Beruflich Dokumente

Kultur Dokumente

Dhampur Sugars - LKP Sec - 30 11 09

Hochgeladen von

api-19978586Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dhampur Sugars - LKP Sec - 30 11 09

Hochgeladen von

api-19978586Copyright:

Verfügbare Formate

Company Update

Dhampur Sugars Ltd Rs.132

…company update Buy

Industry : Sugar BSE/NSE Code : 500119/DHAMPURSUG

Company P/E : 7.4x FY10E 52 Week H/L (Rs) : 145/20

Market Cap. (Rs) : 7.16 bn Avg. Daily Traded Volumes : 276223

Face Value (Rs) : 10 Target (Rs) : 162

Investment Argument

• Raw Sugar To Help Heal The Fall In Cane Sugar Sales

Dhampur has imported raw sugar to bridge the gap due to lower availability of cane sugar. The company has

contracted to import a total of 2,50,000 tons of raw sugar at an extremely competitive rate of ~USD 400 per

ton. Of the total raw sugar contracted, the company has already sold 60,000 tons & has refined 18,000 tons.

The company intends to refine & sell the balance sugar in FY10E. We believe that refining & selling raw sugar

would compensate the loss of revenue due to lower cane sugar.

• New Power Policy By UP Government To Help Boost Power Profitability

The new UP power policy allows sugar mills to produce power from other alternative fuel in absence of

availability of bagasse. Thus, the sugar companies now will be able to produce even during the off-season. The

UP govt. has further allowed the sugar mills to sell 50 % of the power generated during the off-season outside

the state and further 10 % power to a third party within 50 km radius of the sugar mill. The UP govt has upward

revised tariffs for purchase of electricity from sugar mills to Rs 4 a unit from 2009-10 to 2013-14. This has

enabled Dhampur Sugar to implement the installation of Multi-Fuel Boilers and hence there would be an

increased contribution from the power biz from FY'10E onwards.

• Low Cost Loans To Help Improve Profitability this fiscal

Dhampur is replacing its expensive loans with low cost loans. The company has close to Rs.7bn debt as on 30th

September 2009, of which nearly Rs. 1390mn (Rs. 750mn in FY'08) is loan from Sugar Development Fund (SDF)

at an attractive rate of interest of just 4%. The company has Rs.810mn of '0' cost loans. This will help Dhampur

to significantly cut down on its interest cost by ~ Rs.200mn in FY'10E. Dhampur would repay ~ Rs.1200mn of

loans in the current fiscal, resulting in the favorable debt:equity position of 1x v/s 2x in FY08.

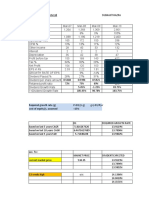

Sensitivity Analysis

Sensitivity 1: Change In EPS With Respect To Sensitivity 2: Change In Target Price With Respect To

Change In Sugar Sold & Sugar Price Change In Sugar Sold & Sugar Price

0.418 0.422 0.425 0.428 0.432 0.418 0.422 0.425 0.428 0.432

32 7 9 11 13 15 32 63 84 100 116 132

33 14 16 18 20 22 33 129 146 162 179 195

34 21 23 25 27 29 34 191 208 225 242 259

35 28 30 32 34 36 35 252 270 288 305 322

36 35 37 39 41 43 36 313 332 350 368 386

Note: The shaded portion is our base case assumptions

1. We have assumed the sugarcane price constant at Rs 210 per quintal.

2. With every Re 1 change in the sugar price per kg, the EPS changes by Rs 7 & the target price changes by Rs

62 per share.

3. With every 0.8 % change in the sugar sold, the EPS changes by Rs 2 & the target price changes by Rs 16 -

Rs 17 per share.

LKP Research November

14 30, 2009 Ami Shah

Company Update

Valuation

India started the current crushing season with a decade low closing stock. Further, we expect the sugarcane

production to remain muted for another year, continuing the upward movement in the sugar cycle. We maintain our

BULLISH OUTLOOK on the sector. Dhampur Sugars Ltd being an integrated sugar mill is expected to post a growth

of ~73% YoY on the back of ~33% increase in realization & ~14% growth in the sales volume due to better yield

& better recovery vis-à-vis the previous year. Dhampur's power business is expected to report ~25% growth YoY, on

account of new power policy announced by UP government. At the CMP of Rs 132, the stock trades at 7.4x its FY'10E

EPS of Rs 18. We re-iterate our BUY call on the stock with a PRICE TARGET OF RS 162 providing a potential upside

of 22%. At our price target the stock would be trading at 9x its FY'10E earnings.

Sector Outlook

Sugar Sector - "Continues To Remain Sweet Amidst Shortage In Supply"

Demand & Supply in India

Million Tons FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10E FY11E FY12E

Opening Stock 9.3 10.7 11.3 11.6 8.5 4.0 3.6 9.2 8.1 2.3 1.5 1.2

% Growth 3% -27% -53% -10% 156% -12% -72% -35% -18%

Production 18.5 18.5 20.1 14.0 12.5 19.3 28.3 26.3 14.7 16.2 21.87 27

% Growth -30% -11% 54% 47% -7% -44% 10% 35% 23%

Imports 0 0 0.4 2 2 6 2

% Growth 400% 200% -67%

Total Avaibality 31.4 25.6 21.0 23.3 31.9 35.5 22.8 18.5 23.4 28.2

% Growth -18% -18% 11% 37% 11% -36% -19% 26% 21%

Domestic Consump 16.2 16.8 18.4 17.3 18.5 18.5 21 22.5 22.5 23.25 23.25 24

% Growth -6% 7% 0% 14% 7% 0% 3% 0% 3%

Exports 1 1.1 1.5 0.2 1.2 1.7 4.9

-87% 42% 188%

Total Consumption 17.2 17.9 19.9 17.5 18.5 19.7 22.7 27.4 22.5 23.0 23.0 23.0

% Growth -12% 6% 6% 15% 21% -18% 2% 0%

Closing Stock 10.7 11.3 11.5 8.5 4.5 3.6 9.2 8.1 2.3 1.5 2.4 5.2

% Growth -26% -47% -20% 156% -12% -72% -35% 58% 120%

Closing Stock/

Consumption 66% 67% 63% 49% 24% 24% 41% 30% 10% 7% 10% 23%

Closing Stock

(No. of Months) 7.9 8.1 7.5 5.9 2.9 2.3 5.3 4.3 1.2 0.8 1.2 2.6

Sugar Prices

(Rs./Kg) 13.0 15.5 18.2 19.0 16.0 16.0 24.0 38.0 38.0 35.0

The closing stock for the season ended on 1st October 2009 was the lowest in a decade. This was mainly due to

low area under sugarcane cultivation, lowest yield, & lowest recovery rates in the past. Historically, the domestic

demand has been growing at a CAGR of 5%, while production has been growing at a comparatively slower pace.

Thus, with the opening stock of merely 2.3 MT, expected production of 16.2 MT & a growing demand of ~ 23.3 MT,

there would be shortage of ~5-6 MT which would be filled in by the way of imports. We therefore believe that there

would be a tremendous pressure in maintaining sugar stocks not only by the end of season 2009-10E but also the

season after that, thus sugar prices making new highs would be inevitable. We maintain our BULLISH stance on the

sector.

LKP Research November

15 30, 2009

Company Update

Table 1: Profit and Loss Table 2 :Balance Sheet

YE March (Rs.Mn) FY07 FY08 FY09 FY10E YE March (Rs.Mn) FY07 FY08 FY09E FY10E

Revenues 6068 6967 9356 15944 SOURCES OF FUNDS

Raw Material Cost 4767 4082 6059 11746 Equity Share Capital 503 540 540 540

Employee Cost 404 435 447 465 Reserves & Surplus 3519 3845 4271 5244

Other Exp 986 1025 939 1420

Total Shareholders Funds 4022 4385 4810 5783

Total Exp 6158 5541 7445 13631

Preference Share Capital 88 88 88 88

EBITDA -90 1426 1911 2313

Total debt 6653 9010 7010 5810

EBIDTA (%) -1% 20% 20% 15%

Dep. & Amortisations 332 534 616 650 Capital Employed 10763 13483 11909 11682

EBIT -422 892 1295 1663 APPLICATION OF FUNDS

Interest 445 773 810 610 Gross Fixed Assets 7794 12307 13500 14000

EBT -867 119 485 1053 Net Fixed Assets 5820 9796 10373 10223

Other Income 82 -180 136 50 Capital WIP 4009 244 0 0

PBT -786 -62 621 1103

Investments 262 278 278 278

Tax -181 -98 59 130

Deferred Tax Asset 33 150 150 150

PAT -605 36 562 973

Current Assets 3485 4705 3914 5792

PAT(%) -10% 1% 6% 6%

Less:Extraordinary Item 82 -180 0 0 Inventoires 1800 2809 2563 3713

APAT -686 216 562 973 Sundry Debtors 485 797 769 1310

APAT (%) -11% 3% 6% 6% Cash and Bank 115 196 377 419

Loans & Advances 1085 904 205 349

Table 3:Key Ratios Current Liabilities 2844 1689 2807 4761

YE March FY07 FY08 FY09E FY10E

Liabilities 2728 1494 2576 4368

Per Share Data (Rs.)

EPS -11.2 0.7 10.4 18.0 Provisions 117 195 231 393

CEPS -7.4 13.9 29.4 12.0 Net Current Assets 640 3016 1108 1031

BV 84.4 81.2 89.1 107.1 Total Assets 10763 13483 11909 11682

Growth Ratios (%)

Net Sales 14.8% 34.3% 70.4% Table 4 : Cash Flow

EBITDA 34.0% 21.0% YE March (Rs.Mn) FY07 FY08 FY09E FY10E

PAT 159.6% 73.2%

Net Income Before Tax -786 -62 621 1103

Valuation Ratios (x)

PE 198.9 12.7 7.4 Depreciation 332 534 616 650

P/CEPS 9.5 4.5 11.0 Oper. profit before w.cap chgs -7 1417 1911 2313

P/BV 1.6 1.6 1.5 1.2 Change in WC -162 -1619 2090 119

EV/Sales 2.3 2.3 1.5 0.8 Tax Paid 21 -57 59 130

EV/EBITDA 11.2 7.2 5.4

Cash Flow From Oper. Activities -190 -144 3941 2302

Mcap/Sales 1.2 1.0 0.8 0.4

Operating Ratios (Days) CAPEX 3350 1452 949 500

Inventory Turnover 115 197 126 99 Cash Flow from Investing -3009 -1476 -949 -500

Recievable 29 42 30 30 Issue Of Share Capital 58

Payables 164 78 101 100 Change In Sec. Prem. Acc. 269

Cash Conversion Cycle -20 161 55 29 Proceeds from borrowings 3651 2275 -2000 -1200

Debt: Equity (x) 1.7 2.1 1.5 1.0

Payment of dividend 70

Profitability Ratios (%)

ROCE 6.6% 10.9% 14.2% Cash flow from Financing 2997 1701 -2810 -1760

RONW 4.9% 11.7% 16.8% Cash & Cash Equivalent 115 196 377 419

LKP Research November

16 30, 2009 Ami Shah

Das könnte Ihnen auch gefallen

- Sugar: Sweetness FadingDokument6 SeitenSugar: Sweetness FadingPradeep MotaparthyNoch keine Bewertungen

- Flour Mill Project Business PlanDokument32 SeitenFlour Mill Project Business PlanSintayehu Yeniew100% (1)

- Promo Snapshot Feb 2022 Sales ReportDokument7 SeitenPromo Snapshot Feb 2022 Sales ReportAtulya gargNoch keine Bewertungen

- Sugar Industry Sector Update April 2018Dokument5 SeitenSugar Industry Sector Update April 2018Sehar IshtiaqNoch keine Bewertungen

- Dairy-Industry Outlook April 2023Dokument5 SeitenDairy-Industry Outlook April 2023Adarsh ChamariaNoch keine Bewertungen

- Financial Report Analysis: Mangalore Chemical & Fertilizers LTD and Madras Fertilizers LTDDokument10 SeitenFinancial Report Analysis: Mangalore Chemical & Fertilizers LTD and Madras Fertilizers LTDRonit VermaNoch keine Bewertungen

- Obour Land FY2022 ENDokument4 SeitenObour Land FY2022 ENAbo BakrNoch keine Bewertungen

- Process Costing SystemDokument5 SeitenProcess Costing SystemSiraj AhmedNoch keine Bewertungen

- Global Cotton Yarn Industry Insights & Ambika Cotton Mills Case StudyDokument7 SeitenGlobal Cotton Yarn Industry Insights & Ambika Cotton Mills Case StudydivyanshNoch keine Bewertungen

- Business Plan For Flour Mill Manufacturing: By: Abraham W/Gebriel, Shewa Robit Town AdminstrationDokument32 SeitenBusiness Plan For Flour Mill Manufacturing: By: Abraham W/Gebriel, Shewa Robit Town AdminstrationTaye EshetuNoch keine Bewertungen

- Indian Edible Oils Demand & Supply and Outlook For 2016-17: Govindbhai G. PatelDokument21 SeitenIndian Edible Oils Demand & Supply and Outlook For 2016-17: Govindbhai G. PatelMohanapriya JayakumarNoch keine Bewertungen

- Business Plan for industrial zone edited 2Dokument33 SeitenBusiness Plan for industrial zone edited 2assefamenelik1Noch keine Bewertungen

- Parag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyDokument10 SeitenParag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyNiravAcharyaNoch keine Bewertungen

- Monthend Review July 2022 FinalDokument9 SeitenMonthend Review July 2022 FinalRohit JaiswalNoch keine Bewertungen

- Mini-Budget Sector Impact FY22Dokument23 SeitenMini-Budget Sector Impact FY22Arsalan LobaniyaNoch keine Bewertungen

- Ptba Ij - 2016Dokument4 SeitenPtba Ij - 2016yasinta faridaNoch keine Bewertungen

- ACC Cement: Reference ModelDokument21 SeitenACC Cement: Reference Modelsparsh jainNoch keine Bewertungen

- 3 February 2009 - SugarDokument6 Seiten3 February 2009 - SugararvindhsamiNoch keine Bewertungen

- Investment ThesisDokument5 SeitenInvestment Thesisu jNoch keine Bewertungen

- Equirus 3 Year Top Ideas Note 15.09.2022Dokument96 SeitenEquirus 3 Year Top Ideas Note 15.09.2022Harshika MehtaNoch keine Bewertungen

- Economics CIA1Dokument34 SeitenEconomics CIA1ABHISHEKA SINGH 2127201Noch keine Bewertungen

- Sugarcane Crisis of Uttar Pradesh: 2013: Economic Survey of IndiaDokument28 SeitenSugarcane Crisis of Uttar Pradesh: 2013: Economic Survey of IndiaAishwarya RaoNoch keine Bewertungen

- Mrs Bectors Q3FY22 Revenue Up 17Dokument3 SeitenMrs Bectors Q3FY22 Revenue Up 17V RajeshNoch keine Bewertungen

- Dhampur Sugar Stock Idea Under Rs. 100Dokument18 SeitenDhampur Sugar Stock Idea Under Rs. 100Pragati ChaudharyNoch keine Bewertungen

- Showarobit Flour Mill Project B PlanDokument30 SeitenShowarobit Flour Mill Project B PlanWubshet Birke100% (1)

- India Sugar SectorDokument4 SeitenIndia Sugar SectorsonysajanNoch keine Bewertungen

- Chambal FertilizersDokument12 SeitenChambal Fertilizerssinharay.cap971100% (1)

- Quarterly Update Q3FY21: Century Plyboards (India) LTDDokument10 SeitenQuarterly Update Q3FY21: Century Plyboards (India) LTDMalolanRNoch keine Bewertungen

- IntroductionDokument28 SeitenIntroductionNitin PatidarNoch keine Bewertungen

- Dhampur Sugar Mill: Investment Rationale Brief & AbstractDokument18 SeitenDhampur Sugar Mill: Investment Rationale Brief & AbstractPragati ChaudharyNoch keine Bewertungen

- Juhayna's Financial Performance AnalysisDokument10 SeitenJuhayna's Financial Performance Analysisradya mosadNoch keine Bewertungen

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDokument10 SeitenQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNoch keine Bewertungen

- FM Assigment 14 FebDokument6 SeitenFM Assigment 14 FebSubhajit HazraNoch keine Bewertungen

- PC - Sugar Sector Update - Feb 2021 20210227004214Dokument16 SeitenPC - Sugar Sector Update - Feb 2021 20210227004214VINAYAK AGARWALNoch keine Bewertungen

- Crude Palm Oil Price FluctuationsDokument10 SeitenCrude Palm Oil Price FluctuationsShivam BatraNoch keine Bewertungen

- 1QFY19 Results Update | Sector: AutomobilesDokument12 Seiten1QFY19 Results Update | Sector: AutomobilesVivek shindeNoch keine Bewertungen

- KTIS 2014 - Lopburi KBE PDFDokument195 SeitenKTIS 2014 - Lopburi KBE PDFAddo HernandoNoch keine Bewertungen

- What Is So Sweet About The Indian Sugar StoryDokument4 SeitenWhat Is So Sweet About The Indian Sugar Storyal.ramasamyNoch keine Bewertungen

- Pakistan's Agricultural Sector Driven by SugarcaneDokument9 SeitenPakistan's Agricultural Sector Driven by SugarcaneUsama QayyumNoch keine Bewertungen

- Nielsen August 2014 Meats Market InsightsDokument15 SeitenNielsen August 2014 Meats Market InsightsAlexandra CioriiaNoch keine Bewertungen

- 2 Feasibility Study On DairyDokument40 Seiten2 Feasibility Study On DairyAdefrisNoch keine Bewertungen

- Dangote Sugar H12014 Results ReleaseDokument5 SeitenDangote Sugar H12014 Results ReleaseIan MutukuNoch keine Bewertungen

- A Presentation On " Indian Sugar Industry"Dokument38 SeitenA Presentation On " Indian Sugar Industry"Nimesh PatelNoch keine Bewertungen

- Sapm AssignmentDokument4 SeitenSapm Assignment401-030 B. Harika bcom regNoch keine Bewertungen

- Korean Dairy Sector Overview 2017Dokument13 SeitenKorean Dairy Sector Overview 2017Vindula PussepitiyaNoch keine Bewertungen

- Diwali Picks 2023 NBRRDokument16 SeitenDiwali Picks 2023 NBRRSharwan KumarNoch keine Bewertungen

- A Presentation On " Indian Sugar Industry"Dokument38 SeitenA Presentation On " Indian Sugar Industry"elzymituNoch keine Bewertungen

- Annual Report Laporan Tahunan: PT Gudang Garam TBKDokument132 SeitenAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaNoch keine Bewertungen

- DR G RaviprasadDokument14 SeitenDR G RaviprasadRavi RajaniNoch keine Bewertungen

- Separation of Muridke FootwearDokument10 SeitenSeparation of Muridke FootwearabdullahNoch keine Bewertungen

- Investor Presentation (Company Update)Dokument24 SeitenInvestor Presentation (Company Update)Shyam SunderNoch keine Bewertungen

- Key Performance Indicators, : Results - Quarter 1 Green Red Blue Orange GreyDokument54 SeitenKey Performance Indicators, : Results - Quarter 1 Green Red Blue Orange GreyMuskan singlaNoch keine Bewertungen

- Sugar Project FinalDokument27 SeitenSugar Project FinalAtharvaNoch keine Bewertungen

- SKP Sec-Balrampur (Init Cov) - 2012Dokument12 SeitenSKP Sec-Balrampur (Init Cov) - 2012rchawdhry123Noch keine Bewertungen

- Hard Candy Manufacturing Rs 11.61 Million May-2019Dokument31 SeitenHard Candy Manufacturing Rs 11.61 Million May-2019Waqas AtharNoch keine Bewertungen

- Price Elasticity of Sugar IndustryDokument26 SeitenPrice Elasticity of Sugar IndustryAshutosh BurnwalNoch keine Bewertungen

- INDIA - AGRI INPUTS - Monthly UpdateDokument13 SeitenINDIA - AGRI INPUTS - Monthly Updaterchawdhry123Noch keine Bewertungen

- Indonesia Palm Oil Tight Supply to Help Prices Long TermDokument40 SeitenIndonesia Palm Oil Tight Supply to Help Prices Long TermatanmasriNoch keine Bewertungen

- Wet Corn Milling Products World Summary: Market Values & Financials by CountryVon EverandWet Corn Milling Products World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentVon EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentBewertung: 5 von 5 Sternen5/5 (1)

- Finwize Investment Services Hand Phone - +91 9920761188 EmailDokument2 SeitenFinwize Investment Services Hand Phone - +91 9920761188 Emailapi-19978586Noch keine Bewertungen

- Yes Bank - Most - 30 11 09Dokument32 SeitenYes Bank - Most - 30 11 09api-19978586Noch keine Bewertungen

- Pantaloon - Annual Report Analysis FY09Dokument8 SeitenPantaloon - Annual Report Analysis FY09api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- UT V Software (UTVSOF) : Unlocking Value..Dokument7 SeitenUT V Software (UTVSOF) : Unlocking Value..api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Cipla - Nov09 (CU)Dokument12 SeitenCipla - Nov09 (CU)api-19978586Noch keine Bewertungen

- Lupin Initiating Coverage Nov'091Dokument44 SeitenLupin Initiating Coverage Nov'091api-19978586Noch keine Bewertungen

- Insead Consulting Club Handbook 2011 PDFDokument108 SeitenInsead Consulting Club Handbook 2011 PDFJasjivan Ahluwalia100% (1)

- HW5 SolnDokument7 SeitenHW5 SolnZhaohui Chen100% (1)

- Press Release Bharti Infratel & Indus Towers Merger 20180425Dokument10 SeitenPress Release Bharti Infratel & Indus Towers Merger 20180425Suratna DasNoch keine Bewertungen

- Dividend DecisionsDokument44 SeitenDividend DecisionsYogesh JoshiNoch keine Bewertungen

- Pabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessDokument8 SeitenPabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessnabsNoch keine Bewertungen

- Tigerair Buyout Offer From SIADokument10 SeitenTigerair Buyout Offer From SIAVivek Sinha100% (1)

- Database BfsiDokument64 SeitenDatabase BfsiShreyaNoch keine Bewertungen

- Modified Dietz Vs Time WeightedDokument8 SeitenModified Dietz Vs Time WeightedSiwon ImNoch keine Bewertungen

- Understanding The Anti-Dummy Law - ABS-CBN NewsDokument4 SeitenUnderstanding The Anti-Dummy Law - ABS-CBN NewsLRMNoch keine Bewertungen

- BizzX Newsletter Summary: 2006-2009Dokument8 SeitenBizzX Newsletter Summary: 2006-2009Dave LivingstonNoch keine Bewertungen

- Is Spandex Corporation Worth It More Dead or AliveDokument2 SeitenIs Spandex Corporation Worth It More Dead or AliveShaheera SuhaimiNoch keine Bewertungen

- Financial goal investment optionsDokument4 SeitenFinancial goal investment optionsSai Krishna Dhulipalla50% (2)

- AFA 100 - Chapter 1 NotesDokument4 SeitenAFA 100 - Chapter 1 NotesMichaelNoch keine Bewertungen

- Forecasting The Return Volatility of The Exchange RateDokument53 SeitenForecasting The Return Volatility of The Exchange RateProdan IoanaNoch keine Bewertungen

- Fundamental Analysis FrameworkDokument9 SeitenFundamental Analysis FrameworkVaibhav KhandelwalNoch keine Bewertungen

- Wacc Ecf Apv Eva SvaDokument13 SeitenWacc Ecf Apv Eva SvaDHRUV SONAGARANoch keine Bewertungen

- 2-22-19 - FILED Complaint - Vanech V Ebersol and AAFDokument92 Seiten2-22-19 - FILED Complaint - Vanech V Ebersol and AAFDeadspin100% (1)

- Time Value of MoneyDokument55 SeitenTime Value of MoneySayoni GhoshNoch keine Bewertungen

- Making A Fortune From Fixed Odds Financial TradingDokument58 SeitenMaking A Fortune From Fixed Odds Financial Tradingbetonmarkets80% (5)

- DSP BlackrockDokument82 SeitenDSP BlackrockParulGuptaNoch keine Bewertungen

- Solution To Problem 9Dokument5 SeitenSolution To Problem 9Ong Ming KaiNoch keine Bewertungen

- Thailand Property Funds With DividendsDokument81 SeitenThailand Property Funds With DividendsMartinNoch keine Bewertungen

- Stocks Bought by Investing Gurus That Now Trade 52-Week LowsDokument63 SeitenStocks Bought by Investing Gurus That Now Trade 52-Week Lowsjga30328Noch keine Bewertungen

- New Annual Report ERC Form DU AO1 1Dokument97 SeitenNew Annual Report ERC Form DU AO1 1Jopan SJNoch keine Bewertungen

- Efficient Capital MarketDokument3 SeitenEfficient Capital MarketTaimoorKhanNoch keine Bewertungen

- The Truth About Money ManagementDokument4 SeitenThe Truth About Money ManagementHai NgoNoch keine Bewertungen

- Business Accounting Question PaperDokument3 SeitenBusiness Accounting Question PaperGajendra GargNoch keine Bewertungen

- Tutorial AnswerDokument14 SeitenTutorial AnswerJia Mun LewNoch keine Bewertungen

- Jun 2003 - Qns Mod BDokument13 SeitenJun 2003 - Qns Mod BHubbak KhanNoch keine Bewertungen

- 2015 Volatility Outlook PDFDokument54 Seiten2015 Volatility Outlook PDFhc87Noch keine Bewertungen