Beruflich Dokumente

Kultur Dokumente

B.F Paper

Hochgeladen von

Adnan SethiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

B.F Paper

Hochgeladen von

Adnan SethiCopyright:

Verfügbare Formate

Do Behavioral Biases Explain Capital Structure Decisions

Anchoring bias: is a cognitive bias that defines the tendency of relying of an individual on the first piece

of information.

Problem statement:

A number of researches are conducted on the capital structure and determinants of capital structure is

developed and developing countries by focusing on the work of Modigliani and miller (1958). These

researches focus on the extant and type of source of capital used by the organizations. These researches

focus on three theories of capital structure like agency cost theories, bankruptcy and tax based theories

and information asymmetric theories. While all these theories focus on the adoption of any of these

theories and find out their relation with the capital structure. These theories are silent on the issue of

managers perception regarding adoption of different sources of finance, due to which the proper

identification of management decisions regarding capital structure is quite impossible.

Research Gap:

The area of discussing behavioral aspects of management in capital structure is not properly explored

and limited research has been conducted before in this area. There is a gap in the academic literature

that link corporate financial and behavioral financial decisions with regard to the issue of capital

structure, however there has been some attempts to explain capital structure from a behavioral

standpoint. This paper examines the relationship between anchoring as a behavioral bias exhibited by

managers and their decisions on whether to issue debt or equity. This relationship is based upon the

argument of market timing, on which managers perceive what the value of firm is and what kind of

sources of financing is best suitable for them. Either debt or equity.

Variables:

We investigate whether anchoring captured by a number of proxies including market to-book ratios, the

proportion of shares sold off that are held by managers, the exercising of stock options held by

managers long before their expiration dates, share repurchases, stock returns, bond yields, 52-week

share price highs, and share prices at last equity issue and last debt issue, sufficiently explains the

changing levels of debt or capital structure mix adopted by firms.

Theoretical background:

The research on capital structure is start its life from Modigliani Millar capital irrelevance theory, which

is further enhanced by introducing the trade off and packing order theories for determination of capital

structure by an organization. These Trade off theories and packing order theories are used widely in

making the capital decisions, both of these theories does not define the behavior of managers regarding

any kind of capital structure decisions. To complement the traditional theories in further explaining

capital structure choices, a new stream of research based on behavioral biases is emerging.

Market timing is used to measure behavior because shefrin (2005) is of the view that capital structure

affected by behavioral biases through market timing as well as financial flexibility. The argument for

market timing emphasize the point that new equity is issued when management perceive that their

share price is overvalued or has reached a peak. This market perception is measured through high

market-to-book ratio. an indicator to capture whether the managers think that their firms share

price has peaked is to observe the proportion of their personal portfolio that they sell off and vice

versa.

The debt to equity choices of firm is based upon the argument of baker and Wurgler (2002), who is of

the view about the inexistence of optimal capital structure of the organization, and this inexistence

provide way to market timing to show its involvement in the capital structure.

Welch (2004) defines stock prices as first order determinants of debt ratios and explained the

relationship between debt ratios and capital structure through omitted share prices variable.

Shefrin (2005) also argues that some firms simply value financial flexibility and will issue debt so as to

hold enough cash especially in times of uncertainty. This might be interpreted from a behavioral

finance perspective that management become overconfident about potential takeover prospects in the

future, at some point when other firms might become distressed and consequently would potentially be

targets for acquisitions.

However, behavioral bias like anchoring effect used in this study is also viewed from prospect theory, in

which investor is indifference among capital gains and losses. The argument of prospect theory in this

study is managers, CEO, insiders of the firm and VCs were satisfied when they realised a net

wealth gain arising from the appreciation in value of their retained shares when the closing price of

the share is higher.

This research adopts the overconfidence of managers as a bias to explain its effect on the capital

structure. In this regard, Barros and Da Silveira (2007) study on Brazilian market is examined that focus

on the managerial optimism and overconfidence on the basis of entrepreneurial nature of the

managers. They are of the view that the firms managed or owned by the overconfident managers focus

on more levered capital structures for their organizations. The market to book ratio as proxy of

measurement of management behavioral perspective is also studied by focusing on the Oliver (2005)

study, which uses consumer sentiment index in this regard and determines market-to-book ratio as a

significant determinant of capital structure decisions.

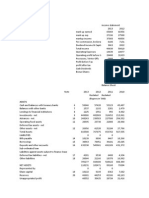

Model and variables:

In our model, we employ different measures of leverage by using both the total debt and long-term debt

scaled by the book value of assets. Total debt overestimates the borrowing capacity of the firm, while

short term debt in the analysis may not capture correctly the true underlying determinants of a firms

borrowing decisions, but longer term contractual obligations are likely to be qualitatively different

compared to those that affect short-term borrowing. In this regard, both long and short term debts are

used in this study.

Behavioral biases are measured through market-to-book ratios, personal sell off of shares held by

managers, managers exercising of stock options, share buy-backs, book-to-market ratios, stock

returns, bond yields, 52-week share price highs, share price at last equity issue, and share price at last

debt issue.

Due to the natural lag inherent in the nature of this study, we use as a proxy the previous

years share price as a measure of anchoring to determine whether managers decide to issue equity or

debt in the current period.

In order to capture the managerial perspective regarding share prices, we considered the six months

before expiration prices of options to better identify their trade off with the money value at expiration.

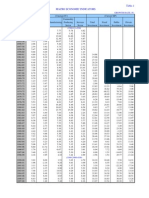

Data and Methodology:

The data used in this study was extracted from the Profit and Loss Accounts and Balance Sheets

of all publicly listed US and Canadian firms from 1990 to 2007.

Thomsons SDC Platinum database to get data of CEOs personal portfolios held and their selling of

shares as well as their exercising of stock options.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Audit Program - CashDokument1 SeiteAudit Program - CashJoseph Pamaong100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- FNC535 Midterms DraftDokument8 SeitenFNC535 Midterms DraftRufino Gerard MorenoNoch keine Bewertungen

- Section 1: Demographic InformationDokument2 SeitenSection 1: Demographic InformationAdnan SethiNoch keine Bewertungen

- Capital Budgeting AssignmentDokument6 SeitenCapital Budgeting AssignmentAdnan SethiNoch keine Bewertungen

- ARDLDokument10 SeitenARDLAdnan SethiNoch keine Bewertungen

- Section 1: Demographic InformationDokument2 SeitenSection 1: Demographic InformationAdnan SethiNoch keine Bewertungen

- Logic Bs-IIIDokument139 SeitenLogic Bs-IIIAdnan Sethi0% (1)

- Calculation of KSE 100 IndexDokument10 SeitenCalculation of KSE 100 IndexAdnan SethiNoch keine Bewertungen

- My Internship Report 13Dokument73 SeitenMy Internship Report 13Adnan SethiNoch keine Bewertungen

- Guru AssignmentDokument3 SeitenGuru AssignmentAdnan SethiNoch keine Bewertungen

- MCB AnalysisDokument7 SeitenMCB AnalysisAdnan SethiNoch keine Bewertungen

- Rough Justification For PaperDokument2 SeitenRough Justification For PaperAdnan SethiNoch keine Bewertungen

- Guru AssignmentDokument3 SeitenGuru AssignmentAdnan SethiNoch keine Bewertungen

- Case Study Dot Com CrashDokument2 SeitenCase Study Dot Com CrashElaineKongNoch keine Bewertungen

- PaperDokument4 SeitenPaperAdnan SethiNoch keine Bewertungen

- Cash Flow StatementDokument10 SeitenCash Flow StatementAdnan SethiNoch keine Bewertungen

- L21 TheDot ComBubbleDokument17 SeitenL21 TheDot ComBubbleAdnan SethiNoch keine Bewertungen

- Not All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsDokument1 SeiteNot All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsAdnan SethiNoch keine Bewertungen

- 7.1 KSE 100 & General Index of All Shares: Sector NameDokument5 Seiten7.1 KSE 100 & General Index of All Shares: Sector NameZahid RehmanNoch keine Bewertungen

- Managment ArticlesDokument1 SeiteManagment ArticlesAdnan SethiNoch keine Bewertungen

- GDP GrowthDokument1 SeiteGDP GrowthAdnan SethiNoch keine Bewertungen

- The Impact of Personality On Psychological ContractsDokument1 SeiteThe Impact of Personality On Psychological ContractsAdnan SethiNoch keine Bewertungen

- Cost Management and Strategy - An Overview: QuestionsDokument29 SeitenCost Management and Strategy - An Overview: QuestionsAdnan SethiNoch keine Bewertungen

- EconomicsDokument7 SeitenEconomicsAdnan SethiNoch keine Bewertungen

- Book 1Dokument8 SeitenBook 1Adnan SethiNoch keine Bewertungen

- EconomicsDokument7 SeitenEconomicsAdnan SethiNoch keine Bewertungen

- 1 Page EssayDokument1 Seite1 Page EssayAdnan SethiNoch keine Bewertungen

- Pioneer Cement FinalDokument48 SeitenPioneer Cement FinalAdnan SethiNoch keine Bewertungen

- Internship Report On Nishat MillsDokument45 SeitenInternship Report On Nishat MillsSana KhanNoch keine Bewertungen

- Evaluating Consumer Loans - 3rd Unit NotesDokument18 SeitenEvaluating Consumer Loans - 3rd Unit NotesDr VIRUPAKSHA GOUD GNoch keine Bewertungen

- 8th Mode of FinancingDokument30 Seiten8th Mode of FinancingYaseen IqbalNoch keine Bewertungen

- Corporate - TreasuryDokument49 SeitenCorporate - TreasuryArif AhmedNoch keine Bewertungen

- " Money and Its History": AboutDokument13 Seiten" Money and Its History": AboutHarsha ShivannaNoch keine Bewertungen

- London NPL Offcycle Internship Job DescriptionDokument1 SeiteLondon NPL Offcycle Internship Job DescriptionHitesh JainNoch keine Bewertungen

- FAR Final Preboards (May 2023)Dokument19 SeitenFAR Final Preboards (May 2023)John DoeNoch keine Bewertungen

- SCF AnswerDokument6 SeitenSCF AnswerLynssej Barbon100% (1)

- What Is Personal FinanceDokument2 SeitenWhat Is Personal FinanceSyai GenjNoch keine Bewertungen

- Fin 311 Weighted Average Cost of CapitalDokument48 SeitenFin 311 Weighted Average Cost of CapitalsenaNoch keine Bewertungen

- UntothislastDokument35 SeitenUntothislastDjim MDNoch keine Bewertungen

- Explanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Dokument3 SeitenExplanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Makan TidorNoch keine Bewertungen

- Aftab Automobiles Limited and Its SubsidiariesDokument4 SeitenAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNoch keine Bewertungen

- Trial Balance Setelah PenyesuaianDokument1 SeiteTrial Balance Setelah Penyesuaianimam hanapiNoch keine Bewertungen

- Ranjith Complete ProjectDokument95 SeitenRanjith Complete Projectarjunmba119624Noch keine Bewertungen

- NZ First-Time-Student-Visa-Application-ChecklistDokument8 SeitenNZ First-Time-Student-Visa-Application-ChecklistNitin RajeevNoch keine Bewertungen

- Account Statement: Folio Number: 1037476469Dokument2 SeitenAccount Statement: Folio Number: 1037476469Manoj MBNoch keine Bewertungen

- DepreciationDokument19 SeitenDepreciationSuleiman BaruniNoch keine Bewertungen

- 19 ROSARIO TEXTILE CORP. v. HOME BANKERS SAVINGS & TRUST CODokument1 Seite19 ROSARIO TEXTILE CORP. v. HOME BANKERS SAVINGS & TRUST COGSSNoch keine Bewertungen

- Loans and Credit CardsDokument27 SeitenLoans and Credit CardsRose MarieNoch keine Bewertungen

- 9-Public DebtDokument19 Seiten9-Public DebtUsama AdenwalaNoch keine Bewertungen

- Stock Present Fair Value CalculatorDokument5 SeitenStock Present Fair Value Calculatorsamcool87Noch keine Bewertungen

- IFS - Chapter 2Dokument17 SeitenIFS - Chapter 2riashahNoch keine Bewertungen

- Business Finance 3: Learning Area Grade Level Quarter DateDokument5 SeitenBusiness Finance 3: Learning Area Grade Level Quarter DatePrincess Charmee Bernas100% (1)

- Property, Plant and EquipmentDokument18 SeitenProperty, Plant and EquipmentKatrina PetracheNoch keine Bewertungen

- Balance of Trade Verses Balance of PaymentDokument5 SeitenBalance of Trade Verses Balance of PaymentMonique McfarlaneNoch keine Bewertungen

- Management of Financial ServicesDokument8 SeitenManagement of Financial ServicesShikha100% (1)

- ExtAud 3 Midterm Exam W AnswersDokument12 SeitenExtAud 3 Midterm Exam W AnswersJANET ILLESESNoch keine Bewertungen

- 2020 Cma P1 B SCFDokument37 Seiten2020 Cma P1 B SCFThasveer AvNoch keine Bewertungen