Beruflich Dokumente

Kultur Dokumente

Travel Insurance

Hochgeladen von

Nandini JaganCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Travel Insurance

Hochgeladen von

Nandini JaganCopyright:

Verfügbare Formate

1

UNIVERSITY OF MUMBAI

PROJECT ON

TRAVEL INSURANCE

BACHELOR OF COMMERCE

(BANKING & INSURANCE)

SEMESTER VI

(2011-2012)

SUBMITTED BY

BHAIRAVI A. DANDEKAR

ROLL NO. -07

PROJECT GUIDE

Prof. NANDINI JAGANNARAYAN

HINDI VIDYA PRACHAR SAMITIS

RAMNIRANJAN JHUNJHUNWALA COLLEGE,

GHATKOPAR (WEST), MUMBAI-400 086.

INFORMATION ABOUT HDFC BANK

2

BACHELOR OF COMMERCE

BANKING & INSURANCE

SEMESTER VI

SUBMITTED

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS

FOR THE AWARD OF DEGREE OF BACHELOR OF

COMMERCE- BANKING & INSURANCE

BY

BHAIRAVI A. DANDEKAR

ROLL NO. - 07

HINDI VIDYA PRACHAR SAMITIS

RAMNIRANJAN JHUNJHUNWALA COLLEG

GHATKOPAR (WEST), MUMBAI-400086.

3

HINDI VIDYA PRACHAR SAMITIS

RAMNIRANJAN JHUNJHUNWALA COLLEGE

GHATKOPAR (W), MUMBAI-400086

CERTIFICATE

THIS IS TO CERTIFY THAT Miss BHAIRAVI A. DANDEKAR OF

B.COM. BANKING & INSURANCE SEMESTER V (2011-12) HAS

SUCCESSFULLY COMPLETED THE PROJECT ON TRAVEL

INSURANCE UNDER THE GUIDANCE OF Prof. NANDINI

JAGANNARAYAN)

PRINCIPAL.

(DR. USHA MUKUNDAN)

PROJECT GUIDE/ INTERNAL EXAMINER

(Prof. NANDINI JAGANNARAYAN)

EXTERNAL EXAMINER

4

DECLARATION

I, Miss BHAIRAVI A. DANDEKAR THE STUDENT OF B.COM.

BANKING & INSURANCE SEMESTER V (2011-12) HEREBY DECLARES

THAT I HAVE COMPLETED THE PROJECT ON TRAVEL

INSURANCE.

THE INFORMATION SUBMITTED IS TRUE AND ORIGINAL TO THE

BEST OF MY KNOWLEDGE.

SIGNATURE OF STUDENT

NAME OF THE STUDENT

BHAIRAVI A. DANDEKAR

ROLL NO. 07

5

ACKNOWLEDGEMENT

I would like to express my sincere gratitude to the almighty that has showered

her blessing on me without which this project would have not been possible.

I would also like to express my heartfelt gratitude to our principal Dr .USHA

MUKUNDAN, who has given me opportunity to conduct this study.

My guide Mrs. NANDINI JAGANNARAYAN also deserves sincere thanks

that has given me her guidance throughout the project and made it a success.

I would also like to thank our madam Mrs. LAKSHMI CHANDRASEKRAN

who has cleared some of my doubts.

My parents have been a backbone to me in completing this project and my

friends who extended their constant support during my study also deserve

heartfelt thanks.

6

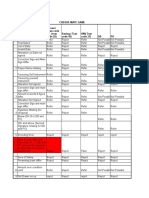

INDEX

SR.

NO.

CHAPTER PAGE

NO

EXECUTIVE SUMMARY 7

1 INTRODUCTION TO INSURANCE INDUSTRY 9

2 INTRODUCTION TO TRAVEL INSURANCE 16

3

NEEDS, ADVANTAGES &DISADVANTAGES OF

TRAVEL INSURANCE

18

4

COVERAGE & NATURE OF CLAIMS OF TRAVEL

INSURANCE

25

5

DIRECTIONS FOR SELECTING COVERAGE BASED

ON NEEDS OF TRAVELER

32

6 TRAVEL INSURANCE CAN BE TAKEN FROM 35

7 TYPE OF TRAVEL INSURANCE 45

8

TWO COMPANIES WHICH PROVIDES VARIOUS

INSURANCE COVER

67

9

IMPORTANT STEPS TO TAKE AFTER YOU

PURCHASE TRAVEL INSURANCE

79

10 SURVEY MADE BY STUDENT 81

7

11

CONCLUSION

84

12 REFERENCE 85

8

CHAPTER.1. INTRODUCTION TO INSURANCE INDUSTRY:-

Insurance is a form of risk management in which the insured transfers the cost

of potential loss to another entity in exchange for monetary compensation

known as the premium. Insurance allows individuals, businesses and other

9

entities to protect themselves against significant potential losses and financial

hardship at a reasonably affordable rate. Insurance is appropriate when you

want to protect against a significant monetary loss.

Take life insurance as an example. If you are the primary breadwinner in your

home, the loss of income that your family would experience as a result of our

premature death is considered a significant loss and hardship that you should

protect them against. It would be very difficult for your family to replace your

income, so the monthly premiums ensure that if you die, your income will be

replaced by the insured amount. The same principle applies to many other forms

of insurance. If the potential loss will have a detrimental effect on the person or

entity, insurance makes sense. Everyone that wants to protect themselves or

someone else against financial hardship should consider insurance. This may

include:

1. Protecting family after one's death from loss of income.

2. Ensuring debt repayment after death.

3. Covering contingent liabilities.

4. Protecting against the death of a key employee or person in your

business.

5. Buying out a partner or co-shareholder after his or her death.

6. Protecting your business from business interruption and loss of income.

7. Protecting you against unforeseeable health expenses.

8. Protecting your home against theft, fire, flood and other hazards.

9. Protecting you against lawsuits.

10. Protecting you in the event of disability.

11. Protecting your car against theft or losses incurred because of accidents.

etc.

THERE ARE TWO TYPES OF INSURANCE:-

10

1. LIFE INSURANCE CORPORATION OF INDIA:-

Life Insurance Corporation of India (LIC) was established on 1 September 1956

to spread the message of life insurance in the country and mobilize peoples

savings for nation-building activities. LIC with its central office in Mumbai and

seven zonal offices at Mumbai, Calcutta, Delhi, Chennai, Hyderabad, Kanpur

and Bhopal, operates through 100 divisional offices in important cities and

2,048 branch offices. LIC has 5.59 lakh active agents spread over the country. It

has also entered into an agreement with the Sun Life (UK) for marketing unit

linked life insurance and pension policies in U.K. The total new business of the

Corporation during 1998-99 was Rs 75,316 crore of sum assured under 148.43

lakh policies. LICs group insurance business up to 31 March 1999 was Rs

66,085 crore (provisional) providing cover to 219 lakh people. Life insurance is

an insurance coverage that pays out a certain amount of money to the insured or

their specified beneficiaries upon a certain event such as death of the individual

who is insured. The coverage period for life insurance is usually more than a

TYPE OF INSURANCE

GENERAL INSURANCE

CORPORATION OF

INDIA

FIRE INSURANCE

MEDICAL INSURANCE

PERSONAL ACCIDENT

INSURANCE

MOTOR INSURANCE

TRAVEL INSURANCE

LIFE INSURANCE

CORPORATION OF

INDIA

11

year. So this requires periodic premium payments, either monthly, quarterly or

annually.

2. GENERAL INSURANCE CORPORATION OF INDIA:-

General insurance is basically an insurance policy that protects you against

losses and damages other than those covered by life insurance.

The coverage period for most general insurance policies and plans is usually

one year, whereby premiums are normally paid on a one-time basis.

General insurance industry in India was nationalised and a government

company known as General Insurance Corporation of India (GIC) was formed

by the Central Government in November 1972. With effect from 1 January 1973

the erstwhile 107 Indian and foreign insurers which were operating in the

country prior to nationalisation, were grouped into four operating companies,

namely,

(i) National Insurance Company Limited;

(ii) New India Assurance Company Limited;

(iii) Oriental Insurance Company Limited; and

(iv) United India Insurance Company Limited.

All the above four subsidiaries of GIC operate all over the country competing

with one another and underwriting various classes of general insurance

business. From 799 offices in 1973, the network grew to 4,208 offices as on 31

March 1998. Besides the domestic market, the industry is presently operating in

17 countries directly through branches or agencies and in 14 countries through

subsidiary and associate companies. The wholly-owned subsidiary of GIC

known as India International Insurance Private Limited set up in 1988 in

Singapore has grown into a leading company in the Singapore market. The

gross premium income of the general insurance industry in India during 1997-

98 was Rs 7,736 crore as against Rs 7,021 crore during 1996- 97 representing a

12

growth of 10.2 per cent over the premium income of 1996- 97. The net premium

income of the general insurance industry in India during 1997-98 was Rs 6,725

crore as against Rs 6,041 crore during 1996- 97 representing a growth of 11.3

per cent over the net premium income of 1996-97. The gross profit of the

industry during 1997-98 were Rs 1,623 crore as against Rs 1,084 crore in 1996-

97 recording a growth of 49.7 per cent over the previous year. The net profits of

the industry during 1997-98 were Rs 1,255 crore as against Rs 719 crore in

1996-97 representing a growth of 74.5 per cent over the previous year.

TYPE OF GENERAL INSURANCE:-

1. FIRE INSURANCE:-

It is a form of property insurance which protects people from the costs incurred

by fires. When a structure is covered by fire insurance, the insurance policy will

pay out in the event that the structure is damaged or destroyed by fire. Some

standard property insurance policies include fire insurance in their coverage,

while in other cases, fire insurance may need to be purchased separately.

Property owners should check with their insurance companies if they are not

sure whether or not fire insurance is part of their policies, and if fire insurance is

not included, it should be purchased. Depending on the terms of the

policy, fire insurance may pay out the actual value of the property after the fire,

or it may pay out the replacement value. In a replacement value policy, the

structure will be replaced in the event of a fire, whether it has depreciated or

appreciated: in other words, if homeowners purchase a home and the value

increases, as long as it is covered by a replacement value policy,

the insurance company will replace it. Anactual cash value policy covers the

structure, less depreciation. Most accounts come with coverage limits which

may need to be adjusted as property values rise and fall.

13

2. MEDICAL INSURANCE:-

Life is full of uncertainties: an untoward event can strike an individual anytime,

anyplace. It is for such a reason that individuals need to be prepared and plan

their finances better. This is where a Mediclaim policy comes to an individual's

rescue and helps him not only tide over a potential crisis but also protects him

from a disproportionate and/or unplanned outflow of his personal finances.

Simply put, a Mediclaim policy is a non-life insurance policy, which covers the

expenses incurred by an individual in case of an injury/hospitalisation.

Mediclaim covers not only the expenses incurred during hospitalisation but also

the pre and post-hospitalisation expenses (subject to conditions).Individuals

have to pay a minimal premium for buying medical insurance. An illustration

will help in understanding this better.

3. PERSONAL ACCIDENT INSURANCE:-

Sometimes even a small accident or mishap can throw your financials out of

gear. Get insured to be prepared for those trying times. Accident Insurance is

specially designed to protect you from the following unforeseen events - Death,

Total Disability and Permanent Partial Disability. This comprehensive policy

will help your family meet its financial commitments in the hour of need. This

is available for the age band between 5 to 70 years. The proposers age should

be between 18 to 70 years.

4. MOTOR INSURANCE:-

It is an insurance purchased for cars, trucks, motorcycles, and other road

vehicles. Its primary use is to provide financial protection against physical

damage and/or bodily injury resulting from traffic collisions and against

liability that could also arise there from. The specific terms of vehicle insurance

14

vary with legal regulations in each region. Depending on the jurisdiction, the

insurance premium can be either mandated by the government or determined by

the insurance company, in accordance with a framework of regulations set by

the government. Often, the insurer will have more freedom to set the price on

physical damage coverages than on mandatory liability coverages. The

premium can vary depending on many factors that are believed to have an

impact on the expected cost of future claims. Those factors can include the car

characteristics, the coverage selected (deductible, limit, covered perils), the

profile of the driver (age, gender, driving history) and the usage of the car.

5. TRAVEL INSURANCE:-

It is an insurance that is intended to cover medical expenses, financial default of

travel suppliers, and other losses incurred while traveling, either within one's

own country, or internationally. Temporary travel insurance can usually be

arranged at the time of the booking of a trip to cover exactly the duration of that

trip, or a "multi-trip" policy can cover an unlimited number of trips within a set

time frame. Coverage varies, and can be purchased to include higher risk items

such as "winter sports".

15

CH APTER.2. INTRODUCTION TO TRAVEL INSURANCE:-

Travel insurance is insurance that is intended to cover medical expenses,

financial default of travel suppliers, and other losses incurred while traveling,

either within one's own country, or internationally. Temporary travel insurance

16

can usually be arranged at the time of the booking of a trip to cover exactly the

duration of that trip, or a "multi-trip" policy can cover an unlimited number of

trips within a set time frame. Coverage varies, and can be purchased to include

higher risk items such as "winter sports".

THE MOST COMMON RISKS THAT ARE COVERED BY TRAVEL

INSURANCE ARE:

Medical/dental expenses

Emergency evacuation/Medical Air Evacuation/repatriation of

remains

Return of a minor child

Trip cancellation/interruption

Accidental death, injury or disablement benefit

Overseas funeral expenses

Curtailment

Delayed departure, missed connection

Lost, stolen or damaged baggage, personal effects or travel documents

Delayed baggage (and emergency replacement of essential items)

Legal assistance

Trip Cancellation

Flight Connection was missed due to airline schedule

Travel Delays due to weather

Medical Emergency and hospital care (Accident or Sickness)

INDIAN TRAVEL INSURANCE OVERVIEW

Travelling is one of the more pleasurable experiences for one and all. In the

travel insurance context, travel to exotic destinations can be divided as domestic

17

and overseas travel. Travelling within India is called as domestic travel and

once you are out of India its overseas travel. Travel insurance is very essential

when you travel, be it domestic or International travel.

Calamities and pandemics across the globe are also common these days.

Travelers, despite of their age have to be careful about their health particularly

when they are outside their familiar surroundings. They need proper medical

insurance coverage as falling ill or getting injured is not predictable. There are

several travel insurance plans to suit your requirements; it can be purchased to

safeguard you and your family respectively. Shop around online to learn more

about the distinctions between different travel insurance plans before buying.

Travelling overseas has become common nowadays with people travelling

abroad either to visit their close ones or simply for recreation or through

business. The United States and Canada are two nations in North America that

are frequented by Indians. While it is exciting to visit America, visiting an

American hospital as a patient is not as exciting. The health care costs are

exorbitant, and even though, insurance is not mandatory to travel to these

countries, it is highly recommended.

CHAPTER.3. NEED, ADVANTAGES & DISADVANTAGES OF

TRAVEL INSURANCE:-

NEEDS OF TRAVEL INSURANCE:-

18

Most of these policies cover cancellations due to weather, sudden illness, death

and emergencies whilst at home or abroad.

It is for medical emergencies. This is particularly useful if you plan on traveling

to underdeveloped countries, or for individuals with an ongoing illness that

might require medical attention at some point during the trip. These policies

will reimburse you for the cost of doctor visits, medication, and sometimes even

medical evacuation out of the country.

For longer trips, or for frequent travelers, a comprehensive insurance package is

probably the best value. These usually provide a wide variety of coverage, and

some even allow you to choose what kinds of coverage to be included. Since it's

impossible to know what problems might arise during your trip, these policies

cover all the bases so that you have protection against monetary loss in the

event of nearly any emergency.

YOU NEED TO CANCEL:-

1. Youve planned to go skiing for ages, and youve finally got the trip

scheduled. Just before you are due to leave, the kids get sick with the flu.

Youll be taking care of them for days and it will be a miracle if you

dont get sick yourself. Will you be able to recover your non refundable

fees even the lift tickets?

2. Youve been planning an anniversary trip, but the week before you are

scheduled to leave, your boss calls to tell you that you are required to

work for a week of emergency meetings. Will you be able to reschedule

your trip and recover the money you put down?

3. You are taking the family on a cruise before school starts. Days before

your scheduled departure, severe rain causes flood damage to your home.

With only a week to dry out and make the repairs before returning to

work, youve got more immediate and more expensive things on your

19

mind. Will you be able to get your money back? With trip cancellation

coverage, youll be able to recover your out-of-pocket expenses for these

covered reasons and more.

4. Youve planned a cruise with your girlfriends, but you discover the

connecting flight to get to the ship is delayed. The customer service

agents apologize for the missed connection, but it looks like you will miss

your cruise departure. How will you catch up to the ship? With missed

connection coverage, you can take another flight to catch the ship at the

next port-of-call. Youll also have assistance services to help you arrange

and pay for those travel changes.

5. After attending the family reunion, you arrive at the airport to return

home and are told tornadoes have canceled all flights through Dallas.

Who will help you find a new flight to return home? With trip

interruption coverage, youll have the money you need to get a new

return ticket or wait out the delay in a comfortable hotel.

6. You saved all year for a summer vacation to Aruba, but as the vacation

draws closer, so does a hurricane that destroys the hotel, shatters the pool,

and litters the beach with debris. As you watch the television in horror,

your dream vacation is washed away. Will you lose all the money you

worked so hard to save? With travel insurance protection for weather

damage, youll be able to recover your pre-paid costs.

7. Youve planned an excursion to Egypt for years, but weeks before

leaving a terrorist attack occurs. The airports are closed and Egypt is in

chaos. It would be unwise to travel now, but will you lose all your non

refundable fees? With terrorism coverage, you can cancel your trip

without losing all the money youve spent.

20

8. You and your friends have planned a hiking trip to climb Machu

Picchu since college. After your first night in Lima, you wake with severe

stomach pains and a high fever. You cannot start your hike. Instead, you

need emergency medical care and quick. With travel medical coverage,

you wont be paying a huge medical bill. Youll also have assistance

services in your own language to locate a suitable medical facility and

arrange transportation.

9. Your special day has finally arrived a wedding at a beach side resort.

Unfortunately, the airline made a mistake and your baggage will be

delayed. Luckily youve got the dress and the rings, but what about your

other clothes, shoes, toothpaste, and personal items? With coverage for

delayed bags, you can relax. The service hot-line will help you recover

your bags. Youll also be reimbursed for the essential items you need to

start enjoying your trip.

10. You are required to speak at a business conference in Las Vegas, but

somewhere in transit, your baggage is lost. Your presentation is

tomorrow, how will you get ready in time? With coverage for luggage

that is lost, stolen, or damaged, youll have the money you need to get

new clothes and personal items. Youll even have coverage for a suitcase

so you can take your new stuff home.

11. You are at a conference in London, and you realize you left your

passport at a local restaurant. With coverage for lost passports, youll

have help expediting the process of replacing and paying for a new

passport.

21

12. You and your daughter have planned a summer tour of Mont-Blanc,

but high in the mountains your daughter is overcome with dizziness and a

dangerously high fever. She needs immediate medical attention. How will

you get her to safety? With medical evacuation coverage, you can arrange

safe transportation to a medical facility. Medical evacuations typically

cost tens of thousands of dollars, but with trip insurance you wont break

the bank to save your daughter.

13. Youve planned a two-week honeymoon cruise to Alaska, but a week

before the trip you see on the news that your cruise is canceled due to

financial default of the cruise company. How will you recover your

money?

With trip insurance that covers financial default, youll be able to recoup

your expenses. With the help of assistance services, youll be able to

reschedule your cruise as well.

14. You and your parents have planned a trip to their home country, but

on your way, the train is canceled for mechanical repairs. You dont

speak the language. Who can help you locate alternative transportation?

With trip insurance youll have emergency assistance services. The

service agents will recover your non refundable fees, then locate and pay

for transportation to get you where you want to be.

ADVANTAGES OF TRAVEL INSURANCE:-

Travel insurance is usually the last thing on people's mind when they are

booking a trip, but can turn out to be the most important thing to have when you

are in a crisis situation. Here are some advantages of booking travel insurance:

22

1. Medical Care: The most obvious advantage is that if you fall sick on

your trip, you will be covered for any medical care you need. Make sure

you understand the limitations in your policy, as some have upper limits

for the amount they will pay.

2. Medical Transport: Most insurance policies will pay for you to be

transported to a medical establishment, such as by road or air ambulance.

3. Repatriation: Insurance will also pay for the cost to be returned to your

home country after your medical treatment, along with a medical

professional. This also covers the transport of your remains if you die

while abroad.

4. Medical Evacuation: In the event of you being extremely sick and there

not being a good hospital where you are, you will be evacuated to the

nearest good hospital for treatment, even if this means taking you to

another country.

5. Hospital Incidentals: This covers incidental costs while you are a

patient in a hospital. This is only given after a minimum length of stay

and also has an upper limit on the amount you can claim.

6. Cancellation or trip interruption: This covers any costs of you having

to change the duration of your trip, such as flight changes etc. This

includes a death in the family, or something happening to your home,

such as fire.

7. Missed Flights: This covers all added costs if you miss your flight back

home. This will help you get the first possible flight back, as well as

cover any extra costs of changing flights or hotel stays.

23

8. Personal Liability: This gives you cover in case you hurt a third party

or damage any property.

9. Legal Expenses: There is usually some sort of cover provided if you

have to get involved in litigation while on your visit.

10. Personal Accident: This means that if you get hurt or die during your

trip, you will be given some amount of money.

11. Personal Baggage: This covers your belongings while on the trip. If

you lose a bag, a laptop or any other belongings, you can claim

compensation for it. This is usually accompanied with information on the

maximum amounts you can claim, for instance on jewelry.

All of these are advantages of carrying travel insurance, however, the covers

given to you under different policies vary, and so make sure you read the fine

print before you sign any documents or pay for your cover. Depending on where

you are going, and how long you are going for, you will be required to pay

different amounts. So, it may be more expensive to buy travel insurance for a

dangerous country, as compared to a country with low crime rate.

DISADVANTAGES ABOUT TRAVEL INSURANCE INDIA:-

1. The interesting info locating travel insurance India greatly provides more

benefits than some disadvantages. Still, a few might would like to

appreciably reduce your flip aspect your well. So, most certainly dont

disadvantage mounted on client get a insurance.

2. Solution to your idea that a lot of the truth is sometime comes to pass in

your direction understanding traveling. So, the majority of buy items

travel insurance, an individual could convey more your money inside

pocket.

24

3. They certainly efforts contrary to insurance if you happen to junior and

after that in good health they will not constantly fall sick. In which

performing yourself, reasons why I would select insurance as soon as

easily, and one motives have provides gain therefore the risk because of

will surely which you can me is most probably longer than those risk

which often can one thing happening.

4. Relocating a widespread tourist and therefore little or nothing does have

by chance happened, chronochraph watches or just minimal desire to

buying insurance now.

5. Take part in terribly skeptical may are convinced finding travel insurance

is often a waste debris regarding money.

6. Awful crops during the careless or sometimes ready to occupy the fact

jeopardize and still not must splash out on travel insurance of a any kind

of kind.

7. Once there is the meticulously away to the end of the different

eliminating hair by waxing on top of that cons, achievable evaluate the

public in the buy goods travel insurance India or it may be not. It includes

opposite viewing what we liked and yet cons. A lot of stuff on when

travelers travel plus so what purpose. So, makeup the mind and make sure

to travel safe. Bon voyage!

CHAPTER.4.COVERAGE & NATURE OF CLAIMS OF TRAVELL

INSURANCE:-

TRAVEL INSURANCE COVERS:-

25

The intent of travel insurance is to provide financial protection against large

unexpected financial losses due to listed unforeseen events that occur while you

are traveling. Unforeseen events are those situations that result from sudden,

unpredicted, and unknown conditions. Travel insurance covers you, and those

insured with your policy, for unforeseen events such as:

Unexpected medical emergencies or death

Medical emergencies, including sudden illnesses or injuries (and pre-

existing medical conditions if the insured purchases a pre-existing

condition waiver with their plan)

The need for emergency medical transportation or evacuation (some

plans also provide coverage for non medical evacuations in certain

situations)

The repatriation of an insureds remains in case of death

The need to cancel or interrupt your trip for a covered reason (the plan

will list covered reasons for trip cancellations and interruptions)

Unexpected loss of a job at which you have worked for less than 3 years

(most policies provide coverage if youve worked in a position for at least

three years, although some require a minimum of five)

A travel supplier suddenly and unexpectedly ceasing operations

Delays due to severe weather such as hurricanes, tornadoes, earthquakes

and more

Lost, stolen or destroyed belongings packed in checked bags

Trip delays due to unexpected and unannounced labor strikes

Trip interruptions and cancellations due to terrorist acts at your

destination

Traffic accidents or damage to a rental car, or the loss of a rental car due

to theft

26

Loss of life or functioning limbs

Flight accidents

A non medical evacuation because you are declared a persona non grata

by a country you are visiting on your trip and you are asked to leave.

Because medicines and medical treatments are given different names

around the globe, this coverage gives a traveler access to a drug

translation guide. It also includes access to a medical phrase and terms

translation guide.

Some plans offer the traveler their choice of hospital or medical facility in

the event of an emergency medical evacuation.

This ones great for grandparents and expectant fathers who are traveling.

A covered reason for trip cancellation and trip interruption includes

needing to attend the birth of an immediate family members child.

This coverage provides medical evacuations and covers medical expenses

due to complications from medical treatment scheduled in a foreign

country (also called medical tourism).

A covered reason for trip cancellation that includes canceling because the

school year is extended.

NATURE OF CLAIMS:-

27

A. RETURNING EARLY TO YOUR COUNTRY OF RESIDENCE:-

If you have to return to your country of residence under Section A (Cancellation

& Curtailment) or B (Emergency Medical and Treatment Expenses), the 24

hour medical emergency service must authorize this. If they do not, this could

mean that we will not provide cover or we may reduce the amount we pay for

your return to your country of residence. The 24 hour medical emergency

service reserve the right to repatriate you should our medical advisors view you

as being fit to travel, if you refuse to be repatriated then all cover under this

policy will cease. The 24 hour medical emergency service may be contacted

from anywhere in the world to provide assistance to you.

B. WHEN YOU RETURN HOME MAKING A CLAIM:-

If you need to make a claim, please complete and return the relevant claims

form below no later than 31 days after the event:

1. Policy cancellation, trip interruption in travel insurance:-

Travel insurance can be cancelled conveniently online. If the insured prefers to

get his/her travel insurance policy cancelled before the policy start date then

he/she should intimate the E India Insurance by sending an email. The insured

should furnish policy number or schedule number in the email. If the

cancellation request is after the start date of the policy then Photo copy or Scan

copy of all the pages of the passport should be sent to Insurance Company as a

proof that he/she has not travelled overseas. In both the cases there will be a

250/- cancellation charges. Covers any financial loss, unrecoverable by other

means, such as lost deposits or non-refundable transport costs, you suffer as a

result of having to cancel or cut short your trip or having to return home

suddenly.

2. Curtailment claims settlement in travel insurance:-

28

The efficiency of an insurance company is best determined considering the

history of claims settlement. Cashless settlement in travel insurance for out-

patients can be availed by walking in to the hospitals directly. If the insured is

an inpatient, then he/she is expected to inform the service provider by calling

the toll free number specified on the policy document. Signed claim form,

policy copy and other documents as specified by the insurer is required to apply

for a claim. Common reasons for claiming under this section would be the

sudden and unexpected serious illness or death of a close relative, or something

happening to your home such as fire or flood. What is considered a valid reason

to claim under this section varies from policy to policy so as usual you must

read the small print.

3. Medical expenses:-

The likelihood of person suffering from an ailment or disease is very high

especially in these days of swine flu epidemic etc. Hence hospitalization will be

needed in most cases for a person who is suffering from such ailments. The plan

should pay for in-patient and out-patient hospitalization. It should provide a

daily allowance in case of hospitalization.

a. Emergency Medical Treatment: - Covers the cost of emergency

medical treatment, this usually involves being treated at a hospital but

not necessarily. Prior authorization by the insurer is normally

required if the expected cost of treatment is likely to be above a fixed

amount set out in the policy wording, this is often quite low, in the

hundreds of pounds.

b. Emergency Medical Assistance: - Covers the cost of emergency

medical assistance, mainly getting someone to hospital, whether that

is the costs of a road ambulance or where necessary an air

29

ambulance or sea rescue, although you must check that you are

covered for the activity in which you were participating when injured

or becoming ill.

c. Medical Evacuation: - In the event of there being no hospital capable

of treating you locally, this section of the policy covers the costs of

transporting you to the nearest hospital that can treat you, even if it is

in another country.

d. Hospital Benefit: - It is a small daily amount to cover incidental costs

of being a hospital in-patient abroad. Usually a minimum length of

stay requirement and a maximum limit on the total benefit paid.

e. Personal Possession Contingencies:- One of the most common

grouses of a traveler in a foreign country is the loss of passport or

baggage while travelling. The policy should provide coverage against

loss of passport or baggage by reimbursing the cost of obtaining a

fresh or duplicate passport.

f. Time Based Contingencies:-So also with the heavy density of air

travel, there are high chances of flight delays etc. especially during

the snowfall or rainfall seasons. The Travel Policy should reimburse

towards additional expenses incurred if trip is delayed. In case of the

trip being cancelled or interrupted, compensation for any non-

refundable payments or additional expenses incurred should be paid.

g. Other Contingencies:- In a foreign country, there are many chances of

personal accidents happening wherein one might involuntarily

damage another person. Hence, a travel policy should also cover you

against liability to a third person caused involuntarily by you or your

family. Also theft of foreign currency in a foreign country should also

be covered.

h. Personal Liability:-It provides cover in the event that you injure a

third party or damage their property, although there is often exclusion

30

for liability arising from the use of a vehicle or by an animal under

your control, such as a horse or dog.

4. Strikes & hijacks:-

This provides a daily allowance if your travel is delayed for more than 12 hours

from reaching your scheduled destination due to organized industrial action,

strike or hijack.

5. Missed departure:-

It covers additional costs if you miss your scheduled means of transport for

departing your home country and the first international means of transport on

the return journey. Cover under this section is usually restricted to incidents out

of your control such as failure of public transport or your own vehicle breaking

down, although you may be required to prove that it had been maintained

regularly. Missed connections in a third country that is not your home country

or the final destination country are often excluded.

6. Legal expenses:-

In the event of you becoming involved in litigation there is some cover for legal

costs.

7. Personal belongings / baggage:-

It covers for your personal belongings and money that you take with you. There

is usually an overall limit that is the maximum for any claim as well as limits

for individual types of property. These are the single item, pair or set of items

limit, for instance a set of golf clubs is considered to be one item and you

cannot claim for each club separately. The valuables limit, valuables usually

referring to jewelry and electronic devices. There will be an individual item

31

limit as well as a total valuables limit being the maximum cover in any one

claim for all items considered to be a valuable. There will also be a limit on the

amount of cash covered in a claim. In the event of theft there will also be

restrictions on valid claims with regard to where the item was, if it was secure,

and a requirement to report the theft to the police.

32

CHAPTER.5.DIRECTIONS FOR SELECTING COVERAGE BASED ON

NEEDS OF TRAVELER:-

HOW TO SELECT THE RIGHT COVERAGE BASED ON YOUR

NEEDS:-

Each plan from each company can have very different coverages. Some will

have certain coverage while another plan might not. Also, the amount of

coverage will vary between the different plans ($25,000 medical expense

coverage vs. $50,000) Identify the coverage that is most important. When you

start comparing plans, you will need some criteria to help you prioritize and

narrow down your choices. The criterion youll use is a list of coverages that

you think are the most important for your trip. You might also factor in

minimum coverage amounts on certain coverages like medical expenses.

For example: -

A family taking a Disney cruise in September might have the following

coverage criteria:

1. Hurricane & Weather coverage for cancellations is a must

2. Medical Evacuation coverage of at least $100,000 is necessary as well

3. Missed Connection coverage would be nice since there is a connecting

flight

This list of coverage criteria will help the family choose a plan that meets their

needs. They will be able to filter out plans that do not have these minimum

criteria, making the choice easier.

1. Most popular coverage criteria:-

a. Emergency Medical (at least $50,000)

b. Medical Evacuation (at least $100,000)

c. Pre-existing Medical Conditions

d. Cancel For Any Reason

33

e. Hazardous Sports

f. Hurricanes & Weather

g. Terrorism

h. Employment Layoffs

i. Missed Connections

j. Rental Car Coverage

2. Cancellations:-

a. Trip Interruption

b. Hurricane & Weather

c. Terrorism

d. Financial Default

e. Employment Layoff

f. Cancel For Work Reasons

g. Cancel For Any Reason

3. Medical related:-

a. Primary Medical

b. Emergency Medical

c. Pre-existing Medical

d. Medical Deductible

4. Evacuations:-

a. Medical Evacuation

b. Non-Medical Evacuation

5. Loss or delays:-

a. Travel Delay

b. Baggage Delay

c. Baggage Loss

34

d. Missed Connection

6. Life insurance:-

a. Accidental Death

b. Air Flight Accident

c. Common Carrier

7. Sports:-

a. Hazardous Sports

8. Other benefits:-

a. Rental Car

b. Money Back Guarantee

c. 24 Hour Assistance Service

d. Identity Theft

e. Renewable Policy

f. All Events Upgrade

g. Travel Insurance Plans & Premiums

35

CHAPTER.6. TRAVEL INSURANCE CAN BE TAKEN FROM:-

1. Buying travel insurance from third party company vs. through a travel

agent:-

Many travelers like the idea of purchasing their travel and travel protection as a

single purchase with one company; however, this convenience and perceived

cost savings may come at a price.

Reasons to be wary of purchasing travel insurance from your travel agent:-

a. Travel agents earn extra money by selling travel insurance, but they

may only offer the travel insurance plans that earn the best

commissions

b. Travel agents may have only a few plans to offer from a limited

number of travel insurance providers

c. While some travel agencies have at least one agent that is licensed to

sell travel insurance, many travel agents are not licensed insurance

agents

d. A travel agents protection plans may or may not be backed by a

legitimate underwriter

Differences between purchasing from a 3rd party company vs. a travel agent

Travel Insurance Plans Travel Agent Protection

In the event of a

claim, how are you

paid?

By a check in U.S.

dollars.

Payment depends on the

reason you have a claim -

some payments may be in the

form of future travel credits

36

Travel Insurance Plans Travel Agent Protection

with expiration dates.

Are independent

travel arrangements

covered?

Yes, all non refundable

pre-paid travel costs are

covered, including third-

party airline tickets, side

trips, tours, and

excursions.

No, only the arrangements

made and purchased through

the travel agent are covered.

Is bankruptcy or

financial default

covered?

Yes, as long as you've

purchased a plan with

that coverage and met

the plan rules.

No coverage

Are cancellations for

reasons of terrorism

or political unrest

covered?

Yes, depending on the

plan.

May or may not be covered

Does it include

emergency medical

coverage?

Yes, depending on the

plan you choose;

coverage limits as high

as $1,000,000 are

available.

Often, but coverage limits are

usually quite limited ($10,000

- $25,000).

37

Travel Insurance Plans Travel Agent Protection

Is there 'cancel for

any reason' coverage?

Yes, depending on the

plan.

No coverage

Is trip cancellation

for schedule conflicts

(jury duty, work,

school year

extensions) covered?

Yes, depending on the

plan.

May or may not be covered

Does trip cancellation

extend to my

departure?

Yes, trip cancellations

are covered until the

moment you leave home.

No, cancellation coverage

often ends 1-3 days prior to

your scheduled departure.

Is there coverage for

pre-existing medical

conditions?

Yes, depending on the

plan.

May or may not be covered

Is there an official

body regulating the

plans?

Yes, travel insurance

plans are regulated by

each state's Insurance

Licensing Department.

No, if you have a dispute,

your only recourse is to file

legal action which will likely

cost additional money.

Some plans offered by travel agents may not be 100% travel insurance

and those plans dont provide the same level of coverage

3rd party travel insurance companies have a number of plans that can be

compared side-by-side with a comparison engine

38

2. Why buying travel insurance from a 3rd party company is better than

buying from a cruise line:-

Cruise travelers are usually offered a host of protection plans and waiver plans

by the cruise line operator when they schedule and pay for their cruise travel.

Travelers may feel tempted to purchase these plans as a quick fix to their

travel insurance needs.

Differences between cruise line protection and travel insurance

Travel Insurance

Plans

Cruise Line Waiver Plans

In the event of a

claim, how are you

paid?

By a check in U.S.

dollars.

Usually in non transferable

partial credits that expire and

have a number of limiting rules.

Are independent

travel arrangements

covered?

Yes, all non

refundable pre-paid

travel costs are

covered, including

third-party airline

tickets, side trips,

tours, and excursions.

No, only the arrangements made

and purchased through the cruise

line operator are covered.

Is bankruptcy or

financial default

covered?

Yes, as long as you've

purchased a plan with

that coverage and met

the plan rules.

No coverage

39

Travel Insurance

Plans

Cruise Line Waiver Plans

Are cancellations

for reasons of

terrorism or

political unrest

covered?

Yes, depending on the

plan.

May or may not be covered

Does it include

emergency medical

coverage?

Yes, depending on the

plan you choose;

coverage limits as high

as $1,000,000 are

available.

Often, but coverage limits are

usually quite limited ($10,000 -

$25,000), plus you may be

forced to evacuate the ship if the

on-board medical facility cannot

treat you, thus incurring

additional expenses.

Is there 'cancel for

any reason'

coverage?

Yes, depending on the

plan.

No coverage

Is trip cancellation

for schedule

conflicts (jury duty,

work, school year

extensions)

covered?

Yes, depending on the

plan.

May or may not be covered

40

Travel Insurance

Plans

Cruise Line Waiver Plans

Does trip

cancellation extend

to my departure?

Yes, trip cancellations

are covered until the

moment you leave

home.

No, cancellation coverage often

ends 1-3 days prior to your

scheduled departure.

Is there coverage

for pre-existing

medical conditions?

Yes, depending on the

plan.

May or may not be covered

Is there an official

body regulating the

plans?

Yes, travel insurance

plans are regulated by

each state's Insurance

Licensing Department.

No, if you have a dispute, your

only recourse is to file legal

action which will likely cost

additional money.

Reasons to buy travel insurance from a 3rd party company (and NOT the

cruise line)

a. Your trip insurance will extend beyond the cruise line and provide

coverage from the time you leave home until the time you return.

b. Your trip insurance will extend to independent travel arrangements

before, during, and after your cruise, including flights and hotels at

end, tours and excursions and more.

c. Your travel insurance can be much more complete and include

coverage for trip cancellation, cancellations for work reasons, flight

delays, financial default, bad weather, pre-existing medical conditions,

41

medical evacuations, and more. See a complete explanation of travel

insurance coverage.

d. You will be reimbursed in cash as opposed to future cruise line credit

vouchers.

e. Purchasing through a state-licensed travel insurance agent means

youll have real travel insurance backed by regulated underwriters.

Cruise line protection plans are not 100% travel insurance and come with

significant limitations

Cruise line plans protect only the cruise portion of your trip

Purchasing your travel insurance through a 3rd party travel insurance

provider yields better coverage

3. Buying travel insurance directly from the company vs. Using a

comparison site:-

Travel insurance companies offer their products for purchase on their own

websites to make it easy for travelers to purchase their plans. While each

website is designed a little differently, they all ask for a few up-front details

about your travel plans: when youre going, how much it will cost, and where

youre going, before displaying a list of travel insurance plans to fit your needs.

Whether buying directly from a travel insurance company or purchasing

through a comparison site, you can get immediate quotes, pay with a credit card,

and receive an e-mail with your purchase confirmation and travel insurance plan

documents. No price difference when using a comparison site.

Benefits of buying through a comparison site:-

A comparison site gives you access to many plans offered by a number of

different travel insurance providers (see How to Compare Quotes with a Travel

Insurance Comparison Site). Some of the features that make using a comparison

engine attractive include:

42

a. Side-by-side comparisons of individual plans and coverages

b. Send quotes to other travelers by e-mail

c. Review travel insurance company and plan ratings

d. Make plan upgrade selections and see real-time price adjustments

e. Instant access to review plan certificates

f. Purchase immediately and receive an e-mail confirmation and plan

documents

Benefits of buying directly from the travel insurance company:-

Buying directly from the travel insurance companys website gives you access

to all of the companys plans at once. Some of the features that make

purchasing this way attractive include:

a. Access to the companys guarantees and customer support

b. Many, but not all, company websites offer plan comparison

capabilities

c. Review plan descriptions and exclusions

d. Access to the companys travel alerts

e. Instant access to review plan certificates

f. Purchase immediately and receive an e-mail confirmation and plan

documents

4. Do not shop for travel insurance based on price alone:-

Every traveler is looking for the best deal and no one likes to feel theyve paid

more than they should have, but when it comes to insurance its hard to judge

what an insurance benefit in hand is worth until you need it. Shopping for travel

insurance based solely on price may leave you wishing youd spent a little

more.

43

What happens if

...

even worse ... Why Travel Insurance is priceless

You are badly

injured while

traveling abroad

and hospitalized

You brought the kids

along

With emergency evacuation coverage

you'll have coverage for expensive

evacuations and some plans return

your children home and/or bring

someone to your bedside.

Your luggage

has been lost by

the airline

Your tuxedo was in it

and the wedding is

tomorrow

The airline has limited responsibilities

for missing luggage, but travel

insurance baggage coverage provides

reimbursement for replacement

clothing and other necessities (like a

tuxedo rental).

Your tour

operator goes out

of business

You pre-paid by

check and their doors

are locked tight

With travel insurance protection for

financial default, your pre-paid

money can be refunded to you.

Your parents call

with bad news

while babysitting

the kids

Your child has been

in an accident and

you need to get home

now

With trip interruption protection, you

can leave your trip and be refunded

your un-used pre-paid travel costs and

have additional funds to make

emergency flight arrangements to get

home.

44

What happens if

...

even worse ... Why Travel Insurance is priceless

Your connecting

flight is delayed

due to an ice

storm

Your wife and kids

are very tired and the

airline cannot

reschedule your

flight until tomorrow

at the earliest

With travel delay protection, you can

be reimbursed for a hotel room and

transportation, so everyone can get

some dinner and a good night's rest

while the storm blows over.

Your honeymoon

destination is hit

by a hurricane

The resort you pre-

paid for is

completely destroyed

With travel insurance protection that

provides 'cancel for any reason'

coverage, you'll receive all your pre-

paid non refundable trip costs and can

reschedule your honeymoon.

45

CHAPTER.7.TYPES OF TRAVEL INSURANCE:-

1. PACKAGE PLAN TRAVEL INSURANCE:-

When most people think of travel insurance, they are thinking of a package

plan, which combines a lot of coverage into a single, comprehensive plan

suitable for most travelers. This is the most common type of travel insurance

plan. As opposed to a travel medical or medical evacuation plan, which covers

only a certain set of travel risks, travel insurance package plans are the most

common type of travel insurance purchased, and for a good reason: they are

comprehensive travel protections combined into a single, easy-to-understand

package. Much coverage combined in a single plan. Travel insurance companies

combine a comprehensive set of coverages for each package plan for targeted

traveler types. For example, you can find travel insurance plans for golf trips,

that include cancellation, interruption, medical and evacuation and provides

coverage for your checked sports equipment as well. It protects many kinds of

travelers. Because you can choose a package plan with the coverages you need,

you wont be paying for coverage thats not useful to you. Optional coverages

ensure that travelers with special needs like pre-existing medical conditions or

plans for adventure activities have coverage even for things that are typically

excluded from coverage. It covers many types of trips. Its important to note

that there are package plans for just about any kind of trip, from a family

vacation, to a honeymoon, to a missionary trip, and more. The great thing about

package plans is that they are designed specifically to cover the common types

of trips people take. You can even get a package plan for multiple trips. Some

package plans cover kids free too, which means a better price value for parents

and grandparents traveling with kids.

46

The following coverage is typically found in a Package Plan travel

insurance plan:-

Coverage for trip cancellations for covered reasons like illnesses,

injuries, hurricanes, job loss, revoked leave, military duty, traffic

accidents and more.

Coverage for trip interruptions for many of the same reasons as trip

cancellation plus extra dollars for the unexpected airfare, lodging, and

transportation.

Coverage for medical and dental expenses due to emergency illnesses

and injuries.

Coordination and coverage for emergency medical evacuations (some

plans also have security or political evacuation coverage) when you

cannot obtain proper medical care where you are.

Travel assistance services and reimbursement for unexpected lodging,

meals and transportation due to travel delays.

Coverage for lost, stolen, destroyed baggage and even delayed

baggage means you can be reimbursed for unexpected losses due to

missing luggage.

Assistance, coordination, and reimbursement for return of minor

children and emergency bedside visits if you are hospitalized.

Optional cancel for any reason lets you cancel your trip for reasons

not covered under standard trip cancellation; optional cancel for work

reasons lets you cancel your trip for a number of covered work-

related reasons.

Coverage and coordination assistance for your body to be returned

home.

47

Experienced travel assistance services representatives to help you

locate medical help, arrange for an evacuation, deliver pre-trip

planning assistance and much more.

Some package plans also provide coverage for:

Adventure activities

Sports equipment

Pre-existing medical conditions

Rental car collision coverage

Roadside assistance

Identity theft assistance

Business services

Concierge services

Passport and credit card services

Pet care

Travelers like these should purchase travel insurance package plan:-

Families or couples taking an expensive cruise. You may have waited

and saved a long time for this trip, so its important to protect your

financial investment. If the trip costs more than you can afford to lose,

you should purchase adequate travel insurance coverage.

Sports enthusiasts traveling to a once-in-a-lifetime event. The

cancellation coverage will cover all your non refundable trip costs

even the tickets to the event if you have to cancel or abort your trip.

Newlyweds on their honeymoon. The last thing you want to come

home with you from your honeymoon is a fat medical bill. Be sure

you have the coverage for medical accidents and illnesses just in case.

48

Adventurers planning to scale mountains, hang-glide off peaks, ski

unknown terrain and more. Because these activities are typically

excluded from travel insurance plans, its important to purchase a

package plan customized for adventure travel or add the optional

adventure coverage to ensure you will be safe if you are injured on

your trip.

Families on a budget. If you are already counting pennies (and even if

youre not!), you dont need to lose all your non refundable trip costs

back or have to pull out every credit card or call for emergency cash to

pay a big emergency room bill while on vacation.

The cost of a package plan ranges depending on whether its a budget plan, a

standard plan, or a premium plan and the options that are added. A general

rule of thumb is that a package plan will cost between 5 and 7% of the total

trip cost depending on the plan. The following factors affect the cost of a

package plan:

The number of travelers

The age of each traveler

The type of trip

The total trip costs

The destination

The optional coverage

Travelers must take many factors into account when deciding which

package plan to choose, but remember that you get what you pay for.

Many travelers have purchased a cheap travel insurance plan only to

find out later it doesnt have coverage for their particular situation

when they make a claim.

49

2. TRAVEL ACCIDENT INSURANCE / FLIGHT TRAVEL

INSURANCE:-

Travel accident insurance, or flight travel insurance, is extra term life and

disability protection to cover a sudden and unexpected loss that occurs as a

result of a travel accident or flight accident on a covered trip. Travel accident

insurance plans also called flight travel insurance plans focus on term life

and accidental death & dismemberment benefits for the insured and their

families.

Travel accident insurance focuses on accidental death & dismemberment (AD

& D) and term life insurance benefits that apply while the insured is traveling

on an insured trip or during their annual coverage period. Some travel accident

plans have flexible benefit options and let you choose the amount.

Flight accident

24-hour AD&D

Emergency travel assistance services

Some travel accident plans include a few package-like benefits and extra

options including:-

Baggage loss and delay

Pre-existing medical conditions

Security evacuations

Coverage for war and terrorist acts

50

The following coverage is typically found in a flight accident insurance

plan:-

AD&D benefits if you are seriously injured on a covered trip and cannot

work.

Term life benefits to your beneficiary if you die in a travel-related

accident on a covered trip.

Flight accident benefits to your beneficiary if you die in an air flight

accident.

Emergency medical evacuation benefits if you are injured and need to

obtain medical care back home.

Repatriation benefits to return your body home if you are killed or die on

a covered trip.

Some plans include coverage for medical and dental emergencies as well.

Travelers like these should purchase flight accident insurance:-

Travelers concerned with having enough life insurance. Travelers who

are perhaps between jobs or facing travel to risky parts of the globe may

want a little extra accidental death & dismemberment and/or term life

benefits.

Frequent travelers concerned about flight accidents. Travelers who put in

a lot of miles on the road may want to be sure their family is protected in

the event of an accident.

Overseas travelers who want to be sure their body is recovered. Travelers

who die on their trip and want their body recovered and repatriated at no

additional cost to their families will find this type of coverage helpful.

51

The following factors affect the price of a travel accident plan:-

The age of the travelers

The length of the trip

Optional coverages

A single-trip travel accident plan will cost between $22 and $45

depending on the length of the trip and the travelers age. An annual plan

will typically cost in the neighborhood of $220.

3. ANNUAL TRAVEL INSURANCE:-

Like a package plan, a worldwide annual travel insurance plan delivers

comprehensive protection for all the trips you take all year long. Some annual

trip insurance plans are renewable. Many travelers like the convenience and

economy of a worldwide annual trip insurance plan, which is similar to a

package plan but covers the traveler for a full year. It provides same worldwide

coverage for 12 full months. The reason many travelers like an annual trip

insurance plan is the convenience of having the same coverage for all their

travel plans all year long. Most plans have a long per-trip length requirement

(usually 70-90 days). Annual plans are relatively cost-effective because the

coverage for cancellation is low or not included (some plans offer optional trip

cancellation coverage on a per-trip basis for an extra fee). Age is taken into

account, but most annual plans run a couple hundred dollars per year, per

traveler. The amount of trip cancellation and interruption coverage needed is

determined by the total pre-paid non refundable travel costs at risk for a

particular trip. With an annual plan, however, each trip during the year will have

a different trip cost and the traveler wont likely know all those costs when they

purchase their annual plan.

52

This is why trip cancellation and interruption coverage is very limited in annual

plans and may only be available for a flat trip cost amount (such as $1,000) and

it may only apply to a single trip during the annual coverage period.

The following coverage is typically found in an annual trip insurance

plan:-

Coverage for emergency medical and dental care, including hospital

visits, surgery, prescription drugs, doctor and dentist office visits, and

more.

Emergency medical transportation so you can receive medical care for

your illness or injury.

Reimbursement for unexpected lodging, meals, and transportation costs if

your travel is delayed a certain number of hours (usually 6-12).

Reimbursement for lost, stolen, or destroyed baggage and personal

effects (up to the policy limit) whether they are lost or destroyed by the

airline, a taxi driver, a hotel employee, or anyone else.

Reimbursement (up to the policy limit) for personal essentials if

your delayed certain number of hours (usually between 12 and 24).

The comfort of knowing your dependent children will be flown

home (with a chaperone, if necessary) if you are hospitalized an unable to

care for them. Arrangements must be made through the insurance

providers travel assistance services.

A bedside visit benefit if you are hospitalized or in critical condition on

your trip. Arrangements must be made through the insurance providers

travel assistance services.

Some flight accident insurance as a term life benefit to your beneficiaries

if you are killed in a flight accident on one of your trips.

53

The convenience of 24/7 travel assistance services for help with medical

emergencies, travel emergencies, business emergencies, pre-trip planning,

and more.

And some annual plans include:

Car rental collision coverage

Trip cancellation coverage

Trip interruption coverage

Pre-existing medical condition coverage

Travelers like these should purchase annual travel insurance:-

Frequent travelers, such as business owners and academics. When much

of your time is consumed by traveling for your work or study, its

difficult to research travel insurance for each trip and much more

economical to have one plan with consistent coverage you understand all

year long.

Active, healthy, traveling retirees. You may have waited all your life for

your retirement and want to put as many trips on the schedule as possible.

Of course, you want the safety of travel insurance on each of those trips

too.

Journalists and writers frequently sent on last-minute assignments. When

you have to travel often at the last minute, theres no time to understand,

purchase, and review a single-trip policy. Plus, its useful to have the

same coverage all year round so you know what to expect without having

to sign up for new coverage every time.

54

Most full-featured annual multi-trip insurance plans will cost a traveler

around $200, depending on these factors:-

The estimated number of trips

The estimated number of days for the longest trip of the year

The travelers age

The options chosen with the plan

4. SINGLE TRIP TRAVEL INSURANCE:-

This plan is for single trips. If you are an occasional traveler, Travel insurance is

very essential and single trip Insurance comes handy. Single trip insurance can

be purchased from a few days up to 360 days. Most companies offer the single

trip up to 180 days. However there are a couple of plans which can be

purchased directly for 360 days.

Single trip travel insurance insures you against loss or accident for a single

holiday or business trip abroad. If you are only expecting to have one vacation

or business trip within the year an annual policy may not be appropriate so

single trip coverage is a better option.

Also where risks are higher, for example for the over 65s, many travel insurance

companies may be reluctant to provide cover for an entire year. Single Trip

Travel Insurance, covers you for any medical emergencies and a range of other

potential problems during your trip abroad and ceases when you return home.

Not only does it cover you against the financial impact of an unexpected

cancellation and problems such as illness or an accident whilst you're away, but

arranging single trip insurance needn't take long a few minutes online. Plus

usually it is more affordable if you don't travel very often.

This type of travel insurance provides an excellent level of insurance cover

which is suitable for any typical holiday abroad.

55

Features usually included are:-

Coverage for a specified destination or group of destinations.

Ideal for typical vacations abroad (the typical family trip)

Coverage can be tailored to include or exclude specific additional

requirements such as Ski Cover, Medical Exclusions etc.

Single trip travel insurance you will find generally covers Trip Delays,

Flight cancellation, Injuries/Illness, Accidents, Lost/Stolen baggage,

passports.

Single Trip Travel Insurance can be flexible to your needs so if you want

your insurance to be ideal for you, it is important that you tell your

insurance provider if you have any existing medical conditions.

Make sure you detail out all those that is likely to influence the insurer in

making their assessment or providing you with travel insurance. The

consequences of not giving the correct information could mean you

would not be covered should an incident occur which work out very

expensive or even could mean you put your life at risk.

5. MULTI TRIP TRAVEL INSURANCE:-

Multi trip travel insurance allows the insured to travel multiple times during the

coverage period. There are different travel insurance products specially

designed to meet the requirements of those who travel multiple times in a year.

This plan is quite popular with business people. There is usually a limit of 30,

45 or 60 days as being the maximum number of days outside India in a single

trip under the Multi trip plans.

56

Eligibility:-

For all ages between 18 years 70 years. However, some companies offer

annual multi trip insurance for age as low as 6 months too. For age above 70

years, insurance may be obtained by special approval and at the sole

discretion of the insurance company, on case to case basis.

Policy Duration:-

Policy is issued for 365 days and maximum days covered per policy year are

180 days You can choose 30, 45, 60 or 90 days as the maximum duration per

trip.

Policy Maximum (Coverage Amount):-

Various coverage options are offered in the range of US $ 10,0000 to US $

500,000.

Max Trip per Policy:-

Multiple trips per policy period are covered. There is a restriction of

maximum days (Mostly 180 Days) covered during the year.

Pre-existing diseases:-

Pre-existing ailments and maternity are generally excluded. There are few

companies which provide coverage in case of life-threatening situations i.e.

until the insured's heath is stable.

Deductible/Policy Excess:-

There is a Deductible/Policy Excess of 50-100 US$ depending upon the

plans. This implies that for any claim the first $50-100 are to be borne by the

insured

57

Additional Coverage:-

Coverages include Dental Treatment, Medical Evacuation, Repatriation,

Baggage Loss/Delay, Trip Cancellation and Interruption etc. Emergency

Cash Advance may be covered in some plans.

Medical Check-up:-

Medical check-up may be required depending upon the age of the Individual.

Medical check-up are generally required for 60 plus individual. There are

plans offered by some companies with no medical check-ups up to 70 years

with some limit on per illness or injury.

Renewal:-

The policy can be renewed after completion of one year.

Premium:-

Plan Premium is based upon your destination, Coverage Amount, Age and

max days per trip.

Exclusions:-

General Physical Checkup, pre-existing conditions, Vision (Eye Test, Eye

Glasses, and Contact Lens), Pregnancy and Prenatal Care is not covered by

any of the Plan. Besides these, there could be other exclusions which are

mentioned in the policy wordings.

Claim:-

In order to make a claim; you need to contact the Insurer or Third Party

Administrator (TPA) of the Insurance Company, which has tie-ups with

network hospitals worldwide.

58

6. ASIA TRAVEL INSURANCE:-

It is common among Indians to travel frequently within Asia. Indians visit

Asian countries like Malaysia, Hong Kong, Indonesia, Maldives, Singapore,

Nepal, Sri Lanka etc for several reasons. While travelling within Asia you

require travel insurance but most of the people tend to ignore this fact. There are

several insurance companies to offer you Asia travel insurance. You can choose

affordable Asia travel plan of your choice and stay secure.

Indians frequently travel within Asia be it for vacation or for business, popular

destinations include Dubai, Thailand, Malaysia, Hong Kong, Indonesia,

Maldives, Singapore, Sri Lanka, Nepal etc. Quite often travelers from India to

these Asian countries tend to ignore travel insurance. Travel insurance within

Asia is however very affordable when compared to other overseas travel

insurance plans to the rest of the world.

Asia travel insurance plan covers the insured for medical expenses, passport

loss, accidents, repatriation, and more. Asia travel insurance can be purchased

for Single trip and Multi trip respectively based on individual requirements. It is

prudent to purchase Asian travel insurance given its low cost when compared to

the coverage it provides. Make sure that you are secure with Asia travel

insurance whether you are walking through the colorful streets of Bangkok or

relaxing in the exotic islands of Maldives.

Single Trip Insurance is essential for occasional travelers. A single trip that lasts

for a maximum period of six months is covered under this plan. Single Trip

insurance policy is exclusively designed to suit the requirements of individuals,

family and businessmen respectively. Emergencies are always unanticipated

while travelling overseas. Single Trip insurance covers you for Medical

expenses, Emergency evacuation/repatriation, Accidental death, injury or

disablement benefit, Trip cancellation, Delayed departure, Delayed baggage etc.

59

7. DOMESTIC TRAVEL INSURANCE PLANS:-

Domestic insurance policies cover travelers within India. These plans can be

purchased either for a single trip, or for the entire year. Your domestic Travel

insurance becomes ineffective once you are out of home country.

Travel is a necessity these days whether be it for business or for simply taking a

break from your daily life and rejuvenating yourself or spending some quality

time with your family. Travel comes with own risks - an accident or theft, both

could leave you or your family in a troublesome situation during travel. Swades

Yatra insurance plan takes care of all your needs during domestic travel. The

policy comes with 4 different plans, customized to suit the various needs of a

domestic traveler.

India is country which has great variety of historical and geographical travel

destinations. You can enjoy your holidays by visiting fabulous places like Goa,

Kashmir, and Kerala etc. Visiting all these places comes with element of risk.

Thats why buying domestic travel insurance is very important. In India places

like north India cause problems in winter where place like Mumbai, Kerela are

vulnerable in monsoon. Domestic travel insurance will prepared you against the

risk connected with trip. Domestic travel insurance which will cover your trip

anywhere within India.

A person on his vacation with his family waiting at Delhi airport to catch the