Beruflich Dokumente

Kultur Dokumente

Dear Andy

Hochgeladen von

Iqra Jawed0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

84 Ansichten7 Seitenaccounts

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenaccounts

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

84 Ansichten7 SeitenDear Andy

Hochgeladen von

Iqra Jawedaccounts

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

Questions Covered

1. What factors should Ameritrade management consider when evaluating

the proposed advertising program and technology upgrades? Why?

2. How can the Capital Asset Pricing Model be used to estimate the cost

of capital for a real (not financial) investment decision?

3. What is the estimate of the risk-free rate that should be employed

in calculating the cost of capital for Ameritrade?

4. What is the estimate of the market risk premium that should be

employed in calculating the cost of capital at Ameritrade?

5. In principle, what are the steps for computing the asset beta in the

CAPM for the purposes of calculating the cost of capital for a project?

6. Ameritrade does not have a beta estimate because the firm has been

publicly traded for only a short time period. Exhibit 4 provides various

choices of comparable firms. What comparable firms do you

recommend as the appropriate benchmarks for evaluating the risk of

Ameritrades planned advertising and technology investments?

7. Using the stock price and returns data in Exhibits 4 and 5, and the

capital structure information in Exhibit 3, calculate the asset betas for

the comparable firms.

8. How should Joe Ricketts, the CEO of Ameritrade, view the cost of

capital you have calculated?

Dear Andy! Sorry for my second delay with the case it is all the preparation to

universityexams. I shall try to finish Friendly Cards in time.So I used to make parallels

from cases to our real life and economic situation in Ukraine. At thetime we do not

have such companies as Ameritrade in Ukraine, because this kind of businessdoes not

have its customers right now. This is a new thing to our country, and as usual, all

thenew things are taken distrustfully.I can recall only one example : it is FOREX, but it

actually deals with the currency exchangerates, buying and selling currency. The only

same thing all the processes are being held online.

1 . Wh a t f a c t o r s s h o u l d A me r i t r a d e c o n s i d e r wh e n e v a l u a t i n g

t h e p r o p o s e d a d v e r t i s i n g program and technology upgrades?Ameritrade

needs a cost of capital to evaluate new projects. Firms maximize their value by taking

all positive NPV projects.

( )

( )

+=

iii

r CF E NPV

*

1

...,2,1,0

=

i

( )

i

CF E

is the expected cash flow in period

i

*

r

is the discount rateTo calculate an NPV, we need a discount rate. In the A-Rod case we

used 8%. In theOcean Carriers case we used 9%. In this case we will learn how to

determine anappropriate rate.If Ameritrade analysts use a discount rate that is too high,

good projects may be rejected.If they use a discount rate that is too low, bad projects

may be accepted.Also the Ameritrade analysts should consider, that their companys

internal discount ratewas often used as 15%, but some managers felt appropriate the

rate of 8-9%. At this time,the external discount rate, used by Credit Swiss First Boston

was 12%.

Goodobservation.

So actually computing the NPV earlier, Ameritrade analysts accepted only the

best projects which fitted their high requirements.

Now at the end of your analysis, we seethat Ameritrade has a cost of capital close to 22%. This

high hurdle rate means thatAmeritrade should only accept projects with a very high potential

rate of return (aslong as they are of similar risk levels).

2 . Ho w c a n t h e Ca p i t a l A s s e t P r i c i n g Mo d e l ( CA P M) b e u s e d

t o e s t i ma t e t h e c o s t o f c a p i t a l for a real investment decision? (Note: A

real

investment decision here is contrastedfrom a

financial

investment decision. We are talking about real projects, with investmentin people and

technologies, etc.)

Because we are talking about risks, we should think about systematic and versatile

non-systematic?

risks. Systematic risks usually depend on overall economical situation,government

steps, state economic policy and law base risks. In the US this kind of risk

iscomparatively low. But in Ukraine it will be much higher because of unstable

economy,government policy and laws. That is why computed cost of capital would be

higher, if this company was situated in Ukraine.

That seems reasonable to me.

Ameritrades cost of capital should reflect a

risk premium

to account for the uncertaintyof the expected future cash flows in addition to reflecting

the time value of money.Cost of capital =

+=

F

Rr

*

risk premium

F

R

is the risk-free return, reflecting the time value of money. Textbook materialexplaining

the CAPM is available on my website. The figure below may help tosummarize:The

CAPM provides a useful framework for determining the discount rate by definingthe

risk premium

above. The diagram illustrates expected return for a stock,

S

R

. Wewant the expected return (the appropriate discount rate) for investments in various

assets,which are financed by a combination of equity and debt, so we use the subscript

A

in place of

S.

In slope-intercept form, the expected return, or appropriate discount rate, may be given

as:

( )

F M Ameritrade A F

R R Rr

+=

*

AmeritradeA

is called beta of the assets of Ameritrade, and represents the risk of Ameritrade. A

company of average risk gets a beta of 1.0.

R

is the return of the average-risk company, or equivalently, the return of a broad- based

portfolio of companies, like those listed on the New York Stock

Exchange(NYSE).3 . W h a t i s t h e e s t i m a t e o f t h e r i s k -

f r e e r a t e

F

R

that should be used in calculating the costof capital for Ameritrade?Since the projects

being contemplated are long-term projects, we should use long-termrates. Since the

projects are in the future, we should use current (at the time of the case)yields, not

historical rates.In my opinion, we should use the risk-free rate equal to yield of 20-year

US governmentsecurities, because it is long-term capital investment. We may use 30-

year rate, but weare investing in technology, and concerning the speed of technological

enhancements, 20-year rate is optimal. So it is 6,69%.

Sounds reasonable to me.

4 . W h a t i s t h e e s t i m a t e o f t h e m a r k e t

r i s k p r e m i u m ,

F M

R R

, that should be used incalculating the cost of capital for Ameritrade?Typically analysts

use the stock market return minus U.S. government bond returns.Unlike the bond

market, where the current yields are the unbiased market prices for bonds whose cash

flows are in the future, we dont have a reliable estimate of where thestock market will

move in the future. Stock brokers have a conflict of interest; if they areoptimistic, and

can persuade people of their optimism, then more funds should flow intothe stock

market and their commissions and salaries increase. Thus we typically usehistorical

spreads over a long period of time, covering many business cycles, and suggestthat

with no better information, we anticipate the future to be like the past. Also, largestocks

tend to better estimate the market than small stocks. That is why we may use

the difference between US Government Securities rate (6,69%)and historical Large

Company Stocks annual returns. But we have 2 numbers: during1950-96 and 1929-96.

The difference between them is 1,3%. I think that we should useyounger value of 14%,

because the years 1930-1949, of course, were under marketeconomy, but at the same

time there were not so stable laws, a Second World War passed, many companies at

that time worked for government orders, so this number may be a bit out of overall

tendencies.

I appreciate your thoughtfulness. You are quiteperceptive. The opposite side of this argument is

that we dont know what thefuture will bring. Perhaps we will have another period of world war,

or terribleglobal market conditions. If such a scenario is not unreasonable, then

we shouldntexclude past data that relates to such times.

F M

R R

=14%-6,69%=7,31%.

5 . I n p r i n c i p l e , wh a t a r e t h e s t e p s f o r c o mp u t i n g t h e a s s e t

b e t a i n t h e CA P M?

A cost of capital is a weighted average of the cost of debt and equity. Likewise, the

asset beta is the weighted average betas of debt and equity. We use

market value

proportionsof debt and equity (see CAPM, p. 476).

E D A

E D E E D D

+++=

It is common to assume that debt has no relationship to market risk; that

.0

=

D

Empirical studies of corporate debt returns suggest it would be better to assign

some

market-related risk to corporate debt; and use estimates ranging from 0.20 to

0.30. Wewill compute both.To get

E

, the equity beta for Ameritrade, we would

normally

run a regression of equityreturns on stock market returns. That is, we would estimate

the slope of the line that bestfits:

Unfortunately, Ameritrade had their IPO (Initial Purchase Offer) in March of 1997,

sothere is not enough data at the time of the case to calculate a reliable beta

estimate. Soinstead, we will look at comparable firms. Firms in the same industry

pursuing the sametypes of projects will have the same sorts of risks, thus their

asset betas

will beapproximately the same. The returns we calculate for these firms, based on stock

pricemovement, dividends, and stock splits, are their

equity betas.

These are influenced by thedegree of leverage each company is using (recall that

higher leverage leads to higher ROE, EPS and DPS, but also leads to greater

variability in earnings). Knowing theamount of debt in their capital structures (at market

values), we can calculate the asset beta for each comparable firm. Then we will

average these to use as a proxy for Ameritrades asset beta.Please see spreadsheet

work.

This is very good. I would just make two observations,however: 1) the debt to total capital ratios

in Exhibit 4 are for the period 1992-1996.

Therefore you should only use equity returns from the same period. 2) The returnfor the very

first period is not a useful number, because you are implicitlysubtracting 0 as the previous price

of the stock.

6 . E x h i b i t 4 p r o v i d e s v a r i o u s c h o i c e s o f c o mp a r a b l e

f i r ms . Wh i c h f i r ms d o y o u r e c o mme n d as the appropriate benchmarks

for evaluating the risk of Ameritrades planned advertisingand technology

investments? Determine the betas for these firms.Let us agree that Charles Schwab is

a comparable firm. Their price changes, dividends,and stock split information for 1992-

1996 is in Exhibit 5. If there were no stock split, thereturn, compared to the previous

period, is given by:

11

+=

t t t t t

P D P P R

. For example, if the price the previous period was $100, then wentup to $104, and in

addition had a dividend of $8, the return would be +0.12, or 12%. In ashort time period,

the returns will be much closer to 0.If there is an

x

for

y

stock split, use the formula:

11

+=

t t t t t

P D y x P P y x R

. To make calculating this efficient, we can set

x

and

y

equal to1 for those periods when there is not a stock split, then we can just use the

secondformula. Here are the first few rows for Schwab

Copy the Rt values into Exhibit 6 alongside the appropriate dates, then regress

theSchwab returns against the value-weighted NYSE returns for the same period. The

slopeof the line is the equity beta.Do this for the other comparable firms. Calculate the

asset betas using the formula inquestion 5 (twice, once with

0

=

D

and once with

25.0

=

D

). Average the results.This should be a good estimate of Ameritrades

asset beta. Finally, put these results back into the equation in #2 to estimate

Ameritrades cost of capital.Please see spreadsheet

calculations.7 . W h a t v a l u e ( s ) f o r

*

r

did you come up with? DONE!!r* for debt beta = 0 is 20,1%r* for debt beta = 0,25 is

20,4%.

http://www.scribd.com/doc/25965357/HBS-Ameritrade-Corporate-Finance-Case-Study-

Solution

Das könnte Ihnen auch gefallen

- HBS Ameritrade Corporate Finance Case Study SolutionDokument6 SeitenHBS Ameritrade Corporate Finance Case Study SolutionEugene Nikolaychuk100% (5)

- R CF E NPV CF E: Historic RF On LTBDokument2 SeitenR CF E NPV CF E: Historic RF On LTBBhawna Khosla100% (2)

- Ameritrade QuestionsDokument3 SeitenAmeritrade Questionsmilan97950% (2)

- Cost of Capital Estimation for AmeritradeDokument2 SeitenCost of Capital Estimation for AmeritradeLogan Zhou100% (1)

- Ameri TradeDokument7 SeitenAmeri TradexenabNoch keine Bewertungen

- Cost of Capital Estimation for AmeritradeDokument13 SeitenCost of Capital Estimation for Ameritradevivek_sayalNoch keine Bewertungen

- Multinational Cost of CapitalDokument35 SeitenMultinational Cost of CapitalNesma El ShahedNoch keine Bewertungen

- FM414 LN 5 Master Copy Presentation Solutions - Discount Rates - 2024 ColorDokument19 SeitenFM414 LN 5 Master Copy Presentation Solutions - Discount Rates - 2024 ColorAntonio AguiarNoch keine Bewertungen

- Cost of Capital Case Study at AmeritradeDokument5 SeitenCost of Capital Case Study at Ameritradeyvasisht3100% (1)

- Wagner's Angels: Case StudyDokument8 SeitenWagner's Angels: Case StudyCamillaGeorgeonNoch keine Bewertungen

- Ameritrade's Cost of Capital AnalysisDokument7 SeitenAmeritrade's Cost of Capital AnalysisTom Ziv100% (2)

- AmeriTrade Case StudyDokument3 SeitenAmeriTrade Case StudyTracy PhanNoch keine Bewertungen

- Star Appliance Cost of Capital AnalysisDokument8 SeitenStar Appliance Cost of Capital AnalysisGiga KutkhashviliNoch keine Bewertungen

- Estimating Cost of Equity and CapitalDokument95 SeitenEstimating Cost of Equity and CapitalFarzad TouhidNoch keine Bewertungen

- BU8201 Tutorial 1Dokument17 SeitenBU8201 Tutorial 1Li Hui83% (6)

- 01 - Midland AnalysisDokument7 Seiten01 - Midland AnalysisBadr Iftikhar100% (1)

- CAPMDokument8 SeitenCAPMshadehdavNoch keine Bewertungen

- Marriott Corporation The Cost of Capital Case Study AnalysisDokument21 SeitenMarriott Corporation The Cost of Capital Case Study AnalysisvasanthaNoch keine Bewertungen

- Web Chapter 20 An Introduction To Security ValuationDokument8 SeitenWeb Chapter 20 An Introduction To Security ValuationVicky N RockNoch keine Bewertungen

- 06 Cost of CapitalDokument13 Seiten06 Cost of Capitallawrence.dururuNoch keine Bewertungen

- FM11 CH 04 Mini-Case Old6Dokument19 SeitenFM11 CH 04 Mini-Case Old6AGNoch keine Bewertungen

- UntitledDokument13 SeitenUntitledJocelyn GiselleNoch keine Bewertungen

- Marriott WACC Analysis for 3 DivisionsDokument6 SeitenMarriott WACC Analysis for 3 Divisionsone990scribdNoch keine Bewertungen

- Capital Asset Pricing ModelDokument6 SeitenCapital Asset Pricing ModelkelvinramosNoch keine Bewertungen

- Calculating AHC's Cost of Capital Using CAPMDokument9 SeitenCalculating AHC's Cost of Capital Using CAPMElaineKongNoch keine Bewertungen

- Required Rate On Equity - CAPM, Fama-French & Build-Up Model - Equity Investments - CFA Level 2 Tutorial - InvestopediaDokument9 SeitenRequired Rate On Equity - CAPM, Fama-French & Build-Up Model - Equity Investments - CFA Level 2 Tutorial - InvestopediaVerifikasi LPPMNoch keine Bewertungen

- HTTP Viking - Som.yale - Edu Will Finman540 Classnotes Class7Dokument7 SeitenHTTP Viking - Som.yale - Edu Will Finman540 Classnotes Class7corporateboy36596Noch keine Bewertungen

- Handout For 7.8 FinmanDokument7 SeitenHandout For 7.8 FinmanRed VelvetNoch keine Bewertungen

- Mar RiotDokument3 SeitenMar RiotAnurag BohraNoch keine Bewertungen

- Journal of Applied Corporate Finance Volume 19 Issue 2 2007 (Doi 10.1111/j.1745-6622.2007.00137.x) Javier Estrada - Discount Rates in Emerging Markets - Four Models and An ApplicationDokument8 SeitenJournal of Applied Corporate Finance Volume 19 Issue 2 2007 (Doi 10.1111/j.1745-6622.2007.00137.x) Javier Estrada - Discount Rates in Emerging Markets - Four Models and An ApplicationJose Francisco TorresNoch keine Bewertungen

- The P - E Ratio - A User's Manual - Epoch Investment Partners, IncDokument17 SeitenThe P - E Ratio - A User's Manual - Epoch Investment Partners, IncMandar Nadgouda100% (1)

- Thesis On Equity Risk PremiumDokument5 SeitenThesis On Equity Risk Premiumfz6zke9m100% (2)

- Option Games - The Key To Competing in Capital-Intensive IndustriesDokument13 SeitenOption Games - The Key To Competing in Capital-Intensive IndustrieswegrNoch keine Bewertungen

- Group 3Dokument54 SeitenGroup 3SXCEcon PostGrad 2021-23Noch keine Bewertungen

- Theory CoC and WACCDokument9 SeitenTheory CoC and WACCMisky1673Noch keine Bewertungen

- Assignment2 Side1Dokument4 SeitenAssignment2 Side1HrishikeshNoch keine Bewertungen

- Applied Corporate FinanceDokument88 SeitenApplied Corporate Financedu_ha_1Noch keine Bewertungen

- MAS 7 Exercises For UploadDokument9 SeitenMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNoch keine Bewertungen

- Escanear 0003Dokument8 SeitenEscanear 0003JanetCruces0% (4)

- New Facts in Finance: Nicola BorriDokument49 SeitenNew Facts in Finance: Nicola BorriZoe RossiNoch keine Bewertungen

- Discount Rate and DCF AnalysisDokument10 SeitenDiscount Rate and DCF AnalysisshlakaNoch keine Bewertungen

- Finance: The Cost of EquityDokument5 SeitenFinance: The Cost of EquityBenjamin ChikeNoch keine Bewertungen

- Cost of Capital Concepts & Capital Structure AnalysisDokument40 SeitenCost of Capital Concepts & Capital Structure AnalysisreginazhaNoch keine Bewertungen

- Cost of CapitalDokument40 SeitenCost of CapitalRohit BhardawajNoch keine Bewertungen

- Valuing Real Assets Using Tracking Portfolios and Risk-Adjusted Discount RatesDokument15 SeitenValuing Real Assets Using Tracking Portfolios and Risk-Adjusted Discount RatesAnish Mittal100% (1)

- Capital Asset Pricing Model: Econ 487Dokument45 SeitenCapital Asset Pricing Model: Econ 487yassine0077Noch keine Bewertungen

- Invisible BurdenDokument63 SeitenInvisible BurdenHARSHVARDHAN KHATRINoch keine Bewertungen

- CAPM Cost of Equity ModelDokument3 SeitenCAPM Cost of Equity ModelAkhil RupaniNoch keine Bewertungen

- Cap.15 MFIDokument44 SeitenCap.15 MFIAndreea VladNoch keine Bewertungen

- Valuation Gordon Growth ModelDokument25 SeitenValuation Gordon Growth ModelwaldyraeNoch keine Bewertungen

- Islamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMDokument7 SeitenIslamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMTaha Wael QandeelNoch keine Bewertungen

- Summary of Aswath Damodaran's The Little Book of ValuationVon EverandSummary of Aswath Damodaran's The Little Book of ValuationNoch keine Bewertungen

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoVon EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNoch keine Bewertungen

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingVon EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingNoch keine Bewertungen

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveVon EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNoch keine Bewertungen

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingVon EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNoch keine Bewertungen

- Annual Report 2016Dokument58 SeitenAnnual Report 2016Iqra JawedNoch keine Bewertungen

- Alif Allah Aur Insaan by Qaisra Hayat 1Dokument321 SeitenAlif Allah Aur Insaan by Qaisra Hayat 1shahidirfanNoch keine Bewertungen

- Auto Finance Analytics PDFDokument6 SeitenAuto Finance Analytics PDFIqra JawedNoch keine Bewertungen

- btn20140526 DLDokument36 Seitenbtn20140526 DLIqra JawedNoch keine Bewertungen

- Proxy Form EnglishDokument1 SeiteProxy Form EnglishIqra JawedNoch keine Bewertungen

- Sources of Short-Term Financing Options Like Trade Credit, Commercial PaperDokument14 SeitenSources of Short-Term Financing Options Like Trade Credit, Commercial PaperIqra JawedNoch keine Bewertungen

- Discounted Dividend Valuation: Presenter Venue DateDokument46 SeitenDiscounted Dividend Valuation: Presenter Venue DateAinie IntwinesNoch keine Bewertungen

- SnlworkbookDokument28 SeitenSnlworkbookIqra JawedNoch keine Bewertungen

- CtrypremDokument212 SeitenCtrypremIqra JawedNoch keine Bewertungen

- How Your Credit Score Is DeterminedDokument3 SeitenHow Your Credit Score Is DeterminedIqra JawedNoch keine Bewertungen

- Auto Finance Analytics PDFDokument6 SeitenAuto Finance Analytics PDFIqra JawedNoch keine Bewertungen

- Business Intelligence: Making Decisions Through Data AnalyticsDokument16 SeitenBusiness Intelligence: Making Decisions Through Data AnalyticsBusiness Expert Press92% (12)

- E Corp Half Yearly Report 2016Dokument29 SeitenE Corp Half Yearly Report 2016Iqra JawedNoch keine Bewertungen

- IdahoDokument4 SeitenIdahoIqra JawedNoch keine Bewertungen

- CH 06Dokument56 SeitenCH 06Iqra JawedNoch keine Bewertungen

- August 21 2017 Great American Eclipse Total Solar EclipseDokument5 SeitenAugust 21 2017 Great American Eclipse Total Solar EclipseIqra JawedNoch keine Bewertungen

- Engro Foods Annual Report 2011 PDFDokument89 SeitenEngro Foods Annual Report 2011 PDFIqra JawedNoch keine Bewertungen

- Docslide - Us - John e Hanke Dean W Wichern Business Forecasting 8th Edition 2005 Pearson PDFDokument2 SeitenDocslide - Us - John e Hanke Dean W Wichern Business Forecasting 8th Edition 2005 Pearson PDFIqra JawedNoch keine Bewertungen

- GrandTeton Park Map 2011-2 PDFDokument1 SeiteGrandTeton Park Map 2011-2 PDFIqra JawedNoch keine Bewertungen

- E Corp Q3 Accounts 2016Dokument28 SeitenE Corp Q3 Accounts 2016Iqra JawedNoch keine Bewertungen

- E-Corp Q1 Accounts2016Dokument26 SeitenE-Corp Q1 Accounts2016Iqra JawedNoch keine Bewertungen

- Corp First Quarterly Report 2015Dokument21 SeitenCorp First Quarterly Report 2015Iqra JawedNoch keine Bewertungen

- q1 Accounts 2017 EngroDokument24 Seitenq1 Accounts 2017 EngroIqra JawedNoch keine Bewertungen

- Slackers Guide To The 2017 Solar EclipseDokument3 SeitenSlackers Guide To The 2017 Solar EclipseIqra JawedNoch keine Bewertungen

- Engro Fertilizers Annual Report 2016 PDFDokument173 SeitenEngro Fertilizers Annual Report 2016 PDFIqra JawedNoch keine Bewertungen

- The Best Places in America To Watch The Total Solar EclipseDokument5 SeitenThe Best Places in America To Watch The Total Solar EclipseIqra JawedNoch keine Bewertungen

- Yellowstone Official Road Map - 2016 2 PDFDokument1 SeiteYellowstone Official Road Map - 2016 2 PDFIqra JawedNoch keine Bewertungen

- Nasa - Gov-Preparing For The August 2017 Total Solar EclipseDokument48 SeitenNasa - Gov-Preparing For The August 2017 Total Solar EclipseIqra JawedNoch keine Bewertungen

- Nasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsDokument45 SeitenNasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsIqra JawedNoch keine Bewertungen

- Here Are The Most Amazing Photos and Videos of The 2017 Solar EclipseDokument5 SeitenHere Are The Most Amazing Photos and Videos of The 2017 Solar EclipseIqra JawedNoch keine Bewertungen

- Stratman NotesDokument2 SeitenStratman NotesWakin PoloNoch keine Bewertungen

- Financial Planning & ForecastingDokument44 SeitenFinancial Planning & Forecastingnageshalways503275% (4)

- Legal Opinion Johnsan Blue Industrial Suspension AmendmentDokument2 SeitenLegal Opinion Johnsan Blue Industrial Suspension AmendmentRudiver Jungco JrNoch keine Bewertungen

- Kellog's Rice Krispies Cereal Brand PresentationDokument16 SeitenKellog's Rice Krispies Cereal Brand PresentationSanni Fatima100% (3)

- SAE1Dokument555 SeitenSAE1Aditya100% (1)

- Foreign Currency Revaluation Configuration - SAP Q&ADokument12 SeitenForeign Currency Revaluation Configuration - SAP Q&ATDAMU88Noch keine Bewertungen

- BBA Viva Final Year PDFDokument70 SeitenBBA Viva Final Year PDFPratikBhowmickNoch keine Bewertungen

- Microsoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Dokument9 SeitenMicrosoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Tayyabshabbir100% (1)

- Square Inc - 2016 Annual Report (Form 10-K)Dokument172 SeitenSquare Inc - 2016 Annual Report (Form 10-K)trung ducNoch keine Bewertungen

- The early days of risk management and derivatives marketsDokument8 SeitenThe early days of risk management and derivatives marketstuzemec19Noch keine Bewertungen

- Icaew Mi - WorkbookDokument452 SeitenIcaew Mi - WorkbookDương Ngọc100% (2)

- Bangladesh Pharmaceutical IndustryDokument5 SeitenBangladesh Pharmaceutical IndustryMizanur Rahman0% (1)

- Toyota C HR Hybrid 10 2016 Workshop ManualDokument12 SeitenToyota C HR Hybrid 10 2016 Workshop Manualbriansmith051291wkb100% (42)

- OpenText Vendor Invoice Management For SAP Solutions 7.5 SP4 - Administration Guide English (VIM070500-04-AGD-En-2)Dokument228 SeitenOpenText Vendor Invoice Management For SAP Solutions 7.5 SP4 - Administration Guide English (VIM070500-04-AGD-En-2)Goran Đurđić Đuka100% (3)

- Technical DetailsDokument3 SeitenTechnical DetailsKimberly NorrisNoch keine Bewertungen

- The biggest asset of the poor is their integrityDokument88 SeitenThe biggest asset of the poor is their integritysujay pratapNoch keine Bewertungen

- Risk Analysis Nina GodboleDokument23 SeitenRisk Analysis Nina GodboleRupesh AkulaNoch keine Bewertungen

- Nbaa BylawsDokument49 SeitenNbaa BylawsAmaniNoch keine Bewertungen

- Problem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at ADokument2 SeitenProblem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at AMa Teresa B. CerezoNoch keine Bewertungen

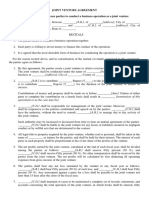

- Joint Venture AgreementDokument2 SeitenJoint Venture Agreementpan RegisterNoch keine Bewertungen

- Bharti Airtel Annual Report 2012 PDFDokument240 SeitenBharti Airtel Annual Report 2012 PDFnikhilcsitmNoch keine Bewertungen

- Job Advert MSDDokument24 SeitenJob Advert MSDRashid BumarwaNoch keine Bewertungen

- SCDL Solved International Finance AssignmentsDokument19 SeitenSCDL Solved International Finance AssignmentsShipra GoyalNoch keine Bewertungen

- How To Understand Managers Investors Liability in BrazilDokument38 SeitenHow To Understand Managers Investors Liability in BrazilPedro AleNoch keine Bewertungen

- Assignment - Business Model Canvas Presentation - Fall - 2020Dokument2 SeitenAssignment - Business Model Canvas Presentation - Fall - 2020MattNoch keine Bewertungen

- Accenture Study Guide Certified AdministratorDokument7 SeitenAccenture Study Guide Certified AdministratorViv ekNoch keine Bewertungen

- Swot AnalysisDokument4 SeitenSwot AnalysisJhoanna Marie Algabre BejarinNoch keine Bewertungen

- Final IMC Plan CreatifyDokument22 SeitenFinal IMC Plan CreatifyRizza Mae SuarezNoch keine Bewertungen

- Managing Human Resources: Chapter # 12Dokument17 SeitenManaging Human Resources: Chapter # 12Malaika Maryam CNoch keine Bewertungen

- SMM Test 20Dokument94 SeitenSMM Test 20Vũ Thị Thanh ThảoNoch keine Bewertungen