Beruflich Dokumente

Kultur Dokumente

Volkswagen Groups Audi Unit Takeover Case Analysis

Hochgeladen von

Ashish_0050 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

220 Ansichten10 SeitenCase study: Volkswagen takeover of Audi

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCase study: Volkswagen takeover of Audi

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

220 Ansichten10 SeitenVolkswagen Groups Audi Unit Takeover Case Analysis

Hochgeladen von

Ashish_005Case study: Volkswagen takeover of Audi

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 10

Uynp;ok

VOLKSWAGEN GROUPS AUDI

UNIT TAKEOVER

Name of the Author Appears Here

Name of the Institute Appears Here

Date of Submission Appears Here

2

EXECUTI VE SUMMARY

Volkswagen acquired Ducati in 2012 through its brand Audi. Ducati had been in financial crisis

for quite some time. Following the acquisition and control, Volkswagen began to rebuild the

management of Ducati and also announced its intentions to enhance its business in China. The

two corporate entities generally have distinct culture and absorption procedure is different in

different acquisition processes.

The motivation for Volkswagen to engage in acquisition of Ducati is to consolidate its

competitive positioning in the product category of motorcycles. Volkswagen also benefited from

the technology of Ducati and skills of the Italian skilled workers. The acquisition is also

beneficial for Ducati to overcome its liquidity problems.

There are significant short-term and long-term repercussions of this acquisition both for the

companies and the motorcycle industry as a whole. The industry dynamics are likely to become

highly competitive. It is expected that the future strategic direction of the group would be to

expand Ducatis market to newer regions for a time horizon of three to seven years.

3

INTRODUCTI ON

Volkswagen AG is a German automobile manufacturer, headquartered in Wolfsburg, which is a

consolidated parent company of commercial vehicles. It is the largest automobile manufacturer

in Europe and the second largest in the world. Through its 12 brands, it is present on all world

markets and manufactures both cheap cars, upscale cars, trucks and motorcycles. Ducati Motor

Holding is a motorcycle manufacturer based in Italian city of Bologna.

The acquisition deal for Ducati has been carried out in 2012 by the Volkswagen Group through

its brand Audi for 860 million Euros in order to compete with rival BMW in the field of

motorcycles. Ducati is a respected brand in consumer markets which was founded in 1926 and is

one of the best known motorcycle manufacturers in the world (Emmi, 2012). On the other hand,

Volkswagen is the largest automobile manufacturer in Europe and the second largest in the

world.

Ducati had been in financial crisis for quite some time and the financial investor Investindustrial

took over the Italian company a few years ago when it was in crisis. The acquisition deal has

been finalized on 25 May 2010 (Cassiman and Colombo, 2006). By September 2012,

Volkswagen began to rebuild the management of Ducati and also announced its intentions to

enhance its business in China.

There are some key considerations in corporate mergers and acquisitions. Firstly, two corporate

entities generally have distinct culture and absorption procedure is different in different

acquisition processes (Wales, 2012). Mergers and acquisitions that turn out to be successful are

those in which corporate cultures are not very distinct or there is mutual tolerance towards

changes in management style.

4

In addition, employees and management must be understanding that mergers and acquisitions not

only entails acquisition of all or a majority of the entity, but also alienation, sale of divisions, sale

of certain subsidiaries or lead changes in the ownership structure of the firm. Therefore,

employees or management of the acquired company must not be disturbed at such occurrences.

In addition, shareholders should not be perturbed or panic during acquisition processes and must

be cognizant of the fact that the purpose of mergers and acquisitions is to increase shareholder

wealth and achieve competitive advantage in the market.

MOTI VATION FOR ACQUI SITION DEAL

The motivation for Volkswagen to engage in acquisition of Ducati is to consolidate its

competitive positioning in the product category of motorcycles in order to compete with rival

BMW. Volkswagens subsidiary Audi has been losing its competitive edge against its archrival

BMW for quite some time (Wales, 2012). The battle that rages between BMW and Audi for the

lead in the premium segment has been a major motivator for Volkswagen to acquire a brand with

strong presence in premium

motorcycle segment. Also,

Volkswagen needed to have

motorcycle manufacturing unit other

than a renowned brand name in its

portfolio.

Volkswagen also benefited from the

technology of Ducati and skills of

the Italian skilled workers which

Figure 1 - Ducati Quarterly Net Income 2008-12 (source: bloomberg.com)

5

harbingers a competitive advantage and a bright future of the company. Ducati had a loyal and

growing customer base, which is a key advantage for global presence. Also, the excellence of

engineering work at Audi and the VW group implies synergies for both entities.

The motivation for Ducati was to overcome its liquidity problems. Although, following 2009

Ducati seemed to recover from its financial crisis, mainly due to the sales success of the Monster

Dark, the debt of the company has been accumulating year after year and had reached 280

million Euros (Cassiman and Colombo, 2006). It was important for the survival of the company

to be owned by a group with strong financials. The debts of the two-wheeler maker had jumped

to 1.7 times its revenue and the annual interest payments on these debts were getting difficult for

the company to be paid annually. Also, strategic difficulties were foreseen by Ducati since the

motorcycle business is getting difficult and the European market has halved in recent years.

There acquisition deal was, therefore, fulfilling needs of the both parties and seemed promising

in terms of benefiting the shareholders of both organizations in the long-run.

SHORT-TERM AND LONG-TERM REPERCUSSIONS OF THE ACQUI SITI ON

There are significant short-term and long-term repercussions of this acquisition both for the

companies and the motorcycle industry as a whole. The acquisition is beneficial for the industry

at large in view of the further development of urban mobility. Ducati is a technologically

superior brand and the acquisition deal took care of the immediate financial distress on this brand

(Paulo, 2012). There are benefits for both Ducati and its consumer market of this acquisition

because it provides much needed sustainability to this brand. Volkswagen, on the other hand,

may not derive any immediate financial gains in the short-run.

6

There are long-run benefits for the industry, as well, since Ducati is in the process of

development of electric two-wheeler vehicles which are needed vehicles for the market

especially for short distances. In the long-run Volkswagen will benefit by a new revenue stream

and will gain profitability through this acquisition. The acquisition of Ducati will benefit it in the

long-run by giving the brand an international exposure which is important because the

motorcycle market in Europe have halved during the last few years.

The industry dynamics will of

course become highly competitive

following the acquisition because

the market size of the industry

does not get impacted due to this

acquisition, however, the

competition does increase

tremendously following this

strategic move of Volkswagen. When Ducati is backed by the ownership of such a strong group,

it will adopt strategic moves to gain market share from existing players in the industry (Emmi,

2012). In addition, Audis management has already expressed intentions to expand their

operations at the global level and increase the reach of the brand beyond the traditional European

market of Ducati. Japanese motorcycle manufacturers like Yamaha, Honda and Suzuki are

also attempting to gain maximum share of global consumer markets on the basis of superior

design and better fuel efficiency.

Figure 2 - Changes in Comparative Market Shares in Global Motorcycle

Industry 2006-11 (source: Yahoo Finance)

7

STRATEGI C OUTCOMES OF THE ACQUI SITION DEAL

The roots of this strategic step of Volkswagen do lies in the past expressions of the company of

the need to gain a sizeable holding in two-wheeler category. Ducatis acquisition by Audi is

certainly a step toward this strategic intent. Even for Ducati, this acquisition comes as a part of

strategic design. The manufacturer had been part of the majority of the Italian financial fund

Investindustrial, but the parent group was not as much interested in the product, but rather about

fast and strong financial gains. Consequently, low investment was made in the product or market

development.

The above mentioned phenomenon is exhibited by the fact that the Italian unions strongly

welcomed Ducati being taken over by Audi. Ducati employees are currently under uncertainty

given that the Italian media have for weeks expressed sentiments against the sale, yet there have

been evidences that the corporate culture of Ducati has remained intact following the takeover

which has been welcomed by employees: Audi has not indicated the slightest intention to

relocate the production site.

Since, it has only been six months since acquisition deal has been executed, it is quite early to

say whether the acquisition deal is a success or not, yet Ducati is the twelfth brand of the

Volkswagen group and is already termed highly important component (Cassiman and Colombo,

2006). Also, the purchase had been long speculated, especially the motorcycle VW supervisory

board chief Ferdinand Piech said to have played a key role in the process, the strategic interest of

the two groups supplemented each other. For this reason, the acquisition deal can be termed as a

success.

8

EXPECTED STRATEGI C DIRECTI ONS OF THE GROUP

The strategic move is coherent in terms of market realities. Ducati offers to its parent group

Volkswagen its experience in lightweight, special motor technology and advanced control

systems. Moreover, the external environmental scans exhibit that the demand for motorcycles in

Asia will grow significantly. With the takeover of Ducati Audi will supplement its own

development endeavours. Audi has for some time been experimenting with different materials to

reduce vehicle weight. Furthermore, Audi plans to profit from a special combustion process that

Ducati has developed. Therefore, to a large extent the strategic move of acquisition form part of

a coherent corporate strategy.

It is expected that the future strategic direction of the group would be to expand Ducatis market

to newer regions for a time horizon of three to seven years. However, during the first two years

of operations, the attempt of the group would be consolidate its own operations and to bring

coherence among the cultures of the two entities. Ducati, established in 1926, is already

accustomed to change. Since the 1980s, the takeover by Audi is now the fourth change of

ownership.

Volkswagen may be short on liquidity to make immediate investments in marketing, since the

final purchase price paid by the parent group is relatively low at 300 million Euros. In the short

run, the group is also likely to adopt extensive measures to reduce costs and to expand

simultaneously (Cassiman and Colombo, 2006). For the time horizon of three to five years,

instead of forming new plants the focus would be on increasing production from plants based in

Thailand and Brazil.

9

CONCLUSI ON

The paper discussed acquisition of Ducati by Volkswagen and the strategic rationale for such

acquisitions. It is found that the motivation for Volkswagen to engage in acquisition of Ducati

was to consolidate its competitive positioning in motorcycle industry. It is concluded that stratic

benefit of this acquisition is that Volkswagen gains superior technology of Ducati and skills of

the Italian skilled workers. Further, it is discovered that the acquisition is also beneficial for

Ducati to overcome its liquidity problems. Finally, it is concluded that short-term and long-term

impacts of this acquisition will be observed in the motorcycle industry and the future strategic

direction of the group would be to expand Ducatis market to newer regions.

10

REFERENCES

Cassiman, B. and Colombo, M. (2006) Mergers & Acquisitions: The Innovation Impact, London:

Edward Elgar Publishing.

Emmi, E. (2012) Ducati brings back Ciabatti, 19 Oct, [Online], Available:

http://www.gpone.com/index.php/en/201210198598/Ducati-brings-back-Ciabatti.html [1 Nov

2012].

Paulo, S. (2012) VW profit slumps on European gloom and tech costs, 24 Oct, [Online],

Available: http://articles.economictimes.indiatimes.com/2012-10-24/news/34708163_1_vw-

profit-italian-motorcycle-maker-ducati-hans-dieter-poetsch [1 Nov 2012].

Sherman, A. (2011) Mergers and Acquisitions from A to Z, Ohio: Amacom Publishing.

Wales, R. (2012) VW celebrates Ducati acquisition with Audi A1 Ducati Edition, 19 Oct,

[Online], Available: http://www.nitrobahn.com/news/vw-celebrates-ducati-acquisition-with-

audi-a1-ducati-edition/ [1 Nov 2012].

Das könnte Ihnen auch gefallen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- Transformation Strategy. Sample Plan for SAAB Automobile ABVon EverandTransformation Strategy. Sample Plan for SAAB Automobile ABNoch keine Bewertungen

- Did You Know That Over 21Dokument9 SeitenDid You Know That Over 21Youssef samirNoch keine Bewertungen

- Ducati Realease Investindustrial 20120418Dokument2 SeitenDucati Realease Investindustrial 20120418cherikokNoch keine Bewertungen

- Microeconomic Analysis of Demand and Supply For Ducati Motor Holding SpaDokument26 SeitenMicroeconomic Analysis of Demand and Supply For Ducati Motor Holding Spaasmita bookNoch keine Bewertungen

- Ducati Case Study Questions Answers - Case Solution - BohatalaDokument8 SeitenDucati Case Study Questions Answers - Case Solution - BohatalaLucasNoch keine Bewertungen

- Merger and Acquisition: Presentation OnDokument20 SeitenMerger and Acquisition: Presentation OnShankar DhondwadNoch keine Bewertungen

- DucatiDokument3 SeitenDucatidipesh341267% (3)

- Ducati turnaround under MinoliDokument3 SeitenDucati turnaround under MinoliCerasella19100% (2)

- DHDHDHDDokument3 SeitenDHDHDHDEmanueleNoch keine Bewertungen

- Ducati Case AnalysisDokument6 SeitenDucati Case Analysisfiona chenNoch keine Bewertungen

- Ducati's Pioneering E-Business Initiative Selling Motorcycles OnlineDokument13 SeitenDucati's Pioneering E-Business Initiative Selling Motorcycles OnlineMaya MelissaNoch keine Bewertungen

- Duc A Ti Case StudyDokument3 SeitenDuc A Ti Case StudyJasmine J. SeapoeNoch keine Bewertungen

- Ducati Case UniKassel DrOliverBohlDokument13 SeitenDucati Case UniKassel DrOliverBohlcherikokNoch keine Bewertungen

- Ducati EssayDokument12 SeitenDucati EssayS Qambar A ShahNoch keine Bewertungen

- Volkswagen Group: Adapting in The Age of AIDokument3 SeitenVolkswagen Group: Adapting in The Age of AIBIBARI BORONoch keine Bewertungen

- Volkswagen Strategic Action Plan ReportDokument17 SeitenVolkswagen Strategic Action Plan Reportkinyuadavid000Noch keine Bewertungen

- Ducati Brand AnalysisDokument7 SeitenDucati Brand AnalysisAboobacker SaadNoch keine Bewertungen

- MQM 385 Group ProjectDokument31 SeitenMQM 385 Group Projectapi-580843559Noch keine Bewertungen

- Volkswagen Group: Adapting in The Age of AiDokument10 SeitenVolkswagen Group: Adapting in The Age of AiAditi SoniNoch keine Bewertungen

- 220-Article Text-676-1-10-20211002Dokument10 Seiten220-Article Text-676-1-10-20211002Iroda MadyarovaNoch keine Bewertungen

- Ducati Case StudyDokument10 SeitenDucati Case StudywilfordbrimleyNoch keine Bewertungen

- Microeconomic Analysis of SKODA Auto: QMU Matriculation No.: 17010046Dokument16 SeitenMicroeconomic Analysis of SKODA Auto: QMU Matriculation No.: 17010046Sreepriya ShresthaNoch keine Bewertungen

- Ducati's Strategic Analysis and Potential Cruiser Market EntryDokument12 SeitenDucati's Strategic Analysis and Potential Cruiser Market EntryJames AllgoodNoch keine Bewertungen

- BUS 5112 - Marketing Management-Written Assignment Unit 3Dokument8 SeitenBUS 5112 - Marketing Management-Written Assignment Unit 3YoYoNoch keine Bewertungen

- VolxwagenDokument8 SeitenVolxwagenAbdul QayumNoch keine Bewertungen

- M&A Presentation on Volkswagen-Audi-Ducati DealDokument19 SeitenM&A Presentation on Volkswagen-Audi-Ducati DealShankar DhondwadNoch keine Bewertungen

- Factbook: 12 9.3 Million 550,000 153Dokument80 SeitenFactbook: 12 9.3 Million 550,000 153Silviu TrebuianNoch keine Bewertungen

- Ducati SolutionDokument14 SeitenDucati SolutionEhsan AlamNoch keine Bewertungen

- TRANSFORMATION OF THE INDIAN TWO-WHEELER MARKETDokument2 SeitenTRANSFORMATION OF THE INDIAN TWO-WHEELER MARKETLogan Crime100% (3)

- Volkswagen Analysis 1.Dokument4 SeitenVolkswagen Analysis 1.b.adnann69Noch keine Bewertungen

- SKODA Rebranding Case StudyDokument8 SeitenSKODA Rebranding Case StudyAditya NayakNoch keine Bewertungen

- Introduction On Indian AutomobileDokument14 SeitenIntroduction On Indian AutomobileZahir ShahNoch keine Bewertungen

- Practice GMDokument20 SeitenPractice GMValentinNoch keine Bewertungen

- Ducati Group Growingsalesrevenuesandearningsin2015Dokument2 SeitenDucati Group Growingsalesrevenuesandearningsin2015cherikokNoch keine Bewertungen

- Volkswagen IndiaDokument25 SeitenVolkswagen IndiaPS VirkNoch keine Bewertungen

- Ducati: Case StudyDokument2 SeitenDucati: Case StudyEmanueleNoch keine Bewertungen

- BCG Matrix and Strategies for Skoda AutoDokument10 SeitenBCG Matrix and Strategies for Skoda AutoernajinaNoch keine Bewertungen

- GEEN 1016-Strategy and ManagementDokument9 SeitenGEEN 1016-Strategy and ManagementAnusmita Dalapati GhoshNoch keine Bewertungen

- Volkswagen of America Final PaperDokument16 SeitenVolkswagen of America Final PaperJawadNoch keine Bewertungen

- HarvardBusinessReviewAnalytic DucatiDokument10 SeitenHarvardBusinessReviewAnalytic DucatiPranshu ChandraNoch keine Bewertungen

- Problem StatementDokument10 SeitenProblem StatementFaith GuballaNoch keine Bewertungen

- Ducati's Strategic Options to Maintain SuccessDokument11 SeitenDucati's Strategic Options to Maintain SuccessAlain SayeghNoch keine Bewertungen

- Ducati SolutionDokument14 SeitenDucati SolutionMBA...KID71% (7)

- FordDokument8 SeitenForddoctorfay100% (1)

- Emissin ScandalDokument15 SeitenEmissin ScandalAiaman ShahzadNoch keine Bewertungen

- VW Strategy 2025: Achieving Vision After Emissions ScandalDokument5 SeitenVW Strategy 2025: Achieving Vision After Emissions ScandalrueNoch keine Bewertungen

- Ducati Should Enter Cruiser Market to Drive GrowthDokument10 SeitenDucati Should Enter Cruiser Market to Drive GrowthVaibhav ShuklaNoch keine Bewertungen

- Skoda AutoDokument4 SeitenSkoda AutoKhairiah Salleh0% (1)

- Global Manufacturing of VolkswagenDokument3 SeitenGlobal Manufacturing of Volkswagennarmin mammadli0% (1)

- Kia Motors Case Study AnalysisDokument7 SeitenKia Motors Case Study AnalysisWhimsical BrunetteNoch keine Bewertungen

- Strategic ManagementDokument12 SeitenStrategic ManagementGaurav JenaNoch keine Bewertungen

- OrdDokument3 SeitenOrdmohit kumarNoch keine Bewertungen

- Volkswagon Case StudyDokument2 SeitenVolkswagon Case StudySyed Kumail Abbas ZaidiNoch keine Bewertungen

- VW's Strategy 2025 Vision and InitiativesDokument8 SeitenVW's Strategy 2025 Vision and InitiativeskhadzNoch keine Bewertungen

- Strategic Analysis HBR Case DucatiDokument1 SeiteStrategic Analysis HBR Case DucatiPlamen DiNoch keine Bewertungen

- HarvardBusinessReviewAnalytic Ducati PDFDokument10 SeitenHarvardBusinessReviewAnalytic Ducati PDFEmanueleNoch keine Bewertungen

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationVon EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNoch keine Bewertungen

- Slogans & TaglinesDokument15 SeitenSlogans & TaglinesKunj ShahNoch keine Bewertungen

- QNT 561, Week 5 Exercises, Chapter 3, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 17Dokument14 SeitenQNT 561, Week 5 Exercises, Chapter 3, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 17Danielle KingNoch keine Bewertungen

- Discos de Friccion ExelDokument148 SeitenDiscos de Friccion ExelHania BarajasNoch keine Bewertungen

- Chapter 15: Statistical Quality ControlDokument111 SeitenChapter 15: Statistical Quality Controljohn brownNoch keine Bewertungen

- Safety Recall Code: 20W9: RevisionDokument54 SeitenSafety Recall Code: 20W9: RevisionMiguel AngelNoch keine Bewertungen

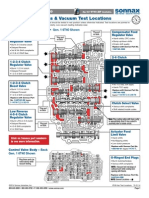

- 6T40-Vac Test LocationsDokument4 Seiten6T40-Vac Test LocationsPedroMecanico100% (4)

- Differences Between British and American EnglishDokument7 SeitenDifferences Between British and American Englishaleksandra_marinko_2Noch keine Bewertungen

- June 23, 2017 Strathmore TiimesDokument32 SeitenJune 23, 2017 Strathmore TiimesStrathmore TimesNoch keine Bewertungen

- Thermax Engineering Construction Co. LTD: Crane Inspection ChecklistDokument2 SeitenThermax Engineering Construction Co. LTD: Crane Inspection ChecklistSrinivasa Rao VenkumahanthiNoch keine Bewertungen

- 1110 SahaDokument4 Seiten1110 SahaSanjeev PatilNoch keine Bewertungen

- Customer Safety Handbook enDokument29 SeitenCustomer Safety Handbook enFabiano OliveiraNoch keine Bewertungen

- Repco Tyre Repair 2014Dokument96 SeitenRepco Tyre Repair 2014rossloveladyNoch keine Bewertungen

- Create 1 - 2 Hex Bolt - SolidWorks TutorialsDokument9 SeitenCreate 1 - 2 Hex Bolt - SolidWorks Tutorialsandres_palacios_1433Noch keine Bewertungen

- Global Passive Safety Systems Market: Trends and Opportunities (2013-18) - New Report by Daedal ResearchDokument11 SeitenGlobal Passive Safety Systems Market: Trends and Opportunities (2013-18) - New Report by Daedal ResearchDaedal ResearchNoch keine Bewertungen

- 6 თვის გატარებების ჟურნალიDokument2.489 Seiten6 თვის გატარებების ჟურნალიgiorgi SHEROZIANoch keine Bewertungen

- Skid Steer LoadersDokument16 SeitenSkid Steer LoadersJuan Jose100% (1)

- Wa0001Dokument12 SeitenWa0001Sudip Issac SamNoch keine Bewertungen

- IsO 50001Dokument48 SeitenIsO 50001Dante Andres Garcia MenesesNoch keine Bewertungen

- Mission and Vision: Mission: We Will Do This. Vision: We Will Be ThisDokument14 SeitenMission and Vision: Mission: We Will Do This. Vision: We Will Be ThisĦåŖśĦīĹ DhiliwalNoch keine Bewertungen

- Operaton Q. PDokument47 SeitenOperaton Q. PPravin KeskarNoch keine Bewertungen

- MM Goodyear-Aquatred Case SubmissionDokument4 SeitenMM Goodyear-Aquatred Case Submissionnilay100% (1)

- Service: Golf 2015Dokument20 SeitenService: Golf 2015Sedin VNoch keine Bewertungen

- Ito PoDokument6 SeitenIto PoJohary EsmailNoch keine Bewertungen

- Value Enhancement PlanDokument3 SeitenValue Enhancement PlanFuad132Noch keine Bewertungen

- 90K56 - Cleco 55NL-3T-960Dokument12 Seiten90K56 - Cleco 55NL-3T-960Saul SotoNoch keine Bewertungen

- Racetrack Raiders MNIT, JaipurDokument13 SeitenRacetrack Raiders MNIT, JaipurKartikey SharmaNoch keine Bewertungen

- PDWA PistonDokument3 SeitenPDWA PistonJadera1989Noch keine Bewertungen

- Marketing Management Project Kia Cars in IndiaDokument17 SeitenMarketing Management Project Kia Cars in IndiaRaj RanganiNoch keine Bewertungen

- ZL50H ManualDokument77 SeitenZL50H Manualjeckohimo89% (18)

- Continental Data GuideDokument48 SeitenContinental Data GuideJose FontenlaNoch keine Bewertungen