Beruflich Dokumente

Kultur Dokumente

Story: Honda Ford Mahindra & Mahindra

Hochgeladen von

arunsanskriti0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten1 SeiteNissan has struggled in the Indian market, with its market share stuck at under 2% for the past two years despite investments and an impressive portfolio. Experts believe Nissan's headquarters does not fully understand the Indian market. Nissan is working to improve its dealer network and customer experience to help boost its performance.

Originalbeschreibung:

jkhhg

Originaltitel

Maruti

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenNissan has struggled in the Indian market, with its market share stuck at under 2% for the past two years despite investments and an impressive portfolio. Experts believe Nissan's headquarters does not fully understand the Indian market. Nissan is working to improve its dealer network and customer experience to help boost its performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten1 SeiteStory: Honda Ford Mahindra & Mahindra

Hochgeladen von

arunsanskritiNissan has struggled in the Indian market, with its market share stuck at under 2% for the past two years despite investments and an impressive portfolio. Experts believe Nissan's headquarters does not fully understand the Indian market. Nissan is working to improve its dealer network and customer experience to help boost its performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

N

issan had a picture perfect start

in India in 2010 with the Micra

launch. The youngest MNC here

invested in a huge capacity, had an ex-

port-led strategy to get quick scale

and manage costs while pushing num-

bers in India. The portfolio also looks

impressive, with the Terrano SUV, the

Datsun Go hatchback, the Sunny se-

dan amongst others covering 95% of

the market. Why then is market share

stuck at just under 2% for the past two

years? Thats disappointing for a com-

pany targeting a 10% share by 2017-18.

I think it is everything bad luck,

bad timing, bad marketing. I dont

think Nissans HQ understands India,

says Mohit Arora, executive director,

JD Power Asia Pacific. It has a complex

corporate structure with three enti-

ties Nissan Motor India, Renault Nis-

san Alliance and Renault Nissan Tech

Centre. Ajay Raghuvanshi, V-P sales

and marketing at the flagship compa-

ny, says Nissan is working to improve

dealer connect and customer experi-

ence. Thats a start.

big story

09

AUGUST 10-16, 2014

M

&Ms market share has slipped from 10.74% in

June 2012 to 8.5%. And the decline continues.

July sales dipped by 5.3% even as the utility ve-

hicle segment, its mainstay, showed robust growth of

18.5% to touch 44,945 units. Between April and July,

sales dipped by 10%. So whats going wrong with Indias

home-grown UV specialist? Its foray into sedans and

compacts with Verito and Vibe is not working. Its UV

territory is under attack from the likes of Ertiga, Mobil-

io, EcoSport, Duster and Terrano. It missed the oppor-

tunity in the crossover and compact SUV segment. It did

not get the Quanto right, says Ramkrishnan of Frost &

Sullivan. With no big launches in the past two-three

years, M&M has been busy restructuring internally and

building a product pipeline with Ssangyong. Next year it

will launch two compact UVs one to take on Duster

and EcoSport and the other to counter Ertiga and Mobil-

io. It is also working on a compact crossover. The com-

pany says it has a robust pipeline until 2019.

L

ike the industry, Toyota Kirloskar Motor too

has bounced back. July sales were up mar-

ginally by 3.5%, just under the 12,000 mark.

But Toyota clearly has a problem in India, with

market share dipping from 7.03% in June 2012 to

5.49% two years later. Its foray into the mass seg-

ment with the Etios and the Liva has not delivered

expected results. And there doesnt seem to be

much in the pipeline. With an eye on profitability,

the company has ruled out entering the mass sub-

`4 lakh category. Grappling with labour unrest,

plant shutdowns and recalls, the company used

the slowdown period to improve internal efficien-

cies. For example, inventory holding costs have

come down by 50% over the past one year, says N

Raja, director, sales and marketing. Nows the time

to shift into higher gear.

T

he slowdown has been the toughest for the home-grown Tata Motorss pas-

senger vehicle business. Its market share has more than halved from 10.8% two

years ago to 5% in June 2014. July sales have been worse with sales dipping by 15%

to 9,167 units. What is worrying is except for some models like the Sumo, the Aria, the Sa-

fari and the Grande, sales have dipped across all other categories, from the Nano (-57%), the

Indica, the Indigo (-9.4%) to the Manza (-34%). The company, which has posted losses in four of

the last eight quarters, has seen big management churn. It has high hopes on the Zest, a compact

sedan that launches next week, its first new offering in four years. The Bolt hatchback will debut later

this year. It plans to launch two models every year until 2020. Will this work? Tata has a big problem,

of poor brand perception, says Rathore. That calls for much more than zest.

HONDA

FORD

I

t was easily the biggest gainer dur-

ing the slowdown. As Jnaneshwar

Sen, senior V-P (marketing and

sales), explains, the tough times be-

gan much earlier for the Japanese

carmaker. First came the Fukushima

nuclear disaster in early 2011 fol-

lowed by floods in Thailand. Also, the

period between 2011 and 2012 was

when diesel engines became a rage

in India, and Honda stood exposed.

The launch of the Amaze, a sub-4 me-

ter sedan with a diesel variant in

April 2013, proved the turning point.

At its peak, it enjoyed a six-month

waiting period and recently reported

cumulative sales of 1 lakh units. At a

time when the industry was an-

nouncing plant shutdowns and lay-

offs, and offering hefty discounts,

Honda was struggling to meet de-

mand, adding a third shift to raise

output, and increasing staff count.

The uptick in the industry is doing

wonders for the just-launched MPV

Mobilio, which has notched up over

10,000 bookings in 15 days.

F

or Ford Motors, the slow-

down was difficult but not

devastating. Between June

2012 and 2014, it has marginal-

ly improved its market share,

thanks largely to one big winner,

the EcoSport which debuted last

year. Demand shot through the

roof, forcing Ford to stop taking

bookings. But the one-car won-

der company must worry on

multiple counts. Its July sales

have dipped by 3.5% to 7,592.

Other than the EcoSport, there is

poor demand for most of its

models. Its compact Figos de-

clined by 43%. Its Fiesta and

Classic have few takers and

have very low volumes, togeth-

er selling just 642 units in July.

Ford has three launches lined up

for the next two years: a sub-4

metre sedan, and the next-gen

versions of the Figo hatchback

and the Endeavour SUV.

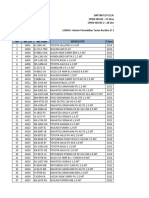

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

22,448

18,635

10.74

8.52

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

2,667

16,316

1.28

7.46

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

6,257 7,258

2.99

3.32

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

22,551

10,999

10.79

5.03

NISSAN

MAHINDRA & MAHINDRA

TOYOTA

TATA MOTORS

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

14,700

12,010

7.03

5.49

THE TOUGH GET GOING

LONG PIPELINE BUT RUNNING SHORT

TIME TO PUSH THE PEDAL

TO THE METAL

STUCK WITH THE SLOWDOWN

ONE-HORSE WONDER

CAN IT REGAIN ITS ZEST?

SALES VOLUME

SHARE %

Jun 2012 Jun 2014

4,167 4,362

1.99 1.99

Das könnte Ihnen auch gefallen

- Motoring: Down Shift or Gear Up?Dokument8 SeitenMotoring: Down Shift or Gear Up?Times MediaNoch keine Bewertungen

- SwotDokument4 SeitenSwotJB RealizaNoch keine Bewertungen

- Can Mahindra Survive Its Own Ambition - Apr - 2015Dokument5 SeitenCan Mahindra Survive Its Own Ambition - Apr - 2015SIDHANSHI SHARMANoch keine Bewertungen

- Final Report Passenger CarsDokument20 SeitenFinal Report Passenger CarsAditya Nagpal100% (1)

- Industrial Organization: "Tata Motors Pvt. LTD.: Analysis"Dokument8 SeitenIndustrial Organization: "Tata Motors Pvt. LTD.: Analysis"sushilNoch keine Bewertungen

- Indian Four Wheeler Industry EditedDokument15 SeitenIndian Four Wheeler Industry EditedRohit GunwaniNoch keine Bewertungen

- Bargaining Power of BuyersDokument7 SeitenBargaining Power of BuyersHaha1234Noch keine Bewertungen

- Automobile Sector - Impact of Indian Automobile Industry On The Global EconomyDokument6 SeitenAutomobile Sector - Impact of Indian Automobile Industry On The Global EconomyShiney BenjaminNoch keine Bewertungen

- Marketingmanagement Assignment: Automobile Industry - HondaDokument27 SeitenMarketingmanagement Assignment: Automobile Industry - HondaBellapu Durga vara prasadNoch keine Bewertungen

- Tata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDokument5 SeitenTata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDhiraj IppiliNoch keine Bewertungen

- Competitor Analysis of Tata MotorsDokument9 SeitenCompetitor Analysis of Tata MotorsDevanshi AroraNoch keine Bewertungen

- Why Tata Motors Succeeded in Global Market and General Motors FailedDokument5 SeitenWhy Tata Motors Succeeded in Global Market and General Motors FailedroshaniNoch keine Bewertungen

- A Study On Employee Welfare at Bimal Auto AgencyDokument73 SeitenA Study On Employee Welfare at Bimal Auto AgencypraveenNoch keine Bewertungen

- Hyundai CompanyDokument67 SeitenHyundai CompanySandeep SinghNoch keine Bewertungen

- Automobile Industry - HondaDokument27 SeitenAutomobile Industry - HondaBellapu Durga vara prasadNoch keine Bewertungen

- What Is The Competition Like? How Does The Market Behave?Dokument4 SeitenWhat Is The Competition Like? How Does The Market Behave?Arkajit DeyNoch keine Bewertungen

- Final Project Sem 1Dokument24 SeitenFinal Project Sem 1sayantan maitraNoch keine Bewertungen

- Auto Industry: A Quick Flashback and Way Forward: April 18, 2013Dokument2 SeitenAuto Industry: A Quick Flashback and Way Forward: April 18, 2013Moiz HussainNoch keine Bewertungen

- CONTENTSDokument22 SeitenCONTENTSYash Saxena KhiladiNoch keine Bewertungen

- 34 Tvs Apache in ShimogaDokument102 Seiten34 Tvs Apache in Shimogaavinash_s1302Noch keine Bewertungen

- Marketing Case StudyDokument10 SeitenMarketing Case StudyShakshi TradersNoch keine Bewertungen

- Automobiles Industry in IndiaDokument79 SeitenAutomobiles Industry in India2014rajpoint0% (1)

- M& Mautomotivesalescrossthe 2,000,000 ThresholdDokument2 SeitenM& Mautomotivesalescrossthe 2,000,000 Thresholdganguli_tanmoyNoch keine Bewertungen

- I. Dilemma of The Case/AbstractDokument11 SeitenI. Dilemma of The Case/AbstractAnindya BasuNoch keine Bewertungen

- Project Final YearDokument79 SeitenProject Final YearTamil film zoneNoch keine Bewertungen

- EICDokument10 SeitenEICDeepak VishwakarmaNoch keine Bewertungen

- 4 Wheeler IndustryDokument21 Seiten4 Wheeler IndustryJaptej Singh100% (1)

- Car AssignmentDokument80 SeitenCar AssignmentVineet SharmaNoch keine Bewertungen

- Customer Satisfaction at ToyotaDokument65 SeitenCustomer Satisfaction at ToyotaMahendra KotakondaNoch keine Bewertungen

- Mba ProjectDokument74 SeitenMba ProjectGarg familyNoch keine Bewertungen

- Report On Hyundai I20Dokument10 SeitenReport On Hyundai I20Sandarbh AgarwalNoch keine Bewertungen

- Industry Analysis: Mahindra Scorpio, One of India's Best Selling Indigenously Developed SUVDokument14 SeitenIndustry Analysis: Mahindra Scorpio, One of India's Best Selling Indigenously Developed SUVPradeep MonteiroNoch keine Bewertungen

- Tata Vs HyundaiDokument49 SeitenTata Vs HyundaiAnkit SethNoch keine Bewertungen

- Project Management AssignmentDokument6 SeitenProject Management AssignmentNishiket DharmikNoch keine Bewertungen

- Automobile IndustryDokument4 SeitenAutomobile IndustryDarshnaNoch keine Bewertungen

- Hyundai: A Case Study On Its Marketing Strategies in IndiaDokument23 SeitenHyundai: A Case Study On Its Marketing Strategies in IndiaShikha_Kapoor_3926Noch keine Bewertungen

- Automobile Industry With Respect To Maruti SuzukiDokument77 SeitenAutomobile Industry With Respect To Maruti Suzukiraul_mahadikNoch keine Bewertungen

- A Comparative Study On Various Premium Segment BikesDokument48 SeitenA Comparative Study On Various Premium Segment BikeskashniavikasNoch keine Bewertungen

- .Volkswagen Big LeapDokument2 Seiten.Volkswagen Big LeapBhaskar MishraNoch keine Bewertungen

- FEDERAL MOGUL GOETZE INDIA LIMITED - ReportDokument56 SeitenFEDERAL MOGUL GOETZE INDIA LIMITED - Reportchaitra rNoch keine Bewertungen

- Maruti Suzuki Limited: Company OverviewDokument7 SeitenMaruti Suzuki Limited: Company OverviewRohit LohiaNoch keine Bewertungen

- Statement of ProblemDokument5 SeitenStatement of ProblemNazim Sha100% (1)

- Esteem PLCDokument24 SeitenEsteem PLCArka Ghosh100% (1)

- Hyundai Auto Mobiles: Durgapur Institute of Management and ScienceDokument55 SeitenHyundai Auto Mobiles: Durgapur Institute of Management and ScienceSubhajit KunduNoch keine Bewertungen

- Passenger Cars Profile and Growth AspectsDokument15 SeitenPassenger Cars Profile and Growth AspectsRam PoddarNoch keine Bewertungen

- Effect of Declining Market On TATA MotorsDokument65 SeitenEffect of Declining Market On TATA Motorsarvind3041990Noch keine Bewertungen

- Analysis of External Business Environment: 1) Bargaining Power of SupplierDokument21 SeitenAnalysis of External Business Environment: 1) Bargaining Power of SupplierTanya RaghavNoch keine Bewertungen

- Automobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureDokument7 SeitenAutomobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureMohammad HasanNoch keine Bewertungen

- Porter's Five Forces Analysis - Indian Automobile Industry: 1. The Threat of New EntrantsDokument33 SeitenPorter's Five Forces Analysis - Indian Automobile Industry: 1. The Threat of New Entrantsneha4301Noch keine Bewertungen

- T8 RevivalDokument6 SeitenT8 RevivalSumit AggarwalNoch keine Bewertungen

- JBMDokument53 SeitenJBMVaibhav Ahlawat100% (1)

- Demand Analysis & Forecasting - The Car Industry: Presented byDokument31 SeitenDemand Analysis & Forecasting - The Car Industry: Presented byprerna_bafnaNoch keine Bewertungen

- Opportunities GLOBAL WORLDDokument10 SeitenOpportunities GLOBAL WORLDmustkimdhukkarediffmNoch keine Bewertungen

- Indian Small Car Industries (Case Study) : Maruti Udyog Limited (MUL)Dokument4 SeitenIndian Small Car Industries (Case Study) : Maruti Udyog Limited (MUL)Hemant BothraNoch keine Bewertungen

- Automobiles Industry ReportDokument5 SeitenAutomobiles Industry ReportvaasurastogiNoch keine Bewertungen

- Moving up the Value Chain: The Road Ahead for Indian It ExportersVon EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNoch keine Bewertungen

- Honda Motor (Review and Analysis of Sakiya's Book)Von EverandHonda Motor (Review and Analysis of Sakiya's Book)Bewertung: 2 von 5 Sternen2/5 (1)

- From the Cradle to the Craze: China's Indigenous Automobile IndustryVon EverandFrom the Cradle to the Craze: China's Indigenous Automobile IndustryNoch keine Bewertungen

- Motoring Africa: Sustainable Automotive Industrialization: Building Entrepreneurs, Creating Jobs, and Driving the World's Next Economic Miracle.Von EverandMotoring Africa: Sustainable Automotive Industrialization: Building Entrepreneurs, Creating Jobs, and Driving the World's Next Economic Miracle.Noch keine Bewertungen

- OB Rudani NewDokument21 SeitenOB Rudani NewarunsanskritiNoch keine Bewertungen

- Ibps So HR Notes NewDokument22 SeitenIbps So HR Notes NewarunsanskritiNoch keine Bewertungen

- TCS Bonus Issue NewDokument5 SeitenTCS Bonus Issue NewarunsanskritiNoch keine Bewertungen

- Are Water Purifiers SafeDokument4 SeitenAre Water Purifiers SafearunsanskritiNoch keine Bewertungen

- Myers Briggstypeindicator1234Dokument15 SeitenMyers Briggstypeindicator1234arunsanskritiNoch keine Bewertungen

- Abbreviations For Competition ExamsDokument19 SeitenAbbreviations For Competition ExamsarunsanskritiNoch keine Bewertungen

- Fera Fema12Dokument21 SeitenFera Fema12arunsanskritiNoch keine Bewertungen

- A Study On GH Stress Among Employees Working in BPOs With Special Reference To CoimbatoreDokument18 SeitenA Study On GH Stress Among Employees Working in BPOs With Special Reference To CoimbatorearunsanskritiNoch keine Bewertungen

- Dusting Off The CompetitionDokument10 SeitenDusting Off The CompetitionarunsanskritiNoch keine Bewertungen

- Computer Capsule Ibps Po 2014Dokument22 SeitenComputer Capsule Ibps Po 2014arunsanskritiNoch keine Bewertungen

- Organizational Behavior: Marie Amirtharaj. F, I - Mba A', DmsDokument14 SeitenOrganizational Behavior: Marie Amirtharaj. F, I - Mba A', DmsarunsanskritiNoch keine Bewertungen

- MBO-management Philisophy For Prosperous Tourism OrganizationsDokument5 SeitenMBO-management Philisophy For Prosperous Tourism OrganizationsarunsanskritiNoch keine Bewertungen

- A Critical Study On Work-Life Balance of BPO Employees in IndiaDokument12 SeitenA Critical Study On Work-Life Balance of BPO Employees in IndiaarunsanskritiNoch keine Bewertungen

- Marca Modelo 2008 2010 Toyota Yaris Hyundai Accent Kia, Carens, Mec, Gas Kia, Carens, Aut, Diesel $ 10,000.00 Kia Carnival, Aut, Diesel $ 12,000.00Dokument26 SeitenMarca Modelo 2008 2010 Toyota Yaris Hyundai Accent Kia, Carens, Mec, Gas Kia, Carens, Aut, Diesel $ 10,000.00 Kia Carnival, Aut, Diesel $ 12,000.00Omar Mendoza QuilleNoch keine Bewertungen

- Bosch Nozzle Injectors Cross References PDF List PDFDokument11 SeitenBosch Nozzle Injectors Cross References PDF List PDFGustampa TampaNoch keine Bewertungen

- Pricelist AUTO2000 BALIDokument1 SeitePricelist AUTO2000 BALIBagoes EnyolNoch keine Bewertungen

- Price List - Mitsubishi Motors Philippines CorporationDokument8 SeitenPrice List - Mitsubishi Motors Philippines CorporationAnonymous ic2CDkFNoch keine Bewertungen

- Honda All Motorcycle Product Codes Chart ManualDokument6 SeitenHonda All Motorcycle Product Codes Chart ManualFlavio D BragaNoch keine Bewertungen

- Daikin Exedy Por Mayor U DetalleDokument45 SeitenDaikin Exedy Por Mayor U DetalleAlejandro SaraviaNoch keine Bewertungen

- Price List With Equipment 2023-01-02 EURDokument22 SeitenPrice List With Equipment 2023-01-02 EURJasminka TopličanecNoch keine Bewertungen

- Brink Kuka Elektroinstalacika 732864Dokument24 SeitenBrink Kuka Elektroinstalacika 732864Mirel OmerovićNoch keine Bewertungen

- Mercancia Recien Llegada 27-01Dokument2 SeitenMercancia Recien Llegada 27-01Juan Carlos Ruiz BarreraNoch keine Bewertungen

- UntitledDokument55 SeitenUntitledMTInversiones100% (1)

- Partner Driver Acquisition Primer PDFDokument6 SeitenPartner Driver Acquisition Primer PDFAleli MatumadiNoch keine Bewertungen

- Fan Clutch NissanDokument8 SeitenFan Clutch NissanPreutsatat UngkarunyakijNoch keine Bewertungen

- Dokumen - Tips Manual Book Honda Supra X 100cc Book Honda Supra X 100cc HondaDokument2 SeitenDokumen - Tips Manual Book Honda Supra X 100cc Book Honda Supra X 100cc HondaYanuari Wìböwö100% (2)

- Instruction Manual: Real Performance Product by GizzmoDokument25 SeitenInstruction Manual: Real Performance Product by GizzmoGarth MarxNoch keine Bewertungen

- 555 HondaDokument13 Seiten555 Hondaxtrmwrld100% (1)

- Control Arms CatalogDokument32 SeitenControl Arms CatalogAhmed RagabNoch keine Bewertungen

- Training Pivot + VlookupDokument9 SeitenTraining Pivot + VlookupTraining ImoraNoch keine Bewertungen

- About Mazda 2Dokument2 SeitenAbout Mazda 2Еliоdоr PNoch keine Bewertungen

- 29 Dec 23 BKS (Mobil) Final CustDokument24 Seiten29 Dec 23 BKS (Mobil) Final Custze230994Noch keine Bewertungen

- Maruti Suzuki India LimitedDokument11 SeitenMaruti Suzuki India LimitedAashishNoch keine Bewertungen

- 普利盤料號Dokument8 Seiten普利盤料號黃飛鳴Noch keine Bewertungen

- Pricelist Mobil DaihatsuDokument1 SeitePricelist Mobil DaihatsuDeeYuu99Noch keine Bewertungen

- Pre Owned Cars For Sale - 182020Dokument20 SeitenPre Owned Cars For Sale - 182020Juke CruzNoch keine Bewertungen

- Catalog - WoraDokument13 SeitenCatalog - WoraEleazar PavonNoch keine Bewertungen

- 1999 Lexus GS300 Overall WiringDokument51 Seiten1999 Lexus GS300 Overall WiringphilNoch keine Bewertungen

- Blank ECM 2-1. North American MarketDokument17 SeitenBlank ECM 2-1. North American MarketgspozoNoch keine Bewertungen

- Leppon Filter Rate List W.E.F - 03!05!2023Dokument8 SeitenLeppon Filter Rate List W.E.F - 03!05!2023loyality bewafaiNoch keine Bewertungen

- Taiho New Item Info 1009030Dokument1 SeiteTaiho New Item Info 1009030Fredy HernanNoch keine Bewertungen

- Injector PressureDokument181 SeitenInjector Pressureคุณชายธวัชชัย เจริญสุข89% (18)

- Vehicles For Sale As of January 07 202Dokument11 SeitenVehicles For Sale As of January 07 202Marie CanariaNoch keine Bewertungen