Beruflich Dokumente

Kultur Dokumente

Aviva 2014 Half Year Analyst Presentation

Hochgeladen von

Aviva GroupCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aviva 2014 Half Year Analyst Presentation

Hochgeladen von

Aviva GroupCopyright:

Verfügbare Formate

2014 Interim Results

1

Cautionary statements:

This should be read in conjunction with the documents filed by Aviva plc (the Company or Aviva ) with the United States Securities and Exchange Commission

( SEC ). This announcement contains, and we may make other verbal or written forward-looking statements with respect to certain of Avivas plans and current goals

and expectations relating to future financial condition, performance, results, strategic initiatives and objectives. Statements containing the words believes , intends ,

expects , projects , plans , will, seeks , aims , may , could , outlook , estimates and anticipates , and words of similar meaning, are forward-looking.

By their nature, all forward-looking statements involve risk and uncertainty. Accordingly, there are or will be important factors that could cause actual results to differ

materially from those indicated in these statements. Aviva believes factors that could cause actual results to differ materially from those indicated in forward-looking

statements in the presentation include, but are not limited to: the impact of ongoing difficult conditions in the global financial markets and the economy generally; the

impact of various local political, regulatory and economic conditions; market developments and government actions regarding the sovereign debt crisis in Europe; the

effect of credit spread volatility on the net unrealised value of the investment portfolio; the effect of losses due to defaults by counterparties, including potential

sovereign debt defaults or restructurings, on the value of our investments; changes in interest rates that may cause policyholders to surrender their contracts, reduce

the value of our portfolio and impact our asset and liability matching; the impact of changes in equity or property prices on our investment portfolio; fluctuations in

currency exchange rates; the effect of market fluctuations on the value of options and guarantees embedded in some of our life insurance products and the value of the

assets backing their reserves; the amount of allowances and impairments taken on our investments; the effect of adverse capital and credit market conditions on our

ability to meet liquidity needs and our access to capital; a cyclical downturn of the insurance industry; changes in or inaccuracy of assumptions in pricing and

reserving for insurance business (particularly with regard to mortality and morbidity trends, lapse rates and policy renewal rates), longevity and endowments; the

impact of catastrophic events on our business activities and results of operations; the inability of reinsurers to meet obligations or unavailability of reinsurance

coverage; increased competition in the UK and in other countries where we have significant operations; the effect of the European Unions Solvency II rules on our

regulatory capital requirements; the impact of actual experience differing from estimates used in valuing and amortising deferred acquisition costs ( DAC ) and

acquired value of in-force business ( AVIF ); the impact of recognising an impairment of our goodwill or intangibles with indefinite lives; changes in valuation

methodologies, estimates and assumptions used in the valuation of investment securities; the effect of legal proceedings and regulatory investigations; the impact of

operational risks, including inadequate or failed internal and external processes, systems and human error or from external events; risks associated with arrangements

with third parties, including joint ventures; funding risks associated with our participation in defined benefit staff pension schemes; the failure to attract or retain the

necessary key personnel; the effect of systems errors or regulatory changes on the calculation of unit prices or deduction of charges for our unit-linked products that

may require retrospective compensation to our customers; the effect of simplifying our operating structure and activities; the effect of a decline in any of our ratings by

rating agencies on our standing among customers, broker-dealers, agents, wholesalers and other distributors of our products and services; changes to our brand and

reputation; changes in government regulations or tax laws in jurisdictions where we conduct business; the inability to protect our intellectual property; the effect of

undisclosed liabilities, integration issues and other risks associated with our acquisitions; and the timing/regulatory approval impact and other uncertainties relating to

announced acquisitions and pending disposals and relating to future acquisitions, combinations or disposals within relevant industries. For a more detailed

description of these risks, uncertainties and other factors, please see Item 3d, Risk Factors , and Item 5, Operating and Financial Review and Prospects in Avivas

most recent Annual Report on Form 20-F as filed with the SEC. Aviva undertakes no obligation to update the forward looking statements in this announcement or any

other forward-looking statements we may make. Forward-looking statements in this announcement are current only as of the date on which such statements are made.

Disclaimer

2

Mark Wilson

Group Chief Executive Officer

2014 Interim Results

3

All metrics in this document other than balance sheet metrics are on a continuing basis

1. On a continuing basis, excluding US Life.

2. VNB on constant currency basis, excluding Eurovita, Malaysia and Aseval. Poland includes Lithuania.

3. The economic capital surplus represents an estimated unaudited position. The term economic capital relates

to Avivas own internal assessment and capital management policies and does not imply capital as required

by regulators or other third parties.

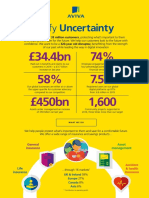

Half Year 2014 Results summary

Cash flow

Cash remittances to Group up 7% at 612m (HY13: 573 million)

Operating capital generation (OCG) stable at 910 million (HY13: 933 million)

Interim dividend per share 5.85p (HY13: 5.6p)

Profit

Profit after tax

1

up 113% to 863 million (HY13: 406 million) due to lower restructuring costs and positive investment variances

Operating profit

1

4% higher at 1,052 million (HY13: 1,008 million)

Operating EPS

1

16% higher at 23.6p (HY13: 20.3p)

Expenses

Operating expenses 1,399 million

1

down 129 million year on year

Annualised expense reduction run-rate equivalent to 568 million vs 400 million target

Group operating expense ratio of 52.1% (HY13: 54.8%

1

)

Value of new business

Value of new business

2

(VNB) up 9%

2

to 453 million (HY13: 428 million)

Poland, Turkey and Asia grew 54%

2

and contributed 25% of Group VNB

Combined operating ratio

Combined operating ratio (COR) improved to 95.5% (HY13: 96.2%)

UK COR of 94.3%, best in 7 years

Balance sheet

IFRS net asset value per share up 7% at 290p (FY13: 270p)

MCEV Net asset value per share up 3% at 478p (FY13: 463p)

External leverage ratio 46% of tangible capital (FY13: 50%), 30% on S&P basis

Intercompany loan reduced to 3.6bn at end of July 2014 (Feb14: 4.1bn)

Economic capital surplus

3

8.0 billion, 180% (FY13: 8.3 billion, 182%)

4

5 key metrics

1,052m

HY14

1,008m

HY13

1,399m

HY14

1,528m

HY13

95.5%

HY14

Operating profit

96.2%

HY13

Combined operating ratio

573m

HY13

453m

HY14

428m

HY13

Cash remittances

612m

Value of new business

HY14

5.6p

HY13 HY14

Operating expenses

Interim dividend

5.85p

55% 52%

5

1. VNB on constant currency basis, excluding Eurovita, Malaysia and Aseval.

4%

8%

0.7

ppt

7%

9%

1

4.5%

Progress on cash flow

C

a

s

h

f

l

o

w

Issue

Early progress satisfactory

1

2

3

4

6

Below 50%

Increase cash flow, efficiency and

retention

Below 40% on TNAV basis and

below 30% on S&P basis

More than double annual run-

rate to 0.8bn

Plan HY update

52% (FY13 54%)

100m from UK Life

back book actions

46% on TNAV

basis, 30% on

S&P basis

Remittances up 7%

to 612m. Central

spend 24% lower

Operating expense ratio is too high

Excess cash flow is inadequate

considering our earnings power

Life back books are inefficient and

capital intensive

High external leverage and debt service

levels deflates profits and restricts

financial flexibility

Progress on growth

Potential for growth through reallocation of capital

5

6

7

8

7

Reallocate resources to growth

businesses

Increase average product holdings

Two million MyAviva customers

Positive external fund flows at

Aviva Investors

VNB up 9%

1

Ongoing

1.2 million customers

1 billion of

platform net flows.

New AIMS product

launched

Growth is necessary but not at the cost

of dividends

Third party flows are weak

Current cross-sell rate is unacceptable

Need to grow digital and direct

G

r

o

w

t

h

1. Constant currency basis. Growth markets: Poland, Turkey and Asia

VNB of growth

markets up 54%

1

U/W result up 11%

Issue Plan HY update

Savings achieved ahead of 400m target

Expense ratios

FY 2013 HY 2013 HY 2014

Restructuring costs 284 120 3

Solvency II 79 44 39

Total 363 164 42

Operating expense ratio

Addressing fixed nature of operating cost base

Applying Systems Thinking to drive sustainable efficiencies

Cells to improve expense ratio

Savings on restructuring costs are in addition to operating

expense reductions

Actions taken in 2014

Satisfactory progress towards operating expense ratio target

-3ppt

50%

Target HY 2014

52%

HY 2013

55%

Below

Reduction in Restructuring costs

8

3,366

3,234

3,006

1,399

(132)

(228)

(208)

FY11 Saving FY12 Saving FY13 Saving FY14 run

rate

568

Annual

Savings

1,399

Implied

FY14

run rate

Below

50%

Sustainable and progressive cash flow growth

Investment Thesis Cash flow plus growth

Remittances from business units less central

and debt financing costs

Cash flow

1. Life Value of new business

2. GI Underwriting result

3. AI External net fund flows

Growth

True customer composite Digital first Not everywhere

Customer experience driven by digital

Serving all customer needs across Life,

GI, Health and Asset Management

Only in markets where we can win

Our strategic anchor

@

9

Tom Stoddard

Chief Financial Officer

2014 Interim Results

10

Operating profit improvement

IFRS Operating profit reconciliation

Operating profit HY13 1,008

UK Annuities (40)

Weather year on year (40)

Aseval (22)

Foreign exchange impact on income (90)

Operating expense savings 129

Other 107

Operating profit HY14 1,052

Operating profit million HY13 HY14 Change

Life 910 954 5%

General Insurance & Health 428 403 (6)%

Fund Management 42 48 14%

Other operations (49) (54) (10)%

Life, GI, fund management

& other operations

1,331 1,351 2%

Corporate costs (72) (64) 11%

Group debt & other interest costs (251) (235) 6%

Operating profit (continuing basis) 1,008 1,052 4%

Integration & restructuring (164) (42) 74%

Operating profit after integration &

restructuring (continuing basis)

844 1,010 20%

Investment Variances (308) 209 N/A

Tax & other Items (130) (356) (174)%

Profit after tax (continuing basis) 406 863 113%

Earnings per share

(basic pps)

HY13 HY14 Growth

Operating EPS 20.3 23.6 16%

Total EPS 10.2 25.0 145%

11

Net asset value per share IFRS MCEV*

Opening NAV per share at 31 December 2013 270p 463p

Operating profit 24p 31p

Dividends and appropriations (9)p (9)p

Investment variances & AFS equity movements 4p 3p

Pension fund 11p 11p

Integration and restructuring costs, goodwill impairment, other (1)p (8)p

Foreign exchange (9)p (13)p

Closing NAV per share at 30 June 2014 290p 478p

Net asset value

Movements shown net of tax and non controlling interests

*Opening MCEV net assets restated

12

Expense focus giving improved operating profit

100m of back book actions achieved in H1

Early stages of back book actions

Regulatory changes impacting VNB but business

adapting

Assets under management on IFA platform

increased to 4bn

UK Life

Operating profit Value of new business

million HY13 HY14

Annuities 138 81 (41)%

Protection 36 45 25%

Pensions 30 27 (10)%

Equity release & other 20 24 20%

Total 224 177 (21)%

472m

438m

263m

296m

350m

300m

36.9%

30.8%

13

Remittance to group

Operating Expense Ratio Operating expenses

HY14 HY13 HY14 HY13

HY14 HY13 HY14 HY13

Combined operating ratio

HY13 HY14

Personal Motor 96% 95%

Home 90% 95%

Commercial Motor 113% 99%

Commercial Property 86% 87%

Total 96% 94%

UK GI

Operating profit

m HY13 HY14

Underwriting result 78 114

Inv Income internal loan 116 82

Other Inv Income 45 55

Total 239 251

Operating Expense Ratio

Net written premium

COR is at its best level for 7 years despite storms in

January & February

Continued benefits from risk selection capabilities

Expense discipline in the face of lower volumes

H2 focus on returning to growth

15.1% 14.9%

1,963m

HY14

1,836m

HY13

Operating expenses

360m

328m

114m

239m

251m

137m

161m

78m

HY14 HY13

Underwriting Result LTIR

Operating profit

HY14 HY13 HY14 HY13

14

Value of new business

m HY13 HY14

Protection 30 30 0%

Unit linked savings 32 53 66%

Other savings 28 27 (4)%

Total 90 110 23%

France

Operating profit up 6% in constant currency

23% VNB growth on top 39% growth in 2013

Assets under management of over 90bn

generating stable revenue

COR improved two percentage points to 94%

216m

222m

Life

29.5%

33.8%

203m

216m

110m

90m

HY14 HY13

GI

11.5%

12.5%

15

Operating Expense Ratio

VNB

Operating expenses

Operating profit

HY14 HY13 HY14 HY13

HY14 HY13

Net written premiums up 6% on constant

currency basis

Remittances expected in H2 2014

Adverse operating profit impacts of weather

40m and foreign exchange 21m

Ontario regulatory reforms progressing in line

with expectations margin neutral

Combined operating ratio

HY13 HY14

Personal Motor 87% 95%

Home 95% 101%

Commercial 97% 97%

Total 92% 97%

Canada

147m

83m

196m

161m

1,026m

1,126m

15.8%

15.1%

16

11.7%

1

12.4%

1

1 Excludes premium tax at c. 3.4%

Operating Expense Ratio

Net written premium

Operating expenses

Operating profit

HY14 HY13 HY14 HY13

HY14 HY13 HY14 HY13

31.0%

General Insurance Combined Operating Ratio

Current year

underlying

loss ratio

Combined

operating

ratio

Prior year

reserve

movement

Weather vs

LTA

64.5%

HY14

64.1%

HY13

(0.8)%

(0.1)%

HY14 HY13

Expense ratio

1Commission ratio

2Expense ratio

95.5%

HY14

96.2%

HY13

32.3%

HY14 HY13

10.5%

2

10.0%

2

21.8%

1

21.0%

1

(0.2)%

0.8%

HY14 HY13

17

GBP

Constant

Currency

HY13** HY14

UK & Ireland 226 19% 183 19%

France 90 23% 110 27%

Poland* 21 58% 34 64%

Turkey 20 30% 14 10%

Asia*

41 62% 66 76%

Italy* 18 44% 26 49%

Spain*

11 61% 18 67%

Total VNB* 428 6% 453 9%

New business

margin* (%APE)

29% 1ppt 28% 1ppt

Value of new business

*Poland includes Lithuania, Italy excludes Eurovita, Spain excludes Aseval and Asia excludes Malaysia.

**HY13 total includes 1m for Russia

UK VNB impacted significantly by lower individual annuities

Greater collaboration with Aviva Investors and UK Life

Improvement in France driven by higher volumes of higher

margin unit linked products

Spain and Italy grew VNB as their turnaround continues, but

remain below their potential

Growth markets Poland, Turkey and Asia accounted for 25%

of Group VNB (HY13: 19%)

Excluding the impact of a change in withholding tax

methodology Turkey VNB stable

Reduction of margin due to the impact of individual annuities

offset by higher margin protection and unit linked

18

A focus on improving efficiency ratios

31%

15%

14%

52%

55%

<50%

14%

12bps

11bps

15%

35%

Expenses per

Profit Driver

Analysis* (PDA)

PDA Expenses

Op Expenses Op Expenses Op Expenses

Op profit + PDA

Expenses

Net Written

Premium

Average Funds

Under

Management

Net Written

Premium

Op profit (before

debt costs) + Op

Expenses

We expect Group operating expense ratio to improve

Life

GI FM Health Group

Segmental efficiency ratios

19

Group ratio

*Life expenses are per the profit driver analysis, excluding commission expenses and DAC on new business.

HY13 HY14 Plan

Cash remittances

Total by country* Operating capital generation

million HY 13 HY 14

UK & Ireland Life 258 414

UK & Ireland GI 216 228

France 174 127

Canada 108 40

Spain 33 23

Italy 52 33

Poland 65 85

Asia 63 (13)

Other** (36) (27)

Total 933 910

Remittances

Comments on remittances

HY 13 HY 14

300 350 Increased by 17%

0 0 Payable in H2 in line with prior year

103 90 Further remittance due in H2

63 0 No interim HY14. Full remittance H2

17 33 Increased by 94%

0 0 Payable in H2 in line with prior year

83 99 Increased by 19%

0 21 Singapore received H1 (2013 received H2)

7 19 AI received H1 (2013 received H2)

573 612

Remittances up 7% to 612m

* Continuing operations

** Other includes AI, Turkey, Other Europe, Aviva Reinsurance and Group activities

20

5.8

4.1

3.6

2.2

0

2

4

6

2012 Feb-14 Jul-14 Dec-15

bn

Improving financial strength

Intercompany loan

External leverage ratio reduced to 46%

Plan

46%

50% 50%

30%

32%

20

25

30

35

40

45

50

Plan

AA

HY14 2013 2012

33%

S&P TNAV

1. The economic capital surplus represents an estimated unaudited position. The term economic capital relates to Avivas own internal assessment and capital management policies

and does not imply capital as required by regulators or other third parties.

21

External leverage ratio

%

Plan

<40%

Economic capital surplus

1

8.0bn (1Q14: 7.8bn)

Central liquidity 1.2bn

External leverage reduced to 46% from 50% at FY13 on TNAV basis

Leverage reduced to 30% on S&P basis from 32% at FY13

Intercompany loan reduced to 3.6bn On plan for 2.2bn for December 2015

Mark Wilson

Group Chief Executive Officer

2014 Interim Results

22

Q & A

2014 Interim Results

23

Appendix

2014 Interim Results

24

Operating Expense Ratio

Components of Operating Expense Ratio

million HY13 HY14

Market Operating Profit 1,331 1,351

Less Corporate Centre (72) (64)

Group Operating profit excluding Debt Costs and Pension income 1,259 1,287

Add operating expenses 1,528 1,399

Operating Income 2,787 2,686

Total Operating Expenses over Operating Income 55% 52%

-3ppt

HY13

55%

52%

HY14

Operating Expense Ratio

Operating expenses

Operating income

= Expense ratio

25

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- PlanningDokument121 SeitenPlanningThessaloe B. FernandezNoch keine Bewertungen

- Aviva PLC - at A Glance March 2018Dokument2 SeitenAviva PLC - at A Glance March 2018Aviva GroupNoch keine Bewertungen

- Aviva at A Glance InfographicDokument2 SeitenAviva at A Glance InfographicAviva GroupNoch keine Bewertungen

- Aviva 2018 Key Metrics InfographicDokument1 SeiteAviva 2018 Key Metrics InfographicAviva GroupNoch keine Bewertungen

- Aviva 2018 Interim Results AnnouncementDokument10 SeitenAviva 2018 Interim Results AnnouncementAviva GroupNoch keine Bewertungen

- What Are We in Business For? Being A Good AncestorDokument22 SeitenWhat Are We in Business For? Being A Good AncestorAviva GroupNoch keine Bewertungen

- Aviva PLC 2016 ResultsDokument71 SeitenAviva PLC 2016 ResultsAviva GroupNoch keine Bewertungen

- Aviva 2017 Interim Results Analyst PresentationDokument64 SeitenAviva 2017 Interim Results Analyst PresentationAviva GroupNoch keine Bewertungen

- 2017 Preliminary Results AnnouncementDokument143 Seiten2017 Preliminary Results AnnouncementAviva GroupNoch keine Bewertungen

- Aviva 2017 Interim Results AnnouncementDokument131 SeitenAviva 2017 Interim Results AnnouncementAviva GroupNoch keine Bewertungen

- Aviva HY16 Results Summary - InfographicDokument1 SeiteAviva HY16 Results Summary - InfographicAviva GroupNoch keine Bewertungen

- Aviva PLC 2016 Results InfographicDokument2 SeitenAviva PLC 2016 Results InfographicAviva GroupNoch keine Bewertungen

- Aviva 2015 Full Year Results TranscriptDokument3 SeitenAviva 2015 Full Year Results TranscriptAviva GroupNoch keine Bewertungen

- Enabling Europe To Compete in The Global World of FinTechDokument2 SeitenEnabling Europe To Compete in The Global World of FinTechAviva GroupNoch keine Bewertungen

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDokument4 SeitenMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNoch keine Bewertungen

- Aviva PLC 2016 Interims Results AnnouncementDokument127 SeitenAviva PLC 2016 Interims Results AnnouncementAviva GroupNoch keine Bewertungen

- Aviva Half Year 2015 AnnouncementDokument163 SeitenAviva Half Year 2015 AnnouncementAviva GroupNoch keine Bewertungen

- Aviva PLC Capital Markets DayDokument2 SeitenAviva PLC Capital Markets DayAviva GroupNoch keine Bewertungen

- Aviva Half Year 2015 Analyst PresentationDokument30 SeitenAviva Half Year 2015 Analyst PresentationAviva GroupNoch keine Bewertungen

- Aviva 2015 Results InfographicDokument1 SeiteAviva 2015 Results InfographicAviva GroupNoch keine Bewertungen

- Aviva 2015 Preliminary AnnouncementDokument10 SeitenAviva 2015 Preliminary AnnouncementAviva GroupNoch keine Bewertungen

- 2015 Half Year Results Interview With Group CEO Mark WilsonDokument4 Seiten2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNoch keine Bewertungen

- Aviva Q1 IMS 2015 PDFDokument17 SeitenAviva Q1 IMS 2015 PDFAviva GroupNoch keine Bewertungen

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDokument5 SeitenInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNoch keine Bewertungen

- Aviva Q1 IMS 2015 PDFDokument17 SeitenAviva Q1 IMS 2015 PDFAviva GroupNoch keine Bewertungen

- Aviva 2014 Results PresentationDokument26 SeitenAviva 2014 Results PresentationAviva GroupNoch keine Bewertungen

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDokument7 Seiten2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNoch keine Bewertungen

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDokument4 SeitenAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNoch keine Bewertungen

- Aviva PLC 2014 Preliminary Results AnnouncementDokument9 SeitenAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNoch keine Bewertungen

- 7110 w12 Ms 21Dokument6 Seiten7110 w12 Ms 21mstudy123456Noch keine Bewertungen

- dp17136 PDFDokument280 Seitendp17136 PDFMahamadali DesaiNoch keine Bewertungen

- Limitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Dokument9 SeitenLimitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Taxpert Professionals Private LimitedNoch keine Bewertungen

- Chapter 3 The Accounting CycleDokument68 SeitenChapter 3 The Accounting CycleChala EnkossaNoch keine Bewertungen

- Project On BudgetingDokument75 SeitenProject On BudgetingManeha SharmaNoch keine Bewertungen

- Importance of Economic Value Added and LDokument9 SeitenImportance of Economic Value Added and LShyam ThapaNoch keine Bewertungen

- Income Taxation Provisions in the PhilippinesDokument11 SeitenIncome Taxation Provisions in the Philippinesroselleyap20Noch keine Bewertungen

- Conceptual Framework PPT 090719 PDFDokument53 SeitenConceptual Framework PPT 090719 PDFSheena OroNoch keine Bewertungen

- IFFCODokument54 SeitenIFFCOPriyanka Sharma67% (3)

- Accounts: Debit CreditDokument15 SeitenAccounts: Debit CreditKarylle LapigNoch keine Bewertungen

- Download Form 990 for Don and Mary Mitchell FoundationDokument1 SeiteDownload Form 990 for Don and Mary Mitchell FoundationSarah SportingNoch keine Bewertungen

- Business Finance Lecture NotesDokument118 SeitenBusiness Finance Lecture NotesYashrajsing Luckkana100% (1)

- HO FS AnalsisDokument15 SeitenHO FS AnalsisGva Umayam0% (2)

- AccointingDokument20 SeitenAccointingGhalib HussainNoch keine Bewertungen

- Tax ReportDokument5 SeitenTax ReportHanna Lyn BaliscoNoch keine Bewertungen

- Adv Accounts 11 Attempts Compilation M24 - UnlockedDokument543 SeitenAdv Accounts 11 Attempts Compilation M24 - Unlockedthakursumit851Noch keine Bewertungen

- Accounting For Consolidation at Acquisition: 2238 Financial Reporting - 2021/2022 T1Dokument25 SeitenAccounting For Consolidation at Acquisition: 2238 Financial Reporting - 2021/2022 T1Tommaso SpositoNoch keine Bewertungen

- Human Resouse Accounting Nature and Its ApplicationsDokument12 SeitenHuman Resouse Accounting Nature and Its ApplicationsParas JainNoch keine Bewertungen

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDokument25 SeitenCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNoch keine Bewertungen

- Netsanet ThesisDokument145 SeitenNetsanet ThesisamanualNoch keine Bewertungen

- Salary Advance Requisition FormDokument2 SeitenSalary Advance Requisition FormDILLIP KUMAR MAHAPATRA100% (1)

- Key Oracle Projects Tables ExplainedDokument8 SeitenKey Oracle Projects Tables ExplainedVishwamber ShettyNoch keine Bewertungen

- Codex PM - Training en - Day 1 - 09.12.2016Dokument166 SeitenCodex PM - Training en - Day 1 - 09.12.2016Iman RamangNoch keine Bewertungen

- FM TemplateDokument3 SeitenFM TemplateWynn WizzNoch keine Bewertungen

- Operating Statement Borrower's Name: XXXXXXXXXXXXXXXXXDokument13 SeitenOperating Statement Borrower's Name: XXXXXXXXXXXXXXXXXAbhishek GoenkaNoch keine Bewertungen

- A REPORT ON Working Capital Management IDokument78 SeitenA REPORT ON Working Capital Management IAriful Islam RonyNoch keine Bewertungen

- Exhibitor Manual CONTECH 2013 EngDokument49 SeitenExhibitor Manual CONTECH 2013 EngctyvteNoch keine Bewertungen

- D. Lilly Orchids CompanyDokument4 SeitenD. Lilly Orchids CompanyDexusNoch keine Bewertungen

- Declaration 80D 80DDBDokument1 SeiteDeclaration 80D 80DDBShobit0% (1)