Beruflich Dokumente

Kultur Dokumente

Finance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge Sections

Hochgeladen von

sanucwa6932Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge Sections

Hochgeladen von

sanucwa6932Copyright:

Verfügbare Formate

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

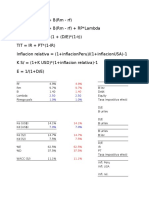

Chapter 1

Q1

Year Price D R

1994 $8.50 $0.25

1995 $12.00 $0.27 44.4%

1996 $16.48 $0.31 39.9%

1997 $24.46 $0.35 50.5%

1998 $34.00 $0.40 40.6%

1999 $51.58 $0.47 53.1%

2000 $47.94 $0.55 -6.0%

2001 $40.08 $0.64 -15.1%

2002 $24.35 $0.72 -37.5%

2003 $30.98 $0.76 30.3%

Q2

W0 I CP W1 EI W5 EI 5

$100 15% Annual $115.00 15.00% $201.14 101.14%

$100 15% Semiannual $115.56 15.56% $206.10 106.10%

$100 15% Quarterly $115.87 15.87% $208.82 108.82%

$100 15% Monthly $116.08 16.08% $210.72 110.72%

$100 15% Continuous $116.18 16.18% $211.70 111.70%

Q3

Year Price D r

1994 $8.50 $0.25

1995 $12.00 $0.27 36.7%

1996 $16.48 $0.31 33.6%

1997 $24.46 $0.35 40.9%

1998 $34.00 $0.40 34.1%

1999 $51.58 $0.47 42.6%

2000 $47.94 $0.55 -6.2%

2001 $40.08 $0.64 -16.3%

2002 $24.35 $0.72 -46.9%

2003 $30.98 $0.76 26.5%

The difference between R and r is large when price changes are large, and small when price changes are small

Q4

Year Price D R r Wealth

1994 $8.50 $0.25 $100.0

1995 $12.00 $0.27 44.4% 36.7% $144.4

1996 $16.48 $0.31 39.9% 33.6% $202.0

1997 $24.46 $0.35 50.5% 40.9% $304.1

1998 $34.00 $0.40 40.6% 34.1% $427.6

1999 $51.58 $0.47 53.1% 42.6% $654.6

2000 $47.94 $0.55 -6.0% -6.2% $615.4

2001 $40.08 $0.64 -15.1% -16.3% $522.7

2002 $24.35 $0.72 -37.5% -46.9% $327.0

2003 $30.98 $0.76 30.3% 26.5% $426.2

Multiperiod 326.2% 145.0%

The difference between R and r is large when price changes are large, and small when price changes are small

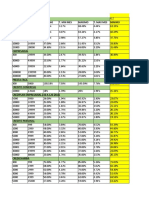

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 2

Q1

Year GM WalMart

1994 -22.00% -14.42%

1995 28.68% 5.56%

1996 8.61% 3.11%

1997 19.21% 74.72%

1998 21.30% 107.55%

1999 25.74% 70.45%

2000 -27.84% -22.79%

2001 -0.98% 8.94%

2002 -20.82% -11.76%

2003 52.85% 5.73%

AM 8.5% 22.7%

GM 5.5% 16.3%

The AM is always larger than or equal to the GM

Q2

Year GM-Return GM-Wealth WM-Return WM-Wealth

1993 $100.0 $100.0

1994 -22.00% $78.0 -14.42% $85.6

1995 28.68% $100.4 5.56% $90.3

1996 8.61% $109.0 3.11% $93.1

1997 19.21% $129.9 74.72% $162.7

1998 21.30% $157.6 107.55% $337.8

1999 25.74% $198.2 70.45% $575.7

2000 -27.84% $143.0 -22.79% $444.5

2001 -0.98% $141.6 8.94% $484.2

2002 -20.82% $112.1 -11.76% $427.3

2003 52.85% $171.4 5.73% $451.7

Q3

GE At AM $225.6

At GM $171.4

WM At AM $773.9

At GM $451.7

The correct terminal wealth is found by compounding at the GM

Q4

GE AM-GM 2.9%

AM/GM-1 53.1%

WM AM-GM 6.4%

AM/GM-1 39.5%

The differences are larger for WalMart because it has a higher volatility (SD)

Q5

Period Price Return Shares-1 CF-1 Wealth-1 Shares-2

1998 $10.70 50 -$535.0 $535.0 800

1999 $38.72 261.9% 100 -$3,872.0 $5,808.0 400

2000 $27.88 -28.0% 200 -$5,576.0 $9,758.0 200

2001 $12.30 -55.9% 400 -$4,920.0 $9,225.0 100

2002 $3.11 -74.7% 800 -$2,488.0 $4,820.5 50

2003 $4.47 43.7% -1550 $6,928.5 $6,928.5 -1550

AM 29.4%

GM -16.0%

DWR -30.7%

The DWR is slighthly higher in the first strategy because the timing of the purchases was somewhat better

CF-2 Wealth-2

-$8,560.0 $8,560.0

-$15,488.0 $46,464.0

-$5,576.0 $39,032.0

-$1,230.0 $18,450.0

-$155.5 $4,820.5

$6,928.5 $6,928.5

-32.1%

The DWR is slighthly higher in the first strategy because the timing of the purchases was somewhat better

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 3

Q1

Year Return

1994 0.9%

1995 38.4%

1996 26.3%

1997 28.4%

1998 22.4%

1999 12.6%

2000 10.2%

2001 -7.6%

2002 -8.9%

2003 20.6%

SD (T) 15.0%

Q2

Year Return

1994 13.5%

1995 42.8%

1996 39.8%

1997 59.9%

1998 15.7%

1999 63.4%

2000 -0.3%

2001 -34.5%

2002 0.2%

2003 37.7%

SD (T) 29.0%

SD (T-1) 30.5%

AMEX is riskier than Exxon but less risky than Intel

Q3

Year Return

1994 13.5%

1995 42.8%

1996 39.8%

1997 59.9%

1998 15.7%

1999 63.4%

2000 -0.3%

2001 -34.5%

2002 0.2%

2003 37.7%

AM 23.8%

R-2*SD -34.1%

R+2*SD 81.7%

The 95% confidence interval is wider than that calculated for Exxon but narrower than that calculated for Intel

Q4

Year Exxon Intel AMEX

1994 0.9% 3.4% 13.5%

1995 38.4% 78.2% 42.8%

1996 26.3% 131.3% 39.8%

1997 28.4% 7.4% 59.9%

1998 22.4% 69.0% 15.7%

1999 12.6% 39.1% 63.4%

2000 10.2% -26.9% -0.3%

2001 -7.6% 4.9% -34.5%

2002 -8.9% -50.3% 0.2%

2003 20.6% 106.6% 37.7%

GM 13.3% 23.8% 20.0%

Approx GM 13.4% 25.3% 20.5%

It works well in general, with the approximation improving for series with smaller returns (Exxon) and worsening for those with larger returns (Intel)

The 95% confidence interval is wider than that calculated for Exxon but narrower than that calculated for Intel

It works well in general, with the approximation improving for series with smaller returns (Exxon) and worsening for those with larger returns (Intel)

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 4

Q1

Year Pepsi HP

1994 -9.5% 28.1%

1995 56.7% 69.4%

1996 6.2% 21.1%

1997 36.6% 25.3%

1998 14.3% 10.7%

1999 -12.5% 67.7%

2000 42.6% -28.6%

2001 -0.5% -34.0%

2002 -12.1% -13.9%

2003 12.0% 34.5%

AM 13.4% 18.0%

SD 23.2% 33.9%

Rho 0.13

The correlation between Pepsi and HP is quite low, which is unsurprising given their very different lines of businesses

Q2

xP xHP Risk Return

100.0% 0.0% 23.2% 13.4%

90.0% 10.0% 21.5% 13.8%

80.0% 20.0% 20.5% 14.3%

70.0% 30.0% 20.2% 14.8%

60.0% 40.0% 20.6% 15.2%

50.0% 50.0% 21.7% 15.7%

40.0% 60.0% 23.4% 16.2%

30.0% 70.0% 25.6% 16.6%

20.0% 80.0% 28.1% 17.1%

10.0% 90.0% 30.9% 17.6%

0.0% 100.0% 33.9% 18.0%

Lowest risk for xP=70% and xHP=30%

MVP for xP=70.6% and xHP=29.4%

Q3

4 assets

5 assets

You get the picture by now, you can do this one yourself!

12%

13%

14%

15%

16%

17%

18%

19%

18% 23%

R

e

t

u

r

n

s

2 / 1

34 4 3 24 4 2 23 3 2 14 4 1 13 3 1 12 2 1

4

4

2

4

2

3

2

3

2

2

2

2

2

1

2

1

} 2 2 2 2 2 2 ) ( ) ( ) ( ) ( ) ( ) ( ) ( ) {( Cov x x Cov x x Cov x x Cov x x Cov x x Cov x x SD x SD x SD x SD x SD

p

The correlation between Pepsi and HP is quite low, which is unsurprising given their very different lines of businesses

23% 28% 33% 38%

Risk

2 / 1

34 4 3 24 4 2 23 3 2 14 4 1 13 3 1 12 2 1

4

4

2

4

2

3

2

3

2

2

2

2

2

1

2

1

} 2 2 2 2 2 2 ) ( ) ( ) ( ) ( ) ( ) ( ) ( ) {( Cov x x Cov x x Cov x x Cov x x Cov x x Cov x x SD x SD x SD x SD x SD

p

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 5

Q1

Date NOR SPA

1994 24.1% -3.9%

1995 6.5% 31.2%

1996 29.2% 41.3%

1997 6.7% 26.2%

1998 -29.7% 50.6%

1999 32.4% 5.3%

2000 -0.4% -15.5%

2001 -11.7% -11.0%

2002 -6.7% -14.9%

2003 49.6% 59.2%

AM 10.0% 16.8%

SD 22.6% 26.9%

Rho 0.27

The correlation between Spain and Norway is rather low, particularly in the context of the highly-integrated European markets

Q2

xN xS Risk Return Ret/Risk

100.0% 0.0% 22.6% 10.0% 44.39

90.0% 10.0% 21.2% 10.7% 50.47

80.0% 20.0% 20.2% 11.4% 56.38

70.0% 30.0% 19.6% 12.1% 61.58

60.0% 40.0% 19.4% 12.7% 65.55

50.0% 50.0% 19.7% 13.4% 67.96

40.0% 60.0% 20.5% 14.1% 68.78

30.0% 70.0% 21.6% 14.8% 68.28

20.0% 80.0% 23.1% 15.5% 66.85

10.0% 90.0% 24.9% 16.1% 64.87

0.0% 100.0% 26.9% 16.8% 62.62

The MVP consists of xN=61.8% and xS=38.2%

The MVP has an expected return of 14.2% and a volatility of 19.43%

The MVP has a higher RAR (68.78) than the 100% Norwegian portfolio (44.39)

The xN=40%/xS=60% portfolio has the highest RAR (68.78 compared to 44.39 for Norway and 62.61 for Spain)

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

18%

R

e

t

u

r

n

The correlation between Spain and Norway is rather low, particularly in the context of the highly-integrated European markets

The xN=40%/xS=60% portfolio has the highest RAR (68.78 compared to 44.39 for Norway and 62.61 for Spain)

18% 20% 22% 24% 26% 28%

Risk

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 6

Q1 - Q6

R(i) 10% Stocks Var(p) SD(p)

SD(i) 30% 1 0.0900 30.00%

Var(i) 0.09 2 0.0550 23.45%

Cov(i,j) 0.02 3 0.0433 20.82%

Rho(i,j) 0.5 4 0.0375 19.36%

5 0.0340 18.44%

6 0.0317 17.80%

7 0.0300 17.32%

8 0.0288 16.96%

9 0.0278 16.67%

10 0.0270 16.43%

11 0.0264 16.24%

12 0.0258 16.07%

13 0.0254 15.93%

14 0.0250 15.81%

15 0.0247 15.71%

16 0.0244 15.61%

17 0.0241 15.53%

18 0.0239 15.46%

19 0.0237 15.39%

20 0.0235 15.33%

21 0.0233 15.28%

22 0.0232 15.23%

23 0.0230 15.18%

24 0.0229 15.14%

25 0.0228 15.10%

26 0.0227 15.06%

27 0.0226 15.03%

28 0.0225 15.00%

29 0.0224 14.97%

30 0.0223 14.94%

As the number of stocks increases risk falls at a decreasing rate

After some 20 or so stocks risk decreases are negligible

Expectedly, the variance of the 30-stock portfolio (0.0223) is very similar to the average covariance across stocks (0.02)

0%

5%

10%

15%

20%

25%

30%

35%

0 5 10 15 20 25 30 35

R

i

s

k

(

S

D

)

Stocks

Expectedly, the variance of the 30-stock portfolio (0.0223) is very similar to the average covariance across stocks (0.02)

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 7

Q1

Year BH Cisco MS S&P500

1994 25.0% 8.7% -0.8% 1.3%

1995 57.4% 112.5% 40.6% 37.6%

1996 6.2% 70.5% 43.2% 23.0%

1997 34.9% 31.4% 80.7% 33.4%

1998 52.2% 149.7% 21.6% 28.6%

1999 -19.9% 130.8% 103.1% 21.0%

2000 26.6% -28.6% 12.2% -9.1%

2001 6.5% -52.7% -28.3% -11.9%

2002 -3.8% -27.7% -27.2% -22.1%

2003 15.8% 85.0% 47.9% 28.7%

AM 20.1% 48.0% 29.3% 13.0%

Beta 0.5 2.8 1.5

There does appear to be a positive relationship between risk (beta) and return

Q2

BH Cisco MS

RRE 7.2% 19.7% 12.8%

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 8

Q1

Year Abbott RP ML RP MRP SMB HML

1994 5.1% -20.8% -4.1% 0.4% -0.1%

1995 24.9% 40.1% 31.0% -6.9% -3.5%

1996 18.2% 56.4% 16.3% -1.9% 0.2%

1997 25.7% 75.6% 26.1% -3.7% 11.1%

1998 47.2% -12.0% 19.4% -23.3% -15.0%

1999 -31.2% 20.2% 20.2% 11.7% -39.4%

2000 30.7% 60.4% -16.7% -5.7% 21.4%

2001 12.0% -27.7% -14.8% 28.4% 27.3%

2002 -30.5% -29.9% -22.9% 4.4% 3.7%

2003 15.0% 52.5% 30.7% 28.1% 15.1%

Abbott Betas 0.66 -1.03 1.05

ML - Betas 1.41 -0.42 1.00

Q2

Abbot ML

RRE-CAPM 8.5% 13.3%

RRE-3FM 9.1% 15.5%

The RRE estimates between the two models are somewhat different

However, note that if the CAPM is used, betas should be estimated from independently, in which case we would obtain:

Abbot ML

Beta 0.37 1.08

RRE-CAPM 6.7% 11.2%

Note, then, that the differences between the (properly-estimated) CAPM-RREs and 3FM-RREs widen

However, note that if the CAPM is used, betas should be estimated from independently, in which case we would obtain:

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 9

Q1 - Q2

Year China Korea

1994 -46.4% 23.7%

1995 -21.1% -3.3%

1996 37.5% -38.1%

1997 -25.3% -66.7%

1998 -42.4% 141.1%

1999 13.3% 92.4%

2000 -30.5% -49.6%

2001 -24.7% 48.7%

2002 -14.0% 8.6%

2003 87.6% 35.9%

AM -6.6% 19.3%

SSD-AM 20.9% 40.1%

SSD-Rf 30.0% 31.7%

SSD-0 26.0% 28.9%

VAR-95: -71.4% -81.0%

VAR-99: -98.6% -123.3%

According to all three SSDs the Korean market is riskier than the Chinese market

Also, according to the VaR the risk of 'extreme' losses is higher in the Korean market

Note, however, that any loss higher than -100% is not possible when investing (long) in equities

This is one of the problems of using distributions that have no lower bound (like the Normal distribution)

This is one of the problems of using distributions that have no lower bound (like the Normal distribution)

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 10

Q1 - Q4

Country AM Country Jensen Country Treynor Country

CAN 13.6% USA 4.6% USA 8.3 USA

USA 13.3% CAN 4.5% ITA 8.1 CAN

ITA 12.3% ITA 3.9% CAN 7.9 ITA

FRA 11.0% FRA 2.0% FRA 5.6 FRA

GER 10.6% UK 1.2% UK 5.2 UK

UK 9.1% GER 1.1% GER 4.7 WOR

WOR 8.7% WOR 0.0% WOR 3.7 GER

JAP 1.9% JAP -6.3% JAP -3.5 JAP

The rankings based on risk-adjusted returns do differ across the different measures

The 'best' country in which to invest depends on the investor's perception of risk (Is it beta? The SD? The SSD?)

However, in this case, the US provides the best RARs for all three measures of risk (beta, SD, and SSD)

Sharpe Country RAP Country Sortino

52.3 USA 12.8% USA 39.9

43.8 CAN 11.5% CAN 37.0

31.1 ITA 9.6% ITA 29.0

31.0 FRA 9.6% FRA 26.1

28.9 UK 9.3% GER 22.0

25.1 WOR 8.7% UK 20.2

24.5 GER 8.6% WOR 17.8

-14.8 JAP 2.8% JAP -11.9

The 'best' country in which to invest depends on the investor's perception of risk (Is it beta? The SD? The SSD?)

However, in this case, the US provides the best RARs for all three measures of risk (beta, SD, and SSD)

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 11

Q1

1a 1b 1c 1d 1e 1f

Weights Weights Weights Weights Weights Weights

-28.6% 0.0% 10.0% -33.1% -25.7% -25.1%

31.5% 14.2% 30.0% 6.1% 48.0% 50.8%

34.9% 26.4% 30.0% 91.3% -1.8% -8.1%

62.2% 59.4% 30.0% 35.7% 79.5% 82.4%

Ep Ep Ep Ep Ep Ep

27.1% 29.9% 31.1% 22.6% 30.0% 30.5%

SDp SDp SDp SDp SDp SDp

33.4% 42.4% 48.9% 29.8% 38.9% 40.0%

Sharpe R. Sharpe R. Sharpe R. Sharpe R. Sharpe R. Sharpe R.

0.66 0.59 0.53 0.59 0.64 0.64

Q2

Date Disney Microsoft 2a 2b 2c

1994 8.7% 51.6% Weights Weights Weights

1995 29.0% 43.6% 82.9% 79.3% 56.8%

1996 19.1% 88.3% 17.1% 20.7% 43.2%

1997 42.9% 56.4%

1998 -8.5% 114.6% Ep Ep Ep

1999 -1.7% 68.4% 13.9% 15.0% 22.0%

2000 -0.4% -62.8%

2001 -27.7% 52.7% SDp SDp SDp

2002 -20.3% -22.0% 21.8% 21.9% 26.0%

2003 44.4% 6.8%

AM 8.5% 39.8% Sharpe R. Sharpe R. Sharpe R.

SD 23.7% 49.8% 0.41 0.46 0.66

Rho 0.05

2d

Weights

25.4%

74.6%

Ep

31.8%

SDp

38.0%

Sharpe R.

0.71

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 12

Q1

P(R>R*) 1 5 10 15 20 25

-5% 82.73% 98.26% 99.86% 99.99% 100.00% 100.00%

0% 73.93% 92.42% 97.87% 99.35% 99.79% 99.93%

5% 63.82% 78.55% 86.83% 91.46% 94.31% 96.15%

10% 53.17% 57.06% 59.93% 62.10% 63.90% 65.46%

12% 48.94% 47.62% 46.64% 45.89% 45.26% 44.70%

14% 44.79% 38.48% 33.94% 30.60% 27.91% 25.63%

16% 40.77% 30.08% 23.02% 18.30% 14.82% 12.16%

18% 36.91% 22.74% 14.53% 9.78% 6.75% 4.74%

20% 33.24% 16.63% 8.53% 4.67% 2.63% 1.51%

25% 25.02% 6.59% 1.66% 0.45% 0.13% 0.04%

30% 18.27% 2.15% 0.21% 0.02% 0.00% 0.00%

For T=1, as the target return increases the probability of achieving higher returns than the target plausibly decreases

The same is true for T=10

For R*=10%, the probability of achieving returns higher than that is plausibly increasing in T (because R*<GM)

For R*=14%, the probability of achieving returns higher than that is plausibly decreasing in T (because R*>GM)

Q2

2a

T 1 5 10 15 20 25

Prob 4.0% 64.3% 89.8% 96.9% 99.0% 99.7%

2b

T 1 5 10 15 20 25

Wealth $1,115 $1,723 $2,969 $5,115 $8,812 $15,183

30

100.00%

99.98%

97.36%

66.84%

44.20%

23.66%

10.05%

3.36%

0.88%

0.01%

0.00%

For T=1, as the target return increases the probability of achieving higher returns than the target plausibly decreases

For R*=10%, the probability of achieving returns higher than that is plausibly increasing in T (because R*<GM)

For R*=14%, the probability of achieving returns higher than that is plausibly decreasing in T (because R*>GM)

30

99.9%

30

$26,159

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 13

Q1

1a 1b - 1c Prices 1d

Rf 4.3% No growth $14.8 Price

MRP 5.5% 3% growth $30.7

Beta 0.30 4% growth $46.9

RRE 6.0%

Q2

Price $66.9

$61.5

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 14

Q1

2003

EFCF $2,584

CFCF $2,570

Q2

CFCF

0 $2,570

1 $2,827

2 $3,110

3 $3,421

4 $3,763

5 $4,140

6 $4,471

7 $4,828

8 $5,215

9 $5,632

10 $6,082

TV $78,174

Q3

WACC 14.2%

Q4

Price $7.9

Q5

Given that Oracle is trading at $11.4 but its intrinsic value is only $7.9, it may not be wise to buy

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 15

Q1

RRE 14.28%

Price $8.0

Q2

RRUE 14.26%

Price $7.9

Q3

The FTE estimate and the APV estimate are very close to each other and to the WACC estimate calculated before

This is the way it should because, when properly applied, all three models should yield the same result

In this case, the near equality also follows from the fact that Oracle is a virtually-unlevered company

The FTE estimate and the APV estimate are very close to each other and to the WACC estimate calculated before

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 16

Q1

Growth 42.3%

Q2

Growth 71.6%

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 17

Q1

As usual, not all ratios point in the same direction, so the question cannot be answered with certainty

In addition, recall that if the multiple of company A is higher than that of company B, it would be incorrect to rush to the conclusion that B is relatively a better buy

It may well be the case that B deserves to be cheaper than A (its fundamentals are not as good as those of A)

Q2

Again, we cannot rush to a conclusion without further analysis

It may be the case that the fundamentals of Pfizer now are better than they were in the past, in which case it would be expected to be more expensive

For example, Pfizer's growth may have increased or its risk may have decreased

Q3

Again, we cannot rush to a conclusion without further analysis

It may be the case that the fundamentals of Pfizer are better than those of its peers, in which case it would be expected to be more expensive

For example, Pfizer may be expected to grow faster than its peers, or it may be expected to be less risky than its peers

Q4

Pfizer still looks expensive relative to its peers

Still, the same caveats mentioned above apply

Even after adjusting by growth, if Pfizer is perceived as less risky than its peers, then it would be expected to be more expensive

In addition, recall that if the multiple of company A is higher than that of company B, it would be incorrect to rush to the conclusion that B is relatively a better buy

It may well be the case that B deserves to be cheaper than A (its fundamentals are not as good as those of A)

It may be the case that the fundamentals of Pfizer now are better than they were in the past, in which case it would be expected to be more expensive

It may be the case that the fundamentals of Pfizer are better than those of its peers, in which case it would be expected to be more expensive

For example, Pfizer may be expected to grow faster than its peers, or it may be expected to be less risky than its peers

Even after adjusting by growth, if Pfizer is perceived as less risky than its peers, then it would be expected to be more expensive

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 18

Q1

US 5.75% BH Motorola Delta

Price (1a) $1,092.5 $959.0 $1,080.9 $1,044.5

Price (1b) $987.6 $864.7 $982.4 $950.8

As expected, when the discount rates increase, bond prices decrease

Note that we're actually calculating our estimates of intrinsic value rather than prices (which are the numbers given in the table)

Q2

US 5.75% BH Motorola Delta

SAy 1.8% 2.1% 2.2% 7.6%

Ay 3.6% 4.2% 4.5% 15.1%

EAy 3.7% 4.2% 4.5% 15.7%

The Ay and the EAy are different because the latter (but not the former) takes into account the effect of compounding

It is the EAy that properly captures the return delivered by a bond

Note that we're actually calculating our estimates of intrinsic value rather than prices (which are the numbers given in the table)

The Ay and the EAy are different because the latter (but not the former) takes into account the effect of compounding

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 19

Q1

US 5.75% BH Motorola Delta

Price (1a) $1,092.5 $959.0 $1,080.9 $1,044.5

Price (1b) $987.6 $864.7 $982.4 $950.8

Price (1c) $1,211.0 $1,065.4 $1,191.7 $1,149.8

Q2

US 5.75% BH Motorola Delta

Change 1-2 -9.6% -9.8% -9.1% -9.0%

Change 1-3 10.8% 11.1% 10.3% 10.1%

Their sensitivity to changes in interest rates is similar though the BH bond seems to have slightly higher interest-rate risk

Q3

Interest-rate risk and default risk are not necessarily correlated in theory, and they are not in this case

For example, Delta has much higher credit risk and yet it does not have higher interest-rate risk

Their sensitivity to changes in interest rates is similar though the BH bond seems to have slightly higher interest-rate risk

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 20

Q1

US 5.75% BH Motorola Delta

Price (1a) $1,092.5 $959.0 $1,080.9 $1,044.5

Price (1b) $1,038.5 $910.4 $1,030.2 $996.2

Price (1c) $1,150.0 $1,010.6 $1,134.6 $1,095.6

Q2

US 5.75% BH Motorola Delta

Duration 5.2 5.3 5.0 4.9

In all cases the durations are longer than the average maturity of 3.5 years because the bonds' cash flows are heavily weighted towards the end of their life

Q3

US 5.75% BH Motorola Delta

Mod Dur 5.0 5.1 4.7 4.6

These numbers indicate the expected change in the bonds' prices when discount rates increase by 1 percentage point

Q4

US 5.75% BH Motorola Delta

Change 1-2 -4.9% -5.1% -4.7% -4.6%

Change 1-3 5.3% 5.4% 5.0% 4.9%

Average 5.1% 5.2% 4.8% 4.8%

For each bond, the average change (in absolute value) is virtually identical to the bond's modified duration

This indicates that the modified duration is a very good approximation to the interest-rate risk of these bonds

In all cases the durations are longer than the average maturity of 3.5 years because the bonds' cash flows are heavily weighted towards the end of their life

These numbers indicate the expected change in the bonds' prices when discount rates increase by 1 percentage point

For each bond, the average change (in absolute value) is virtually identical to the bond's modified duration

This indicates that the modified duration is a very good approximation to the interest-rate risk of these bonds

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 21

Q1

A B C D E E'

0 -100 -100 -100 100 -10 -90

1 30 100 75 -15 4 26.0

2 30 100 75 -15 4 26.0

3 30 100 75 -15 3 27.0

4 30 75 75 -15 3 27.0

5 30 -300 -250 -15 3 27.0

NPV $13.7 $13.6 -$17.5 $43.1 $3.1 $10.6

IRR 15.2% 5.3% N/A -8.9% 22.4% 14.5%

IRR-2 72.3%

Q2

Yes, because its NPV is positive (and its IRR is higher than the discount rate)

Q3

Yes, because its NPV is positive

This is the case although one of the two IRRs is lower than the discount rate

When the NPV and the IRR approaches conflict, the NPV gives the more correct answer

Q4

No, because its NPV is negative

Note that this project has no IRR

Q5

The company should go for project A because it has a higher NPV

This is the case despite the fact that A has a lower IRR than E

As "project" E' shows, the NPV of the incremental cash flows of A has a positive NPV ($10.6)

Q6

No, because the project's NPV is negative (-$0.5m)

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 22

Q1

Time CFs - Low CFs - High E(CFs)

0 -200 -200 -200

1 20 40 30

2 20 40 30

3 20 40 30

4 20 40 30

5 20 40 30

6 20 40 30

7 20 40 30

8 20 40 30

9 20 40 30

10 20 40 30

NPV ($77.1) $45.8 ($15.7)

According to the project's expected CFs, the company should not buy the rights to extract copper

That being the case, this is obviously not a good project in the case of low CFs

However, when CFs are high, the project does deliver a positive NPV

Q2

Time CFs - Low CFs - High

0

1 -200 -200

2 20 40

3 20 40

4 20 40

5 20 40

6 20 40

7 20 40

8 20 40

9 20 40

10 20 40

NPV-1 ($84.8) $30.4

NPV-0 $13.8

RO $29.5

As before, if CFs are low, the company should not invest in this project

And also as before, if the CFs are high, the company should invest in this project

The NPV of the project, evaluated one period down, the road is $30.4m

With 50% probability the company will invest and obtain this NPV, and with 50% probability the company will not invest

The weighted-average of this two scenarios, today, is a positive $13.8m

Therefore, it pays for the company to invest $5m in the rights to extract copper

The implicit value of the real option is $29.5m (the difference between $13.8m and -$15.7m)

With 50% probability the company will invest and obtain this NPV, and with 50% probability the company will not invest

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 23

Q1 - Q4

Industry ROC COC Capital NOPAT RI RI-2

Cable TV 6.7% 10.3% $189.0 $12.6 ($6.9) ($6.9)

Drugs 28.6% 10.2% $174.1 $49.8 $32.0 $32.0

Life Ins 51.3% 8.4% $126.7 $65.1 $54.4 $54.4

Property Ins 0.3% 8.4% $115.6 $0.3 ($9.4) ($9.4)

Tel Equip 4.6% 14.2% $39.8 $1.8 ($3.8) ($3.8)

According to this framework, the drug and life insurance industries created value and the other three destroyed value in 2003

According to this framework, the drug and life insurance industries created value and the other three destroyed value in 2003

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 24

Q1

Call price = $3.9

Q2

Put price = $2.3

Q3

$50.0 $40.0 $50.0 $40.0 25.0% 15.0%

Call $7.6 $1.5 $1.9 $7.2 $4.7 $3.2

Put $0.9 $4.9 $5.0 $0.7 $3.0 $1.6

Q4

The qualitative relationships discussed in the text do hold in the exhibit above

S X SD

1.00 0.5 6.0% 4.0%

$4.7 $3.1 $4.1 $3.8

$2.5 $2.0 $2.1 $2.4

Rf T

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 25

Q1 - Q2

Beta = 0.8 Beta = 0.8 Beta = 1.2 Beta = 1.2

S $10,000 $10,000 $10,000 $10,000

c 5.0% 5.0% 5.0% 5.0%

y 1.0% 1.0% 1.0% 1.0%

T 0.5 0.5 0.5 0.5

F(0) $10,202 $10,202 $10,202 $10,202

Dow(0) 10000 10000 10000 10000

Dow(1) 9000 11000 9000 11000

Rm -9.5% 10.5% -9.5% 10.5%

Beta 0.8 0.8 1.2 1.2

Pfolio (0) $4,000,000 $4,000,000 $4,000,000 $4,000,000

Rp -7.1% 8.9% -11.9% 12.1%

Pfolio (1) $3,716,000 $4,356,000 $3,524,000 $4,484,000

Gain/Loss -$284,000 $356,000 -$476,000 $484,000

F(0) $10,202.0 $10,202.0 $10,202.0 $10,202.0

F(1) 9000 11000 9000 11000

N 32 32 48 48

Gain/Loss $384,644.3 -$255,355.7 $576,966.4 -$383,033.6

Total G/L $100,644.3 $100,644.3 $100,966.4 $100,966.4

Invest @Rf $4,101,260.5 $4,101,260.5 $4,101,260.5 $4,101,260.5

Gain $101,260.5 $101,260.5 $101,260.5 $101,260.5

Difference -$616.2 -$616.2 -$294.0 -$294.0

In both cases the hedges are almost perfect

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 26

Q1

1a - For both European and Americans it is the same buying the flat-screen TV in the US or in Europe

1b - In this case the flat-screen TV is cheaper in Europe, and therefore this is not an absolute PPP equilibrium

1c - In this case the flat-screen TV is cheaper in the US, and therefore this is not an absolute PPP equilibrium

Q2

2a- The dollar will depreciate to 1.544

2b- US interest rates will rise to 9% and European interest rates will rise to 6%

2c- The dollar-euro one-year forward exchange rate will be 1.542

2d- At a forward rate of 1.542 Americans would be indifferent between investing in the US or in Europe

2e- At a forward rate of 1.542 Europeans would be indifferent between investing in the US or in Europe

2f- Borrow 100, convert to dollars and invest in the US at 9% for one year, locking a certain profit of 4.5

2g- Borrow $100, convert to euros and invest in Europe at 6% for one year, locking a certain profit of 2.5

1b - In this case the flat-screen TV is cheaper in Europe, and therefore this is not an absolute PPP equilibrium

1c - In this case the flat-screen TV is cheaper in the US, and therefore this is not an absolute PPP equilibrium

2d- At a forward rate of 1.542 Americans would be indifferent between investing in the US or in Europe

2e- At a forward rate of 1.542 Europeans would be indifferent between investing in the US or in Europe

2f- Borrow 100, convert to dollars and invest in the US at 9% for one year, locking a certain profit of 4.5

2g- Borrow $100, convert to euros and invest in Europe at 6% for one year, locking a certain profit of 2.5

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 27

Q1 - Q2

Year ARG BRA

1993

1994 -23.6% 65.7%

1995 12.9% -19.2%

1996 20.3% 42.5%

1997 24.6% 27.3%

1998 -24.3% -39.6%

1999 34.3% 67.2%

2000 -25.1% -11.4%

2001 -18.3% -17.0%

2002 -50.5% -30.7%

2003 101.3% 115.0%

Mean 5.2% 20.0%

Median -2.7% 8.0%

Mode N/A N/A

Var (T) 0.1703 0.2392

SD (T) 41.3% 48.9%

Covar 0.1577

Correl 0.78

Var (T-1) 18.9% 26.6%

SD (T-1) 43.5% 51.6%

The mean and the median are different because these distributions are skewed (asymmetric)

The mode does not exist because there is no value that occurs more often than others (all values occur just once in both samples)

The covariance indicates a positive linear relationship between the stock markets of Argentina and Brazil

The correlation indicates that this positive linear relationship is quite strong

The mode does not exist because there is no value that occurs more often than others (all values occur just once in both samples)

The covariance indicates a positive linear relationship between the stock markets of Argentina and Brazil

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 28

Q1

Range AbsFreq RelFreq

(1, 2) 0 0.0%

(2, 3) 1 5.0%

(3, 4) 2 10.0%

(4, 5) 2 10.0%

(5, 6) 5 25.0%

(6, 7) 2 10.0%

(7, 8) 2 10.0%

(8, 9) 2 10.0%

(9, 10) 1 5.0%

(10, 11) 1 5.0%

(11, 12) 1 5.0%

(12, 13) 1 5.0%

(13, ) 0 0.0%

20 1

The distributions of returns does not appear to be normal, it actually appears to have a long right tail (positive skewness)

Q2 - Q3

Prob (R12%) = 50.0%

Prob (R5%) = 36.3%

Prob (R30%) = 18.4%

Prob (5%R20%) = 29.2%

0

1

2

3

4

5

6

A

b

s

o

l

u

t

e

F

r

e

q

u

e

n

c

y

The distributions of returns does not appear to be normal, it actually appears to have a long right tail (positive skewness)

0%

5%

10%

15%

20%

25%

30%

R

e

l

a

t

i

v

e

F

r

e

q

u

e

n

c

y

Range

Range

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 29

Q1

Skewness 1.05 Sum Stats

Kurtosis 1.01 Mean 6.9%

Std Error 0.0066

Median 5.9%

Mode 5.6%

SD 3.0%

Sample Var 0.0009

Kurtosis 1.01

Skewness 1.05

Range 11.8%

Minimum 2.9%

Maximum 14.7%

Sum 138.5%

Count 20

Q2

Prob (R10%) = 55.8%

Prob (R20%) = 24.4%

Prob (5%R25%) = 38.8%

Finance in a Nutshell

Javier Estrada

FT Prentice Hall, 2005

Answer Key to Challenge Sections

Chapter 30

Q1

Regression Statistics

R Square 0.05

Adj R2 0.02

Std Error 0.01

Observations 30

ANOVA df SS MS F Signif F

Regression 1 0.0001 0.0001 1.60 0.22

Residual 28 0.0012 0.0000

Total 29 0.0012

Coefficients Std Errors t Stat P-value

Intercept 0.001 0.005 0.25 0.80

X Variable 1 0.060 0.048 1.26 0.22

The R square is rather low at 5%, indicating that volatility (SD) explains about 5% of the variability in MRs

Consistently, the slope coefficient is not significant according to the standard t-test (and, say, a 5% significance level)

The slope coefficient indicates that a 1% increase in SD leads to a 0.6% increase in MRs

In short, SDs do not seem to be very closely related to MRs

Q2

Regression Statistics

R Square 0.11

Adj R2 0.08

Std Error 0.01

Observations 30

ANOVA df SS MS F Signif F

Regression 1 0.0001 0.0001 3.45 0.07

Residual 28 0.0011 0.0000

Total 29 0.0012

Coefficients Std Errors t Stat P-value

Intercept 0.003 0.002 1.38 0.18

X Variable 1 0.004 0.002 1.86 0.07

The R square is still rather low but over twice as high compared to that of the previous regression

Beta is not significant at the usual 5% level of significance (but it would be at the 10% level)

Beta seems to explain MRs somewhat better than volatility but neither provides a substantial explanation for the variability in MRs

Q3

Regression Statistics

R Square 0.11

Adj R2 0.05

Std Error 0.01

Observations 30

ANOVA df SS MS F Signif F

Regression 2 0.0001 0.0001 1.69 0.20

Residual 27 0.0011 0.0000

Total 29 0.0012

Coefficients Std Errors t Stat P-value

Intercept 0.004 0.005 0.80 0.43

X Variable 1 -0.016 0.074 -0.21 0.84

X Variable 2 0.004 0.003 1.32 0.20

The R square of this regression is almost identical to that of the previuos regression

Neither volatility nor beta seem to explain a substantial part of the variability in MRs

The adjusted R squares of this regression and the previous one indicate that it does not pay to add volatility to a regression between MRs and betas

The R square is rather low at 5%, indicating that volatility (SD) explains about 5% of the variability in MRs

Consistently, the slope coefficient is not significant according to the standard t-test (and, say, a 5% significance level)

Beta seems to explain MRs somewhat better than volatility but neither provides a substantial explanation for the variability in MRs

The adjusted R squares of this regression and the previous one indicate that it does not pay to add volatility to a regression between MRs and betas

Das könnte Ihnen auch gefallen

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsVon EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNoch keine Bewertungen

- Excel Stock and Bond PortfolioDokument7 SeitenExcel Stock and Bond Portfolioapi-27174321Noch keine Bewertungen

- Fundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFDokument31 SeitenFundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFRussellFischerqxcj100% (11)

- CRE99Dokument31 SeitenCRE99wissalriyaniNoch keine Bewertungen

- Fundamentals of Corporate Finance Australian 7th Edition Ross Solutions ManualDokument10 SeitenFundamentals of Corporate Finance Australian 7th Edition Ross Solutions Manualelizabethmitchelldajfiqwory100% (28)

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualDokument10 SeitenFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (18)

- Applied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions ManualDokument31 SeitenApplied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions Manualthioxenegripe.55vd100% (25)

- Calculadora 1Dokument45 SeitenCalculadora 1Fatima LuyandoNoch keine Bewertungen

- FMDFINA Risk-Return-Problem-SetDokument2 SeitenFMDFINA Risk-Return-Problem-SetmilanomenganNoch keine Bewertungen

- The Basics of Risk: Problem 1Dokument7 SeitenThe Basics of Risk: Problem 1Sandeep MishraNoch keine Bewertungen

- Ch4sol PDFDokument7 SeitenCh4sol PDFAmine IzamNoch keine Bewertungen

- Efficient FrontiersDokument10 SeitenEfficient FrontiersMuhammad Ahsan MukhtarNoch keine Bewertungen

- Corporate AssingmentDokument10 SeitenCorporate AssingmentHeitham OmarNoch keine Bewertungen

- Session 3 ADokument10 SeitenSession 3 AAashishNoch keine Bewertungen

- PovertyDokument5 SeitenPovertytp077535Noch keine Bewertungen

- BetaDokument7 SeitenBetaMutaz AleidehNoch keine Bewertungen

- Lat Uas BabdDokument12 SeitenLat Uas BabdRivaldi LiemNoch keine Bewertungen

- National DebtDokument9 SeitenNational DebtGenelyn Cabudsan MancolNoch keine Bewertungen

- Group Assignment 2: Country Selected: ItalyDokument2 SeitenGroup Assignment 2: Country Selected: ItalyAbhijitNoch keine Bewertungen

- Testul 8Dokument18 SeitenTestul 8PirvuNoch keine Bewertungen

- Regresion SimpleDokument10 SeitenRegresion SimpleCamilo BuitragoNoch keine Bewertungen

- Ch1sol-Đã G PDokument31 SeitenCh1sol-Đã G PLinh LinhNoch keine Bewertungen

- Year Nominal Return Inflation Real Rate of Return VarianceDokument14 SeitenYear Nominal Return Inflation Real Rate of Return VarianceKunal NakumNoch keine Bewertungen

- PD 2 - SolucionarioDokument32 SeitenPD 2 - SolucionarioAdrian Pedraza AquijeNoch keine Bewertungen

- Country Risk EXDokument6 SeitenCountry Risk EXIfechukwu AnunobiNoch keine Bewertungen

- BorradorDokument7 SeitenBorradorPaola Hernández PradoNoch keine Bewertungen

- Semana 10 - Ing. ManttDokument5 SeitenSemana 10 - Ing. ManttJhonny Jhoel Ccanto GuadalupeNoch keine Bewertungen

- Distribucion de Frecuencia Del PesoDokument12 SeitenDistribucion de Frecuencia Del PesoDANIELNoch keine Bewertungen

- Kel 2Dokument24 SeitenKel 2Rita MulyandariNoch keine Bewertungen

- Comprador TaxasDokument4 SeitenComprador TaxasRenan MartinelliNoch keine Bewertungen

- FM09-CH 15Dokument7 SeitenFM09-CH 15Mukul Kadyan100% (1)

- Week 120 (Jan.14-20,2019)Dokument52 SeitenWeek 120 (Jan.14-20,2019)Gabriel Enrico EstoniloNoch keine Bewertungen

- DCF ModelDokument51 SeitenDCF Modelhugoe1969Noch keine Bewertungen

- Applied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions ManualDokument5 SeitenApplied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions ManualAmandaNoblegqiez100% (18)

- Ejercicios Finanzas RDokument61 SeitenEjercicios Finanzas Rkevin100% (2)

- Investments Problem SetDokument5 SeitenInvestments Problem Setzer0fxz8209Noch keine Bewertungen

- Samsung Electronics: Earnings Release Q4 2020Dokument8 SeitenSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNoch keine Bewertungen

- Reporte de Recaudacion y Recuperacion Al 08.06Dokument2.650 SeitenReporte de Recaudacion y Recuperacion Al 08.06Piero RVNoch keine Bewertungen

- Cases SolutionDokument10 SeitenCases Solutionhimanshu sagarNoch keine Bewertungen

- Price and Return Data For Walmart (WMT) and Target (TGT)Dokument8 SeitenPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17Noch keine Bewertungen

- The Unidentified Industries - Residency - CaseDokument4 SeitenThe Unidentified Industries - Residency - CaseDBNoch keine Bewertungen

- AFM 273 F2021 Midterm W AnswersDokument31 SeitenAFM 273 F2021 Midterm W AnswersAustin BijuNoch keine Bewertungen

- Determinant Factors of InflationDokument7 SeitenDeterminant Factors of InflationTheodor MunteanuNoch keine Bewertungen

- Emprendero Minimo Maximo Minimo T. Min Mes Maximo T. Max Mes MinimoDokument4 SeitenEmprendero Minimo Maximo Minimo T. Min Mes Maximo T. Max Mes MinimoCarlos NarroNoch keine Bewertungen

- Polymers of Styrene, in Primary FormsDokument1 SeitePolymers of Styrene, in Primary FormslyesNoch keine Bewertungen

- Testul 6Dokument10 SeitenTestul 6PirvuNoch keine Bewertungen

- Marcospelaez PracproblemsDokument23 SeitenMarcospelaez Pracproblemsapi-270738615Noch keine Bewertungen

- Exercise 4 Time Series ForecastingDokument16 SeitenExercise 4 Time Series ForecastingAngel Yohaiña Ramos SantiagoNoch keine Bewertungen

- Dwnload Full Applied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions Manual PDFDokument36 SeitenDwnload Full Applied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions Manual PDFthomasriddledisrgzembc100% (14)

- Data PhillipsDokument8 SeitenData Phillipserina khalisahNoch keine Bewertungen

- Balkrishna IndsDokument9 SeitenBalkrishna Indssaufin29Noch keine Bewertungen

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDokument10 SeitenThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNoch keine Bewertungen

- Jindal Steel Ratio AnalysisDokument1 SeiteJindal Steel Ratio Analysismir danish anwarNoch keine Bewertungen

- Rizal NHS Nutrional Status Sy 2021 2022Dokument1 SeiteRizal NHS Nutrional Status Sy 2021 2022Jennifer AlbaradoNoch keine Bewertungen

- Ass No 4Dokument10 SeitenAss No 4Muhammad Bilal MakhdoomNoch keine Bewertungen

- Does Trend Following Work On Stocks? Part II: What To Buy/sellDokument5 SeitenDoes Trend Following Work On Stocks? Part II: What To Buy/selldatsnoNoch keine Bewertungen

- MOOC - Corporate Finance Essentials: Javier Estrada - IESE Business School - BarcelonaDokument2 SeitenMOOC - Corporate Finance Essentials: Javier Estrada - IESE Business School - Barcelonanelson arangoNoch keine Bewertungen

- Practica-1 Excel G-ADokument7 SeitenPractica-1 Excel G-AEstrella CarolinqNoch keine Bewertungen

- Base Case - Financial ModelDokument52 SeitenBase Case - Financial Modeljuan.farrelNoch keine Bewertungen

- DYNE Industries Pty LTD: No-Load Loss (Pno (2+ (0.00566 (250-Pno) ) ) /100) WattDokument7 SeitenDYNE Industries Pty LTD: No-Load Loss (Pno (2+ (0.00566 (250-Pno) ) ) /100) WattChesy KadekNoch keine Bewertungen

- ChallengeDokument30 SeitenChallengesanucwa6932Noch keine Bewertungen

- FSA1Dokument16 SeitenFSA1sanucwa6932Noch keine Bewertungen

- Excel 2007 Intermediate: Learning OutcomesDokument16 SeitenExcel 2007 Intermediate: Learning Outcomessanucwa6932Noch keine Bewertungen

- Questions, Exercises, Problems, and Cases: Answers and SolutionsDokument20 SeitenQuestions, Exercises, Problems, and Cases: Answers and Solutionssanucwa6932Noch keine Bewertungen

- Ge Washing Machine ManualDokument52 SeitenGe Washing Machine Manuallillith1723Noch keine Bewertungen

- 6 Elements of A Healthy ChurchDokument2 Seiten6 Elements of A Healthy ChurchJayhia Malaga JarlegaNoch keine Bewertungen

- BF2207 Exercise 6 - Dorchester LimitedDokument2 SeitenBF2207 Exercise 6 - Dorchester LimitedEvelyn TeoNoch keine Bewertungen

- Emailing Prime - Brochure - DigitalDokument32 SeitenEmailing Prime - Brochure - DigitalCASA VALLINoch keine Bewertungen

- Om - 3M CaseDokument18 SeitenOm - 3M CaseBianda Puspita Sari100% (1)

- Allama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Dokument2 SeitenAllama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Tehmina HanifNoch keine Bewertungen

- Technical Writing PDFDokument129 SeitenTechnical Writing PDFKundan Kumar100% (1)

- Natural GeotextilesDokument27 SeitenNatural GeotextilesDr Muhammad Mushtaq Mangat100% (1)

- Lezione Argiolu - Master Roma3!3!12-2010 - Test Di Application SecurityDokument26 SeitenLezione Argiolu - Master Roma3!3!12-2010 - Test Di Application SecurityWB_YeatsNoch keine Bewertungen

- Harmonic Distortion CSI-VSI ComparisonDokument4 SeitenHarmonic Distortion CSI-VSI ComparisonnishantpsbNoch keine Bewertungen

- A Flight Plan in 10 StepsDokument4 SeitenA Flight Plan in 10 StepsThar LattNoch keine Bewertungen

- NO.76 Method Statement for Chemical Anchoring of Rebars on Piles - Rev.0第一次Dokument5 SeitenNO.76 Method Statement for Chemical Anchoring of Rebars on Piles - Rev.0第一次Amila Priyadarshana DissanayakeNoch keine Bewertungen

- Unilift de DGDDokument36 SeitenUnilift de DGDLove SemsemNoch keine Bewertungen

- Raul C. Cosare v. Broadcom Asia Inc. and Dante ArevaloDokument4 SeitenRaul C. Cosare v. Broadcom Asia Inc. and Dante ArevaloRam Migue SaintNoch keine Bewertungen

- Notes in Judicial AffidavitDokument11 SeitenNotes in Judicial AffidavitguibonganNoch keine Bewertungen

- Sony Ericsson Secret MenuDokument2 SeitenSony Ericsson Secret MenuZeljana MaksicNoch keine Bewertungen

- EECI-Modules-2010Dokument1 SeiteEECI-Modules-2010maialenzitaNoch keine Bewertungen

- Tween 80 CoADokument1 SeiteTween 80 CoATấn Huy HồNoch keine Bewertungen

- A Branding Effort of Walt DisneyDokument17 SeitenA Branding Effort of Walt DisneyKanishk GuptaNoch keine Bewertungen

- Excel Tips TricksDokument26 SeitenExcel Tips Tricksskondra12Noch keine Bewertungen

- Revised Procedural Manual On Hazardous Waste Management (Revised DAO 04-36) I CONTENTS Chapter Page PDFDokument53 SeitenRevised Procedural Manual On Hazardous Waste Management (Revised DAO 04-36) I CONTENTS Chapter Page PDFdennisNoch keine Bewertungen

- Lower Gasket Kit (S/N E/ 9Fz999 & Below) : Model Number: 335 Serial Number: A9KA11001 & Above, AAD111001 & AboveDokument2 SeitenLower Gasket Kit (S/N E/ 9Fz999 & Below) : Model Number: 335 Serial Number: A9KA11001 & Above, AAD111001 & Abovezeeshan tanveerNoch keine Bewertungen

- Daftar Kalibrasi Peralatan MedisDokument34 SeitenDaftar Kalibrasi Peralatan Medisdiklat rssnNoch keine Bewertungen

- Production of BiodieselDokument49 SeitenProduction of Biodieselteja100% (1)

- 785 TrucksDokument7 Seiten785 TrucksJavier Pagan TorresNoch keine Bewertungen

- UN - Towards Sustainable DevelopmentDokument17 SeitenUN - Towards Sustainable Developmentviva_33Noch keine Bewertungen

- Battlab Report 12 FinalDokument48 SeitenBattlab Report 12 FinalLianNoch keine Bewertungen

- UNDCO Disability Inclusion Strategy 2022 - 2025Dokument28 SeitenUNDCO Disability Inclusion Strategy 2022 - 2025Nelson MichmeNoch keine Bewertungen

- Opposition To Motion For Judgment On PleadingsDokument31 SeitenOpposition To Motion For Judgment On PleadingsMark Jaffe100% (1)

- Case Study 1Dokument2 SeitenCase Study 1asad ee100% (1)