Beruflich Dokumente

Kultur Dokumente

Midlands Case Final

Hochgeladen von

Sourav SinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Midlands Case Final

Hochgeladen von

Sourav SinghCopyright:

Verfügbare Formate

Midlands Energy Resources

Midland Energy Resources is a global energy company with operations in oil and gas exploration and

production (E&P), refining and marketing (R&M) and petrochemicals. The company had been incorporated

more than 120 years previously and in 2007 had more than 80000 employees. On a consolidated basis, the firm

had 2006 operating revenue and operating income of $248.5 billion and $42.2 billion, respectively. E&P is

Midlands most profitable business. However measured by revenue its refining and marketing business is its

largest. Petrochemicals is midlands smallest division.

Midland must calculate an appropriate cost of capital that will help them achieve an optimal capital structure.

Assumptions in our model:

The Cost of Debt assumption: The ratio of D/D+E is calculated for each of the companies. This ratio is compared with

the debt/value ratio given in Table 1 of the case. The

D

value corresponding to the credit ratings have been calculated

from the article Risk in capital structure arbitrage mentioned during class discussions. For Exploration & Production

division, as all the comparable firms have a debt/value ratio less than or equal to 46%, we have assumed AAA rating for

each one of them (This implies

D

=0).

The Risk free rate Assumption: We take 4.98% as the risk free rate of return based on returns for Treasury bond for 30

years and 5% as the equity market risk premium. Because the period from 1798-2006 has the least standard error we are

going with the approximation of equity market risk premium of 5%.

Exploration & Production (E&P)

E&P is Midlands most profitable business with net margin over the previous five years among the highest in

the industry. It produces 67% of the companys net income. Midland must calculate an appropriate cost of

capital that will help them achieve an optimal capital structure. Capital Spending in E&P was expected to

exceed $8billion in 2007 and 2008

Using the data that we have for comparable companies in this sector, we need to calculate the unlevered cost of

capital for this division of Midland.

Based on the

D

values we can calculate the unlevered

separately for each similar company as per the formula

u

= (E)/(D+E)x

E

+ (D)/(D+E)x

D

Which gives

U.

From each individual

U

we calculate the weighted

W

from the given firms by weighing the assets of the

firms.

Where Assets = (Market value + Net Debt) and w = (

U

x Individual Assets)/ (Total Assets)

The final

W

= 0.59

Now, we can apply CAPM and calculate the unlevered cost of capital using the formula

r

U

= r

f

+ [E(r

m

)-r

f

]

W .

Therefore r

u

= 4.98% + (0.59x5%) = 7.94% where 4.98% is the risk free rate of return.

Hence, the unlevered beta for Exploration and Production division is 0.59 and the rate of return is 7.94%.

Refining & Marketing (R&M)

In terms of revenue, Midland's refining and marketing business was the company's largest. However, its

products were highly commoditized resulting in stiff competition. After tax earnings totaled only $4million.

Midland was the market leader in this business due to its advanced technology and vertical integration.

Using the same model as the Refining and Production division, the unlevered beta for Exploration and

Production division is 1.116 and the rate of return is 10.56%.

Petrochemicals

Petrochemicals is Midland's smallest division but capital spending in petrochemicals was expected to grow in

the near-term as several older facilities were sold or retired and replaced by more efficient capacity. Revenue

and After tax earnings in 2006 were $23.2 billion and $2.1 billion respectively

As we already have the unlevered beta for the Exploration and Refining divisions, we can use this data along

with the unlevered beta of the whole company, to find out the unlevered beta for the petrochemicals division

using the formula:

)

The detailed workings of the same have been shown in exhibit 3.

The unlevered beta for Petrochemical division is 0.453 and the rate of return is 7.24%.

Verdict:

The rate of returns for the Petrochemical division is the lowest at 7.24%, while it is maximum for the Refining

and Marketing division at 10.56%.

A note on Hurdle Rate

For our evaluation of Midlands, instead of using one fixed rate of return (hurdle rate) for the whole company,

we have used a separate hurdle rate for each division. This has been done because the performance of the

divisions will vary since Midland is a large enterprise. Hence different risk factors are present in different

divisions and there are different risk premiums. This is so because these divisions operate in different industries

and have a different market risk associated with them. So hurdle rates for these divisions should be calculated

separately based on the market risk of the division.

If a single hurdle rate is used all along, these problems can affect the value assessment of Midlands:

i) Midlands will allocate resources/investments improperly among the three divisions. It will invest

relatively more in poorly performing divisions resulting in wastage of assets. Similarly it will not

invest enough in divisions which are earning more profits.

Eg: If we find the single hurdle rate for the company: r

U

= 4.98% + (0.764x5%) = 8.8%

In such a case if we straight away use 8.8% for all departments, the company will overstate the risk

as well as returns for Exploration & Production as well as Petrochemical Divisions. Thus, we will

not invest much in these relatively lower risk departments, and hence, the overall volatility of the

returns for Midlands will increase, making the stock more risky.

ii) This decision will adversely affect the performance of the different divisions and hence the company

as a whole. Hence its brand equity will decrease and stock prices will also fall. Overall value of the

firm will be overstated by using one higher rate of return the risk premium will increase.

Exhibits:

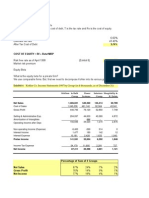

Exhibit 1: Comparable companies showing debt beta and unlevered beta for Exploration and

Production sector.

Equity Net

Equit

y LTM LTM

Exploration

&

Production:

Ratin

g

D/D+

E

Marke

t

Value Debt D/E Beta

Revenu

e

Earning

s

Debt

beta

Unlevere

d beta

Jackson

Energy, Inc. AAA 10% 57,931 6,480

11.2

% 0.89 18,512 4,981 0 0.790

Wide Palin

Petroleum AAA 46% 46,089

39,37

5

85.4

% 1.21 17,827 8,495 0 0.176

Corsicana

Energy

Corp. AAA 13% 42,263 6,442

15.2

% 1.11 14,505 4,467 0 0.941

Worthington

Petroleum AAA 32% 27,591

13,09

8

47.5

% 1.39 12,820 3,506 0 0.730

Exhibit 2: Comparable companies showing debt beta and unlevered beta for Refining and Marketing

sector.

Equity Net Equity LTM LTM

Refining &

Marketing:

Ratin

g

D/D+

E

Marke

t Value Debt D/E Beta

Revenu

e

Earning

s

Deb

t

beta

Unlevere

d beta

Bexar

Energy, Inc. AAA 9% 60,356 6,200

10.3

% 1.70 160,708 9,560 0 1.542

Kirk Corp. AAA 16% 15,567 3,017

19.4

% 0.94 67,751 1,713 0 0.787

White Point

Energy AAA 17% 9,204 1,925

20.9

% 1.78 31,682 1,402 0 1.472

Petrarch

Fuel

Services AAA -14% 2,460 (296)

-

12.0

% 0.24 18,874 112 0 0.273

Arkana

Petroleum

Corp. A 24% 18,363 5,931

32.3

% 1.25 49,117 3,353 0.05 0.957

Beaumont

Energy, Inc. AAA 17% 32,662 6,743

20.6

% 1.04 59,989 1,467 0 0.862

Dameron

Fuel

Services BBB 33% 48,796

24,52

5

50.3

% 1.42 58,750 4,646 0.10 0.978

Exhibit 3: Calculation of Unlevered Beta and Rate of Return for Petrochemical Division of Midlands.

Enterprise value = Equity + Debt Cash

Where

= Unlevered beta for Midlands

E = Shareholders equity

D = Long term debts

Equity beta

Equity (in

mill $) Debt beta

Total debt (in

mill $)

D+E-cash

(in mill $)

Unlevered beta

for Company

1.25 97280 0 81078 159152 0.764049462

The debt beta has been assumed as 0, because, the companys credit rating is A+.

Now, to find the Unlevered Beta for Petrochemical Division:

Company Asset Value (in mill. $)

E & P (A1) 140100

R & M (A2) 93829

Petro (A3) 28450

Now:

)

Where

0.764049462,

0.59 and

1.116

From this we find,

0.453

r

U

= r

f

+ [E(r

m

)-r

f

]

A3

Where 4.98% is the risk free rate of return for Treasury bond for 30 years and 5% is the equity market risk

premium.

r

U

= 4.98%+(0.3x5%) = 7.24%

Das könnte Ihnen auch gefallen

- MIdland FInalDokument7 SeitenMIdland FInalFarida100% (8)

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Dokument13 SeitenMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaNoch keine Bewertungen

- Midland Energy Group A5Dokument3 SeitenMidland Energy Group A5Deepesh Moolchandani0% (1)

- Midland FinalDokument8 SeitenMidland Finalkasboo6Noch keine Bewertungen

- MidlandDokument9 SeitenMidlandvenom_ftw100% (1)

- Midland Energy's Cost of Capital CalculationsDokument5 SeitenMidland Energy's Cost of Capital CalculationsJessica Bill100% (3)

- Midland's Cost of Capital Calculations for DivisionsDokument8 SeitenMidland's Cost of Capital Calculations for DivisionsDevansh RaiNoch keine Bewertungen

- Example MidlandDokument5 SeitenExample Midlandtdavis1234Noch keine Bewertungen

- Midland Energy Case StudyDokument5 SeitenMidland Energy Case StudyLokesh GopalakrishnanNoch keine Bewertungen

- Midland Energy Case StudyDokument5 SeitenMidland Energy Case Studyrun2win645100% (7)

- Midland Energy ResourcesDokument2 SeitenMidland Energy Resourcesambreen khalidNoch keine Bewertungen

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDokument11 SeitenMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- Case Study: Midland Energy Resources, IncDokument13 SeitenCase Study: Midland Energy Resources, IncMikey MadRatNoch keine Bewertungen

- Midland Energy Resources (Final)Dokument4 SeitenMidland Energy Resources (Final)satherbd21100% (3)

- Midland WACCDokument2 SeitenMidland WACCDeniz Minican100% (3)

- Midland Energy Resources Cost of Capital AnalysisDokument8 SeitenMidland Energy Resources Cost of Capital AnalysisAli Tariq Butt100% (2)

- Midland Case CalculationsDokument24 SeitenMidland Case CalculationsSharry_xxx60% (5)

- Midland Energy Resources Inc SolutionDokument2 SeitenMidland Energy Resources Inc SolutionAashna MehtaNoch keine Bewertungen

- Midland Energy A1Dokument30 SeitenMidland Energy A1CarsonNoch keine Bewertungen

- 01 - Midland AnalysisDokument7 Seiten01 - Midland AnalysisBadr Iftikhar100% (1)

- Midland Energy ResourcesDokument21 SeitenMidland Energy ResourcesSavageNoch keine Bewertungen

- Midland WACC CalculationsDokument19 SeitenMidland WACC CalculationsRyan Domke50% (2)

- Midland Energy Resources FinalDokument5 SeitenMidland Energy Resources FinalpradeepNoch keine Bewertungen

- Midland Energy Resources Group Project Cost of Capital AnalysisDokument6 SeitenMidland Energy Resources Group Project Cost of Capital AnalysisAnshul SehgalNoch keine Bewertungen

- Lex Service PLCDokument11 SeitenLex Service PLCArup Dey0% (1)

- Mariott Wacc Cost of Capital DivisionalDokument6 SeitenMariott Wacc Cost of Capital DivisionalSuprabhat TiwariNoch keine Bewertungen

- AmeriTrade Case StudyDokument3 SeitenAmeriTrade Case StudyTracy PhanNoch keine Bewertungen

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Dokument6 SeitenAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Sealed Air Co Case Study Queestions Why Did Sealed Air Undertake A LeveragDokument9 SeitenSealed Air Co Case Study Queestions Why Did Sealed Air Undertake A Leveragvichenyu100% (1)

- Marriott Case AnalysisDokument3 SeitenMarriott Case AnalysisNikhil ThaparNoch keine Bewertungen

- Ameritrade Case PDFDokument6 SeitenAmeritrade Case PDFAnish Anish100% (1)

- Midland EnergyDokument9 SeitenMidland EnergyPrashant MishraNoch keine Bewertungen

- Ameritrade's Cost of Capital AnalysisDokument7 SeitenAmeritrade's Cost of Capital AnalysisTom Ziv100% (2)

- Case 5 Midland Energy Case ProjectDokument7 SeitenCase 5 Midland Energy Case ProjectCourse HeroNoch keine Bewertungen

- Marriott Solution FinalDokument20 SeitenMarriott Solution FinalBharani Sai PrasanaNoch keine Bewertungen

- Marriott Cost of Capital Analysis for Lodging DivisionDokument3 SeitenMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoNoch keine Bewertungen

- 13 American Chemical Corporation - Group 13Dokument5 Seiten13 American Chemical Corporation - Group 13Anonymous MpSSPQi0% (1)

- Case BBBYDokument7 SeitenCase BBBYgregordejong100% (1)

- Ocean Carries HBS Case StudyDokument4 SeitenOcean Carries HBS Case StudyRatul EsrarNoch keine Bewertungen

- Massey Ferguson CaseDokument6 SeitenMassey Ferguson CaseMeraSultan100% (1)

- R CF E NPV CF E: Historic RF On LTBDokument2 SeitenR CF E NPV CF E: Historic RF On LTBBhawna Khosla100% (2)

- Adecco Olesten Merger CaseDokument4 SeitenAdecco Olesten Merger CaseAnonymous qbVaMYIIZ100% (1)

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Dokument30 SeitenYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Marriott Corporation Case SolutionDokument4 SeitenMarriott Corporation Case SolutionccfieldNoch keine Bewertungen

- Cost of Capital Case Study at AmeritradeDokument5 SeitenCost of Capital Case Study at Ameritradeyvasisht3100% (1)

- Midland Energy SolutionDokument3 SeitenMidland Energy SolutionAditya BansalNoch keine Bewertungen

- Marriott SolutionDokument3 SeitenMarriott Solutiondlealsmes100% (1)

- Ameritrade Case SolutionDokument31 SeitenAmeritrade Case Solutionsanz0840% (5)

- KohlerDokument10 SeitenKohleragarhemant100% (1)

- Marriot Corporation Case SolutionDokument5 SeitenMarriot Corporation Case Solutionmanoj1jsrNoch keine Bewertungen

- Hill Country Snack Foods Co - UDokument4 SeitenHill Country Snack Foods Co - Unipun9143Noch keine Bewertungen

- Hertz IPO CaseDokument6 SeitenHertz IPO CaseHamid S. Parwani100% (1)

- Williams Seeks $900M Financing to Address Liquidity CrisisDokument4 SeitenWilliams Seeks $900M Financing to Address Liquidity CrisisAnirudh SurendranNoch keine Bewertungen

- Midland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoyDokument13 SeitenMidland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoymariliamonfardineNoch keine Bewertungen

- Midland Energy Cost of Capital Analysis for 3 DivisionsDokument2 SeitenMidland Energy Cost of Capital Analysis for 3 Divisionsambreen khalidNoch keine Bewertungen

- Midland Energy's Cost of Capital CalculationsDokument5 SeitenMidland Energy's Cost of Capital CalculationsOmar ChaudhryNoch keine Bewertungen

- Chapter 12: Calculating Cost of Capital and Project RiskDokument29 SeitenChapter 12: Calculating Cost of Capital and Project RiskazmiikptNoch keine Bewertungen

- Midland Energy WACC AnalysisDokument7 SeitenMidland Energy WACC AnalysisYagil HadriNoch keine Bewertungen

- Hewlett Packard (HPQ) Equity ValuationDokument10 SeitenHewlett Packard (HPQ) Equity ValuationMada ArslanNoch keine Bewertungen

- Topic 6 Supplement (Cost of Capital, Capital Structure and Risk)Dokument36 SeitenTopic 6 Supplement (Cost of Capital, Capital Structure and Risk)Jessica Adharana KurniaNoch keine Bewertungen

- Knowledge Management at AccentureDokument13 SeitenKnowledge Management at AccentureSourav Singh100% (1)

- Drive 10,000 Dashly App Downloads with SEO, Display, and Social CampaignsDokument7 SeitenDrive 10,000 Dashly App Downloads with SEO, Display, and Social CampaignsSourav SinghNoch keine Bewertungen

- WACC TutorialDokument15 SeitenWACC TutorialDidit SinagaNoch keine Bewertungen

- Kookuburra Cricket Bats Excel SheetDokument4 SeitenKookuburra Cricket Bats Excel SheetSourav SinghNoch keine Bewertungen

- 5E Lesson PlanDokument3 Seiten5E Lesson PlanSangteablacky 09100% (8)

- Bioassay Techniques For Drug Development by Atta-Ur RahmanDokument214 SeitenBioassay Techniques For Drug Development by Atta-Ur RahmanEmpress_MaripossaNoch keine Bewertungen

- Rebekah Hoeger ResumeDokument1 SeiteRebekah Hoeger ResumerebekahhoegerNoch keine Bewertungen

- Grammar Level 1 2013-2014 Part 2Dokument54 SeitenGrammar Level 1 2013-2014 Part 2Temur SaidkhodjaevNoch keine Bewertungen

- Yoga Practice Guide: DR - Abhishek VermaDokument26 SeitenYoga Practice Guide: DR - Abhishek VermaAmarendra Kumar SharmaNoch keine Bewertungen

- Maheshwar Handlooms Cluster Diagnostic StudyDokument15 SeitenMaheshwar Handlooms Cluster Diagnostic Studyumang31390100% (3)

- 6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston CollegeDokument17 Seiten6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston Collegeapi-498419042Noch keine Bewertungen

- Script - TEST 5 (1st Mid-Term)Dokument2 SeitenScript - TEST 5 (1st Mid-Term)Thu PhạmNoch keine Bewertungen

- Intern - Annapolis PharmaceuticalsDokument34 SeitenIntern - Annapolis Pharmaceuticalsjoycecruz095Noch keine Bewertungen

- Mixed-Use Proposal Dormitory and Hotel High-RiseDokument14 SeitenMixed-Use Proposal Dormitory and Hotel High-RiseShanaia BualNoch keine Bewertungen

- Q3 Week 7 Day 2Dokument23 SeitenQ3 Week 7 Day 2Ran MarNoch keine Bewertungen

- (Coffeemaker) Tas5542uc - Instructions - For - UseDokument74 Seiten(Coffeemaker) Tas5542uc - Instructions - For - UsePolina BikoulovNoch keine Bewertungen

- SuccessDokument146 SeitenSuccessscribdNoch keine Bewertungen

- Sarina Dimaggio Teaching Resume 5Dokument1 SeiteSarina Dimaggio Teaching Resume 5api-660205517Noch keine Bewertungen

- KINGS OF TURKS - TURKISH ROYALTY Descent-LinesDokument8 SeitenKINGS OF TURKS - TURKISH ROYALTY Descent-Linesaykutovski100% (1)

- Bullish EngulfingDokument2 SeitenBullish EngulfingHammad SaeediNoch keine Bewertungen

- Abhivyakti Yearbook 2019 20Dokument316 SeitenAbhivyakti Yearbook 2019 20desaisarkarrajvardhanNoch keine Bewertungen

- Summary Essay Items..EditedDokument8 SeitenSummary Essay Items..EditedJoboy FritzNoch keine Bewertungen

- Calvo, G (1988) - Servicing The Public Debt - The Role of ExpectationsDokument16 SeitenCalvo, G (1988) - Servicing The Public Debt - The Role of ExpectationsDaniela SanabriaNoch keine Bewertungen

- Cek List in House BakeryDokument20 SeitenCek List in House BakeryAhmad MujahidNoch keine Bewertungen

- Recommender Systems Research GuideDokument28 SeitenRecommender Systems Research GuideSube Singh InsanNoch keine Bewertungen

- GEA 1000 Tutorial 1 SolutionDokument12 SeitenGEA 1000 Tutorial 1 SolutionAudryn LeeNoch keine Bewertungen

- Budgetary Control NumericalDokument8 SeitenBudgetary Control NumericalPuja AgarwalNoch keine Bewertungen

- Reaction PaperDokument1 SeiteReaction Papermarvin125Noch keine Bewertungen

- Georgetown University NewsletterDokument3 SeitenGeorgetown University Newsletterapi-262723514Noch keine Bewertungen

- Pashmina vs Cashmere: Which Luxury Fiber Is SofterDokument15 SeitenPashmina vs Cashmere: Which Luxury Fiber Is SofterSJVN CIVIL DESIGN100% (1)

- OutliningDokument17 SeitenOutliningJohn Mark TabbadNoch keine Bewertungen

- INDIA'S DEFENCE FORCESDokument3 SeitenINDIA'S DEFENCE FORCESJanardhan ChakliNoch keine Bewertungen

- AnnovaDokument4 SeitenAnnovabharticNoch keine Bewertungen

- CH 2 Short Questions IXDokument2 SeitenCH 2 Short Questions IXLEGEND REHMAN OPNoch keine Bewertungen