Beruflich Dokumente

Kultur Dokumente

International Business Transactions: Documentary Sales Transaction

Hochgeladen von

businessman0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten52 SeitenForeign direct investment doesn't have to worry about protecting technology. Non-tariff barriers, State trading organization, communist countries are important. Foreign law vs. International laws are key to international business transactions.

Originalbeschreibung:

Originaltitel

IBT Outline

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenForeign direct investment doesn't have to worry about protecting technology. Non-tariff barriers, State trading organization, communist countries are important. Foreign law vs. International laws are key to international business transactions.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten52 SeitenInternational Business Transactions: Documentary Sales Transaction

Hochgeladen von

businessmanForeign direct investment doesn't have to worry about protecting technology. Non-tariff barriers, State trading organization, communist countries are important. Foreign law vs. International laws are key to international business transactions.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 52

International Business Transactions

Text: International Business Transactions, 6th Ed., Folsom,

Gordon, Spanogle

1) Transfer of technology v. Foreign direct investment

a) Transfer of technology- you find someone in Tropica

who will make the stuff and you license them the

technology.

b) Foreign direct investmentyou go there and start a

plant yourself and keep the technology secret.

c) Problem: Some countries are known for using or

confiscating technology without paying for it: does the

country have copyright laws?

d) With foreign direct investment, you dont have to

worry about protecting it.

2) Non-tariff barriers

3) State trading organizationcommunist countries. Some

of these dont let you take profits out of the country. you

would want to invest in such a country because

of Investment marketingsomeday it will pay off, change.

4) World alliancesGATT, IMF, WTO,

a) developed v. undeveloped nations

b) Countries cultures are important.

5) Chapter 2: The Actors

a) Roles to nations play in international trade: as

producers or purchasers; if so you want to ask whether

they can claim sovereign immunity.

b) Multinational corporation:

i) does business with several foreign countries, or

ii) has shareholders in different countries, or

iii) where it is incorporated.

c) Labor issues: can you get workers, visas, whose labor

laws, what laws apply to the foreign nationals, how to

fire them.

d) Creeping expropriation: begins by a country

imposing regulations on a corporation, it slowly you

need more and more permits.

6) Foreign law vs. international laws.

a) International economic institutions.

i) UN, has different economic commissions.

ii) UN commission on international trade law

(1) These write model laws, like the CISG, p. 19

7) Bretonwoods Conference after WWII created the

World Bank, GATT, WTO etc., to promote trade to

countries would be less likely to go to war again.

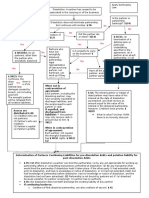

8) Documentary sales transaction, p. 48

a) International transaction different from a domestic one?

i) Number of parties.

ii) Risks.

(1) Different currencies.

(a) Devaluation. You may not want the

currency of country X, and it may devalue by

the time it gets to you,

(b) Removal from the country. Can you can

take dollars out of the country.

iii) Different Legal systems, lawscommon v. civil

law; export laws. Does the particular buyer live in a

country that has a boycott.

iv) Intl law treaties. Are there treaties that will

establish different legal.

v) Will the seller get paid?

vi) Will the buyer getting the quality and quantity of

goods he ordered.

b) Intl Laws:

i) licensing requirements,

ii) in US, instead of article 7 UCC

iii) Federal rules applies

(1) Pomerene Act (Federal Act on Bill of Lading).

(2) carrier of goods--COGSA, Carriage of Goods

by Sea Act.

iv) CISG, an intl treaty. If I do a transaction with a

country that has signed onto the CISG, then

the CI SG applies, not the UCC. But we

might want the UCC to apply, and we can do that by

putting it into the contract that the CISG doesnt

apply.

c) Responses to the risks Chop the risks into smaller

risks, to those who are in the best position to evaluate

the risks.

d)

i) Special terms governed by INCOTERMS.

(a) F.A.S,

(b) C.I.F.,

(c) F.O.B.,

(d) non-negoiable Bill of Lading,

(e) negotiable draft (or bill of exchange),

(f) confirmed and irrevocable letter of credit.

9) Problem 4.0 The basic documentary sale

transaction Toys to Greece, p. 75

a) facts

i) Santa Claus company of Aurora, NY will sell toys

to Alpha Company of Athens, Greece.

b) Contracts: independent but interrelated.

i) sale contract

(1) between buyer and seller

ii) letter of credit contract

(1) between Buyers bank issuer and Seller

(beneficiary)

(a) buyer is applicant

(b) Sellers Bank is confirming or advising

bank;

iii) Bill of Lading contract:

(1) Between Seller (shipper) and carrier

c) Sales Contract

d) How established:

(1) request for an offer: Buyer sends a request for

offer, and letter from Alpha.

(2) Offer made. Then Santa Claus sends the offer

itself with the proforma invoice.

(3) Acceptance. the purchase order is an acceptance

(but this would be a rejection and counter offer, if

they had changed the terms. There is a new term

here delivery required prior to July 1, 2000,

and a request for a response.)

ii) Terms of the offer: Form 2, proforma invoice.

(1) Payment terms: Confirmed irrevocable letter

of credit confirmed by US bank and called

for payment against documents in NY City in US

funds.

(2) F.O.B. East Aurora, NY (buyer has risk)

(3) F.A.S. NY City (seller has risk) (Ill ship the

stuff so its free alongside the ship)

(4) C&F (cost and freight) (once on the

ship, buyer has the risk; on the dock side, seller

has risk)

(5) C.I.F. (Cost, insurance, and freight)its

payment against documents.

(6) Payment against documentshe gets paid

when he presents the documents, the documents

are listened in the payment of credit.

e) Letter of Credit Contract, FORM 4, p. 55

i) Places the risk of default on the hands of the

participant who can best evaluate the risk (Buyers

Bank, because they can get a credit report, or have

done business with Alpha in the past.)

(1) Buyer is concerned about getting the right

quantity and quality. How to deal with

this? Inspection Certificate.

ii) How established: Buyer goes to his bank and asks

them to issue a letter of credit to Santa Claus. This

is a contract between the Buyers bank and

the Seller.

(1) Bank promises to pay the seller if he produces

certain documents.

(2) The Sellers bank confirms the letter of credit

with the seller.

iii) Form 4: p. 59: Confirmed and irrevocable. The

seller wont be paid unless the seller produces these

five documents:

(1) negotiable Bill of Lading,

(2) Insurance policy,

(3) Packing list,

(4) Commercial invoice,

(5) Export Declaration.

iv) Governed by the UCPUniform Customs and

Practices. If this hadnt been there, the UCC

probably would control.

f) Bill of lading, (agreement between the shipper and

the carrier).

i) Deliver the goods to the individual or entity bearing

it (Deliver to the order of . . . . This makes it

a negotiableinstrument.

ii) This is between the buyers bank and sellers

bank. The Buyers Bank is promising that if you

handover the bill of lading, we will pay you. It

wants to see the Bill of Lading made out To the

Order of Greek bank. But we put our own name on

it, because the Bill of Lading Controls the goods. I

want to maintain control so Ill get paid. The letter

of credit was confirmed, so the Seller just brings it to

his own bank in NY. The sellers bank will pay for it

because the Sellers Bank has a contract this

Seller. My bank will buy the documents from me

and they want the seller to signed the documents

over to the NY Bank. Marine Midland Bank will

then signed the documents over to Athens, in

exchange for the funds. Then Athens bank is the

only one who can control them. The Athens bank

then sells them to Alpha, who then is the only one

who can go to the dock and pick up the toys.

g) Form 2, p. 53 Proforma, FORM 5.

h) FORM 9. Dock Receipt--clean on board = no

damage to the goods.

i) COGSAinsures for up to $500 per package.

1) PROBLEM 4.1, p. 75

a) FACTS: Universal Pipe Inc., in Kansas sells insulation

to Euro, Ltd. Offer and acceptance have different terms.

(1) goods sold as is with all faults (see UCC 2-

316).

(2) Contract governed by the laws of Kansas.

ii) Euro incurs $1m loss when insulation corrodes

refinery pipes.

b) Analyze breach of contract

i) First: Conflict of laws

(1) whose law governs interpretation of the contract?

ii) Second: Contract formation/Battle of the forms

(1) Substantive law question: How will contract be

interpreted? will the law chosen govern it?

c) Conflict of Laws Whose law governs?

i) US law on conflicts (Kansas or Federal)

(1) UCC 1-105, p. 993:

(a) Parties chose --- reasonable relation.

(i) TEST: the law chosen must be that of a jx

where a significant enough portion of the

making or performance of the contract is to

occur or occurs. Seeman v. Philadelphia.

(b) Parties dont chose --- appropriate relation..

(2) Restatement of Conflict of law. 188 p. 78-9

use the law of the state that has the

most significant relation to the transaction.

(3) Problem: difficult to figure out.

ii) German Law on Conflicts. p. 77-78.

(1) E.E.C. Convention of the Law Applicable to

Contractual Obligations.

(a) freedom of choice. Art. 3

(i) Mandatory lawscant escape. art. 3(3)

if we make a contract and the contract has

everything to do with Germany, but we

choose English law, we cant use Germany

law to escape mandatory German law.

(b) Default. Art 4(1): if no choice is made, apply

the law of the country with which the contract

is most closely connected. p. 1057,

supplement.

(i) TEST: characteristic

performance. 4(2) presumption of closely

related to the country conducting the

characteristic performance: The act

required of the contract(here, the

shipping).

d) Substantive Potential Jx--contract interpretation

i) US

(a) UCC 2-207, p. 81-84

ii) German Substantive Law, p. 85-87

(a) Ruster Article, p. 85-87

iii) Treaty

(1) CISG p. 91

iv) United States

(1) UCC 2-207--Between merchants, additional

terms become part of the contract unless . . . they

materially alter it.

(a) Are these additional or different terms? If

there is no choice of law designation, the

CISG applies.

(i) p. 29: CISG Art. 1 this law applies, unless

under Art. 6 the parties opt out of it.

(b) Different terms:

(i) Choice of law: The statement that Kansas

law applies.

1. law of Kansas as to the contract is

substantive law and it has to be

material.

(ii) disclaimer. comment 4: a disclaimer of

warranty is a material altering.

(iii) Arbitration.

v) 2-207 is very confusing, even White and Summers

disagree, p. 81

(1) gap-fillers , such as 2-314 (Implied Warranty

of Merchantability). If they are different terms,

they get knocked out. and you have to figure out

which law will provide the gap fillers.

(2) White says they both get knocked-out, even

when there is a contract. p. 82

(3) What if we make the decision that both of these

terms are part of the contract? Then Kansas law

applies, which is UCC and CISG, federal law will

trump state law.

(4) How would you argue to include UCC: if I

hadnt said anything the CISG, and I said Kansas

law, and because you cited the UCC. In real life

you need to specifically opt out of the CISG

under article 6.

2) B. German Substantive Law.

a) Mirror image. If the acceptance isnt exactly the same

as the offer, then its a counter offer.

i) EX: A client calls and the goods are on the ship, and

the German buyer wants to renege, why do you want

the contract to be governed by the UCC? Because

the German law is a mirror image rule. If German

law applies, theres no contract, unless the

buyer performs, but as long as they are still in transit,

buyer hasnt performed and he can renege.

b) No Acceptance by silence. General rule is no. p.

86. Silence is generally not recognized as acceptance.

i) Exception

(1) prior business relationship. However, if youre

dealing with someone with whom you have a

prior business relationship, you are obligated to

answer immediately, and silence will be deemed

acceptance of the offer.

(2) Good faith; Acceptance of the new offer by

silence is assumed where food faith standards

would have require explicit rejection. p. 85

3) CISG (Treaty law default law, art. 1)

a) Material changecounter offer. Article 19, p. 32;

i) No contract. if terms materially change the

contract, then its a counter offer, and there is no

contract. If no materially change, then acceptance.

(UCC would just knock out the different terms, but

there would still be a contract)

ii) Material: paragraph 3: terms relating to the price,

payment, quality and quantity of the good, place and

time of delivery, extent of one partys liability to the

other, or the settlement of disputes are considered to

alter the terms of the offer materially.

iii) But a german court held that such a modification

was nonmaterial, and there was therefore still a

contract. p. 92. So we dont know how the CISG

will be interpreted. A German court may interpret it

narrowly (more like the UCC), while a French court

may interpret it broadly.

b) Defaultabsent choice of law. Filanto, p. 94

i) Citing art 1(a) of the CISG, the court state that

absent a choice of law provision, the CISG

governs all contracts between parties with places

of business in different nations, so long as both

nations are signatories to the CISG.

c) Parties may opt out under Article 6.

i) USA has made a reservation under art. 95, with

respect to art. 1(b). We want to apply the UCC.

ii) Germany: as to any country that has reserved

rights under art. 95, we reserve the right to treat them

reciprocally. Apply 1(b) with reciprocity.

d) When would 1(b) apply? CISG will apply between

contracting parties. But when theres a Contracting

party (USA) and a non-Contracting party (Thailand),

and they have a choice of forum clause which places

them in a German court.

e) The contract says apply Kansas law. You want CISG

to apply. How could it come in under 1(b)?-- CISG

law is Kansas law because of the preemption law. So

the German court should apply CISG, but theyre not

going to because Germany has made a reservation

which says that were not going to apply 1(b) to those

who have made a reservation regarding 1(1)(b).

f) p. 91: Germany holds the view that Parties to the

Convention that have made a declaration under art. 95

of the Convention are not considered Contracting

States within the meaning of subparagraph (1)(b) of

art. 1 of the Convention. Accordingly, there is no

obligation to apply [...] this provision when the rule of a

private intl law leads to the application of the law of a

party that had made a declaration to the effect that will

not be bound by sub 1(1)(b) art. 1 of the Convention.

4) UNIDROITa Restatement of International trade

custom. use to supplement your contract terms. Why

would you want to

a) UNIDROIT Principles: If the parties have difficulty

agreeing ... p. 97

b) Battle of forms, p. 97

i) custom made acceptance (including

handwritten)-same as art 1 of the CISG.

ii) Use of Pre-printed standard form (boiler plate)

form of acceptance of either parties form forms

agree or else they knockout.

iii) Written confirmations: If a written confirmation

of a contract previously made is sent by one party to

the other, and additional or different term becomes

part of the contract unless it materially alters the

contract or the recipient of the confirmation objects

to the term.

c) Arbitrators often use UNIDROIT.

d) Problem: theres no database to find all the

UNIDROIT decisions.

5) Filanto v. Chilewich

a) Chilewich is buying shoes....contract with Russia

includes an arbitration clause. Chilewich contracts with

an Italian company, and says that all disputes have to be

resolved in Russia. The first communication says

arbitration, the second says no arbitration. There was no

response from Filanto and Chilewich opened a letter of

credit, which sounds like reliance. Then Filanto sends a

letter excluding the Russian arbitration clause. Filanto

sues in US District Court. Chilewich says you cant sue

us in a US district Court.

i) p. 95

ii) R: What law applies?- CISG.

iii) Silence as acceptance under CISG. Court focuses

on 18(1) A statement made by or other conduct of

the offeree indicating assent to an offer is

acceptance. Filanto says that because it was silent

there was no acceptance. The court says you knew

that Chilewich had opened a letter of credit in

Filantos name.

b) Moral: if your client needs a particular term, make sure

that its in the contract before hand, because if you have

to go into a foreign court. If the other party wont allow

that term, tell your client to charge more.

6) Problem 4.2 Commercial Terms, Bills of lading and

insuranceBooks to Bath, p. 105

a) Facts; Sam (Your client) is a book writer. Bill Bones

(publisher in England) wants two dozen

gross. Howard Hunt Terms: contract with Bones;

FOB Savanna; contract governed by ICC INCOTERMS

(1990). Contract with Hunt: CIF, Bath, United

Kingdom; terms governed by ICC INCOTERMS

(2000). CN: no letter of credit in this case, these are

small sells, and people with whom Sam has dealt with

before.

b) difference between

i) mandatory laws. (state laws binding on the parties

, may not be set aside),

(1) COGSA

(2) Pomerene Act.

ii) optional laws, eg.,

(1) UCC

(2) trade customs-INCOTERMS

c) Trade terms

i) FOB

(1) English meaning of fob = the American fob

vessel.

(2) supply transactionseller needs to obtain export

license.

(3) Export transaction buyer needs to obtain

export license.

ii) C&F/CIF

(1) Must have a negotiable Bill of Lading, p. 109

(2) basically FOB plus obligation for seller to

arrange for carriage and carriage and insurance,

respectively.

(3) Two critical points

(a) passing of the risk, like FOB - at port

of shipment.(ships rail)

(b) costs of carriage and insurance, occurs

at port of destination.

iii) CIF-Sale of documents, p. 110

1) Shipping documents : The seller has the obligation of

tendering:

i) bill of lading

ii) insurance policy

iii) invoice

(1) shows the price, and a deduction of

the freight which the buyer pays before delivery

at the port of discharge.

2) CIF is a contract for the sale of goods to be performed

by the delivery of documents, at which time the

a) buyer is bound to pay for the goods, even if

i) goods have already been lost. p. 111, C. Groom

v. Barber

ii) Name not controlling. if a contract does not

possess this sale of documents character, it will not

be a CIF, even though the parties call it that. The

Julian, p. 111.

3) No right to inspection. youre buying documents in

lieu of the goods, you cannot refuse to buy the

documents just because you have not had the

opportunity to inspect the goods.

4) Loading of goods. If the goods are not being loaded in the

tradition way that is, using a crane to take the goods over

the ships rail, then you dont want to use either CIF or

FOB.

5) INCOTERMS (2000 ed.), p. 113 : separate from

substantive law, but rules which the parties may choose.

a) Free on Board means

b) Questions on 105:--FOB

i) No, Sam has no duty to do this, INCOTERMS, p.

113, A3 (sellers has no obligation to contract

carriage or insurance), the buyer is supposed to

arrange for the transportation of the goods for an

FOB.

ii) If Sam arranges transportation, and wants to be sure

that Bill pays--Make the Bill of Lading

a negotiable bill, (its starting to look like a CIF)

iii) No, seller has not responsibility to obtain insurance,

only in a CIF.

iv) In an FOB, seller doesnt need to buy any

insurance. But you should go ahead and buy

insurance. But COGSA already provides

insurance. But there are lots of limitations on the

insurance that COGSA provides. So you probably

want to buy additional insurance. But if youre

going to pay for carriage and insurance its

essentially a CIF.

v) Can he put them all in one container and ship them

separately? No, they are separate contracts and

require separate documents.

vi) Buyers have no right to inspect.

vii) What kinds of FOB contracts require

a negotiable bill of lading--all? UCC 2-319, p.

1006. Only one person will be able to pick up that

one package.

viii) must relate only to the goods which the buyer

has agreed to buy p. 111: Where the bill of lading

is tendered to the buyer, it must relate only to the

goods which the buyer has agreed to buy; if it covers

other goods as well, the buyer may refuse the

tender.

(1) To enable the buyer to deal with the goods

while they are afloat the bill of lading must be

one that covers only the quantity of goods called

for by the contract. The buyer is not required to

accept his part of the goods without a bill of

lading because the latter covers a larger quantity ,

not is he required to accept a bill of lading for the

whole quantity under a stipulation to hold the

excess for the owner.1008, UCC, 2-320, comnt

4:

c) Right to inspect.

i) YesFOB plant.

ii) No

(1) C.I.F. p. 1008: comnt 1, the buyer has no right

to inspection prior to payment or acceptance of

documents.

(2) FOB vessel, FAS--If its payment against

documents, whether fob or otherwise. see UCC

2-319(4).

(3) The leading case concerning buyers (lack of a)

right of inspection under CIF contract (or any

other contract which requires payment against

documents) is Biddell Bros. v. Clemens

Horst. See, p. 112;

iii) Not directly covered under INCOTERMS, but.

negotiable bill of lading CIFto the order of

negotiable bill of lading,

not necessary

FOBto the bearer of

(1) A10FOB vessel--the seller must render the

buyer every assistance.

iv) Since both buyers have declared INCOTERMS,

buyer would have the right to inspect.

v) If they specified the UCC, then buyer wouldnt have

the right to inspect.

d) CIF is negotiable, made to the order of

i) The Carrier stamps it On Board Sams Load,

Weight & Count and Contents Unknown Its not

a clean bill of lading. Sam is worried that its a foul

or unclean bill of lading. But does this stamp make

it an a foul Bill of lading? no.

(1) p. 126, note 10: The following clauses do not

convert a clean into an unclean bill of lading:

e) Mandatory laws. Can the shipper disclaim

responsibility for shipping the wrong goods? Look to

the mandatory laws? COGSA. Or in international law:

the Hague Convention (1924), which were an attempt to

codify an uniform international aw of carriers and

shippers. This was amended in the Hague/Visby

(1968), now the Hamburg convention.

i) Carriers liability. It is now less advantageous to

the carrier: Now they say that they cannot have

exclusion law, but liability is limited to $500 per

package.

ii) Declaring a higher valueobvious

opportunity. What if Im the shipper and I want

more than $500 of coverage? You declare a higher

value on the Bill of Lading. (p. 64). The carrier must

give the shipper an obvious opportunity to declare a

higher value. But then the carrier can charge the

shipper a little more.

iii) Paramount clause p. 127. You cant contract

out of the Hague Rules. Both the Hague and

Hague/Visby Rules contain paramount clauses.

iv) COGSA is the American version of the Hague

Rules.

(1) applies to both import and export. p. 128

f) Three Roles of the Bill of Lading, p. 129,

i) contract for carriage

ii) receipt of goods

iii) document of title

g) p. 121: Hypo: if you send your agent to the dock to

deliver the goods and he returns with a

i) seaway bill--not a title to the goods).

ii) Multi-modal transport bill of lading-- not a

negotiable, (banks dont want to make these

negotiable because theres so many different carriers

involved).

iii) Electronic bills of ladingnon-negotiable: You

give the goods to the carrier and he will create an

electronic PIN. Then whoever shows up at the port

with the PIN. A new Pin would have to be issued for

each party. This method has not been all very

successful.

h) The Transnational law of intl commercial transaction,

p. 130

i) The various systems of national law essentially

consist of two types of the legal rules. Some of them

are mandatory in character, others are optional. The

mandatory rules have to be accepted by the persons

affected by them, whether they like them or not. The

optional rules may be accepted by the parties or not,

or they may be modified for their convenience.

i) Carriers duty to inspect. Berisford, p. 131

i) Facts; The carrier locked the containers in Brazil,

and when they arrived in the USA, some of them

were empty.

j) COGSA requires the carriers to conduct a

reasonable inspection.

k) p. 133, role of the Bill of lading: It is sole integral to

international business transactions, that errors are not

excused.

i) acknowledgement by the carrier of receipt of the

goods

ii) a contract for carriage

iii) a document of title it controls the possession of the

goods themselves.

l) Where does the carrier provide a description of the

goods for which they are responsible.? On the Bill of

lading.

m) What if the shipper says its books, but sends garbage.

Is the carrier responsible for a mis-description? The

carrier is responsible to provide a reasonable

inspection of the goods. Carriers are allowed to stamp

this on the bill of lading: Desire Under the Thornbush,

shippers count, weight and.

n) It was unreasonable for them to say that they loaded an

hundred ingots when they only shipped 30 and, and the

containers weigh 78k lbs less than it was supposed to.

o) Ct: yes, Carrier is contractually limited to $500 per

container if you perform the contract, but if you

breach the contract, then COGSA doesnt apply. So did

it breach the contract, and is there a liability for mis-

description?

i) Even if opening of the containers posed

difficulties, at the very least the carrier owed a duty

to verify the weight of the containers at shipside

before they were placed aboard its ship and before it

stated that they contained 100 bundles of tin ingots

weighing the equivalent of 111,656 lbs., which

would have been 80k lbs. in excess of the weight the

containers actually loaded.

p) Generally, the carrier will be relieved of liability if he

stamps on it Shippers Load, Weight and Count. unless

a reasonable inspection . . . if it is obviously not what it

says to be, then it wont be a reasonable inspection.

q) Tetley, p. 129 the carrier must inspect the goods

upon receiving them. The inspection is nevertheless

only a reasonable inspection.

i) This is important so he can give a clean bill of

lading. If it weighs 78k lbs less then when you

received it, it is probably not reaonsable.

r) POLICY REASON: to protect the integrity of the bill

of lading.

s) Julia case, p. 111

i) CN: even if the good have been destroyed, I can

turn the documents over to you have, and you have

to pay. The parties called it a c.i.f. contract but it

wasnt, it was just a contract to purchase. Rye was

sent to Belgium, the ship gets captured by the Nazis

and goods dont get delivered. Argentina found that

it wasnt a c.i.f. Ex ship does not require payment

against documents.

Intl state to state Within State

COGSA-

federal

Harter Act UCC

1) The problem with FOB is knowing whether it should be

defined by UCC, INCOTERMS, or English law.

a) Under UCC

i) Does FOB provide for a negotiable Bill of lading?

yes, unless FOB vessel. Does it require an inspection

of goods? If theres a negotiable Bill of Lading..

b) INCOTERMS

(1) Does FOB provide for a negotiable bill of

lading? no.

(2) Buyer pays cost of Inspection? yes.

c) Payment against documents precludes inspection.

1) PROBLEM 4.3 Wars and other Frustrations: Oil

from Araby, p. 136

a) Section 1: the Setting

i) Gulf Refinery (Araby) ---- Jean Val Jean-----

Javert (France)

1) Contract w/ Gulf Refinary

i) FOB Refinery in Araby

ii) Force majeure

2) Contract with Constant Carrier:

i) Liberties clause: in event of great risk, Carrier may

require shipper to take the goods at the port of

shipment, or he make unload the cargo

somewhere. He neednt give notice of this, and such

discharge will constitute complete delivery and

performance of the goods.

3) Contract with Javert.

i) c.i.f. Marseilles, France

ii) escalator clause

iii) Excuse clause

4) Events:

i) Fire in Araby refinery causing delays

ii) War between Iran-Iraq

b) CN: Either the law of US or Araby? Are they both

members of the CISG. On an exam you want to say,

you didnt tell me if they are members of the CISG, but

if they are then CISG applies, if they are not then apply

the UCC. Do a choice of law for each contract.

c) Whose law applies in the contract between Jean and

Araby?

i) Issue: is there an excuse to get us out of the

contract?

ii) France: Use Contractual obligations (EEC): if

the contract is entered into in the course of the

partys trade or profession ... [then apply the law of]

where the performance is to be effected. p. 1057,

art. (4)(2) (absent a choice of law, the law of the

country which is most closely connect, which, when

the contract is entered into in the course of that

partys profession, where performance is to be

effected.) and the performance would be effected in

France, so French law applies. [even though neither

party is French??]

iii) Also, the contracts themselves should apply, thus

the force majeure, thus excuse. If the force majeure

clauses dont apply then . . .

iv) What could have been done better for our client

regarding the force majeure clauses. Provide some

kind of remedy?

v) it looks like Araby is excused, if it was beyond their

control. But what if there were no force majeure

clause? Can we make Araby pay damages?

vi) What substantive law applies? Araby is not a

party to the CISG, so you cant use that. Look at all

the possible laws, which one is best for your

client? You want something that says that Araby

cant get out unless its absolutely

impossible. Which is the harshest law? -- French.

vii) The French law.

(1) p. 161, it has to be absolutely impossible.

(2) According to the doctrine of force

majeure, prerequisites for discharge are:

(a) unforeseeability of a fortuitous event,

(b) absolute impossibility of performance and not

mere onerousness, and

(c) no fault on the obligors part.

viii) Which conflicts of law will we apply?: Araby may

be a former French colony, so they may follow

French law. Where suing? England, Araby?

d) All of the laws require unforeseeability.

i) The following general characteristics can be traced

in all national jx:

(1) (a) occurrence of an event after the making of

contract;

(2) (b) unforeseeable of the event;

(3) (c) alteration of the contract in an intolerable

degree, and

(4) (d) no fault on the obligors part. p. 163:

(i) CN: even if its completely impossible to

perform, they may not be excused because

it may be their own fault.

ii) Was it Araby Oil refinerys fault? Did they have

fire trucks handy? was someone smoking?

iii) Is it unforeseeable?

(1) The more sophisticated and widespread

international commerce becomes, the more

difficult it is to say that a party could not

reasonably have been expected to take an

impediment into account. This is reflected in the

paucity of successful cases under 2-615 of the

UCC (Impracticality . .. a contingency the

nonoccurrence of was a basic assumption ). p.

153

(2) As commerce grows more sophisticated and

multinational it becomes more vulnerable to

disruption from embargoes, wars, revolutions,

and terrorism in countries producing natural

resources. p. 156

e) Force Majeure clauses are options. We can select the

CISG. But force majeure clause could amend the force

majeure clause and the same things with the UCC.

f) Substantive law:

g) English: Radical difference

(1) The Eugenia, p. 141

(a) The ship was stuck in the canal. Once they

got out the original contract called for them to

travel through the Suez, but it was blocked so

they had to go around Africa. The owners say

they had to pay more money. But the

charterers say that it should be excused.

(2) TEST: a situation must arise which renders

performance of the contract a thing radically

different from that which was undertaken by the

contract.

(3) R: The fact that it has become more

onerous or more expensive for one party than he

though is not sufficient to bring about a

frustration.

(4) By the time you have to look at is the entire trip,

and theres not that much of a difference.

h) There are things which distinguish this case and make it

radically different?

i) p. 156:

j) p. 145: If the goods were subject to spoilage (here is

was iron ore).

5) Which Contract would the CISG (Treaty) apply to?

a) With Javert-France is a party to the CISG.

i) EXCUSE: article 79: impediment beyond his

control. The CISG applies to any party in any

situation. Whereas the

b) Elastic words, p. 151 (Nicolas)The court decides if

theres an impediment. But the problem with elastic

words, It allows for nonconformity in the interpretation

of law, between the civil and common law system.

Courts in these different systems will start interpreting

the terms in this convention and in doing so they will

rely on their own precedent. The Germans will look at

how German courts will interpret it: broadly, whereas

france will interpret it narrowly. This defeats the

purpose of having an international convention.

c) First, look to the definitions of the contract. Does the

CISG allow you to change the definition under article 6?

d) If you dont use your own law, you look to other

courts. If there a prevailing pattern which is

e) article 7(1)in the interpretation of the convention,

regard is to be made to its international character and in

need to preserve uniformity.

6) Apply:

a) Is Jean excused in the Javert contract under the

CISG? Maybe, under 79(2). This force majeure clause

is a form force majeure clause, its too generic. One

of the things Jean could have done was to define what

any circumstance is. Jean could have say Im going

to deliver this unless anything intervenes, like my

supplier breaks down.

b) But 79(2) would only work if Araby would be excused

c) But this force majeure clause is so vague that it could

be interpreted that he still has to deliver oil and he can

still get oil form other source such as the Holland on the

spot market, though at a high expense. He should have

put it into the contract oil from Araby.

d) What obstacles will jean run into if he starts including

all these provisions? it suggests that the oil shortage was

within his reasonable contemplation.

e) Perhaps a generic force majeure is better because it

show he didnt contemplate this fire ....but this couldnt

help because the seller is responsible

f) p. 155 To assist...

i) Cn: just because we dont address it in the contract,

there are contingencies which ...the seller will be

held liable notwithstanding the occurance.

g) CISG covers both the buyer and the seller.

i) Rise in market price is not excuse to seller.

(1) Exception. Astronomical increase in

price. Lord Reid, Tsakiroglou. note 4, p. 148.

He hints that an astronomical increase in price

might be a factor. neither is a rise in the market,

because ... but a severe shortage due to a

contingency such as war...but it must be

unforeseen. there is very little today which is

unforeseen, and court often will not use this to let

you out of the contract.

h) UCC provisions rarely lead a court to permit excuse

for performance....The court should seek to determine

whether the risk was consciously undertaken or not. If

so, it should follow the parties expectations based on

(a) type of business each merchant engaged in

(b) how a reasonable person would allocate risk

(c) the historical background of such risks

(d) how that would affect foreseeability.

(e) Note 8, p. 167 (Like Summers article):

ii) Youre not expected for foresee every contingency,

but you are supposed to foresee the things that have

happened in the past: the Suez closes, the mid-east is

constantly at war, oil refineries catch fire.

i) The Sellers answer is to charge more.

i) LAW:

(1) CISG--

(2) UCC--impracticality

(3) English lawradical difference test

ii) Civil law -- provides for reformation, because

contracts are for the social good.

iii) Common lawstrictly upheld. felt this was a

contract between two individuals and we will uphold

it. But it is starting to become more forgiving.

(1) France exception, which is very

strict. Rapsomaticous.

iv) UNIDROITfor majeure and hardship. p. 157

(1) Force majeure comes under the nonperformance.

(2) Hardshipnothing short of total

impossibility will excuse nonperformance.

7) Problem 4.4 Electronic Commerce: Professor Pedro

Buys A book, p. 169

a) CN: contract made over the internet; not in writing,

non-human. Is there a contract?--Pedro orders some

books over the internet which he pays for with his

brothers credit card. The books are automatically

packed and sent by rhein.com and new books ordered

from rhein.com from East.

b) CN: E-commerce is a huge industry. But different

countries are passing different laws, which leads to a

non-uniformity. What did companies do to get around

these laws? Trading partner agreements where two

entities agree to conduct business electronically, and

promise not to sue each other under UCC 2-201--

statute of frauds, which requires a signature and a

writing. They establish the procedure by which an offer

and acceptance are to take place.

c) Pedro, rhein.com and East all want to know if they have

enforceable contracts.

i) Rhein.com is a German company owned by an

American company, rivers.com. River.com

prepares lists of customers preferences, and wants

to know if it can continue this practice

d) in light of the new EU Privacy Directive.

i) Law: all of these pretty much say that an electronic

contract will be binding despite that the writing is in

an electronic form. A writing can be reflected in an

electronic media, but there is the question of

authentication.

8) Federal

a) Electronic Signatures in Global and National

Commerce Act (E-SIGN Act), Suppl. p. 980: contract

cannot be denied legal effect because they are based on

an electronic signature.

i) 102-exemption to preemptionif the state

adopts the Uniform Electronix Transactions Act

ii) 106-definitions

9) State

a) Uniform Electronic Transactions Act (UETA)( same

guys as wrote UCC)(preempts federal), 2, 4,7, Suppl.

p. 1037.

i) Parties must agree to electronic media. applies

only when the parties have each agreed to the use of

electronic media. 5(b).

ii) Must in fact be persons act. 9(a)an electronic

record or signature is attributable to a person only if

it is in fact produced by an act of that person.

iii) No Presumptions.

b) Authentication--Digital Signature Statutes, (see

Hornung: p. 172). How to get around the Statute of

frauds when there is no signature? The UCC requires a

writing for every sale valued at $500 or more.

i) PKI(public key encryption infrastructure). The

problem with this is that it creates a bureaucracy,

because you need a third party who verifies the

signature. Problems: there could still be fraud but

theres probably only fraud if you gave it to an

agent; also, it doesnt provide for a natural evolution

and PKI may limit the methods of authentication.

(1) Germany use

(2) Utah use

ii) Biometricsretina scans, fingerprints

iii) Digital signatures rarely used. no one is really

using these digital signatures. People are using the

existing infrastructure such as credit card numbers,

billing address. Antifraud software that companies

have recorded your spending history. Companies are

assuming the risks theyve always assumed. Winn,

p. 180

iv) digital certificates,

v) PinOp

10) International

a) UNCITRAL Model Law on Electronic Commerce,

see Reed, 7, 11, Suppl. p. 65: (written by the CISG

writers, purpose: harmonize trade law) party

autonomy. Does not specify what method of signing a

message might be appropriate under particular

circumstances. Even an X at the end of an e-mail would

make it legally binding.

b) GUIDECavoids mandatory systems based on a

specific technology. p. 182.

i) signature

(1) any symbol executed or adopted by a party with

present

(2) intention to authenticatea writing. Because an

ensured message (digital signature) is difficult to

forge, its use binds the signatory, precluding a

later repudiation of the message and form the

basis for forming legally binding contracts ...

since the ensured message can provide

electronically the same forensic effect a signed

paper message provides.

(a) Ensured message means:

(i) 1) ensurer had contact with the message

and

(ii) 2) message has been preserved

intact since it was ensured.

(b) Agency: a principal will be bound if the

agent had sufficient authority to ensure the

message.

11) Foreign

a) Digital Signature Statutes

i) EU Directive on Electronic Signatures, see

Barofsky:

ii) Germany: one of the most restrictive legal regimes

in cyberspace in terms of signatures. PKI only, no

legal effect to electronic signature or email

exchanges. If you dont meet the technical standard

established by the German government for the

proper PKI, you achieve no legal recognition.

12) Computer initiated transactions, p. 184

a) Can a computer bind a contract? Only persons legally

capable of contracting may enter into a binding contract,

only natural persons or those who have legal capacity.

You had to have intent, and ability to negotiate.

i) Agency law: consent by both parties is required.

The computer is an extension of the human

being. We can attribute human action to the

computer so the computer contracts on behalf of the

individual. What if there is a malfunction? The

principal has to take responsibility.

b) UNCITRAL, article 2: the originator of a data

message includes both a person by whom or on whose

behalf a message is purported, which includes

computers. Article 13(2)(b)attributes the operations

of electronic devised to the person who originate the

data message if it was sent by an information system

programmed by, or on behalf of, the originator to

operate automatically.

c) UETA 2(6) expressly recognizes that an electronic

agent a can operate without review or action by an

individual and the definition of electronic agent seems

wide enough to encompass both electronic agents that

act automatically and those that act autonomously

(intelligent agents).

13) (b) Privacy

i) EU Privacy Directive on Data Protection. p. 190.

Suppl. p. 1079--EU passed this omnibus privacy law

because the various countries were each developing

their own.

ii) General Rule: Article 25 prohibits Member states

from sending personal data to any nation outside the

EU

(1) unless that nations privacy protections are

(a) similar and provide similar regulatory

structure, including enforcement actions.

25(3) if you decide it doesnt have adequate

protection, inform the other Members. 25(4)

the commission may have already decided

that the third country does not provide

adequate protection. circumstances to look

to: the nature of the data, the purpose and

nature of the proposed processing, the country

of origin, the country of final destination, the

rules of law in the third country and the

professional rules and security measure in the

third country.

iii) Exceptions:

(1) 25(2) adequate protections.

(2) 26(1) consent.

(3) 26(2) where the controller of the data determines

that adequate safeguard of individuals privacy

rights exist. p. 193:

(4) Article 25 does not explain what constitutes an

adequate level of protection. p. 195. How to

show adequate protection: 193: circumstances

b) The US has no similar privacy protection regulation.

U.S. has patchwork of privacy laws. Fair Credit

Reporting Act, 1970; Privacy Act, 1974; Computer

Matching and Privacy Protection Act, 1988. This is

because of the First Amdt. Also, noninterference by the

govt.

14) Application: rhein.com will violate article 25 by sending

the information to its parent company, unless it

gets permission from Pedro, or unless the US has adequate

protection. But the US doesnt have adequate protection.

a) p. 196: Although Member state should not white list

the entire private sector, particular areas of the private

sector do ensure adequate protection. EX: credit

reporting industry, part of the telecommunications

sector.

b) Member states should not white list many areas of

US private sector. Ex: data protection in health care,

direct marketing.

15) In general will river.com have adequate protection?

no. But does it fall under any of the exceptions under

26(1)? Was there consent? no. Is there any thing in 26(2)?

Does the control adduce adequate safeguards with respect

to the protection of the privacy?

a) What is consent? If I enter all my information and an

offer to read the privacy policy pops up and you say

no, is that consent? Does it have to say do you give

us your permission? and they have to click yes.?

b) Does Pedro have a private right of action against an

EU company? 198

c) All the substantive law still applies. There may be a

battle of the forms, but you have to figure out whose

law applies. The CISG doesnt require a writing. The

only new thing added here is the electronic part.

16) Problem 4.5 The Bill of Lading: Computers to

Caracas, p. 200

a) Seller: S&A

b) Buyer: Campeador

(1) Contract: 100 El Cid computers, 10k each,

C.I.F. (payment against

documents). Inspection Certificate by ms.

Jimena.

c) Carrier: Saragossa Sea Shipping Lines.

d) Facts: Three things that go wrong.

(i) S&A send both conforming and non

conforming goods; forged the Certificate

of Inspection; Saragossa loaded the goods

but stamped it Shippers Load, Weight,

and Count. The bill of lading for the 10

computers is lost and found by Garcia

Ordonez.

(ii) 20 cartons of cheap computers. SA stolen

blank bills of lading.

(iii) 70 cartons of cheap computers, forged the

blank bills of lading.

e) Part A. Forged Endorsements and mis-delivery, p.

202

f) CN: this section will deal with the problem 1, the ten

computers.

g) English law : Schmitt, , p. 203

i) Intl rules relating to Bills of Lading,

ii) The Bill of lading is a contract between the shipper

and the carrier, but the shipper has little discretion in

the negotiation of the terms. However, the shipper is

protected against abuse by legislation.

(1) By making the bill of lading negotiable, the

cargo is made negotiable. The holder of a bill of

lading cannot acquire a better title than his

predecessor possessed, which means that where a

negotiable bill of lading is obtained by fraud

and indorsed to a bona fide indorsee for

value, the latter does not acquire a title to the

goods represented by the bill, while if the same

happened in case of a bill of exchange which is

regular or its face, and nor overdue or

dishonored, the indorsee is entitled to all rights

arising under the bill of exchange.

h) Carrier: p. 204 The carrier is not responsible for

wrongful delivery of the goods against the bill unless

he knows of the defect in the title of the holder. If the

carrier delivers the goods to a person who is not the

older of the bill of lading, he does so as his peril. The

carrier who delivers to someone who is not the true

owner is liable to the true owner for conversion of the

goods.

i) Sze Hai Tong Bank v. Rambler Cycle, p. 204

j) A ship-owner who delivers without production of

the bill of lading does so at his peril. The contract is

to deliver, on production of the bill of lading, to the

person entitled under the bill of lading. If he delivers

the goods without the production of the bill of

lading, carrier is liable in conversion.

k) But even a true owner who cannot produce the bill

of lading cannot claim the goods.

l) They delivered the goods to someone other than the

individual identified on the bill of lading, and the

indemnity couldnt protect them because they

breached their contractual obligation.

m) Some foreign countries, such as Venezuala and

other South American countries, a consignee may

obtain delivery of the cargo without actual tender of

the bill of lading.

n) Applicable law, p. 205

o) Normally, in an action against a carrier, you apply the

law of the jx in which the bill was issued.

p) But shipments to or from the US is governed by

COGSA which requires litigation to be determined

by the US COGSA.

q) The Pomerene Act applies to ocean bills issued in

the US for shipment to a foreign country but not to

bills issued abroad for shipment to the US, and it

does contain provisions on rights acquired by

negotiation.

r) Adel Precision, p. 206

i) The carrier is the RR which released good to an

entity that produced a forged bill of lading, and the

RR is trying to get out of it. The Pomerene act

places the burden on the carrier.

s) There was no proper endorsement on the order bill

of lading, accordingly .

t) The new version of the Pomeren Act does not

contain the properly endorsed but courts have

construed it to contain this requirement.

u) Application:

v) Who is liable for the 10 computers? The carrier is

responsible to the owner, who is probably the Bank

of Valencia. Why is the carrier responsible? Under

Pomerene Act, the carrier cannot deliver to someone

who is not the bill of lading. The Carrier must

deliver the goods to someone who holds the bill of

lading which has been properly endorsed.

w) Part B. Misdescription and disclaimers of

Description.

x) Law governing the B of Lading contract with regard

to negligent stowage or care of goods during transit.

(a) COGSA (based on the Hague rules).

(b) Harterfederal state to federal state, or

within the U.S.

ii) Law governing the transfer or transferability of the

bill of lading.

(1) Pomerene act: applies only to Bills of lading

created in the US.

iii) If the bill of lading was written in a foreign country

for shipment to the US, which law applies? If

written in Australia, then Australian law.

iv) Summary: factsseller bought 20 cartons of

computers and the carrier signed off on the bill of

lading but didnt inspect, and they get delivered but

theyre not the right computers. So whos

responsible.

v) Law: carrier has a duty to do

a reasonable inspection. And because they did not

stamp it Shippers, load, weight and count, there

was no disclaimer so the carrier is responsible for

misdelivery and misdescription.

y) Both COGSA and Pomerene Act.

z) MitsuiCogsa and harter both allow disclaimers, but

they dont have any legal effect. But Pomerene

modifies the legal effect that the bills of lading would

otherwise have under the Harter Act and COGSA.

aa) TO have a valid exculpatory clause, they must have a

valid disclaimer. Shippers load weight and count.

Then the shipper has to load them.

bb) ftnt, p. 215.

cc) Questions, p. 219:

dd) 3.

(1) not responsible because not responsible for how

many and how much they weigh.

(2) 20 cartons of El Cid. Same.

(3) 15 cartons delivered. All are operational. But

the Bill of lading says 20 cartons. they will be

liable because theres no disclaimer.

(4) same as c, but ... it would depend on who loaded

it. If the shipper loaded it then they are protected

by an exculpatory clause

(5) i

(6) Sancho and Alfonso delivers 20 cartons.....The

question is if it would be reasonable for them to

inspect. In this case its so obvious.

(7) probably even more liable because they had an

opportunity to see what was going on.

ee) Part C: Forged Bills of Lading, p. 220

ff) Three functions of the bill of lading:

i) receipt for the goods,

ii) document of title to the goods and

iii) evidence of contract of carriage.

gg) Facts: S & A stole blank bill of ladings, and took

the forged bill of lading to the bank. The Campeador

pays for them. Whos responsible now for the loss?

hh) Bank of Valencia will look it over to make sure all

the documents are in order, then take it to

campeador. Campeador will pay Valencia, and

Valencia will pay the US bank, which will pay

Sancho and Alfonso.

ii) Law: Pomerene act because it deals with

transferability.

jj) Campeador will be responsible because no one had

endorsed it along the way. Only Campeador

endorsed it. Had it been a letter of credit transaction,

then each would have endorsed it along the way and

the buyer would not be liable.

kk) Fort Worth Elevator, p. 222

i) F: Tankersley had forged a bill of landing saying he

shipped a truckload of wheat to Texas. Here a draft

written off on Fort Worth bank account, pay me for

it. Then Fort Worth finds that nothing was ever

shipped.

ii) held, the bank is responsible for the loss because

Pomerene had been passed by then. they accepted

the obligation to accept it as a genuine bill.

iii) How can I get out of any liability for warrantees

under the Pomerene: Document a contrary

intention.

iv) p. 224Unless a contrary intention appears

17) Problem 4.6 Selling through distributorships/Agents

and the use of countertrade: p. 228

a) Facts: Client Sells Sollate, patented in the United

States, Mexico and most European nations. He

wants to expand into Mexcan market and Russian

market. Set up either an indepndent agent or

independent distributor.

b) Independent agenttitle remains with seller,

based on commission, risk on seller.

i) Independent distributortitle passes to the

distributor.

c) Part A. Sales Agent and distributorship

Agreements.

d) Folsom, p. 230

i) Independent foreign agent: a foreign person who

does not take title to the goods, is paid on

commission; does not bear risk that the buyer might

not pay. Uncertain whether he has power to bind US

supplier unless expressly given. he neednt provide

storage. Usually more legal problems than an

independent foreign distributor. Agency law differs

in different countries, some of which cannot be

contracted away and is mandatory.

e) Independent foreign distributor (agent): buys the

companys products and resells them through the

foreign distributors network. Takes title, assumes the

risk of not being able to resell goods. Must find

storage. No power to bind the supplier, because he buys

the goods himself.

agent distributorMexico doesnt

have this

title remains with seller title passes to distributor

risk of no sale remains with seller risk passes to distributor

more control (price, distribution) less control (price, distribution)

seller responsible for storage distributor responsible for storage

can Bind the principal, possibly cannot bind the principal

f) ISSUES: host government laws: antitrust law, labor

laws, termination rights and obligations, import (in

retaliation, or isolationism) /export (repatriation of

profits) restriction.

g) Siqueiros, Legal framework for the sale of goods to

Mexico, p. 235

h) Antitrust in Mexico. A seller residing abroad will not

encounter problems with antitrust when selling goods to

Mexico, even when exclusive agents or distributors are

appointed for certain areas of the country.

i) But the seller is subject to the antitrust laws if it enters

into agreements with other suppliers of goods, within or

outside of Mexico, to restrict the access of products or

to gain any other unfair advantage to the detriment of

the Mexican consumer.

j) What kind of contract do you write if you want to

create an independent distributor?

k) Contracto innominado.

i) One commercial code;

ii) Civil code one for every state, plus the federal code.

l) Contrato Mediacionhe goes from farm to farm and

asks the people if they need a tractor, hands them a

catalogue and tells them that if they want anything, they

should contact the seller.

i) Payment method: finders fee.

m) Contrato commissioncloser to an agency

relationship. closer to a employee/er relationship. If

you call it a commission it will probably be called

a contrato de commission. This does give the person

power of attorney so he can bind the principal. You can

add terms, But by adding terms you might turn it into a

different kind of contract, because the Mexican courts

dont look at the title of the contract.

n) Labor law issues: who can we hire?We probably

wont be able to hire foreign nationals to work in

Mexico. An independent distributor may be an entity

and Mexico may say that a certain percentage has to be

Mexican owned.

o) Termination:

p) At will v. causegovt may control this, and

what cause is.

q) Severancepenalties, inventory, breach

penalty, good will.

r) Noticemay be established by the govt or the

parties.

s) p. 241: List of possible bases of just cause:

t) Waver of termination rightsusually the govt

will not allow a waiver of these rights.

u) Part B. Countertrade, p. 243

v) Why would I prefer good instead of money? Russia

has soft currency, or it lacks hard currency, or the govt

wont let it out of the country.

i) What goods are you getting?

ii) How do you value the goods?

w) What is the quality?

x) Is there a market for this stuff?

y) Danger of dumpingsell product for below the

market cost in the home country, antitrust laws

prevent you from. so can you sell it for the price you

want to sell it for.

z) Exchange rate? once you figure out the value, is it

in the official rate or the market rate?

aa) McVey, p. 246

i) Types of Countertrade:

ii) Counterpurchase. A private firm agrees to sell

products to a sovereign nation and to purchase

from the nation goods which are unrelated to the

items which it is selling.

(1) Then he has a certain period of time, 3 to 5

years. Three contracts: one to sell the jets,

one for the goods in return, one for the

protocol

iii) Compensation (buyback)a private firm will

sell equipment, technology, or even an entire

plant to a sovereign nation and agree to purchase

a portion of the output product from the use of

the equipment.

(1) Period of time is much longer than in

counterpurchase.

iv) Switch tradingwhen you get a third party to take

over your obligation. EX: Romania agrees to buy

100k, Brazil agrees to buy 100k, but Brazil only

buys 70k worth, and Romania has no more goods it

wants. So they finds a switch trader who finds

Guatemala who wants Romanian goods. So Brazil

will sell it to Guatemala at a 30% discount.

18) Chapter 5: Financing the Intl sale of Goods, p. 255

19) Problem 5.1 Letter of Credit and Electronic

communication: Gold Watch pens for France.

(1) Shady (beneficiary)

(2) UCC, p. 1024, 5-107, definitions, 5-102;

Adviser, confirmer, nominated person, issuer.

(3) The letter is sent from BNP (issuer) to Metro

(adviser, confirmer) bank. This is the letter of

credit contract.

(4) Ship LCD lighters and watches.

(5) fixed letter of credit: certain amount of time

after presentation. It can become exhausted,

either from the time passing or the amount being

paid. 256:

(6) sight letter of credit: must pay on sight.

(7) General letter of credit: allows

(8) Special instructions:

(9) 258: Please add your

b) mistake in the description: ICD. Now BNP is

refusing to pay because the documents are not

conforming. If they dont conform and BNP pays then

BNP is responsible.

c) Autonomous principle: The documents are

autonomous, and banks may refuse to look at anything

else, if the documents dont conform, then they will

refuse to pay.

d) ON September 25, BNP received a telex from Metro

that the credit had been used. Did they use is in

time? yes. But had it been the 26, then it would not

have been valid.

e) Which date should control? When the

beneficiary presents to the confirming bank? UCC 5-

108the issuers rights and obligations. Comment 1. p.

1027.

i) Beneficiarys presentation of documents. The

key date is when the beneficiary presents the

documents.

(1) Notice requirementreasonable time, not

more than 7 business days. How much time

does the issuer or confirmer have to notice:

maximum of 7 business/banking days, but

sometimes shorter than 7 days. 7 days is not a

safe harbor. UCC 5-108(b),

(a) reasonable time no greater than 7

days. an issuer has a reasonable timeafter

presentation but not beyond the 7th business

day to honor or reject. Comment 2, p. 1028,

What is a reasonable time is not extended

to accommodate an issuers procuring a

waiver from the applicant. See also UCP

14(c)(the issuing bank may in its sole

judgment appeach the Applicant for a waiver

of the discrepancy).

(b) But under the UCP. 13 UCP, p. 268 .. but this

is not a safe harbor either, but 14(e) says that

if the bank fails to act in accordance with this

shall waive their right to object. P. 265 The

preclusion applies if the bank fails to give the

prompt notice or fails to give notice for more

than seven days after the beneficiary presents

his documents. The bank that delays

examining the documents for more than a

reasonable time will escape the preclusion as

long as it notifies the beneficiary promptly

after it finally decides not to accept the

documents and does so within the 7 days.

(2) Requirement that all discrepancies be

presented at the same time. You have present

all the discrepancies at one time. UCP

14(d)(2).p. 269 Such notice must state all

discrepancies of which the bank refuses the

documents and must also state whether it is

holding the documents at the disposal of, or is

retuning to them, to the presenter.

ii) Why do you only get one bite at the apple?

iii) The UCC does not require you to do it all at

once. But case law might require it. p. 266. By

formally placing its refusal to pay on one ground, the

defendant must be hel to have waived all

others. Bank of Taiwan.

iv) So BNP will be precluded from the objections

raised on October 6th.

20) Whos at risk here? Does Metro need to go to Galleries

and tell them of the discrepancy? no. Because they look

only to the documents.

a) If they honored the LC and pay Shady, can they force

Shady to take the goods back.

b) Metro is claiming that it was conforming, because their

letter of Credit said ICD.

c) But: p. 270: art. 16 UCPbanks assume no

responsibility in the transit of the message or other

errors arising from any transmission.

d) If they are both banks and theyre both not responsible

then whos responsible?

i) Confirming letter. Schmitthoff, p. 280: Telex

instructions: Probably BNP is in trouble for not

sending a confirming letter of credit like they should

have under Article 12 of the UCP. Art. 12 provides

that the issuing bank should make it clear in the telex

that it considers the confirming letter as operative. If

this is the intention, then works such as full details

to follow or words of similar effect should be

inserted into the telex or , better still, the telexk

should state the the mail confirmation will he the

operative credit instrument or operative

amendment.

21) But Galleries (applicant) might be responsible, under art

18, 16.

22) Conformity:

23) Slavish conformity not required. The UCC 5-108,

comment 1. Substantial performance is not enough. Strict

compliance does not mean slavish conformity to the terms

of the letter of credit.

i) Strict compliance is measure by standard

practice. Id.

ii) Standard Banking Practices. UCP Article 13, p.

283: Compliance shall be determined by

international standard banking practices.

b) Under the autonomy principle, the Bank should look

only to the documents and not at the underlying

transaction.

24) Some spelling errors are ok, p. 1027, of the UCC 5-108

Comment 1 3d para; and Hanil Case, p. 277 When its

a clear typographical error.

a) Hanil Case, p. 274: the

(1) Letter of Credit Sun Jin;

(2) Actual beneficiary Sun Jun.

b) Policy: It is too cumbersome.

c) Can we look to the UCC? Yes, because the UCP is not

a law.

25) Application: LCD and ICD might be an obvious

typographical error.

a) But banks dont have to have special knowledge.

b) Rayner, p. 262:

(1) Letter of Credit: Coromandel ground nuts.

(2) Bill of Lading : CRS.

(a) (universally understood in the nut business to

mean coromandel.)

c) It is quite impossible to suggest that a banker is to be

affected with knowledge of the customs and customary

terms of every one of the thousand of trades for whose

dealing he may issue letters of credit.

d) But its the bank who decides whether its an error or

not. Bankers dont have the time to review all the

underlying details.

26) This is a fixed credit -- it will expire. The buyer is

concerned with the expiration. Shady has a certain amount

of time to comply. If Metro say theres a problem with

this, shady will be able to reform it. But the time is running

out.

27) Terms: p. 256:

a) Standby letter of Credit: its a guarantee of

performance. If I am doing construction. This is a

mirror image of the letter of credit in the documentary

sale transaction, Because now the applicant is the seller,

not the buyer.

b) Im selling my services to Guatemala. If I, the

construction company, breach my duty to build the

plant, Guatemala can go to the bank and collect. In the

normal documentary sales transaction .... what must you

present to collect? You wnt them to present come

document that is certified....but many standby letter of

credits dont require much documentation, also a

suicide letter of credit.

c) Revolving letter of credit. Progress payments. I get

the first stage of the project done.

28) Problem 5.2 Enjoining Payment of Letters of Credit

for Fraud, p. 292

a) Exception to the autonomy principle. Originated in

the Cardozo dissent: I dissent from the view that if the

issuing bank chooses to investigate and discovers

thereby that the merchandise tendered is not in truth the

merchandise which the documents describe, it may be

forced by the delinquent seller to make payment of the

price irrespective of its knowledge. But theres a

difference between fraud and breach of warranty.

b) Policy:

i) good: it prevents someone from perpetuating a

fraud.

ii) Bad: it allows the buyers to get out of their

contract, it would slow down the international

business process every time a buyer raises, but the

letter of credit places the risk of fraud on the

applicant/buyer, so why should we let him get out of

the contract?

29) Our client has just learned that the seller is sending him

junk and wants to stop the bank from honoring the letter of

credit.

a) First: has it happened before or after the LoC has been

negotiated. If it has already been negotiated with a

holder in due course, youre out of luck. UCC 5-109:

30) You can call the bank and ask them not to honor it. But

the bank may not listen to you because theyve already

made a contract with the seller in Seoul. It will probably

depend on how much money and business you do with

them.

31) Mid-Americas case, p. 293

32) I: Issue even if a letter of credit contract requires the UCP,

apply UCC in cases of fraud because the UCC is the gap

filler, art. 5.

a) Measure of Fraudmaterial fraud: 5-109only

material fraud by the beneficiary will justify an

injunction against honor. Material fraud means fraud

that so vitiated the entire transaction that the legitimate

purposes of the independence of the issuers of the

issuers obligation can no longer be served. Courts

must look to the underlying contract.

33) In the Little John hypo, the bank will probably not stop

payment on its own initiative.

34) Dolan, p. 304: The LC should be rapid and inexpensive,

and if this exception is allowed it sort of defeats that

purpose.

35) Fraud by the beneficiary (seller). Smith, p. 307,-

American Accord. Where does the fraud lie and who has to

commit the fraud for the buyer to invoke the

exception. The American Accord [English case] says it has

to be the beneficiarys/sellers fraud. Could this fraud

exception to the established principles of documentary

credits law be expanded to encompass the fraudulent acts

of third parties as well as those of the seller? No.

a) USA: UCC 5-109even if there is a third party forgery

or fraud.

i) Fraud in the transaction, only the beneficiarys

fraud will invoke the exception.

ii) Fraud in the documents, then anyone can enjoin.

(1) When bank must honor, despite fraud, UCC 5-

109a1

(a) holders in due course, banks have to pay,

because theyre innocent. But if hes not a

holder in due course, go to para 2.

(2) paragraph 2 the bank may honor or dishonor.

b) Dangers in honoring or dishonoring?: p. 308 If a

bank refuses to pay against documents which are in fact

genuine, although the bank honestly believed them

forged, it has no defense to the sellers action for

wrongful repudiation.

i) good faith means honesty in fact. This is a

subjective test.

c) So the bank may tell the applicant to go to the court and

get an injunction and make me stop payment, because it

doesnt want to be liable.

36) UCC 5-109(b)the court can only enjoin if the court

finds the following:

i) the relief is not prohibited under the law

ii) a beneficiary, issuer, or nominated person who may

be adversely affected is adequately protected [i.e.,

requiring the asking party to put up a bond]

against that it may suffer because the relief is

granted.

iii) on the basis of the information submitted to the

court, the applicant is more likely than not to

succeed under its claim of forgery or fraud.

b) Clean credit (a suicide credit)this is very hard to

prove fraud because theres no documents. See

comment 3. p. 1032.

c) While the risk is on the applicant, he can protect

himself by having an independent inspection

certificate. But the banks are not in the business of

adjudicating fraud, all they should have to look at is in

the documents.