Beruflich Dokumente

Kultur Dokumente

Tax Update July 2014 - 0001 - NEW

Hochgeladen von

Trina GebhardOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Update July 2014 - 0001 - NEW

Hochgeladen von

Trina GebhardCopyright:

Verfügbare Formate

SUM-M.

[T

CERTIFIED PRACTISING ACCOUNTANT

ABN:76 302 505 202

r 02 40131222

F 02 4951 4977

A Room 4, Level 1,69 Cowper St

Wallsend NSW 2287

E admin@summitacc.com.au

W summitacc.com.au

JulY 2014

SuperStream starting 1 July for many employers

Under'superStream', employers will need to be able to make super contributions on

behalf of their employees by submitting data and payments electronically.

Equally, all superannuation funds, including SMSFs, will need to be able to receive

contri butions electronically.

Employers with 20 or more employees

From 1 July 2014*, these employers should start using the SuperStream standard to

send contribution data and payments electronically.

Note(*): The ATO is being flexible on thre start datu, provided the employer is doing their

best to implement SuperSfrea m, and has a firm plan fo do so no laterthan 30 June 2015.

Employers with 1 I or fewer employees

From 1 July 2015*, these employers will also be required to send contributions data and

payments electronically. However, some may choose to implement SuperStream

sooner.

Note{"): The ATO is a/so being flexibte on this start date, provided the employer has a

firm plan fo do so no laterthan 30 June 2016.

Employers

Employers have two options for meeting SuperStream; either:

(a) using software that conforms to SuperStream; or

(b) using a service provider that can meet SuperStream on their behalf.

The ATO recommends that employers start investigating their options now, and has

provided information and a list of providers on its website.

Editar: tf you need any assr.sfance with SuperStream

please contacl our office, and we'll

be glad ta get yau started and walk you through fhe proaass.

Practice Update

,::ffirI.$tt?:.i# @sl H

t***,*H":rfi:"u::H:'

ATO's new Business Viability Assessment

Tool

The ATO has designed and launched a new online tool to help businesses

and tax

agents determine whether a business is viable'

Once the tax agent or taxpayer has answered a $eries of questions, they will be provided

with a report that will contain an overall viability assessment

of their business based on

the infornation they have provided, consisting of:

D a summary of key financials and business

performance; and

tr charts that

provide a visual summary of the trends of key financial results

generated bY the business.

Editor: lf, for any reasQn,

you would tike ta discuss the above taal, please contact our

afftce.

Project DO lT update

The ATO says that its voluntary disclosure initiative, Project DO lT (in relation to

taxpayers coming fonward and disclosing overseas income and assets), is receiving a

strong response with a number of

people having already come forward to make a

disclosure.

Response so far

a Over 350 inquiries-

a Almost 100 disclosures lodged'

a strong indication that many others will make a disclosure in the near future'

Editor: To remind clients, Proiect'DO lT'. (i.e., 'disclose offshore income today') is an

amnesty for taxpayers with offshore assefs or income to valuntaily come clean by 19

December 2014.

lJnder Proied DA lT, taxPaYers:

tr are encouraged to disclose omitted income or aver-claimed deduc*ians

relating to

th ei r offsh a re activ itie s

;

tr wit{not be investigated or refened for criminat investigation

bythe ATa; and

tr will

generatly only be assessed far the last four years'

ATO Div.7A benchmark

interest rate

The benchmark interest rate for 2Q14115, for the

purposes of the deemed dividend

provisions of Div.7A, can now be calculated as 5.95%

(down from 6.20% for 2013114\'

ATO warning on 2013/14 work-related

deductions

This tax time the ATO says that, in relation to work-related expenses, it will not be limiting

its attention to certain occupations.

lnstead,

partlcular atention will be paid to wort(-related

expense claims relating to:

. overnight travel;

a transporting bulky tools and equipment;

and

a the work-related

proportion of use for computers,

phones or other electronic

devices.

2A14l15 Luxury car tax (LCT) limit

The LCT threshold for the 2014t15 financial

year is $61,884

(increasing the previous

year's LGT threshold of $60,316

by an indexation factor of 1.026).

ATO campaign warns of tax time scams

The ATO is again reminding taxpayers to be wary of scams this tax time as fraudsters

become more ambitious in their efforts to dupe the public into releasing their

personal

information.

since 1 March 2014 the ATO has seen a spike in reports from the public of email and

phishing scams from 9,368 to 11,344, compared with the same

period last year'

Some of the tips for taxpayers include:

D Never share

personal infonnation, such as

your TFN, myGov or bank account

details on social media.

tr change any

passwords that may have been shared with family or friends'

IGT

-

ATO debt colleetion

With uncollected

taxes blowing out to $17.7

billion in 2}1il13

(over 60% owed by small

businesses),

the lnspector General of Taxation

(lGT) has stepped into the fray and

announced that he is

going to review the ATO's approach to debt collection'

The ATO has stated that more recent increases are a result of economic ccnditions and

its assistance to viable businesses

to stay afloat, but the IGT is concerned

that it is a

persistent source of taxpayer complaint.

Other aspects of the ATO's debt management,

including its use of third

party debt

collectors, have also been

questioned.

Confidential submissions can be made to the IGT until 18 July 2414'

Glc and slc rates for the 2014 September

quarter

The ATO has released the 2014 September

quarter rates for the General lnterest Charge

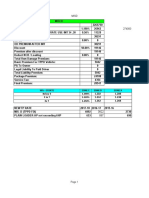

(GlC) and the Shortfall lnterest Charge (SlC) as follows:

GIC annual rate

9.69%

GIC daily rate 0.a2654794%

SIC annual rate 5.690/o

SIC daily rate 0.01558904%

general in nature and anYone

ir**Oing to apply the information to practical circumstances should seek

professional

ajviCe ti inOddehaentry verity their iriterpretation and the information's

applicabili$ to

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Cash Flow Statement Template in ExcelDokument5 SeitenCash Flow Statement Template in ExcelOyewale OyelayoNoch keine Bewertungen

- GST Invoice Format 1Dokument1 SeiteGST Invoice Format 1Prem Kumar YadavalliNoch keine Bewertungen

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument2 SeitenForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryShantru RautNoch keine Bewertungen

- EinDokument1 SeiteEinruovzuffNoch keine Bewertungen

- IT Declaration FormatDokument2 SeitenIT Declaration FormatKamal VermaNoch keine Bewertungen

- Four Year Profit ProjectionDokument1 SeiteFour Year Profit ProjectionDebbieNoch keine Bewertungen

- Information About Moving ExpensesDokument6 SeitenInformation About Moving ExpensesSebastien OuelletNoch keine Bewertungen

- January: Date Name of Statue Form Name of To Be Sent To ReturnDokument8 SeitenJanuary: Date Name of Statue Form Name of To Be Sent To Returnjimit0810Noch keine Bewertungen

- Boat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Dokument3 SeitenBoat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Ram RahimNoch keine Bewertungen

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDokument1 SeiteBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNoch keine Bewertungen

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDokument8 SeitenInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNoch keine Bewertungen

- BIR 1902 (Quezon)Dokument1 SeiteBIR 1902 (Quezon)Rayross Jamilano YacabaNoch keine Bewertungen

- Fit Chap012Dokument56 SeitenFit Chap012djkfhadskjfhksd100% (2)

- AC GST Tax Invoice 1Dokument1 SeiteAC GST Tax Invoice 1Akshay KadamNoch keine Bewertungen

- Revenue Regulations No 3-98 FBTDokument15 SeitenRevenue Regulations No 3-98 FBTeric yuulNoch keine Bewertungen

- Pajak Pertambahan Nilai Terhadap Penyerahan Kendaraan Bermotor Bekas Secara Eceran: Siapa Yang Paling Diunntungkan?Dokument7 SeitenPajak Pertambahan Nilai Terhadap Penyerahan Kendaraan Bermotor Bekas Secara Eceran: Siapa Yang Paling Diunntungkan?PUTRI DIAH ANGGRAININoch keine Bewertungen

- GCV Premium - Calculators - With - New - TPDokument11 SeitenGCV Premium - Calculators - With - New - TPGunjan NimjeNoch keine Bewertungen

- Property TaxDokument2 SeitenProperty TaxLilly HernandezNoch keine Bewertungen

- Inv 652292993 200280251 202004290300Dokument1 SeiteInv 652292993 200280251 202004290300Chris AlphonsoNoch keine Bewertungen

- Discretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesDokument4 SeitenDiscretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesKeanu Menil MoldezNoch keine Bewertungen

- SLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Dokument308 SeitenSLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Deva T NNoch keine Bewertungen

- Direct Tax Amendments May Nov 19 New by CA Siddartha SuranaDokument17 SeitenDirect Tax Amendments May Nov 19 New by CA Siddartha SuranaKumar SwamyNoch keine Bewertungen

- Frequently Asked Questions of Sukuk Simpanan Rakyat (SSR) 01-2009Dokument3 SeitenFrequently Asked Questions of Sukuk Simpanan Rakyat (SSR) 01-2009Yowchuan Lee100% (1)

- Vat System and OptDokument15 SeitenVat System and Optlyra21Noch keine Bewertungen

- Corporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)Dokument38 SeitenCorporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)oneNoch keine Bewertungen

- Fee Voucher With ArrearsDokument1 SeiteFee Voucher With Arrearssaqib lodhiNoch keine Bewertungen

- Paranginan Partners Tax Law FirmDokument5 SeitenParanginan Partners Tax Law FirmBram SostenesNoch keine Bewertungen

- Master NotesDokument270 SeitenMaster NotesdavidcleeNoch keine Bewertungen

- Byrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDokument39 SeitenByrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test Bankhumidityhaygsim8p100% (16)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument2 SeitenTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sachin ChadhaNoch keine Bewertungen