Beruflich Dokumente

Kultur Dokumente

Aurelius Statement 08-14 - FINAL

Hochgeladen von

Cronista.com0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10K Ansichten1 SeiteAurelius capital management, LP says no realistic prospect of a private solution. Argentina's leaders have made a calculated, cynical decision to violate and repudiate court orders. Nothing herein should be considered investment advice or a recommendation to buy or sell any security.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAurelius capital management, LP says no realistic prospect of a private solution. Argentina's leaders have made a calculated, cynical decision to violate and repudiate court orders. Nothing herein should be considered investment advice or a recommendation to buy or sell any security.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10K Ansichten1 SeiteAurelius Statement 08-14 - FINAL

Hochgeladen von

Cronista.comAurelius capital management, LP says no realistic prospect of a private solution. Argentina's leaders have made a calculated, cynical decision to violate and repudiate court orders. Nothing herein should be considered investment advice or a recommendation to buy or sell any security.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

AURELIUS CAPITAL MANAGEMENT, LP

FOR IMMEDIATE RELEASE

August 13, 2014

CONTACT:

Hal Bienstock

Prosek Partners

hbienstock@prosek.com

212-279-3115 x253

Brian Schaffer

Prosek Partners

bschaffer@prosek.com

212-279-3115 x229

AURELIUS CAPITAL COMMENTS ON ARGENTINAS DEFAULT SAGA

Aurelius Capital Management, LP today issued the following statement:

In addition to our exhaustive efforts to settle with Argentina, we have engaged with many private

parties about a so-called private solution that would avert or end the present Event of Default

on tens of billions of dollars of Argentine sovereign debt. That engagement has convinced us

that there is no realistic prospect of a private solution.

No proposal we received was remotely acceptable. The entities making such proposals were not

prepared to fund more than a small part, if any, of the payments they wanted us to accept. One

proposal was withdrawn before we could even respond. And no proposal made by us received a

productive response.

Stripped of this mirage, the sober truth remains: Argentinas leaders have made a calculated,

cynical decision to violate and repudiate court orders and to place the Republic in wholesale

default. Argentine officials hide behind the RUFO provision but make no effort to seek waivers

from it (despite being offered them by many of the exchange bondholders).

The Argentine people have already paid a dear price for their leaders hubris. With Argentina

yet again defaulting on its bonds, we fear the worst is yet to come.

NOTE: Aurelius Capital Management, LP undertakes no duty to update this statement. Nothing herein should be

considered investment advice or a recommendation to buy or sell any securities.

Das könnte Ihnen auch gefallen

- El FMI Sobre La Inteligencia ArtificialDokument42 SeitenEl FMI Sobre La Inteligencia ArtificialCronista.comNoch keine Bewertungen

- YPF 3Q23 Earnings Webcast PresentationDokument9 SeitenYPF 3Q23 Earnings Webcast PresentationCronista.comNoch keine Bewertungen

- Documento Completo Del FMIDokument111 SeitenDocumento Completo Del FMILPONoch keine Bewertungen

- Vision Argentina FMIDokument17 SeitenVision Argentina FMICronista.comNoch keine Bewertungen

- Igj KMBDokument21 SeitenIgj KMBCronista.comNoch keine Bewertungen

- Fallo Expropiación YPFDokument64 SeitenFallo Expropiación YPFLPO100% (1)

- 2206 1Q Staff ReportDokument105 Seiten2206 1Q Staff ReportCronista.comNoch keine Bewertungen

- PR Russia ClassificationDokument3 SeitenPR Russia ClassificationBAE NegociosNoch keine Bewertungen

- World Happiness ReportDokument158 SeitenWorld Happiness ReportCronista.com100% (1)

- Carta MartinezDokument4 SeitenCarta MartinezbracamontiNoch keine Bewertungen

- Berkshire Hathaway IncDokument2 SeitenBerkshire Hathaway IncZerohedgeNoch keine Bewertungen

- FMI ArgentinaDokument135 SeitenFMI ArgentinaCronista.com100% (2)

- Fdius Ubo Detailed Country Position 2008 2019Dokument7 SeitenFdius Ubo Detailed Country Position 2008 2019Cronista.comNoch keine Bewertungen

- YPF 3Q21 Earnings Webcast Presentation FINAL.Dokument11 SeitenYPF 3Q21 Earnings Webcast Presentation FINAL.Cronista.com100% (1)

- CamScanner 12-16-2021 11.38Dokument2 SeitenCamScanner 12-16-2021 11.38Cronista.comNoch keine Bewertungen

- Ley Alivio Fiscal MonotributoDokument18 SeitenLey Alivio Fiscal MonotributoCronista.com100% (1)

- Paises Mas CarosjpgDokument1 SeitePaises Mas CarosjpgCronista.comNoch keine Bewertungen

- Frente de TodosDokument10 SeitenFrente de TodosCronista.comNoch keine Bewertungen

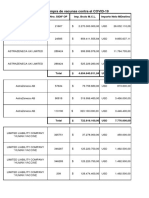

- Pagos Efectuados A LaboratoriosDokument14 SeitenPagos Efectuados A LaboratoriosCronista.comNoch keine Bewertungen

- Frente Vamos Con VosDokument4 SeitenFrente Vamos Con VosCronista.comNoch keine Bewertungen

- Fdius Ubo Detailed Country Position 2020, BEADokument5 SeitenFdius Ubo Detailed Country Position 2020, BEACronista.comNoch keine Bewertungen

- JuntosDokument6 SeitenJuntosCronista.comNoch keine Bewertungen

- Inversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosDokument19 SeitenInversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosCronista.comNoch keine Bewertungen

- Gas DeudaDokument5 SeitenGas DeudaCronista.comNoch keine Bewertungen

- Direct Investment by Country and Industry, 2020Dokument12 SeitenDirect Investment by Country and Industry, 2020Cronista.com100% (1)

- Deuda Provincia Buenos Aires Propuesta BonistasDokument6 SeitenDeuda Provincia Buenos Aires Propuesta BonistasCronista.comNoch keine Bewertungen

- Apéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaDokument122 SeitenApéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaCronista.com100% (1)

- El Informe de The LancetDokument2 SeitenEl Informe de The LancetCronista.comNoch keine Bewertungen

- Ley Alivio Fiscal MonotributoDokument18 SeitenLey Alivio Fiscal MonotributoCronista.com100% (1)

- Soñando Un Mejor ReinicioDokument4 SeitenSoñando Un Mejor ReinicioCronista.comNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Navneet Kumar: Account StatementDokument5 SeitenNavneet Kumar: Account StatementNavneet Kumar VermaNoch keine Bewertungen

- Indirect Tax Part 1 MCQsDokument7 SeitenIndirect Tax Part 1 MCQsGs WaliaNoch keine Bewertungen

- Gmail - Your Tickets PDFDokument2 SeitenGmail - Your Tickets PDFJugJyoti BorGohainNoch keine Bewertungen

- Ch03 SM 9eDokument156 SeitenCh03 SM 9ekmmkmNoch keine Bewertungen

- Tolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Dokument1 SeiteTolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Andrew Gallardo100% (1)

- Jean Keating and Jack SmithDokument13 SeitenJean Keating and Jack Smithpackagingwiz93% (14)

- A Typical Business Organisation May Consist of The Following Main Departments or FunctionsDokument5 SeitenA Typical Business Organisation May Consist of The Following Main Departments or FunctionsGhalib HussainNoch keine Bewertungen

- Car Wash: Executive SummaryDokument5 SeitenCar Wash: Executive SummaryNick CiochinaNoch keine Bewertungen

- Advanced Corporate ReportingDokument5 SeitenAdvanced Corporate ReportingZUNERAKHALIDNoch keine Bewertungen

- Nevis Bank Account Application GuideDokument3 SeitenNevis Bank Account Application GuideBhagwan Singh KeerNoch keine Bewertungen

- Regional Rural Bank (Employees') : Pension Scheme, 2018Dokument8 SeitenRegional Rural Bank (Employees') : Pension Scheme, 2018SAKETSHOURAVNoch keine Bewertungen

- FRM I 2016 - VaR Quiz 2 - NewDokument9 SeitenFRM I 2016 - VaR Quiz 2 - NewImran MobinNoch keine Bewertungen

- To Enter The Section and Row Titles and System Date: BTW Global FormattingDokument28 SeitenTo Enter The Section and Row Titles and System Date: BTW Global FormattingMARINELLA MARASIGANNoch keine Bewertungen

- Manufacturing Cost Sheet Group 1Dokument7 SeitenManufacturing Cost Sheet Group 1Anantha KrishnaNoch keine Bewertungen

- Finals Exercise 2 - WC Management InventoryDokument3 SeitenFinals Exercise 2 - WC Management Inventorywin win0% (1)

- West Bengal Land Reforms Act 1955Dokument77 SeitenWest Bengal Land Reforms Act 1955Pakela ThakelaNoch keine Bewertungen

- Arizona Durable Power of Attorney Form PDFDokument2 SeitenArizona Durable Power of Attorney Form PDFmax midas100% (1)

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDokument1 SeiteBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNoch keine Bewertungen

- Domestic Travel Insurance CoverageDokument1 SeiteDomestic Travel Insurance CoveragePrabhakar DasNoch keine Bewertungen

- Income Taxation NotesDokument31 SeitenIncome Taxation NotesPaul VillacortaNoch keine Bewertungen

- High Court of Calcutta education case decisionsDokument84 SeitenHigh Court of Calcutta education case decisionsShashank SumanNoch keine Bewertungen

- 1 - Case 12 Guna FibresDokument11 Seiten1 - Case 12 Guna FibresBalaji Palatine100% (1)

- Recruitment Agency AgreementDokument3 SeitenRecruitment Agency AgreementratyuNoch keine Bewertungen

- Satisfactory VoucherDokument1 SeiteSatisfactory Vouchervrevatienterprises100% (2)

- Doc. No - Page No. - Book No. - Series of 2019Dokument2 SeitenDoc. No - Page No. - Book No. - Series of 2019Fernan Del Espiritu Santo100% (2)

- Advanced Financial Accounting Problems on Derivatives & HedgingDokument4 SeitenAdvanced Financial Accounting Problems on Derivatives & HedgingalyssaNoch keine Bewertungen

- Comparison Between Retail and CorporateDokument10 SeitenComparison Between Retail and CorporateAkshay RathiNoch keine Bewertungen

- Notification Regarding No MarriageDokument106 SeitenNotification Regarding No MarriageAssistant DirectorNoch keine Bewertungen

- Ias 1Dokument6 SeitenIas 1Aakanksha SaxenaNoch keine Bewertungen

- Villaroel vs. Estrada DigestDokument2 SeitenVillaroel vs. Estrada DigestKattNoch keine Bewertungen