Beruflich Dokumente

Kultur Dokumente

Pay Slip Sample

Hochgeladen von

Joseph ClaveriaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pay Slip Sample

Hochgeladen von

Joseph ClaveriaCopyright:

Verfügbare Formate

Example employee pay slip

Please read this example in conjunction with the Employer obligations in relation to employer

records and pay slips Fact Sheet.

The following is an example of an employees pay slip. In this example, the employer has used the

pay slip template available on the Fair Work Ombudsmans website. To download this pay slip and

other templates visit our templates section.

Example:

Francois is the owner of Fabulous Hair Pty Ltd. He employs Larissa, a full-time hairdresser. Under the

Fair Work Act 2009, Francois is required to keep time and wage records for Larissa and issue her with

a pay slip for every payment made to her.

Under the Hair and Beauty Industry Award 2010, Larissa is classified as a Level 3 Hair and Beauty

employee. Based on the hours Larissa worked during the fortnightly pay period of 8 July 2013 to 21

July 2013 she is entitled to:

76 ordinary hours of work paid at $19.07 per hour. Larissa takes 9 hours of this as personal

leave

2 hours overtime paid at time and a half

A tool allowance of $8.64 paid for each week.

Larissa enters her start and finish times on a timesheet and signs this at the end of the pay period to

verify the hours she has worked. At the end of the pay period, Francois works out Larissas pay by

individually calculating her ordinary hours, leave, overtime, tool allowance and making any authorised

deductions.

Francois uses this information to create Larissas pay slip which he issues to Larissa within one day

after making payment into her account (refer to Figure 1).

Example employee pay slip

Please read this example in conjunction with the Employer obligations in relation to employer

records and pay slips Fact Sheet.

Figure 1 - Pay slip

Date of payment: 22/07/2013

Pay period: 8/07/2013 to 21/07/2013

Employers name: Fabulous Hair Pty Ltd

ABN: 12 325 678 910

Employees name: Larissa Smith

Employment status*: Full-time

Name of Modern Award*: Hair and Beauty Industry Award 2010

Classification under the Modern Award*: Hair and Beauty Employee, Level 3

The award and employee classification details.

Hourly rate: $19.07

Bank disbursement*: Account Name - L. Smith BSB 123 456 Account 87654321

Annual leave entitlement: 80 hour(s) and 50 minute(s) as at 21/07/2013*

Personal/carers leave entitlement: 51 hour(s) and 25 minutes(s) as at 21/07/2013*

Entitlement Unit Rate Total

Wages for ordinary hours worked

Larissa works 67 ordinary hours and takes 9 hours of

personal leave. Together these make up her 76

ordinary hours of work for the fortnight.

67 hours $19.07 $1277.69

Personal leave* 9 hours $19.07 $171.63

TOTAL ORDINARY HOURS = 76 hours

Overtime

Larissa works 2 hours overtime in excess of her

ordinary hours of work. In this case she is entitled to

time and a half of her base rate of pay ($19.07).

2 hours* $28.61* $57.22

Tool allowance

The monetary allowance paid for this period.

2 weeks* $8.64* $17.28

Gross payment $1523.82

Deductions

Taxation

$176.00-

Total deductions

The amount taken out of Larissas pay for authorised deductions.

$176.00-

Net payment $1347.82

Employer superannuation contribution - Superannuation Guarantee 9.25%

Name of fund: SuperHair Fund Number of fund: 0123 456 78

Contribution

The superannuation contribution liable to be made for this period.

$140.95

* The Fair Work Ombudsman acknowledges that the inclusion of information marked with an asterisk (*) is not a requirement

under the Fair Work Regulations 2009, effective 1 July 2009. This template is provided as a best practice model. An employer

is not compelled to provide information outside the requirements contained in the pay slip provisions of the Fair Work

Regulations 2009.

To download this pay slip template visit our templates section.

Das könnte Ihnen auch gefallen

- Payroll Accounting 2016 2nd Edition Landin Solutions ManualDokument43 SeitenPayroll Accounting 2016 2nd Edition Landin Solutions Manualphongtuanfhep4u100% (30)

- Gratuity Law in PakistanDokument4 SeitenGratuity Law in Pakistanshahidtoor175% (4)

- Business Math Q2 Week 3Dokument9 SeitenBusiness Math Q2 Week 3john100% (1)

- Employee Compensation Package ExplainedDokument11 SeitenEmployee Compensation Package ExplainedJoanne PorioNoch keine Bewertungen

- Module 11 - Business MathematicsDokument31 SeitenModule 11 - Business MathematicsMaam AprilNoch keine Bewertungen

- Bm (1)Dokument10 SeitenBm (1)DaniiNoch keine Bewertungen

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryVon EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNoch keine Bewertungen

- Compensation and BenefitsDokument3 SeitenCompensation and BenefitsBago Resilyn100% (1)

- Chapter 2 Payroll NotesDokument7 SeitenChapter 2 Payroll NotesHarithaNoch keine Bewertungen

- Plan LectorDokument5 SeitenPlan LectorCristian MurciaNoch keine Bewertungen

- Social Performance ReportsDokument10 SeitenSocial Performance Reportsanil kumarNoch keine Bewertungen

- Everything you need to know about Statutory CompanyDokument19 SeitenEverything you need to know about Statutory CompanyBhanupratap Singh ShekhawatNoch keine Bewertungen

- Payroll Accounting 2015 1st Edition Landin Solutions ManualDokument34 SeitenPayroll Accounting 2015 1st Edition Landin Solutions Manualhofulchondrin6migjb100% (20)

- Payroll Accounting 2017 3Rd Edition Landin Solutions Manual Full Chapter PDFDokument47 SeitenPayroll Accounting 2017 3Rd Edition Landin Solutions Manual Full Chapter PDFentrickaretologyswr100% (8)

- Payroll Accounting 2017 3rd Edition Landin Solutions ManualDokument26 SeitenPayroll Accounting 2017 3rd Edition Landin Solutions Manualcuclex61100% (32)

- Choosing: A Retirement SolutionDokument8 SeitenChoosing: A Retirement Solutionapi-309082881Noch keine Bewertungen

- Business Math 2ND QuarterDokument33 SeitenBusiness Math 2ND QuarterKuroeNoch keine Bewertungen

- How To Calculate Overtime Pay For Employees in MaDokument1 SeiteHow To Calculate Overtime Pay For Employees in MashahbrahimNoch keine Bewertungen

- Payroll Accounting 2017 3rd Edition Landin Solutions Manual 1Dokument48 SeitenPayroll Accounting 2017 3rd Edition Landin Solutions Manual 1allen100% (40)

- Calculating Costs of New Employee Recruitment: Student Date PeriodDokument8 SeitenCalculating Costs of New Employee Recruitment: Student Date PeriodIbrah1mov1chNoch keine Bewertungen

- BIFFPP-Step 9 CPA BermudaDokument18 SeitenBIFFPP-Step 9 CPA BermudaRG-eviewerNoch keine Bewertungen

- Principle of Accounting 2 - Unit 6Dokument24 SeitenPrinciple of Accounting 2 - Unit 6Asmamaw50% (2)

- Orrick Bonus Memo 2013Dokument3 SeitenOrrick Bonus Memo 2013david_latNoch keine Bewertungen

- Adjusting EntriesDokument4 SeitenAdjusting EntriesNoj WerdnaNoch keine Bewertungen

- Final Project of TaxDokument26 SeitenFinal Project of TaxakshataNoch keine Bewertungen

- Guide To Taxation of Employee Disability Benefits: Standard Insurance CompanyDokument26 SeitenGuide To Taxation of Employee Disability Benefits: Standard Insurance CompanyJacen BondsNoch keine Bewertungen

- Employer's Report of Injury/disease (Form 7) : Reference Guide For EmployersDokument35 SeitenEmployer's Report of Injury/disease (Form 7) : Reference Guide For Employersarafat albadriNoch keine Bewertungen

- Payroll Accounting - Principles of AccountingDokument7 SeitenPayroll Accounting - Principles of AccountingAbdulla MaseehNoch keine Bewertungen

- Ias 19Dokument43 SeitenIas 19Reever RiverNoch keine Bewertungen

- Week 2 Payroll PDFDokument8 SeitenWeek 2 Payroll PDFVassish DassagneNoch keine Bewertungen

- KSRTCDokument39 SeitenKSRTCVidyaNoch keine Bewertungen

- Session 10 - Payroll (PAYE, NIS HS) PDFDokument7 SeitenSession 10 - Payroll (PAYE, NIS HS) PDFDarrel SamueldNoch keine Bewertungen

- Accouc Payroll CH3Dokument15 SeitenAccouc Payroll CH3Nimona Beyene50% (2)

- Understanding Life Insurance and Imputed Income: Table 1 RatesDokument3 SeitenUnderstanding Life Insurance and Imputed Income: Table 1 RatesarbindokiluNoch keine Bewertungen

- 494 SCS HomeworkDokument3 Seiten494 SCS HomeworkborokawNoch keine Bewertungen

- Tax Exempt and Government Entities (TE/GE) Employee PlansDokument34 SeitenTax Exempt and Government Entities (TE/GE) Employee PlansIRSNoch keine Bewertungen

- Chapter 6 VDokument14 SeitenChapter 6 VAdd AllNoch keine Bewertungen

- Bizmath 2ndqtreviewerDokument10 SeitenBizmath 2ndqtreviewerSocial Anxiety At its finest :PNoch keine Bewertungen

- Principles of taxation projectDokument22 SeitenPrinciples of taxation projectRishabhBhargav0% (1)

- The 13th Month Pay Decree: Key Provisions and GuidelinesDokument13 SeitenThe 13th Month Pay Decree: Key Provisions and GuidelinesHardlyjun NaquilaNoch keine Bewertungen

- Payroll It Is The Total Amount That Has Been Paid Out To Employees For TheDokument4 SeitenPayroll It Is The Total Amount That Has Been Paid Out To Employees For TheKate Andrea MillanNoch keine Bewertungen

- The Zinnia - HRM 459 (Collective Bargaining Agreement)Dokument13 SeitenThe Zinnia - HRM 459 (Collective Bargaining Agreement)Kerry Morris100% (10)

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2Von EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2Noch keine Bewertungen

- Employee CompensationDokument7 SeitenEmployee CompensationDaniiNoch keine Bewertungen

- Chapter 4 PayrolDokument12 SeitenChapter 4 Payrolibrahim JimaleNoch keine Bewertungen

- TAX Ch05Dokument12 SeitenTAX Ch05GabriellaNoch keine Bewertungen

- ACC 111 Chapter 7 Lecture NotesDokument5 SeitenACC 111 Chapter 7 Lecture NotesLoriNoch keine Bewertungen

- Corp Hinal AkashDokument17 SeitenCorp Hinal AkashAmarendra AnmolNoch keine Bewertungen

- Finance Plan: Financing Method ValueDokument11 SeitenFinance Plan: Financing Method ValueImeshaNoch keine Bewertungen

- Salaries and Wages: Definitions, Calculations, BenefitsDokument47 SeitenSalaries and Wages: Definitions, Calculations, BenefitsJenny Stypay100% (1)

- Accounting Assignment 1Dokument12 SeitenAccounting Assignment 1TongNoch keine Bewertungen

- Employment Income - Derivation, Exemptions, Types and DeductionsDokument57 SeitenEmployment Income - Derivation, Exemptions, Types and DeductionsTeh Chu Leong100% (1)

- MODULE3 ls2022Dokument60 SeitenMODULE3 ls2022Caryl SequitinNoch keine Bewertungen

- Tax Midterm PrepDokument28 SeitenTax Midterm PrepDhruv MehtaNoch keine Bewertungen

- BUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONDokument14 SeitenBUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONJASON DAVID AMARILANoch keine Bewertungen

- Employee Death Benefits.: A. Gifts and InheritancesDokument5 SeitenEmployee Death Benefits.: A. Gifts and Inheritances张心怡Noch keine Bewertungen

- Chapter 3- Ethiopian Payroll SystemDokument9 SeitenChapter 3- Ethiopian Payroll SystemAbdu YaYa AbeshaNoch keine Bewertungen

- Payroll MGMT Learner GuideDokument6 SeitenPayroll MGMT Learner GuideEphraim PryceNoch keine Bewertungen

- ACT 205 Taxation Theory Practice - Lecture 3 (New)Dokument16 SeitenACT 205 Taxation Theory Practice - Lecture 3 (New)Kaycia HyltonNoch keine Bewertungen

- Payroll Summary Explains Key Terms and DeductionsDokument4 SeitenPayroll Summary Explains Key Terms and DeductionsKate Andrea MillanNoch keine Bewertungen

- How Many Countries Are in The WorldDokument3 SeitenHow Many Countries Are in The WorldJoseph ClaveriaNoch keine Bewertungen

- Most Common Prefixes and SuffixesDokument2 SeitenMost Common Prefixes and Suffixesseanwindow5961Noch keine Bewertungen

- Most Common Prefixes and SuffixesDokument2 SeitenMost Common Prefixes and Suffixesseanwindow5961Noch keine Bewertungen

- What Are Foodborne IllnessesDokument2 SeitenWhat Are Foodborne IllnessesJoseph ClaveriaNoch keine Bewertungen

- Unfamiliar Words - FinalDokument19 SeitenUnfamiliar Words - FinalJoseph ClaveriaNoch keine Bewertungen

- GST Guide On Reimbursement and Disbursement of ExpensesDokument47 SeitenGST Guide On Reimbursement and Disbursement of ExpensesharryNoch keine Bewertungen

- (Digest) Cena v. CSCDokument3 Seiten(Digest) Cena v. CSCJechel TBNoch keine Bewertungen

- PRP Scheme July2020 EnglishDokument23 SeitenPRP Scheme July2020 EnglishAbhishekNoch keine Bewertungen

- Statement of Comprehensive Income: Problem 1: True or FalseDokument17 SeitenStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Computation of Taxable Income Under Various HeadsDokument155 SeitenComputation of Taxable Income Under Various Headsdajit1100% (6)

- Mejares and Cayno vs. Hyatt Taxi Services Inc.Dokument3 SeitenMejares and Cayno vs. Hyatt Taxi Services Inc.Briana Kinagan Amangao100% (1)

- Luton Inc Solution: © Corporate Finance InstituteDokument2 SeitenLuton Inc Solution: © Corporate Finance InstitutePirvuNoch keine Bewertungen

- What Is Annuity?: Future Value of AnnuityDokument4 SeitenWhat Is Annuity?: Future Value of AnnuityS- AjmeriNoch keine Bewertungen

- Class Notes - Employee BenefitsDokument5 SeitenClass Notes - Employee BenefitsMabvuto PhiriNoch keine Bewertungen

- Here Are Examples of Documents You Can SendDokument2 SeitenHere Are Examples of Documents You Can SendCurtis SavageNoch keine Bewertungen

- Charity Care Application EnglishDokument7 SeitenCharity Care Application EnglishDavidNoch keine Bewertungen

- Study Unit C - Gross Income General DeductionsDokument44 SeitenStudy Unit C - Gross Income General DeductionsEverjoyNoch keine Bewertungen

- Prorata Pension DetailsDokument6 SeitenProrata Pension Detailsshaunak_srNoch keine Bewertungen

- Taxation: Dr. Maina N. JustusDokument10 SeitenTaxation: Dr. Maina N. JustusSkyleen Jacy VikeNoch keine Bewertungen

- retirewell-ebook-2023Dokument47 Seitenretirewell-ebook-2023gohzen10Noch keine Bewertungen

- Incentives and BenefitsDokument14 SeitenIncentives and BenefitsAditya PandeyNoch keine Bewertungen

- Scenario Positive Negative Case-by-Case A: Weighing The MarketDokument3 SeitenScenario Positive Negative Case-by-Case A: Weighing The MarketJohanna Gutierrez84% (25)

- Getting Paid Math ScoglandDokument3 SeitenGetting Paid Math Scoglandapi-26781533414% (7)

- CIR v. Isabela Cultural CorporationDokument1 SeiteCIR v. Isabela Cultural Corporationthirdy demaisipNoch keine Bewertungen

- Fabm 2: Quarter 4 - Module 5-6 Principles and Processes of Income and Business TaxationDokument12 SeitenFabm 2: Quarter 4 - Module 5-6 Principles and Processes of Income and Business TaxationChelsea Mae AlingNoch keine Bewertungen

- MM Integrated Annual Report 2019 20 PDFDokument424 SeitenMM Integrated Annual Report 2019 20 PDFRohan DharneNoch keine Bewertungen

- Chapter 2 SlidesDokument35 SeitenChapter 2 SlidesHoyin SinNoch keine Bewertungen

- Chapter 13 - Benefits ServicesDokument11 SeitenChapter 13 - Benefits ServicesHassaan Bin KhalidNoch keine Bewertungen

- Covid Debts PayoffDokument20 SeitenCovid Debts PayoffChi VũNoch keine Bewertungen

- Ap Revised Pension RulesDokument2 SeitenAp Revised Pension Rulesmd yusufNoch keine Bewertungen

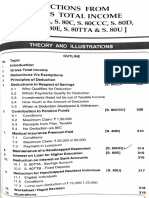

- Deductions From Gross Total IncomeDokument9 SeitenDeductions From Gross Total IncomeShraddha BhusariNoch keine Bewertungen

- Solved Harper Company S Job 501 For The Manufacture of 2 200 CoatsDokument1 SeiteSolved Harper Company S Job 501 For The Manufacture of 2 200 CoatsAnbu jaromiaNoch keine Bewertungen

- Home Loan Interest Deduction Under Section 24 of Income TaxDokument6 SeitenHome Loan Interest Deduction Under Section 24 of Income TaxshahpinkalNoch keine Bewertungen

- BIR - Invoicing RequirementsDokument17 SeitenBIR - Invoicing RequirementsCkey ArNoch keine Bewertungen

- Vivint Solar 401 (K) Enrollment Workbook - 528946Dokument62 SeitenVivint Solar 401 (K) Enrollment Workbook - 528946KieraNoch keine Bewertungen