Beruflich Dokumente

Kultur Dokumente

Investment Analysis

Hochgeladen von

Jaya TibrewalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investment Analysis

Hochgeladen von

Jaya TibrewalCopyright:

Verfügbare Formate

Course Objective

This course provides a comprehensive coverage of the basic concepts, theories, and decision-

making rules for financial investments. Students taking this course should expect to acquire skills

in valuation techniques, the pricing of fixed-income securities, equities, as well as the principles

of finance, including arbitrage, market efficiency, asset pricing models and portfolio theory,

primarily portfolio selection and management on the basis of risk and return. The course will also

provide an introduction to the institutions and the instruments commonly used to raise money.

Pre-requisites

Core Corporate Finance course. There will be no significant overlap, but we will have a refresher

on the principles of corporate finance.

Teaching Material

1. Investments: Reilly Frank K. and Brown Keith C., Investment Analysis and Portfolio

Management, Eighth Edition, Cengage Learning, New York, 2006.

2. References

a. Modern Portfolio Theory And Investment Analysis, 7

th

Ed, Edwin J. Elton,

Martin J. Gruber, Stephen J. Brown, William N. Goetzmann

b. Frank J. Fabozzi, ed., The Handbook of Fixed Income Securities, 3

rd

Ed.

Readings

1. Does Asset Allocation Policy explain 40, 90 or 100 Percent of Performance

2. What Drives Long term equity Returns (Barra Research)

3. The fundamentals of fundamental factor models (Factor analysis, APT)

4. Indian_Savings and Bond_Market

5. FCFE valuation from Valuations by Aswath Damodaran

6. Technical Analysis Note: Darden publishing

7. Introduction to Valuation Multiples :HBS

8. Are the markets really efficient, Mr.Markowitz : Book extract.

9. NCFM material on capital markets module. (to be downloaded by the students

themselves)

10. RBI extracts.

Cases and general readings

1. The Bernard Madoff Financial Scam

2. Gold as a long term investment Fading glitter?

3. Darden Capital Management the Monticello Fund

4. Investment Management at Harvard management Company- ICMR

5. Does the CAPM work?

Other readings (optional) will be distributed depending on the interest of the class.

Class Preparation:

It is expected that students will come prepared to class, and material covered in the assigned

textbook readings will generally not be repeated in class. Class time will be devoted to lecture

and case discussion, applying the material covered in the readings.

Course Outline

The course will cover the following topics

1. Utility Theory, Mean Variance Portfolio Theory

2. Single Index Models, Capital Asset Pricing Model, APT, Factor Models

3. Asset Allocation; Portfolio Construction

4. Market Efficiency: Random Walk Theory

5. Equities: Determinants of Value/Industry Analysis and Valuation/Fundamental and

Technical Analysis

6. Fixed Income Security Analysis

7. Performance measurement time weighted, money weighted measures, ratios.

8. Derivatives (more from an investment perspective, knowledge of OFD is assumed)

Grading Pattern

The course grade will be determined as follows:

Midterm 30 % (Date to be informed by Office)

End term 30 % (Date to be informed by Office)

Class Quiz (best 2 of 3) 8% (Surprise Quizzes)

Class Activity (Case CP) 7% (Group activities)

Assignment 15 % (Group homework, dates to be informed in class)

Presentations 10% (Topics will be distributed in the 2nd week)

Mid term dates will be announced by the PGP office it is likely to be in the break between the

9

th

and 11

th

sessions.

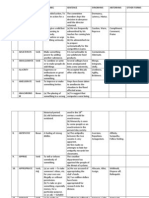

Syllabus and Course Schedule

Sessions Topics

1

2

3 and 4

Introduction to terms in investment analysis, institutions in financial markets and

instruments such as bonds, equity, short and medium term instruments of borrowing

etc

Basics of valuation recap of corporate finance basics. Valuation of equity, Valuation

of bonds, calculating yields, FCFE methods

Group team names to be provided .

Utility Theory, Types of utility functions. Characteristics of Utility functions.

Maximization of expected utility, Risk aversion and certainty equivalent. Commonly

used utility functions, coefficient of risk aversion, Insurance

Know your investor questionnaire activity;

Read: Gold fading glitter; Does Asset Allocation explain 40,50 or 90%

Chapter 1, 2, Chapter 3 (section on Global investment options pg 79-90 only) and

appendix 3 on covariance and correlation, chapter 4 pg 125-130 (types of orders

and margin). Chapter 5 (till pg 162 ) types of indices (will be covered in student

presentations)

Additional optional reading from NCFM material on capital markets (will be

covered in student presentations)

5,6

Introduction to Portfolio Theory: Risk and Return. Measures of Risk, measures of

return. Capital Allocation between Risky and Risk Free Asset

Mean Variance efficiency - Markowitz optimal portfolio selection

Trading activity commences; Barra research : the fundamentals of fundamental

factor models

Assignment 1 will be provided on 29

th

Jun. Due 8

th

Jul midnight

Chapter 7

7,8

Introduction to the Capital Asset Pricing Model, Beta of companies, using beta to

value stocks, Single Index and Multifactor Models, other models of stock valuation.

Activity Case Monticello fund; Does the CAPM work

Reading: what drives long term returns

Chapter 8, 9

9,10

Efficient markets hypothesis, Portfolio Strategy and Asset Allocation; Fundamental

and technical analysis

Technical Analysis note; Valuation by damodaran; Valuation multiples note;

Discussion: Are markets really efficient Mr.Markowitz

Chapter 6 (recap), 10-15 (review of FSA), 16

Mid Term Exams

11,12 Portfolio performance evaluation, measures to evaluate portfolios

Mutual Fund performance case Harvard Management Company;

Assignment 2 will be provided on 14

th

Jul. Due 5

th

Aug midnight.

Chapter 17,26

13,14, 15, 16 Fixed Income Security valuation; valuation of bonds, yields, running yield, YTM

Term Structure of Interest rates.

Bond valuation: advanced topics such as Duration, Immunization, etc.

Assignment 3 will be provided on 10

th

Aug, due 24

th

Aug midnight.

Chapter 17,18,19,20

17,18

19,20

Project Analysis presentations

Derivatives, hedging and Wrap up

Chapter 21,22

Hedging activity

Trading activity ends: portfolios to be submitted by 25

th

Aug midnight.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Rule: Bonds and Notes and Securities, U.S. Treasury: Legacy Treasury Direct and TreasuryDirect Systems Update and Regulations SimplificationDokument11 SeitenRule: Bonds and Notes and Securities, U.S. Treasury: Legacy Treasury Direct and TreasuryDirect Systems Update and Regulations SimplificationJustia.com100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Glossary of Construction Cost EstimatingDokument8 SeitenGlossary of Construction Cost EstimatingFaty BercasioNoch keine Bewertungen

- CSEC Chemistry June 2009 P1Dokument14 SeitenCSEC Chemistry June 2009 P1Kizzy Anne Boatswain Carbon83% (18)

- Chap 11 Credit Risk Individual LoansDokument116 SeitenChap 11 Credit Risk Individual LoansAfnan100% (1)

- Sps Cha Vs CADokument2 SeitenSps Cha Vs CALara YuloNoch keine Bewertungen

- Bank GuaranteeDokument11 SeitenBank GuaranteeFaysal Haque100% (1)

- Alcohols, Phenols, and EthersDokument33 SeitenAlcohols, Phenols, and EthersKevin ThomasNoch keine Bewertungen

- IodoformDokument18 SeitenIodoformNurel HidayahNoch keine Bewertungen

- Makati Dev - T Vs EmpireDokument2 SeitenMakati Dev - T Vs EmpireEcnerolAicnelavNoch keine Bewertungen

- Indian Financial MarketsDokument24 SeitenIndian Financial MarketsNidhi BothraNoch keine Bewertungen

- Zara CaseDokument24 SeitenZara CaseJaya Tibrewal100% (1)

- CokeDokument2 SeitenCokeJaya TibrewalNoch keine Bewertungen

- Vik18 1Dokument18 SeitenVik18 1meetwithsanjayNoch keine Bewertungen

- Budget Pressures - Productivity - 3 Mar 11Dokument11 SeitenBudget Pressures - Productivity - 3 Mar 11GothamSchools.orgNoch keine Bewertungen

- Commerce Bank Case Assignment QuestionsDokument1 SeiteCommerce Bank Case Assignment QuestionsJaya Tibrewal0% (1)

- Brand Audit Report On MicromaxDokument14 SeitenBrand Audit Report On MicromaxJaya TibrewalNoch keine Bewertungen

- Enron and The Use and Abuse of Special Purpose Entities in CorporDokument10 SeitenEnron and The Use and Abuse of Special Purpose Entities in CorporJaya TibrewalNoch keine Bewertungen

- ICS English MOTHER QuestionnaireDokument40 SeitenICS English MOTHER QuestionnaireJaya TibrewalNoch keine Bewertungen

- Applichem PaperDokument11 SeitenApplichem PaperJ Conde ValNoch keine Bewertungen

- Vik18 1Dokument18 SeitenVik18 1meetwithsanjayNoch keine Bewertungen

- Latest Example of Shared ValueDokument2 SeitenLatest Example of Shared ValueJaya TibrewalNoch keine Bewertungen

- TechnicalAnalysis101 Session03Dokument27 SeitenTechnicalAnalysis101 Session03Jaya TibrewalNoch keine Bewertungen

- National Cranberry Power PointDokument6 SeitenNational Cranberry Power PointVarun ChandNoch keine Bewertungen

- TCDokument34 SeitenTCJaya TibrewalNoch keine Bewertungen

- 1932020Dokument5 Seiten1932020Jaya TibrewalNoch keine Bewertungen

- UG Courses of Study 2007Dokument147 SeitenUG Courses of Study 2007dinu1903100% (2)

- CQ Chem ReactionsDokument4 SeitenCQ Chem Reactionsapi-218999959Noch keine Bewertungen

- INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFDokument4 SeitenINVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFVidushi ThapliyalNoch keine Bewertungen

- ct12005 2009Dokument176 Seitenct12005 2009nigerianhacksNoch keine Bewertungen

- Ca PDFDokument139 SeitenCa PDFSomenath PaulNoch keine Bewertungen

- 2011 JC1 H2 Chemistry Promo P2Dokument19 Seiten2011 JC1 H2 Chemistry Promo P2joshua_98548Noch keine Bewertungen

- Reactions of AlcoholsDokument10 SeitenReactions of AlcoholsNeen NaazNoch keine Bewertungen

- Two Year CRP (1416) Pt-1 A Lot Paper-2 Set-BDokument14 SeitenTwo Year CRP (1416) Pt-1 A Lot Paper-2 Set-BShlok Sah86% (7)

- PS - Project Finance Concepts and ApplicationsDokument283 SeitenPS - Project Finance Concepts and ApplicationsLahinNoch keine Bewertungen

- Sn2 MechanismDokument18 SeitenSn2 MechanismDian MustikasariNoch keine Bewertungen

- Multiple Choice Questio10Dokument21 SeitenMultiple Choice Questio10Achiket Anand DesaiNoch keine Bewertungen

- Carbonyls PDFDokument10 SeitenCarbonyls PDFMaheshNoch keine Bewertungen

- Zero Coupon Bond ForwardDokument4 SeitenZero Coupon Bond Forwardminandiego29Noch keine Bewertungen

- Classification of HydrocarbonsDokument9 SeitenClassification of Hydrocarbonsdave_1128Noch keine Bewertungen

- Affidavit (For Change of Signature) : Folio No. No. of Shares/ Certificate No. Dnrs DnrsDokument2 SeitenAffidavit (For Change of Signature) : Folio No. No. of Shares/ Certificate No. Dnrs DnrsGhajini SanjayNoch keine Bewertungen

- Lesson Plan Intermolecular Forces BaruDokument30 SeitenLesson Plan Intermolecular Forces BaruIrvan AdisthaNoch keine Bewertungen

- Sample TestDokument11 SeitenSample Testgloworm44Noch keine Bewertungen

- 1.4 Assessed Homework Mark Scheme: 10.4 Periodicity HW MSDokument2 Seiten1.4 Assessed Homework Mark Scheme: 10.4 Periodicity HW MSSumathi GanasenNoch keine Bewertungen

- Enzyme 2Dokument12 SeitenEnzyme 2shimaNoch keine Bewertungen

- Icho 17Dokument21 SeitenIcho 17los sabiosNoch keine Bewertungen

- Chemistry 11 TH 12 THDokument52 SeitenChemistry 11 TH 12 THSudhir ChhetriNoch keine Bewertungen

- Chapter 4 Phase DiagramDokument24 SeitenChapter 4 Phase Diagrampoom2007Noch keine Bewertungen