Beruflich Dokumente

Kultur Dokumente

US Shake Out Eventually Hits Australia

Hochgeladen von

cpscapitalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Shake Out Eventually Hits Australia

Hochgeladen von

cpscapitalCopyright:

Verfügbare Formate

US Shake out eventually hits Australia

Author:KATRINA

NICHOLASandJANEAKIN

Date:05/04/2000

Australian tech stocks suffered one of their worst days ever yesterday, with the Biz.com Investor

Web technology index plummeting more than 12 per cent, or 844.8 points, to 5864.3.

One market watcher described the performance as the ``shake-out we had to have", after the

Nasdaq, the US technology barometer, dived 349.15 to 4223.68.

Nasdaq registered its dramatic fall when investors sold Microsoft stock before a US court ruled that

the computer giant had violated the Sherman Anti-Trust Act. Since last week Nasdaq has dropped

more than 17 per cent. Technology indices in other overseas markets were not immune either, with

the British TechMark index losing 247.5 to close at 4083.3.

Locally, 24 tech stocks fell more than 15 per cent. Those worst hit were Open Telecommunications,

down 40c to $11.60, Davnet, down 95c to $4.05, Isis Communications, 50c to $1.55, Solution 6,

$1.45 to $8.95 and Melbourne IT, $1.83 to $11.30.

Ecorp, Solution 6 and Reckon are now almost 50 per cent off their recent highs. But despite the

widespread falls, telecom player Tele2000 and e-commerce outfit Working Systems, which both made

debuts yesterday, closed above their 50c issue prices.

Shares in Working Systems, which is valued at $65 million, opened at $1 and closed at 86c, while

Tele2000 closed at 58c after opening at 49c.

Tele2000 chief executive Mr Daniel Hayman said considering he could not have picked a worse day to

list, the company had done quite well. ``This doesn't make us that nervous because we're in it for the long

run."

Mr Marcus Fanning, AMP head of Australian equities and a widely respected fan of ``growth" stocks,

predicted that the phenomenal bull run in the technology sector was finally over.

``Many times over the last three years we've seen the sector cool down and then recover," Mr Fanning

said. ``But I don't think this is the same. The easy money days are over."

Mr Fanning, who heads the second-best-performing fund in the market, said his investment strategy

would not be affected by the sell-off. ``I don't think buying in growth is dead. In fact, I think some will be

priced ever higher, but the investment will be much more selective," he said. ``The real key to what

happens will be the retail investor. This was the first day retail investors didn't see a major bounce after

a major fall."

William Noall analyst Mr Matthew Rey said both ``good and bad Internet stocks" were pummelled

yesterday.

``I don't think the market is distinguishing [between tech stocks] yet, but it will happen and it's shake-

outs like this which make it more likely," he said. ``This is the beginning of the wash-out people have

been expecting."

Mr Rey said he had already heard of tech companies that were due to float in coming months ``hitting

the cancel button", adding that few firms would want to underwrite a float in such volatile conditions.

Another analyst also said he doubted whether some tech floats would go ahead, especially if further

Nasdaq falls translated to continued slides on the local market. He said Nasdaq could fall below 4000,

causing more retail investors to ``stampede".

However, some analysts said the correction might be temporary.

CPS Capital's Mr Tony Cunningham said strong after-market trading

in the US resulted in many US tech stocks regaining lost ground.

``So we shouldn't be writing tech stocks off just yet."

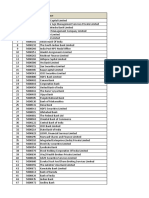

WINNERS

LOSERS

Working Systems 71.2% 86c

Pharmanet Online 4% 52c

131 Shop.com 3.2% 32c

Securenet 25.7% $9.14

Isls Comm 24.4% $1.55

Open Telecom 24.2% $11.60

Das könnte Ihnen auch gefallen

- Boom in Techs Not Based On The 'Facts'Dokument4 SeitenBoom in Techs Not Based On The 'Facts'cpscapitalNoch keine Bewertungen

- Net Debs Fail To Shine, But The DanceDokument4 SeitenNet Debs Fail To Shine, But The DancecpscapitalNoch keine Bewertungen

- Sausage Pair Pick Up $10mDokument3 SeitenSausage Pair Pick Up $10mcpscapitalNoch keine Bewertungen

- Net Losers Do $28.5mDokument2 SeitenNet Losers Do $28.5mcpscapitalNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Dokument29 SeitenThe Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Cherry BlasoomNoch keine Bewertungen

- PMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमDokument31 SeitenPMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमAbinash MandilwarNoch keine Bewertungen

- Environmental Justice and Nigerian OilDokument26 SeitenEnvironmental Justice and Nigerian OilLiz Miranda100% (1)

- BHP OkDokument4 SeitenBHP Okahmad ari bowoNoch keine Bewertungen

- L&T DemergerDokument28 SeitenL&T DemergerAmit MehraNoch keine Bewertungen

- Auditing FundamentalsDokument15 SeitenAuditing FundamentalsDiana Faye CaduadaNoch keine Bewertungen

- Accounting Chapter 16 exercises and solutionsDokument10 SeitenAccounting Chapter 16 exercises and solutionsAnonymous jrIMYSz9Noch keine Bewertungen

- Global Medical Systems #27, Model House II Street, Basavanagudi, Bengaluru - 560004 2661 7623, 2661 1679 9 4404979Dokument2 SeitenGlobal Medical Systems #27, Model House II Street, Basavanagudi, Bengaluru - 560004 2661 7623, 2661 1679 9 4404979Archesh DeepNoch keine Bewertungen

- Anil AmbaniDokument13 SeitenAnil AmbaniJayaJayashNoch keine Bewertungen

- Annual Report 4Dokument156 SeitenAnnual Report 4Sassy TanNoch keine Bewertungen

- Average Costing in Oracle R12 EBS SuiteDokument26 SeitenAverage Costing in Oracle R12 EBS Suitehsk12100% (1)

- About Unilever Presentation - tcm96-227455Dokument26 SeitenAbout Unilever Presentation - tcm96-227455asma246Noch keine Bewertungen

- Petronas License NorimaxDokument4 SeitenPetronas License NorimaxSalman FarisiNoch keine Bewertungen

- Strategic Cost Management Preliminary ExamDokument8 SeitenStrategic Cost Management Preliminary ExamJam Crausus100% (1)

- PHD Thesis - Table of ContentsDokument13 SeitenPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Karnataka Police Establishment BoardDokument64 SeitenKarnataka Police Establishment BoardxfilesindiaNoch keine Bewertungen

- Divya Pandya NNDokument29 SeitenDivya Pandya NNKrishnaNoch keine Bewertungen

- Sr. No POP Reg No POP NameDokument8 SeitenSr. No POP Reg No POP NameSwati Rohan JadhavNoch keine Bewertungen

- Arco Pulp and Paper Co Vs LimDokument2 SeitenArco Pulp and Paper Co Vs LimJoey Albert De Guzman100% (1)

- Seating Arrangement: Directions (Q. 1-5) Study The Following Information To Answer The Given QuestionsDokument7 SeitenSeating Arrangement: Directions (Q. 1-5) Study The Following Information To Answer The Given QuestionsbrmNoch keine Bewertungen

- A Study On Murex-AparnaDokument11 SeitenA Study On Murex-AparnaG.v. Aparna50% (2)

- 5.1 Capital Companies in PolandDokument6 Seiten5.1 Capital Companies in PolandBianca SăvulescuNoch keine Bewertungen

- Loudwolf Holdings LTD.: Disclosure Statement: by Unanimous Consent of The Board of Directors, The Executive ofDokument5 SeitenLoudwolf Holdings LTD.: Disclosure Statement: by Unanimous Consent of The Board of Directors, The Executive ofLivingStone2012Noch keine Bewertungen

- CANALISATIONDokument34 SeitenCANALISATIONPiyushVarmaNoch keine Bewertungen

- American Wheels Chinese RoadsDokument2 SeitenAmerican Wheels Chinese RoadsDean RussellNoch keine Bewertungen

- Objective of The StudyDokument68 SeitenObjective of The StudyArchie SrivastavaNoch keine Bewertungen

- Fiat Case StudyDokument10 SeitenFiat Case StudyVipra PandeyNoch keine Bewertungen

- 04 - Asymmetric Information - Moral HazardDokument24 Seiten04 - Asymmetric Information - Moral Hazardepl_manutdNoch keine Bewertungen

- Leng Chan QuekDokument3 SeitenLeng Chan QuekEddy Fazwan0% (1)

- ChennaiDokument28 SeitenChennaiPrabhu Ta100% (1)