Beruflich Dokumente

Kultur Dokumente

All Corporate Governance Scams in India

Hochgeladen von

Sumanth KumarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

All Corporate Governance Scams in India

Hochgeladen von

Sumanth KumarCopyright:

Verfügbare Formate

18. THE BIGGEST IT SCAMSTER.

19. T he biggest corporate scam in India has come from one of the most respected businessmen.

Satyam founder Byrraju Ramalinga Raju resigned as its chairman after admitting to cooking up

the account books. His efforts to fill the "fictitious assets with real ones" through

Maytas acquisition failed, after which he decided to confess the crime. With a fraud involving

about Rs 8,000 crore (Rs 80 billion), Satyam is heading for more trouble in the days ahead. O n

Wednesday, India's fourth largest IT company lost a staggering Rs 10,000 crore (Rs 100

billion) in market capitalisation as investors reacted sharply and dumped shares, pushing down

the scrip by 78 per cent to Rs 39.95 on the Bombay Stock Exchange. The NYSE-listed firm could

also face regulator action in the US.

20. "I am now prepared to subject myself to the laws of the land and face consequences

thereof," Raju said in a letter to SEBI and the Board of Directors, while giving details of

how the profits were inflated over the years and his failed attempts to "fill the fictitious

assets with real ones." Raju said the company's balance sheet as of September 30

carries "inflated (non-existent) cash and bank balances of Rs 5,040 crore (Rs 50.40 billion)

as against Rs 5,361 crore (Rs 53.61 billion) reflected in the books."

21. INTRODUCTION TO THE BIG BULL OF THE TRADING FLOOR.

22. THE PIED PIPER OF STOCK MARKET.

23. HARSHAD MEHTA : THE SCAMSTER.

24. H e was known as the 'Big Bull'. However, his bull run did not last too long. He

triggered a rise in the Bombay Stock Exchange in the year 1992 by trading in shares at a

premium across many segments. Taking advantages of the loopholes in the banking system,

Harshad and his associates triggered a securities scam diverting funds to the tune of Rs 4000

crore (Rs 40 billion) from the banks to stockbrokers between April 1991 to May 1992.

25. Harshad Mehta worked with the New India Assurance Company before he moved ahead to

try his luck in the stock markets. Mehta soon mastered the tricks of the trade and set out on

dangerous game plan. Mehta has siphoned off huge sums of money from several banks and

millions of investors were conned in the process. His scam was exposed, the markets crashed

and he was arrested and banned for life from trading in the stock markets.

26. He was later charged with 72 criminal offences. A Special Court also sentenced Sudhir

Mehta, Harshad Mehta's brother, and six others, including four bank officials, to rigorous

imprisonment (RI) ranging from 1 year to 10 years on the charge of duping State Bank of India to

the tune of Rs 600 crore (Rs 6 billion) in connection with the securities scam that rocked the

financial markets in 1992. He died in 2002 with many litigations still pending against him.

27. THE FOLLOWER OF THE BIG BULL

28. Ketan Parekh followed Harshad Mehta's footsteps to swindle crores of rupees from

banks. A chartered accountant he used to run a family business, NH Securities.Ketan however

had bigger plans in mind. He targetted smaller exchanges like the Allahabad Stock Exchange and

the Calcutta Stock Exchange, and bought shares in fictitious names.

29. His dealings revolved around shares of ten companies like Himachal Futuristic, Global Tele-

Systems, SSI Ltd, DSQ Software, Zee Telefilms, Silverline, Pentamedia Graphics and Satyam

Computer (K-10 scrips). Ketan borrowed Rs 250 crore from Global Trust Bank to fuel his

ambitions. Ketan alongwith his associates also managed to get Rs 1,000 crore from the

Madhavpura Mercantile Co-operative Bank. According to RBI regulations, a broker is allowed a

loan of only Rs 15 crore (Rs 150 million). There was evidence of price rigging in the scrips of

Global Trust Bank, Zee Telefilms, HFCL, Lupin Laboratories, Aftek Infosys and Padmini Polymer.

30. ONE MORE STOCK MARKET SCAMC.R.Bhansali.

31. T he Bhansali scam resulted in a loss of over Rs 1,200 crore (Rs 12 billion). He first launched

the finance company CRB Capital Markets, followed by CRB Mutual Fund and CRB Share

Custodial Services. He ruled like a financial wizard 1992 to 1996 collecting money from the

public through fixed deposits, bonds and debentures. The money was transferred to companies

that never existed. CRB Capital Markets raised a whopping Rs 176 crore in three years. In 1994

CRB Mutual Funds raised Rs 230 crore and Rs 180 crore came via fixed deposits. Bhansali also

succeeded to to raise about Rs 900 crore from the markets.

32. However, his good days did not last long, after 1995 he received several jolts. Bhansali tried

borrowing more money from the market. This led to a financial crisis. It became difficult for

Bhansali to sustain himself. The Reserve Bank of India (RBI) refused banking status to CRB and

he was in the dock. SBI was one of the banks to be hit by his huge defaults.

33. THE COBBLERS SCAMSOHIN DAYA.

34. SohinDaya, son of a former Sheriff of Mumbai, was the main accused in the multi-crore

shoes scam. Daya of Dawood Shoes, RafiqueTejani of Metro Shoes, and KishoreSignapurkarof

Milano Shoes were arrested for creating several leather co-operative societies which did not

exist. They availed loans of crores of rupees on behalf of these fictitious societies

35. The scam was exposed in 1995. The accused created a fictitious cooperative society of

cobblers to take advantage of government loans through various schemes.Officials of the

Maharashtra State Finance Corporation, Citibank, Bank of Oman, Dena Development Credit

Bank, Saraswat Co-operative Bank, and Bank of Bahrain and Kuwait were also charge sheeted.

36. DINESH DALMIAS STOCK SCAM.

37. DineshDalmiawas the managing director of DSQ Software Limited when the Central Bureau

of Investigation arrested him for his involvement in a stocks scam of Rs 595 crore (Rs 5.95

billion). Dalmia's group included DSQ Holdings Ltd, Hulda Properties and Trades Ltd, and

Powerflow Holding and Trading Pvt Ltd. Dalmia resorted to illegal ways to make money through

the partly paid shares of DSQ Software Ltd, in the name of New Vision Investment Ltd, UK, and

unallotted shares in the name of DineshDalmia Technology Trust.Investigation showed that 1.30

crore (13 million) shares of DSQ Software Ltd had not been listed on any stock exchange.

38. THE FAKE STAMP RACKET.

39. H e paid for his own education at SarvodayaVidyalaya by selling fruits and vegetables on

trains.He is today famous (or infamous) for being he man behind one of The Telgi case is

another big scam that rocked India. The fake stamp racket involving Abdul KarimTelgiwas

exposed in 2000. The loss is estimated to be Rs 171.33 crore (Rs 1.71 billion), it was initially

pegged to be Rs 30,000 crore (Rs 300 bilion), which was later clarified by the CBI as an

exaggerated figure.

40. In 1994, Abdul KarimTelgiacquired a stamp paper license from the Indian government and

began printing fake stamp papers. Telgi bribed to get into the government security press in

Nashikand bought special machines to print fake stamp papers. Telgi's networked spread

across 13 states involving 176 offices, 1,000 employees and 123 bank accounts in 18 cities.

41. THE MONEY MARKET FRAUD.

42. VirendraRastogichief executive of RBG Resources was charged with for deceiving banks

worldwide of an estimated $1 billion. He was also involved in the duty-drawback scam to the

tune of Rs 43 crore (Rs 430 milion) in India. The CBI said that five companies, whose directors

were the four Rastogi brothers -- Subash, Virender, Ravinde and Narinder -- exported bicycle

parts during 1995-96 to Russia and Hong Kong by heavily over invoicing the value of goods for

claiming excessduty draw back from customs.

43. THE UTI SCAM.

44. Former UTI chairman P S Subramanyam and two executive directors -- M M Kapur and S K

Basu -- and a stockbroker Rakesh G Mehta, were arrested in connection with the 'UTI

scam'. UTI had purchased 40,000 shares of Cyberspace On September 25, 2000, for about

Rs 3.33 crore (Rs 33.3 million) from Rakesh Mehta when there were no buyers for the scrip. The

market price was around Rs 830. The CBI said it was the conspiracy of these four people which

resulted in the loss of Rs 32 crore (Rs 320 million).

45. Subramanyam, Kapur and Basu had changed their stance on an investment advice of the

equities research cell of UTI. The promoter of Cyberspace Infosys, Arvind Johari was arrested in

connection with the case. The officals were paid Rs 50 lakh (Rs 5 million) by Cyberspace to

promote its shares. He also received Rs 1.18 crore (Rs 11.8 million) from the company through a

circuitous route for possible rigging the Cyberspace counter.

46. SANJAY AGARWALS FINANCE PORTAL.

47. H ome Trade had created waves with celebrity endorsements. But Sanjay Agarwal's

finance portal was just a veil to cover up his shady deals. He swindled a whopping Rs 600 crore

(Rs 6 billion) from more than 25 cooperative banks. The government securities (gilt) scam of

2001 was exposed when the Reserve Bank of India checked the acounts of some cooperative

banks following unusual activities in the gilt market.

48. Co-operative banks and brokers acted in collusion in abid to make easy money at the cost of

the hard earned savings of millions of Indians. In this case, even the Public Provident Fund (PPF)

was affected. A sum of about Rs 92 crore (Rs 920 million) was missing from the Seamen's

Provident Fund. Sanjay Agarwal, Ketan Sheth (a broker), Nandkishore Trivedi and Baluchan Rai

(a Hong Kong-based Non-Resident Indian) were behind the Home Trade scam.

49. Gilt funds, as they are conveniently called, are mutual fund schemes floated by asset

management companies with exclusive investments in government securities. The schemes are

also referred to as mutual funds dedicated exclusively to investments in government securities.

Government securities mean and include central government dated securities, state

government securities and treasury bills. The gilt funds provide to the investors the safety of

investments made in government securities and better returns than direct investments in these

securities through investing in a variety of government securities yielding varying rate of returns

gilt funds, however, do run the risk.. The first gilt fund in India was set up in December 1998. .

50. The Biggest Risk In Life Is Not Taking One.- Tag Line of the Movie Gafla

Das könnte Ihnen auch gefallen

- Actuaryasacareer 120713100221 Phpapp01Dokument46 SeitenActuaryasacareer 120713100221 Phpapp01Pratik MehtaNoch keine Bewertungen

- Tutor2u - Fixed and Floating Exchange RatesDokument4 SeitenTutor2u - Fixed and Floating Exchange RatesSumanth KumarNoch keine Bewertungen

- Guide To Understanding Mutual FundsDokument40 SeitenGuide To Understanding Mutual FundsLeslie WarholNoch keine Bewertungen

- Make A List of Brands of Toothpastes That Are Available in IndiaDokument8 SeitenMake A List of Brands of Toothpastes That Are Available in IndiaSumanth KumarNoch keine Bewertungen

- Reverse Mortgage SumanthDokument10 SeitenReverse Mortgage SumanthSumanth KumarNoch keine Bewertungen

- Leasing and Hire PurchasingDokument33 SeitenLeasing and Hire PurchasingSumanth KumarNoch keine Bewertungen

- Merchant BanksDokument50 SeitenMerchant BanksSumanth KumarNoch keine Bewertungen

- INTRODUCTION ON MACRO BUSINESS ENVIRONMENT As Per VTU Module OneDokument35 SeitenINTRODUCTION ON MACRO BUSINESS ENVIRONMENT As Per VTU Module OneSumanth KumarNoch keine Bewertungen

- Business Researchbrm-Dec-Jan-08-09aDokument1 SeiteBusiness Researchbrm-Dec-Jan-08-09aSumanth KumarNoch keine Bewertungen

- Business Researchbrm-Jul-06Dokument2 SeitenBusiness Researchbrm-Jul-06Sumanth KumarNoch keine Bewertungen

- Business Researchbrm-Jul-08Dokument2 SeitenBusiness Researchbrm-Jul-08Sumanth KumarNoch keine Bewertungen

- Business Researchbrm Jul 06 Old SchemeDokument2 SeitenBusiness Researchbrm Jul 06 Old SchemeSumanth KumarNoch keine Bewertungen

- Business Researchbrm-Dec-Jan-07-08Dokument2 SeitenBusiness Researchbrm-Dec-Jan-07-08Sumanth KumarNoch keine Bewertungen

- Business Research - Jul-09Dokument1 SeiteBusiness Research - Jul-09Sumanth KumarNoch keine Bewertungen

- Business Researchbrm-Jul-07Dokument2 SeitenBusiness Researchbrm-Jul-07Sumanth KumarNoch keine Bewertungen

- Business Researchbrm-Dec-Jan-06-07Dokument2 SeitenBusiness Researchbrm-Dec-Jan-06-07Sumanth KumarNoch keine Bewertungen

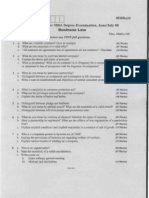

- Business Law Vtu Question Papersbl-Jul-07Dokument1 SeiteBusiness Law Vtu Question Papersbl-Jul-07Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersbl Jul 06 Old SchemeDokument1 SeiteBusiness Law Vtu Question Papersbl Jul 06 Old SchemeSumanth KumarNoch keine Bewertungen

- Fianacial Management Vtu Question Papers-July-06Dokument4 SeitenFianacial Management Vtu Question Papers-July-06Sumanth KumarNoch keine Bewertungen

- FM Jul 09Dokument3 SeitenFM Jul 09Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersbl-Dec-Jan-06-07Dokument1 SeiteBusiness Law Vtu Question Papersbl-Dec-Jan-06-07Sumanth KumarNoch keine Bewertungen

- Fianacial Management Vtu Question Papersfm-Dec-Jan-06-07Dokument3 SeitenFianacial Management Vtu Question Papersfm-Dec-Jan-06-07Sumanth KumarNoch keine Bewertungen

- Fianacial Management Vtu Question Papersfm-Aug-05Dokument5 SeitenFianacial Management Vtu Question Papersfm-Aug-05Sumanth KumarNoch keine Bewertungen

- Business Researchbrm Dec Jan 06 07 Old SchemeDokument2 SeitenBusiness Researchbrm Dec Jan 06 07 Old SchemeSumanth KumarNoch keine Bewertungen

- Fianacial Management Vtu Question Papersfm-Dec-Jan-07-08Dokument4 SeitenFianacial Management Vtu Question Papersfm-Dec-Jan-07-08Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersl-Jul-08Dokument1 SeiteBusiness Law Vtu Question Papersl-Jul-08Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersbl-Dec-Jan-07-08Dokument1 SeiteBusiness Law Vtu Question Papersbl-Dec-Jan-07-08Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersbl-Dec-Jan-08-09Dokument1 SeiteBusiness Law Vtu Question Papersbl-Dec-Jan-08-09Sumanth KumarNoch keine Bewertungen

- Business Law Vtu Question Papersbl-Jul-06Dokument1 SeiteBusiness Law Vtu Question Papersbl-Jul-06Sumanth KumarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Public Mutual Private Retiremenent Scheme ProducthighlightDokument12 SeitenPublic Mutual Private Retiremenent Scheme ProducthighlightBenNoch keine Bewertungen

- Arihant Upsc Indian Economy Practice Set 1. CB1198675309Dokument4 SeitenArihant Upsc Indian Economy Practice Set 1. CB1198675309Lavita DekaNoch keine Bewertungen

- Vice President Director Finance in Philadelphia PA Resume Nino ToscanoDokument2 SeitenVice President Director Finance in Philadelphia PA Resume Nino ToscanoNinoToscanoNoch keine Bewertungen

- CIS UrbaDokument6 SeitenCIS UrbaUrbaJoeNoch keine Bewertungen

- ESG InvestingDokument15 SeitenESG Investingselina_kollsNoch keine Bewertungen

- Reverse Mortgage For Dummies PDFDokument290 SeitenReverse Mortgage For Dummies PDFDaisuke GatsuNoch keine Bewertungen

- Pacific National Bank ATM Case StudyDokument15 SeitenPacific National Bank ATM Case StudyLaurence Ibay PalileoNoch keine Bewertungen

- Cash PoolingDokument10 SeitenCash PoolingsavepageNoch keine Bewertungen

- PDFDokument10 SeitenPDFAnonymous jtL0rQrcNoch keine Bewertungen

- Summer Internship Project Karvy....Dokument61 SeitenSummer Internship Project Karvy....Preet Josan100% (2)

- Board Resolution Credit PolicyDokument2 SeitenBoard Resolution Credit PolicyJayson Silot CabelloNoch keine Bewertungen

- Debentures Issued Are SecuritiesDokument8 SeitenDebentures Issued Are Securitiesarthimalla priyankaNoch keine Bewertungen

- Cma Format For Bank-3Dokument40 SeitenCma Format For Bank-3technocrat_vspNoch keine Bewertungen

- Loksabhaquestions Annex 1714 AS135Dokument12 SeitenLoksabhaquestions Annex 1714 AS135skparamjyotiNoch keine Bewertungen

- Resources Understanding ISO20022 NACHA Payments 2013Dokument121 SeitenResources Understanding ISO20022 NACHA Payments 2013Rajendra PilludaNoch keine Bewertungen

- Resume of Ladreshawalker2008Dokument2 SeitenResume of Ladreshawalker2008api-32798914Noch keine Bewertungen

- Union Bank: Personal BankingDokument3 SeitenUnion Bank: Personal BankingBryan ParkerNoch keine Bewertungen

- Case Study 03Dokument2 SeitenCase Study 03professorchanakyaNoch keine Bewertungen

- Organizational Study of The Perla Service Co-operative BankDokument37 SeitenOrganizational Study of The Perla Service Co-operative BankFathima LibaNoch keine Bewertungen

- Credit Transactions Digested CasesDokument9 SeitenCredit Transactions Digested CasesEstelaBenegildoNoch keine Bewertungen

- Pos Laca DC10044778 20180210Dokument13 SeitenPos Laca DC10044778 20180210Ezudin ShahNoch keine Bewertungen

- United States District Court: Northern District of Illinois, Eastern DivisionDokument5 SeitenUnited States District Court: Northern District of Illinois, Eastern DivisionChicago TribuneNoch keine Bewertungen

- Landman Right of Way Agent in Oklahoma City OK Resume David ManningDokument2 SeitenLandman Right of Way Agent in Oklahoma City OK Resume David ManningDavid ManningNoch keine Bewertungen

- IRCTC E Wallet User GuideDokument8 SeitenIRCTC E Wallet User GuideVikas PatelNoch keine Bewertungen

- Report On HR PDFDokument61 SeitenReport On HR PDFBhasha KoiralaNoch keine Bewertungen

- Complete ProjectDokument99 SeitenComplete ProjectDANJUMA ADAMUNoch keine Bewertungen

- 1 Registration Process: BUET Post Graduate Registration SystemDokument5 Seiten1 Registration Process: BUET Post Graduate Registration SystemBit bitNoch keine Bewertungen

- CEZA Regulations - 2018Dokument48 SeitenCEZA Regulations - 2018Eunice Sagun100% (1)

- 26TSPS N22 026Dokument2 Seiten26TSPS N22 026Narayanan JeganNoch keine Bewertungen

- World Bank ReportDokument14 SeitenWorld Bank Reportaditya_erankiNoch keine Bewertungen