Beruflich Dokumente

Kultur Dokumente

A Brown vs. CIR

Hochgeladen von

Kwini Rojano0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

186 Ansichten11 Seitentax remedies

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentax remedies

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

186 Ansichten11 SeitenA Brown vs. CIR

Hochgeladen von

Kwini Rojanotax remedies

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

Copyright 1994-2009 CD Technologies Asia, Inc.

Philippine Taxation 2008 1

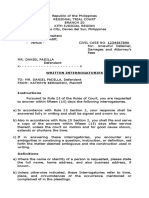

[C.T.A. CASE NO. 6357. June 7, 2004.]

A BROWN CO., INC., petitioner, vs. COMMISSIONER OF

INTERNAL REVENUE, respondent.

D E C I S I O N

This case involves tax deficiency assessments covering taxable year 1997 made

by respondent against petitioner. The petitioner seeks the cancellation of the above

disputed tax assessments inclusive of increments.

The facts of the case as culled from the records and evidence are as follows:

Petitioner is a corporation duly organized and existing under and by virtue of

the laws of the Republic of the Philippines and holds office at the Xavier Estates,

Upper Balulang, Cagayan de Oro, Philippines.

Pursuant to the Letter of Authority No. 21938 dated November 6, 1998, the

Bureau of Internal Revenue (BIR), through its Revenue District Office No. 39, South

Quezon City (RDO 39) conducted a tax investigation/examination of the books of

accounts and other accounting records of petitioner A Brown Co., Inc. (ABCI) for the

period 1997.

In addition to the opening of petitioner's books for examination, two (2)

requests for presentation of records were made to which the petitioner complied by

submitting copies of certain books of accounts and other documents such as the 1997

VAT Returns, 1997 Income Tax Return, 1997 Trial Balance, 1997 Lease Contracts

and working papers of the accounting firm of Laya Mananghaya.

Subsequently, on November 10, 1999, petitioner received from respondent,

through RDO 39, a letter numbered 39-707 formally informing the petitioner of the

Report of Investigation and that for the year 1997 it is liable for a Total Deficiency

Income Tax of P4,511,035.67.

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 2

On January 4, 2001, more than a year after the issuance of the Report of

Investigation, respondent issued a Preliminary Assessment Notice (PAN) against

petitioner finding it liable for income tax deficiency, deficiency documentary stamp

tax (DST) and deficiency value-added tax (VAT) in the amount of P119,419,076.68,

P236,059.08 and P12,824,527.42, respectively (Annex "A", Petition for Review). The

said PAN gave the petitioner fifteen (15) days from receipt thereof to present its side.

However, the letter and assessments were sent to petitioner's previous principal

address at Antonia Center Condominium, 94 Kamuning Road, Quezon City despite

respondent's knowledge of petitioner's change of principal office. It was only the

Building Administrator of Antonia Center who sent the same to petitioner on January

15, 2001.

However, as early as January 19, 2001, without awaiting for petitioner's reply

or the lapse of the required fifteen (15) day period, the BIR had issued a set of

unnumbered Assessments, together with the Formal Demand and Details of

Discrepancy (Annexes "B" to "E", Petition for Review) and sent to petitioner's

previous, principal office at 573 Gloria Street, Marick Subdivision, Sto. Domingo,

Cainta, Rizal. The same letter and assessments were received by petitioner on January

30, 2001.

On February 5, 2001, another set of unnumbered Assessment, together with the

Formal Demand and the Details of Discrepancy (Annexes "G " to "K", Petition for

Review), identical in form and substance to the first set of Assessment, was received

at petitioner's previous principal office at Antonia Center Condominium, 94

Kamuning Road, Quezon City.

On March 1, 2001, petitioner ABCI filed a Protest to the subject Assessment

Notices (Annex "L", Petition for Review) and subsequently, submitted all the relevant

supporting documents to justify the protest.

On November 26, 2001, there being no action on the part of the BIR, petitioner

filed this, Petition for Review.

The issues proposed by the petitioner are as follows:

1. Whether or not respondent faithfully complied with the

requirements in Section 228 of the National Internal Revenue Code

and Revenue Regulations 12-85 and 12-99, and Revenue

Memorandum Order 37-94; and

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 3

2. Whether or not the assessments were arbitrary and in violation of

the constitutional rights of petitioner ABCI to due process.

After considering the attending facts, the evidence adduced and the applicable

laws and jurisprudence, the court finds for the petitioner. cEDIAa

Inasmuch as Section 228 of the NIRC is the crux of contention, the same is

hereby quoted for easy reference, to wit:

"Section 228. Protesting of Assessment. When the

Commissioner or his duly authorized representative finds that proper taxes

should be assessed, he shall first notify the taxpayer of his findings: Provided,

however, That a pre-assessment notice shall not be required in the following

cases:

(a) When the finding for any deficiency tax is the result of mathematical

error in the computation of the tax as appearing on the face of the return; or

(b) When a discrepancy has been determined between the tax withheld

and the amount actually remitted by the withholding agent; or

(c) When a taxpayer who opted to claim a refund or tax credit of

excess creditable withholding tax for a taxable period was determined to have

carried over and automatically applied the same amount claimed against the

estimated tax liabilities for the taxable quarter or quarters of the succeeding

taxable year; or

(d) When the excise tax due on excisable articles has not been paid; or

(e) When an article locally purchased or imported by an exempt person,

such as, but not limited to, vehicles, capital equipment, machineries and spare

parts, has been sold, traded or transferred to non-exempt persons.

The taxpayer shall be informed in writing of the law and the facts on

which the assessment is made: otherwise, the assessment shall be void.

Within a period to be prescribed by implementing rules and regulations,

the taxpayer shall be required to respond to said notice. If the taxpayer fails to

respond, the Commissioner or his duly authorized representative shall issue an

assessment based on his findings.

Such assessment may be protested administratively by fling a request for

reconsideration or reinvestigation within thirty (30) days from receipt of the

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 4

assessment in such form and manner as may be prescribed by implementing rules

and regulations. Within sixty (60) days from the filing of the protest, all relevant

supporting documents shall have been submitted; otherwise, the assessment shall

become final.

If the protest is denied in whole or in part, or is not acted upon within

one hundred eighty (180) days from submission of documents, the taxpayer

adversely affected by the decision or inaction may appeal to the Court of Tax

Appeals within thirty (30) days from receipt of the said decision, or from the

lapse of the one hundred eighty (180)-day period; otherwise, the decision shall

become final, executors and demandable." (Emphasis supplied)

Likewise, Revenue Regulations Nos. 12-85 and 12-99, and Revenue

Memorandum Order 37-94 provide similar procedural requirements that must be

followed in order to sustain the validity and legality of an assessment.

The pertinent provisions of Revenue Regulation No. 12-85 the quoted as

follows:

"Section 1. Post-reporting notice. Upon receipt of the report of

finding, the Division Chief, Revenue District Officer or Chief, Office Audit

Section, as the case may be, shall send to the taxpayer a notice for on informal

conference before forwarding the report to higher authorities for approval. The

notice which is Annex "A" hereof shall be accompanied by a summary of findings

as basis for the informal conference.

In case where the taxpayer has agreed in writing to the proposed

assessment, or where such proposed assessment has been paid, the required

notice may be dispensed with.

xxx xxx xxx

Section 2. Notice of proposed assessment. When the Commissioner

or his duly authorized representative finds that taxes should be assessed, he shall

first notify the taxpayer of his findings in the attached prescribed form as Annex

''B" hereof. The notice shall be made in writing and sent to the taxpayer at the

address indicated in his return or at his last known address as stated in his notice

of change of address. . . .

Section 3. Time to reply. Venue for filing reply.

(a) Regional Office cases The taxpayer shall reply within a period

of fifteen (15) days from receipt of the pre-assessment notice. In meritorious

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 5

cases and upon written request of the taxpayer an extension maybe granted

within which to respond, but in no case shall the extension exceed a total of ten

(10) days. . . .

Section 4. Examination of records. In case the taxpayer responds to

the notice within the above-prescribed period, he or his duly authorized

representative shall be allowed to examine the records of the case and to

present his arguments in writing protesting the proposed assessment.

Thereafter, the Commissioner or his authorized representative shall, on the basis

of the evidence on record, decide whether or not to approve the report as a

prelude to the issuance of the corresponding assessment notice.

Section 5. Failure to reply to pre-assessment notices; issuance of

assessment. In the event the taxpayer fails to respond to the pre-assessment

notice within the above prescribed period, or when the Commissioner or his duly

authorized representative finds the response to be without merit, he should be

informed of such fact and the report of investigation shall be given due course."

(Emphasis supplied)

Revenue Regulation No. 12-99 states as follows:

"Section 3. Due Process requirement in the Issuance of a Deficiency

Tax Assessment. . . .

3.1.1 Notice for informal conference. The Revenue Officer who

audited the taxpayer's records shall, among others, state in his report whether or

not the taxpayer agrees with his findings that the taxpayer is liable for deficiency

tax or taxes. If the taxpayer is not amenable, based on the said officer's submitted

report of investigation, the taxpayer shall be informed, in writing, by the Revenue

District Office or by any Special Investigation Division, as the case may be (in

the case of Revenue Offices) or by the Chief of Division concerned (in the case

of the BIR National Office) of the discrepancy or discrepancies in the taxpayer's

payment of his internal revenue taxes, for the purpose of "Informal Conference,"

in order to afford the taxpayer with an opportunity to present his side of the

case. If the taxpayer fails to respond within fifteen (15) days from date of

receipt of the notice for informal conference, he shall be considered in default in

which case, the Revenue District Officer or the Chief of the Special Investigation

Division of the Revenue Regional Office, or the Chief of Division in the National

Office, as the case may be, shall endorse the case with the least possible delay to

the Assessment Division of the Revenue Regional Office or to the Commissioner

or his duly authorized representative, as the case may be for appropriate review

and issuance of a deficiency tax assessment, if warranted.

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 6

3.1.2 Preliminary Assessment Notice (PAN). If after review and

evaluation by the Assessment Division or by the Commissioner or his duly

authorized representative, as the case may be, it is determined that there exists

sufficient basis to assess the taxpayer for any deficiency tax or taxes, the said

Office shall issue to the taxpayer, at least by registered mail, a Preliminary

Assessment Notice (PAN) for the proposed assessment, showing in detail, the

facts and the law, rules and regulations, or jurisprudence on which the proposed

assessment is based (see illustration in ANNEX A hereof). If the taxpayer fails

to respond within fifteen (15) days from date of receipt of the PAN, he shall be

considered in default, in which case, a formal letter of demand and assessment

notice shall be caused to be issued by the said Office, calling for the payment of

the taxpayer's deficiency tax liability, inclusive of the applicable penalties. . . .

3.1.4 Formal Letter of Demand and Assessment Notice. The formal

letter of demand and assessment notice shall be issued by the Commissioner or

his duly authorized representative. The letter of demand calling for payment of

the taxpayer's deficiency tax or taxes shall state the facts, the law, rules and

regulations, or jurisprudence on which the assessment is based, otherwise, the

formal letter of demand and assessment notice shall be void (see illustration in

ANNEX B hereof). The same shall be sent to the taxpayer only by registered

mail or by personal delivery. If sent by personal delivery, the taxpayer or his duly

authorized representative shall acknowledge receipt thereof in the duplicate copy

of the letter of demand, showing the following: (a) His name; (b) signature; (c)

designation and authority to act for and in behalf of the taxpayer, if

acknowledged received by a person other than the taxpayer, if acknowledged

received by a person other than the taxpayer himself; and (d) date of receipt

thereof. . . ." (Emphasis supplied)

Revenue Memorandum Order No. 37-94, which governs the "procedures on

the preparation, approval and release of assessment notices and demand letters"

further provides thus:

"xxx xxx xxx

C. Review of Reports of Investigation and Service of Pre-assessment

Notices

xxx xxx xxx

''2 The aforementioned reviewing offices, after haying reviewed the

report of investigation, shall send a pre-assessment notice to the taxpayer,

indicating therein the basis of the assessment, and a definite time frame within

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 7

which he may protest the same if he is not agreeable. If the taxpayer files his

protest within the period prescribed in the aforementioned notice, the same

reviewing offices shall likewise decide whether the protest conforms with

existing requirements and whether or not to give due course to the protest. The

reviewing office shall then inform the taxpayer in writing of the result of the

resolution of his protest.

If the pre-assessment notice is not protested within the prescribed period,

the reviewing office shall then issue a letter of demand and assessment notice to

the taxpayer." (Emphasis supplied)

The foregoing provisions of law and rules and regulations clearly enumerate

the procedural due process requirements that must be strictly followed in order to

sustain the validity and legality of an assessment. First, a notice for informal

conference shall be sent to the taxpayer accompanied by a Summary of Findings or

Report of Investigation. Following the informal conference, the Commissioner or his

duly authorized representative, if he finds that taxes should be assessed shall again

notify the taxpayer in writing in the form of a Pre-Assessment Notice (PAN).

The taxpayer is then given fifteen (15) days from receipt to make a reply. In

addition, the taxpayer is permitted to examine the records of the case and to present

his arguments in writing. Only then, can the Commissioner or his authorized

representative, on the basis of the evidence on record, decide whether or not to

approve the report as a prelude to the issuance of the corresponding assessment. A

subsequent notice is then required to notify the taxpayer of the fact that he either

failed to respond to the pre-assessment notice or that his response is without merit.

In the case before us, the records show that the respondent failed to comply

with these prerequisites.

First, the Report of Investigation which respondent sent to the petitioner prior

to the issuance of the pre-assessment notice indicated that there is a finding of

deficiency income tax of only P4,511,035.67 (Exhibit "G-1-a"). If ever a

pre-assessment should properly issue against the petitioner, the same should have

reflected the findings made on the Report of Investigation. Instead, the pre-assessment

notice completely departed from result of the Report of Investigation by increasing the

alleged tax liabilities of the petitioner.

Secondly, the law and the rules and regulation is issued pursuant thereto

clearly give the taxpayer the right to reply to the pre-assessment notice. The period

given to the taxpayer is fifteen (15) days from receipt of the Preliminary Assessment

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 8

Notice. Here, the same was withheld from the petitioner. IHaCDE

The records indicate that the respondent issued the Preliminary Assessment

Notice on January 4, 2001. However, on the same date, respondent, through registered

mail, sent the Preliminary Assessment Notice to petitioner ABCI's former address in

Antonia Center Condominium, 94 Kamuning Road, Quezon City. On January 15,

2001, the Building Administrator of Antonia Center Condominium received the

mailed Preliminary Assessment Notice and forwarded it to petitioner the same day.

Assuming that there was a proper service of the Preliminary Assessment Notice

on January 15, 2001, it is clear that petitioner had until January 30, 2001 within which

to file a Reply.

Nevertheless, as early as January 19, 2001 or merely four (4) days after the

Preliminary Assessment Notice was received at petitioner's previous address, and

without waiting for the lapse of the mandatory 15-day period for petitioner to reply,

respondent had already issued the subject assessments. Such actuations reveal a

disposition to prejudge petitioner as liable for assessment, even before it could be

given a chance to be heard. It cannot be argued that the issuance of a Preliminary

Assessment Notice may be legally dispensed with inasmuch as the situation of the

present case is not one of the excepted circumstances justifying the issuance of an

Assessment without the Preliminary Assessment.

Moreover, the Preliminary Assessment and Assessment Notices were sent to

the wrong addresses. The Preliminary Assessment Notice and one of the first of the

two sets of questioned assessments were sent both to 94 Antonia Center, Kamuning

Road, Quezon City. The other set of questioned assessments was sent to 573 Gloria

Marick Subd., Sto. Domingo, Cainta, Rizal. These were one despite the fact that

petitioner had already informed respondent of its change of addresses as well as its

transfer to another Revenue District Office. The record proves that respondent knew

at that time that petitioner's principal office was at Sitio Harangan, Plaza Aldea,

Tanay, Rizal as respondent was already communicating to petitioner at this address,

evidenced by his letter dated January 11, 2000, classifying petitioner as a Large

Taxpayer (Annex "N", Petition for Review).

The sending of the Preliminary Assessment Notice and the Assessment Notice

to the wrong address may only be seen as an attempt to mislead or confuse petitioner,

especially as to the period to reply thereto or to file a Protest. Noteworthy is the fact

that the period given under the law and the rules and regulations are very material,

and call for such stringent obligation upon a taxpayer, that a delay to reply or to file a

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 9

Protest would make the Assessment final and executory.

Clearly, the issuance of the questioned assessments is in blatant violation of

Section 228 of the NIRC, the provisions of Revenue Regulations Nos. 12-85 and

12-99, and Revenue Memorandum Order No. 37-94.

The question now is "Would these violations render null and void the subject

assessments?"

A review of the prevailing jurisprudence on the matter proves that the answer

is in the affirmative.

In Commissioner of Internal Revenue v. Algue, Inc., G.R. No. L-28896,

February 12, 1988, (158 SCRA 9), the Supreme Court explained the raison d'etre

behind this strict adherence to the prescribed procedure:

"Traces are life blood of the government and so shall be collected

without unnecessary hindrance. On the other hand, such collection should be

made in accordance with law as any arbitrariness will negate the very reason

for government itself. It is therefore necessary to reconcile the apparently

conflicting interests of the authorities and the taxpayers so that the real purpose

of taxation, which is the promotion of the common good, May be achieved. . . .

It is said that taxes are what we pay for civilized society. Without taxes,

the government would be paralyzed for lack of the motive power to activate and

operate it. Hence, despite the natural reluctance to surrender part of one's

hard-earned income to the taxing authorities, every person who is able to must

contribute his share in the running of the government. The government, for its

part, is expected to respond in the form of tangible and intangible benefits

intended to improve the lives of the people and enhance their moral and material

values. This symbiotic relationship is the rationale of taxation and should dispel

the erroneous notion that it is an arbitrary method of exaction by those in the

seat of power.

"But even as we concede the inevitability and indispensability of

taxation, it is a requirement in all democratic regimes that is exercised

reasonably and in accordance with the prescribed procedure. If it is not, then

the taxpayer has a right to complain and the courts will then come to his succor.

For all the awesome power of the tax collector, he may still be stopped in his

tracks if the taxpayer can demonstrate, as it has here, that the law has not been

observed." (Emphasis supplied)

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 10

Similarly, the CTA on numerous occasions provided assistance to taxpayers

whose rights to due process were disregarded. In BPI Data System Corp. vs. CIR,

CTA Case No. 4530, January 12, 1994, the court ruled against the respondent when

he failed to give the taxpayer a chance to respond to a pre-assessment notice before

issuing an assessment. The CTA explained its decision in this manner:

"One of the most basic and fundamental precept of law enshrined in the

Constitution is that no person shall be deprived of his property without due

process of law (Sec. 1, Art. III, 1987 Constitution). The persuasiveness of the

right to due process reaches our both substantive and procedural rights,

regardless of their source, be it the constitution, or only a statute or a rule of

court (Tupas vs. Court of Appeals, 193 SCRA 597). The procedure granted by

law under Section 229 of the National Internal Revenue Code is a statutory

right of the taxpayer that cannot be wantonly disregarded without violating the

taxpayer's right to due process.

In the observance of procedural due process, this court is always

mindful that a taxpayer being made liable with his property be given an

opportunity to be heard which is one of its essential elements (Banco Espaol

vs. Palanca, 37 Phil. 921). With the failure of the respondent to strictly comply

with the procedure prescribed by law and the failure of the petitioner to receive

a copy of the alleged assessment, the latter was not afforded its right to be

heard for it was denied the opportunity to protest or dispute the alleged

assessment. The respondent utterly failed to establish that the assessment it has

conducted is a disputed assessment whereby 'the taxpayer questions an

assessment and asks the Collector to reconsider or cancel the same because he

believes he is not liable therefore. (Morales vs. Collector of Internal Revenue, 17

SCRA 1018).

Had the taxpayer been given an opportunity to dispute the questioned

assessment, then the same may have been given due consideration. In the

absence of any showing that administrative remedies granted by law has been

properly exhausted or that the petitioner failed to file a protest on the assessment

within the prescribed period despite receipt thereof, this Court could not bestow

the presumption of correctness on the said assessment. . . ." (Emphasis supplied)

Likewise, in the case of Caltex (Philippines), Inc. vs. CIR, CTA Case No.

5664, October 4, 2000, the CTA, in declaring the questioned assessments null and

void, opined:

". . . this Court is of the opinion that herein respondent committed an

arbitrary act tantamount to a violation of petitioner's right to procedural due

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 11

process when the former issued the assessment in question. Petitioner has

assiduously denounced the lack of prior notice for an informal conference and a

pre-assessment notice attending the issuance of the assailed assessment, as

required under BIR Revenue Regulation No. 12-85 which was issued pursuant

to Section 229 of the Tax Code, as amended. Inexplicably, records bear that

respondent did nothing to disprove petitioner's alleged non-receipt of notices."

To reiterate, the respondent committed grave violations of the law and

regulations when he issued the subject Assessments. The above violations go against

the values of right to due process held dearly by the judiciary. And this court is not

about to exempt this instant case from the same principle it has long enshrined.

WHEREFORE, the subject assessments are hereby declared as null and void,

cancelled and set aside. AaHTIE

SO ORDERED.

(SGD.) ERNESTO D. ACOSTA

Presiding Justice

WE CONCUR:

(SGD.) JUANITO C. CASTAEDA, JR.

Associate Justice

(SGD.) LOVELL R. BAUTISTA

Associate Justice

Das könnte Ihnen auch gefallen

- Abci V Cir DigestDokument9 SeitenAbci V Cir DigestSheilaNoch keine Bewertungen

- Prulife Vs CirDokument12 SeitenPrulife Vs CirERWINLAV2000Noch keine Bewertungen

- Arellano University School of Law Syllabus for Remedial Law Review IDokument41 SeitenArellano University School of Law Syllabus for Remedial Law Review IMrStereophoneixNoch keine Bewertungen

- TAXREV SANTOSsyllabusDokument7 SeitenTAXREV SANTOSsyllabusJoma CoronaNoch keine Bewertungen

- Revenue Memorandum Circular No. 50-2018: Quezon CityDokument18 SeitenRevenue Memorandum Circular No. 50-2018: Quezon CityKyleZapanta100% (1)

- Lakas Atenista Notes JurisdictionDokument8 SeitenLakas Atenista Notes JurisdictionPaul PsyNoch keine Bewertungen

- Taxation Law Mock BarDokument4 SeitenTaxation Law Mock BarKrizzy GayleNoch keine Bewertungen

- Silkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Dokument3 SeitenSilkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Vince LeidoNoch keine Bewertungen

- Republic of The Philippines Regional Trial CourtDokument2 SeitenRepublic of The Philippines Regional Trial CourtMarcus GilmoreNoch keine Bewertungen

- Cir Vs San Roque 690 Scra 336Dokument5 SeitenCir Vs San Roque 690 Scra 336Izzy Martin MaxinoNoch keine Bewertungen

- People vs. MendezDokument84 SeitenPeople vs. MendezYosef_dNoch keine Bewertungen

- Supreme Court Rules Muntinlupa City Ordinance Imposing 3% Tax on Alcohol, Tobacco Sales InvalidDokument8 SeitenSupreme Court Rules Muntinlupa City Ordinance Imposing 3% Tax on Alcohol, Tobacco Sales InvalidPaul Joshua SubaNoch keine Bewertungen

- Quezon City Ordinance Requiring Memorial Parks to Set Aside Land for Paupers' Burials Declared InvalidDokument95 SeitenQuezon City Ordinance Requiring Memorial Parks to Set Aside Land for Paupers' Burials Declared InvalidKNoch keine Bewertungen

- BAR E&AMINATION 2004 TAXATIONDokument8 SeitenBAR E&AMINATION 2004 TAXATIONbubblingbrookNoch keine Bewertungen

- All Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjDokument16 SeitenAll Jrdoss No Crsrxs or Court Op: (La Ïp Studr2Vt PractjcrjJan Erik Manigque100% (1)

- People v. Gloria KintanarDokument47 SeitenPeople v. Gloria KintanarLaurice Claire C. Peñamante50% (2)

- Tax AmnestyDokument25 SeitenTax AmnestyCali Shandy H.Noch keine Bewertungen

- Legal Counselling Case Digest Feb 12Dokument30 SeitenLegal Counselling Case Digest Feb 12angelicaNoch keine Bewertungen

- fflmtiln: Upreme LourtDokument11 Seitenfflmtiln: Upreme LourtJesryl 8point8 TeamNoch keine Bewertungen

- Mindanao Shopping (Reso)Dokument12 SeitenMindanao Shopping (Reso)JCapskyNoch keine Bewertungen

- Section 401-402Dokument8 SeitenSection 401-402Rigel Kent Tugade100% (1)

- CTA En Banc Correctly Dismissed Petition for Failure to File ReconsiderationDokument1 SeiteCTA En Banc Correctly Dismissed Petition for Failure to File ReconsiderationOrlando DatangelNoch keine Bewertungen

- CIR Vs ReyesDokument16 SeitenCIR Vs Reyes123456789Noch keine Bewertungen

- Joint Sustainability Initiatives in Competition LawDokument7 SeitenJoint Sustainability Initiatives in Competition LawBoogie San JuanNoch keine Bewertungen

- Engtek v. CIR PDFDokument16 SeitenEngtek v. CIR PDFArnold Rosario ManzanoNoch keine Bewertungen

- 15 Republic Vs AblazaDokument5 Seiten15 Republic Vs AblazaYaz CarlomanNoch keine Bewertungen

- Possibilities in Taxation - Atty. Bobby LockDokument14 SeitenPossibilities in Taxation - Atty. Bobby LockROCHELLENoch keine Bewertungen

- Victorias Milling v. Philippine Ports AuthorityDokument3 SeitenVictorias Milling v. Philippine Ports Authoritybile_driven_opusNoch keine Bewertungen

- Public International Law: By: Atty. CandelariaDokument2 SeitenPublic International Law: By: Atty. CandelariaEan PaladanNoch keine Bewertungen

- Part 2 Political Law Reviewer by Atty SandovalDokument67 SeitenPart 2 Political Law Reviewer by Atty SandovalHazel Toledo MartinezNoch keine Bewertungen

- 050 Smart Communications. Inc. v. Municipality of Malvar, Batangas, G.R. No. 204429, February18, 2014Dokument5 Seiten050 Smart Communications. Inc. v. Municipality of Malvar, Batangas, G.R. No. 204429, February18, 2014Jerome MoradaNoch keine Bewertungen

- Lecture Notes - TrustDokument3 SeitenLecture Notes - TrustGalanza FaiNoch keine Bewertungen

- Civ Pro CasesDokument5 SeitenCiv Pro CasesClaudine SumalinogNoch keine Bewertungen

- Commissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Dokument9 SeitenCommissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Mariel ManingasNoch keine Bewertungen

- Natonton V MagawayDokument1 SeiteNatonton V MagawayFidelis Victorino QuinagoranNoch keine Bewertungen

- 4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006Dokument10 Seiten4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006FredamoraNoch keine Bewertungen

- Ha An An An An An N: Mock Bar Essay Exams ON Criminal Law By: Prof. Ramel C. Muria Prof Ro MS MSDokument4 SeitenHa An An An An An N: Mock Bar Essay Exams ON Criminal Law By: Prof. Ramel C. Muria Prof Ro MS MSJoan BaltazarNoch keine Bewertungen

- 02.BM - Taxing Off-Line Carriers. (07!12!07) .ICNDokument3 Seiten02.BM - Taxing Off-Line Carriers. (07!12!07) .ICNNotario PrivadoNoch keine Bewertungen

- Speccom-Exam - (Pilacan, Karyl Vic) PDFDokument8 SeitenSpeccom-Exam - (Pilacan, Karyl Vic) PDFPilacan KarylNoch keine Bewertungen

- Republic Vs Central Surety and Po Kee KamDokument1 SeiteRepublic Vs Central Surety and Po Kee KamSbl IrvNoch keine Bewertungen

- Rem Rev 1 PDFDokument12 SeitenRem Rev 1 PDFJohn Romano AmansecNoch keine Bewertungen

- Landmark VAT Cases on Zero-Rated Sales and Franchise OperationsDokument12 SeitenLandmark VAT Cases on Zero-Rated Sales and Franchise OperationsJudeRamosNoch keine Bewertungen

- Vallacar Transit - Hambala v. YapDokument2 SeitenVallacar Transit - Hambala v. YapMarlon Rey AnacletoNoch keine Bewertungen

- Tax 2 Remedies Digests KoDokument29 SeitenTax 2 Remedies Digests KoMary Ann LeeNoch keine Bewertungen

- Summary of Significant CTA Decisions (February 2011)Dokument2 SeitenSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNoch keine Bewertungen

- Taxation Answer Key Highlights Business VAT RulesDokument11 SeitenTaxation Answer Key Highlights Business VAT RulesKim AranasNoch keine Bewertungen

- Value Added Tax2Dokument28 SeitenValue Added Tax2biburaNoch keine Bewertungen

- Double Insurance and Over InsuranceDokument2 SeitenDouble Insurance and Over InsuranceHannah Keziah Dela CernaNoch keine Bewertungen

- Philippine Phosphate Fertilizer Corporation v. CirDokument2 SeitenPhilippine Phosphate Fertilizer Corporation v. CirLoNoch keine Bewertungen

- VAT Law - Pre-BarDokument37 SeitenVAT Law - Pre-BarKennedy AbarcaNoch keine Bewertungen

- Unfair Labor PracticeDokument2 SeitenUnfair Labor PracticejeandpmdNoch keine Bewertungen

- Mindanao Shopping v. Davao CityDokument7 SeitenMindanao Shopping v. Davao CityPaul Joshua SubaNoch keine Bewertungen

- For Judge San PedroDokument112 SeitenFor Judge San PedroHershey GabiNoch keine Bewertungen

- CIR v. AcesiteDokument4 SeitenCIR v. AcesiteTheresa BuaquenNoch keine Bewertungen

- Prescription - PenaltiesDokument13 SeitenPrescription - PenaltiesFrancisCarloL.FlameñoNoch keine Bewertungen

- Code of Commerce of The PhilippinesDokument3 SeitenCode of Commerce of The PhilippinesLance KerwinNoch keine Bewertungen

- CTA Case No. 6191Dokument11 SeitenCTA Case No. 6191John Kenneth JacintoNoch keine Bewertungen

- Coon of Tax Appeals: Second DivisionDokument12 SeitenCoon of Tax Appeals: Second DivisionGeorge HabaconNoch keine Bewertungen

- Digests 2Dokument17 SeitenDigests 2Henry LNoch keine Bewertungen

- Atlas V CIRDokument5 SeitenAtlas V CIRAgnes FranciscoNoch keine Bewertungen

- Doledo18 A DC 01 12Dokument3 SeitenDoledo18 A DC 01 12robinrubinaNoch keine Bewertungen

- DO 174-17 Rules Implementing Articles 106 To 109 of The Labor Code, As AmendedDokument13 SeitenDO 174-17 Rules Implementing Articles 106 To 109 of The Labor Code, As AmendedGloria Mira91% (11)

- PP vs. Janjalani Full TextDokument29 SeitenPP vs. Janjalani Full TextKwini RojanoNoch keine Bewertungen

- Chu vs. Mach AsiaDokument1 SeiteChu vs. Mach AsiaKwini RojanoNoch keine Bewertungen

- Latest Jurisprudence in Civil Law - MJDokument32 SeitenLatest Jurisprudence in Civil Law - MJKwini RojanoNoch keine Bewertungen

- Remedial Law 1 Cases CompleteDokument22 SeitenRemedial Law 1 Cases CompleteKwini RojanoNoch keine Bewertungen

- Abellana vs. PPDokument1 SeiteAbellana vs. PPKwini RojanoNoch keine Bewertungen

- Latest Civ CasesDokument13 SeitenLatest Civ CasesKwini RojanoNoch keine Bewertungen

- 16th Congress House Bill No - 2624Dokument4 Seiten16th Congress House Bill No - 2624Kwini RojanoNoch keine Bewertungen

- Cerezo vs. People FullDokument17 SeitenCerezo vs. People FullKwini RojanoNoch keine Bewertungen

- Medado vs. Heirs of Antonio Consing DigestDokument3 SeitenMedado vs. Heirs of Antonio Consing DigestKwini RojanoNoch keine Bewertungen

- City of Iligan Vs Principal MGT GroupDokument9 SeitenCity of Iligan Vs Principal MGT GroupKwini RojanoNoch keine Bewertungen

- Aznar vs. CtaDokument14 SeitenAznar vs. CtaKwini RojanoNoch keine Bewertungen

- State Prosecutors Vs MuroDokument2 SeitenState Prosecutors Vs MuroKwini RojanoNoch keine Bewertungen

- Insight in Ship Crews: Multiculturalism and Maritime SafetyDokument18 SeitenInsight in Ship Crews: Multiculturalism and Maritime SafetyKwini RojanoNoch keine Bewertungen

- Advanced Legal Writing Course SyllabusDokument4 SeitenAdvanced Legal Writing Course SyllabusKwini RojanoNoch keine Bewertungen

- Insight in Ship Crews: Multiculturalism and Maritime SafetyDokument18 SeitenInsight in Ship Crews: Multiculturalism and Maritime SafetyKwini RojanoNoch keine Bewertungen

- Aznar vs. CtaDokument14 SeitenAznar vs. CtaKwini RojanoNoch keine Bewertungen

- The 2007-2008 Outline in Constitutional LawDokument14 SeitenThe 2007-2008 Outline in Constitutional Lawhardcore88Noch keine Bewertungen

- The 2007-2008 Outline in Constitutional LawDokument14 SeitenThe 2007-2008 Outline in Constitutional Lawhardcore88Noch keine Bewertungen

- CIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationDokument10 SeitenCIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationhenzencameroNoch keine Bewertungen

- CIR vs. Metro Star SuperamaDokument15 SeitenCIR vs. Metro Star SuperamaKwini RojanoNoch keine Bewertungen

- Sanlakas Vs Exec Sec 2004Dokument38 SeitenSanlakas Vs Exec Sec 2004Kwini RojanoNoch keine Bewertungen

- RMO No 8-2014Dokument3 SeitenRMO No 8-2014Kwini RojanoNoch keine Bewertungen

- Dela Pena vs. HidalgoDokument18 SeitenDela Pena vs. HidalgoKwini RojanoNoch keine Bewertungen

- Francisco vs. House of RepDokument55 SeitenFrancisco vs. House of RepKwini RojanoNoch keine Bewertungen

- CIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationDokument10 SeitenCIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationhenzencameroNoch keine Bewertungen

- 02 Macariola V AsuncionDokument14 Seiten02 Macariola V AsuncionCarmela Lucas DietaNoch keine Bewertungen

- N Jaworski Vs PagcorDokument1 SeiteN Jaworski Vs PagcorKwini RojanoNoch keine Bewertungen

- Smith Bell Dodwell Shipping Agency Corporation vs. BorjaDokument7 SeitenSmith Bell Dodwell Shipping Agency Corporation vs. BorjaElephantNoch keine Bewertungen

- Sample Complaint Affidavit For Estafa Case (ARRA)Dokument4 SeitenSample Complaint Affidavit For Estafa Case (ARRA)Moises ApolonioNoch keine Bewertungen

- An Analysis On The Concept of Retrenchment in The Light of BSNL v. Bhurumal (2014) 2 SCC (L&S) 373Dokument21 SeitenAn Analysis On The Concept of Retrenchment in The Light of BSNL v. Bhurumal (2014) 2 SCC (L&S) 373Uditanshu MisraNoch keine Bewertungen

- Heirs of Gamboa Vs TevesDokument1 SeiteHeirs of Gamboa Vs TevesmarvinNoch keine Bewertungen

- The Effectiveness of Protecting Children's Rights in Post-Conflict LiberianDokument72 SeitenThe Effectiveness of Protecting Children's Rights in Post-Conflict LiberianMbeeNoch keine Bewertungen

- Case DigestsDokument13 SeitenCase DigestsZaira Gem GonzalesNoch keine Bewertungen

- Shahani v. United Commercial Bank Bankruptcy AppealDokument18 SeitenShahani v. United Commercial Bank Bankruptcy AppealNorthern District of California BlogNoch keine Bewertungen

- IJHRL v6 2011-2012 Birkenthal pp.27-40Dokument14 SeitenIJHRL v6 2011-2012 Birkenthal pp.27-40iik19Noch keine Bewertungen

- Legal Aspects of NursingDokument22 SeitenLegal Aspects of NursingPayal Thakker90% (20)

- German Management Services Vs CADokument9 SeitenGerman Management Services Vs CAMica ValenzuelaNoch keine Bewertungen

- Affidavit-Complaint: People of The Philippines CRIMINAL CASE NO. 11E-03792Dokument3 SeitenAffidavit-Complaint: People of The Philippines CRIMINAL CASE NO. 11E-03792Kristia CapioNoch keine Bewertungen

- Moot ProblemDokument14 SeitenMoot ProblemSaumya RaizadaNoch keine Bewertungen

- Republic of the Philippines Regional Trial Court Written InterrogatoriesDokument3 SeitenRepublic of the Philippines Regional Trial Court Written InterrogatoriesKobe Bullmastiff100% (10)

- Lect. 4.2 NuisanceDokument50 SeitenLect. 4.2 NuisanceKaycia HyltonNoch keine Bewertungen

- City of Baguio v. de LeonDokument1 SeiteCity of Baguio v. de LeonJulia ChuNoch keine Bewertungen

- Ashok Jain FinalDokument8 SeitenAshok Jain FinalSonu KumarNoch keine Bewertungen

- Supreme Court upholds constitutionality of VAT Reform ActDokument11 SeitenSupreme Court upholds constitutionality of VAT Reform ActNathaniel CaliliwNoch keine Bewertungen

- Judicial Process in Modern IndiaDokument3 SeitenJudicial Process in Modern Indiasaurabh887Noch keine Bewertungen

- Japan Alcohol Tax CaseDokument2 SeitenJapan Alcohol Tax CaseNguyễn ThảoNoch keine Bewertungen

- N I P P: R ("Nipp")Dokument44 SeitenN I P P: R ("Nipp")Pradeep KumarNoch keine Bewertungen

- Fernando Gallardo V. Juan Borromeo: DecisionDokument2 SeitenFernando Gallardo V. Juan Borromeo: DecisionKRISTINE MAE A. RIVERANoch keine Bewertungen

- Cease and Desist To Taco Bell For Trademark InfringementDokument2 SeitenCease and Desist To Taco Bell For Trademark InfringementDavis BauerNoch keine Bewertungen

- Vietnam Legislative ProcessDokument2 SeitenVietnam Legislative Processhiepd1Noch keine Bewertungen

- PP v. Palanas - Case DigestDokument2 SeitenPP v. Palanas - Case DigestshezeharadeyahoocomNoch keine Bewertungen

- Labor NotesDokument3 SeitenLabor Notesregine rose bantilanNoch keine Bewertungen

- Judicial Ethics DigestsDokument23 SeitenJudicial Ethics DigestsJanineNoch keine Bewertungen

- Batchelder v. CBDokument7 SeitenBatchelder v. CBJuan TagadownloadNoch keine Bewertungen

- Akhil Gogoi Judgeme1Dokument57 SeitenAkhil Gogoi Judgeme1DipeshNoch keine Bewertungen

- CHED FOI Manual Provides Guidance on Right to Information RequestsDokument20 SeitenCHED FOI Manual Provides Guidance on Right to Information RequestsPhilAeonNoch keine Bewertungen

- Government of PakistanDokument13 SeitenGovernment of PakistanAyub ShahNoch keine Bewertungen