Beruflich Dokumente

Kultur Dokumente

Trustee OF REMIC TRUST Powerpoint Summary of Ownership by Trust For Debtor in Bankruptcy

Hochgeladen von

Julio Cesar NavasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Trustee OF REMIC TRUST Powerpoint Summary of Ownership by Trust For Debtor in Bankruptcy

Hochgeladen von

Julio Cesar NavasCopyright:

Verfügbare Formate

American Bankruptcy Institute

667

Understanding the Securitization Process and the Impact on

Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

I. Introduction to Securitization

Securitization is a complex series of financial transactions designed to maximize cash

flow and reduce risk for debt originators. This is achieved when assets, receivables or financial

instruments are acquired, classified into pools, and offered as collateral for third-party

investment. Then, financial instruments are sold which are backed by the cash flow or value of

the underlying assets.

Securitization typically applies to assets that are illiquid (i.e. cannot easily be sold). It is

common in the real estate industry, where it is applied to pools of leased property, and in the

lending industry, where it is applied to lenders' claims on mortgages, home equity loans, student

loans, vehicle loans and other debts. A list of the types of financial debt instruments that have

been securitized is included in these materials.

Any assets can be securitized so long as they are associated with a steady amount of cash

flow. Investors "buy" these assets by making loans which are secured against the underlying

pool of assets and its associated income stream. Securitization thus "converts illiquid assets into

liquid assets" by pooling, underwriting and selling their ownership in the form of asset-backed

securities (ABS).

Securitization utilizes a special purpose vehicle (SPV) (alternatively known as a special

purpose entity [SPE] or special purpose company [SPC]) in order to reduce the risk of

668

15th Annual Rocky Mountain Bankruptcy Conference

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

bankruptcy and thereby obtain lower interest rates from potential lenders. A credit derivative is

also generally used to change the credit quality of the underlying portfolio so that it will be

acceptable to the final investors.

II. History

Asset securitization began with the structured financing of mortgage pools in the 1970s.

For decades before that, banks were essentially portfolio lenders; they held loans until they

matured or were paid off. These loans were funded principally by deposits, and sometimes by

debt, which was a direct obligation of the bank (rather than a claim on specific assets). After

World War II, depository institutions simply could not keep pace with the rising demand for

housing credit. Banks, as well as other financial intermediaries sensing a market opportunity,

sought ways of increasing the sources of mortgage funding. To attract investors, bankers

eventually developed an investment vehicle that isolated defined mortgage pools, segmented the

credit risk, and structured the cash flows from the underlying loans. Although it took several

years to develop efficient mortgage securitization structures, loan originators quickly realized the

process was readily transferable to other types of loans as well."

In February 1970, the U.S. Department of Housing and Urban Development created the

transaction using a mortgage-backed security. The Government National Mortgage Association

(GNMA or Ginnie Mae) sold securities backed by a portfolio of mortgage loans.

To facilitate the securitization of non-mortgage assets, businesses substituted private

credit enhancements. First, they over-collateralized pools of assets; shortly thereafter, they

improved third-party and structural enhancements. In 1985, securitization techniques that had

American Bankruptcy Institute

669

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

been developed in the mortgage market were applied for the first time to a class of non-mortgage

assets automobile loans. A pool of assets second only to mortgages in volume, auto loans

were a good match for structured finance; their maturities, considerably shorter than those of

mortgages, made the timing of cash flows more predictable, and their long statistical histories of

performance gave investors confidence.

The first significant bank credit card sale came to market in 1986 with a private

placement of $50 million of outstanding bank card loans. This transaction demonstrated to

investors that, if the yields were high enough, loan pools could support asset sales with higher

expected losses and administrative costs than was true within the mortgage market. Sales of this

type with no contractual obligation by the seller to provide recourse allowed banks to

receive sales treatment for accounting and regulatory purposes (easing balance sheet and capital

constraints), while at the same time allowing them to retain origination and servicing fees. After

the success of this initial transaction, investors grew to accept credit card receivables as

collateral, and banks developed structures to normalize the cash flows.

III. Benefits of Securitization

There are good reasons why securitization has taken off. The existence of a liquid

secondary market for home mortgages and other financial debt instruments increases the

availability of capital to make new loans. This increases the availability of credit. Securitization

also helps to decrease the cost of credit by lowering originators financing costs by offering

lenders a way to raise funds in the capital market with lower interest rates. Finally, securitization

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

bankruptcy and thereby obtain lower interest rates from potential lenders. A credit derivative is

also generally used to change the credit quality of the underlying portfolio so that it will be

acceptable to the final investors.

II. History

Asset securitization began with the structured financing of mortgage pools in the 1970s.

For decades before that, banks were essentially portfolio lenders; they held loans until they

matured or were paid off. These loans were funded principally by deposits, and sometimes by

debt, which was a direct obligation of the bank (rather than a claim on specific assets). After

World War II, depository institutions simply could not keep pace with the rising demand for

housing credit. Banks, as well as other financial intermediaries sensing a market opportunity,

sought ways of increasing the sources of mortgage funding. To attract investors, bankers

eventually developed an investment vehicle that isolated defined mortgage pools, segmented the

credit risk, and structured the cash flows from the underlying loans. Although it took several

years to develop efficient mortgage securitization structures, loan originators quickly realized the

process was readily transferable to other types of loans as well."

In February 1970, the U.S. Department of Housing and Urban Development created the

transaction using a mortgage-backed security. The Government National Mortgage Association

(GNMA or Ginnie Mae) sold securities backed by a portfolio of mortgage loans.

To facilitate the securitization of non-mortgage assets, businesses substituted private

credit enhancements. First, they over-collateralized pools of assets; shortly thereafter, they

improved third-party and structural enhancements. In 1985, securitization techniques that had

670

15th Annual Rocky Mountain Bankruptcy Conference

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

reallocates risk by shifting the credit risk associated with securitized assets to investors, rather

than leaving all the risk with the financial institutions.

IV. Who are the Players in the Securitization Process?

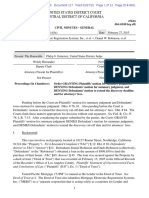

The primary players in the securitization of any particular pool of assets can vary. Included

in these materials is a flow chart for the MBS (mortgage backed securities) issue identified as

Meritage Mortgage Loan Trust 2005-2, Asset-Backed Certificates, Series 2005-2. The flow

chart illustrates the roles of and the relationships between the various primary parties in a typical

issue. Each party is addressed below:

A. Originators the parties, such as mortgage lenders and banks, that initially create the

assets to be securitized.

B. Aggregator purchases assets of a similar type from one or more Originators to form the

pool of assets to be securitized.

C. Depositor creates the SPV/SPE for the securitized transaction. The Depositor acquires

the pooled assets from the Aggregator and in turn deposits them into the SPV/SPE.

D. Issuer acquires the pooled assets and issues the certificates to eventually be sold to the

investors. However, the Issuer does not directly offer the certificates for sale to the

investors. Instead, the Issuer conveys the certificate to the Depositor in exchange for the

pooled assets. In simplified forms of securitization, the Issuer is the SPV which finally

holds the pooled assets and acts as a conduit for the cash flows of the pooled assets.

E. Underwriter usually an investment bank, purchases all of the SPVs certificates from

the Depositor with the responsibility of offering to them for sale to the ultimate investors.

American Bankruptcy Institute

671

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

The money paid by the Underwriter to the Depositor is then transferred from the

Depositor to the Aggregator to the Originator as the purchase price for the pooled assets.

F. Investors purchase the SPVs issued certificates. Each Investor is entitled to receive

monthly payments of principal and interest from the SPV. The order of priority of

payment to each investor, the interest rate to be paid to each investor and other payment

rights accorded to each investor, including the speed of principal repayment, depending

on which class or tranche of certificates were purchased. The SPV makes distributions to

the Investors from the cash flows of the pooled assets.

G. Trustee the party appointed to oversee the issuing SPV and protect the Investors

interests by calculating the cash flows from the pooled assets and by remitting the SPVs

net revenues to the Investors as returns.

H. Servicer the party that collects the money due from the borrowers under each

individual loan in the asset pool. The Servicer remits the collected funds to the Trustee

for distribution to the Investors. Servicers are entitled to collect fees for servicing the

pooled loans. Consequently, some Originators desire to retain the pools servicing rights

to both realize the full payment on their securitized assets when sold and to have a

residual income on those same loans through the entitlement to ongoing servicing fees.

Some Originators will contract with other organizations to perform the servicing

function, or sell the valuable servicing rights.

Often, there are multiple servicers for a single SPV. There may be a Master Servicer, a

Primary Servicer, a Sub-Servicer, and a Default or Special Servicer. Each will have

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

reallocates risk by shifting the credit risk associated with securitized assets to investors, rather

than leaving all the risk with the financial institutions.

IV. Who are the Players in the Securitization Process?

The primary players in the securitization of any particular pool of assets can vary. Included

in these materials is a flow chart for the MBS (mortgage backed securities) issue identified as

Meritage Mortgage Loan Trust 2005-2, Asset-Backed Certificates, Series 2005-2. The flow

chart illustrates the roles of and the relationships between the various primary parties in a typical

issue. Each party is addressed below:

A. Originators the parties, such as mortgage lenders and banks, that initially create the

assets to be securitized.

B. Aggregator purchases assets of a similar type from one or more Originators to form the

pool of assets to be securitized.

C. Depositor creates the SPV/SPE for the securitized transaction. The Depositor acquires

the pooled assets from the Aggregator and in turn deposits them into the SPV/SPE.

D. Issuer acquires the pooled assets and issues the certificates to eventually be sold to the

investors. However, the Issuer does not directly offer the certificates for sale to the

investors. Instead, the Issuer conveys the certificate to the Depositor in exchange for the

pooled assets. In simplified forms of securitization, the Issuer is the SPV which finally

holds the pooled assets and acts as a conduit for the cash flows of the pooled assets.

E. Underwriter usually an investment bank, purchases all of the SPVs certificates from

the Depositor with the responsibility of offering to them for sale to the ultimate investors.

672

15th Annual Rocky Mountain Bankruptcy Conference

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

responsibilities related to the pooled assets, depending on the circumstances and

conditions.

V. The Whys and Hows of Securitization

A. True Sale and HIDC Status

The securitization process is designed, in most cases, to make the pooled assets

bankruptcy remote. To accomplish this, the transfer of the pooled assets from the Originator

to the SPV must be accomplished by way of a true sale. If the asset transfer is not a true sale,

investors are vulnerable to claims against the Originator, including the claims of a bankruptcy

trustee that might be appointed if the Originator were to file bankruptcy. Without bankruptcy

remoteness, Investors would bear the risk of default in the underlying pooled assets, as well as

any claim by the Originators bankruptcy trustee that the pooled assets or cash flows from those

assets are part of the bankruptcy estate which could be used to satisfy claims of the Originators

creditors. A true sale also protects the Originator from claims by investors. If the pooled assets

are sold into an SPV, the Investor can only seek payment from that entity, not from the general

revenues of the Originator.

In order to create the desired bankruptcy remoteness, the pool assets must be

transferred by true sale. Such a sale also provides the SPV with Holder in Due Course (HIDC)

status and protection. In order to gain HIDC status, the SPV must satisfy the requirements of

UCC section 3-302. The SPV must: take the instrument for value, in good faith, without notice

that the instrument is overdue, dishonored or has an uncured default, without notice that the

instrument contains unauthorized signatures or has been altered, and without notice that any

American Bankruptcy Institute

673

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

party has a claim or defense in recoupment. Additionally, the instrument, when issued or

negotiated to the holder, cannot bear any evidence of forgery or alteration or have irregularities

that would give rise to questions of authenticity. The main benefit of HIDC status is that the

holder may enforce the payment rights under the negotiable instrument free from all by a limited

number of defenses as outlined in UCC 3-305. The HIDC takes the note or instrument free from

competing claims of ownership by third parties.

B. Pooling and Servicing Agreement

One of the most important documents in the securitization process is the Pooling and

Servicing Agreement (PSA). This is the contract that governs the relationship between the

various parties in the securitization process. The PSAs in many securitization deals can run 300-

500 pages in length, spelling out the duties and obligations of each party and the mechanics by

which the actual securitization is accomplished. Included in these materials is an excerpt of the

PSA for the Meritage Mortgage Loan Trust 2005-2 Asset-Backed Certificates, Series 2005-2.

VI. Impact of Securitization on Consumer Bankruptcy Practice

A. Does the Trust Actually Own a Securitized Obligation? Challenges Based on

Standing

Securitization impacts consumer bankruptcy practice in a number of ways, most

frequently in the context of motions for relief from stay and proofs of claim. Specifically,

debtors counsel must consider who actually owns the mortgage note, auto loan or credit card

receivable that has been securitized. Is the Trust that is asserting ownership the true owner?

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

responsibilities related to the pooled assets, depending on the circumstances and

conditions.

V. The Whys and Hows of Securitization

A. True Sale and HIDC Status

The securitization process is designed, in most cases, to make the pooled assets

bankruptcy remote. To accomplish this, the transfer of the pooled assets from the Originator

to the SPV must be accomplished by way of a true sale. If the asset transfer is not a true sale,

investors are vulnerable to claims against the Originator, including the claims of a bankruptcy

trustee that might be appointed if the Originator were to file bankruptcy. Without bankruptcy

remoteness, Investors would bear the risk of default in the underlying pooled assets, as well as

any claim by the Originators bankruptcy trustee that the pooled assets or cash flows from those

assets are part of the bankruptcy estate which could be used to satisfy claims of the Originators

creditors. A true sale also protects the Originator from claims by investors. If the pooled assets

are sold into an SPV, the Investor can only seek payment from that entity, not from the general

revenues of the Originator.

In order to create the desired bankruptcy remoteness, the pool assets must be

transferred by true sale. Such a sale also provides the SPV with Holder in Due Course (HIDC)

status and protection. In order to gain HIDC status, the SPV must satisfy the requirements of

UCC section 3-302. The SPV must: take the instrument for value, in good faith, without notice

that the instrument is overdue, dishonored or has an uncured default, without notice that the

instrument contains unauthorized signatures or has been altered, and without notice that any

674

15th Annual Rocky Mountain Bankruptcy Conference

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

Many times the answer is NO because the Trust has failed to properly acquire ownership of the

note or receivable.

As discussed above, the goal of securitization is to achieve a true sale so that the SPV

(Trust), not the Originator, will be the owner of each obligation in the pool. In order to achieve

this goal, each party in the chain of transfer, from Originator to Aggregator, to Depositor, to

Issuer mush actually pay value for the assets in order to acquire them by of true sale and be able

to transfer them to the next party in the chain.

It is one thing for a Trust to assert ownership of a securitized obligation, but proving

ownership requires more than a certification of hearsay statements. Ownership is a fundamental

pre-requisite to give a movant constitutional standing to enforce any rights on the underlying

obligation in the bankruptcy court. Despite the importance of this issue, most motions for relief

from stay fail to properly establish the Trusts ownership of the underlying debt.

The issue of standing has become increasingly prominent over the past few years. In

2007, a series of foreclosure cases in the United States District Courts in the Northern and

Southern Districts of Ohio considered whether the plaintiff in the foreclosure cases was in fact

the holder of the mortgage and note on the real property. See In re Foreclosure Cases, 521 F.

Supp. 2d. 650 (S.D. Ohio 2007), In re Foreclosure Cases, 2007 WL 4034554 (N.D. Ohio Nov.

14, 2007). In these cases, the Judges dismissed more than 60 cases finding that, despite the

plaintiffs assertion that it was the holder of the note and mortgage; the documentation provided

showed that the Originator was the holder of the note and mortgage.

American Bankruptcy Institute

675

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

Many bankruptcy courts have cited the In re Foreclosure cases in disallowing proofs of

claim and denying motions for relief from stay on standing grounds. In In re Nosek, 386 B.R.

374 (Bankr. D. Mass. 2008), the court was presented with conflicting proofs of claim and

representations regarding ownership of the note and mortgage. The Nosek Court stated that the

confusion and lack of knowledge, or perhaps sloppiness resulted in the Court having to expend

time and resources . . . because of the carelessness of those in the residential mortgage industry.

The Nosek Court went on to impose significant sanctions under Bankruptcy Rule 9011.

So, what must a Trust produce to establish ownership of a securitized obligation? In

order for the Trust to asset and establish ownership of an instrument that has been securitized the

Trust must demonstrate that it has acquired the note by proper indorsement and delivery in strict

accordance with the mandatory transfer procedures and time requirements established in the

PSA. This will require producing the original note with all proper indorsements establishing an

unbroken chain of transfer from the Originator to the Aggregator, from the Aggregator to the

Depositor, and from the Depositor to the Trustee.

In some cases, despite the requirements of the PSA, the note was never transferred to the

Trusts Document Custodian or the note was transferred but was not properly indorsed. Unless

ownership is established, a movant lacks standing to enforce a negotiable instrument.

B. Who Can Assert the Trusts Ownership Rights in Court? Real Party in Interest

Status

Related to the issue of ownership and standing is the issue of whether or not a Servicer

that purports to act on behalf of the Trust is a real party in interest and entitled to file claims

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

Many times the answer is NO because the Trust has failed to properly acquire ownership of the

note or receivable.

As discussed above, the goal of securitization is to achieve a true sale so that the SPV

(Trust), not the Originator, will be the owner of each obligation in the pool. In order to achieve

this goal, each party in the chain of transfer, from Originator to Aggregator, to Depositor, to

Issuer mush actually pay value for the assets in order to acquire them by of true sale and be able

to transfer them to the next party in the chain.

It is one thing for a Trust to assert ownership of a securitized obligation, but proving

ownership requires more than a certification of hearsay statements. Ownership is a fundamental

pre-requisite to give a movant constitutional standing to enforce any rights on the underlying

obligation in the bankruptcy court. Despite the importance of this issue, most motions for relief

from stay fail to properly establish the Trusts ownership of the underlying debt.

The issue of standing has become increasingly prominent over the past few years. In

2007, a series of foreclosure cases in the United States District Courts in the Northern and

Southern Districts of Ohio considered whether the plaintiff in the foreclosure cases was in fact

the holder of the mortgage and note on the real property. See In re Foreclosure Cases, 521 F.

Supp. 2d. 650 (S.D. Ohio 2007), In re Foreclosure Cases, 2007 WL 4034554 (N.D. Ohio Nov.

14, 2007). In these cases, the Judges dismissed more than 60 cases finding that, despite the

plaintiffs assertion that it was the holder of the note and mortgage; the documentation provided

showed that the Originator was the holder of the note and mortgage.

676

15th Annual Rocky Mountain Bankruptcy Conference

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

and motions for relief from stay. The Servicer is not the owner of the underlying obligation in a

typical securitization transaction. Instead, the Servicer collects payments due and remits them to

the Trustee on behalf of the Investors. Despite this, most courts have recognized that real party

in interest status is not the same as the constitutional pre-requisite of standing and have

concluded that, even though a Servicer doesnt own the obligation it seeks to enforce, it is a real

party in interest and is able to file motions and claims on behalf of the Trust.

C. How and Where does the Mortgage Electronic Registry System (MERS, Inc.)

Fit In?

MERS, Inc. is a Delaware corporation owned by 26 mortgage originators and buyers of

brokered loans. MERS is a national electronic registry that tracks servicing rights and beneficial

ownership interests in mortgage loans. MERS also acts as a nominee for the Servicers. MERS

is not a lender, it is not an Originator. MERS never owns the note and cannot therefore establish

standing on its own.

Many standing and evidentiary issues arise when MERS attempts to file motions for

relief from stay. This is illustrated in the case of In re Vargas, 2008 WL 4864986 (Bankr. C.D.

Cal. 2008). The Court in the Vargas case denied MERS motion for relief from stay because

MERS failed to prove it had standing and that it was a real party in interest. Instead, MERS was

attempting to obtain relief from stay on behalf of undisclosed third parties. The opinion provides

a thorough review of the evidentiary requirements necessary for establishing (a) standing and

ownership of a mortgage note; (b) the amount claimed to be due; and (c) the admissibility of

American Bankruptcy Institute

677

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

computer and business records. It emphasizes the need to prove ownership through competent

and admissible evidence.

VII. Conclusion

The securitization process is complex and often confusing. Understanding how

securitization affects consumer debtors and the bankruptcy process is the first step in properly

protecting your clients.

Understanding the Securitization Process and the Impact on Consumer Bankruptcy Cases

Tara E. Gaschler, Esq.

The Gaschler Law Firm LLC

and motions for relief from stay. The Servicer is not the owner of the underlying obligation in a

typical securitization transaction. Instead, the Servicer collects payments due and remits them to

the Trustee on behalf of the Investors. Despite this, most courts have recognized that real party

in interest status is not the same as the constitutional pre-requisite of standing and have

concluded that, even though a Servicer doesnt own the obligation it seeks to enforce, it is a real

party in interest and is able to file motions and claims on behalf of the Trust.

C. How and Where does the Mortgage Electronic Registry System (MERS, Inc.)

Fit In?

MERS, Inc. is a Delaware corporation owned by 26 mortgage originators and buyers of

brokered loans. MERS is a national electronic registry that tracks servicing rights and beneficial

ownership interests in mortgage loans. MERS also acts as a nominee for the Servicers. MERS

is not a lender, it is not an Originator. MERS never owns the note and cannot therefore establish

standing on its own.

Many standing and evidentiary issues arise when MERS attempts to file motions for

relief from stay. This is illustrated in the case of In re Vargas, 2008 WL 4864986 (Bankr. C.D.

Cal. 2008). The Court in the Vargas case denied MERS motion for relief from stay because

MERS failed to prove it had standing and that it was a real party in interest. Instead, MERS was

attempting to obtain relief from stay on behalf of undisclosed third parties. The opinion provides

a thorough review of the evidentiary requirements necessary for establishing (a) standing and

ownership of a mortgage note; (b) the amount claimed to be due; and (c) the admissibility of

678

15th Annual Rocky Mountain Bankruptcy Conference

American Bankruptcy Institute

679

Types of Financial Debt Instruments or Obligations That Have Been

Made the Subject of Securitization Issues

Residential Mortgages (Prime)

Residential Mortgages (Alt-A)

Residential Mortgages (Sub-prime)

Home-improvement Loans

Home-equity Loans

Home-equity Lines of Credit

No-equity Mortgage Loans

Reverse Mortgages

Manufactured Housing Loans

Non-performing Mortgages

Timeshare Loans

Construction Loans

Auto Loans (Prime)

Auto Loans (Sub-prime)

Auto Leases

Truck Loans

Truck Leases

Motorcycle Loans

ATV Loans

Boat Loans

RV Loans

Student Loans

Unsecured Consumer Loans

Credit Card Debts

Pay-day Loans

Bank Loans

Rent Receipts

Aircraft-lease Receivables

Airline-ticket Receivables

Municipal Leases

Mutual Fund Fees

Natural Resources

Collateralized Debt Obligations

Project Finance Receivables

Royalties

Delinquent Receivables

Equipment Loans

Equipment Leases

Small-business Loans

Export Receivables

Legal Settlements

Franchise Fees

Franchise Loans

Tax Liens

Floor Plan Loans

Trade Receivables

Guaranteed Investment Contracts

Toll-road Receivables

Healthcare Receivables

Transportation Receivables

Utility Receivables

Insurance-premium Loans

Weather and Climate Risk Obligations

Viatical Settlements (Investments in

Another Person's Life Insurance Policy)

680

15th Annual Rocky Mountain Bankruptcy Conference

N

o

t

e

&

D

e

e

d

o

f

T

r

u

s

t

N

e

v

e

r

S

o

l

d

t

o

T

r

u

s

t

R

e

t

u

r

n

O

n

I

n

v

e

s

t

m

e

n

t

N

e

t

O

f

f

e

r

i

n

g

P

r

o

c

e

e

d

s

M

o

n

t

h

l

y

P

a

y

m

e

n

t

s

M

o

n

t

h

l

y

D

i

s

t

r

i

b

u

t

i

o

n

s

C

e

r

t

i

f

i

c

a

t

e

s

C

e

r

t

i

f

i

c

a

t

e

s

N

e

t

O

f

f

e

r

i

n

g

P

r

o

c

e

e

d

s

O

f

f

e

r

i

n

g

P

r

o

c

e

e

d

s

C

e

r

t

i

f

i

c

a

t

e

s

N

o

t

e

&

D

e

e

d

o

f

T

r

u

s

t

L

o

a

n

P

u

r

c

h

a

s

e

P

r

i

c

e

C

a

s

I

h

t

o

F

u

n

d

M

o

r

t

g

a

g

e

L

o

a

n

J

U

L

I

O

C

.

N

A

V

A

S

M

O

R

T

G

A

G

O

R

A

.

F

i

n

a

n

c

e

A

m

e

r

i

c

a

L

L

C

(

S

u

b

s

i

d

i

a

r

y

o

f

L

e

h

m

a

n

)

O

R

I

G

I

N

A

T

O

R

P

R

O

C

E

S

S

E

S

A

N

D

F

U

N

D

S

I

N

D

I

V

I

D

U

A

L

L

O

A

N

S

S

a

x

o

n

M

o

r

t

g

a

g

e

S

e

r

v

i

c

e

s

,

I

n

c

.

M

A

S

T

E

R

S

E

R

V

I

C

E

R

S

E

R

V

I

C

E

S

I

N

D

I

V

I

D

U

A

L

L

O

A

N

S

;

A

G

G

R

E

G

A

T

E

S

C

O

L

L

E

C

T

I

O

N

S

;

P

E

R

F

O

R

M

S

D

U

T

I

E

S

U

N

D

E

R

T

R

U

S

T

'

S

P

O

O

L

I

N

G

&

S

E

R

V

I

C

I

N

G

A

G

R

E

E

M

E

N

T

B

.

L

e

m

a

n

B

r

o

t

h

e

r

s

H

o

l

d

i

n

g

s

,

I

n

c

.

S

E

L

L

E

R

/

S

P

O

N

S

O

R

P

U

R

C

H

A

S

E

S

L

O

A

N

S

F

R

O

M

O

R

I

G

I

N

A

T

O

R

;

F

O

R

M

S

P

O

O

L

C

.

S

t

r

u

c

t

u

r

e

d

A

s

s

e

t

S

e

c

u

r

i

t

i

e

s

C

o

r

p

(

S

u

b

s

i

d

i

a

r

y

o

f

L

e

h

m

a

n

)

D

E

P

O

S

I

T

O

R

C

R

E

A

T

E

S

T

R

U

S

T

-

I

S

S

U

I

N

G

E

N

T

I

T

Y

D

.

M

e

r

i

t

a

g

e

M

o

r

t

g

a

g

e

L

o

a

n

T

r

u

s

t

2

0

0

5

-

1

1

T

R

U

S

T

F

U

N

D

-

I

S

S

U

I

N

G

E

N

T

I

T

Y

H

O

L

D

S

P

O

O

L

O

F

L

O

A

N

S

;

I

S

S

U

E

S

C

E

R

T

I

F

I

C

A

T

E

S

L

e

h

m

a

n

B

r

o

t

h

e

r

s

I

n

c

.

(

S

u

b

s

i

d

i

a

r

y

o

f

L

e

h

m

a

n

B

r

o

s

.

H

o

l

d

i

n

g

s

I

n

c

.

)

U

N

D

E

R

W

R

I

T

E

R

S

S

E

L

L

S

C

E

R

T

I

F

I

C

A

T

E

S

T

O

I

N

V

E

S

T

O

R

S

;

C

O

L

L

E

C

T

S

O

F

F

E

R

I

N

G

P

R

O

C

E

E

D

S

U

.

S

.

B

a

n

k

C

o

m

p

a

n

y

T

R

U

S

T

E

E

P

E

R

F

O

R

M

S

O

N

L

Y

T

I

T

U

L

A

R

D

U

T

I

E

S

F

O

R

I

N

V

E

S

T

O

R

S

'

C

A

L

C

U

L

A

T

E

S

C

A

S

H

F

L

O

W

S

;

P

R

O

V

I

D

E

S

R

E

P

O

R

T

S

R

E

M

I

T

S

R

E

V

E

N

U

E

S

C

e

d

e

f

a

s

t

,

C

e

d

e

&

C

o

F

a

s

t

I

N

V

E

S

T

O

R

S

P

U

R

C

H

A

S

E

M

O

R

T

G

A

G

E

B

A

C

K

E

D

S

E

C

U

R

I

T

I

E

S

A

S

D

E

F

I

N

E

D

I

N

C

E

R

T

I

F

I

C

A

T

E

S

S

E

C

U

R

I

T

I

Z

A

T

I

O

N

F

L

O

W

C

H

A

R

T

M

e

r

i

t

a

g

e

M

o

r

t

g

a

g

e

L

o

a

n

T

r

u

s

t

2

0

0

5

-

2

,

A

s

s

e

t

-

B

a

c

k

e

d

C

e

r

t

i

f

i

c

a

t

e

s

,

S

e

r

i

e

s

2

0

0

5

-

2

A

A

a

A

R

R

O

W

L

E

G

E

N

D

P

u

r

p

l

e

-

M

o

r

t

g

a

g

e

D

o

c

u

m

e

n

t

s

B

l

u

e

-

S

e

c

u

r

i

t

i

e

s

C

e

r

t

i

f

i

c

a

t

e

s

O

r

a

n

g

e

-

I

n

v

e

s

t

o

r

F

u

n

d

s

G

r

e

e

n

-

B

o

r

r

o

w

e

r

F

u

n

d

s

T

r

u

t

h

I

n

L

e

n

d

i

n

g

A

u

d

i

t

&

R

e

c

o

v

e

r

y

S

e

r

v

i

c

e

s

,

L

L

C

C

o

p

y

r

i

g

h

t

2

0

0

8

S

o

l

d

m

y

N

o

t

e

&

D

e

e

d

o

f

T

r

u

s

t

1

2

/

1

/

2

0

0

5

-

u

n

d

e

r

T

r

u

e

S

a

l

e

f

o

r

V

a

l

u

e

F

i

l

e

d

B

a

n

k

r

u

p

t

c

y

9

/

1

5

/

2

0

0

8

Das könnte Ihnen auch gefallen

- Rquest To Reschedule 341 MeetingDokument1 SeiteRquest To Reschedule 341 MeetingJulio Cesar NavasNoch keine Bewertungen

- Massachussetts Business Trust - Law ReviewDokument36 SeitenMassachussetts Business Trust - Law ReviewJulio Cesar NavasNoch keine Bewertungen

- Contracts Supreme Court Case - Lloyd V MurphyDokument9 SeitenContracts Supreme Court Case - Lloyd V MurphyJulio Cesar NavasNoch keine Bewertungen

- U S Bank Resulting Trust Using Money From Another Person To Buy Property For Self EnrichmentDokument14 SeitenU S Bank Resulting Trust Using Money From Another Person To Buy Property For Self EnrichmentJulio Cesar NavasNoch keine Bewertungen

- California Guide to Trust Deeds and Foreclosure RulesDokument28 SeitenCalifornia Guide to Trust Deeds and Foreclosure RulesJulio Cesar NavasNoch keine Bewertungen

- Court Files $25B Mortgage SettlementDokument3 SeitenCourt Files $25B Mortgage SettlementRazmik BoghossianNoch keine Bewertungen

- Fabio - Abandnment of Claim, Federal Law Over State Law Crummett v. Miller (1997)Dokument12 SeitenFabio - Abandnment of Claim, Federal Law Over State Law Crummett v. Miller (1997)Julio Cesar NavasNoch keine Bewertungen

- Philippines Tax Business Tax Laws Summary Oxford Business GroupDokument13 SeitenPhilippines Tax Business Tax Laws Summary Oxford Business GroupJulio Cesar NavasNoch keine Bewertungen

- Foreclosure Philippines No Money Lent Famous Case Is Legal NullityDokument8 SeitenForeclosure Philippines No Money Lent Famous Case Is Legal NullityJulio Cesar NavasNoch keine Bewertungen

- Fabio - Hoa - All Owners Must Be Made Party To Lawsuit or Are Not Bound by Court OrderDokument7 SeitenFabio - Hoa - All Owners Must Be Made Party To Lawsuit or Are Not Bound by Court OrderJulio Cesar NavasNoch keine Bewertungen

- Chase Bank Foreclosure Case Appeal RejectedDokument13 SeitenChase Bank Foreclosure Case Appeal RejectedJulio Cesar NavasNoch keine Bewertungen

- Chase Bank Foreclosure Case Appeal RejectedDokument13 SeitenChase Bank Foreclosure Case Appeal RejectedJulio Cesar NavasNoch keine Bewertungen

- Tom Deutsch TestimonyDokument53 SeitenTom Deutsch TestimonySmithLawChicago100% (2)

- CFPB Mortgage Request-Error-ResolutionDokument4 SeitenCFPB Mortgage Request-Error-Resolutionmarief86Noch keine Bewertungen

- Encyclopædia of Law and - Forms PDFDokument731 SeitenEncyclopædia of Law and - Forms PDFJulio Cesar Navas100% (1)

- Fabio - Deed of Trust California Laws and Cases - Docx Version 2Dokument24 SeitenFabio - Deed of Trust California Laws and Cases - Docx Version 2Julio Cesar NavasNoch keine Bewertungen

- How To Brief A Case PDFDokument4 SeitenHow To Brief A Case PDFLigwina DNoch keine Bewertungen

- Fabio - Mers Niel Garfield - AttorneysDokument7 SeitenFabio - Mers Niel Garfield - AttorneysJulio Cesar NavasNoch keine Bewertungen

- Adams Case Ucc Not Holder Alonge Gena Gerwig United States Court of AppealsDokument14 SeitenAdams Case Ucc Not Holder Alonge Gena Gerwig United States Court of AppealsJulio Cesar NavasNoch keine Bewertungen

- U S Bank - Majewsky Case - Resulting Trust Using Money From Another Person To Buy Property For Self EnrichmentDokument14 SeitenU S Bank - Majewsky Case - Resulting Trust Using Money From Another Person To Buy Property For Self EnrichmentJulio Cesar NavasNoch keine Bewertungen

- 07-16226 MERS OpinionDokument15 Seiten07-16226 MERS Opinionindio007Noch keine Bewertungen

- Ocwen BK Code 3001 Perfection of Secured Interest in Note in Bankruptcy California Case BK Rule 3001Dokument17 SeitenOcwen BK Code 3001 Perfection of Secured Interest in Note in Bankruptcy California Case BK Rule 3001Julio Cesar NavasNoch keine Bewertungen

- Adams Case Ucc Not Holder Alonge Gena Gerwig United States Court of AppealsDokument14 SeitenAdams Case Ucc Not Holder Alonge Gena Gerwig United States Court of AppealsJulio Cesar NavasNoch keine Bewertungen

- MERS v. Daniel Robinson, Et Al - OrderDokument14 SeitenMERS v. Daniel Robinson, Et Al - OrderJulio Cesar NavasNoch keine Bewertungen

- Dirt Lawyers and Dirty REMICsDokument8 SeitenDirt Lawyers and Dirty REMICscanydig5793Noch keine Bewertungen

- Us Bank Automatic Stay BK Laws and Cases Banruptcy Law Institute Explains Issues Considered by JudgeDokument22 SeitenUs Bank Automatic Stay BK Laws and Cases Banruptcy Law Institute Explains Issues Considered by JudgeJulio Cesar NavasNoch keine Bewertungen

- 07-16226 MERS OpinionDokument15 Seiten07-16226 MERS Opinionindio007Noch keine Bewertungen

- Us Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionDokument4 SeitenUs Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionMike Maunu100% (1)

- Us Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionDokument4 SeitenUs Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionMike Maunu100% (1)

- U S Bank Remic Cant Own Notes by Tax Law DefintionDokument4 SeitenU S Bank Remic Cant Own Notes by Tax Law DefintionJulio Cesar NavasNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 10 Stocks I Am Studying For 2023Dokument44 Seiten10 Stocks I Am Studying For 2023Ateeque MohdNoch keine Bewertungen

- Marginable SecuritiesDokument4 SeitenMarginable SecuritiesAbraham LinkonNoch keine Bewertungen

- Bajaj Finserv (BAFINS) : Finance Momentum Strong Life Picks UpDokument12 SeitenBajaj Finserv (BAFINS) : Finance Momentum Strong Life Picks Uparun_algoNoch keine Bewertungen

- FIMM BookletDokument12 SeitenFIMM BookletGoh Koon LoongNoch keine Bewertungen

- AXIS BANK + EnaamDokument8 SeitenAXIS BANK + Enaammaharshi_mehta2089Noch keine Bewertungen

- BBPW3103 Financial Management IDokument399 SeitenBBPW3103 Financial Management IPhewit Tyme100% (3)

- Debt vs equity instruments advantages disadvantagesDokument3 SeitenDebt vs equity instruments advantages disadvantagesIrfaN TamimNoch keine Bewertungen

- COTEC Corporate-PresentationDokument28 SeitenCOTEC Corporate-PresentationLeandro DijonNoch keine Bewertungen

- A Study On Awareness of Merchant Banking PDFDokument56 SeitenA Study On Awareness of Merchant Banking PDFShweta SharmaNoch keine Bewertungen

- Report on Trend and Progress of Banking in India 2011-12Dokument191 SeitenReport on Trend and Progress of Banking in India 2011-12Chandan AgarwalNoch keine Bewertungen

- COUNTY of LOS ANGELES - Anticipation Note-Series A EtcDokument212 SeitenCOUNTY of LOS ANGELES - Anticipation Note-Series A EtcBONDCK88507Noch keine Bewertungen

- Third Amended and Restated Certificate of IncorporationDokument5 SeitenThird Amended and Restated Certificate of Incorporationjan012583Noch keine Bewertungen

- Beams11 ppt01Dokument42 SeitenBeams11 ppt01Nia TambunanNoch keine Bewertungen

- Collateral Asset DefinitionsDokument116 SeitenCollateral Asset Definitionsapi-3748391100% (2)

- Long Quiz ReviewDokument5 SeitenLong Quiz ReviewShaneen AdorableNoch keine Bewertungen

- Internship Report On MCB Bank LimitedDokument40 SeitenInternship Report On MCB Bank Limitedbbaahmad89Noch keine Bewertungen

- Reforms in Indian Capital Market: A Brief HistoryDokument2 SeitenReforms in Indian Capital Market: A Brief HistoryApurv SuryaNoch keine Bewertungen

- Importance of liquidity for financial statement usersDokument15 SeitenImportance of liquidity for financial statement usersSharmila Devi100% (1)

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDokument12 Seiten(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-Valuecoolacl0% (2)

- Loans and Advances: Aishwarya ParthasarathyDokument31 SeitenLoans and Advances: Aishwarya ParthasarathyNikita Rane InamdarNoch keine Bewertungen

- MA Standard - Transfer - FormDokument1 SeiteMA Standard - Transfer - Formapi-3852735Noch keine Bewertungen

- Squadron MadoffDokument31 SeitenSquadron MadoffadamlisbergNoch keine Bewertungen

- GajradrhpDokument286 SeitenGajradrhpm_laddhaNoch keine Bewertungen

- SERIES A TERM SHEET FOR MEXICAN COMPANYDokument14 SeitenSERIES A TERM SHEET FOR MEXICAN COMPANYRomanNoch keine Bewertungen

- Shareholders' EquityDokument49 SeitenShareholders' EquityPeter Banjao50% (2)

- Economic Survey Volume I Complete PDFDokument298 SeitenEconomic Survey Volume I Complete PDFAbhishek KumarNoch keine Bewertungen

- Amendment For Law-Nov 21 by AoDokument12 SeitenAmendment For Law-Nov 21 by AoConsultant NNoch keine Bewertungen

- Goldman Sachs US Options Research Weekly Options Watch Jan 16, 2013Dokument11 SeitenGoldman Sachs US Options Research Weekly Options Watch Jan 16, 2013gneymanNoch keine Bewertungen

- "A Comparative Analysis of ULIP of Bajaj Allianz Life: Research Project Report ONDokument86 Seiten"A Comparative Analysis of ULIP of Bajaj Allianz Life: Research Project Report ONdipidipigNoch keine Bewertungen

- IFS Chapter 3Dokument26 SeitenIFS Chapter 3riashahNoch keine Bewertungen