ;uotation on the spot,

1Nmonth, 9Nmonth and :Nmonth for!ard rate. $he trader has responded !ith the

follo!ing

+ /.'.1K6M1, 964, M61, 1961/

a7 >hat does this mean in terms of dollars per EurosE

b7 (f you !ished to buy spot Euros, ho! much !ould you pay in DollarsE

c7 (f you !anted to purchase spot A3D, ho! much !ould you ha@e to pay in

EuroE

d7 >hat is the premium or discount in the 1, 9, : month for!ard rate in annual

percentageE

So7)t/o5

a7 ?ssume you are buying Euros

3!ap points& N Hor!ard rates can be expressed by gi@ing spot rates and their

respecti@e s!ap points

E.g.1&N 964 in the abo@e problem indicates premium s!ap point since bid s!ap point is

lesser than as" s!ap point6offer s!ap point.

E.g.'&N M61 in the abo@e problem indicates discount s!ap point since bid s!ap point is

greater than as" s!ap point6offer s!ap point.

Hor!ard rate , 3pot rate J 0remium 3!ap point or

Hor!ard rate , 3pot rate G Discount 3!ap point

9/

0articulars Buying Rate )ffer Rate

3pot Rate /.'.1K /.'.M1

1 #onth Hor!ard Rate /.'.M' /.'.M:

9 #onth Hor!ard Rate /.'.11 /.'.1.

: #onth Hor!ard Rate /.'.:: /.'.11

Rudramurthy B.V

b7 Q5../9/:6../99K76A3D

3pot Euros can be bought at ban"ers offer rate of + /.'.M16Q

-ote& N ustomerPs buying rate !ill be ban"erPs selling rate and customerPs selling

rate !ill be ban"erPs buying rate.

c7 0urchase of spot A3D can be made at ban"erPs offer rate of Q../99K6+

d7 alculation of Hor!ard premium or discount

1Nmonth Hor!ard premium

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /.'.M: G /.'.M1 C 9:/

/.'.M1 9/

, '..' F

9Nmonth Hor!ard discount

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /.'.1. G /.'.M1 C 9:/

/.'.M1 K/

, 1.19 F

:Nmonth Hor!ard discount

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /.'.11 G /.'.M1 C 9:/

/.'.M1 1M/

, /.M/: F

:. ?n ?merican firm purchases + ./// !orth of perfume 5b '////7 from a Hrench

firm, the ?merican distributor must ma"e the payment in K/ days in Hrench Hranc

the follo!ing ;uotations and expectations exists for the Hrench Hranc

3pot rate , + /.'//, K/Nday for!ard rate , + /.''/, interest rate in A3 , 14 F,

interest rate in Hrance , 1/ F.

=our expectation of spot rate K/ days hence is + /.'./

a7 >hat is the premium on the for!ard Hrench HrancE >hat is the interest

rate differential bet!een Hrance and A3E (s there an incenti@e for co@ered

interest arbitrageE

91

Rudramurthy B.V

b7 (f there is a co@ered interest arbitrage ho! can an arbitrager ta"e ad@antage

of gi@en situation assume the arbitrager is !illing to borro! + ./// or

Hrench Hranc 5b7 '//// and there are no transaction costs.

c7 (f transaction costs are + 4/ !ould an opportunity still exists for co@ered

interest arbitrage.

d7 alculate the cost co@ered interest arbitrage and suggest !hether co@ered

interest arbitrage !as re;uired considering abo@e cost of hedging.

So7)t/o5

a7 alculation of Hor!ard premium on Hrench Hranc

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /.''// G /.'/// C 9:/

/.'/// K/

, ./ F

alculation of interest differential

A3 interest rate per annum , 14 F

Hrance interest rate per annum , 1/ F

(nterest rate differential , 4 F

$here exists co@ered interest arbitrage opportunity since for!ard

differential and interest rate differential are not e;ual.

b7 3ince for!ard differential is grater than interest differential in@est in that

countryPs currency !hich is expected to appreciate thus borro! in A3 and

in@est in Hrance

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! + ./// in A3 at the rate of 14 F for K/ days.

'. on@ert the abo@e dollars into Hrench Hranc using spot rate.

, .///6/.'// , b '////

9. (n@est b '//// at the rate of 1/ F for K/ days in Hrance

(nterest , '//// C /.1/ C K/69:/ , 4//

0rincipal , '////

#aturity Value , '/4//

.. on@ert the abo@e amount to dollars using K/Nday for!ard rate.

, '/4// C /.''// , =510

9'

Rudramurthy B.V

4. alculate loan repayment amount

Toan (nterest , ./// C /.14 C K/69:/ , 14/

0rincipal amount , .///

Toan repayment , =150

:. ?rbitrage profit , + .41/ G + .14/ , + 9:/

c7 alculation of arbitrage profit after transaction cost

?rbitrage profit before transaction cost , + 9:/

Tess transaction cost , + /4/

?rbitrage 0rofit , M310

d7 alculation of arbitrage profit on unco@ered interest arbitrage

, b '/4// C /.'./ , + .K'/

?rbitrage profit , + .K'/ N + .14/ , + 11/

?rbitrage profit after transaction cost , + 11/ N + 4/ , + 1'/

ost of hedging , $ransaction cost J forgone profit

ost of hedging , 4/ J 511/ G 9:/7 , + .:/

1. (s co@ered interest arbitrage possible in the follo!ing situationE (f so calculate

arbitrage profit

a7 3pot rate anadian dollar , 1.9116A3D, anada interest rate , : F

:Nmonth for!ard rate , + 1.'K4/6A3D, A3 interest rate , 1/ F.

b7 3pot rate 1// =en , Rs 94.//', (ndian interest rate , 1' F

:Nmonth for!ard rate , Rs 94.K/1/61// =en, <apan interest rate , 1 F.

So7)t/o5

a7

Direct %uote , -r , Dome ountry .

Dr Horeign ountry

, HR G 3R C 9:/ . C 1//

3R Hor!ard contract period in days

, 1.911/ G 1.'K4/ C 9:/ C 1//

1.911/ K/

, 9.9. F

(nterest rate differential , 1/ G : , .F

St(1t'94: & (nterest rate differential Z Hor!ard rate differential

(n@est in A3 and borro! in anada

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! anadian + 1///// in anada at the rate of : F for 1M/ days

99

Rudramurthy B.V

'. on@ert the abo@e anadian dollars into A3D using spot rate.

, 1/////61.911 , 14K9/ A3D

9. (n@est b '//// at the rate of 1/ F for K/ days in Hrance

(nterest , 14K9/ C /.1/ C :61' , 91K:.4/

0rincipal , 14K9/ .

#aturity Value , 1K1':.4/

.. on@ert the abo@e amount to dollars using :Nmonth for!ard rate.

, 1K1': C 1.'K4/ , 1032=5.CM

4. alculate loan repayment amount

Toan (nterest , 1///// C /.: C :61' , 9///

0rincipal amount , 1/////

Toan repayment , 103000

:. ?rbitrage profit , + 1/9'.4.M G + 1/9/// , + '.4.M

alculation of arbitrage profit in 0ercentage

, + '.: C 1// , /.'.: F

1/////

b7

alculation of Hor!ard rate differential

, HR G 3R C 9:/ . C 1//

3R Hor!ard contract period in days

, 94.K/1/ G 94.//' C 9:/ C 1//

94.//' K/

, 4.1. F

(nterest rate differential , 1' G 1 , 4F

St(1t'94: & (nterest rate differential [ Hor!ard rate differential

(n@est in <apan and borro! in (ndia

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! (ndian Rs 1///// in (ndia at the rate of 1' F for : months

'. on@ert the abo@e (ndian Rupees into =en using spot rate.

, 51///// C 1//7694.//' , c 'M4:KM

9.

Rudramurthy B.V

9. (n@est c 'M4:KM at the rate of 1 F for : months in <apan

(nterest , 'M4:KM C /./1 C :61' , KKKK

0rincipal , 'M4:KM .

#aturity Value , 'K4:K1

.. on@ert the abo@e amount to Rupees using :Nmonth for!ard rate.

, 'K4:K1 C 94.K/1/61// , R# 10>15

4. alculate loan repayment amount

Toan (nterest , 1///// C /.1' C :61' , :///

0rincipal amount , 1/////

Toan repayment , 10>000

:. ?rbitrage profit , Rs 1/:14M G Rs 1/:/// , Rs 14M

alculation of arbitrage profit in 0ercentage

, Rs 14M C 1// , /.14M F

1/////

M. 3pot ;uotation of 3ingapore + is Rs '4. (nterest rate in 3ingapore is : F and

interest rate in (ndia is 1/ F. >hat shall be the for!ard rate a year latter, also

calculate '1/Nday for!ard rate.

So7)t/o5

alculation of 1Nyear for!ard rate using (nterest rate parity theory

e

t

, e

/

51 J r

hc

7

t

51 J r

fc

7

t

e

t

, '4 51 J /.1/7

1

51 J /./:7

1

HR , Rs '4.K.

alculation of '1/Nday for!ard rate using (nterest rate parity theory

e

t

, e

/

51 J r

hc

7

t

t , '1/69:/ , /.14

51 J r

fc

7

t

e

t

, '4 51 J /.1/7

/.14

51 J /./:7

/.14

HR , Rs '4.1/.:

K. alculate Hor!ard rate using the follo!ing data

P1(t/,)71(# I50/1 USA

ost of Dairy #il" Rs ./ + 1

(nflation 1/ F : F

94

Rudramurthy B.V

So7)t/o5

3pot rate + 1 , Rs ./

HR , 3R 51 J r7

n

HV , 0V 51 J r7

n

HR , ./ 51 J /.1/7

1

.. , 0V 51 J /./:7

1

HR , Rs .. 0V , ..61./: , .1.4/K

alculation of 1Nyear for!ard rate using (nterest rate parity theory

e

t

, e

/

51 J r

hc

7

t

51 J r

fc

7

t

e

t

, ./ 51 J /.1/7

1

51 J /./:7

1

HR , Rs .1.4/K

1/. Hollo!ing are rates ;uoted in #umbai for British 0ound Rs6B0 , 4'.:/61/ and

three month for!ard rate '/61/, interest rate in (ndia is M F, interest rate in

Tondon is 4 F. Verify !eather there is any scope for o@ered interest arbitrage if

you borro! in R3 5(ndia7.

So7)t/o5

3pot rate& Rs6B0 , 4'.:/61/ , 4'.:/64'.1/

Hor!ard rate& Rs6B0 , 4'.M/649../

St(1t'94& Borro! in (ndia and in@est in Tondon

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! Rs 1///// in (ndia at the rate of M F for 9 months

'. on@ert the abo@e (ndian Rupees into 0ounds using spot rate.

, 1/////64'.1/ , 8 1MKM

9. (n@est 8 1MKM at the rate of 4 F for 9 months in A2

(nterest , 1MKM C /./4 C 961' , '9.19

0rincipal , 1MKM .

#aturity Value , 1K'1.19

.. on@ert the abo@e amount to Rupees using 9Nmonth for!ard rate.

, 'K4:K1 C 4'.M/ , R# 101=>F

4. alculate loan repayment amount

Toan (nterest , 1///// C /./M C 961' , '///

0rincipal amount , 1/////

Toan repayment , 102000

:. ?rbitrage profit , Rs 1/1.:1 G Rs 1/'/// , N Rs 499

9:

Rudramurthy B.V

St(1t'94& Borro! in Tondon and in@est in (ndia

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! 8 1///// at the rate of 4 F for 9 months

'. on@ert the abo@e Tondon 0ounds into Rupees using spot rate.

, 1///// C 4'.:/ , Rs 4':////

9. (n@est Rs 4'://// at the rate of M F for 9 months in (ndia

(nterest , 4'://// C /./M C 961' , 1/4'//

0rincipal , 4':////

#aturity Value , 49:4'//

.. on@ert the abo@e amount to 0ounds using 9Nmonth for!ard rate.

, 49:4'// a 4'../ , O 100=F1.<1

4. alculate loan repayment amount

Toan (nterest , 1///// C /./4 C 961' , 1'4/

0rincipal amount , 1/////

Toan repayment , 101250

:. ?rbitrage profit , Rs 1//.11.K1 G Rs 1/1'4/ , N Rs 11M./M

-ote& N o@ered (nterest ?rbitrage !ith t!oN!ay ;uote should be done using trial and

error methodO both strategies can gi@e loss because of PSPREADQ

11. Hind cross rates from the follo!ing information

a7 +68 , 1.4'./, c68 , '94.'/, c6+ ,E

b7 Q68 , '.414/, Q6$ , '/4.M/, $68 ,E

c7 +68 , 1.449164K, Q6+ , /.1KM'6K', Q68 ,E

d7 +68 , './/1469/, +63HR , /.:K:461/, 863HR ,E

So7)t/o5

a7 c , c C 8 , '94.'/ C 1 . , 14..99/

+ 8 + 1.4'./

b7 $ , $ C Q , 1 . C '.414/ , /./1''

8 Q 8 '/4.M/

c7 Q , Q C + , 5/.1KM' C 1.44917 6 5/.1KK' C 1.444K7. , /.9/1K6/.9/KK

8 + 8

d7 8 , 8 C + , _5'.//9/7

N1

C /.:K:4`6 _5'.//147

N1

C /.:K1/` , /.9.11 6 M'

3HR + 3HR

91

Rudramurthy B.V

1'. ? foreign exchange trader ;uotes for Belgium Hranc spot, 1Nmonth, 9Nmonth and

:Nmonth for!ard rate to A3 based treasurer

+ /./'.1M6M/, .6:, K6M, 1.611

a7 alculate the outright ;uote for 1, 9, : month for!ard.

b7 (f treasurer !ished to buy Belgium Hranc 9Nmonths for!ard, ho! much !ould

you pay in DollarsE

c7 (f you !anted to purchase A3D 1Nmonth for!ard, ho! much !ould you ha@e

to pay in Belgium HrancE

d7 ?ssuming Belgium Hranc !as brought !hat is the premium or discount in the

1, 9, : month for!ard rate in annual percentageE

e7 >hat do the abo@e ;uotations imply in respect of term structure of interest in

A3? and BelgiumE

So7)t/o5

a7 ?ssume you are buying Euros

3!ap points& N Hor!ard rates can be expressed by gi@ing spot rates and their

respecti@e s!ap points

E.g.1&N .6: in the abo@e problem indicates premium s!ap point since bid s!ap point is

lesser than as" s!ap point6offer s!ap point.

E.g.'&N K6M in the abo@e problem indicates discount s!ap point since bid s!ap point is

greater than as" s!ap point6offer s!ap point.

Hor!ard rate , 3pot rate J 0remium 3!ap point or

Hor!ard rate , 3pot rate G Discount 3!ap point

b7 $he treasurer can buy Belgium Hranc 9Nmonth for!ard at his bid rate of

+ /./'.:K6Belgium Hranc

-ote& N ustomerPs buying rate !ill be ban"erPs selling rate and customerPs selling

rate !ill be ban"erPs buying rate.

c7 + /./'.M'6M: for 1BHr

BHr , 516/./'.M: G 16/./'.M'7 per +

BHr , 5./.''4'N'K/17 per +

d7 alculation of Hor!ard premium or discount

1Nmonth Hor!ard premium

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

9M

0articulars Buying Rate )ffer Rate

3pot Rate /./'.1M /./'.M/

1 #onth Hor!ard Rate /./'.M' /./'.M:

9 #onth Hor!ard Rate /./'.:K /./'.1'

: #onth Hor!ard Rate /./'.:. /./'.:K

Rudramurthy B.V

, /./'.M' G /./'.1M C 9:/

/./'.1M 9/

, 1.K. F

9Nmonth Hor!ard discount

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /./'.1M G /./'.:K C 9:/

/./'.1M K/

, 1..4 F

:Nmonth Hor!ard discount

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /./'.1M G /./'.:. C 9:/

/./'.1M 1M/

, 1.19 F

e7 3pot to 1Nmonth for!ard

3ince dollar is depreciating from spot to 1Nmonth for!ard, interest rate

in A3 is higher compared to interest rate in Belgium.

3pot to 9Nmonth for!ard

3ince dollar is appreciating from spot to 9Nmonth for!ard, interest rate

in Belgium is higher compared to interest rate in A3

3pot to :Nmonth for!ard

3ince dollar is appreciating from spot to 9Nmonth for!ard, interest rate

in Belgium is higher compared to interest rate in A3

19. Dutch #ar" spot !as ;uoted at +/..6D# in -e! =or", the price of 0ound 3terling

!as ;uoted at +1.M68

a7 >hat !ould you expect the price of 0ound to be in GermanyE

b7 (f the 0ound !ere ;uoted in Hran" Hort at D# .../68 !hat !ould you do

to profit from the abo@e situation

So7)t/o5

e7 D# , D# C + , 1 . C 1.M , ..4

8 + 8 /..

f7 Buy 1 pound for D# ... in Hran" Hort and !ith the abo@e pound buy +1.M/ in

-e! =or" and !ith the abo@e dollars buy D# ..4 in Germany thus arbitrage

!ill ma"e profit of D# /.1 for an in@estment of D# .../

?rbitrage profit in 5F7 , /.16... C 1// , '.'1 F

9K

Rudramurthy B.V

3electi@e Dedging

1.. ?n (ndian ompany ?B limited imports machinery !orth of 8 ' million and is to

ma"e the payment after : months the current rates are

3pot rate , Rs::.K:68

:Nmonth for!ard rate ,Rs:1.4/68

a7 >hat should ?B limited do if they expect that in : months time the pound

!ill settle at Rs:1.1468E

b7 >hat are the options a@ailable to the company in case of an expected

appreciation or depreciation in RupeeE

So7)t/o5

a7 (n the case of recei@able exposure if HR 5Hor!ard Rate7 Z H30 5Hor!ard 3pot

Rate7 hedge your position !here as incase of payable position if HR Z H30 do

not hedge your position.

(n the abo@e problem ?B limited has payable exposure and since HR Z

H30, do not hedge your position

b7 (f Rupee appreciates 58 is depreciating7 no hedging

(f Rupee depreciates 58 is appreciating7 hedging is re;uired.

14. Brun Derbal products located in (ndia is an old line producer of herbal teas and

medicines, their products are mar"eted throughout (ndia and Europe

Brun Derbal generally in@oices in rupees !hen it sells to foreign customers in

order to guard against exchange rate changes ho!e@er company has recei@ed an

order from large !holesaler in Hrance for b ./ la"hs of its product. $he condition

is that the deli@ery should be in 9 months time and order in@oiced in Hrench Hranc.

$he manager decides to contact firmPs ban"ers for suggestions about hedging the

exchange rate exposure.

$he ban"er informs company that spot rate is 1 b , Rs :.:/ thus in@oice

amount should be Rs ':./////. $he K/Nday for!ard rate for Rs and b and A3D

are 1b , Rs :.4/ and 1+ , .'./'M9. $he ban"er offers to setup Hor!ard hedge for

selling HHr recei@able for Rupee based on cross for!ard exchange rates implicit in

for!ard rate against dollar, !hat !ould be your decision if you !ere manager of

Brun DerbalE 3ho! the rele@ant calculations

(nterest rates in (ndia and Hrance are K F 0a and 1' F 0a respecti@ely.

So7)t/o5

3electi@e hedging 5recei@able position7

H30 Z HR do not hedge

H30 [ HR hedge

alculation of expected future spot price according to (R0

(nterest rate differential , Hor!ard differential

(nterest rate differential , 1'F N KF , 9 F

Hor!ard rate for K/ days should be calculated

N9 F , x G :.: C 9:/ C 1//

:.: K/

x G :.: , N9 C :.:

. C 1//

x G :.: , N/./.K4

./

Rudramurthy B.V

x , :.44/4

i.e. K/Nday for!ard for 1b , Rs :.44/4

Dence it !ould be ad@isable for the company not to hedge its ris" by selling

Hrench Hranc for!ard. Expected spot price 51b , Rs :.44/47 is greater than

for!ard rate 51b , Rs :.47

1:. (n Hran" Hort the Hrench Hranc is selling for D# /..9.9 spot and the 9Nmonth

for!ard rate is D# /..9//. $he 9Nmonth Euro D# inter ban" rate is 4.14 F and

the Euro Hrench inter ban" rate is K F.

a7 ?re exchange rate and money mar"et rate in e;uilibriumE >hyE

b7 (s there any !ay to ta"e ad@antage of the situationE (f so ho!E

c7 >hat rate trends !ould appear in the mar"et if a large number of operators

too" the action indicated in 5B7 abo@eE

So7)t/o5

a7 alculation of interest rate differential

9Nmonth EuroND# inter ban" rate , 4.14 F

9Nmonth EuroNHHr inter ban" rate , K F .

(nterest differential , 9.'4 F

alculation of Hor!ard discount

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /..9.9 G /..9// C 9:/

/..9.9 K/

, 9.K: F

3ince interest rate differential is not e;ual to for!ard rate differential there

exists no e;uilibrium bet!een exchange rate and money mar"et.

b7 3ince there is no e;uilibrium bet!een exchange rates and money mar"et there

exists arbitrage opportunity.

3trategy& N Borro! in Hrance and in@est in Germany.

1. Borro! b 1///// at the rate of K F pa for 9 months

'. on@ert the abo@e Hrench Hranc into Dutch #ar" using spot rate.

, 1///// C /..9.9 , D# .9.9/

9. (n@est D# .9.9/ at the rate of 4.14 F for 9 months

(nterest , 4'://// C /./414 C 961' , :'.

0rincipal , .9.9/

#aturity Value , ../4.

.. on@ert the abo@e amount to Hrench Hranc using 9Nmonth for!ard

rate.

, 49:4'// a /..9 , N 102=51

.1

Rudramurthy B.V

4. alculate loan repayment amount

Toan (nterest , 1///// C /./K C 961' , ''4/

0rincipal amount , 1/////

Toan repayment , 102250

:. ?rbitrage profit , b 1/'.41 G b 1/''4/ , b '/1

c7 Targe number of operators by ta"ing arbitrage opportunity as indicated in WbP

abo@e brings bac" the e;uilibrium in exchange rate and money mar"et there by

no further arbitrage opportunity exists.

11. ? trader !or"s for -e! =or" ban", the spot exchange rate against anadian dollar

is A3D /.KK:M and 1Nmonth and 1Nyear for!ard rates are A3D /.KKM4 and A3D

1./1:: respecti@ely. $!el@eNmonth interest rate in A3? and anada may be ta"en

as :..4 F and ...: F respecti@ely.

a7 >hat is the for!ard premium as annual percentageE

b7 >hich currency is at a premiumE >hyE

$he trader becomes party to some insider information !hich suggests

the A3 interest rate !ill rise by 1 F pa during the next month. $he

ban" has a rule that in foreign exchange mar"ets UBuy e;uals 3ellV this

means that for any currency the total of long positions must be e;ual to

the total of short positions but this aggregation disregards maturity.

c7 (ndicate the mechanism of t!o operations by !hich you may trade in

expectation of profit for the ban". 3hould the insider information turns out

to be !ell founded

So7)t/o5

a7 alculation of Hor!ard premium or discount

1Nmonth Hor!ard premium

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, /.KKM4 G /.KK:M C 9:/

/.KK:M 9/

, './4 F........................................................... 517

1Nyear Hor!ard premium

, HR G 3R C 9:/ .

3R Hor!ard contract period in days

, 1./1:: G /.KK:M C 9:/

/.KK:M K/

, 1.KK F

.'

Rudramurthy B.V

b7 anadian dollar is at premium because 1Nmonth for!ard and 1Nyear for!ard is

grater than spot rate

urrent interest rate in A3 , :..4 F

J Expected increase based on insider information , 1 F .

, 1..4 F

alculation of interest rate differential

Expected interest rate in A3 , 1..4 F

(nterest rate in anada , ...: F

(nterest rate differential , '.KK F........................ 5'7

c7 (nterest rate differential , '.KK F 5from 5'77

1Nmonth for!ard differential in anada , './4 5from 5177

3ince interest rate differential is grater than for!ard differential

arbitrage opportunity exists

3trategy& NBorro! in anada and in@est in A3.

C17,)71t/o5 o: 1(*/t(19' !(o:/t

1. Borro! + 1///// at the rate of ...: F for 1 month

'. on@ert the abo@e anadian Dollars into A3D using spot rate.

, 1///// C /.KK:M/ , + KK:M/

9. (n@est A3 + KK:M/ at the rate of 1..4 F for 1 month in A3

(nterest , KK:M/ C /./:.4 C 161' , :1M.M4

0rincipal , KK:M/ .

#aturity Value , 1//'KK

.. on@ert the abo@e amount to + using 1Nmonth for!ard rate.

, 1//'KK a /.KKM4 , +1//..K.4

4. alculate loan repayment amount

Toan (nterest , 1///// C /./..: C 161' , 91'

0rincipal amount , 1/////

Toan repayment , 1003F2

:. ?rbitrage profit , + 1//..K.4 G + 1//91' , + 11.4

.9

Rudramurthy B.V

1M. =our company has to ma"e A3D ' million payment in 9 months time, the dollars

are a@ailable no!. =ou decide to in@est them for 9 months and you are gi@en the

follo!ing information.

$he A3 deposit rate is M F pa

$he sterling deposit rate is K F pa

$he spot expected rate is + 1.M168

$he 9Nmonth for!ard rate is + 1.1M68

a7 >here should your company in@est for better returnsE

b7 ?ssume that the A3 interest rates and the spot expected return remain as

abo@e, !hat for!ard rate !ould yield an e;uilibrium situationE

c7 ?ssuming that the A3 interest rate, 3pot and for!ard rates remains as in the

original ;uestion, !here !ould you in@est if the sterling deposit rate is

1. F paE

d7 >ith the originally stated spot and for!ard rates and the same dollar deposit

rate, !hat is the e;uilibrium sterling deposit rateE

So7)t/o5

a7 ?lternati@e 1& N

(n@est A3D 1 million in A3 at the rate of M F pa for 9 months

(nterest income , 1 million C M F C 961' , A3 +'////

?lternati@e '&N

(n@est in Tondon at the rate of 1/ F pa for 9 months

1. on@ert 1 million A3D into e;ui@alent pounds using spot rate.

, 1////// a 1.M , 8 44444:

'. (n@est 8 44444: at the rate of 1/ F pa for 9 month

(nterest , 44444: C /.1/ C 961' , 19MMK

0rincipal , 44444: .

#aturity Value , 4:K..4

9. on@ert the abo@e amount to A3D using for!ard rate.

, 4:K..4 C 1.1M , +1/19:1'

.. 0rofit or gain , + 1/19:1' G + 1////// , + 19:1'

Co5,7)#/o5: & (n@est in A3 since gain is more !hen compared to Tondon

b7 (nterest rate in A3 is M F pa

(nterest rate for sterling deposit is 1/ F pa

(nterest rate differential , 1/ F N M F , ' F

Expected spot rate is

N' F , x G 1.M C 9:/ C 1//

1.M K/

x G 1.M , N' C 1.M

..

Rudramurthy B.V

. C 1//

x G 1.M , N/.//K

x , + 1.1K