Beruflich Dokumente

Kultur Dokumente

Deegan Technical Update2 December10

Hochgeladen von

frieda20093835Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Deegan Technical Update2 December10

Hochgeladen von

frieda20093835Copyright:

Verfügbare Formate

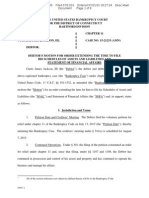

Technical Update No.

2

to accompany

Australian Financial Accounting

6

th

edition by Craig Deegan

Prepared by Parmod Chand

December 2010 Technical update t/a Australian Financial Accounting 6e by Deegan

CONTENTS Page Number

Chapter 1: An Overview o the Au!tralian "#ternal $eporting "nvironment 6

Chapter 2: The Conceptual %ramewor& o Accounting and it! $elevance to %inancial Accounting 12

Chapter ': Theorie! o %inancial Accounting 1'

Chapter (: An Overview o Accounting or A!!et! 1(

Chapter ): Depreciation o *roperty+ *lant and ",uipment 1)

Chapter 6: $evaluation! and -mpairment Te!ting o .on/Current A!!et! 16

Chapter 0: -nventory 10

Chapter 1: Accounting or -ntangible! 11

Chapter 2: Accounting or 3eritage A!!et! and 4iological A!!et! 12

Chapter 10: An Overview o Accounting or 5iabilitie! 20

Chapter 11: Accounting or 5ea!e! 21

Chapter 12: 6et/O and "#tingui!hment o Debt 22

Chapter 1': Accounting or "mployee 4eneit! 2'

Chapter 1(: 6hare Capital and $e!erve! 2(

Chapter 1): Accounting or %inancial -n!trument! 2)

Chapter 16: $evenue $ecognition -!!ue! 20

Chapter 10: The 6tatement o Comprehen!ive -ncome and 6tatement o Change! in

",uity 21

Chapter 11: Accounting or 6hare/ba!ed *ayment! 22

Chapter 12: Accounting or -ncome Ta#e! '0

Chapter 20: The 6tatement o Ca!h %low! '1

Chapter 21: Accounting or the "#tractive -ndu!trie! '2

Chapter 22: Accounting or 7eneral -n!urance Contract! ''

Chapter 2': Accounting or 6uperannuation *lan! '(

Chapter 2(: "vent! Occurring ater the $eporting *eriod ')

Chapter 2): 6egment $eporting '6

Chapter 26: $elated/*arty Di!clo!ure! '0

Chapter 20: "arning! *er 6hare '1

Chapter 21: Accounting or 7roup 6tructure! '2

Chapter 22: %urther Con!olidation -!!ue! - 8 Accounting or -ntragroup Tran!action! (1

Chapter '0: %urther Con!olidation -!!ue! -- 8 Accounting or .on/Controlling -ntere!t! (2

Chapter '1: %urther Con!olidation -!!ue! --- 8 Accounting or -ndirect Owner!hip -ntere!t! ('

Chapter '2: %urther Con!olidation -!!ue! -9 8 Accounting or Change! in the Degree o

Owner!hip o a 6ub!idiary ((

Chapter '': Accounting or ",uity -nve!tment! ()

December 2010 Technical update t/a Australian Financial Accounting 6e by Deegan

Chapter '(: Accounting or -ntere!t! in :oint 9enture! (6

Chapter '): Accounting or %oreign Currency Tran!action! (0

Chapter '6: Tran!lating the %inancial 6tatement! o %oreign Operation! (1

Chapter '0: Accounting or Corporate 6ocial $e!pon!ibility (2

5

The!e technical development! are current a! at '1 December 2010; They repre!ent addition! to the regulatory

ramewor& and Au!tralian Accounting 6tandard! !ince publication o the !i#th edition o Australian Financial

Accounting by Craig Deegan in 2010;

CHAPTER 1: AN OVERVIEW OF THE AUSTRALIAN EXTERNAL REPORTING ENVIRONMENT

Au!tralia ha! adopted the -nternational Accounting 6tandard! <-A6!= and -nternational %inancial $eporting 6tandard!

<-%$6!=+ which are developed by the -nternational Accounting 6tandard! 4oard <-A64=+ a! their national !tandard!

rom 1 :anuary 200); The Au!tralian Accounting 6tandard! 4oard <AA64= ound it nece!!ary to converge the

conceptual ramewor& given that -A6!/-%$6! are ba!ed on the -A64 conceptual ramewor&; -n the near uture change!

are e#pected in the conceptual ramewor& document a! the -A64 >Conceptual %ramewor& *ro?ect@ which wa! initiated

in October 200( i! nearing it! completion; Thi! i! a ?oint pro?ect with the A6 %inancial Accounting 6tandard! 4oard

and the primary ob?ective o the pro?ect i! to develop a conceptual ramewor& that i! complete and internally

con!i!tent; 6uch a ramewor& would lay a !ound oundation or developing uture accounting !tandard! which i! the

ultimate goal o the -A64; Thi! will enable -A64 to develop !tandard! that are principle!/ba!ed+ internally con!i!tent+

internationally converged+ and that lead to inancial reporting that provide! the inormation needed or inve!tment+

credit and !imilar deci!ion! <-A64+ 200(+ p; 1=;

There have been a number o !igniicant change! in the accounting !tandard! in late 2002 and in 2010; The AA64 ha!

i!!ued our omnibu! !tandard! in December 2002 and ten omnibu! !tandard! in 2010 to ma&e amendment! to the

e#i!ting !tandard! <!ee Table 2=; A! ar a! change! in 2002 are concerned+ the ma?or amendment! ari!e a! a re!ult o the

i!!uance o AA64 2 Financial Instruments in December; AA64 2 include! re,uirement! or the cla!!iication and

mea!urement o inancial a!!et! re!ulting rom the ir!t part o *ha!e 1 o the -A64B! pro?ect to replace -A6 '2

Financial Instruments: Recognition and Measurement. -n particular+ the!e re,uirement! improve and !impliy the

approach or cla!!iication and mea!urement o inancial a!!et! compared with the re,uirement! o AA64 1'2 <AA64

2+ p; 6=;

AA64 10)' Application of Tiers of Australian Accounting Standards i!!ued in :une 2010 e!tabli!he! a dierential

inancial reporting ramewor& con!i!ting o two Tier! o reporting re,uirement! or preparing general purpo!e inancial

!tatement! in Au!tralia <Tier 1: Australian Accounting StandardsC and Tier 2: Australian Accounting Standards

Reduced Disclosure Requirements=; -n particular+ Tier 2 compri!e! the recognition+ mea!urement and pre!entation

re,uirement! o Tier 1 and !ub!tantially reduced di!clo!ure! corre!ponding to tho!e re,uirement!; Though+ the

di!clo!ure! re,uired by Tier 2 and the di!clo!ure! re,uired by the -A64B! International Financial Reporting Standard

for Small and Medium-sized ntities <-%$6 or 6D"!= are highly !imilar+ Tier 2 re,uirement! and the -%$6 or 6D"!

are not directly comparable a! a con!e,uence o Tier 2 including recognition and mea!urement re,uirement!

corre!ponding to tho!e in -%$6!+ wherea! the -%$6 or 6D"! include! limited modiication! to tho!e re,uirement!

<AA64 10)'+ pp; )6=; AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting

6tandard!+ including -nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or

application by certain type! o entitie! in preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=;

6everal amendment! to e#i!ting accounting !tandard! al!o re!ult rom the i!!uance o the -A64B! Annual Impro!ements

to IFRSs in 2010; 6ome o the e#i!ting !tandard! have been rei!!ued ta&ing into account the change! made by the

omnibu! !tandard! <!ee Table 1=; The Argent -!!ue! 7roup <A-7= which i! now replaced by AA64B! -nterpretation!

Advi!ory *anel! ha! al!o i!!ued a number o interpretation! which are e,uivalent to -nternational %inancial $eporting

-nterpretation! Committee -nterpretation! <-%$-C= <Table '=; 5a!tly+ the AA64 ha! al!o invited or comment! on a

number o e#po!ure drat! <"D!= <Table (=; The!e development! and their implication! are di!cu!!ed in greater detail in

the relevant chapter! o thi! technical update;

6tudent! are encouraged to reer to the web!ite! o the -A64 <http://www;ia!c;org;u&= and the AA64

<http://www;aa!b;com;au= or a continuou! update with re!pect to the !tate o e#i!ting !tandard! and current "D! and

their technical content; Additionally+ both o the proe!!ional bodie! <C*A Au!tralia and -CAA= have detailed update!

in their web!ite!; Thi! i! al!o recommended a! a u!eul re!ource or !tudent! re,uiring inormation on development!

and implication! o new accounting !tandard! and e#po!ure drat!;

6

Accou!"g S!a#ar#$

The ollowing !tandard! have been i!!ued <or rei!!ued= by the AA64 in late 2002 and in 2010;

Tab%e 1 AAS& Standards

AAS& S!a#ar#$

'"$$ue #a!e(

O)er)"e*

AA64 1 First-time Adoption of

Australian Accounting Standards

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 2 S"are-#ased $a%ment

<:uly 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 ' &usiness 'om#inations

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 ( Insurance 'ontracts

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 ) (on-current Assets )eld

for Sale and Discontinued

*perations <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 0 Financial Instruments:

Disclosures <:une 2010=

AA64 0 lead! to the withdrawal o AA64 1'0 Disclosures in t"e Financial Statements of

&an+s and Similar Financial Institutions and !uper!ede! paragraph! )182) o AA64 1'2;

AA64 0 now bring! in one place all di!clo!ure! relating to inancial in!trument!;

AA64 1 *perating Segments

<December 2002=

Thi! 6tandard applie! to or/proit entitie! who!e debt or e,uity in!trument! are traded in a

public mar&et or that ile!+ or i! in the proce!! o iling+ it! inancial !tatement! with a

!ecuritie! commi!!ion or other regulatory organi!ation or the purpo!e o i!!uing any cla!! o

in!trument! in a public mar&et;

AA64 2 Financial Instruments

<December 2010=

AA64 2 include! re,uirement! or the cla!!iication and mea!urement o inancial a!!et!

re!ulting rom the ir!t part o *ha!e 1 o the -A64B! pro?ect to replace -A6 '2 Financial

Instruments: Recognition and Measurement. -n particular+ the!e re,uirement! improve and

!impliy the approach or cla!!iication and mea!urement o inancial a!!et! compared with

the re,uirement! o AA64 1'2;

AA64 101 $resentation of

Financial Statements <October

2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 102 In!entories <:une 2002= Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 100 Statement of 'as"

Flo,s <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 101 Accounting $olicies-

'"anges in Accounting stimates

and rrors <December 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 110 !ents after t"e

Reporting $eriod <December

2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 112 Income Ta.es <October

2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 116 $ropert%- $lant and

quipment <:une 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 110 /eases <:une 2002= Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 111 Re!enue <October

2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 112 mplo%ee &enefits

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 121 T"e ffects of '"anges

in Foreign .c"ange Rates

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 12' &orro,ing 'osts <:une

2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

7

AA64 12( Related $art%

Disclosures <December 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 122 Financial Reporting in

)%perinflationar% conomies <:une

2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'2 Financial Instruments:

$resentation <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'' arnings per S"are

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'( Interim Financial

Reporting <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'6 Impairment of Assets

<:une 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'0 $ro!isions- 'ontingent

/ia#ilities and 'ontingent Assets

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'1 Intangi#le Assets <:une

2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1'2 Financial Instruments:

Recognition and Measurement

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1(0 In!estment $ropert%

<October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 1(1 Agriculture <October

2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 102' 0eneral Insurance

'ontracts <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 10'1 /ife Insurance

'ontracts <October 2010=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 10'2 'oncise Financial

Reports <:une 2002=

Thi! 6tandard wa! revi!ed to ta&e into account the amendment! made by one or more o the

Omnibu! 6tandard! that have been i!!ued <!ee Table 2=;

AA64 10(1 Interpretation of

Standards <:une 2010=

Thi! 6tandard ha! been revi!ed to provide an up/to/date li!ting o A-7 -nterpretation! and to

en!ure the eectivene!! o reerence! in AA64 6tandard! to A-7 -nterpretation!; Thi! i! part

o a continuou! proce!!;

AA64 10)' Application of Tiers of

Australian Accounting Standards

<:une 2010=

Thi! 6tandard e!tabli!he! a dierential inancial reporting ramewor& con!i!ting o two Tier!

o reporting re,uirement! or preparing general purpo!e inancial !tatement! in Au!tralia

<Tier 1: Au!tralian Accounting 6tandard!C and Tier 2: Au!tralian Accounting 6tandard! 8

$educed Di!clo!ure $e,uirement!=;

6ource: Adapted rom AA64 6tandard! available on http://www;aa!b;com;au;

8

Omnibus Standards

The ollowing !tandard! are the omnibu! !tandard! that the AA64 ha! i!!ued in late 2002 and in 2010 to amend the

e#i!ting !tandard!;

Tab%e + Omnibus Standards

Om"bu$ S!a#ar#$ O)er)"e*

AA64 2002/11 Amendments to

Australian Accounting Standards

<i!!ued December 2002=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! ari!ing rom AA64 2

EAA64 1+ '+ (+ )+ 0+ 101+ 102+ 101+ 112+ 111+ 121+ 120+ 121+ 1'1+ 1'2+ 1'6+ 1'2+ 102' F 10'1

and -nterpretation! 10 F 12G;

AA64 2002/12 Amendments to

Australian Accounting Standards

<i!!ued December 2002=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! EAA64 )+ 1+ 101+ 110+

112+ 112+ 1''+ 1'0+ 1'2+ 102' F 10'1 and -nterpretation! 2+ (+ 16+ 10'2 F 10)2G;

AA64 2002/1' Amendments to

Australian Accounting Standards

<i!!ued December 2002=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! ari!ing rom

-nterpretation 12 EAA64 1G;

AA64 2002/1( Amendments to

Australian Interpretation <i!!ued

December 2002=

Thi! 6tandard ma&e! amendment! to Au!tralian -nterpretation 1(;

AA64 2010/1 Amendments to

Australian Accounting Standards

<i!!ued %ebruary 2010=

The ob?ective o thi! 6tandard i! to ma&e amendment! to Au!tralian Accounting 6tandard! 8

5imited "#emption rom Comparative AA64 0 Di!clo!ure! or %ir!t/time Adopter! EAA64 1

F AA64 0G;

AA64 2010/2 Amendments to

Australian Accounting Standards

<i!!ued :une 2010=

Thi! 6tandard amend! Au!tralian Accounting 6tandard! ari!ing rom $educed Di!clo!ure

$e,uirement! EAA64 1+ 2+ '+ )+ 0+ 1+ 101+ 102+ 100+ 101+ 110+ 111+ 112+ 116+ 110+ 112+ 121+

12'+ 12(+ 120+ 121+ 1'1+ 1''+ 1'(+ 1'6+ 1'0+ 1'1+ 1(0+ 1(1+ 10)0 F 10)2 and -nterpretation! 2+

(+ )+ 1)+ 10+ 120+ 122 F 10)2G;

AA64 2010/' Amendments to

Australian Accounting Standards

<i!!ued :une 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! ari!ing rom the Annual

-mprovement! *ro?ect EAA64 '+ 0+ 121+ 121+ 1'1+ 1'2 F 1'2G;

AA64 2010/( Amendments to

Australian Accounting Standards

<i!!ued :une 2010=

Thi! 6tandard ma&e! amendment! to AA64 !tandard! ari!ing rom the Annual -mprovement!

*ro?ect EAA64 1+ 0+ 101 F 1'( and -nterpretation 1'G;

AA64 2010/) Amendments to

Australian Accounting Standards

<i!!ued October 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! EAA64 1+ '+ (+ )+ 101+

100+ 112+ 111+ 112+ 121+ 1'2+ 1''+ 1'(+ 1'0+ 1'2+ 1(0+ 102' F 10'1 and -nterpretation! 112+

11)+ 120+ 1'2 F 10(2G;

AA64 2010/6 Amendments to

Australian Accounting Standards

<i!!ued .ovember 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! 8 Di!clo!ure! on

Tran!er! o %inancial A!!et! EAA64 1 F AA64 0G;

AA64 2010/0 Amendments to

Australian Accounting Standards

<i!!ued December 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! ari!ing rom AA64 2

EAA64 1+ '+ (+ )+ 0+ 101+ 102+ 101+ 112+ 111+ 120+ 121+ 120+ 121+ 1'1+ 1'2+ 1'6+ 1'0+ 1'2+ 102'

F 10'1 and -nterpretation! 2+ )+ 10+ 12+ 12 F 120G;

AA64 2010/1 Amendments to

Australian Accounting Standards

<i!!ued December 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! 8 Deerred Ta#:

$ecovery o Anderlying A!!et! EAA64 112G;

AA64 2010/2 Amendments to

Australian Accounting Standards

<i!!ued December 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! 8 6evere 3yperinlation

and $emoval o %i#ed Date! or %ir!t/time Adopter! EAA64 1G;

AA64 2010/10 Amendments to

Australian Accounting Standards

<i!!ued December 2010=

Thi! 6tandard ma&e! amendment! to Au!tralian Accounting 6tandard! 8 $emoval o %i#ed

Date! or %ir!t/time Adopter! EAA64 2002/11 F AA64 2010/0G;

<6ource: Adopted rom http://www;aa!b;com;au;=

9

AAS& I!er,re!a!"o$-UIG I!er,re!a!"o$

The ollowing AA64 -nterpretation! were i!!ued or amended in late 2002 and in 2010;

Tab%e . AAS& I!er,re!a!"o$

AAS& I!er,re!a!"o$ O)er)"e*

2 Mem#ers1 S"ares in 'o-

operati!e ntities and Similar

Instruments <i!!ued December

2002=

Thi! -nterpretation applie! to inancial in!trument! within the !cope o AA64 1'2+ including

inancial in!trument! i!!ued to member! o co/operative entitie! that evidence the member!B

owner!hip intere!t in the entity; Thi! -nterpretation doe! not apply to inancial in!trument! that

will or may be !ettled in the entityB! own e,uity in!trument!;

( Determining ,"et"er an

Arrangement contains a /ease

<i!!ued December 2002=

Thi! -nterpretation contain! amended -%$-C ( Determining ,"et"er an Arrangement contains

a /ease a! amended by the -A64;

1( AAS& 223 T"e /imit on

a Defined &enefit Asset-

Minimum Funding Requirements

and t"eir Interaction <i!!ued

December 2002=

Thi! -nterpretation incorporate! amended -%$-C 1( IAS 23 T"e /imit on a Defined &enefit

Asset- Minimum Funding Requirements and t"eir Interaction a! amended by the -A64;

16 )edges of a (et In!estment in

a Foreign *peration <i!!ued

December 2002=

Thi! -nterpretation provide! guidance on accounting or the hedge o a net inve!tment in a

oreign operation in an entityB! con!olidated inancial !tatement!;

12 .tinguis"ing Financial

/ia#ilities ,it" quit%

Instruments <i!!ued December

2002=

Thi! -nterpretation addre!!e! the accounting by an entity when the term! o a inancial liability

are renegotiated and re!ult in the entity i!!uing e,uity in!trument! to a creditor o the entity to

e#tingui!h all or part o the inancial liability; -t doe! not addre!! the accounting by the creditor;

11) *perating /eases

Incenti!es <i!!ued December

2010=

Thi! -nterpretation addre!!e! the i!!ue o how incentive! in an operating lea!e !hould be

recogni!ed in the inancial !tatement! o both the le!!ee and the le!!or;

1'2 Intangi#le Assets

4e# Site 'osts <i!!ued October

2010=

Thi! -nterpretation outline! how to account or Heb 6ite Co!t!;

10'2 Su#stanti!e nactment of

Ma5or Ta. &ills in Australia

<i!!ued December 2002=

Thi! -nterpretation include! A-7 -nterpretation 10'2 Su#stanti!e nactment of Ma5or Ta. &ills

in Australia a! amended;

10)2 Ta. 'onsolidation

Accounting <i!!ued December

2002=

Thi! -nterpretation include! both mandatory re,uirement!+ which are applicable to all entitie!+

and the ta# con!olidation !y!tem provi!ion!+ which entitie! can elect to adopt;

<6ource: Adopted rom http://www;aa!b;com;au;=

10

Se%ec!e# E/,o$ure 0ra1!$

AA64 ha! al!o i!!ued a number o e#po!ure drat! or comment!; A ew e#po!ure drat! are provided in Table (;

Tab%e 2 AAS& E/,o$ure 0ra1!$

E/,o$ure 0ra1!$ O)er)"e*

"D 12' 'onceptual Frame,or+

for Financial Reporting: T"e

Reporting ntit% <i!!ued Darch

2010=

AA64 i! inviting comment! on any o the propo!al! in the -A64 "#po!ure Drat; Thi!

e#po!ure drat 'onceptual Frame,or+ for Financial Reporting: T"e Reporting ntit% i!

publi!hed or comment only; The propo!al may be modiied in the light o the comment!

received beore being i!!ued in inal orm;

-TC 2' Request for 'omment on

IAS& Discussion $aper

D$6782862 .tracti!e Acti!ities

<i!!ued April 2010=

AA64 i! inviting comment! that public con!ultation proce!! will identiy the e#tractive

activitie! pro?ect a! a candidate or inclu!ion in the 4oardB! agenda; The comment! received in

relation to thi! di!cu!!ion paper will al!o a!!i!t the 4oard in ma&ing it! agenda deci!ion!;

D 239 Fair :alue *ption for

Financial /ia#ilities <i!!ued Day

2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on the propo!al! in thi! e#po!ure drat+ along with the e#i!ting

re,uirement! in -A6 '2;

"D 120 $resentation of Items of

*t"er 'ompre"ensi!e Income

;proposed amendments to AAS&

282< <i!!ued :une 2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on the propo!ed amendment! to AA64 101;

"D 121 $evenue rom Contract!

with Cu!tomer! <i!!ued :uly

2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on the propo!al! in thi! e#po!ure drat which i! the !econd !tage in the

development by the -A64 and the A6 %inancial Accounting 6tandard! 4oard <%A64= o

conceptual guidance and a new comprehen!ive 6tandard or revenue recognition; -n -%$6!+ it

i! planned that the 6tandard ari!ing rom the "#po!ure Drat will replace the e#i!ting

6tandard! on revenue recognition+ namely+ -A6 11 'onstruction 'ontracts and -A6 11

Re!enue;

"D 122 Measurement

=ncertaint% Anal%sis Disclosure

for Fair :alue Measurements

;/imited re-e.posure of proposed

disclosure< <i!!ued :uly 2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on the propo!al! in thi! "D which apply to all cla!!e! o a!!et! and

liabilitie! within the !cope o the propo!ed 6tandard %air 9alue Dea!urement; Thereore+ thi!

"D ha! implication! or any a!!et! and liabilitie! <including property+ plant and e,uipment=

mea!ured at air value u!ing !igniicant unob!ervable input!;

"D 200 Amendments to AAS& >:

Tier 7 <i!!ued December 2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on amendment! to AA64 0: Tier 2;

"D 201 )edge Accounting

<i!!ued December 2010=

The AA64 ha! publi!hed thi! -nvitation to Comment to acilitate Au!tralian con!tituent!

providing comment! on the propo!al! on 3edge Accounting;

<6ource: Adopted rom http://www;aa!b;com;au;=

11

CHAPTER +: THE CONCEPTUAL FRAMEWOR3 OF ACCOUNTING AN0 ITS RELEVANCE TO

FINANCIAL ACCOUNTING

Hhile there ha! not been any change! in the conceptual ramewor& or any dome!tic legi!lative change! in 2010 to

aect thi! chapter+ development! are e#pected in the near uture; Change! are e#pected in the conceptual ramewor&

document a! the >Conceptual %ramewor& *ro?ect@ between the -A64 and A6 %A64 which wa! initiated in October

200( i! nearing it! completion;

12

CHAPTER .: THEORIES OF FINANCIAL ACCOUNTING

There have been no dome!tic legi!lative change! or proe!!ional development! in 2010 to aect thi! chapter;

13

CHAPTER 2: AN OVERVIEW OF ACCOUNTING FOR ASSETS

There have been no ma?or change! in 2010 which aect! AA64 116 $ropert%- $lant and quipment; 3owever+ AA64

10)' Application of Tiers of Australian Accounting Standards i!!ued in :une 2010 e!tabli!he! a dierential inancial

reporting ramewor& con!i!ting o two Tier! o reporting re,uirement! or preparing general purpo!e inancial

!tatement! in Au!tralia <Tier 1: Australian Accounting StandardsC and Tier 2: Australian Accounting Standards

Reduced Disclosure Requirements=; -n particular+ Tier 2 compri!e! the recognition+ mea!urement and pre!entation

re,uirement! o Tier 1 and !ub!tantially reduced di!clo!ure! corre!ponding to tho!e re,uirement! <AA64 10)'+ p; )=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=; The ollowing !ubheading and

paragraph! are added to AA64 116:

Au!1;1 *aragraph! 0'<e=<viii=+ 0(<b=+ 0(<d=+ 00<e=+ Au!00;1 and 02 o thi! 6tandard do not apply to entitie! preparing general

purpo!e inancial !tatement! under Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!; "ntitie!

applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t+ e#cept or

comparative di!clo!ure! !ub?ect to $D$ paragraph!;

Au!1;10 The $D$ paragraph in thi! 6tandard applie! only to entitie! preparing general purpo!e inancial !tatement! under

Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$0';1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! i! not re,uired to di!clo!e the

reconciliation !peciied in paragraph 0'<e= or prior period!; <AA64 2010/2+ p; 2'2(=;

14

CHAPTER 4: 0EPRECIATION OF PROPERT56 PLANT AN0 E7UIPMENT

There have been no apparent development! locally or internationally to directly aect thi! chapter;

15

CHAPTER 8: REVALUATIONS AN0 IMPAIRMENT TESTING OF NON9CURRENT ASSETS

There have been no ma?or change! in 2010 which aect! AA64 116 $ropert%- $lant and quipment <!ee chapter (=;

AA64 2002/11 Amendments to Australian Accounting Standards Arising from AAS& 3 i!!ued in December 2002 ma&e!

amendment! to AA64 1'6; -n particular+ the reerence to AA64 1'2 ha! been replaced with AA64 2;

16

CHAPTER :: INVENTOR5

AA64 10)' Application of Tiers of Australian Accounting Standards i!!ued in :une 2010 al!o applie! to AA64 102;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 102:

Au!1;1 *aragraph! '6<c=+ '6<g= and Au!'6;1<= o thi! 6tandard do not apply to entitie! preparing general purpo!e inancial

!tatement! under Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!; "ntitie! applying Au!tralian

Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o the!e e#cluded

re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ pp; 12820=;

AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing rom

AA64 2+ including AA64 102; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to Australian Accounting

Standards ari!ing rom AA64 2 i!!ued in December 2002;

17

CHAPTER ;: ACCOUNTING FOR INTANGI&LES

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 1'1 Intangi#le Assets:

Au!1;1 *aragraph! 111<e=<vii=+ 120+ 12(<a=<iii=+ Au!12(;1 and 121 o thi! 6tandard do not apply to entitie! preparing general

purpo!e inancial !tatement! under Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!; "ntitie!

applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t+ e#cept or

comparative di!clo!ure! !ub?ect to $D$ paragraph!;

Au!1;10 The $D$ paragraph in thi! 6tandard applie! only to entitie! preparing general purpo!e inancial !tatement! under

Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$111;1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! i! not re,uired to di!clo!e the

reconciliation! !peciied in paragraph 111<e= or prior period!; <AA64 2010/2+ p; '2=;

18

CHAPTER <: ACCOUNTING FOR HERITAGE ASSETS AN0 &IOLOGICAL ASSETS

There have not been any !ub!tantial dome!tic or international development! to directly impact on accounting or

heritage a!!et! and biological a!!et!; 3owever+ AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many

Au!tralian Accounting 6tandard!+ including -nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the

pronouncement! or application by certain type! o entitie! in preparing general purpo!e inancial !tatement!; Thi!

6tandard give! eect to Australian Accounting Standards Reduced Disclosure Requirements and AA64 10)'

provide! urther inormation regarding the dierential reporting ramewor& and the two tier! o reporting re,uirement!

or preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are

added to AA64 1(1 Agriculture:

Au!1;1 *aragraph! (0+ ('/(6+ (1+ (2+ )1/)'+ )(<c=+ ))+ )6 and )0<c= o thi! 6tandard do not apply to entitie! preparing general

purpo!e inancial !tatement! under Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!; "ntitie!

applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t;

Au!1;10 The $D$ paragraph in thi! 6tandard applie! only to entitie! preparing general purpo!e inancial !tatement! under

Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$)0;1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! i! not re,uired to di!clo!e the

reconciliation !peciied in paragraph )0 or prior period!; <AA64 2010/2+ pp; ''8'(=;

19

CHAPTER 1=: AN OVERVIEW OF ACCOUNTING FOR LIA&ILITIES

Though there have been no ma?or dome!tic or international legi!lative change! or proe!!ional development! to directly

aect accounting or liabilitie!+ AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December

2002 ma&e! editorial amendment! to AA64 1'0 $ro!isions- 'ontingent /ia#ilities and 'ontingent Assets; -n particular+

reerence! to Iater the end o the reporting periodB <wherever occurring+ including in deined term!= are amended to

Iater the reporting periodB; 3owever+ the!e amendment! have no ma?or impact on the re,uirement! o the amended

pronouncement <AA64 2002/12+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 1'0:

Au!1;1 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! 1(<b=+ 1(<e= and 1)<c=C

<b= in paragraph 0)+ the te#t >- an entity !tart! to J o the inancial !tatement!;@C and

<c= in paragraph 1)<b=+ the te#t >; Hhere nece!!ary J paragraph (1@;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ pp; '18'2=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to relect change! made to the te#t o -%$6! by the -A64; The!e

amendment! have no ma?or impact on the re,uirement! o the amended pronouncement!;

5a!tly+ AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing

rom AA64 2+ including AA64 1'0; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to Australian Accounting

Standards ari!ing rom AA64 2 i!!ued in December 2002;

20

CHAPTER 11: ACCOUNTING FOR LEASES

The -A64 i! underta&ing a pro?ect to !ee& to improve accounting or lea!e! by developing an approach that i! more

con!i!tent with the conceptual ramewor& deinition! o a!!et! and liabilitie!; To provide a more ocu!ed direction on

the lea!ing re!earch+ the -A64 ha! made !ome tentative deci!ion! regarding the oundation! o a conceptual model or

analy!ing the a!!et! and liabilitie! that ari!e rom lea!e contract!; 7enerally+ the -A64 ha! agreed that accounting or

lea!e! !hould be ba!ed on the analy!i! o the a!!et! and liabilitie! that ari!e rom contractual right! and obligation!; The

-A64 tentatively agreed that the a!!et! and liabilitie! recogni!ed in re!pect o lea!e! !hould relect the conveyance o

the right o u!e and control o the a!!ociated uture economic beneit! or the period o the contract <rather than

conveyance o the whole o the phy!ical property+ >whole o a!!et@ approach=; %or e#ample:

i a lea!e contract i! reely cancellable by the le!!ee+ the a!!et and liability amount! recogni!ed by the le!!or and le!!ee

!hould relect both <i= the conveyance o the right o u!e up to the date at which the lea!e can be cancelled by the le!!ee

and <ii= the le!!eeB! option in re!pect o period! beyond that dateC and

i a lea!e contract i! reely cancellable by the le!!or+ the a!!et and liability amount! recogni!ed by the le!!or and le!!ee

!hould relect both <i= the conveyance o the right o u!e up to the date at which the lea!e can be cancelled by the le!!or

and <ii= the le!!orB! option in re!pect o period! beyond that date; <-A64+ 200)+ p; 1=;

-A64 argue! that the recognition o a!!et! and liabilitie! !hould not be limited to contract! that convey right! that are

economically !imilar to outright owner!hip; $ather the primary ocu! !hould be on the conveyance o right! to uture

economic beneit! <!uch a! the right o u!e=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 110:

Au!1;1 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! '1<c=+ '1<d=+ ')<b= and (1C

<b= in paragraph '1<b=+ the te#t >a reconciliation J pre!ent value;@ and+ in the !econd !entence+ the te#t >-n addition+ an

entity !hall di!clo!e@ and >and their pre!ent value+@C

<c= in paragraph ')<c=+ the te#t >+ with !eparate amount! J !ublea!e payment!@C and

<d= in paragraph )6<a=+ the word! >in the aggregate and@;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ p; 2(=;

21

CHAPTER 1+: SET OFF AN0 EXTINGUISHMENT OF 0E&T

AA64 101( Set *ff and .tinguis"ment of De#t ha! been !uper!eded by AA64 1'2 Financial Instruments; AA64 1'2

prohibit! the u!e o in!ub!tance debt deea!ance a! a mean! o removing debt rom the balance !heet; The -A64 had

i!!ued "D 0 Financial Instruments: Disclosures in :uly 200(+ propo!ing the withdrawal o -A6 '0 and amendment! to

-A6 '2 Financial Instruments: Disclosures and $resentation; The AA64 had reproduced -A64 "D 0 Financial

Instruments: Disclosures without amendment a! part o "D 1'0 to identiy the propo!ed amendment!; The ma?or

dierence! between the re,uirement! o -A64 "D 0+ AA64 1'0 and AA64 1'2 were:

<a= All the di!clo!ure! !hould apply to all type! o entitie! that have inancial in!trument!+ however the e#tent o di!clo!ure re,uired

depend! on the e#tent o the entityB! u!e o inancial in!trument! and o it! e#po!ure to ri!&+ wherea! the re,uirement! o AA64

1'0 pre!ently apply only to ban&! and !imilar inancial in!titution!;

<b= The propo!ed 6tandard ari!ing rom -A64 "D 0 !hould add to the re,uirement! pre!ently in AA64 1'2 by re,uiring enhanced

balance !heet and income !tatement di!clo!ure!;

<c= The propo!ed 6tandard ari!ing rom -A64 "D 0 !hould re,uire ,ualitative and ,uantitative di!clo!ure! about e#po!ure to ri!&!

ari!ing rom inancial in!trument!; Together the di!clo!ure! provide an overview o the entityB! u!e o inancial in!trument! and the

e#po!ure! to ri!&! they create;

<d= The propo!ed 6tandard ari!ing rom -A64 "D 0 !hould re,uire !peciied minimum di!clo!ure! about credit ri!&+ li,uidity ri!&

and mar&et ri!& <including intere!t rate ri!&= di!clo!ure;

<e= The propo!ed 6tandard ari!ing rom -A64 "D 0 !hould re,uire di!clo!ure! about capital; <"D 1'0+ p; vi=;

-n Augu!t 200)+ AA64 0 Financial Instruments: Disclosures wa! i!!ued+ which i! the Au!tralian e,uivalent to -%$6 0

Financial Instruments: Disclosures; AA64 0 led to the withdrawal o AA64 1'0 Disclosures in t"e Financial

Statements of &an+s and Similar Financial Institutions and !uper!ede! paragraph! )1/2) o AA64 1'2; AA64 0 now

bring! in one place all di!clo!ure! relating to inancial in!trument!; Comparatively+ AA64 0 i! broader in !cope than

both AA64 1'0 and AA64 1'2 and improve! the inormation provided in the inancial report by re,uiring di!clo!ure

o both the !igniicance o inancial in!trument! to the inancial po!ition and perormance o an entity and the nature+

e#tent and management o the re!ulting ri!& inherent in the e#po!ure;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to relect change! made to the te#t o -%$6! by the -A64; The!e

amendment! have no ma?or impact on the re,uirement! o the amended pronouncement!;

5a!tly+ AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing

rom AA64 2+ including AA64 0 and AA64 1'2; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to Australian

Accounting Standards ari!ing rom AA64 2 i!!ued in December 2002;

22

CHAPTER 1.: ACCOUNTING FOR EMPLO5EE &ENEFITS

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 112; -n particular+ reerence! to Iater the end o the reporting periodB <wherever occurring+

including in deined term!= are amended to Iater the reporting periodB; Thi! 6tandard al!o ma&e! numerou! editorial

amendment! to a range o Au!tralian Accounting 6tandard! and -nterpretation!+ including amendment! to relect

change! made to the te#t o -%$6! by the -A64; 3owever+ the!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement! <AA64 2002/12+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 112:

Au!1;0 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! '0<c=<ii=+ '(4+ (0+ 120+ 120A<c=+ 120A<d=+ 120A<e=<i=/<iii=+ 120A<e=<vii=+ 120A<e=<viii=+ 120A<l=+ 120A<n=

<iii=+ 120A<o=/<,=+ 12(<b= and 1('C

<b= the third !entence in paragraph 2'C

<c= in paragraph 120A<g=+ the te#t >or each o J in paragraph )1<b=@C

<d= in paragraph 120A<m=+ the te#t >+ a! well a! J paragraph 10(A@C and

<e= the !econd !entence in paragraph 1'1;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;1 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t+ e#cept or

comparative di!clo!ure! !ub?ect to $D$ paragraph!;

Au!1;2 $D$ paragraph! in thi! 6tandard apply only to entitie! preparing general purpo!e inancial !tatement! under Au!tralian

Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$120A;1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! !hall di!clo!e a

reconciliation o opening and clo!ing balance! o the deined beneit obligation !howing !eparately beneit! paid and all

other change!; The!e di!clo!ure! may be made in total+ !eparately or each plan+ or in !uch grouping! a! are con!idered to

be the mo!t u!eul;

$D$120A;2 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! i! not re,uired to di!clo!e

the reconciliation! !peciied in paragraph! 120A<e= and $D$120A;1 or prior period!; <AA64 2010/2+ pp; 2)826=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to relect change! made to the te#t o -%$6! by the -A64; The!e

amendment! have no ma?or impact on the re,uirement! o the amended pronouncement!;

23

CHAPTER 12: SHARE CAPITAL AN0 RESERVES

There have been no !igniicant development! dome!tically or internationally to directly aect thi! chapter;

24

CHAPTER 14: ACCOUNTING FOR FINANCIAL INSTRUMENTS

The ma?or amendment! ari!e a! a re!ult o the i!!uance o AA64 2 Financial Instruments in December 2002; AA64 2

include! re,uirement! or the cla!!iication and mea!urement o inancial a!!et! re!ulting rom the ir!t part o *ha!e 1

o the -A64B! pro?ect to replace -A6 '2 Financial Instruments: Recognition and Measurement. -n particular+ the main

change! rom AA64 1'2 are a! ollow!:

<a= %inancial a!!et! are cla!!iied ba!ed on <a= the ob?ective o the entityB! bu!ine!! model or managing the inancial a!!et!C and <b=

the characteri!tic! o the contractual ca!h low!; Thi! replace! the numerou! categorie! o inancial a!!et! in AA64 1'2+ each o

which had it! own cla!!iication criteria; Application guidance ha! been included in AA64 2 on how to apply the condition!

nece!!ary or amorti!ed co!t mea!urement;

<b= AA64 2 allow! an irrevocable election on initial recognition to pre!ent gain! and lo!!e! on inve!tment! in e,uity in!trument!

that are not held or trading in other comprehen!ive income; Dividend! in re!pect o the!e inve!tment! that are a return on

inve!tment can be recogni!ed in proit or lo!! and there i! no impairment or recycling on di!po!al o the in!trument;

<c= %inancial a!!et! can be de!ignated and mea!ured at air value through proit or lo!! at initial recognition i doing !o eliminate!

or !igniicantly reduce! a mea!urement or recognition incon!i!tency that would ari!e rom mea!uring a!!et! or liabilitie!+ or

recogni!ing the gain! and lo!!e! on them+ on dierent ba!e!;

<d= 3ybrid contract! with inancial a!!et ho!t! are cla!!iied and mea!ured in their entirety in accordance with the cla!!iication

criteria; "mbedded derivative a!!et! that are !eparated rom inancial liability or non/inancial ho!t! in accordance with AA64 1'2

are to be accounted or in accordance with AA64 2;

<e= -nve!tment! in un,uoted e,uity in!trument! <and contract! on tho!e inve!tment! that mu!t be !ettled by delivery o the un,uoted

e,uity in!trument= mu!t be mea!ured at air value; 3owever+ in limited circum!tance!+ co!t may be an appropriate e!timate o air

value;

<= -nve!tment! in contractually lin&ed in!trument! that create concentration! o credit ri!& <tranche!= are cla!!iied and mea!ured

u!ing a Iloo& throughB approach; 6uch an approach loo&! to the underlying a!!et! generating ca!h low! and a!!e!!e! the ca!h low!

again!t the cla!!iication criteria <di!cu!!ed in <a= above= to determine whether the inve!tment i! mea!ured at air value or

amorti!ed co!t;

<g= %inancial a!!et! are recla!!iied when there i! a relevant change in the entityB! bu!ine!! model change!; <AA64 2+ p; 680=;

AA64 2002/11 Amendments to Australian Accounting Standards Arising from AAS& 3 i!!ued in December 2002 ma&e!

amendment! to AA64 0 and AA64 1'2; -n particular+ the reerence to AA64 1'2 ha! been replaced with AA64 2;

AA64 2002/11 al!o ma&e! con!e,uential amendment! to AA64 1'2;

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 1'2; 3owever+ the!e amendment! have no ma?or impact on the re,uirement! o the amended

pronouncement <AA64 2002/12+ p; (=;

AA64 2010/1 Amendments to Australian Accounting Standards i!!ued in %ebruary 2010 ma&e! amendment! to AA64

0; The!e amendment! principally give eect to e#tending the tran!ition provi!ion! o AA64 2002/2 Amendments to

Australian Accounting Standards Impro!ing Disclosures a#out Financial Instruments to ir!t/time adopter! o

Au!tralian Accounting 6tandard! <AA64 2010/1+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including AA64 0+

to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o entitie! in

preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting Standards

Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential reporting

ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement! <AA64 2010/

2+ p; )=;

AA64 2010/' Amendments to Australian Accounting Standards arising from t"e Annual Impro!ements $ro5ect i!!ued

in :une 2010 al!o ma&e! amendment! to AA64 0+ AA64 1'2 and AA64 1'2; -n particular+ principal amendment!

25

relate! to tran!ition re,uirement! or contingent con!ideration rom a bu!ine!! combination that occurred beore the

eective date o the revi!ed AA64 ' <2001= <AA64 2010/'+ p; )=;

%urthermore+ AA64 2010/( Amendments to Australian Accounting Standards arising from t"e Annual Impro!ements

$ro5ect i!!ued in :une 2010 al!o ma&e! amendment! to AA64 0; -n particular+ the!e amendment! re!ult rom propo!al!

that were included in "#po!ure Drat "D 111 Impro!ements to IFRSs publi!hed in 6eptember 2002 and in "D 11)

Rate-regulated Acti!ities publi!hed in :uly 2002+ and ollow the i!!uance o the -A64 6tandard -mprovement! to -%$6!

in Day 2010; The amendment re!ulting rom "D 11) provide! only an e#emption in AA64 1 or ir!t/time adopter!

with operation! !ub?ect to rate regulation <AA64 2010/(+ p; (=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to relect change! made to the te#t o -%$6! by the -A64; The!e

amendment! have no ma?or impact on the re,uirement! o the amended pronouncement!;

5a!tly+ AA64 2010/6 Amendments to Australian Accounting Standards Disclosures on Transfers of Financial Assets

i!!ued in .ovember 2010 al!o ma&e! amendment! to AA64 0; -n particular+ thi! 6tandard add! and amend! di!clo!ure

re,uirement! about tran!er! o inancial a!!et!+ including in re!pect o the nature o the inancial a!!et! involved and

the ri!&! a!!ociated with them <AA64 2010/6+ p; (=;

26

CHAPTER 18: REVENUE RECOGNITION ISSUES

There have been no local or international development! to directly aect AA64 111 Re!enue; 3owever+ AA64 2002/

11 Amendment! to Au!tralian Accounting 6tandard! Ari!ing rom AA64 2 i!!ued in December 2002 ma&e!

amendment! to AA64 111; -n particular+ reerence to AA64 2 ha! been included;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to AA64 111; The!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement!;

5a!tly+ AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing

rom AA64 2+ including AA64 111; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to Australian Accounting

Standards ari!ing rom AA64 2 i!!ued in December 2002;

27

CHAPTER 1:: THE STATEMENT OF COMPREHENSIVE INCOME AN0 STATEMENT OF CHANGES IN

E7UIT5

There have been no local or international development! to directly aect thi! chapter in 2010;

28

CHAPTER 1;: ACCOUNTING FOR SHARE9&ASE0 PA5MENTS

AA64 2 S"are-#ased $a%ment wa! rei!!ued in :uly 2002; AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to

many Au!tralian Accounting 6tandard!+ including -nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the

pronouncement! or application by certain type! o entitie! in preparing general purpo!e inancial !tatement!; Thi!

6tandard give! eect to Australian Accounting Standards Reduced Disclosure Requirements and AA64 10)'

provide! urther inormation regarding the dierential reporting ramewor& and the two tier! o reporting re,uirement!

or preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are

added to AA64 2:

Au!1;6 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! ()<c=+ ()<d=+ (6+ (0<a=+ (0<b=+ (0<c=<ii=+ (0<c=<iii= and (1/)2C and

<b= in paragraph (0+ the te#t >to give eect to the principle in paragraph (6+@;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;0 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t;

Au!1;1 $D$ paragraph! in thi! 6tandard apply only to entitie! preparing general purpo!e inancial !tatement! under Au!tralian

Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$(6;1 %or e,uity/!ettled !hare/ba!ed payment arrangement!+ an entity applying Au!tralian Accounting 6tandard! 8 $educed

Di!clo!ure $e,uirement! !hall di!clo!e inormation about how it mea!ured the air value o good! or !ervice! received or

the air value o the e,uity in!trument! granted; - a valuation methodology wa! u!ed+ the entity !hall di!clo!e the method

and it! rea!on or choo!ing it;

$D$(6;2 %or ca!h/!ettled !hare/ba!ed payment arrangement!+ an entity applying Au!tralian Accounting 6tandard! 8 $educed

Di!clo!ure $e,uirement! !hall di!clo!e inormation about how the liability wa! mea!ured;

$D$)0;1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! !hall di!clo!e the ollowing

inormation about the eect o !hare/ba!ed payment tran!action! on the entityB! proit or lo!! or the period and on it!

inancial po!ition:

<a= the total e#pen!e recogni!ed in proit or lo!! or the periodC and

<b= the total carrying amount at the end o the period o liabilitie! ari!ing rom !hare/ba!ed payment tran!action!; <AA64

2010/2+ pp; 1281'=;

29

CHAPTER 1<: ACCOUNTING FOR INCOME TAXES

AA64 2002/11 Amendments to Australian Accounting Standards Arising from AAS& 3 i!!ued in December 2002 ma&e!

amendment! to AA64 112 Income Ta.es; -n particular+ the reerence to AA64 1'2 ha! been replaced with AA64 2;

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 112; -n particular+ reerence! to Iater the end o the reporting periodB <wherever occurring+

including in deined term!= are amended to Iater the reporting periodB; Thi! 6tandard al!o ma&e! numerou! editorial

amendment! to a range o Au!tralian Accounting 6tandard! and -nterpretation!+ including amendment! to relect

change! made to the te#t o -%$6! by the -A64; 3owever+ the!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement! <AA64 2002/12+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 112:

Au!1;1 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! 11<ab=+ 11<=+ 11<i=/<&=+ 12 and 10/10CC and

<b= the !econd !entence in paragraph 12A; "ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure

$e,uirement! may elect to comply with !ome or all o the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t;

Au!1;10 The $D$ paragraph in thi! 6tandard applie! only to entitie! preparing general purpo!e inancial !tatement! under

Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!;

$D$11;1 An entity applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! !hall di!clo!e the aggregate

amount o current and deerred income ta# relating to item! recogni!ed in other comprehen!ive income; <AA64 2010/2+

pp; 2282'=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to AA64 112; The!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement!;

AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing rom

AA64 2+ including AA64 112; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to Australian Accounting

Standards ari!ing rom AA64 2 i!!ued in December 2002;

5a!tly+ AA64 2010/1 Amendments to Australian Accounting Standards Deferred Ta.: Reco!er% of =nderl%ing Assets

i!!ued in December 2010 ma&e! amendment! to AA64 112; -n particular+ >the amendment! provide a practical

approach or mea!uring deerred ta# liabilitie! and deerred ta# a!!et! when inve!tment property i! mea!ured u!ing the

air value model in AA64 1(0 In!estment $ropert%; Ander AA64 112+ the mea!urement o deerred ta# liabilitie! and

deerred ta# a!!et! depend! on whether an entity e#pect! to recover an a!!et by u!ing it or by !elling it; 3owever+ it i!

oten diicult and !ub?ective to determine the e#pected manner o recovery when the inve!tment property i! mea!ured

u!ing the air value model in AA64 1(0; To provide a practical approach in !uch ca!e!+ the amendment! introduce a

pre!umption that an inve!tment property i! recovered entirely through !ale; Thi! pre!umption i! rebutted i the

inve!tment property i! held within a bu!ine!! model who!e ob?ective i! to con!ume !ub!tantially all o the economic

beneit! embodied in the inve!tment property over time+ rather than through !ale@ <AA64 2010/1+ p; (=;

CHAPTER +=: THE STATEMENT OF CASH FLOWS

30

AA64 100 'as" Flo, Statements ha! been rei!!ued in :une 2002; AA64 2010/2 i!!ued in :une 2010 ma&e!

amendment! to many Au!tralian Accounting 6tandard!+ including -nterpretation!+ to introduce reduced di!clo!ure

re,uirement! to the pronouncement! or application by certain type! o entitie! in preparing general purpo!e inancial

!tatement!; Thi! 6tandard give! eect to Australian Accounting Standards Reduced Disclosure Requirements and

AA64 10)' provide! urther inormation regarding the dierential reporting ramewor& and the two tier! o reporting

re,uirement! or preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=; The ollowing !ubheading and

paragraph! are added to AA64 100:

Au!1;1 *aragraph! Au!20;1+ Au!20;2+ (0+ (1+ (6+ )0<d= and )2 o thi! 6tandard do not apply to entitie! preparing general purpo!e

inancial !tatement! under Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!; "ntitie! applying

Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o the!e

e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ p; 20=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to AA64 100; The!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement!;

CHAPTER +1: ACCOUNTING FOR THE EXTRACTIVE IN0USTRIES

31

There are no ma?or change! to AA64 6 .ploration for and !aluation of Mineral Resources in 2010;

CHAPTER ++: ACCOUNTING FOR GENERAL INSURANCE CONTRACTS

32

Any development in AA64 ( Insurance 'ontracts- AA64 102' 0eneral Insurance 'ontracts and AA64 10'1 /ife

Insurance 'ontracts are relevant to thi! chapter; AA64 (- AA64 102' and AA64 10'1 have been amended by a ew

omnibu! !tandard! i!!ued in late 2002; AA64 2002/11 Amendments to Australian Accounting Standards Arising from

AAS& 3 i!!ued in December 2002 ma&e! amendment! to AA64 (+ 102' and AA64 10'1; -n particular+ the reerence to

AA64 1'2 ha! been replaced with AA64 2;

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 102'; -n particular+ reerence! to Iater the end o the reporting periodB <wherever occurring+

including in deined term!= are amended to Iater the reporting periodB; 3owever+ the!e amendment! have no ma?or

impact on the re,uirement! o the amended pronouncement <AA64 2002/12+ p; (=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to AA64 102' and AA64 10'1; The!e amendment! have no

ma?or impact on the re,uirement! o the amended pronouncement!;

5a!tly+ AA64 2010/0 i!!ued in December 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard! ari!ing

rom AA64 2+ including AA64 102' and AA64 10'1; Thi! 6tandard !uper!ede! AA64 2002/11 Amendments to

Australian Accounting Standards ari!ing rom AA64 2 i!!ued in December 2002;

CHAPTER +.: ACCOUNTING FOR SUPERANNUATION PLANS

33

There have been no local or international development! to directly aect thi! chapter in 2010;

CHAPTER +2: EVENTS OCCURRING AFTER THE REPORTING PERIO0

34

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 110 !ents after t"e Reporting $eriod; -n particular+ reerence! to Iater the end o the reporting

periodB <wherever occurring+ including in deined term!= are amended to Iater the reporting periodB; Thi! 6tandard al!o

ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting 6tandard! and -nterpretation!+ including

amendment! to relect change! made to the te#t o -%$6! by the -A64; 3owever+ the!e amendment! have no ma?or

impact on the re,uirement! o the amended pronouncement! <AA64 2002/12+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 110:

Au!1;1 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! 1'+ 12 and 20C and

<b= in paragraph 22<a=+ the te#t ><AA64 ' J in !uch ca!e!=@;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ pp; 21822=;

CHAPTER +4: SEGMENT REPORTING

35

AA64 1 *perating Segments i! a new accounting !tandard that ha! been i!!ued in %ebruary 2000; AA64 1 >applie! to

or/proit entitie! who!e debt or e,uity in!trument! are traded in a public mar&et or that ile!+ or i! in the proce!! o

iling+ it! inancial !tatement! with a !ecuritie! commi!!ion or other regulatory organi!ation or the purpo!e o i!!uing

any cla!! o in!trument! in a public mar&et; AA64 11( applied to a broader range o or/proit entitie!+ namely tho!e

that are or/proit reporting entitie!@ <AA64 1+ p; )=;

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! amendment! to

AA64 1; AA64 1 i! amended a! a re!ult o the i!!uance o revi!ed AA64 12( Related $art% Disclosures in December

2002; -n particular+ the amendment to AA64 1 re,uire! an entity to e#erci!e ?udgement in a!!e!!ing whether a

government and entitie! &nown to be under the control o that government are con!idered a !ingle cu!tomer or the

purpo!e! o certain operating !egment di!clo!ure! <AA64 2002/12+ p; (=; 6peciically+ paragraph '( i! amended a!

ollow! and paragraph '64 i! added:

'( An entity !hall provide inormation about the e#tent o it! reliance on it! ma?or cu!tomer!; - revenue! rom tran!action! with

a !ingle e#ternal cu!tomer amount to 10 per cent or more o an entityB! revenue!+ the entity !hall di!clo!e that act+ the total

amount o revenue! rom each !uch cu!tomer+ and the identity o the !egment or !egment! reporting the revenue!; The entity

need not di!clo!e the identity o a ma?or cu!tomer or the amount o revenue! that each !egment report! rom that cu!tomer;

%or the purpo!e! o thi! 6tandard+ a group o entitie! &nown to a reporting entity to be under common control !hall be

con!idered a !ingle cu!tomer; 3owever+ ?udgement i! re,uired to a!!e!! whether a government <including government

agencie! and !imilar bodie! whether local+ national or international= and entitie! &nown to the reporting entity to be under the

control o that government are con!idered a !ingle cu!tomer; -n a!!e!!ing thi!+ the reporting entity !hall con!ider the e#tent o

economic integration between tho!e entitie!;

'64 AA64 2002/12 Amendments to Australian Accounting Standard! amended paragraph '( or annual reporting period!

beginning on or ater 1 :anuary 2011; - an entity applie! AA64 12( <revi!ed 2002= or an earlier period+ it !hall apply the

amendment to paragraph '( or that earlier period; <AA64 2002/12+ p; 1=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 1:

Au!2;6 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; 4y virtue o

paragraph Au!2;1 thi! 6tandard applie! to Tier 1 entitie! preparing general purpo!e inancial !tatement! in accordance with

Au!tralian Accounting 6tandard!; "ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!

may elect to comply with !ome or all o the e#cluded re,uirement!; <AA64 2010/2+ p; 10=;

CHAPTER +8: RELATE09PART5 0ISCLOSURES

36

AA64 12( Related $art% Disclosures wa! rei!!ued in December 2002+ which ta&e! into account the amendment! made

by one or more o the Omnibu! 6tandard! that have been i!!ued; %urthermore+ AA64 2010/2 i!!ued in :une 2010

ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including -nterpretation!+ to introduce reduced

di!clo!ure re,uirement! to the pronouncement! or application by certain type! o entitie! in preparing general purpo!e

inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting Standards Reduced Disclosure

Requirements and AA64 10)' provide! urther inormation regarding the dierential reporting ramewor& and the two

tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement! <AA64 2010/2+ p; )=; The ollowing

!ubheading and paragraph! are added to AA64 12( Related-$art% Disclosures:

Au!1;11 The ollowing do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement!:

<a= paragraph! Au!1';1+ 26+ 20 and Au!22;1/Au!22;2;'C

<b= in paragraph 10+ the te#t >and or each o J <e= !hare/ba!ed payment@C and

<c= in paragraph 22+ the te#t ><!ee paragraph '(4 o AA64 112=@;

"ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement! may elect to comply with !ome or all o

the!e e#cluded re,uirement!;

Au!1;12 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; <AA64

2010/2+ p; 20=;

CHAPTER +:: EARNINGS PER SHARE

37

AA64 2002/12 Amendments to Australian Accounting Standards i!!ued in December 2002 ma&e! editorial

amendment! to AA64 1'' arnings $er S"are; -n particular+ reerence! to Iater the end o the reporting periodB

<wherever occurring+ including in deined term!= are amended to Iater the reporting periodB; Thi! 6tandard al!o ma&e!

numerou! editorial amendment! to a range o Au!tralian Accounting 6tandard! and -nterpretation!+ including

amendment! to relect change! made to the te#t o -%$6! by the -A64; 3owever+ the!e amendment! have no ma?or

impact on the re,uirement! o the amended pronouncement! <AA64 2002/12+ p; (=;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including

-nterpretation!+ to introduce reduced di!clo!ure re,uirement! to the pronouncement! or application by certain type! o

entitie! in preparing general purpo!e inancial !tatement!; Thi! 6tandard give! eect to Australian Accounting

Standards Reduced Disclosure Requirements and AA64 10)' provide! urther inormation regarding the dierential

reporting ramewor& and the two tier! o reporting re,uirement! or preparing general purpo!e inancial !tatement!

<AA64 2010/2+ p; )=; The ollowing !ubheading and paragraph! are added to AA64 1'':

Au!1;2 The re,uirement! that do not apply to entitie! preparing general purpo!e inancial !tatement! under Au!tralian Accounting

6tandard! 8 $educed Di!clo!ure $e,uirement! are identiied in thi! 6tandard by !hading o the relevant te#t; 4y virtue o

paragraph Au!1;1 thi! 6tandard applie! to Tier 1 entitie! preparing general purpo!e inancial !tatement! in accordance with

Au!tralian Accounting 6tandard!; "ntitie! applying Au!tralian Accounting 6tandard! 8 $educed Di!clo!ure $e,uirement!

may elect to comply with !ome or all o the e#cluded re,uirement!; <AA64 2010/2+ p; 22=;

AA64 2010/) i!!ued in October 2010 ma&e! numerou! editorial amendment! to a range o Au!tralian Accounting

6tandard! and -nterpretation!+ including amendment! to AA64 1''; The!e amendment! have no ma?or impact on the

re,uirement! o the amended pronouncement!;

CHAPTER +;: ACCOUNTING FOR GROUP STRUCTURES

38

The ollowing commentary applie! to Chapter! 218'';

AA64 2002/11 Amendment! to Au!tralian Accounting 6tandard! ari!ing rom AA64 2+ i!!ued in December 2002+

amended paragraph! 16+ (2 and )1 in AA64 ' &usiness 'om#inations; An entity !hall apply tho!e amendment! when it

applie! AA64 2; -n particular+ paragraph 16 i! amended a! ollow!:

16 -n !ome !ituation!+ Au!tralian Accounting 6tandard! provide or dierent accounting depending on how an entity

cla!!iie! or de!ignate! a particular a!!et or liability; "#ample! o cla!!iication! or de!ignation! that the ac,uirer !hall

ma&e on the ba!i! o the pertinent condition! a! they e#i!t at the ac,ui!ition date include but are not limited to:

<a= cla!!iication o particular inancial a!!et! and liabilitie! a! mea!ured at air value or at amorti!ed co!t+ in accordance with

AA64 2 %inancial -n!trument! and AA64 1'2;;; <AA64 2002/11+ p; 1)=;

AA64 2002/11 al!o ma&e! amendment! to AA64 120 'onsolidated and Separate Financial Statements and AA64

121 In!estments in Associates; -n particular+ reerence to AA64 2 ha! been included;

AA64 2010/2 i!!ued in :une 2010 ma&e! amendment! to many Au!tralian Accounting 6tandard!+ including AA64 '+