Beruflich Dokumente

Kultur Dokumente

Connected TV Advertising's Growing Potential

Hochgeladen von

Saksbjørn IhleOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Connected TV Advertising's Growing Potential

Hochgeladen von

Saksbjørn IhleCopyright:

Verfügbare Formate

A FierceCable eBrief

FierceCable

Sponsored by:

CONNECTED TV ADVERTISINGS

GROWING POTENTIAL

Te lack of industry standards coupled with an uncertain business model is making connected

TV ads a challenge, but many companies are preparing for what could be a huge opportunity

By Kevin Downey

he next big thing in TV is here

with the majority of people

projected to own an IP-

connected TV within just a few

years. But advertising revenue for

connected TVs interactive ads and targeted

ads will likely lag behind.

Connected TV will have to overcome a few

signifcant hurdles before it starts taking

away some of the $74 billion that Kantar

Media estimates advertisers spent on

traditional TV advertising in 2013. Tose

hurdles span basic issues like consumers

learning how to use interactive ads, to

complex issues like of a lack of industry

standards for the way connected TV ads are written.

Tis is a big opportunity to create an even more engaging advertising marketplace, said Mark Lieberman,

president and CEO at Viamedia. But there are some fundamental questions that need to be asked frst.

Business model uncertainty

Unlike traditional TV, manufacturers have the capability to place ads onto smart TVs, meaning they can potentially

sell ad time.

Ten, what kind of ads can be placed on those TVs? Lieberman asked. Are they overlay ads? Can they be

synchronized with national ads? Whats the business model? Whats the [cost per thousand]? How do you post

against these ads?

A more signifcant hurdle is the lack of standards. Advertisers have to recreate the same ad over and over for

diferent connected TV platforms.

T

A FierceCable eBrief

CONNECTED TV ADVERTISINGS GROWING POTENTIAL

Tats the challenge a fragmented authoring

environment, said Sachin Sathaye, vice president of

strategy and product management at ActiveVideo.

Tere are no standards. A websites interactive ads are

written in HTML5. Its fairly standard. When you try

to bring that to television, whether its a set-top box or

a directly connected television, there is a vast array of

operating standards.

Te lack of standards means placing a media buy can be

challenging for advertisers and their agencies.

If you want to use interactive TV ads, you have to

keep changing these ads to work on a cable network

and then an IP network, Sathaye said. Tey have to

change content and the creative. Te third challenge is

the lack of consistent metrics. If you go to a website,

everything is standard. Who clicked where? Which

web page did they click? How long did they stay on the

page? Tats not so for connected TV ads.

Revenue potential is increasing

Today, connected TV ad revenue is a tiny fraction of

traditional TVs $74 billion.

Ad revenue for these IP-connected platforms is low

compared to overall television advertising, said Brett

Sappington, director of research at Parks Associates.

However, these revenues are increasing and ad rates are

increasing as advertisers and ad sellers become better at

valuing ad inventory on these connected platforms.

PricewaterhouseCoopers is projecting that advertisers

this year will spend $4.4 billion in the U.S. on

multichannel systems, which includes connected

TVs but also pay-TV providers and digital terrestrial

television.

Te Carmel Groups Jimmy Schaefer estimates

that advertisers are spending close to $5 billion on

connected TVs and other IP-connected platforms.

Youll see single-digit billion-dollar growth for the

next three to fve years, Schaefer said. It will take

a long time to get to the point that it will challenge

traditional TV.

TV manufacturers poised for opportunity

Once connected TV ad revenue takes of, analysts

expect the revenue to be split among pay-TV providers,

smart TV manufacturers and third-party platforms.

Lots of folks are trying to get their foot into the door

of the TV business through hardware or software:

Roku, Google TV, Apple TV, Amazon Fire, Xbox,

said Dave Morgan, CEO of Simulmedia, an audience-

targeted TV advertising company. However, in our

mind, the only hardware certain in the future of TV is

the TV. Tus, the TV manufacturers are in a very good

spot if they are smart in creating a robust and open

developer ecosystem, not unlike what Apple has done

with iOS and Google with Android.

Despite challenges to connected TV advertising

reaching its full potential, it will eventually get there.

Te size of the ad market is getting bigger as more

consumers buy connected TVs for their homes.

In 2014, an estimated 113 million people are using

connected TVs, up 107 percent from just two years

ago, according to research frm eMarketer. Moreover, a

projected 191.4 million people will use connected TVs

in 2018 a 69 percent increase over 2014. At that time,

58 percent of people in the United States will have

connected TVs.

Tere are a couple of factors happening in parallel

that explain [this], said David Hallerman, principal

analyst at eMarketer. Tere are more and more

devices for connected TV, whether its smart TVs

from manufacturers, set-top boxes like Roku, or game

players from Microsoft or Sony or even computers with

HTMI output that you put into the TV.

Second, consumers are attracted to Internet-based

services such as Netfix that are creating original

programming like Orange is the New Black that they

can get on connected TVs, he added. l

millions, % of population and % of internet users

US Connected TV Users, 2012-2018

2012

54.7

17.4%

23.0%

2013

83.6

26.4%

34.0%

2014

113.2

35.5%

45.0%

2015

138.8

43.2%

54.1%

2016

160.9

49.7%

61.7%

2017

177.2

54.3%

67.0%

2018

191.4

58.2%

71.4%

Connected TV users % of population % of internet users

Note: individuals of any age who use the internet through a connected TV

at least once per month

Source: eMarketer, June 2014

174380 www.eMarketer.com

SPONSORED CONTENT

A FierceCable eBrief

CONNECTED TV ADVERTISINGS GROWING POTENTIAL

placemedia is creating value for advertisers and

media providers by leveraging technology and data to

deliver audience based targeting on linear television.

Te placemedia platform helps media companies

monetize long-tail and undersold inventory through

targeted audience reach and aggregation. In addition,

placemedia helps advertisers efectively target their

audiences on linear TV at a higher index and lower cost

per targeted impression.

Why Does Linear TV Need a Programmatic

Solution?

Audience fragmentation on linear TV has been a

challenge for advertisers and media providers since the

early 1980s. Hundreds of cable network choices and a

legacy media measurement system that benefts highly-

rated cable networks, has made it challenging for

advertisers to fnd and engage their audience on long-

tail cable networks and difcult for media providers to

prove value outside the top 30 cable networks.

Even with all of the opportunities on linear TV,

advertisers are still spending 85% of their television

budgets on the top 20 cable networks, while leaving

millions of valuable impressions on the table with the

bottom 180 cable networks.

placemedias programmatic solution solves the puzzle

of audience fragmentation with automation, inventory

aggregation, better audience targeting and sound logic.

How Does placemedia Work?

placemedia has partnered with Rentrak to analyze and

match actual consumer viewing behavior in 14 million

homes. Tat data is overlaid with several third-party

databases to utilize audience based targeting across all

cable networks. Te results are extremely compelling.

Better Audience Targeting

One persistent challenge with linear TV is

measurement and reporting. When planning

advertising based on the traditional method (spots,

GRPs and content context), it is difcult to fnd

audiences outside the top 30 cable networks.

placemedia has changed the currency of television from

GRPs and spots to audiences and impressions. Tis,

combined with the Rentrak data, lets placemedia fnd

audiences much deeper in the cable network set than

traditional planning methodology. Te result is highly

targeted impressions at a much lower cost per targeted

impression.

End-to-End Automation

Linear TV is also challenged by legacy systems and

processes that make true end-to-end automation

difcult - if not impossible. Trough its unique

partnership with Viamedia, placemedia is pioneering

a fully automated solution for both national and local

advertisers. Te placemedia platform includes a front-

end desktop solution that enables advertisers and

agencies to develop programmatic plans. Once an order

is ingested into the trafcking system, insertion orders

are generated and copy is delivered to cable, satellite

and cable network partners instantaneously. Daily

as-run information is automatically ingested in the

platform, giving advertisers near real-time reporting on

the status of their campaigns.

Aggregation

Because no single cable provider or cable network can

efciently reach a targeted audience on the national or

local level, placemedia aggregates advertising inventory

from multiple sources to ensure the most efcient and

efective ad delivery.

Sound Logic

Te placemedia solution is also designed to get smarter

and more efcient with every order. Visibility into

media partner advertising inventory and analysis

of historic clearance rates drive a logic engine that

builds future campaigns. Te goal is to provide media

companies with an optimal rate for inventory, while

ensuring that advertisers are able to efciently and

efectively reach their target.

Te programmatic future for linear TV is bright and

exciting. As technology and big data continue to

emerge, advertisers and media providers will continue

to beneft from placemedia.

HOW PLACEMEDIA IS USING BIG DATA TO DELIVER AUDIENCE BASED

TARGETING ON LINEAR TELEVISION

A FierceCable eBrief

CONNECTED TV ADVERTISINGS GROWING POTENTIAL

Within the next few years connected TV ads will

start chipping away at the $74 billion traditional

TV ad market, according to industry experts. But

to do that, content networks and advertisers will

need ad solutions that make it easier than it is

today to place ads onto connected TVs.

Companies like Canoe, Google/DFP, ActiveVideo

and dozens of other companies are developing

solutions that place ads onto connected TVs and

tailor those ads to the individuals who see them.

Tese solutions also take a multitude of diferent

standards, reconfgure them in the cloud, and then

stream them back to IP-connected platforms.

Engaging viewers with targeted ads

Te sofware company Canoe, for instance, has

been placing ads on cable set-top-box VOD

systems for several years. But, now, it is expanding

its VOD ad-insertion technology to IP-connected

devices such as smart TVs, set-top-boxes and

gaming consoles. Canoe is a consortium of

pay-TV providers Brighthouse Networks, Cox

Communications, Comcast and Time Warner

Cable.

With the same workfow and process were using

today with the classic set-top box, when our cable

operators have an IP-delivered product in the home

with that same VOD service on it, we can also

deliver an ad to that device, said Chris Pizzurro,

head of products, sales and marketing at Canoe.

We have the IP capability ready to go. Well test

it this summer with some of our operators. We

expect to deploy it in fourth quarter.

Canoes IP workfow system will work with ad

monetization systems Black Arrow and Comcasts

Freewheel.

Black Arrow delivers targeted ads to IP devices to

some 30 million users.

We get a connection from a video player and we

usually [fnd out] which asset was requested, which

station was tuned in and we get a time stamp,

said Chris Hock, senior vice president, product

management and marketing at Black Arrow. Ten

we fgure out which ad to deploy.

Tat happens in real time and the ads are tailored

to individual viewers.

With our Black Arrow product, we take the cookie

information of the device and put it up in the

server, Hock said. When [a content distributors]

user connects and goes to an ad, we get a device ID.

We check that against the Black Arrow audience

the broadcasters subscriber base, which gives us

information for targeting.

Te targeted ads do a better job of engaging

viewers, said Hock, who expects content networks

to charge higher CPMs for these ads than for

traditional TV spots.

Time-Warner Cable began using the Black Arrow

last year.

Meantime, automatic content recognition (ACR)

sofware helps to identify the programs that

SOLVING THE CONNECTED TV AD CONUNDRUM By Kevin Downey

Companies are developing new solutions that will overcome many of the hurdles associated with connected

TV advertising

We get a connection

from a video player

and we usually [fnd

out] which asset was

requested, which station was tuned

in and we get a time stamp.

Chris Hock, senior vice president, product

management and marketing at Black Arrow

A FierceCable eBrief

CONNECTED TV ADVERTISINGS GROWING POTENTIAL

connected TV viewers are watching. A projected

2.5 billion devices will be equipped with ACR

technology by 2017, according to NextMarket

Insights.

Te Holy Grail of all this is targeted advertising,

said Jimmy Schaefer, principal analyst at Te

Carmel Group. Tats tomorrows advertising

environment. Te idea is that, if you can put a

viable advertising mechanism in place, then IP-TV

thrives.

Solving standards issues

Still, there are obstacles to getting from where

we are today to a time when a good chunk of

traditional TV ad revenue shifs to connected TV.

Perhaps the biggest obstacle is a lack of standards.

Unlike web ads, connected TV ads are not

uniformly written in one language. Instead, there

are many, which means media buyers have to buy

multiple connected TV ads, not just one ad buy.

And its tough for advertisers to create ads thatll

run on traditional TV and various IP-connected

devices.

But ad solutions are being deployed to make the

lack of standards less of a headache.

If you write an interactive ad for DirecTV, you

have to write the interactive ad specifcally for

that, said Sachin Sathaye, vice president of strategy

and product management at ActiveVideo. If the

same brand wants to bring that ad to AT&T set-

top boxes, they have to now create it in a diferent

writing. If you go to cable, you have to change it

again.

In January, at CES, ActiveVideo in partnership with

BrightLine launched CloudTV AdCast. It enables

pay-TV providers to deliver targeted, interactive

ads to connected TVs.

We render this application in the cloud on

HTML 5, Sathaye said. We convert that as an

interactive video stream. Tat allows a consistent

experience across devices. Suddenly, the device

becomes agnostic.

Building a better experience

Te companies take it a few steps further, to help

advertisers get their ads in front of connected TV

viewers and to gather information about who they

are and what they are watching.

BrightLine would build something like a Home

Depot connected-TV microsite, said Mike Fisher,

director of strategy and innovation at BrightLine.

We would go to our client with a list of all the

places they should make a media buy. We might say,

What we built for you is supported in Samsungs

banner inventory. It is supported inside a publishers

app. Its supported in a publishers pre-roll video.

Its supported on the legacy side on DirecTV. We

provide rollup analytics of how they got to it, who

goes to it and what they do afer they go to it. l

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 92-96 4ws SystemDokument49 Seiten92-96 4ws Systemsean1121100% (3)

- Clothes, Clothes, Clothes. Music, Music, Music. Boys, Boys, Boys.: A MemoirDokument3 SeitenClothes, Clothes, Clothes. Music, Music, Music. Boys, Boys, Boys.: A MemoirJadson Junior0% (1)

- Kingmaker With Mike Rashid - 4 Weeks To Fighting ShapeDokument6 SeitenKingmaker With Mike Rashid - 4 Weeks To Fighting ShapeRayNoch keine Bewertungen

- Selection1 PDFDokument198 SeitenSelection1 PDFjONATHANNoch keine Bewertungen

- AL Liars Night 2018Dokument2 SeitenAL Liars Night 2018Mike LlamasNoch keine Bewertungen

- Securing Lte Networkswhat Why and HowDokument10 SeitenSecuring Lte Networkswhat Why and HowSaksbjørn IhleNoch keine Bewertungen

- An Overview of Cloud Deployment OptionsDokument8 SeitenAn Overview of Cloud Deployment OptionsSaksbjørn IhleNoch keine Bewertungen

- Insurance Companies Once Again Drive Cybercrime Headlines: Financials SectorDokument5 SeitenInsurance Companies Once Again Drive Cybercrime Headlines: Financials SectorSaksbjørn IhleNoch keine Bewertungen

- Software Defined Network and Network Functions VirtualizationDokument16 SeitenSoftware Defined Network and Network Functions VirtualizationSaksbjørn Ihle100% (1)

- Enterprise Imaging Value Based CareDokument8 SeitenEnterprise Imaging Value Based CareSaksbjørn IhleNoch keine Bewertungen

- Context-Based AuthenticationDokument10 SeitenContext-Based AuthenticationSaksbjørn IhleNoch keine Bewertungen

- SRLabs BadUSB BlackHat v1Dokument22 SeitenSRLabs BadUSB BlackHat v1Saksbjørn IhleNoch keine Bewertungen

- Realizing Openflow Switches With Aricent FrameworksDokument10 SeitenRealizing Openflow Switches With Aricent FrameworksSaksbjørn IhleNoch keine Bewertungen

- Esg Brief Acronis Ofs Control and ComplianceDokument3 SeitenEsg Brief Acronis Ofs Control and ComplianceSaksbjørn IhleNoch keine Bewertungen

- WP Value of Integration WebDokument9 SeitenWP Value of Integration WebSaksbjørn IhleNoch keine Bewertungen

- Reading 1Dokument2 SeitenReading 1Janaina FerreiraNoch keine Bewertungen

- 2015-2016 ONKYO AV CatalogDokument20 Seiten2015-2016 ONKYO AV CatalogThawatchai PirapongsilNoch keine Bewertungen

- Table Manners: MaterialsDokument8 SeitenTable Manners: MaterialsStacey LiuNoch keine Bewertungen

- FIFA World Cup Winners List For General AwarenessDokument3 SeitenFIFA World Cup Winners List For General AwarenessKonda GopalNoch keine Bewertungen

- Mixdown For Mastering TipsDokument12 SeitenMixdown For Mastering Tipshelboy_trcNoch keine Bewertungen

- PRINT - Service Manuals - Service Manual MC Kinley Eu GD 13 06 2019Dokument73 SeitenPRINT - Service Manuals - Service Manual MC Kinley Eu GD 13 06 2019Sebastian PettersNoch keine Bewertungen

- EC Lecture 1Dokument18 SeitenEC Lecture 1abusalih88Noch keine Bewertungen

- ALDI Growth Announcment FINAL 2.8Dokument2 SeitenALDI Growth Announcment FINAL 2.8Shengulovski IvanNoch keine Bewertungen

- Vector IndexDokument13 SeitenVector IndexJondri Yoza0% (1)

- ImpulseDokument15 SeitenImpulseCheah Chong ShengNoch keine Bewertungen

- 21 Defensive IdDokument29 Seiten21 Defensive IdJay Green100% (1)

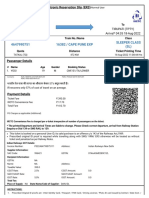

- Cape Pune Exp Sleeper Class (SL)Dokument2 SeitenCape Pune Exp Sleeper Class (SL)Yogiswar Goud RathipinniNoch keine Bewertungen

- 6 Tourist Information Office PDFDokument7 Seiten6 Tourist Information Office PDFMaría Luján PorcelliNoch keine Bewertungen

- Frumpled Fairy TalesDokument8 SeitenFrumpled Fairy Talestawsbd100% (1)

- DessertsDokument3 SeitenDessertseatlocalmenusNoch keine Bewertungen

- Neoverter III: Single-Split Inverter SeriesDokument10 SeitenNeoverter III: Single-Split Inverter SeriesdaveleyconsNoch keine Bewertungen

- Reviewer For Business MarketingDokument5 SeitenReviewer For Business MarketingEira AvyannaNoch keine Bewertungen

- 14-IP CamVision-ENG - With - GPLDokument18 Seiten14-IP CamVision-ENG - With - GPLnampleikuNoch keine Bewertungen

- 3D W 2015 05Dokument100 Seiten3D W 2015 05Rafael Ibelli100% (1)

- 3dboxx w4880 SeriesDokument2 Seiten3dboxx w4880 SeriesSaud AhmedNoch keine Bewertungen

- RunfinalDokument5 SeitenRunfinalapi-257966132Noch keine Bewertungen

- The Big Welsh Book Dummy PagesDokument7 SeitenThe Big Welsh Book Dummy PagesRanit MukherjeeNoch keine Bewertungen

- Complex SentencesDokument3 SeitenComplex SentencesPilar Romero CandauNoch keine Bewertungen

- S.No Name of The Student Reg - No Elective ChoosenDokument3 SeitenS.No Name of The Student Reg - No Elective ChoosenHarshaNoch keine Bewertungen

- Session 2 - English ViDokument20 SeitenSession 2 - English ViMANUEL FELIPE HUERTAS PINGONoch keine Bewertungen