Beruflich Dokumente

Kultur Dokumente

Office of Retirement Services: Overtime and Your Pension

Hochgeladen von

Michigan News0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten2 SeitenPublic Act 264 changed the way overtime will be used to calculate pension value. Change doesn't affect you if you haven't earned any overtime. How overtime is included depends on when your FAC period starts and ends.

Originalbeschreibung:

Originaltitel

Office of Retirement Services: Overtime and Your Pension

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPublic Act 264 changed the way overtime will be used to calculate pension value. Change doesn't affect you if you haven't earned any overtime. How overtime is included depends on when your FAC period starts and ends.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten2 SeitenOffice of Retirement Services: Overtime and Your Pension

Hochgeladen von

Michigan NewsPublic Act 264 changed the way overtime will be used to calculate pension value. Change doesn't affect you if you haven't earned any overtime. How overtime is included depends on when your FAC period starts and ends.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Public Act 264 changed the way overtime will be used to calculate the value of your

pension. Visit www.michigan.gov/orsstatedb for more information, including a tutorial

with an example walkthrough.

Overtime and Your Pension

Tis change does not afect you if you havent earned any overtime.

If you have, it wont have a signifcant impact on your pension if

your overtime earnings have been relatively stable.

FAC: Te average of your highest three consecutive years (36 consecutive months) of compensation. It

could be any time during your career. When ORS determines this, we include base salary, overtime, and

any annual leave payouts, if applicable.

FAC period: Te period from the begin date to the end date of your highest three-year (36-month) span;

if your FAC period starts on March 13, 2008, and you work full-time, it ends on March 13, 2011.

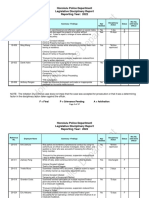

How overtime is included depends on when your FAC period starts and ends,

and how much overtime you work.

STARTS: Before January 1, 2012

ENDS: Before January 1, 2012

STARTS: After January 1, 2012

ENDS: After January 1, 2015

STARTS: Before January 1, 2012

ENDS: Before January 1, 2015

NO CHANGE. Actual overtime will be included in your Final Average

Compensation as part of your wages when it was earned.

2010 2011 2012

Includes actual overtime earned before January 1, 2012 Average overtime prorated

back to January 1, 2009

2009

overtime

2010

overtime

2011

overtime

2012

overtime

+ + +

=

4 years

Final Average Compensation Pension Factor Years Of Service (DB)

FAC

x

1.5%

x

YOS

FAC

x

1.5%

x

YOS

The Pensi on Formul a

2013 2014 2015

Overtime averaged back six years

2015

overtime

2010

overtime

2011

overtime

2012

overtime

+ + +

=

6 years

2013

overtime

2014

overtime

+ +

R0954G (Rev. 7/2014)

Authority: 1943 P.A. 240, as amended

Example 1

Example 2

Example 3

Example 3

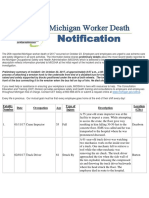

Ben is retiring. After he terminates employment, ORS determines his highest three consecutive years (36 months) of

earnings, using his base salary, overtime and annual leave payout. This is Bens FAC period. ORS then checks to see

whether that three-year period includes any overtime.

ORS recalculates his FAC for the same three-year period using the averaged overtime (averaged over six years). Overtime

earned from 2010-2015 adds up to $32,400, divided by six years = $5,400 averaged overtime. The averaged overtime is

added to his regular wages for his adjusted total compensation. These fgures are used in the FAC calculation.

R0954G (Rev. 7/2014)

Authority: 1943 P.A. 240, as amended

2010 2011 2012 2013 2014 2015

Base salary 49,000 50,000 50,000 50,000 51,000 51,000

Actual Overtime 5,000 4,400 4,000 6,000 6,000 7,000

Annual Leave Payout 5,908

Total Compensation 54,000 55,400 54,000 56,000 57,000 63,908

Averaged Overtime (prorated over six years) 5,400 5,400 5,400

Adjusted Total Compensation 55,400 56,400 62,308

55,400 + 56,400 + 62,308

3

=

58,036 Final Average Compensation

Example 1

Kevin is retiring. After he terminates employment, ORS determines his highest three consecutive years (36 months) of

earnings, using his base salary, overtime, and annual leave payout. This is Kevins FAC period.

2009 2010 2011 2012 2013 2014

Base Salary 49,000 50,000 50,000 50,000 51,000 51,000

Actual Overtime 20,000 20,000 10,000 5,000 5,000 5,000

Annual Leave Payout 6,087

Total Compensation 69,000 70,000 60,000 55,000 56,000 62,087

Kevins last year of compensation, which includes overtime and his annual leave payout, is not included in the FAC

period. Since he worked signifcantly more overtime before January 1, 2012, his FAC period falls before January 1, 2012.

Averaging does not come into play and actual overtime is included in his FAC as part of his wages.

69,000 + 70,000 + 60,000

3

=

66,333 Final Average Compensation

Example 2

Jessica is retiring. After she terminates employment, ORS determines her highest three consecutive years (36 months) of

earnings, using her base salary, overtime, and annual leave payout. ORS then checks to see if that three-year FAC period

includes any overtime. Jessicas FAC period begins before January 1, 2012, and ends after that date.

2009 2010 2011 2012 2013 2014

Base salary 49,000 50,000 50,000 50,000 51,000 51,000

Actual Overtime 5,000 10,000 20,000 20,000 1,000 5,000

Annual Leave Payout 5,908

Total Compensation 54,000 60,000 70,000 70,000 52,000 61,908

Averaged Overtime (prorated back to 2009) NA NA 13,750

Adjusted Total Compensation 60,000 70,000 63,750

60,000 + 70,000 + 63,750

3

=

64,583 Final Average Compensation

Only the period of the FAC after January 1, 2012, includes averaged overtime rather than actual overtime. It is averaged

over the period from January 1, 2009 to the end of the FAC period (four years in this example). Overtime earned from

2009-2012 adds up to $55,000, divided by four years = $13,750 averaged overtime. The averaged overtime is added to her

regular wages of $50,000 for an adjusted total compensation for 2012 of $63,750. This fgure is used in the FAC calculation.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- (Written Work) & Guide: IncludedDokument10 Seiten(Written Work) & Guide: IncludedhacknaNoch keine Bewertungen

- HPD Discipline ReportDokument17 SeitenHPD Discipline ReportHNNNoch keine Bewertungen

- Constructive Dismissal - 2016Dokument9 SeitenConstructive Dismissal - 2016Irene Quimson100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Seminar in Public Management - Chapter 1Dokument18 SeitenSeminar in Public Management - Chapter 1ibudanish79100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Authoritarianism and Creativity: Else Frenkel-Brunswik and The Authoritarian PersonalityDokument15 SeitenAuthoritarianism and Creativity: Else Frenkel-Brunswik and The Authoritarian PersonalityAlfonso MontuoriNoch keine Bewertungen

- Moral Turpitude: Misleading the Court - California Compendium on Professional Responsibility State Bar Association -Moral Turpitude Defined and Applied - California Attorney Misconduct Legal Reference - Business & Professions Code § 6106 Commission of Any Act Involving Moral Turpitude, Dishonesty or Corruption - California Supreme Court Justice Leondra R. Kruger, Justice Mariano-Florentino Cuellar, Justice Goodwin H. Liu, Justice Carol A. Corrigan, Justice Ming W. Chin, Justice Kathryn M. Werdegar, Justice Tani G. Cantil-Sakauye California Business and Professions Code § 6100 Supreme Court Summary DisbarmentDokument3 SeitenMoral Turpitude: Misleading the Court - California Compendium on Professional Responsibility State Bar Association -Moral Turpitude Defined and Applied - California Attorney Misconduct Legal Reference - Business & Professions Code § 6106 Commission of Any Act Involving Moral Turpitude, Dishonesty or Corruption - California Supreme Court Justice Leondra R. Kruger, Justice Mariano-Florentino Cuellar, Justice Goodwin H. Liu, Justice Carol A. Corrigan, Justice Ming W. Chin, Justice Kathryn M. Werdegar, Justice Tani G. Cantil-Sakauye California Business and Professions Code § 6100 Supreme Court Summary DisbarmentCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNoch keine Bewertungen

- 11go Coc CoeDokument2 Seiten11go Coc CoePatrick Ignacio83% (48)

- To Our Customers: DuMouchellesDokument1 SeiteTo Our Customers: DuMouchellesMichigan NewsNoch keine Bewertungen

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDokument2 SeitenMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNoch keine Bewertungen

- Shots FiredDokument2 SeitenShots FiredMichigan NewsNoch keine Bewertungen

- ShootingsDokument4 SeitenShootingsMichigan NewsNoch keine Bewertungen

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDokument1 SeiteDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNoch keine Bewertungen

- The 25th Reported Michigan Worker Death of 2017 Occurred On October 23Dokument6 SeitenThe 25th Reported Michigan Worker Death of 2017 Occurred On October 23Michigan NewsNoch keine Bewertungen

- Six Public Building Projects Honored For $2.1 Million in Annual Energy Savings Through Use of Performance ContractsDokument3 SeitenSix Public Building Projects Honored For $2.1 Million in Annual Energy Savings Through Use of Performance ContractsMichigan NewsNoch keine Bewertungen

- Liposuction Doctor Suspended For Health Code ViolationsDokument1 SeiteLiposuction Doctor Suspended For Health Code ViolationsMichigan NewsNoch keine Bewertungen

- Schuette West Bloomfield Doctor Plead No Contest To Larceny ChargesDokument2 SeitenSchuette West Bloomfield Doctor Plead No Contest To Larceny ChargesMichigan NewsNoch keine Bewertungen

- Legal Profession Reviewer MidtermsDokument9 SeitenLegal Profession Reviewer MidtermsShasharu Fei-fei LimNoch keine Bewertungen

- People V Alberto Anticamara, 651 SCRA 489 - CASE DIGESTDokument7 SeitenPeople V Alberto Anticamara, 651 SCRA 489 - CASE DIGESTTheodoreJosephJumamilNoch keine Bewertungen

- Civ Pro 13.2Dokument3 SeitenCiv Pro 13.2Taylor Shelton HowardNoch keine Bewertungen

- Pepsi CoDokument3 SeitenPepsi CoCH Hanzala AmjadNoch keine Bewertungen

- Seminar On Refinery Maintenance Management and TPM Held at Saudi Aramcos Ras Tanura RefineryDokument4 SeitenSeminar On Refinery Maintenance Management and TPM Held at Saudi Aramcos Ras Tanura Refinerychaitanya_kumar_13Noch keine Bewertungen

- Quran From The Point of View of NonDokument1 SeiteQuran From The Point of View of NonArfaq HussainNoch keine Bewertungen

- Spec Pro - Digests Rule 91 Up To AdoptionDokument11 SeitenSpec Pro - Digests Rule 91 Up To Adoptionlouis jansenNoch keine Bewertungen

- Surf Excerl SurndraDokument26 SeitenSurf Excerl SurndraAnil ChauhanNoch keine Bewertungen

- University of The East Basic Education Department-ManilaDokument4 SeitenUniversity of The East Basic Education Department-ManilaTrixia ElizanNoch keine Bewertungen

- Od QuestionsDokument2 SeitenOd QuestionsAuberon Jeleel OdoomNoch keine Bewertungen

- Pineda vs. CADokument15 SeitenPineda vs. CAAji AmanNoch keine Bewertungen

- Individual Technical Report: (For Home Improvement/ Home Extension)Dokument4 SeitenIndividual Technical Report: (For Home Improvement/ Home Extension)lakshmi narayanaNoch keine Bewertungen

- Omprakash V RadhacharanDokument2 SeitenOmprakash V RadhacharanajkNoch keine Bewertungen

- Uttar Pradesh State Legal Services Authority: Final Draft OnDokument23 SeitenUttar Pradesh State Legal Services Authority: Final Draft OnAnkur BhattNoch keine Bewertungen

- TKD Amended ComplaintDokument214 SeitenTKD Amended ComplaintHouston ChronicleNoch keine Bewertungen

- Narrative Report MCLEDokument1 SeiteNarrative Report MCLEMayer BaladbadNoch keine Bewertungen

- Francis Bacon Revenge Download PDFDokument2 SeitenFrancis Bacon Revenge Download PDFannabeth chaseNoch keine Bewertungen

- Unit 18Dokument18 SeitenUnit 18Sai Anil SNoch keine Bewertungen

- Ten Commandments of Espionage PDFDokument8 SeitenTen Commandments of Espionage PDFlionel1720Noch keine Bewertungen

- Vanshika Gupta - Professional EthicsDokument16 SeitenVanshika Gupta - Professional EthicsVanshika GuptaNoch keine Bewertungen

- Pode Não-Europeus Pensar?Dokument9 SeitenPode Não-Europeus Pensar?Luis Thiago Freire DantasNoch keine Bewertungen

- Rizal Activity 1Dokument2 SeitenRizal Activity 1Mesael S. Mateo Jr.Noch keine Bewertungen

- Cross Cultural Human Resource ManagementDokument34 SeitenCross Cultural Human Resource ManagementZunair Shahid100% (1)