Beruflich Dokumente

Kultur Dokumente

ITC Under GVat 231113

Hochgeladen von

ravindra_manek123Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ITC Under GVat 231113

Hochgeladen von

ravindra_manek123Copyright:

Verfügbare Formate

By CA. Ravindra R.

Manek

INPUT TAX CREDIT UNDER GUJARAT VAT

At Jamnagar Branch of WIRC of ICAI

On 23

rd

November, 2013

Introduction

VAT = Value Added Tax = Tax on Value Addition

It is basic principle of VAT Law that Tax is charged on amount of

Value Addition.

For this purpose, under Gujarat VAT Act, provisions are made

wherein, selling dealers are required to collect tax on full amount of

sale and allowed tax credit of eligible purchases against this output

tax liability resulting into net payment tax only on Value Addition.

Net Tax Liability = Output Tax Input Tax = Tax on Value Addition

by the dealer

2

ITC Governed

by

GVAT Act, 2003

GVAT Rules, 2006

Notifications

Determination Order U/s. 80 &

Other Judicial Pronouncements

Introduction

3

Introduction

ITC Section 11

& Section 12

Section 11 Heart of VAT

Section 12 One Time

Transitional Provision

4

Section 11 Brief Overview

Basic

Section

Conditions Reduction /

Reversal /

Adjustment

Ineligible

11(1) 11(2) Records & Books

11(3)(a) - Intention

11(4) Tax Invoice

11(7A) - Paid

11(9) Compute as Per

Rules

11(11) Fair &

Reasonable method

11(3)(b) B.T. /

Cons. / Fuel

11(6) Notification

2% ITC

11(8)(a) & (b)

Not Used as

Intended

11(10) CN / DN

11(5)

Ineligible

11(7) - Bills

11(12) Non

transferrable

Total 13 (1 to 12 & 7A) Sub Sections & One Explanation

5

Admissibility

of Tax Credit

R.D. T.G. R.D. in a Tax Period

(I) Tax

Collected by

SD / Tax

Payable by

PD

(II) Purchase

Tax PAID -

u/s. 9(1),

9(2), 9(5) &

9(6)

(III) Entry Tax

PAID

Section 11(1)(a) - Basic Section

6

Section 11(1)(b)

ITC Subject to

Provisions of

Subsection (2)

to (12)

7

RD intending to claim ITC Shall Maintain

Register &

Books of Account

in such manner as may be prescribed Rule 45

Section 11(2) - Registers

8

Section 11(3)(a) - Key Conditions

T. G. Purchased within the state WHICH

ARE INTENDED FOR THE PURPOSE OF

Resale (Local)

Resale (Interstate)

Branch Transfer or Consignment of Goods to other

States

Sales in the course of Export

Sales to SEZ

Use as RAW MATERIAL in the Manufacture of T. G.

intended for above purposes or in the Packing of the

Goods so Manufactured

Use as CAPITAL GOODS meant for use in

manufacture of T. G. intended for aforesaid

purposes

Tax Credit

for Which

Purchases

Proviso Partially for such purposes Proportionate ITC

9

Raw Material Defined U/s. 2(19) of the Act as

under;

raw materials means

goods used as ingredient in the manufacture of other

goods and includes

processing materials,

consumable stores

and material used in the packing of the goods so

manufactured

but does not include fuels for the purpose of generation of

electricity;

Section 11(3)(a) - Important Terms

10

Manufacture Defined U/s. 2(14) of the Act as

under;

manufacture with its grammatical variations and

cognate expressions means includes

producing, making, extracting, collecting, altering,

ornamenting, fishing, assembling or otherwise processing,

treating or adapting any goods;

but does not include such manufactures or manufacturing

processes as may be prescribed;

Section 11(3)(a) - Important Terms

11

Capital Goods Defined U/s. 2(5) of the Act as

under;

Capital Goods means

plant and machinery (other than second hand plant and

machinery)

meant for use in manufacture of taxable good

and accounted as capital assets in the books of accounts;

Section 11(3)(a) - Important Terms

12

ITC shall be REDUCED by 4% of THE TAXABLE TURNOVER OF

PURCHASES in following cases;

Section 11(3)(b) Reduction of ITC

@ 4%

of T.G. consigned or dispatched for B.T. or to his agent

outside the state, OR

@ 4%

of T.G. used as RM in the Mfg., or in the packing of goods

which are dispatched outside the State in the course of B.T.

or consignment or to his agent outside the State.

@ 4%

of FULES used for the manufacture of goods.

Proviso If Tax Rate of item is < 4%, Reduction at such lower rate.

13

No ITC to be claimed Except

ORIGINAL TAX INVOICE Received

Invoices - Section 60

R.D. T.G. R.D.

Rule 42

Serially & Mechanically Numbered

Zero Rated Sale Triplicate

Other details to be contained in TI.

Section 11(4) ITC On TI Only

14

Section 11(5) Ineligible ITC

11(5) No ITC on Purchases of / from

Unregistered Dealer

Dealer Not liable to Tax

Lump sum Dealer paying Tax U/s. 14, 14A, 14B, 14C or

14D

15

Section 11(5)

made prior to the relevant date of liability to pay tax as

provided in sub-section (3) of section 3;

made prior to the date of registration;

However, provisions have been made wherein,

A registered dealer shall be allowed to claim tax credit

for the taxable goods held in stock on the date of registration

which are purchased after 1st April, 2008

and during the period of one year ending on the date of

registration. (Explanation I)

Rule 15(5A) Registration Within 30 days

Form 111 To be filed with the first return after registration

16

Inter-State purchase;

Goods which are disposed of otherwise than in sale, resale or

manufacture;

Schedule I Goods / Wholly Exempt Goods by a notification u/s.

5(2);

Goods which are used in manufacture / packing of Sch. I Goods /

Wholly Exempt Goods by a Notification u/s. 5(2);

CG which are used in Mfg. of Sch. I Goods / Wholly Exempt

Goods by Noti. u/s. 5(2) or in generation of electrical energy

including captive power;

Section 11(5)

17

Vehicles of any type and its equipment, accessories or spare

parts (expect for resale)

Goods not connected with the business of the dealer;

Goods which are used as fuel in generation of electrical

energy meant for captive use or otherwise;

Petrol, high speed diesel, crude oil and lignite unless for

resale;

Goods which are used as fuel in motor vehicles;

Section 11(5)

18

Capital Goods involved in execution of Works contract;

Goods for which right to use is transferred;

Made from a dealer AFTER the name of such dealer has

been published u/s. 27(11) or section 97; (Clause -

mmmm)

Unsold stock at the time of closure of business;

Section 11(5)

19

Goods purchased by Lump sum Dealer;

However, provisions have been made wherein,

Lump sum Dealer is allowed to claim tax credit

for the taxable goods held in stock

which are purchased after 1st April, 2008 and

during the period of one year ending on the date of

liability to pay tax under section 7. (Explanation III)

Rule 15(5B) Application within 30 days

Form 112 To be filed with the first return as a regular

dealer

Benefit Not available in case of compulsory revocation

of Lump sum Permission on violation of any conditions.

Section 11(5)

20

Where original invoice does not contain the details of tax

charged separately;

where original tax invoice or duplicate as per rules not

available with purchasing dealer or there is evidence that

invoice is false / fabricated;

Section 11(5)

21

Section 11(6) - Power of S.G.

The State Government may, by notification in the Official

Gazette, specify

any goods or

the class of dealers

that shall not be entitled to whole or partial tax credit.

Govt. of Gujarat has issued Notification for Reduction of 2%

ITC of Taxable Goods used in interstate trade or commerce.

First Notification issued on 29

th

June, 2010

Notification amended on 7

th

September, 2010 - (GHN-35)

VAT-2010-S11(6)

22

Section 11(6) - Notification

Description of goods Non-entitlement

of tax credit

whether whole

or partial

Restrictions and conditions

if any

All goods excluding the

goods specified in

Schedule-II of the Act,

in entries at serial

numbers,-

(i) 13,

(ii) 24,

(iii) 48(i) namely

Isabgul, Jira, variali,

Methi, Suva, Ajma,

Asalia, Kalingda

seeds, Khas khas,

Dhana, Dhana dal

and Pepper,

(iv) 54 and

(v) 76.

To the extent of

2% on

the taxable

turnover of

purchases

within the State

for WHICH TAX

CREDIT IS

ADMISSIBLE.

(1)This entry shall come into force with effect from 1st

October,

2010.

(2)The input tax credit shall be reduced when;

(i) the goods are sold/resold in the

course of inter state trade and

commerce, or

(ii) the goods are used as input including raw

material in the

manufacture of goods which are sold in the course of

inter state

trade and commerce.

23

Section 11(6) Auditor Note

ITC 2% Reduction

VAT Audit? How to Verify?

24

Section 11(7) Billing Dealers

Where a R.D. without entering into a transaction of sale,

issues to another R.D.

tax invoice, retail invoice, bill or cash memorandum

with the intention to defraud the Govt. revenue or with the

intention that the Govt. may be defrauded of its revenue,

the Commissioner may, after making such inquiry as he thinks fit

and giving a reasonable opportunity of being heard,

deny the benefit of tax credit, in respect of such transaction,

to such R.D. ISSUING OR ACCEPTING such TI, RI, bill, cash

memo either PROSPECTIVELY OR RETROSPECTIVELY

from such date as the Commissioner may, having regard to the

circumstances of the case, fix.

25

New Section Inserted w.e.f. 01.04.2013

No ITC if tax not paid by vendor dealer;

Notwithstanding anything contained in this section,

In no case

The amount of tax credit on any purchase of goods

shall exceed

The amount of tax in respect of the same goods, actually paid, if

any , under this Act or any earlier law, into the Government Treasury

Facility to Check ITC Profile on VAT Website

Circular No. 123 dated 21.05.2013

Section 11(7A) -

Tax Payment - Must

26

To practically facilitate the provisions, facility has been

provided to Check ITC Profile on VAT Website

Section 11(7A)

27

Section 11(8)(a) - Reduction

Goods Not used for intended purposes

Either as per 11(3) or

used in any prohibited activity as per provision of 11(5)

Partly or Fully

Proportionate Credit

28

Capital Goods

Not used for Continuous Period of Five Years

Proportionate Reduction

Temporary discontinuation due to Repairs & Maintenance?

Section 11(8)(b) - Reduction of

ITC on Capital Goods

29

Section 11(8)(b) Audit Note

30

Section 11(9)

The registered dealer may claim

the amount of net tax credit,

which shall be determined in the manner as may be prescribed.

Rule 15 (Computational Provision General)

31

Section 11(10) C. N. / D. N.

Credit / Debit Note as per Section 61

Goods return, Discount or any other reason

ITC Excess / Short Claim

Adjust amount of ITC in Tax Period in which C.N. / D. N. issued

Section 61 - Subject to the provisions of sections 8 and 60,

where a TI is issued and

(a) Tax Charged > The actual tax charged in respect of the sale

concerned, the seller shall provide the purchaser with a credit

note;

(b) Actual tax charged > The tax shown in the tax invoice as

charged, the seller shall provide the purchaser with a debit note:

32

Section 11(11)

R. D. to apply FAIR & REASONABLE Method to

determind eligible ITC

What is Fair & Reasonable? Subjective / Objective?

Commissioner given power to reject method adopted

by R.D.

33

Section 11(12)

ITC cannot be transferred to any other dealer except

as provided.

Principal & Commission Agent Rule 17

Transfer of Business

34

For the purpose of this section

the amount of Tax Credit on any purchase of goods

shall not exceed

the amount of tax actually paid or payable

under this Act in respect of the same goods.

What does this mean?

Explanation to Section 11

35

POSERS

Poser - 1

Whether Purchase Tax U/s. 9 of the Act is required to be PAID IN

CASH only to be eligible to get its Input Tax Credit? Does the

same hold equally good for Entry Tax?

38

Section 11(1)(a) provides credit for Purchase Tax & Entry Tax Paid

Rule 15(5) of GVAT Rules, 2006 reads as under;

The amount of tax paid under sub-section (1), (2), (5) or (6) of

section 9 of the Act and the amount of tax paid under the Gujarat

Tax on Entry of Specified Goods into Local Areas Act, 2001 shall

be claimed in the tax period in which such amount has been

paid.

Explanation.- For the purpose of calculating the tax credit, the

amount of tax under sub-section (1), (5) or (6) of section 9 of the

Act or the amount of tax under the Gujarat Tax on Entry of Specified

Goods into Local Areas Act, 2001 is shown payable by the dealer in

his return for a tax period, then such amount of tax shall be

considered to have been paid In such tax period.

Poser - 1

39

Thus, it is not necessary that Purchase Tax is to be PAID IN

CASH ONLY.

Entry Tax being governed by the Gujarat Tax on Entry of

Specified Goods into Local Areas Act, 2001, GVAT Rules cant

override it and it has to be paid as per provision of that Act.

However, dealer is entitled to ITC of Entry Tax of November

Month paid in the month of December in the November month

itself by virtue of this explanation.

Poser - 1

40

Poser - 2

ABC Metal Products is manufacturer of various brass products.

For the year 2012-13, it has purchased Machineries worth ` 20

Lac for manufacture of its goods. Whether 100% ITC of VAT

paid on these machineries is available in the first year itself?

While doing VAT Audit, any precaution to be kept by VAT

Auditor while certifying its admissibility? What if Machineries are

sold after 3 years?

Yes

Auditors Note

Proportionate ITC to be reversed.

41

Poser - 3

Mr. A is running a petrol pump. He has purchased tanker for

transportation of petrol and diesel from Company Depot to its

Petrol Pump. Is he eligible to get input tax credit of Vat Paid on

Tanker?

No

Section 11(5)(j) specifically prohibits credit of any Vehicle.

42

Poser - 4

In a Petrol Pump run by Mr. A, there occurs natural loss of

quantity of petrol and diesel due to evaporation and moisture.

Whether any ITC is to be reduced?

It is a kind of Natural Loss.

Circular No. Gujka/VAT/28/2008-09/94 dated 09.04.2009

specifies the limit to which such loss is allowable.

Hence No ITC Reduction for loss occurred within that limit.

43

Poser - 5

ABC Limited has just commenced its business of manufacturing

brass electrical parts in FY 2012-13. It has made purchases of

machineries worth ` 4 Lac prior to date of its registration under

VAT Act. It has duly made application for registration within 30

days of its liability under VAT Act. Can it claim ITC of such

machineries?

As per Section 11(5), a R. D. shall be allowed to claim tax credit

for the taxable goods held in stock on the date of registration

which are purchased after 1st April, 2008 and during the period

of one year ending on the date of registration.

As in the section words used are Taxable Goods held in

Stock, it appears that same benefit is not available to Capital

Goods and hence credit may not be admissible.

44

Poser - 6

ABC & Co. has claimed input tax credit of building and

construction material purchased for construction of foundation of

Plant & Machinery and accounted for them as Capital Goods in

its books of account. During the course of assessment, CTO is

denying ITC on such goods. Discuss its validity or otherwise.

What is Capital Goods? What is P & M?

Plant & Machinery cant function without foundation for it.

Hence building & construction material purchased for

construction of foundation of P & M becomes part and parcel

of Plant itself and hence eligible for ITC.

Anil Products Ltd v. State of Gujarat 2011-GSTB-IV-1201

(Followed Orissa HC judgment in Orissa Power Generation

Corp. Ltd. V/s. Commissioner of Commercial Taxes)

45

Poser - 7

ABC & Co. has claimed input tax credit electrical goods / items

to be used in operation of its Plant & Machinery. It has accounted

these electrical goods as Capital Goods in its books of account.

ITC on these goods is denied by VAT Department. Discuss

admissibility of ITC on such goods.

Plant & Machinery cannot be operated without Electrical

Goods. Hence ITC allowed. (Doesnt apply to all Electrical

Goods)

Anil Products Limited v. The State of Gujarat (GVAT TRI.)

2011-GSTB-IV-1201

Hitachi Home & Life Solutions (India) Ltd. v. The State of

Gujarat (GVAT Tri.) 2010-GSTB-II-648

46

Poser - 8

How to calculate ITC to be reduced of goods sold in the course of

interstate trade or commerce?

Local Trader Only sells in Gujarat Not Applicable

OGS Trader No Local Sale All sales are in the course of

interstate trade or commerce Reduce 2% of Taxable

Turnover of Purchases within State of which Credit is

available.

Local & OGS Sale Purchase Relating to OGS Sale can be

identified separately Reduce ITC on that only Proper &

Separate Records must be kept to justify such reduction.

47

Poser - 8

Local & OGS Sale Identification of Goods Not Possible

Proportionate Based on % of Interstate Sales / Total Sales

Apply this ratio to Taxable Turnover of Purchases within

Gujarat of which credit is admissible to compute such

eligible goods used in the course of interstate trade or

commerce and then reduce 2% ITC.

Pro-Rata Method upheld in the decision of Jayant Extraction

Industries v. State of Gujarat 85 STC 3 (Guj.)

48

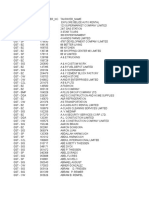

Purchase Amt. (`) Sales Amt. (`)

Local Purchase (TI 4%) 10,00,000 Local Sales (TI 4%) 22,50,000

Local Purchase (TI 12.5%) 2,50,000 Interstate Sales C Form 7,50,000

Local Purchase (RI) 5,00,000

Import 7,50,000

Interstate Purchase C Form 2,50,000

Total Purchase 27,50,000 Total Sales 30,00,000

Poser - 9

A dealer has following purchases and sales during a quarter.

Quantify the amount of ITC to be reduced?

49

Poser - 9

Interstate Sales % [7.50/30.00*100] = 25.00%

Purchases on which ITC is to be reduced

50

Particulars Amount

Local Purchase (TI - 4%) 10,00,000

Local Purchase (TI - 12.5%) 2,50,000

Local Purchase (RI), Import & Interstate Purchase is not

be considered as no credit for the same is available.

0

Total Purchase 12,50,000

Purchase Turnover deemed to be attributable to

Interstate Sales @ 25%

3,12,500

ITC Reduction @ 2% 6,250

Poser - 10

ABC Enterprise is engaged in manufacturing and trading brass

parts. Its 90% sales are Inter-state sales. Such sales are either

being made against C Form @ 2% or without any C Form @

5%. Whether ITC is required to be reduced for goods sold in the

interstate transaction at full rate of 5% (i.e., not at concessional

rate of 2%)?

Yes

ITC Reduction is independent of rate of tax on Interstate Sale.

51

Poser - 11

Whether Notional ITC claimed on purchase of goods from

Unregistered Dealers is subject to 2% reduction for sales made in

the course of interstate trade or commerce?

Whether URD goods on which purchase tax is paid can be

said to be Taxable Goods within the state of which Tax Credit

is available?

Credit is available of what? Purchase Tax Paid or of goods?

Divergent Views

52

Poser - 12

Whether purchases of Capital Goods are required to be

considered while calculating 2% reduction for interstate sale?

Provision applies to the taxable goods which are used as

input including raw material in the manufacture of goods

which are sold in the course of interstate trade and

commerce

No Cant be said Taxable Goods Capital Goods are

New Plant & Machinery

53

Poser - 13

For the purpose of ITC reduction on account of goods sold in the

course of inter-state trade or commerce, whether, purchase price

of taxable turnover is to be considered inclusive of VAT or

exclusive of VAT?

What is Turnover of Purchase?

Section 2(32) - turnover of purchases means the aggregate of

the amounts of purchase price paid or payable by a dealer in

respect of any purchase of goods made by him during a given

period after deducting the amount of purchase price, if any,

refunded to the dealer by the seller in respect of any goods

purchased from the seller and returned to him within the

prescribed period;

54

Based on this definition, Ld. Joint Commissioner of Commercial Tax (Legal)

has passed a determination order u/s. 80 of the Act, wherein, he has held

that reduction should be made on turnover of purchase price inclusive of

VAT Amount. (Aerolex Cables Pvt. Ltd. vide order Dt. 26/06/2013

reported in Sales Tax Journal, July 2013, P. No. 399)

However, while passing this order what is the meaning of word purchase price

that has not been considered. It is defined u/s.s. (18) of the as Act as under;

purchase price means the amount of valuable consideration paid or payable

by a person for any purchase made including the amount of duties levied or

leviable under the CET Act, 1985 or the Customs Act, 1962 and any sum

charged for anything done by the seller in respect of the goods at the time of

or before delivery thereof, other than the cost of insurance for transit or of

installation, when such cost is separately charged and includes, -.

VAT is not specifically covered. Whether Tax Charged / Collected forms

part of sales price / purchase price?

Poser - 13

55

Hon'ble Supreme Court in the case of Anand Swarup Mahesh Kumar vs.

The Commissioner of Sales Tax 46 S.T.C. 477 (S.C.) has made the law clear

by making following observations

"From the observations made in the decisions referred to above, it follows

that where a dealer is authorized by law to pass on any tax payable by

him on the transaction of sale to the purchaser, such tax does not form

part of the consideration for purposes of levy of tax on sales or

purchases but where there is no statutory provision authorizing the dealer

to pass on the tax to the purchaser, such tax does form part of the

consideration when he includes it in the price and realizes the same from

the purchaser. The essential factor which distinguishes the former class of

cases from the latter class is the existence of a statutory provision

authorizing a dealer to recover the tax payable on the transaction of sale

from the purchaser."

Poser - 13

56

This decision has been followed in the recent decision of

Gujarat VAT Tribunal in the case of Essar Steel Limited,

wherein, it has been held that in case of reduction of ITC for

B.T., purchase turnover is to be taken exclusive of VAT

amount.

Poser - 13

57

Poser - 14

AK Electronics is engaged in the business of sale of LED, LCD,

Television, and other electrical products. During festival season, it

offers to its customers various schemes such as on purchase of one

LED, small music system/pressing iron is given free. All items given

free by it are purchased against Tax Invoice and ITC is claimed

on these goods. Can it claim ITC on these goods?

Goods given free are not used for allowed intended purposes

Provisions of Section 11(5) apply

If dealer can prove that free item price is already marked up

or included in sale price of main item Can dealer escape

from ITC reversal? Very Difficult to establish and litigation is

possible.

59

Poser - 15

A dealer has made certain taxable purchases against Retail

Invoice. RI contains all details required in Tax Invoice. Can he

claim Tax Credit? Are there any exceptional circumstances

wherein ITC is held to be allowable on RI Purchases?

Section 11(4) mandates Original Tax Invoice

Section 11(5)(o)(p) disallows ITC in the absence of TI

Section 60 Tax Invoice r.w.r. 42

60

In the case of Gill & Co. Pvt. Ltd. (Tax Reporter, April 2013, P. No. 55),

Hon. Tribunal has laid down that ITC can be allowed to the purchasing

dealer in absence of tax invoice only when following three conditions are

satisfied;

RI, Debit Note or Cash Memo produced in lieu of TI contains all the requisite

particulars of TI;

Selling Dealer is prohibited under the Act from issuance of tax invoice;

Selling Dealer has paid the tax amount collected from the purchasing dealers to

the State Govt.

When all these three condition are satisfied, then only ITC can be allowed

to the purchasing dealer even on the basis of RI, DN or Cash Memo.

M/s. Rajkamal Auto Centre v. The State of Gujarat (Tax Reporter Sept.

2013 P. No. 73) Condition No. 2 Relaxed in the manner that technical

problem in issuance of TI also considered valid to allow ITC on RI.

Poser - 15

61

Poser - 16

ABC Limited is an export-oriented unit. It incurs heavy

expenditure on preparation of leaflets / pamphlets of various

products manufactured by it. Can it claim ITC of VAT borne on

preparation of these advertising materials?

No

It is not for intended purposes as prescribed u/s. 11(3)(a)

Alembic Limited v. State of Gujarat 2010-GSTB-I-37

62

Poser - 17

Can ITC be reduced of goods destroyed in fire or flood or by

any other Act of God? Can it be said under such cases that

goods are disposed of in the manner other than allowed

intended purpose?

Section 11(8) Reduction of ITC if goods not used for

intended purposes.

An act of God is a good excuse for not complying any

condition Industrial Financial Corporation of India Ltd. v.

Cannor Sppinnig & Weaving Mills Ltd. [AIR 2002 SC 1841]

Nonperformance of any condition for reasons beyond the

control of a party is a good excuse.

S. A. Himnani Distributors Pvt. Ltd. (Trib) -2013-GSTB-I-268

Rollcon Engg. Co. Ltd. (21 VST 117)

63

Section 11(5)(f) provides that if the goods are disposed of

otherwise than in sale, resale or manufacture, ITC shall not be

allowed of such goods.

Hon. SC has, in the case of Deputy Commissioner Of Sales

Tax (Law),Board Of Revenue (Tax) V. Thomas Stephen &

Co. Ltd. [69 STC 320] has held that disposal means transfer

of property in goods from one to another.

In case of destruction of goods, there can not be transfer of

ownership of goods.

Poser - 17

64

Poser - 18

LSD Private Limited is a manufacture of drugs and medicines.

Under the Drugs & Cosmetic Act, 1940, it is required to keep a

laboratory and test its goods before marketing? Is ITC allowable

of goods used for such testing purpose?

No

Alembic Limited v. State of Gujarat 2010-GSTB-I-214

65

Poser - 19

ABC Limited is engaged in manufacture of various crude and

other products. After manufacture of such goods, same are

transferred to its branches located outside Gujarat. In

manufacture of these goods, furnace oil taxable @ 5% and

natural gas taxable @ 15% is used. ITC is to be reduced under

which clause and at what rate?

Section - 11(3)(b)

Which clause (b) or (c) or both

Reliance Industries Limited v. State of Gujarat (2013) 58 VST

376 (Guj HC) restricted disallowance to 4% only holding out

that only one sub-clause will apply. Dept. has preferred

appeal against this order in the SC.

66

Poser - 20

In the above case, lignite is also used by the company in

manufacture of goods which are sent to its branches located

outside Gujarat. Lignite is taxable @ 20% + 2.5%. Assessing

Authority is of view that ITC is to be reduced @ 8% of purchase

price of Lignite. Kindly share your view on validity or otherwise

of this proposition.

No ITC of Lignite u/s. 11(5)

Can anything be reduced from Zero?

Explanation to 11(3)(b) also clarifies that where ITC available is

less than 4%, disallowance is to be restricted to that much amount

only.

No Essar Steel Limited (Gujarat VAT Tri.)

67

Poser - 21

In case of Branch Transfer of Goods outside the State for

manufacturing there and receiving back in the State after

manufacturing, whether ITC is to be reduced? All goods are

received back in the State of Gujarat and Output Tax Liability is

also discharges as per Law.

No revenue loss.

However, Hon. Tribunal has held that provision of 11(3)(a) are

subject to provisions of 11(3)(b) and hence ITC is to be reduced.

JCT Limited v . The State of Gujarat 2008-GSTB-II-307

68

Poser - 22

Iron Limited is engaged in the business of manufacture of sponge

iron. Coal is used as Raw Material in manufacture of sponge iron.

Can ITC be reduced u/s. 11(3)(b)(iii) of the Act considering it to

be used as fuel in the manufacturing of goods?

Coal is not used for generating heat Hence cant be said to be

used as fuel.

Welspun Steel Limited v. The State of Gujarat

69

Poser - 23

In case of reduction of ITC u/s. 11(3)(b) of the Act, whether ITC to

be reduced is on VAT Inclusive / Exclusive amount?

Exclusive

Essar Steel Limited S.A. No. 155 of 2020 decided on

05/06/2013

70

Poser - 24

G & Co. has purchased goods from F & Co. during the year

2008-09. Registration Certificate of F & Co. has been cancelled

retrospectively w.e.f. 01.04.2006. Order cancelling RC of F &

Co. has been passed in the year 2010-11 and its name is

published in that year only. In the assessment, authorities are

denying ITC to G & Co. of all goods purchased from F & Co. in

the year 2008-09, when, it was holding valid Registration

Certificate. Is this valid?

Section 11(5)(mmmm)

Section 11(7)

71

Decisions in favour of dealer

Meet Traders v. State of Gujarat (SCA 14739 of 2012)

Mahesh Traders v. State of Gujarat (Trib.) 2011-GSTB-IV-1792

Shree Kiran Oil Mill V. State of Gujarat (Trib.) 2011-GSTB-I-349

Harsh Jewellers v. CTO, Hyderabad[2013] 57 VST 538 (AP)

Althaf Shoes (P) Ltd. v. Asst. Com. (CT), [2012] 50 VST 179 (Mad.)

Gheru Lal Bal Chand v. State of Haryana and Another [2011] 45

VST 195 (P&H)

Giriraj Sales Corporation v. State of Guj. & Oth 125 STC 369 (Guj.)

State of Maharashtra v. Suresh Trading Company 109 STC 439 (SC)

Vijaya Traders V. CTO [2011] 45 VST 113 (AP)

Poser - 24

72

Poser - 24

Decisions against Dealer

Madhav Steel Corporation v. The State of Gujarat (Trib.) (SA No. 451 of

2011 dated 01.08.2013) (Sales Tax Journal, August 2013, P. No. 495)

Mahalaxmi Cotton Ginning Pressing and Oil Ind. V. State of Maharashtra

and Others [2012] 51 VST 1 (Bom)

Timex Art Dcor Pvt. Ltd. v. State of Maharashtra and others [2013] 61 VST

324 (Bom.)

73

Poser - 25

In case of genuine transactions, whether purchasing

dealer can be denied of ITC for non-payment of taxes

by vendor? Can he be penalized for such breach of law

not committed by him?

For Period Prior to 01.04.2013 - No

For Period after 01.04.2013 - Yes Lets be on a safer side -

11(7A) Subject to Constitutional Validity and Litigation - Too

Early to Say

Penalty Where are we?

Hindustan Steel Ltd. V. State of Orissa 1970 AIR 253 (SC)

74

Poser - 26

Newtech Mobile Private Limited is an authorized dealer of Nokia Company.

Modus operandi and billing system under this business is as under; Company

bills it a mobile instrument, say at ` 30000 on which VAT @ 15% is charged

and collected by company. Thereafter, company issues to it CN of ` 3000,

wherein, no separate mention of any VAT particular is made. It sells this mobile

instrument at ` 28000 and VAT is paid on this amount. On account of effective

reduction in cost of mobile and subsequent sale at a price below originally

billed price, dealer is always having surplus VAT Credit. It has claimed for

refund of this amount. Department is denying it on the ground that it has sold

goods at loss and hence refund cannot be allowed. Alternatively, they are

allowing credit of only ` 27000 (30000-3000) and not of ` 30000. Discuss its

validity.

Debatable Issue

No ITC for goods sold below price? Under which Provision?

If CN doesn't show tax separately, can it be considered inclusive of tax?

Though such objections are being raised at assessment time, at present, in

some cases, refunds are ultimately granted by Department.

75

Disclaimer

Immense care has been taken while preparing the presentation; however,

mistakes may creep in. It is, therefore, recommended that the Original

Provisions of Act & Rules may be referred to or professional advice may

be sought before acting on the basis of views, analysis and

interpretations in this presentation. This presentation is for general

information and intended for private circulation only among clients,

friends and relatives.

Contact Info

CA. Ravindra R. Manek

Chartered Accountant

+91 0288-2677752

rmanek_associates@yahoo.in

R. Manek & Associates

Chartered Accountants

224-225-226,

Indraprasth Complex,

Pancheshwar Tower Road,

Jamnagar (GUJARAT) 361001

Das könnte Ihnen auch gefallen

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisVon EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNoch keine Bewertungen

- TRAINING. NOTES Commercial TaxDokument116 SeitenTRAINING. NOTES Commercial TaxVipin Thomas100% (1)

- 2022 P T D (Trib.) 783Dokument7 Seiten2022 P T D (Trib.) 783livajan212Noch keine Bewertungen

- VAT ERROR Madurai 19092015 Session VDokument40 SeitenVAT ERROR Madurai 19092015 Session VsolomonNoch keine Bewertungen

- Western Mindanao Power Corporation Vs Cir GR No. 181136Dokument15 SeitenWestern Mindanao Power Corporation Vs Cir GR No. 181136Sonny MorilloNoch keine Bewertungen

- Excise DutyDokument4 SeitenExcise DutyDigvijay LakdeNoch keine Bewertungen

- TaxmannPPT - Threadbare Discussion On Clause 44Dokument21 SeitenTaxmannPPT - Threadbare Discussion On Clause 44VaibhavNoch keine Bewertungen

- Fort Bonifacio Development vs. CIRDokument23 SeitenFort Bonifacio Development vs. CIRred gynNoch keine Bewertungen

- Sales Tax - 03Dokument6 SeitenSales Tax - 03Bilal ShaikhNoch keine Bewertungen

- Rmo 3-2009Dokument29 SeitenRmo 3-2009sheena100% (2)

- 43677RMO 3-2009 - Suspension GroundsDokument29 Seiten43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjNoch keine Bewertungen

- Gujarat Value Added Tax ActDokument7 SeitenGujarat Value Added Tax ActvikrantkapadiaNoch keine Bewertungen

- I. Courts Case Digests: Tax Updates SeminarDokument9 SeitenI. Courts Case Digests: Tax Updates SeminarJennilyn TugelidaNoch keine Bewertungen

- Unit 3 Notes GSTDokument8 SeitenUnit 3 Notes GSTayusha dasNoch keine Bewertungen

- Input Tax Credit (GST)Dokument16 SeitenInput Tax Credit (GST)ravi.pansuriya07Noch keine Bewertungen

- CREATE-IRR 5nov DTIDOFPOGO-transitoryDokument3 SeitenCREATE-IRR 5nov DTIDOFPOGO-transitorygraceNoch keine Bewertungen

- Rulings1998 DigestDokument29 SeitenRulings1998 DigestsophiegenesisNoch keine Bewertungen

- Small Scale Exemption SchemeDokument8 SeitenSmall Scale Exemption SchemebakulhariaNoch keine Bewertungen

- Nippon Express Vs CIRDokument5 SeitenNippon Express Vs CIRClariza ReyesNoch keine Bewertungen

- TaxationDokument55 SeitenTaxationorlandoNoch keine Bewertungen

- Itc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund TransferDokument51 SeitenItc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund Transfershivam beniwalNoch keine Bewertungen

- Rulings2000 DigestDokument21 SeitenRulings2000 DigestArriane MartinezNoch keine Bewertungen

- Goods and Service Tax NoDokument5 SeitenGoods and Service Tax NonitinNoch keine Bewertungen

- Updates and Critical Areas in TaxationDokument327 SeitenUpdates and Critical Areas in TaxationMark MagnoNoch keine Bewertungen

- EOU Audit ChecksDokument5 SeitenEOU Audit Checksశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- Field Training Report 127411Dokument7 SeitenField Training Report 127411deepak mauryaNoch keine Bewertungen

- Fort Bonifacio v. CIRDokument3 SeitenFort Bonifacio v. CIRAngelique Padilla UgayNoch keine Bewertungen

- Excise Law PDFDokument54 SeitenExcise Law PDFJay BudhdhabhattiNoch keine Bewertungen

- Sales Tax PesentationDokument19 SeitenSales Tax PesentationMukund MungalparaNoch keine Bewertungen

- GST Unit 1 BDokument23 SeitenGST Unit 1 BMukul BhatnagarNoch keine Bewertungen

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDokument4 SeitenComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- GST Itc DetailDokument8 SeitenGST Itc DetailAnonymous ikQZphNoch keine Bewertungen

- 53 Summary On Vat CST and WCTDokument16 Seiten53 Summary On Vat CST and WCTYogesh DeokarNoch keine Bewertungen

- Section 195 and Form 15CBDokument53 SeitenSection 195 and Form 15CBVALTIM09Noch keine Bewertungen

- Revenue Bulletin No. 1-2003 No Ruling AreasDokument3 SeitenRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilNoch keine Bewertungen

- VAT RulesDokument11 SeitenVAT RulesamrkiplNoch keine Bewertungen

- (VAT) in To: Clarifying (RR) No. The The Tax of (TaxDokument13 Seiten(VAT) in To: Clarifying (RR) No. The The Tax of (TaxShiela Marie Maraon100% (1)

- RMC No. 24-2022Dokument13 SeitenRMC No. 24-2022arnulfojr hicoNoch keine Bewertungen

- SGV Tax Updates 2018 PDFDokument24 SeitenSGV Tax Updates 2018 PDFRhenfacelManlegroNoch keine Bewertungen

- Punjab Vat NoteDokument12 SeitenPunjab Vat NoteSuraj SinghNoch keine Bewertungen

- Returns: FAQ'sDokument25 SeitenReturns: FAQ'smun1barejaNoch keine Bewertungen

- Requirements U/S 195: By: Ca Sanjay K. AgarwalDokument71 SeitenRequirements U/S 195: By: Ca Sanjay K. AgarwalHemanthKumarNoch keine Bewertungen

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Dokument7 SeitenStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNoch keine Bewertungen

- @GSTMCQ Chapter 5 Input Tax CreditDokument15 Seiten@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNoch keine Bewertungen

- Value Added TaxDokument20 SeitenValue Added TaxJerlene Sydney Centeno100% (1)

- GST Unit 3 (2021)Dokument43 SeitenGST Unit 3 (2021)Anwesha HotaNoch keine Bewertungen

- 099 - Chamber of Real Estate and Builders Associations Inc v. Romulo DigestDokument6 Seiten099 - Chamber of Real Estate and Builders Associations Inc v. Romulo DigestCharvan CharengNoch keine Bewertungen

- INPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTDokument3 SeitenINPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTthinkbeforeyoutalkNoch keine Bewertungen

- 2011 PTD (Trib) 1306Dokument22 Seiten2011 PTD (Trib) 1306Imran Memon100% (1)

- 6.case Study On Input Tax Credit Under GSTDokument17 Seiten6.case Study On Input Tax Credit Under GSTSUNIL PUJARINoch keine Bewertungen

- VAT 404 - Guide For Vendors - External GuideDokument110 SeitenVAT 404 - Guide For Vendors - External Guidesimphiwe8043Noch keine Bewertungen

- Bir Atp MemoDokument10 SeitenBir Atp Memobge5Noch keine Bewertungen

- Petitioner Vs Vs Respondents: en BancDokument30 SeitenPetitioner Vs Vs Respondents: en BancZen DanielNoch keine Bewertungen

- Overview of GST Session II and III Final - RTCDokument25 SeitenOverview of GST Session II and III Final - RTCSuresh Kumar YathirajuNoch keine Bewertungen

- Article On Composition Scheme With Case StudyDokument12 SeitenArticle On Composition Scheme With Case StudySejal GuptaNoch keine Bewertungen

- GR No. 173425 Full CaseDokument24 SeitenGR No. 173425 Full CaseRene ValentosNoch keine Bewertungen

- RR No. 16-18Dokument5 SeitenRR No. 16-18Ckey ArNoch keine Bewertungen

- Lipton Brand PlanDokument44 SeitenLipton Brand PlanHassan AhmedNoch keine Bewertungen

- EU Legislation Labelling of Textile Products - Including GarmentsDokument5 SeitenEU Legislation Labelling of Textile Products - Including GarmentsBill KelsoNoch keine Bewertungen

- A Publication of The Nashville Downtown PartnershipDokument19 SeitenA Publication of The Nashville Downtown Partnershipapi-26011493Noch keine Bewertungen

- Marketing StratergyDokument3 SeitenMarketing StratergyPratik RaneNoch keine Bewertungen

- Company Profile 2018Dokument35 SeitenCompany Profile 2018berlin tipoNoch keine Bewertungen

- Case Study - PatanjaliDokument19 SeitenCase Study - PatanjalishruthiNoch keine Bewertungen

- Case Study - Wal-Mart Failure in GermanyDokument5 SeitenCase Study - Wal-Mart Failure in GermanyYasser SadekNoch keine Bewertungen

- Adidas CasestudyDokument3 SeitenAdidas Casestudynandini_mba4870Noch keine Bewertungen

- Population Study of SMKCDokument20 SeitenPopulation Study of SMKCAshish DeotaleNoch keine Bewertungen

- TBWA CredentialsDokument29 SeitenTBWA Credentialsvoodooch1ld20% (1)

- Unit 7 Short Test 1A: GrammarDokument2 SeitenUnit 7 Short Test 1A: GrammarOrsolya Óbert100% (1)

- TescoDokument20 SeitenTescoMakp112Noch keine Bewertungen

- PDFDokument1 SeitePDFSandeep RajbharNoch keine Bewertungen

- Hang Out WB 4Dokument6 SeitenHang Out WB 4hassan12201Noch keine Bewertungen

- Robert A. Brechner Level 1 Chapter 8 - Section I - Exercise 17Dokument8 SeitenRobert A. Brechner Level 1 Chapter 8 - Section I - Exercise 17clint0% (1)

- Purchase ManagementDokument19 SeitenPurchase ManagementUmair SaeedNoch keine Bewertungen

- Fragmatic: Smell Only Good Phase-3Dokument9 SeitenFragmatic: Smell Only Good Phase-3Udit AgarwalNoch keine Bewertungen

- Service Sector TrendsDokument2 SeitenService Sector TrendsAbu BasharNoch keine Bewertungen

- GST Agents July 2016Dokument286 SeitenGST Agents July 2016Shaik NoorshaNoch keine Bewertungen

- STP Analysis of L'oreal.: Presented By: Shreya Gupta Roll No: 59 Course: MBA Sem 1Dokument11 SeitenSTP Analysis of L'oreal.: Presented By: Shreya Gupta Roll No: 59 Course: MBA Sem 1shreyaNoch keine Bewertungen

- Case 6 - Retailing in IndiaDokument22 SeitenCase 6 - Retailing in IndiaSanjay NayakNoch keine Bewertungen

- Synopsis Python CaptchaDokument5 SeitenSynopsis Python CaptchaWIIL WAAALNoch keine Bewertungen

- Business Plan Idea: Epoka UniversityDokument12 SeitenBusiness Plan Idea: Epoka UniversityErli MisNoch keine Bewertungen

- The Effect of Information Satisfaction and Relational Benefit On Consumer's Online Shopping Site CommitmentDokument3 SeitenThe Effect of Information Satisfaction and Relational Benefit On Consumer's Online Shopping Site CommitmentRidho Bramulya IkhsanNoch keine Bewertungen

- Amul Market Analysis - PunjabDokument19 SeitenAmul Market Analysis - PunjabRidhi Dandona100% (1)

- Food AggregatorsDokument3 SeitenFood AggregatorsAnany UpadhyayNoch keine Bewertungen

- Comparative Analysis Between Pizza Hut and DomminosDokument30 SeitenComparative Analysis Between Pizza Hut and DomminosRohan Philips100% (1)

- CASE STUDY: Can Technology Save Sears ?: Group 2Dokument2 SeitenCASE STUDY: Can Technology Save Sears ?: Group 2bui ngoc hoang100% (1)

- Krispy Kreme Matrices-ReportsDokument14 SeitenKrispy Kreme Matrices-ReportsAbid Stanadar100% (1)

- An Introduction To Integrated Marketing CommunicationsDokument28 SeitenAn Introduction To Integrated Marketing Communicationsapi-379300989% (9)