Beruflich Dokumente

Kultur Dokumente

OCOM MPP Mar14 12998007 MAIN

Hochgeladen von

حازم صبحىOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

OCOM MPP Mar14 12998007 MAIN

Hochgeladen von

حازم صبحىCopyright:

Verfügbare Formate

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 1 of 22

Marketing Plan to decrease Jeddah Cables' Customers churn

in GCC Countries

CIM membership no: 70889221

To: XXXXXXXX Marketing and Sales Director

From: XXXXXX Marketing Unit Head

Total word count

Executive summary: 436 (including title)

Marketing plan: 3350 (including titles)

Marketing Audit: 6 pages (Appendix III)

I confirm that in forwarding this assessment for marking, I understand and have applied the CIM

policies relating to word count, plagiarism and collusion for all tasks. This assessment is the result of

my own independent work except where otherwise stated. Other sources are acknowledged in the

body of the text, a bibliography has been appended and Harvard referencing has been used. I have

not shared my work with other candidates. I further confirm that I have submitted an electronic copy

of this assessment to CIM in accordance with the regulations.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 2 of 22

Contents

Executive Summary 3

Task 2 : Marketing Plan 4

1.0 Audit main findings and its evaluation 4

2.0 Marketing Plan proposal 5

3.0 Objectives 5

4.0 Strategies 5

5.0 Segmentation 5

6.0 Targeting 6

7.0 Positioning 6

8.0 Tactics 7

8.1 Product 7

8.2 Price 7

8.3 Place 7

8.4 People 8

8.5 Physical evidence 8

8.6 Process 8

8.7 Promotion 8

9.0 Action with budget 11

10.0 Control 12

11.0 Bibliography 12

Appendix I Abbreviation 14

Appendix II Organizational Overview 15

Appendix II Task 2: Market Audit 17

1.0 Marketing Plan rationale 17

2.0 Product portfolio analysis 17

3.0 Macro-Environment Audit 17

3.1 PESTEL analysis 17

3.2 Porter 5 Forces 18

4.0 Task Environment Audit 19

4.1 Customer audit 19

4.2 Product Trends in LV market 19

4.3 Market Size of Low Voltage Market 19

4.4 Market Growth 19

4.5 Market Share 19

5.0 Market Strategy Audit 20

5.1 Strategy Analysis 20

5.2 Resources 20

6.0 Market Organization Audit 20

7.0 Market System Audit 20

8.0 Marketing Function Audit 20

9.0 Market Productivity Audit 20

10.0 SWOT 21

11.0 Bibliography 21

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 3 of 22

Executive Summary (Word Count: 436)

Just before the global economic recession several GCC market's consumption reached 7,969 Million SAR

(MESC, 2013) check figure 1, that market consumptions attracted many investors to start investing in cables

manufacturing, by the end of 2008 there was 18 cables manufacturing plant in KSA only, 2 new factories in

Qatar, about four factories in UAE and two in Oman, which changed all the industry dynamics into a pure

competition market.

Jeddah Cables is considered to be one of the largest cables manufacturers in the GCC, recently the company

lacks profitability, also it suffered from a 8.55% customer churn in its Electrical procurement contracting

contractors (EPC) and distributors customers' segments, this churn was a result of multiple internal and

external factors as follows:

Internal Factors External Factors

Relatively high cables prices.

Lack of availability due to there is no market

studies for the ideal stock mix.

Relative long delivery period, which force the

customer's to switch.

Marketing strategy that focuses on ministries

more than EPC and distributors.

Lack of marketing retention activities.

The economic recessions, which resulted cash flow problems

lead to holding and postponing of many projects in GCC market.

New market trends in cables that Jeddah cables has to work on.

Economic factors as Fluctuating copper prices, which affect the

sales process.

Pure competition market, where the manufacturers number

increased to reach 26 cables manufacturers.

Low differentiated product where the only two main

differentiators are the price and the availability of the product.

By the end of 2013 this growing situation pushed the management planning to alter their current strategy,

since Jeddah Cables has found that its current strategy need to be amended by increasing the ratio of

profitable customers' segments as EPC and distributors, which could be conducted through decreasing

customer churn by engaging customer loyalty and retention plan.

The customer loyalty plan contains many aspects such as optimizing cables costs and schemes to shorten the

delivery periods, obtaining new quality certificates; reasonable prices premium quality pricing strategy

backed-up with annual loyalty promotions, these actions will satisfy the basic needs for the consumer.

Moreover Jeddah Cables plans for engaging retention tools to help in retaining those customers and

generating customer loyalty to sustain its future position away of consumers basic needs, as endorsement

schemes for distributors, technical support for EPC, developing its sales team technical competency and

customer service skills, in addition to several promotional activities that aims to help decreasing the

customer churn. Also Jeddah Cables is planning to possess 11 % of the upcoming GCC's cables' market

consumption, which is estimated to be 18 Billion USD in the next decade (Deloitte, 2013).

0

2,000

4,000

6,000

8,000

10,000

12,000

2007 2008 2009 2010 2011 2012

Consumption by product (million Riyals) for LV cables

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 4 of 22

Task 2: Marketing Plan (Word Count: 3350)

1.0 Audit main findings and its evaluation

Summary points Evaluation and correction routes

1 Jeddah Cables LV wires

and cables BCG product

portfolio analysis.

The analysis illustrated the main points LV wires and cables needs in

order to convert the products into stars and cash cows which will

decrease the customer churn as :

Optimizing design cost, which will help developing a cost

leadership position in GCC markets.

Sufficient balanced stock of the LV wires and cables, backed

up with efficient marketing activities, this will maintain the

availability of balanced stock.

Developing the planning process in order to decrease the

delivery periods.

Acquiring product quality, tests certificates, system

certification and Build representative technical catalogues for

instrumentation, control and fire cables.

These amendments solely will help satisfying the basic needs for the

customer, in order to decrease the customer churn.

2 Economic Factors:

Copper prices

fluctuation

It pointed out the copper's price high impact, which its depression

could slow down the sales continuity process or even stop it, which

equivalent to the un-availability of the products, which will lead

customers switch to other competitor increasing the customer churn.

3 New materials and

cables trends

Technological External factor and new cables trends had point out the

need of using new materials and acquiring new quality certificates to

increase the customer retention by increasing integrating Jeddah cables

portfolio, which will decrease the churn.

4 Rivalry market force

and New entrant threats

The rivalry force has a major impact on the customer churn, since there

are 28 cables manufacturer in the region, moreover it is expected due

to low entry barriers that when the market increase new competitor will

immerge, where Jeddah Cables needs to develop a rigid retention plan

in order to secure its short and long term market position

5 Customer and key

account analysis.

The combination of these two points pointed out the customer churn

average rate (8.55%), also it pointed out that the price and availability

are the main aspects to decrease customer churn, also laterally gave us

the importance of limiting the ministries (Key accounts) percentage of

Jeddah Cables' sales.

6 Market size of LV wires

and cables

It pointed out the importance of diversification of product range in

profit maximization, also the need for development of retention plan in

order to acquire leading market share in the future.

7 Current Market Strategy It illustrated the focus on ministries segment as a key account, in spite

of its narrow profit margin, also the different resources that could be a

great asset in decreasing the customer churn, as abroad offices, in-

house copper plant, and brand equity.

8 Marketing function

audit

It pointed out the absence of marketing function, where there are no

communications, customer relation management or even intelligence

activities.

9 Customer churn

calculation

It pointed out the average customer churn rate starting from 2009 to

2013 is 8.55% among EPC and distributors; which it is vital to reduce

in order to make the company profitable.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 5 of 22

2.0 Marketing Plan proposal

This plan will be based on 3 years' time frame; while all the main tactics will be set in the period of a year,

the market plan main objective to decrease the customer churn by 10% annually, toward its minimum by the

end of 2017, through developing a customer loyalty program, suitable cost leadership competitive advantage,

and acquiring the data for the new products and market trends.

3.0 Objectives

3.1 Corporate Objectives:

3.1.1 Increase Jeddah Cables sales revenues in GCC market by to reach 10% in the period

2014-2017.

3.2 Marketing & Sales Objectives

3.2.1 Decrease customer churn percentage 10% annually in the period 2014-2017.

3.2.2 Increase customer retention by 10% annually in the period 2014-2017.

3.2.3 Increase Market share to 13% of the total GCC market by the end of 2017 (1.5%

annually).

3.2.4 Position Jeddah Cables as "good quality, good price cables" in the period 2014-

2017.

4.0 Strategies

4.1 Competitive Strategy

As stated in the Audit, GCC market is a pure competitive market and LV wires and Cables is a low

differentiated product, moreover the main customer values are the price and availability. Giving the relatively

high Jeddah cables' production capacity and the long experience that has been developed over the years,

since having a low-cost position yields the firm above-average returns in its industry despite the presence of

strong competitive force (Market Audit, 2014, p19). The best competitive strategy is the cost leadership

through cost minimizing all over copper purchasing, optimizing designing cost, efficient manufacturing

planning process and logistics, which will help to provide the customer with its main values in order to

decrease the customer churn.

4.2 Growth Strategy

The suitable growth strategy for Jeddah Cables LV wires and cables in order to decrease the customer churn

and have a higher market share, given Jeddah Cables main strengths as high production capacity, brand

awareness, pure competition market, customer behaviour, values and needs, low differentiated product, and

fluctuating cost of production, is market penetration, from Ansoffs growth strategies (Ansoff 1965, cited

in Blythe and Megicks 2010). This strategy is low risk but allows Jeddah Cables to use the high production

capacity and cost leadership. As it is a lower risk strategy than others suggested in Ansoffs Product Market

Matrix (Ansoff 1965, cited in Blythe and Megicks 2010), moreover marketing penetration has a higher

success rate than any of the others; backed up with the cost-leadership competitive strategy it will exceed

customer expectations, since it doesn't just provide better price and availability, moreover marketing

activities, as branding to its distributors, technical webinars, and software for electrical calculations to its

EPC, these activities will act as a retention tools, that will help to retain current customers, attract new and

ex-customers, and generate customers' loyalty. This customer loyalty will be an asset on the short run by

decreasing the customer churn, also on the long run will be an edge against new entrants. If more viral

marketing such as word of mouth recommendations start to take place, this will in turn increases market

penetration introducing a multiplying effect.

5.0 Segmentation

Since GCC cables market is a business to business market the most appropriate segmentation approach is the

organizational size and its choice criteria, where all of these segments are current customers:

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 6 of 22

Electrical Ministries Segment EPC contractors segment Distributors segment

They possess 50% of market volume, they

usually purchase through tenders with a

volume range from 1 million SAR to 3-4

billion SAR

They possess 30% of market

volume, they purchase through

simple price comparisons, their

main judgment factor is the price,

but at a certain situation delivery

time is a crucial factor

They possess 20% of market

volume, they purchase

according to an agreement,

between them and a certain

manufacturer, since they

always try to appear like a

certain brand agent

As the audit stated the main reason of the lack of profitability is the current strategy, which focuses on the

ministries with its narrow profit, and in turn generated a customer churn in EPC contractors and distributors,

so in order to regenerate profit Jeddah cables has to divert the customer churn rate in those two segments,

through limiting the ministries sales, and focusing on EPC and distributors needs.

6.0 Targeting

Targeted segments are:

EPC contractors

Distributors

Given the different profit margin, volume, churn rate, needs and behaviours of each segment, Jeddah Cables

needs to adopt a differentiated concentrated market strategy. This exploits the differences between

marketing segments by designing a specific marketing mix for each segment (Jobber, 2013). This

differentiation is needed to decrease the customer churn for each of them, a relevant set of activities are

needed to meet the customer values and exceed it, for example Jeddah cables can't offer EPC a branding

option for his premises, also it can't offer a distributor a technical webinar about electrical loads calculation,

since these activities will not be valued by the distributor. This is illustrates the need for multiple targeting

differentiated strategy in order to provide each segment with relevant activities.

7.0 Marketing positioning

Giving its cost leadership competitive strategy, Jeddah Cables has to position itself as reasonable price

premium quality cables, also it should reflect its technical competency through technical webinars, websites,

catalogues, electrical calculations software and its' sales team technical knowledge. Once market segment

has been established and an effective targeting strategy has been formed. Jeddah Cables can produce a

differential advantage through its positioning strategy, as a result of effective segmentation and targeting that

produces a sustainable future position.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 7 of 22

8.0 Tactics

8.1 Product

Low voltage wires and cables ranges as follows:

# Product

1 LV Power Wires & Cables

2 LV Fire Alarm Cables

3 LV Instrumentation and control cables

In order to reduce EPC and Distributors' customer churn Jeddah Cables

have to conduct the following tactics:

Optimizing design, which will help developing a cost leadership

position in GCC markets, through decreasing copper used and

maintaining the same resistance of the given cable size.

Stock a sufficient balanced stock for each country based on the

country's product mix, which maintain the availability of the high

running item in each market.

Working on developing the planning process in order to decrease the delivery periods.

Especially for EPC, acquiring product quality certificates, system certification and Build representative

technical catalogues for instrumentation, control and fire cables, which help in developing customer's

acceptable quality perception of Jeddah Cables.

Especially for Distributors, LV wires and cables' packaging needs to be illustrating the main data in

more visible way, which will help the distributors to sort the products in a faster efficient way, since

the data will be more visible, these actions will develop the customer perception of Jeddah Cables, also

it will help to add a new value that will act as a retention tool.

8.2 Price

Since Jeddah Cables is adopting marketing penetration as a growth strategy. It should maintain prices to be

competitive in the market, where every aspect in the firm will be calculated to serve the cost leadership

strategy, which will result an optimum cost that secure overall profit which is a must for financial stability of

the whole firm. But Jeddah Cables will need to take into consideration to balance the prices as many people

use price as an indicator of quality (Jobber, 2013). In order to conduct this pricing strategy, the prices'

discount for EPC and distributor should be 10% and 8% respectively under the normal market price, of

course this percentage should vary according to each order volume, also a calculated further discount or a

refund in the end of each year will be refunded, if the total sales volume exceeded a certain limit, which

could act as a refund for loyalty, that help encouraging the customers for increasing sales volume and

decrease the customer churn.

8.3 Place

Jeddah Cables should carefully adopt a number of distributors in each GCC country, with taking into

consideration their sizes, geographical coverage, and market reputation. Also Jeddah Cables should work on

branding distributors' outlets with Jeddah Cables brand identity, but Jeddah Cables should manage the cost of

distributors' outlets furnishing with the distributor. Also Jeddah Cables should endorse the distributor on its

website, these marketing tactics are great help for the distributors, where most of them don't even have a

marketing department, which will be highly appreciated, at mean while it will decrease the distributors'

customer churn, since if the distributor switch the supplier this will make him lose a lot of benefits; this

investment should be done after a probation period for each distributor. While for EPC has an important

aspects as the availability of technical catalogues, electrical calculations and technical consultation on the

website, these aspects will act as retention tools for the EPC, also it will be driving the relation with the

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 8 of 22

customers away from the price and availability. Also Jeddah cables should adopt e-orders through its

website, then route the order to the nearest warehouse or distributor.

8.4 People

A crucial element in which Jeddah Cables can develop to act as strong retention tool is through its staff

members' technical competence regarding all the technical aspects related to the low voltage electrical cables

calculations, taking in consideration the cost leadership strategy, Jeddah Cables could develop an obligatory

online technical course through its intra-net, this course could be linked with the incentive that each salesman

receive to insure commitment, and these staff will be a valuable source of information for their customers. A

regular webinars should be conducted in order to increase the sales force awareness of customer relation

management, meaningful conversations with customers, through the technicalities of the products will

enhance the customer perception about the company, and building one-to-one relation which increase

customer loyalty. The people element of the marketing mix will be the same across the segments.

8.5 Physical evidence

One of the essential physical evidence is the company's website, which needs a major development under the

company's corporate identity, also the regional offices should be carefully branded, in addition to samples

boards since it reflects Jeddah Cables professionalism, catalogues' design and its' data also are a crucial

physical evidence of Jeddah cables, which needs a lot of development as per Jeddah cables corporate identity

manual. The physical evidence element of the marketing mix will be the same across the segments.

8.6 Process

The process of purchasing orders should be short and simple; Jeddah Cables should monitor its product

availability in its and distributors' warehouses, where each warehouse keeper can monitor the availability in

other countries' warehouse, to efficiently guide their customers to the nearest place where they can get their

products or be delivered to their premises in the shortest period. Also an engineer should be assigned for each

country in the planning department to insure the delivery on time. The process element of the marketing mix

will be the same across the segments. As the process become easier, the customers will favour Jeddah Cables

than others, which will develop customer loyalty.

8.7 Promotion

8.7.1 Above the line

Above the line activities will be limited to the following activities due to the nature of cables industry B2B

business:

Specialized magazines:

Specialized magazines will help us promoting Jeddah Cables strategy, especially for periodical technical

article, which will laterally develop a customer's perception of Jeddah Cables technical competency; this will

help in positioning Jeddah Cables as a good quality and good price cables in the customer's mind.

Website

A representable website became a crucial communication tool, where it should contain catalogues,

brochures, and technical calculations programs for the cables electrical loads calculations. That will increase

the benefits of Jeddah Cables for its customers, which will laterally decrease the customers' churns

percentage.

8.7.2 Bellow the line activities

Bellow the line activities will range on a spectrum of activities, which will be differentiated as per each

targeted EPC and distributors' segments:

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 9 of 22

Promotion Activity

Segment

Impact

E

P

C

D

i

s

t

r

i

b

u

t

o

r

s

Periodical seminars and webinars on

international manufacturing standards,

installation standards, and electrical

calculations

X - Increase customers' perception of Jeddah

cables' technical competency, which act as a

retention tool decreasing the customer churn,

this will help a lot of contractors with their

daily installation and technical problems.

Periodical Email update of LME

prices after the subscription on

company website

X X - This will add an extra-customer value, since it

keeps the customer updated with the market

prices, which could act as a retention tools.

Also it help building a database for the target

markets to help sales later in building a one-

to-one customer relations, which is a great

asset in customer loyalty which decreases the

customer churn laterally.

Smart phone and PC electrical

calculations applications

X - Since electrical calculations are a daily part of

each engineer life, providing electronic

solution to this problem that will ease his daily

calculations with accuracy will increase the

corporate image, which directly increase

customer retention, and decrease customer

churn.

Price Promotion amended to the total

customer s' purchase volume per each

year

X X - This is a crucial promotion since the main

customer's values are the price and

availability, annual discount or refund

according to the total purchase volume will

secure more volume than stand-alone sales

promotion, since the customers will be

encouraged to make more orders to get a

higher refund, which will help to decrease the

customer churn.

Periodical technical articles Emails

about cables

X - This will increase the customer education that

will be perceived as technical competency in

the consumers' mind, which will decrease the

customer churn, as the customer will perceive

Jeddah cables' product as a source of

knowledge.

Place furnishing, Branding and

endorsement through Jeddah Cables

website.

X - Updating the distributors' shop board to

include Jeddah cables corporate identity colors

and logo, consider to be an ad , also endorsing

distributor on Jeddah cables' website will

increase the demand on Jeddah Cables through

that distributor, which will increase distributor

retention, since Jeddah cables provide them

endorsement, at mean while it decrease

distributors' churn.

Giveaways to distributors staff

members and labors

X - T-shirts, cabs, pen and notes is very cheap

giveaways, which will increase the positive

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 10 of 22

word of mouth of Jeddah Cables distributors'

sales force and retailers, leading to generate

demand on Jeddah cables than other brands,

which decrease the customer churn as it

increase the demand on Jeddah cables.

Printed, electronic Catalogues and

sample boards

X - They are representative tools in the process for

ministers and EPC contractors' approval

process to help them evaluate Jeddah cables'

technical data.

News letter X X - Information about Jeddah Cables

achievements as new tenders, projects,

products etc, will be sent periodically.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 11 of 22

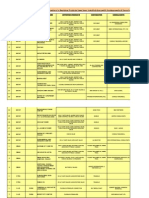

9.0 Action with budget

Action Description

Direct Cost

(SAR)/ Annum

Time Plan & Progress

Plan Done on time Delayed Postponed

J

a

n

-

1

4

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

n

-

1

4

J

u

l

-

1

4

A

u

g

-

1

4

S

e

p

-

1

4

O

c

t

-

1

4

N

o

v

-

1

4

D

e

c

-

1

4

J

a

n

-

1

5

F

e

b

-

1

5

M

a

r

-

1

5

1 Above the line activities

1.1 Magazines Campaign

Cost of 4 full pages ads 4 times / annum

= 100,000 SAR

SAR 300,000.00

1.1.1 Gulf magazine

1.1.2 MEP magazine

1.1.3 Construction today

1.2 Web-site design SAR 250,000.00

2 Below the line activities

2.1 Seminars and webinars

seminars: 6 seminars * 20,000 SAR * 6

GCC countries = 720,000 SAR

Webinars = 80,000 SAR

SAR 800,000.00

2.2 LME prices email Cost of the email shot SAR 5,000.00

2.3 Electronic applications

this is the cost of the programing on

windows, mac, android and iOS7

SAR 10,000.00

2.4 Price promotion

2.5

Technical articles Email

and new letters

the cost of the technical revision on an

article written by one of Jeddah cables'

technical engineers

SAR 5,000.00

2.6

Distributors premises

furnishing

after a trail period for each distributor, he

will be offered a branded shop board and

branded material that cost 10000 SAR

SAR 200,000.00

2.7 Giveaways branded T-shirts, pens, notes and caps. SAR 750,000.00

2.8 Catalogues

there are 4 main catalogues each will

have 5000 for catalogue and the

economic cost is 5 SAR for each

SAR 100,000.00

SAR 2,420,000.00

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 12 of 22

10.0 Control (KPI)

In order to measure whether the overall objectives are being met, performance metrics and key

performance indicators (KPIs) can be used in order to effectively establish the performance of the

plan in meeting the objectives set.

Objective

KPI

Measurement metrics

S

a

l

e

s

r

e

v

e

n

u

e

s

C

u

s

t

o

m

e

r

r

e

c

a

l

l

Decrease customer churn percentage 10%

annually In the period of 2014-2017.

X Customer purchase volume, number of orders

per customers and number of new customers

with respect to the previous years . This again

needs to be compared year on year to previous

performance.

Increase Market share to 13% of the total

GCC market by the end of 2017

X Market share this can be calculated based on

sales revenue divided by the total market

revenue. This again needs to be compared year

on year to previous performance and current

relative performance based on these

measurements.

Increase customer retention percentage

10% annually In the period of 2014-2017.

X Total won purchase orders won from the

customers to the total volume of the enquiries.

Customer perception of Jeddah X A periodical small questionnaire about level of

satisfaction of relative prices and availability to

our competitors could be done through direct

calls and website.

11.0 Bibliography

Ansoff, (1970) cited in Groucutt, J, Leadley, P & Forsyth, P (2004). Marketing: essential principles,

new realities. UK: Kogan Page Ltd. p212.

Jobber, D (2013). Principles and Practice of Marketing. Seventh edition, UK: McGraw-Hill

Education.

Porter, M (1980) Competitive strategy: techniques analysing industries and competitors. First Free

Press edition 1980. Simon & Schuster Inc. p35.

Blythe .J and Megicks .P Marketing Planning: strategy, environment and context. First edition, UK :

Pearson Education Limited.

Boston Consultancy Group, 1970 cited in Griffin, R (2010). Management. 10th ed. USA: South

Western Cengage Learning. p255.

Porter, M (1979)., cited in Hill, C & Jones, G (2009). Strategic Management Theory: An Integrated

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 13 of 22

Approach. 9th ed. USA: Griffin,South Western Cengage Learning. p42.

Porter, M (1979) cited in Porter, M. (2008). The Five Competitive Forces That Shape Strategy.

Harvard Business Review. 1 (2), p24-27.

Newell, D (1983), World archaeology Vol 1, No 2, Industrial archaeology. P184-195

Electronic Resources

MESC Prospectus (2013) MESC Prospectus [online] www.cma.org.sa/En/prospectuses/MESC-

Main%20RI-EN-Final.pdf [Accessed 30 August 2012]

Deloitte (2013) Deloitte GCC Powers of Construction: Construction section overview. [online]

http://www.deloitte.com/assets/Dcom-

MiddleEast/Local%20Assets/Documents/Industries/Real%20Estate/Construction/me_real-

estate_gcc_construction_ppt_13.pdf [Accessed 30 August 2012]

LME (2013), Historical Data [online] http://www.lme.com/metals/non-ferrous/copper/#tab2[Accessed

30 August 2012]

Hadley F (2007) Goodbye wires!. MITnews [online], http://web.mit.edu/newsoffice/2007/wireless-

0607.html [Accessed 30 August 2012]

http://www.arabnews.com/expat-population-%E2%80%98could-threaten%E2%80%99-gcc-

security [accessed in 14 December 2013]

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 14 of 22

Appendix I - Abbreviations

Term Definition

ADWEA Abu Dhabi water and electricity authority in Emirates

ASHGHAL Public work authority of Qatar

BASIC certificate

Bid Price offer from the Institutional Investors through the Rump Offering.

CAD Cash Against Document

CAGR Compound Annual Growth Rate.

CCV lines A cables isolation line, one of the productivity standards for cables plants.

CEO Chief Executive Officer of the Company.

DEWA Dubai electricity and water ministry in Emirates

DUCAB Dubai Cables Company

EPC Engineering Procurement and contracting

EWA Electricity and water authority in Bahrain

GCC Gulf Cooperation Council including the Kingdom of Saudi Arabia, Kuwait, Oman, Bahrain, United

Arab Emirates, and Qatar.

GDP Gross domestic product

HV High Voltage cables

ISO International Organization for Standardization.

Kahramaa Electricity and water authority in Qatar

KEMA certificate An international laboratory which provide type tests certificates

LME London metal exchange

KSA or Kingdom The Kingdom of Saudi Arabia

KV Kilovolt, the international standard for measuring electrical voltage.

LV cables Big sizes Low voltage Cables starting from 4 cores 95 SQ.MM area

LV Cables Small

Sizes

Low voltage Cables smaller than 4 cores 95 SQ.MM area

Management Jeddah Cables Management

MESC Middle East Specialized Cables Company.

MEW Ministry of water and electricity in Kuwait

MT Metric Ton.

MV Medium Voltage

OEM Original Equipment Manufacturers

OHTL Overhead Transmission line

PAEW Public Authority for Electricity and Water in Oman

Public Includes institutional and individual investors.

PVC Plastic granules used in cable insulation and wrapping.

SAR Saudi Arabian Riyals.

SEWA Sharjah electricity and water authority in Emirates

Shareholders Jeddah Cables Shareholders

Tender An offer to supply goods or Carry out work for a ministry at a stated fixed price.

UAE United Arab Emirates.

VCV lines A high-voltage cables isolation line.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 15 of 22

Appendix II Organisational Overview

Jeddah Cables is a Saudi Arabian cables manufacturer which was established in 1989 as a start-up

plant in low voltage Cables, Today it has 5 plants running under the certification of ISO 9001, which

assures high quality products. It has a production capacity of 110,000 ton/annum of copper cables

and 26,000 ton/annum of aluminium cables, 175,000

3

production facility's area, 35,000

3

warehouses' area and 1500 employees. Jeddah Cables Generate annually around 2 billion SAR. On

the regional level Jeddah Cables operates in Kuwait, Qatar, Bahrain, United Arab Emirates and

Oman under the name of Energya Cables International. Jeddah Cables produce comprehensive

products for the LV as well as Oil & Gas markets based on International standards and/or Client

specifications. The product ranges in size (0.5 mm to 1000 mm) and voltage rating (up to 220kV).

These Cables also range in their applications, which include:

L

V

w

i

r

e

s

a

n

d

C

a

b

l

e

s

Building wires: Used for fixed indoor installations inside conduits and within the walls. Multi-core Cables

can be used to connect the power supply with large loads such as air conditioning systems.

Low voltage Multi-cores cables: used to transmit large amounts of current and voltage. They are employed

in various aspects of the transmission and distribution of electricity to various loads.

L

V

S

p

e

c

i

a

l

C

a

b

l

e

s

Control cables and instrumentation: Used for outdoor/indoor installations for connecting signalling and

control units in various industries, railways, and traffic signals.

Fire alarm and Fire resistance cables: Used for indoor installation for the connection of fire and safety

devices.

M

V

C

a

b

l

e

s

Medium voltage cables are manufactured based on International Standards and/or client specifications, which

used in power distribution inside the cities.

O

H

T

L

They come as bare conductors and used for earthing electrical systems (when soft drawn copper is used) and

in transmission/distribution of high voltage electricity.

o AAC (All Aluminum Conductors) used in short spans

o AAAC (All-Aluminum-Alloy Conductors)

o ACSR (Aluminum Conductor Steel Reinforced) used in large spans

o ACAR (Aluminum Conductor, Alloy Reinforced)

o ACSR/AW (Aluminum Conductor Steel Reinforced with Aluminum Clad Steel)

C

o

p

p

e

r

R

o

d

s

Jeddah Cables has conducted a vertical integration by construction of a copper rod plant produces50,000 MT

per year copper rods using continuous casting technique with copper cathodes. This plant supplies other

external cable manufacturers with Copper Rods. It also takes scrap copper refines and reprocesses them to

make new copper Rods.

Jeddah cables Directors:

Directors: Name Designation

Mouhammad Itani Managing Director

Dr. Jaber Dandachi General Manager Operations

Said Minkara Engineering Projects Director

Bassam Zubaidi Marketing and Sales Director

Abd elrehaman Hanbali ICT Director

Dr. Mouhammad Al Wohoush Energya Plastic Director

Salam Choucair Supply Chain Director

Nashat Fakhri Finance Director

Ghassan Ibrahim Organizational Development

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 16 of 22

Principal Clients:

- Saudi Electricity Company - SEC

- Dubai Electricity and water company - DEWA

- Hesham Elsewedy Company - HSE

Regional Offices:

- Energya Cables International Dubai

- Jeddah Cables Company-Qatar

- Energya Cables International Oman

- Energya Cables International Kuwait

- Energya Cables International Bahrain

Revenues

Million SAR 2009 2010 2011 2012 2013

Sales 1,499,870,544 1,879,685,204 2,266,489,229 1,951,798,150 1,907,521,177

Net profit margin 53,833,291 30,718,245 10,787,858 9,876,521 7,628,871

Cash Flow (Negative) Positive (Negative) (Negative) (Negative)

Ministries % of revenues 72% 74% 76% 78% 81%

EPC % of revenues 10% 9% 8% 7% 6%

Distribution % of revenues 18% 17% 16% 15% 13%

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 17 of 22

Appendix III Task 1: Marketing Audit

1.0 Marketing Plan rationale

The Marketing Plan for Jeddah Cables will be developed around the low voltage (LV) wires and cables

portfolio, where in the past 5 years there was a constant depression in the LV Cables and wires portfolio's annual

profitability, where the main reason is the growing customer's churn percentage which resulted a depression in

EPC and distributors orders' total volume, even there are a constant growing demand for these products in the

GCC markets by 9% each year since 2009 (MESC, 2013). Moreover Jeddah Cables has a regional offices

reinforced with authorized distributor in each GCC's country; which could be an asset to develop a mid-term

plan to decrease this customers' churn percentage by more than 10% year over year (YOY).

2.0 Product portfolio analysis

Product portfolio of Jeddah cables are analyzed using the

Boston Consultancy Groups matrix, 1970. This model could

set out to reveal potential opportunities for the organization to

capitalize on.

# Product

1 LV Power Wires & Cables

2 LV Fire Alarm Cables

3 LV Instrumentation and control cables

Stars Question

Cash

Cows

Dogs

2.1 BCG analysis

Stars Problem Child

N/A LV Fire cables, control and instrumentation are considered to be problematic children in Jeddah Cables portfolio, since they

possess small market share in a relatively new high growing market with respect to the LV wires and cables all over the

GCC. The main reasons for that are as follows:

The relative small number of product quality and type tests certificates, especially UL-certificates, which negatively affect

customers' perception of Jeddah Cables quality.

No approvals from ministries of defense in GCC countries, due to the few numbers of certificates, which limit the sales to

low quality customers.

No available technical catalogues, which negatively affect customers' image of Jeddah cables' technical competency.

Cash Cows Dogs

N/A The LV power wires and cables are considered to be dogs for the following reasons :

Relatively high prices with respect to competition, which makes customers switch to approved cheaper competitors.

Lack of stock mix availability and long delivery periods (6-8 weeks), which makes customers, goes for other faster

delivery manufacturers (4-6 weeks), since they would like to have short delivery periods.

These two reasons force the customers to switch to fast suppliers and increase the customer churn.

3.0 Macro-Environment Audit

3.1 PESTEL analysis

P

o

l

i

t

i

c

a

l

The Arab Spring, which created instability in numerous countries in the Middle East and North Africa region, catalyzed some

discontent in some GCC countries. While this was short-lived and quickly contained, it remains a risk (Deloitte, 2013).

In Qatar, thronging of Tamim Bin Hamad Al-Thani was unpredictable event with a lot of rumors about it, which may lead to a political

instability due to Tamim's new domestic and foreign policies (Deloitte, 2013).

In Kuwait, The threat of domestic political unrest is growing due to many political and religious aspects; also the political disagreement

with Iraq and other neighbors may threaten regional stability too. (Deloitte, 2013).

In Bahrain, the continuing struggle between the minority Sunni Muslims authorities and majority Shiaa citizen is elevating, which

results an unstable environment for the country development (Deloitte, 2013).

This political instability decreases the size of the market, moreover subject more pressure on the consumers decisions since they demand

short delivery period, to crash the project schedule to finalize the project in the shortest period, to secure their payments before any

changes in the country policy occur, which makes customer usually switch to faster suppliers increasing the customer churn.

Market Growth

R

e

l

a

t

i

v

e

M

a

r

k

e

t

S

h

a

r

e

7

0

3

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 18 of 22

E

c

o

n

o

m

i

c

a

l

GDP: Demand for cables is closely linked to the overall economic activity and

conditions that are measured by GDP. GDP in the Arabian Gulf region is usually

affected by oil prices.

LME: Raw material prices, especially copper (70% of the cost of the cables); is

consistently fluctuating according to London Metal Exchange (LME, 2013), this

could stop the stock's sales operation or to sell under the production cost in case of

the sudden hard depression in the LME's copper prices causing major losses, while

Jeddah cables are stocking cables on high LME's copper prices, which makes

customer goes for those who has a better prices, increasing the customer churn.

S

o

c

i

a

l

Inadequately educated workforce: Most of GCC courtiers depend on the expatriates in their work force, and usually the investors try

to get cheap work force from countries like India and Pakistani, where combined they possess 62% of the work force in GCC(Arab

news, 2013). Recently GCC but some regulations for national work force percentage, and K.S.A consider being the highest work

percentage which increase the operation cost with respect to the other GCC cables suppliers, makes the customer switch for lower price

approved cables, which increasing customer churn.

T

e

c

h

n

o

l

o

g

y

Manufacturing Technology: The Company relies on specialized technology for the production of its cables. However, rapid

technology developments have helped many competitors to reduce their capitals by purchasing some Chinese production machines with

approximately half the cost of European machine manufacturers, this give the competitors an edge in costing.

Material: there are several insulation materials that emerged in the last decade as LS0H, which consider being a next step for natural

wires' insulation, which needs update to production lines or replacement of some machines.

These two factors affect the costing process of the cables leading to high cost cables, which makes the customer switch for lower price

approved cables, increasing customer churn.

E

n

v

i

r

o

n

m

e

n

t

a

l

Power saving and low losses regulation: The authorities now are aware of the human consumption of resources' impact on the

environment that is why they have raised their technical specification to decrease the losses of the electrical network as possible, which

increase the designing cost of the cables, moreover it lengthen the planning process due to the amendment of the production process as

per each order for each country separately, which gives advantage for the local manufacturers, where mainly they amended their

manufacturing process to manufacture the standard of their countries, leading to a better planning cost.

L

e

g

a

l

Governmental polices: As far as cables are concerned, the Governments decisions to initiate large-scale projects are considered the

main driver of demand. These decisions include those relating to infrastructure and construction projects such as electricity and

communication networks, residential and commercial buildings, as well as transport infrastructure, which affect the cables market

heavily.

Restrictive Labor regulations: Except Bahrain and UAE, all GCC countries have a strict labor regulation, which require a sponsorship

from a national citizen, and give the sponsor a full authority and control over its labor force, where it is very difficult to headhunt or

recruit someone with background in same field, since any sponsor will never let his employee go for competitor.

Inefficient government bureaucracy: The governmental authorities are characterized by bureaucracy, modest qualification staff and

long process to commence any plan, which affect the communication efficiency and process.

3.2 Porters Five Forces

I

n

d

u

s

t

r

y

c

o

m

p

e

t

i

t

i

v

e

r

i

v

a

l

r

y

Rivalry force has a high impact on customer churn since if the customer finds a better price, available and approved cables by the

consultancy party he will immediately switch for it, and that is for the low differentiated product and high competitive

environment of GCC countries. Each GCC country has main players, and always the national manufacturer has an edge in price

due to shipping cost and availability due to its existence, taking in consideration there are 26 cable manufacturers in the region.

The manufacturers /market are as follows:

Kuwait Bahrain Qatar Oman UAE

Leader Gulf Cables

(National

manufacturer)

Ducab Elsewedy

(National

manufacturer)

Oman

(National

manufacturer)

Ducab

(National

manufacturer)

Challenger Oman Cables Jeddah Cables Oman Cables Nuhas Oman

(National

manufacturer)

Oman Cables

T

h

r

e

a

t

o

f

s

u

b

s

t

i

t

u

t

e

s

The cables industry doesn't have any substitution according the current technology, since it is the most efficient way of

transmitting electricity (Newell,1983). even recently there was an initiation for the wireless electricity transmission in June

2007. A research team succeeded to develop theories from Nikola Tesla's theories that allowed them to transmit the electricity

wirelessly for couple of meters to light a bulb with efficiency 40%, years later the wireless electricity (Witricity) has been

commercialized. But still these technology limited in efficiency, range and power, also can't beat the 98.9% transmission

efficiency of the current technology (MITnews, 2007), which makes substitution force a minor impact force on customer churn.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 19 of 22

T

h

r

e

a

t

o

f

N

e

w

E

n

t

r

a

n

t

The GCC authorities had dedicated 1.8 trillion USD for its projects in the next decade, which will attract more investors in many

fields, but it needs at least 13 Million USD to start a small production capacity plant with European machinery and half the

investment in case of Chinese machinery and 2 years of construction, moreover 2 years to possess a reasonable market share,

currently the market doesn't attract any investors, but it may be very attractive when the market grow again. Due to the

investment in the region as football world cup 2022 in Qatar, and EXPO 2020 in Dubai, these events make of new entrant threat

a high impact force on future customer churn, since a cheaper approved manufacture in the future will sure cause the customer

to switch.

C

u

s

t

o

m

e

r

s

B

a

r

g

a

i

n

i

n

g

p

o

w

e

r

Distributors: they get 5-8% discount on Jeddah Cables' normal prices for the bulk quantities.

EPC contractors has a high value project, they may have a discount on the Jeddah cables' prices, for large scale projects they

get from 8-10% discount from the normal Jeddah Cables prices.

Ministries are the highest negotiator not just for the large quantities it takes, they could get 12-16% discount from the Jeddah

Cables' prices.

The customer bargaining power is a high impact force on customer churn, since when customer possess a higher order volume he

can negotiate for a better price, where he can find better prices and delivery period among cables manufacturers.

S

u

p

p

l

i

e

r

s

B

a

r

g

a

i

n

i

n

g

p

o

w

e

r

Suppliers bargaining force will always lie in the cash on delivery and down payment terms, since the price is relatively the same

for all suppliers, while they differ in the capacity supplied. This force could be considered a low impact force on customer churn,

due to the relatively high bargaining power of Jeddah Cables due to its high consumption capacity among the middle east cables

suppliers.

4.0 Task Environment Audit

The following section's data has been gathered as per a survey included 3 distributors and 3 major EPC

contractors in each GCC country, 5 regional sales managers phone interviews from different GCC

manufacturers and integer-research MENA region review:

4.1 Customer audit

Electrical Ministries EPC contractors Distributors

C

h

u

r

n

%

'

0

9

-

'

1

3

Electrical ministry segment's revenues is

increasing YOY

YOY churn is ranging 9-13% YOY churn is ranging 7-9%

R

e

a

s

o

n

f

o

r

C

h

u

r

n

There is no complaints' history within that

segment.

Their major problem that some

cables' demand is lower than the

minimum manufacturing order

quantities.

Jeddah cables has long period of

deliveries.

Jeddah cables Offices usually compete with

them in the local market.

Jeddah cables has long period of deliveries.

Relatively high prices.

S

i

z

e

50% of the total demand in the GCC

market.

30% of the total demand in the

GCC market.

20% of the total demand in the GCC market.

D

e

s

c

r

i

p

t

i

o

n

&

B

e

h

a

v

i

o

r

The ministries in the GCC are as follows:

MEW - Kuwait.

EWA Bahrain.

DEWA - UAE

ADWEA - UAE

SEWA UAE

PAEW - Oman

Kahramaa Qatar

They purchase their orders through tenders,

in bulk quantities. But they are

bureaucratic, delay payments, and demand

long procedures contain a lot of

documentations in shipping the products.

They usually have averagely high

demand starts from 1 million to 15

million SAR. Usually they deal in

LC payments which considered

being low financial risk.

They usually have a high demand for fast

moving wires and cables, they target the

retailers and the projects lower than 1 million

SAR, they possess high bargaining power due

to their constant reasonable demand. They deal

always on open account bases, which make

them high risk customers financially, but they

have relatively high margin with compare to the

other segments.

N

e

e

d

s

They require a lot of quality system and

product certificate and some may assign a

third party quality auditor to perform on

site audit on the factory to evaluate its

process.

They usually take a discount 12-16%

under normal market prices.

Their main concern is the price

and the approval of the cables

from the project's assigned

consultancy office.

They usually take a discount 5-

12% discount under the normal

market prices

They usually need support of their suppliers

to don't compete with them in the local

market. Also to provide them a competitive

prices.

They usually take discounts from 5-10%

under normal market prices.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 20 of 22

L

o

y

a

l

t

y

They have no loyalty. Who will provide a

better price will win the tender.

Loyalty will be affected by the

supplier's delivery period, cheap

prices and technical support.

Loyalty will be affected by the supplier's

coverage acts and low prices to secure profit

margin, and availability of wires and cables.

4.2 Product Trends in the LV market

LV power wires and cables LV fire alarm cables LV Instrumentation and control cables

These cables used to transmit power; it has

a new trend called LS0H cables which most

consultancies recommend in high rising

buildings due to its low fumes emissions.

Fire alarm cables and its systems have

been an obligation lately for all buildings

in GCC countries, and for years the

market depended on importing these

types of cables.

Cables manufacturers consider the LV

Instrumentation and control cables to be profitable

cable segment especially in the GCC countries,

due to the huge investment in oil and gas segment

and the high tech. buildings management systems

(BMS) which spread recently in GCC counties.

These trends have a high impact on the customer churn since the unavailability of these ranges cause the

customer to switch to other competitors who have the full range, in order to avoid pre-qualifying multiple cables

suppliers for the same project, which consider to be a lengthy process for a contractor.

4.3 Market Size Low Voltage Cables

In the GCC, there has been a dramatic increase in demand for LV wire and cable. GCC wire and cable

consumption more than doubled between 2003 and 2008, from 461,000 tons to 1.1 million tons in 2008, the

following data illustrate the following years (MESC, 2013).

Consumption by

Country ('000 tons)

2007 2008 2009 2010 2011 2012

Total 907 1093 949 994 1119 1204

2008 2009 2010 2011 2012

GCC Consumption Percentage increase 21% -13% 5% 13% 8%

GCC Production Capacity percentage increase 10% -9% 18% 11% 13%

4.4 Market Growth

The value of construction projects planned for the GCC up to

2018 is estimated at US$1.8 trillion (Deloitte, 2013). Wires and

Cables value considered to be 10% of that number, and varies

according to the nature of the project. Decreasing customer

churn and engaging customer loyalty program will secure a

sustainable advantage that secure a leading market share of

these upcoming projects.

4.5 Market share

Jeddah Cables current market share of GCC is 6% of the total GCC revenues' value, even Jeddah Cables

production capacity share is 9%. At mean while Ducab considered to have approximately the same production

capacity while it possess 14 % of market's total revenues (MESC, 2013), the reason is that Ducab developed its

LV fire, instrumentation, and control cables to possess a leading position in the market, which emphasis the role

of acquiring new market trends mentioned in (point 4.2), in order to maximize profits, mean while having this

broad cables portfolio reflect the technical competency of the company which help in customer retention, also

these types of special cables' revenues has profit margins more than other LV wires and cables.

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 21 of 22

5.0 Market strategy audit

5.1 Strategy Analysis

Jeddah Cables dedicating 65-75 %of its production capacity for the

Saudi Electricity Company, around 15% for Dubai Electricity

Company, 15% for its sister distribution company Hesham Elsewedy

Establishment which focuses mainly on K.S.A, and 5-15% for aboard

operations. This formula secures a high turnover since ministries'

orders are bulky and easy to plan through production, but with narrow

profit margin, while other strategy like focusing on distributors and

EPC consider containing risks due to their unpredictable demand, by

applying the Survival Matrix devised by marketing strategist,

Professor Malcolm McDonald (2005, p.15-18), Jeddah Cables' Dying

quickly position is calculated to need a more efficient Strategic plan

to achieve a thriving status.

5.2 Resources

There are a lot of tangible resources for Jeddah Cables:

High manufacturing Capacity, which give the edge of economy scale.

Regional office in each GCC country which could facilitate the dealing with EPC and distributors, also

it could act as an intelligence unit which could help in the project forecast, which help to develop a

better planning that result a better cost and stock mix.

In-house copper production facility, which improves the supply chain process leading to better delivery

periods.

Also intangible as follows:

High brand equity all over GCC

Strong sales team

Good relations with no-complaints with

ministries of GCC countries.

6.0 Market Organisation Audit

There is a lack of communication between the abroad business units, where they don't share their consultancies'

approvals certificates; even it could be a great retention tool, since it will maintain the customer perception of

Jeddah Cables product quality due to the approvals of multiple well-known international consultancies, which

decreases the customer churn.

7.0 Market System Audit

The installation of enterprise resource planning (ERP) system is a great planning tool that enables the managers

to act strategically, and help to sort the planning process in order to meet tight delivery lines to decrease churn.

8.0 Market Function Audit

The plan has already discussed the product, place, prices; the following will be the remaining of the 7ps

Promotion There are no promotional schemes of any type, and marketing activities is limited to participation in exhibition,

where most of marketing activities is assigned to sales forces.

Process Ordering processing is very long with respect to competitors, where the minimum delivery for LV wires and cables

is 8-10 weeks, where some competitors as Ducab provides 4-6 Weeks.

Physical

evidence

The website of Jeddah Cables is poor.

Weak representative LV power wires and cables catalogue.

No LV fire, instrumentation and control cables catalogue.

People There a lot of qualified employees and managers in Jeddah Cables, but they need to have some soft skills training in

the field of customer service skills.

9.0 Market Productivity audit

The profit margin has been diminishing since 2009, for two main reasons, firstly Customer churn in EPC and

Distributor segment, secondly the corporate strategy that focus on the ministries despite its narrow profit margin

and its complicated approving process per each order. The following table illustrate the previous reasons

March 2014

Board

CIM Professional Diploma in Marketing

Marketing Planning Process

Candidate Number

70889221

Page 22 of 22

numerically.

Million SAR 2009 2010 2011 2012 2013

Sales 1,499,870,544 1,879,685,204 2,266,489,229 1,951,798,150 1,907,521,177

Net profit margin 53,833,291 30,718,245 10,787,858 9,876,521 7,628,871

Cash Flow (Negative) Positive (Negative) (Negative) (Negative)

Ministries % of revenues 72% 74% 76% 78% 81%

EPC % of revenues 10% 9% 8% 7% 6%

EPC YOY customer churn

- 9% 10% 11% 13%

Distribution % of revenues 18% 17% 16% 15% 13%

Distribution YOY customer churn

- 7% 6.8% 7% 9%

9.1 Average churn percentage could be calculated as follows

% =

( %) %+( . %) %

%+ %

% =

. % %+. %

%+ %

= . %

10.0 SWOT

Strengths Weakness

In-House copper rod facility secures half of the demand.

Abroad offices in each GCC country.

High production capacity (6

th

all over the MENA).

Prominent manufacturer and strong brand equity in power

cables market.

Strong relationship with ministries.

Strong sales team.

EPR system EPICOR

Relative high cables' designs cost.

Relatively long delivery periods.

No promotional schemes.

Weak website

Weak LV power wires and cables catalogue.

No Special wires and cables catalogue.

Weak marketing activities.

Weak connection with consultancy offices.

Equipment and operational costs risks, and business disruption risk

Dependence on key customers

Short products' approval certificates.

Opportunities Threats

GCC's low voltage cables market is constantly growing. Cost depends on constantly fluctuating due to copper prices.

Credit risk with the customer, which may affect the cash flow.

Pure competition market.

Bureaucratic governments.

Low entry barriers for new entrants.

Economical disturbance in the world's economy.

Das könnte Ihnen auch gefallen

- Ansi Pipe Marker Regulations CADokument2 SeitenAnsi Pipe Marker Regulations CAMuhammad HaroonNoch keine Bewertungen

- Documents - Tips Mesc Fujikura PrequalificationDokument73 SeitenDocuments - Tips Mesc Fujikura Prequalificationحازم صبحى100% (1)

- Marketing Plan To Decrease Jeddah Cables' Customers Churn in GCC CountriesDokument31 SeitenMarketing Plan To Decrease Jeddah Cables' Customers Churn in GCC Countriesحازم صبحى100% (1)

- Books For PostgradeDokument3 SeitenBooks For Postgradeحازم صبحىNoch keine Bewertungen

- OCOM PMiM SEP14 12998007 Final Correct VersionDokument40 SeitenOCOM PMiM SEP14 12998007 Final Correct Versionحازم صبحىNoch keine Bewertungen

- How To Answer DCV ExamDokument11 SeitenHow To Answer DCV Examحازم صبحىNoch keine Bewertungen

- Delivering Customer Value - SummaryDokument19 SeitenDelivering Customer Value - Summaryحازم صبحىNoch keine Bewertungen

- Master Optical Fiber PDFDokument11 SeitenMaster Optical Fiber PDFrt1973Noch keine Bewertungen

- Improving Marketing Performance through Quality ManagementDokument59 SeitenImproving Marketing Performance through Quality Managementحازم صبحىNoch keine Bewertungen

- List of Projects WTH ApprovalsDokument20 SeitenList of Projects WTH ApprovalsharshilrasputraNoch keine Bewertungen

- Madar CertificatesDokument1 SeiteMadar Certificatesحازم صبحىNoch keine Bewertungen

- QMS Audit - Checklist - IsO 9001 - 2008Dokument27 SeitenQMS Audit - Checklist - IsO 9001 - 2008Rizaldi DjamilNoch keine Bewertungen

- OCOM MM Jun14 12998007Dokument59 SeitenOCOM MM Jun14 12998007حازم صبحىNoch keine Bewertungen

- Alter Ego 1 - Cahier D ActivitesDokument126 SeitenAlter Ego 1 - Cahier D Activitessanal_ram100% (4)

- Regus SWOT and competitive analysisDokument4 SeitenRegus SWOT and competitive analysisحازم صبحىNoch keine Bewertungen

- Leader and ManagerDokument8 SeitenLeader and Managerحازم صبحىNoch keine Bewertungen

- HS CODES For CablesDokument3 SeitenHS CODES For Cablesحازم صبحىNoch keine Bewertungen

- NeaveDokument11 SeitenNeaveRohit SinhaNoch keine Bewertungen

- Approved HV Contractors in BahrainDokument1 SeiteApproved HV Contractors in Bahrainحازم صبحىNoch keine Bewertungen

- Riyadh Cables PDFDokument6 SeitenRiyadh Cables PDFحازم صبحىNoch keine Bewertungen

- Telecommunications Building Cabling Systems Planning and DesignDokument45 SeitenTelecommunications Building Cabling Systems Planning and Designศิษย์เก่า ทีเจพี100% (1)

- Cable Engineering in Substation and Power PlantDokument6 SeitenCable Engineering in Substation and Power Plantحازم صبحى100% (1)

- List of Dystopian LitretureDokument5 SeitenList of Dystopian Litretureحازم صبحىNoch keine Bewertungen

- Women's Anima and Men's AnimusDokument4 SeitenWomen's Anima and Men's Animusحازم صبحىNoch keine Bewertungen

- FTimes MBA RANKINGSDokument1 SeiteFTimes MBA RANKINGSJason ChiaNoch keine Bewertungen

- Toshiba Medium Voltage Motor SolutionsDokument6 SeitenToshiba Medium Voltage Motor Solutionsحازم صبحى100% (1)

- SPRING 2002 CHILD GROWTH/DEVELOPMENT TELECOURSE STUDENT HANDBOOKDokument123 SeitenSPRING 2002 CHILD GROWTH/DEVELOPMENT TELECOURSE STUDENT HANDBOOKحازم صبحىNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Lecture 2 Data Analytics Video Transcript 2Dokument11 SeitenLecture 2 Data Analytics Video Transcript 2bong hui chenNoch keine Bewertungen

- Case Study of Verizon WirellesDokument5 SeitenCase Study of Verizon WirellesPranab DharNoch keine Bewertungen

- Forrester Tei RTD 432543 PDFDokument26 SeitenForrester Tei RTD 432543 PDFPablo Fernández-CastanysNoch keine Bewertungen

- SaaS ChecklistDokument3 SeitenSaaS ChecklistXipu LiNoch keine Bewertungen

- Measure Customer Churn Rates & Prevent Revenue LossDokument5 SeitenMeasure Customer Churn Rates & Prevent Revenue LossAkshatNoch keine Bewertungen

- High Growth SaaS PlaybookDokument101 SeitenHigh Growth SaaS PlaybookKDEWolf100% (4)

- Expert Models Predict Cellular Customer ChurnDokument3 SeitenExpert Models Predict Cellular Customer ChurnDiego GamboaNoch keine Bewertungen

- Recurly Choosing Right Subscription Billing PlatformDokument15 SeitenRecurly Choosing Right Subscription Billing PlatformV KeshavdevNoch keine Bewertungen

- Loginext Payroll Management AasaanjobsDokument2 SeitenLoginext Payroll Management AasaanjobsKamleshNoch keine Bewertungen

- Pointillist Journey Analytics Telecom Use Cases EbookDokument21 SeitenPointillist Journey Analytics Telecom Use Cases EbookMiguel FlorezNoch keine Bewertungen

- Churn AnalysisDokument7 SeitenChurn AnalysisgauravNoch keine Bewertungen

- Big Data Work Book PDFDokument65 SeitenBig Data Work Book PDFjibykNoch keine Bewertungen

- Mobile App Performance Assessement - FINALDokument16 SeitenMobile App Performance Assessement - FINALredejavoeNoch keine Bewertungen

- Telecom Analytics SolutionsDokument12 SeitenTelecom Analytics Solutionsdivya2882Noch keine Bewertungen

- Case Analysis - HubSpot: Inbound Marketing and Web 2.0Dokument14 SeitenCase Analysis - HubSpot: Inbound Marketing and Web 2.0azayverma75% (12)

- 2018 State of Embedded Amalytics ReportDokument29 Seiten2018 State of Embedded Amalytics ReportCarlos MarquesNoch keine Bewertungen

- A Novel Approach For Churn Prediction Using Minimal Factor Selection ApproachDokument5 SeitenA Novel Approach For Churn Prediction Using Minimal Factor Selection ApproachMalik GNoch keine Bewertungen

- Netflix Exhibits in Epic Games v. AppleDokument40 SeitenNetflix Exhibits in Epic Games v. AppleMacRumorsNoch keine Bewertungen

- Optimove Preparation ExamDokument32 SeitenOptimove Preparation ExamAndreea0% (2)

- Retention ModelDokument24 SeitenRetention ModelRania DirarNoch keine Bewertungen

- Castlight Health CEO Discusses Q3 2020 ResultsDokument10 SeitenCastlight Health CEO Discusses Q3 2020 ResultsrojNoch keine Bewertungen

- Organizational Effectiveness MetricsDokument3 SeitenOrganizational Effectiveness MetricsAshutosh SharmaNoch keine Bewertungen

- Virgin Mobile USADokument11 SeitenVirgin Mobile USAcesarcito100% (1)

- Unit Economics - Mike Lingle For FI - 2021Dokument28 SeitenUnit Economics - Mike Lingle For FI - 2021Founder Institute100% (1)

- The Truth About Customer ExperienceDokument11 SeitenThe Truth About Customer Experienceaksr27Noch keine Bewertungen

- Estimating Cancer Ward Occupancy and Consumer TastesDokument4 SeitenEstimating Cancer Ward Occupancy and Consumer TastesHylda Octavia100% (2)

- Customer Retention - AppsterDokument26 SeitenCustomer Retention - Appsterjimbaqi100% (1)