Beruflich Dokumente

Kultur Dokumente

A Study of Non Performing Assets in Bank of Baroda

Hochgeladen von

Mohamed TousifOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Study of Non Performing Assets in Bank of Baroda

Hochgeladen von

Mohamed TousifCopyright:

Verfügbare Formate

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

1

INTRODUCTION

The three letters NPA Strike terror in banking sector and business circle today. NPA is

short form of Non Performing Asset. The dreaded NPA rule says simply this: when interest

or other dues to a bank remains unpaid for more than 90 days, the entire bank loan

automatically turns to a non performing asset. The recovery of loan has always been problem

for banks and financial institution. An asset becomes NPA when:

Interest and/or instalment of principal remains overdue for two harvest seasons

but for a period not exceeding two half years in the case of an advance granted

for agricultural purposes, and

Any amount to be received remains overdue for a period of more than 90 days in

respect of other accounts.

For any nation, banking system plays a vital role in the development of its sound economy.

Banking is an important segment of the tertiary sector and acts as a back bone of economic

progress. Banks are supposed to be more directly and positively related to the performance of

the economy. Banks act as a development agency and are the source of hope and aspirations

of the masses. Commercial banks are the major players to develop the economy. A major

threat to banking sector is prevalence of Non-Performing Assets (NPAs). NPAs reflect the

performance of banks. A high level of NPAs suggests high probability of a large number of

credit defaults that affect the profitability and net-worth of banks and also erodes the value of

the asset. The NPA growth involves the necessity of provisions, which reduces the overall

profits and shareholders value. In present scenario NPAs are at the core of financial problem

of the banks. Concrete efforts have to be made to improve recovery performance. The main

reasons of increasing NPAs are the target-oriented approach, which deteriorates the

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

2

qualitative aspect of lending by banks and willful defaults, ineffective supervision of loan

accounts, lack of technical and managerial expertise on the part of borrowers.

The purpose of the study is to identify the causes of loans becoming NPAs and to identify the

action plan to reduce the NPAs in Bank of Baroda.

Definitions:

An asset, including a leased asset, becomes non-performing when it ceases to generate

income for the bank.

A Non-Performing Asset (NPA) was defined as a credit facility in respect of which the

interest and/ or instalment of principal has remained past due for a specified period of time.

A non performing asset (NPA) is a loan or an advance where;

i. Interest and/or installment of principal remain overdue for a period of more

than 90 days in respect of a term loan,

ii. The account remains out of order for a period of more than 90 days ,in

respect of an overdraft/cash credit (OD/CC),

iii. The bill remains overdue for a period of more than 90 days in case of bill

purchased or discounted,

iv. the installment of principal or interest thereon remains overdue for two crop seasons

for short duration crops,

v. the instalment of principal or interest thereon remains overdue for one crop

season for long duration crops,

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

3

vi. the amount of liquidity facility remains outstanding for more than 90 days, in

respect of a securitisation transaction undertaken in terms of guidelines on

securitisation dated February 1, 2006.

vii. in respect of derivative transactions, the overdue receivables representing

positive mark-to-market value of a derivative contract, if these remain unpaid

for a period of 90 days from the specified due date for payment.

In case of interest payments, banks should, classify an account as NPA only if the interest due

and charged during any quarter is not serviced fully within 90 days from the end of the

quarter.

' 'O Ou ut t o of f O Or rd de er r' ' s st ta at tu us s: :

An account should be treated as 'out of order' if the outstanding balance remains

continuously in excess of the sanctioned limit/drawing power. In cases where the outstanding

balance in the principal operating account is less than the sanctioned limit/drawing power, but

there are no credits continuously for six months as on the date of Balance Sheet or credits are

not enough to cover the interest debited during the same period, these accounts should be

treated as 'out of order'.

O Ov ve er rd du ue e : :

Any amount due to the bank under any credit facility is overdue if it is not

paid on the due date fixed by the bank.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

4

Problems due to NPA:

1. Owners do not receive a market return on their capital .in the worst case, if the banks

fails, owners lose their assets. In modern times this may affect a broad pool of

shareholders.

2. Depositors do not receive a market return on saving. In the worst case if the bank

fails, depositors lose their assets or uninsured balance.

3. Banks redistribute losses to other borrowers by charging higher interest rates, lower

deposit rates and higher lending rates repress saving and financial market, which

hamper economic growth.

4. Nonperforming loans epitomize bad investment. They misallocate credit from good

projects, which do not receive funding, to failed projects. Bad investment ends up in

misallocation of capital, and by extension, labour and natural resources.

Non Performing Asset may spill over the banking system and contract the money stock,

which may lead to economic contraction. This spill over effect can channelize through

liquidity or bank insolvency:

a) When many borrowers fail to pay interest, banks may experience liquidity shortage.

This can jam payment across the country,

b) Illiquidity constraints bank in paying depositors

.c) Undercapitalized banks exceeds the banks capital base.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

5

Types of NPA

A] Gross NPA

B] Net NPA

A] Gross NPA:

Gross NPAs are the sum total of all loan assets that are classified as NPAs as per RBI

guidelines as on Balance Sheet date. Gross NPA reflects the quality of the loans made by

banks. It consists of all the non standard assets like as sub-standard, doubtful, and loss

assets.

It can be calculated with the help of following ratio:

Gross NPAs Ratio Gross NPAs

Gross Advances

B] Net NPA:

Net NPAs are those type of NPAs in which the bank has deducted the provision regarding

NPAs. Net NPA shows the actual burden of banks. Since in India, bank balance sheets

contain a huge amount of NPAs and the process of recovery and write off of loans is very

time consuming, the provisions the banks have to make against the NPAs according to the

central bank guidelines, are quite significant. That is why the difference between gross and

net NPA is quite high.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

6

It can be calculated by following:

Net NPAs Gross NPAs Provisions

Gross Advances - Provisions

Asset Classification:

Categories of NPAs

Standard Assets:

Standard assets are the ones in which the bank is receiving interest as well as the principal

amount of the loan regularly from the customer. Here it is also very important that in this case

the arrears of interest and the principal amount of loan do not exceed 90 days at the end of

financial year. If asset fails to be in category of standard asset that is amount due more than

90 days then it is NPA and NPAs are further need to classify in sub categories.

Banks are required to classify non-performing assets further into the following

three categories based on the period for which the asset has remained non-performing and the

reliability of the dues:

(1) Sub-standard Assets

(2) Doubtful Assets

(3) Loss Assets

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

7

(1) Sub-standard Assets:--

With effect from 31 March 2005, a sub standard asset would be one, which has remained

NPA for a period less than or equal to 12 month. The following features are exhibited by sub

standard assets: the current net worth of the borrowers / guarantor or the current market value

of the security charged is not enough to ensure recovery of the dues to the banks in full; and

the asset has well-defined credit weaknesses that jeopardise the liquidation of the debt and are

characterised by the distinct possibility that the banks will sustain some loss, if deficiencies

are not corrected.

(2) Doubtful Assets:--

A loan classified as doubtful has all the weaknesses inherent in assets that were classified as

sub-standard, with the added characteristic that the weaknesses make collection or liquidation

in full, on the basis of currently known facts, conditions and values highly questionable

and improbable.

With effect from March 31, 2005, an asset would be classified as doubtful if it remained in

the sub-standard category for 12 months.

(3) Loss Assets:--

A loss asset is one which is considered as uncollectible and of such little value that its

continuance as a bankable asset is not warranted- although there may be some salvage or

recovery value. Also, these assets would have been identified as loss assets by the bank or

internal or external auditors or the RBI inspection but the amount would not have been

written-off wholly.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

8

Impact of NPA on:

Profitability:-

NPA means booking of money in terms of bad asset, which occurred due to wrong

choice of client. Because of the money getting blocked the prodigality of bank decreases not

only by the amount of NPA but NPA lead to opportunity cost also as that much of profit

invested in some return earning project/asset. So NPA not only affect current profit but also

future stream of profit, which may lead to loss of some long-term beneficial opportunity.

Another impact of reduction in profitability is low ROI (return on investment), which

adversely affect current earning of bank.

Liquidity:-

Money is getting blocked, decreased profit lead to lack of enough cash at hand which lead to

borrowing money for shot\rtes period of time which lead to additional cost to the company.

Difficulty in operating the functions of bank is another cause of NPA due to lack of money.

Involvement of management:-

Time and efforts of management is another indirect cost which bank has to bear due to NPA.

Time and efforts of management in handling and managing NPA would have diverted to

some fruitful activities, which would have given good returns. Now days banks have special

employees to deal and handle NPAs, which is additional cost to the bank.

Credit loss:-

Bank is facing problem of NPA then it adversely affect the value of bank in terms of market

credit. It will lose its goodwill and brand image and credit which have negative impact to the

people who are putting their money in the banks.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

9

UNIT- 2

INDUSTRY PROFILE

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

10

Indian Banking System:

The banking system of a country plays an important role in the economic development of any

country. Banking system comprises of the banking institutions functioning in the country.

Banking system comprises from the central bank to all banking institutions which are

functioning and providing financial facilities to any developmental sector like agriculture,

industries, trade, housing etc.

Under the Indian banking structure central bank in the name of the Reserve Bank of India

which regulates, directs and controls the banking institutions. Separate institutions are

functioning to meet the financial requirement of the different sectors of the economy.

Indigenous bankers and moneylenders do dominant in the unorganized sector. Regional Rural

Banks are meeting the requirement of the rural population. Cooperatives are working to meet

the requirement of medium, short and long-term credit for agriculture sector. Development

banks are meeting the business and industrial requirements. Thus, we can say that the

structure of Indian banking system has an international level banking system which can meet

the economic requirements of globalized world.

The Indian banking structure has a wide and comprehensive form. Apex institutions in the

form of banking institutions are playing important role in the country. The chief regulator of

banking system in our country is the Reserve bank of India. Industrial Development Bank of

India (IDBI) is an apex body in the industrial sector. National Bank of Agriculture and Rural

Development (NABARD) has been working as an apex institution for the agriculture and

rural development. Import-Export Bank of India (EXIM) is an Apex body of international

trade. National Housing Bank (NHB) is an apex institution in field of housing construction.

Thus these four apex institutions are accelerating the banking system by providing refinance

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

11

facilities to commercial banks and other financial institutions along with other banking

services.

The major financial institutions of the Indian Banking system can be seen from the figure.

Present Structure of Indian Banking Industry:

The Indian financial system comprises a large number of commercial and cooperative banks,

specialized developmental banks for industry, agriculture, external trade and housing, social

security institutions, collective investment institutions, etc. The banking system is at the heart

of the financial system.

The Indian banking system has the RBI at the apex. It is the central bank of the country under

which there are the commercial banks including public sector and private sector banks,

foreign banks and local area banks. It also includes regional rural banks as well as

cooperative banks. The structure of the Indian banking system is given in the figure

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

12

INDIAN BANKING SYSTEM

After the overview of the development of the Indian banking sector since 1947, this section

focuses on the structure of the banking system as it presents itself today. In many respects the

current structure can be directly related to the policies described in the previous sections,

including the nationalization of banks in 1969 and 1980 and the opening up of the banking

sector for new players after 1991.

In India, the most important intermediaries in the banking system today are scheduled

commercial banks, co-operative banks, development financial institutions (DFI) and non-

bank financial companies. The large state owned and private sector banks that form part of

the scheduled commercial banks are the most visible representatives of the banking system.

While the scheduled commercial banks hold more that 80% of the banking systems assets,

they represent a minority in term of numbers. The main focus of this study is scheduled

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

13

commercial banks; however, a brief description of the four most important types of

institutions will enable a better overview of the structure of the banking system in India.

Commercial Banks:

In the organized sector of the money market, commercial banks and cooperative banks have

been in existence for the past several decades. A commercial bank which is run for the

benefit of a group of members of the cooperative body, e.g., housing cooperative society. The

commercial banks are spread across the length and breadth of the country, and cater to the

short term needs of industry, trade and commerce and agriculture unlike the developmental

banks which focus on long term needs. These days the commercial banks also look after other

needs of their customers including long term credit requirements.

The banking sector has been undergoing drastic metamorphosis. The rapid progress

witnessed in the realm of banking services has been engineered by the trends in globalization,

liberalization and privatization. The technological revolution and demographic changes have

also helped to change the face of banking in India. More banks are switching over to virtual

banking for the brick and mortar banks, and are providing a vast array of products through

very innovative channels and at highly competitive prices. Banks are now free to quote their

own interest rates in loan/advances and term deposits. They now have to manage their

investments and loans portfolios based on the international norms and practices of risk

management including asset liability management.

Commercial banks operating in India may be categorized into public sector, private sector,

and Indian or foreign banks depending upon the ownership, management and control. They

may also be differentiated as scheduled or non-scheduled banks.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

14

Banking sector in India:

Public sector bank:

Public Sector Banks (PSBs) are banks where a majority stake (i.e. more than 50%) is held

by a government. The shares of these banks are listed on stock exchanges. There are a total of

26 PSBs in India.

Emergence of public sector banks:

The Central Government entered the banking business with the nationalization of the

Imperial Bank of India in 1955. A 60% stake was taken by the Reserve Bank of India and the

new bank was named as the State Bank of India. The seven other state banks became the

subsidiaries of the new bank when nationalised on 19 July 1960.

The next major

nationalisation of banks took place in 1969 when the government of India, under prime

minister Indira Gandhi, nationalised an additional 14 major banks. The total deposits in the

banks nationalised in 1969 amounted to 50 crores. This move increased the presence of

nationalised banks in India, with 84% of the total branches coming under government

control.

The next round of nationalisation took place in April 1980. The government nationalised six

banks. The total deposits of these banks amounted to around 200 crores. This move led to a

further increase in the number of branches in the market, increasing to 91% of the total

branch network of the country. The objectives behind nationalisation where:

To break the ownership and control of banks by a few business families,

To prevent the concentration of wealth and economic power,

To mobilize savings from masses from all parts of the country,

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

15

To cater to the needs of the priority sectors

Public sector banks before the economic liberalization:

The share of the banking sector held by the public banks continued to grow through the

1980s, and by 1991 the public sector banks accounted for 90% of the banking sector. A year

later, in March, 1992, the combined total of branches held by public sector banks was 60,646

across India, and deposits accounted for Rs. 1, 10,000 crores. The majority of these banks

were profitable, with only one out of the 27 public sector banks reporting a loss.

Problem with nationalised banks reporting a combined loss of Rs.1160 crores. However, the

early 2000s saw a reversal of this trend, such that in 2002-03 a profit of Rs. 7780 crores by

the public sector banks: a trend that continued throughout the decade, with a Rs. 16856 crores

profits in 2008-2009.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

16

List of public sector bank:

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

IDBI

Oriental Bank of Commerce

Punjab National Bank

Punjab and Sind Bank

State Bank of India

Syndicate Bank

UCO Bank

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

17

Union Bank of India

United Bank of India

Vijaya Bank

Subsidiaries of State Bank of India:

State Bank of Bikaner and Jaipur

State Bank of Mysore

State Bank of Hyderabad

State Bank of Patiala

State Bank of Travancore

State Bank of Saurashtra and State Bank of Indore are merged with SBI

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

18

COMPANY PROFILE

Bank of Baroda:

Bank of Baroda (BoB) is an Indian state-owned banking and financial services company

headquartered in Vadodara (earlier known as Baroda) in Gujarat, India. It offers a range of

banking products and financial services to corporate and retail customers through its branches

and through its specialised subsidiaries and affiliates in the areas of retail banking, investment

banking, credit cards, and asset management. During the FY 2012-13, Its total global

business was 8,021 billion, making it the second largest bank in India after State Bank of

India.

In addition to its headquarters in its home state of Gujarat, it has a corporate

headquarters in the Bandra Kurla Complex in Mumbai.

Based on 2012 data, it is ranked 715 on Forbes Global 2000 list. BoB has total assets in

excess of 3.58 trillion (short scale), 3,583 billion (long scale), a network of 4283

branches (out of which 4172 branches

are in India) and offices, and over 2000 ATMs.

The bank was founded by the Maharaja of Baroda, H. H. Sir Sayajirao Gaekwad III on 20

July 1908 in the Princely State of Baroda, in Gujarat.

The bank, along with 13 other major

commercial banks of India, was nationalised on 19 July 1969, by the Government of

India and has been designated as a profit-making public sector undertaking (PSU).

Bank of Baroda is one of the Big Four banks of India, along with State Bank of India, ICICI

Bank and Punjab National Bank.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

19

Board of directors:

Chairman & Managing

Director

Shri S.S Mundra

Executive Director Shri P. Srinivas

Shri Ranjan Dhawan

Shri Bhuwanchandra B. Joshi

Director Dr K.P Krishnan

Shri Maulin Arvind Vaishnav

Regional Director Shri Sudarshan Sen

Director (Workmen

Employee)

Shri Vinil Kumar Saxena

Non-Executive Director &

Chartered Accountant

Shri Surendra Singh Bhandari

Shri Rajib Sekhar Sahu

Company Secretary M.L Jain

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

20

History:

19081959

In 1908, Maharaja Sayajirao Gaekwad III, one of the knights of the Maratha Kingdom, set up

the Bank of Baroda (BoB). Two years later, BoB established its first branch in Ahmedabad.

The bank grew domestically, until after World War II. Then in 1953 it crossed the Indian

Ocean to serve the communities of Indians in Kenya and Indians in Uganda by establishing a

branch each in Mombasa and Kampala. The next year it opened a second branch in Kenya,

in Nairobi, and in 1956 it opened a branch in Dar-es-Salaam. Then in 1957 BoB took a giant

step abroad by establishing a branch in London. London was the center of the British

Commonwealth and the most important international banking centre. 1959 saw BoB

complete its first domestic acquisition when it took over Hind Bank.

1960s

In 1961, BoB merged in New Citizen Bank of India. This merger helped it increase its branch

network in Maharashtra. BoB also opened a branch in Fiji. The next year it opened a branch

in Mauritius. Bank of Baroda In 1963, BoB acquired Surat Banking Corporation in Surat,

Gujarat. The next year BoB acquired two banks: Umbergaon Peoples Bank in

southern Gujarat and Tamil Nadu Central Bank in Tamil Nadu state.

In 1965, BoB opened a branch in Guyana. That same year BoB lost its branch in Narayanjanj

(East Pakistan) due to the Indo-Pakistani War of 1965. It is unclear when BoB had opened

the branch. In 1967 it suffered a second loss of branches when the Tanzanian government

nationalised BoBs three branches there (Dar es Salaam, Mwanga, and Moshi), and

transferred their operations to the Tanzanian government-owned National Banking

Corporation.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

21

In 1969 the Indian government nationalised 14 top banks, including BoB. BoB incorporated

its operations in Uganda as a 51% subsidiary, with the government owning the rest.

1970s

In 1972, BoB acquired Bank of Indias operations in Uganda. Two years later, BoB opened a

branch each in Dubai and Abu Dhabi.

Back in India, in 1975, BoB acquired the majority shareholding and management control of

Bareilly Corporation Bank (est. 1928) and Nainital Bank (est. in 1954), both in Uttar Pradesh.

Since then, Nainital Bank has expanded to Uttarakhand state.

International expansion continued in 1976 with the opening of a branch in Oman and another

in Brussels. The Brussels branch was aimed at Indian firms from Mumbai (Bombay) engaged

in diamond cutting and jewellery having business in Antwerp, a major center for diamond

cutting.

Two years later, BoB opened a branch in New York and another in the Seychelles. Then in

1979, BoB opened a branch in Nassau, the Bahamas.

1980s

In 1980, BoB opened a branch in Bahrain and a representative office in Sydney, Australia.

BoB, Union Bank of India and Indian Bank established IUB International Finance, a licensed

deposit taker, in Hong Kong. Each of the three banks took an equal share. Eventually (in

1998), BoB would buy out its partners.

A second consortium or joint-venture bank followed in 1985. BoB (20%), Bank of

India (20%), Central Bank of India (20%) and ZIMCO (Zambian government; 40%)

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

22

established Indo-Zambia Bank in Lusaka. That same year BoB also opened an Offshore

Banking Unit (OBU) in Bahrain.

Back in India, in 1988, BoB acquired Traders Bank, which had a network of 34 branches in

Delhi.

1990s

In 1990, BoB opened an OBU in Mauritius, but closed its representative office in Sydney.

The next year BoB took over the London branches of Union Bank of India and Punjab &

Sind Bank (P&S). P&Ss branch had been established before 1970 and Union Banks after

1980. The Reserve Bank of India ordered the takeover of the two following the banks'

involvement in the Sethia fraud in 1987 and subsequent losses.

Then in 1992 BoB incorporated its operations in Kenya into a local subsidiary with a small

tranche of shares quoted on the Nairobi Stock Exchange. The next year, BoB closed its OBU

in Bahrain.

In 1996, BoB Bank entered the capital market in December with an Initial Public

Offering (IPO). The Government of India is still the largest shareholder, owning 66% of the

bank's equity.

In 1997, BoB opened a branch in Durban. The next year BoB bought out its partners in IUB

International Finance in Hong Kong. Apparently this was a response to regulatory changes

following Hong Kongs reversion to the Peoples Republic of China. The now wholly owned

subsidiary became Bank of Baroda (Hong Kong), a restricted license bank. BoB also

acquired Punjab Cooperative Bank in a rescue. BoB incorporate wholly owned

subsidiary BOB Capital Markets Ltd. for broking business.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

23

In 1999, BoB merged in Bareilly Corporation Bank in another rescue. At the time, Bareilly

had 64 branches, including four in Delhi. In Guyana, BoB incorporated its branch as a

subsidiary, Bank of Baroda Guyana. BoB added a branch in Mauritius and closed its Harrow

Branch in London.

2000s

2000: BoB established Bank of Baroda (Botswana).

2002: BoB acquired Benares State Bank (BSB) at the Reserve Bank of Indias

request. BSB was established in 1946 but traced its origins back to 1871 and its

function as the treasury office of the Benares state. In 1964, BSB had acquired

Bareilly Bank (est. 1934), with seven branches; it also had taken over Lucknow Bank

in 1968. The acquisition of BSB brought BoB 105 new branches.

2002: Bank of Baroda (Uganda) was listed on the Uganda Securities

Exchange (USE).

2003: BoB opened an OBU in Mumbai.

2004: BoB acquired the failed Gujarat Local Area Bank, and returned to Tanzania by

establishing a subsidiary in Dar-es-Salaam. BoB also opened a representative office

each in Kuala Lumpur, Malaysia, and Guangdong, China.

2005: BoB built a Global Data Centre (DC) in Mumbai for running its centralized

banking solution (CBS) and other applications in more than 1,900 branches across

India and 20 other countries where the bank operates. BoB also opened a

representative office in Thailand.

2006: BoB established an Offshore Banking Unit (OBU) in Singapore.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

24

2007: In its centenary year, BoBs total business crossed 2.09 trillion (short scale), its

branches crossed 1000, and its global customer base 29 million people.

2008: BoB opened a branch in Guangzhou, China (02/08/2008) and in Kenton,

Harrow United Kingdom. BoB opened a joint venture life insurance company

with Andhra Bank and Legal and General (UK) called IndiaFirst Life Insurance

Company.

2010s

In 2010, Malaysia awarded a commercial banking license to a locally incorporated bank to be

jointly owned by Bank of Baroda, Indian Overseas Bank and Andhra Bank. That same year,

BoB also opened a branch in New Zealand.

In 2011, BoB opened an Electronic Banking Service Unit (EBSU) was opened at Hamriya

Free Zone, Sharjah (UAE). It also opened four new branches in existing operations in

Uganda, Kenya (2), and Guyana. BoB closed its representative office in Malaysia in

anticipation of the opening of its consortium bank there. BoB received In Principle approval

for the upgrading of its representative office in Australia to a branch.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

25

Global presence:

Bank of Baroda is operating its financial services in different countries through:

Branches Subsidiaries Joint

Venture

Representative Offices

Australia Botswana Zambia Thailand

Bahamas Ghana Malaysia

Bahrain Guyana

Belgium Kenya

China New Zealand

Fiji Islands Tanzania

Hong Kong Trinidad &

Tobago

Mauritius Uganda

Republic of South

Africa

Seychelles

Singapore

Sultanate of Oman

United Arab

Emirates

United Kingdom

United States of

America

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

26

UNIT- 3

SURVEY OF LITERATURE

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

27

Findings of previous studies:

A large number of researchers have studied the issue of Non Performing Assets (NPAs) in

banking industry .A review of the relevant literature has been described as under: -

1. Prashanth K Reddy (research paper)

(From article-International Journal of Economic Practices and Theories, Vol. 1,

No. 2, 2011 (October), e-ISSN 2247 7225)

Prashanth K. Reddy (2002) in his research paper on the topic, A comparative study

of Nonperforming Assets in India in the Global context examined the similarities and

dissimilarities, remedial measures. Financial sector reform in India has progressed

rapidly on aspects like interest rate deregulation, reduction in reserve requirements,

barriers to entry, prudential norms and risk-based supervision. The study reveals that

the sheltering of weak institutions while liberalizing operational rules of the game is

making implementation of operational changes difficult and ineffective. Changes

required to tackle the NPA problem would have to span the entire gamut of judiciary,

polity and the bureaucracy to be truly effective. This paper deals with the experiences

of other Asian countries in handling of NPAs. It further looks into the effect of the

reforms on the level of NPAs and suggests mechanisms to handle the problem by

drawing on experiences from other countries.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

28

2. RBI turns heat on banks to check bad loans. (news paper article.)

(from Hindustan Times (New Delhi, India) October 13, 2011)

State-owned banks have witnessed a surge in the level of bad assets (loans) or NPAs

in recent times. The gross non-performing assets (NPA) of public sector banks stood

at Rs. 71,047 crores for the period ended March, 2011. A loan that stops earning

interest after 90 days is defined as an NPA.

According to CRISIL(Credit Rating Information Services of India Ltd), the Indian

arm of global ratings major Standard and Poors, a slowdown in economic growth and

increases in equated monthly installments (EMIs) resulting from subsequent rate hikes

by the RBI, would also increase banks NPAs. Rising interest rates would increase the

EMIs of home loan borrowers alone by about Rs. 6000 crores annually, the study

said. Banks, however, are optimistic. There is no cause for concern as of now. We

are focusing on recovery and we have registered a very healthy recovery, TM

Bhasin, chairman and managing director, Indian Bank, told Hindustan Times.

In the wake of surging NPA levels, banks have decided to get tough on willful

defaulters borrowers who have not repaid their dues despite having the capacity to

do so. An estimated Rs. 11,000 crores of funds is locked up with willful defaulters.

The central bank has also asked banks to monitor their asset qualities on

a regular basis, especially with interest rates steadily inching upwards.

Finance minister Pranab Mukherjee, in his last meeting with bank chairmen, had

asked SBI to look into its asset quality. He is also said to have sought an explanation

from banks on the reason for the rise in the level of bad assets.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

29

There has been a substantial increase in bad loans and this is primarily because

public sector banks have been very lenient on willful defaulters, said CH

Venkatachalam, general secretary, All India Bank Employees Association.

3. Dr. A. Shyamala (research paper)

(From article-Dr. A. Shyamala NPAS IN INDIAN BANKING SECTOR:

IMPACT ON PROFITABILITY: Indian Streams Research Journal (June;

2012))

Findings of the study indicated that Indian banking sector is facing a serious problem

of NPA is comparatively higher in public sector banks. To improve the efficiency and

profitability, various steps have been taken by the government to reduce the NPA. It is

highly impossible to have zero percentage NPA. But at least Indian banks can try

competing with foreign banks to maintain international standard.

4. Siraj.K.K and Prof. (Dr). P. Sudarsanan Pillai (research paper)

(From article-International Journal of Marketing, Financial Services &

Management Research-ISSN 2277- 3622 Vol.2, No. 9, September (2013))

The researchers found that Non Performing Assets endangered negative impact on

banking stability and growth. Issue of NPA and its impact on erosion of profit and

quality of asset was not seriously considered in Indian banking prior to 1991. There

are many reasons cited for the alarming level of NPA in Indian banking sector. Asset

quality was not prime concern in Indian banking sector till 1991, but was mainly

focused on performance objectives such as opening wide networks/branches,

development of rural areas, priority sector lending, higher employment generation,

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

30

etc. The accounting treatment also failed to project the problem of NPA, as interest on

loan accounts were accounted on accrual basis.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

31

UNIT 4

RESEARCH METHODOLOGY

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

32

Research:

Research is a process in which the researcher wishes to find out the end result for a given

problem and thus the solution helps in future course of action. The research has been defined

as A careful investigation or enquiry especially through search for new facts in branch of

knowledge

The study has been done in one of the leading Public sector bank. This study is based on

secondary data, which have been obtained from published sources i.e. Annual report for the

period of 10 years (i.e. from 2004-13).

Statement of problem:

NPAs always affect the profit & also the prestige of bank, so here the research problem is to

identify the causes for the NPA and to identify the action plan to reduce the NPA.

Background of the problem:

NPAs always have adverse effect on the profitability of the bank & thereby increasing the

level of sub-standard assets. Banks have to take adequate measures to reduce NPA levels

since banks have responsibility to the various stake holders. This in turn would provide

chances of recovery from NPAs.

Objectives of the study:

To understand the reasons for NPAs.

To assess the impact of NPA on banks profitability.

To suggest ways and needs to reduce NPA and its growth.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

33

Hypothesis:

Ho (Null) = There is no significant relationship between gross NPA & operating profit.

H

1

(Alternate) = There is significant relationship between gross NPA & operating profit.

Sampling plan & methodology:

Ten years data was collected with respect to gross NPAs & net profit & 6 years data was

obtained with respect to Standard, sub-standard, Doubtful & loss assets.

Type of study:

This is a descriptive cum analytical study.

Data collection source:

Primary: Primary data is a type of information that is obtained directly from first-hand

sources by means of surveys, observation or experimentation. It is a data that has not been

previously published and is derived from a new or original research study and collected at the

source.

Secondary: Secondary data is all the information collected for purposes other than the

completion of a research project and it is used to gain initial insight into the research

problem. It is classified in terms of its source either internal or external.

The data for the current study was collected mainly from secondary sources like Companys

annual reports & records, Newspapers/Magazines were all used to collect information.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

34

Limitations of the study:

This study is limited to ten years data.

Time was the major constraint for the study.

Statistical tool used:

Correlation Analysis

Correlation Analysis:

Meaning:

Correlation analysis measures the relationship between two items, like, NPAs and Net profits

of Bank of Baroda. The resulting value (called the "correlation coefficient") shows if changes

in one item (e.g., NPAs) will result in changes in the other item (e.g., Net Profits).

Objective:

The main objective of this topic is to measure the degree of relationship between the

variables under consideration. The correlation analysis refers to the techniques used in

measuring the closeness of the relationship between the variables.

Definition:

When the relationship is of quantitative nature, the appropriate statistical tool for

discovering & measuring the relationship & expressing it in brief formula is known as

correlation.

----- Croxton & Cowden

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

35

Thus correlation is a statistical device which helps in analyzing the covariance between two

or more variables. It is one of the most common & most useful statistics

Interpretation:

When comparing the correlation between two items, one item is called the "dependent" item

and the other the "independent" item. The goal is to see if a change in the independent item

(which are NPAs) will result in a change in the dependent item (usually Net Profits). This

information helps you understand an indicator's predictive abilities.

Correlation coefficient can be calculated manually using the following formula:

The quantity r, called the linear correlation coefficient, measures the strength and the

direction of a linear relationship between two variables. The linear correlation

coefficient is sometimes referred to as the Pearson product moment correlation

coefficient in honor of its developer Karl Pearson.

It can also be calculated with the help of excel option.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

36

UNIT 5

DATA ANALYSIS AND INTERPRETATION

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

37

Definition:

Analysis of data is a process of inspecting, cleaning, transforming, and modeling data with

the goal of discovering useful information, suggesting conclusions, and supporting decision

making. Data analysis has multiple facets and approaches, encompassing diverse techniques

under a variety of names, in different business, science, and social science domains.

Data pertaining to gross NPAs, net profit & total advances was collected for 10 years & then

data pertaining to standard, sub-standard, doubtful & loss assets was collected for 6 years.

The data so collected were analysed & have been depicted in the following graph.

Table no:1 Year wise Net profit from 2004-13(in Crs.)

YEAR Net Profit (Rs.in

Crs.)

2004 9,669,959

2005 6,768,399

2006 8,269,597

2007 10,264,645

2008 14,355,215

2009 22,272,018

2010 30,583,310

2011 42,416,797

2012 50,069,562

2013 44,807,200

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

38

Graph 1 Showing net profit from 2004-13(in Crs)

I nterpretation: The graph depicts that the net profits during the years shown increment except in the years 2005 & 2013.

0

20000000

40000000

60000000

1

2

3

4

5

6

7

8

9

10

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

9,669,959

6,768,399 8,269,597

10,264,645

14,355,215

22,272,018

30,583,310

42,416,797

50,069,562

44,807,200

YEAR Net Profit

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

39

Table no: 2 Year wise advances from 2004-13(in Crs.)

YEAR

Advances (Rs.in

Crs.)

2004 35,600.88

2005 43,400.38

2006 59,911.78

2007 83,620.87

2008 1,06,701.32

2009 1,43,985.9

2010 1,75,035.29

2011 2,28,676.36

2012 2,87,377.29

2013 3,28,185.76

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

40

Graph 2 showing advances from 2004-13(in Crs.)

I nterpretation: The above graph shows that advances kept on increasing till 2013 without any downfall in any of the year.

0

100000

200000

300000

400000

1

2

3

4

5

6

7

8

9

10

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

35,600.88

43,400.38

59,911.78

83,620.87

106,701.32

143,985.90

175,035.29

228,676.36

287,377.29

328,185.76

YEAR Advances

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

41

Table no: 3 Year wise Standard assets from 2008-13(in Crs.)

YEAR 2008 2009 2010 2011 2012 2013

STANDARD

ASSETS (in Crs.)

105690.44 143001.94 174736.43 228273.03 286542.59 324828.74

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

42

Graph 3 showing standard assets from 2008-13(in Crs.)

I nterpretation: The graph shows that there has been a considerable increment in standard assets from 2008-13.

0

100000

200000

300000

400000

1

2

3

4

5

6

2008

2009

2010

2011

2012

2013

105690.44

143001.94

174736.43

228273.03

286542.59

324828.74

YEAR STANDARD ASSETS

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

43

Table no: 4 Year wise Sub-standard assets from 2008-13(in Crs.)

YEAR 2008 2009 2010 2011 2012 2013

SUB-STANDARD ASSETS

(in Crs.)

366.12 665.26 894.83 1097.23 2661.82 4981.15

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

44

Graph 4 showing sub-standard assets from 2008-13(in Crs.)

I nterpretation: The graph depicts a vigorous increment in sub-standard assets from 2008 & reaches its highest peak in 2013.

0

1000

2000

3000

4000

5000

1

2

3

4

5

6

2008

2009

2010

2011

2012

2013

366.12 665.26

894.83

1,097.23

2661.82

4981.15

YEAR SUB-STANDARD ASSETS

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

45

Table no: 5 Year wise Doubtful assets from 2008-13(in Crs.)

YEAR 2008 2009 2010 2011 2012 2013

DOUBTFUL ASSETS

(in Crs.)

887.65 832.32 743.22 1336.64 1318.71 2628.33

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

46

Graph 5 showing doubtful assets from 2008-13(in Crs.)

I nterpretation: In the above graph there has been a downfall in the doubtful assets from 2008 to 2010 & again increases except in 2012.

0

500

1000

1500

2000

2500

3000

1

2

3

4

5

6

2008

2009

2010

2011

2012

2013

887.65

832.32

743.22

1,336.64

1,318.71

2628.33

YEAR DOUBTFUL ASSETS

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

47

Table no: 6 Year wise loss assets from 2008-13(in Crs.)

YEAR 2008 2009 2010 2011 2012 2013

LOSS ASSETS

(in Crs.)

727.61 345.34 762.64 718.63 484.22 373.1

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

48

Graph 6 showing loss assets from 2008-13(in Crs.)

I nterpretation: The above graph shows that there has been reduction in the loss assets but falls down suddenly to lowest level in 2009 & became

highest in 2010 & again starts falling down constantly till 2013.

0

500

1000

1500

2000

2500

1

2

3

4

5

6

2008

2009

2010

2011

2012

2013

727.61

345.34

762.64

718.63

484.22

373.1

YEAR LOSS ASSETS

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

49

Table no: 7 Year wise Gross NPA from 2004-13(in Crs.)

YEAR Gross NPAs (Rs. in Crs.)

2004 3979.86

2005 3321.81

2006 2390.14

2007 2092.14

2008 1981.38

2009 1842.92

2010 2400.69

2011 3152.5

2012 4464.75

2013 7982.58

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

50

Graph 7 showing total NPA from 2004-13(in Crs.)

I nterpretation: Graph showing downfall of gross NPAs from 2004 to 2009 then again it showed increment till it reaches its highest peak.

0

2000

4000

6000

8000

1

2

3

4

5

6

7

8

9

10

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

3979.86

3321.81

2390.14

2092.14

1981.38

1842.92

2400.69

3152.5

4464.75

7982.58

YEARS TOTAL NPA

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

51

Hypothesis Testing:

Statisticians follow a formal process to determine whether to reject or accept a null

hypothesis, based on sample data. This process is called hypothesis testing which consists of

four steps:

State the hypothesis, This involves stating the null and alternative hypothesis. The

hypothesis are stated in such a way that they are mutually exclusive i.e., if one is true,

the other must be false.

Formulate an analysis plan, The analysis plan describes how to use sample data to

evaluate the null hypothesis. The evaluation often focuses around a single test

statistics.

Analyze sample data, Find the value of the test statistic (i.e., Correlation coefficient

which is denoted by r) described in the analysis plan.

Interpret results, Apply the decision rule described in the analysis plan. If the value

of the test statistic is unlikely, based on the null hypothesis, reject the null hypothesis.

The actual test begins by considering two Hypothesis. They are called the null hypothesis &

the alternate hypothesis. These hypothesis contain opposing view points.

Ho: The null hypothesis: It is a statement about a population that will be assumed to be true

unless it can be shown to be correct beyond a reasonable doubt. Stating the Null Hypothesis

is the starting point of any hypothesis testing question solution & the necessary information

tends to be in the first sentence of the problem.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

52

H

1

: The alternate hypothesis: The Alternate Hypothesis accompanies the Null Hypothesis

as the starting point to answering hypothesis testing questions & it is the stated or assumed

value of a population parameter if the Null Hypothesis (H0) is rejected (through testing).

The following null hypothesis was formulated for the study:

Ho (Null) = There is no significant relationship between gross NPA & net profit.

H

1

(Alternate) = There is significant relationship between gross NPA & net profit.

Correlation analysis was done to find out the relationship between gross NPA and Net

profit.

For the current research study, significance of correlation coefficient was used to accept or

reject null hypothesis. 5 % sig level was used.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

53

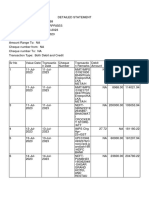

Data of NPA and Net profit of Bank of Baroda for 10 years

Here ten years data has been analysed in which Gross NPAs are independent variables and

NET PROFITs are dependent variable. The relationship between these two variables is

found out using correlation analysis.

S.NO YEARS X GROSS NPA (in

Crs.)

Y NET PROFIT (in

Crs.)

1 2013 7982.58 44,807,200

2 2012 4464.75 50,069,562

3 2011 3152.5 42,416,797

4 2010 2400.69 30,583,310

5 2009 1842.92 22,272,018

6 2008 1981.38 14,355,215

7 2007 2092.14 10,264,645

8 2006 2390.14 8,269,597

9 2005 3321.81 6,768,399

10 2004 3979.86 9,669,959

TOTAL

33608.77 2,39,476,702

Correlation coefficient was calculated using excel 2007 option. Calculated r value = .557

As per the table of critical values for Pearsons correlation, the value of r is .707. The calculated

value of r is less than the table value. Hence null hypothesis was accepted & concluded that there

is no relation between the gross NPA & Net Profit.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

54

UNIT 6

FINDINGS OF THE STUDY

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

55

Findings (Results of the study):

From the above data analysis it was observed that net profits kept on rising except in 2005,

2006 & 2013, as the net profit declined in the very recent year i.e. on 2013, so the bank

needs to increase its profitability by taking appropriate measures through proper

management of NPA.

It was also observed that advances kept on increasing from 2004 to 2013, which depicted

that banks position is also good for sanctioning loans.

The standard assets also shown rise from 2008 to 2013, which lead to total advances.

The sub-standard assets was at its highest peak which reveals that chances for recovery of

NPA are high.

The doubtful assets also shown rise which means that bank should take corrective action

recovery through policy to reduce the level of doubtful assets.

The loss assets got declined this year which means that bank has taken appropriate

measures thereby reducing the level of loss assets.

The Gross NPAs shown increment in the very recent year i.e. on 2013 due to ongoing

slowdown in the industrial sector which would be recovered by improvement in assets

quality.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

56

Suggestions and recommendations:

1. Bank should have its own independent credit rating agency which should evaluate the financial

capacity of the borrower before that credit facility.

2. Special accounts should be made of the clients where monthly loan concentration report should

be made.

3. There should be proper monitoring of the restructuring accounts because there is every

possibility of the loan slipping into NPAs category.

4. Proper training is important for the staff of the bank at the appropriate level either ongoing

process, so that they should deal with the problem of NPAs and steps should to be taken to reduce

the NPAS.

5. It is recommended that the proper documentation and verification should be made before

sanctioning the loan.

6. Constant interaction has to be maintained with the customers to keep track of their loan

payment.

7. Strict measure has to be taken while issuing or sanctioning the loan. The measure can include

verification of sanctioning the loan, job and salary slips, and verification of securities.

8. When all possible attempt for recovery is failed then only option is to proceed with legal action

along with speed otherwise it would be costly.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

57

9. It is also wise for the bank to carry out special investigative audit of all financial and business

transaction and books of accounts of the borrower company when there is possibility of the

diversion of the funds and mismanagement.

10. Independent settlement procedure should be more strict and faster and the decision made by

the settlement committee should be binding both borrower and lenders and any one of them

failing to follow the decision of the statements committee should be punished severely.

11. The bank should come out with new innovative methods to recover NPAs and should

motivate customers to pay their dues in time.

12. Willful default of bank loans should be made a criminal offence.

13. Identifying reasons for turning of each accounts of branch into NPAs is the most important

factor for upgrading the asset quality because that would help to initiate suitable steps to upgrade

the accounts.

14. The bank must focus on recovery from those borrowers who have the capacity to repay but are

not repaying initiation of coercive action a few such borrowers may help.

15.The recovery machine of the bank has to be in streamlined targets should have fixed offence

supervisors not only for recovery in general but also in terms of upgrading numbers of existing

NPAs.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

58

Conclusion:

The issue of Non-Performing Assets (NPAs) has been an area of concern for all economies &

reduction in NPAs has become synonymous with functional efficiency of financial intermediaries.

Although NPAs are a balance sheet issue of individual banks and financial institutions, it has

wider macroeconomic implications. It is important that, if resolution strategies for recovery of

dues from NPAs are not put in place quickly and efficiently, these assets would deteriorate in

value over time and only scrap value would be realized at the end. It should, however, be kept in

mind that NPAs are an integral part of the business financial sector and the players are in as they

are in the business of taking risk and their earnings reflect the risk they take. They operate in an

environment, where there would be defaults as well as deterioration in portfolio value, as market

movements can never be predicted with certainty. It is in this context, that countries have adopted

regulatory measures and the guiding structure has been provided by the Basel guidelines.

So we conclude that NON-PERFORMING ASSETS are like black spots on diamond. They affect

the profit of bank and also the financial health of bank. If it is not controlled or managed properly

then it affects the banks growth.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

59

UNIT - 7

BIBILIOGRAPHY

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

60

REFERENCES:

Research Methodology: Methods &Techniques-CR Kothari.

Report on trend and progress of banking in India 2013-12, 2011- 2012.

Annual report of Bank of Baroda from March 2008-13.

Balance sheet, Profit and loss account and accounts of NPA for 10 years from 2004 to

2013.

Master Circular No. DBOD.No.BP.BC.9/21.04.048/2012-13 dated July 2, 2012

(International Journal of Marketing, Financial Services & Management Research-

ISSN 2277- 3622 Vol.2, No. 9, September (2013)) - Siraj.K.K and Prof. (Dr). P.

Sudarsanan Pillai

(Dr. A. Shyamala NPAS IN INDIAN BANKING SECTOR: IMPACT ON

PROFITABILITY: Indian Streams Research Journal (June; 2012)) -Dr. A. Shyamala

(International Journal of Economic Practices and Theories, Vol. 1, No. 2, 2011

(October), e-ISSN 2247 7225) -Prashanth K Reddy

WEBSITE:

www.bank of baroda.com

www.rbi.org.in

www.abhinavjournal.com

www.financialexpress.com India

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

61

UNIT 8

APPENDIX- I (COPY OF SYNOPSIS)

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

62

ANNAMALAI UNIVERSITY

PROFORMA FOR APPROVAL OF

PROJECT PROPOSAL

(Strike out whichever is not applicable)

Scrutinised by Approved / To Resubmitted

Head Management Wing

Enrolment Number: 2491200037

1. Name and Address of the

Student

: TAMAL SARKAR

Ramaiah Institute of Management & Sciences (RIMS)

# 15, New, B.E.L. Road, MSR Nagar,

MSRIT Post, Bangalore

Karnataka 560054

2. Subject Area of the Project : FINANCE

3. Title of the Project

(In capital letters)

: STUDY OF NON PERFORMING ASSETS IN BANKOF

BARODA

4. Name and Official Address of

the Research Supervisor.

(Bio-Data should be enclosed)

: Prof. Padma S. Rao

Ramaiah Institute of Management & Sciences (RIMS)

# 15, New, B.E.L. Road, MSR Nagar,

MSRIT Post, Bangalore

Karnataka 560054

Signature of the Student :

Date :

Signature of the Research Supervisor:

Name:

Academic Year :

Number of Candidates:

(Number of candidates should not exceed Five for a Research

supervisor in an academic year)

Encl : 1. Synopsis

2. Bio- Data of the Research Supervisor

(for office use only)

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

63

INTRODUCTION

Area of project work: Finance

Introduction to the topic:

The three letters NPA Strike terror in banking sector and business circle today. NPA is

short form of Non Performing Asset. The dreaded NPA rule says simply this: when interest

or other dues to a bank remains unpaid for more than 90 days, the entire bank loan

automatically turns to a non performing asset. The recovery of loan has always been problem

for banks and financial institution. An asset becomes NPA when:

Interest and/or instalment of principal remains overdue for two harvest seasons

but for a period not exceeding two half years in the case of an advance granted

for agricultural purposes, and

Any amount to be received remains overdue for a period of more than 90 days in

respect of other accounts.

For any nation, banking system plays a vital role in the development of its sound economy.

Banking is an important segment of the tertiary sector and acts as a back bone of economic

progress. Banks are supposed to be more directly and positively related to the performance of

the economy. Banks act as a development agency and are the source of hope and aspirations

of the masses. Commercial banks are the major players to develop the economy. A major

threat to banking sector is prevalence of Non-Performing Assets (NPAs). NPAs reflect the

performance of banks. A high level of NPAs suggests high probability of a large number of

credit defaults that affect the profitability and net-worth of banks and also erodes the value of

the asset. The NPA growth involves the necessity of provisions, which reduces the overall

profits and shareholders value (Parul Khanna, 2012). In present scenario NPAs are at the

core of financial problem of the banks. Concrete efforts have to be made to improve recovery

performance. The main reasons of increasing NPAs are the target-oriented approach, which

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

64

deteriorates the qualitative aspect of lending by banks and willful defaults, ineffective

supervision of loan accounts, lack of technical and managerial expertise on the part of

borrowers (Kamini Rai, 2012).

The purpose of the study is to identify the causes of loans becoming NPAs and to identify the

action plan to reduce the NPAs in Bank of Baroda.

Bank of Baroda:

Bank of Baroda (BoB) is the highest profit-making public sector undertaking (PSU) bank in

India and the second largest PSU bank in terms of number of total business in India. Based

in Vadodara, India, it is the country's first largest public sector lender in terms of annual

profit. BoB is ranked 715 on Forbes Global 2000 list. BoB has total assets in excess of Rs.

3.58 trillion (short scale), or Rs. 3,583 billion, a network of 4261 branches (out of which

4168 branches are in India) and offices, and over 2000 ATMs. It plans to open 400 new

branches in the coming year. It offers a wide range of banking products and financial services

to corporate and retail customers through its delivery channels and through its specialized

subsidiaries and affiliates in the areas of investment banking, credit cards and asset

management. Its total global business was Rs. 7,003.30 billion as of 30 Sep 2012. Its

headquarter is in Vadodara and corporate headquarter is in Bandra Kurla Complex Mumbai.

Statement of research problem:

The problem is stated as

Study of Non Performing Assets (NPAs) in Bank of Baroda.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

65

REVIEW OF LITERATURE

Findings of previous studies:

A large number of researchers have studied the issue of Non Performing Assets (NPAs) in

banking industry .A review of the relevant literature has been described as under: -

5. Prashanth K Reddy (research paper)

(From article-International Journal of Economic Practices and Theories, Vol. 1, No. 2,

2011 (October), e-ISSN 2247 7225)

Prashanth K. Reddy (2002) in his research paper on the topic, A comparative study of

Nonperforming Assets in India in the Global context examined the similarities and

dissimilarities, remedial measures. Financial sector reform in India has progressed rapidly on

aspects like interest rate deregulation, reduction in reserve requirements, barriers to entry,

prudential norms and risk-based supervision. The study reveals that the sheltering of weak

institutions while liberalizing operational rules of the game is making implementation of

operational changes difficult and ineffective. Changes required to tackle the NPA problem

would have to span the entire gamut of judiciary, polity and the bureaucracy to be truly

effective. This paper deals with the experiences of other Asian countries in handling of

NPAs. It further looks into the effect of the reforms on the level of NPAs and suggests

mechanisms to handle the problem by drawing on experiences from other countries.

6. Dr. A. Shyamala (research paper)

(From article-Dr. A. Shyamala NPAS IN INDIAN BANKING SECTOR: IMPACT ON

PROFITABILITY: Indian Streams Research Journal (June; 2012))

Findings of the study indicated that Indian banking sector is facing a serious problem of NPA

is comparatively higher in public sectors banks. To improve the efficiency and profitability,

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

66

the NPA has to be scheduled various steps have been taken by government to reduce the

NPA. It is highly impossible to have zero percentage NPA. But at least Indian banks can try

competing with foreign banks to maintain international standard.

7. Siraj.K.K and Prof. (Dr). P. Sudarsanan Pillai (research paper)

(From article-International Journal of Marketing, Financial Services & Management

Research-ISSN 2277- 3622 Vol.2, No. 9, September (2013))

The researchers found that Non Performing Assets endangered negative impact on banking

stability and growth. Issue of NPA and its impact on erosion of profit and quality of asset was

not seriously considered in Indian banking prior to 1991. There are many reasons cited for the

alarming level of NPA in Indian banking sector. Asset quality was not prime concern in

Indian banking sector till 1991, but was mainly focused on performance objectives such as

opening wide networks/branches, development of rural areas, priority sector lending, higher

employment generation, etc. The accounting treatment also failed to project the problem of

NPA, as interest on loan accounts were accounted on accrual basis (Siraj K.K. and P.

Sudarsanan Pillai, 2012).

RESEARCH METHODOLOGY

Objectives of the study:

To understand the reasons for NPAs.

To assess the impact of NPA on banks profitability.

To suggest ways and needs to reduce NPA and its growth.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

67

Hypothesis:

Ho = There is no significant relationship between gross NPA & net profit.

H

1

= There is significant relationship between gross NPA & net profit.

Statistical tools to be used:

Correlation Analysis

Sampling plan & methodology:

Data collection:

This is a descriptive cum analytical study based on secondary data which will be collected

from the following sources:

Company Records and Reports.

Newspapers/Magazines.

Various Websites.

Research Design:

Descriptive research procedure is used for describing the recent situations in the bank and

analytical research to analyze the results by using appropriate research tools.

A STUDY OF NON PERFORMING ASSETS IN BANK OF

BARODA

68

PROPOSED PLAN OF WORK

Data collection:

Data will be collected for ten years from banks annual reports & other related documents

from 2004-13.

Data presenting and evaluation:

The data so collected will be analysed by calculating correlation coefficient.

Hypothesis testing:

Based on significance of correlation coefficient, null hypothesis will be tested to reject or

accept.

EXPECTATIONS

The current study would throw a light on the banks position in respect of non-performing

assets. It is expected that it would also help to pin point the reasons for loans becoming NPAs

& the actions taken by the banks to reduce NPAs.

REFERENCES

Research Methodology: Methods &Techniques-CR Kothari.

Report on trend and progress of banking in India 2011-12, 2010- 2011.

Annual report of Bank of Baroda from March 2008-09 to 2011-12.

WEBSITE:

www.bank of baroda.com

Das könnte Ihnen auch gefallen

- A Study On Non Performing Assets of Sbi and Canara BankDokument75 SeitenA Study On Non Performing Assets of Sbi and Canara BankeshuNoch keine Bewertungen

- Comparative Analysis of Non-Performing Assets of Public Sector Banks, Private Sector Banks & Foreign Banks Research Marketing ShardaDokument70 SeitenComparative Analysis of Non-Performing Assets of Public Sector Banks, Private Sector Banks & Foreign Banks Research Marketing ShardaRahul Gujjar100% (2)

- Project Reports On Non Performing Assets (NPAs) in Banking IndustryDokument70 SeitenProject Reports On Non Performing Assets (NPAs) in Banking IndustryShivam Yadav79% (14)

- Comparative Analysis of Non Performing Assets of Public Sector, Private Sector & Foreign BanksDokument73 SeitenComparative Analysis of Non Performing Assets of Public Sector, Private Sector & Foreign BanksGaurav S. Godwani0% (1)

- Study On Npa With Special Reference To ICICI Bank, by Swaroop DhariwalDokument102 SeitenStudy On Npa With Special Reference To ICICI Bank, by Swaroop Dhariwalswaroopdhariwal83% (30)

- A Study of Non Performing Assets in Bank of BarodaDokument88 SeitenA Study of Non Performing Assets in Bank of BarodaShubham MayekarNoch keine Bewertungen

- Comparative Analysis On NPA of Private & Public Sector BanksDokument86 SeitenComparative Analysis On NPA of Private & Public Sector BanksNagireddy Kalluri100% (1)

- Tabarsum NON PERFORMING ASSETS AXIS BANKDokument73 SeitenTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- Synopsis On NPA Project For MBA PDFDokument3 SeitenSynopsis On NPA Project For MBA PDFSachin100% (1)

- Project On NpaDokument83 SeitenProject On NpaTouseef Shagoo64% (11)

- Icici Loans and AdvancesDokument88 SeitenIcici Loans and AdvancesSaraswati Pratik0% (1)

- Consumer Satisfaction On Nashik Merchamt BankDokument40 SeitenConsumer Satisfaction On Nashik Merchamt BankKunal Hire-Patil100% (1)

- NPA and its impact on JK Bank performanceDokument44 SeitenNPA and its impact on JK Bank performanceHuza if50% (2)

- Comparative Study of The Public Sector Amp Private Sector BankDokument70 SeitenComparative Study of The Public Sector Amp Private Sector BankSetuAgrawalNoch keine Bewertungen

- Study On Home LoansDokument52 SeitenStudy On Home LoansbrijeshcocoNoch keine Bewertungen

- Study of Non Performing Assets in Bank of Maharashtra.Dokument74 SeitenStudy of Non Performing Assets in Bank of Maharashtra.Arun Savukar60% (10)

- Comparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other BanksDokument136 SeitenComparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other Banksrahulsogani12350% (2)

- Ratio Analysis of Bank of India, Salem BranchDokument57 SeitenRatio Analysis of Bank of India, Salem Branchdeegaur100% (1)

- Synopsis Mba ProjectDokument12 SeitenSynopsis Mba ProjectDhiraj MehtaNoch keine Bewertungen

- Bank of IndiaDokument22 SeitenBank of IndiaLeeladhar Nagar100% (1)

- A Study On RDCC BankDokument94 SeitenA Study On RDCC BankBettappa patil33% (3)

- Retail Banking at HDFCDokument56 SeitenRetail Banking at HDFCutkarsh jaiswalNoch keine Bewertungen

- TJSBDokument59 SeitenTJSBMonik Maru Fakra He63% (8)

- NPAs at ApexDokument78 SeitenNPAs at ApexAman RajputNoch keine Bewertungen

- SBI Home Loan Final MunnaDokument67 SeitenSBI Home Loan Final MunnaSai PrintersNoch keine Bewertungen

- A Comparative Study Between Private Sector Banks and Public Sector Banks With Respect To Cachar DistrictDokument72 SeitenA Comparative Study Between Private Sector Banks and Public Sector Banks With Respect To Cachar Districtdeepanjan11Noch keine Bewertungen

- Financial Analysis of HDFC BankDokument58 SeitenFinancial Analysis of HDFC BankInderdeepSingh50% (2)

- Comparative Study of Private and Public Sector BankDokument21 SeitenComparative Study of Private and Public Sector BankbuddysmbdNoch keine Bewertungen

- Comparative Study of Sbi Abd AxisDokument77 SeitenComparative Study of Sbi Abd AxisNivesh GurungNoch keine Bewertungen

- Sbi ProjectDokument60 SeitenSbi Projectjithu100% (3)

- Bank of MaharashtraDokument84 SeitenBank of Maharashtrachakshyutgupta100% (5)

- Black Book ProjectDokument4 SeitenBlack Book ProjectSwapnil HengadeNoch keine Bewertungen

- Non Performing Assets Project MBADokument69 SeitenNon Performing Assets Project MBAsrikanthmogilla1285% (34)

- Shweta TybbiDokument72 SeitenShweta Tybbishwetalad887% (30)

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDokument32 SeitenComparative Analysis On Non Performing Assets of Private and Public Sector Bankssai thesis33% (3)

- Working Capital Management of Bank of Baroda LTDDokument232 SeitenWorking Capital Management of Bank of Baroda LTDAbhijit Nandi100% (2)

- Non Performing Assets of BanksDokument109 SeitenNon Performing Assets of BanksJIGAR87% (23)

- Investment Banking Project ReportDokument84 SeitenInvestment Banking Project ReportSohail Shaikh64% (14)

- Bank of BarodaDokument90 SeitenBank of Barodaabhishek pandeyNoch keine Bewertungen

- Project Report On NPA Policies of Bank of MaharashtraDokument64 SeitenProject Report On NPA Policies of Bank of MaharashtraAMIT K SINGH88% (8)

- Credit Risk at Sbi Project Report Mba FinanceDokument103 SeitenCredit Risk at Sbi Project Report Mba FinanceBabasab Patil (Karrisatte)100% (3)

- A STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIADokument98 SeitenA STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIAShanu shriNoch keine Bewertungen

- Black BookDokument55 SeitenBlack Bookshubham50% (2)

- Final Project NPA MANAGEMENT IN BANKSDokument88 SeitenFinal Project NPA MANAGEMENT IN BANKSmanish223283% (18)

- A Project Report On HDFC BankDokument45 SeitenA Project Report On HDFC BankMukesh LalNoch keine Bewertungen

- HOME LOANS OF HDFC BANK Research Report Finance 2017Dokument63 SeitenHOME LOANS OF HDFC BANK Research Report Finance 2017GAGAN KANSALNoch keine Bewertungen

- Sbi and HDFC Comparative Study of Customer S Satisfaction TowardsDokument67 SeitenSbi and HDFC Comparative Study of Customer S Satisfaction TowardsMõørthï Shãrmâ75% (4)

- A Study On Non Performing Assets With Special Reference To Canara BankDokument55 SeitenA Study On Non Performing Assets With Special Reference To Canara BankNaveena Shankara100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- A Study of Non Performing Assets in Bank of BarodaDokument68 SeitenA Study of Non Performing Assets in Bank of BarodaSuryaNoch keine Bewertungen

- NPA NotesDokument33 SeitenNPA NotesAdv Sheetal SaylekarNoch keine Bewertungen

- Non Performing Assets (Npa)Dokument16 SeitenNon Performing Assets (Npa)Avin P RNoch keine Bewertungen

- Problem FormulationDokument35 SeitenProblem FormulationJewel Binoy100% (1)