Beruflich Dokumente

Kultur Dokumente

Ten Principles of Economics

Hochgeladen von

Bea Maxine P. Bandigan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

62 Ansichten8 SeitenEconomics

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenEconomics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

62 Ansichten8 SeitenTen Principles of Economics

Hochgeladen von

Bea Maxine P. BandiganEconomics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

Ten Principles of Economics

Scarcity limited nature of societys resources.

Economics the study of how society manages its scarce resources.

Principles are rules by which conduct may be guided.

Principles should be followed whenever the field/subject it pertains to is being practices. Principles are the foundation of any field; it is where other concepts and practice of it

is based upon.

E.g. Ten Principles of Economics

Seven Principles of Accounting

(E.g. principle of conservatism, uniform currency, and of perpetuity)

The Ten Principles of Economics

How People Make Decisions

1.) People face trade-offs.

2.) The cost of something is what you give up to get it.

3.) Rational people think at the margin.

4.) People respond to incentives.

How People Interact

5.) Trade can make everyone better off.

6.) Markets are usually a good way to organize economic activity.

7.) Government can sometimes improve market conditions.

How the Economy as a Whole Works

8.) A countrys standard of living depends on its ability to produce goods and services.

9.) Prices rise when the government prints too much money.

10.) Society faces a short-run trade-off between inflation and unemployment.

PRINCIPLE 1: People face trade-offs.

To get what we like, we give up another thing that we also like. Making decisions requires trading off one goal against another. Basis is that we in particular and society in

general have limited resources to spare but usually numerous or even unlimited use for that particular resource. Related to the concept of opportunity cost.

Based on the adage (proverb) there is no such thing as a free lunch - meaning you have to pay the price (the resource you have) to get the commodity you like. Another

adage is you cannot have your cake and eat it too meaning if you equally like a commodity, because of limited resources, you must give up the other one.

Examples:

With you available time (the most important resource students like you have, because you are still young), for what purpose will you use it for? Would you study

economics or spend it for other possible uses for the time spent for studying economics: study marketing, watch TV, malling, spend time with the family at home, etc.

The price of not studying economics might be more costly than the other options stated above because it will result in a failing mark which would cost you your time, effort

and money for a repeated course, not to mention a failing grade could disapprove your application for work after graduation.

Opportunity cost if time is also the reason you should not be late - to give respect to the time of other people so as not to waste their time. Do not be early also because in that

case, you will be wasting your own time. Best option: be on time.

Usually, as we have discussed before, among the options we have for the use of a certain resource, the one that have the highest value or utility is chosen (even if they have

equal prices), i.e. lock for your room instead of buying the money and for your make-up kit that are priced equally.

Efficiency and Equity (usually being decided by the government)

Efficiency means that the society is getting the maximum benefits from its scarce resources.

Equity means that those benefits are distributed fairly among societys members.

E.g.: When the government says that GNP increased by 7%, people always doubt it.. The concern actually is the distribution (equity of that increase. The pie got bigger, but

my share got smaller, people would say.

Issue: taking the money from the rich to attain equity will discourage people to work hard and might be rewarding people who were lazy (the possible reason why they got a

smaller piece of the pie.)

Note: Recognizing that people face trade-offs does not by itself tells us what decisions they will or should make, i.e. people will not abandon study of psychology to have

more time for economics because they are equally important subjects. The poor should not be ignored just because helping them disrupts work incentives. Land should not be

in the hands of the few only (landlords)

PRINCIPLE 2: The cost of something is what you give up to get it.

Because people face trade-offs, making decisions requires comparing the costs and benefits of alternative courses of action. In many cases, the cost of some action is not as

obvious as it may appear.

E.g.: going to college benefit: intellectual enrichment and lifetime

costs: money, effort and time (the greatest cost to young people, and the most valuable to the old ones) cost of tuition, board, transportation, books,

lost of time for a job or full enjoyment of other things to do (malling, time with friends, sports, etc.)

Opportunity cost: - is what you give up to get an item. This represents the other items you cannot do or get because you have chosen the other commodity.

E.g.:

Dropping out of school to be an athlete the opportunity cost (not being able to go to college) is much higher than the income o be earned from sports, therefore the rationale

should be to continue school. But if the income from sports (i.e. NBA) is very high to off-set the possible lifetime income after college, students will choose that sport.

Choice of buying a lock or make-up for the same price (e.g. 150 php) - Since they have the same price, we should pick up the one that has a higher value or usefulness. The

value of having the lock (being secure at home in your room and having a good night sleep) is better than the value (opportunity cost) of getting the make-up kit.

Note: Please copy the graph to be written on the board by the instructor. The graph is nearly impossible to construct in MS Word.

PRINCIPLE 3: Rational people think at the margin

A rational decision maker or consumer takes an action if and only if the marginal benefit of the action exceeds the cost.

Rational people people who systematically and purposefully do the best they can to achieve their objective.

Marginal changes small incremental changes to a plan of action.

Marginal benefit - incremental value when consuming another unit of a product or when adding an additional unit of resource in your business.

Marginal Cost incremental price you have to pay for an additional unit of good one will be having.

How to achieve maximum profits for the firm and maximum satisfaction for the consumer?

Maximum profits benefit condition: MB MC = P

In the process of getting more benefit from a certain additional commodity, of course, additional costs or marginal costs are associated, but as long as marginal benefit is

greater than marginal cost (MB>MC), the rational person will continue consuming that commodity.

E.g.: having additional subjects will let you finish college early, as long as each of the additional subjects will not be too costly in terms of time, effort, and tuition fees, and

the earlier graduation will bring in more benefits like an early job, students would be enticed to enroll in more subjects.

Firms decide how many workers to hire and how much of their product to manufacture and sell to maximum profits. Consumers buy a bundle of goods and services to achieve

the highest possible level of satisfaction subject to their income and prices of the commodities.

Margin means edge, so marginal changes are adjustment around the edges of what you are doing.

E.g.:

Airline tickets

If the cost plus some profit of a one way flight for a certain airline company is 400,000.00 php and the maximum number of passengers the plane can accommodate, then the

price (cost) per ticket in 400,000.00 php/200 = 2,000.00 php. If the plane about to leave still has 8 seats left? Is it worth it to accommodate another passenger at 1000 php

only? Yes, because the additional 1,000 php is greater than the additional cost to be incurred (the additional snacks to be served).

Paradox existence of a two conditions that is both contrary to what is expected to be normal.

Paradox of water and diamonds why is water cheaper when it is more useful than diamonds?

This is partly because since water is so plenty, the additional or marginal value of an additional unit of water is small as compared to having your first diamond and the

succeeding ones. But think of this: if you are in the middle of the desert, you will choose water over diamonds because it definitely, the marginal satisfaction or usefulness of

it is way much higher than diamonds (the human body is about 90% water, the brain is about 75% water, if someone will loose 10% of his /her bodys water content, he/she

will die).

PRINCIPLE 4: People respond to incentives

Because rational people make decisions by comparing costs and benefits, they respond to incentives.

I ncentive something that induces a person to act.

Whats the greatest incentive for a firm/entrepreneur? More Profit

Whats the greatest incentive for a consumer? More benefit/ satisfaction

Whats the greatest benefit for an employee? Higher salary through promotions/ bonuses

For a student? Higher grades? Higher allowance? More make-up kit?

E.g.: When the price of pork gets higher, hog farmers would be encouraged to invest more on hog raising, however, pork consumers may turn to beef or chicken because the

price of pork is higher.

PRINCIPLE 5: Trade can make everyone better off.

A commodity that is best produced by each individual or nation and traded can make everyone better off.

This involves the concept of specialization (division of labor) and natural resource endowments. Imagine if you or your family will not trade for any services or goods

because you want to be self-sufficient, then you will have to produce everything you need in life food, clothes medicines, education, house, etc. Trade can also make

available goods that can never be produced in a certain locality. E.g.: apples and coconut that can only be grown in certain parts of the world; oil and diamonds where they can

only be found.

With trade and the accompanying competition such as competition in jobs, hunting and competition in buying the best foods for the lowest prices, your family gains much

from its ability to trade with others. You now can therefore specialize in the best thing you can do and let the others do the other things they can do better and just trade in.

This applies to nations as well.

Overall result is a variety of goods and services available at the market at competitive prices.

E.g.:

The Philippines can also produce its own cars, computers, cell phones, medicines, but to do this, we will have to invest a lot on research, manpower development, design

machineries, time, etc. before we can develop an efficient manufacturing facility to have competitively priced commodities.

PRINCIPLE 6: Markets are usually a good way to organize economic activity.

Centrally Planned Economy (communism in Central and Eastern Europe before 1980s) based on the idea that central planning by the government could organize

economic activity in a way that promoted economic well-being for the country as a whole. The government determine what goods and services were produced, how to

produce them, how much was produced, and who will produce and consume these goods. Even the profession a child should take is also decided upon by the central

government.

Market economy an economy that allocated resources through the decentralized decisions of many firms and households as they interact in markets for goods and services.

- Decisions of a central planner are replaced by the decisions of millions of firms and households.

- Firms decide who to hire and what to produce.

- Households decide which firms to work for and what to buy with their incomes.

- Firms and households interact in the marketplace, where prices and self-interest guide their decisions.

- Nobody is looking for the well being of society as a whole (mostly only self-interest exists).

Despite the decentralized decision making and self interest decision makers, market economies have proven remarkably successful in organizing economic activity in a way

that promoted overall economic well-being.

The invisible hand by Adam Smith in his book (An Inquiry into the Nature and Causes of the Wealth of Nations)

- Prices are the instrument with which the invisible hand directs economic activity.

- Prices directs consumers how much to demand while it directs firms how much to supply.

- Household and firms interacting in the market act as if they are guided by an invisible hand that leads them to desirable market outcomes and maximize the welfare

of the society as a whole.

PRINCIPLE 7: Government can sometimes improve market conditions.

If the invisible hand is so great, what do we need the government for? The invisible hand can only work its magic if the government would:

1.) Enforce the rules and maintains the institutions that are key to the market economy. i.e. setting up the environment for a pure competitive market like EPIRAL

law, anti-thrust laws, etc.

2.) Setting up property rights, e.g. preventing theft of goods produced including copying of CDs.

3.) Change the allocation of resources that people would choose on their own: to promote efficiency and to promote equity.

Market failure a situation in which a market left on its own fail to allocate resources efficiently.

E.g.: there are many college graduates in the Philippines yet we fail to employ them in a more productive manner (unemployment, underemployment, average of 12 to 14

months before getting a job)

Externality the impact of one persons on the well-being of the bystander, spill-over effect of ones economic activity that was not done intentionally but associated with

the activity.

Market power the ability of a single economic actor (or small group of actors) to have a substantial influence on the market prices.

e.g.: NPC owns about 80% of electricity generating power plants, this is one of the reasons why the EPIRA law was enacted.

Land Reform (CARP): this is aimed to have more equity in the distribution of a very important productive resource, the land. Furthermore, having a landlord

and a tenant is a manifestation of a primitive economic system, feudalism, that will no longer work or applicable in a modern day economy (will just cause unrests).

Japan and the US have completed their land reform long ago (1800s), as well as other countries of the modern world.

CARP mandates that an individual now can only own a maximum of five hectares of land, with some exceptions or conditions.

Policies are aimed to enlarge the economic pie or to change how the pie is divided. But although it has altruistic intentions, it is not perfect; sometimes it fails to deliver the

objective it has set.

PRINCIPLE 8: A countrys standard of living depends on its ability to produce goods and services.

Productivity the quantity of goods and services produced from each hour of a workers time (related to efficiency).

The differences in the living standards around the world are staggering.

- In 2003, an average American had an annual income of $37,500.00 (about 2,000,000.00 php per year)

- Average Mexican earned $8,950.00 (about 200,000.00 php)

- Nigerians earned $900.00 (about 37,000.00 php)

These variations in average income are reflected in various measures of the quality of life such as:

- Material possessions (cars, cell phones, TV sets, good house, nice clothes jewelries, etc.)

- Better health care

- Better nutrition

- Longer life expectancy

These variations are caused by the differences in productivity nations in which their workers can produce a large quantity of goods and services from each hour or day of

workers time; they enjoy a high standard of living. With less productive workers, most people endure a more meager (too little) existence. Similarly, the growth rate of a

nations productivity determines the growth rate of its average income.

Thats why the land reform (CARP) would be implemented immediately and in full to let our workers be more productive or at least they will get the return due them and not

to the landlords.

Government, on the other hand, in making decisions and policies, should always think how policy can raise productivity by ensuring that workers are well educated, have the

tools needed to produce goods and services, and have the best available technology.

Additional staggering differences in world income in poor countries:

- widespread poverty and growing income as asset inequality

- rapid population growth

- low levels of literacy and nutrition intake

- rising levels of urban employment and underemployment

- chronic balance of payments and foreign balance of payments and foreign debt burdens

- more than of the worlds people live in developing countries but they only enjoy 16% of the world income; while then richest 20% have 85% of the global income.

Adage: If you want a high standard of living, then settle for a low quality of life.

PRINCIPLE 9: Prices rise when the government prints too much money.

I nflation increase in the overall level of prices in the economy.

What causes inflation? The ultimate cause of inflation is growth in the quality of money. When government creates large amount of money, the value of money falls.

E.g.: In Germany in 1921 to 1922, inflation rate was more than 23 million per cent ( a newspaper priced 0.30 marks became 70,000,000 marks). This was mainly caused y the

printing of money brought about by World War I. In Brazil in the 1960s, inflation was about 2000% every month due to political instability (military rule).

PRINCIPLE 10: Society faces a short-run trade-off between inflation and unemployment.

Higher level of prices (inflation) in the long-run is the primary effect of increasing the quantity of money.

In the short run, the effects of increased quantity of money are as follows:

- Increasing the amount of money in the economy stimulates the overall level of spending and thus the demand for goods and services.

- Higher demand may cause firms to raise their prices and may also encourage them to increase the quantity of goods and services they produce and to hire more

workers to produce their goods and services.

- More hiring means low underemployment.

- These lead to an economy-wide trade-off in the short run (about 1 to 2 years) between inflation and underemployment (an increase in monetary supply will lead to

higher inflation but will reduce underemployment)

- This trade-off is independent of the level of inflation and unemployment prior to the introduction of more money to the economy.

The government can exploit the short-run trade-off between inflation and underemployment by using various policy instrument:

- changing the amount the government spends

- lower or higher taxes (fiscal policies)

- the amount of money it prints (monetary policy)

These instruments of economic policy are potentially powerful, policy makers should be careful should use these instruments judiciously.

Business Cycle: fluctuations in economic activity, such as employment and production.

Reference: Principles of Economics by Mankiw.

In the Philippines, how do we increase the volume of monetary supply in the market?

One method is for the Bangko Sentral ng Pilipinas (BSP) to buy treasury bills at a higher price than usually offered. Treasury bills are government bonds that will

earn interest usually in 90 days. These are called the mother of all interest rates because it is where the banks base their interest rates to loan borrowers.

BSP, although part of our government, is autonomous in its policies and functions. The governor, unlike the cabinet members, is not appointed by the President.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Introduction To Public HealthDokument54 SeitenIntroduction To Public HealthKristelle Marie Enanoria Bardon50% (2)

- CogAT 7 PlanningImplemGd v4.1 PDFDokument112 SeitenCogAT 7 PlanningImplemGd v4.1 PDFBahrouniNoch keine Bewertungen

- Toward A Design Theory of Problem SolvingDokument24 SeitenToward A Design Theory of Problem SolvingThiago GonzagaNoch keine Bewertungen

- Facilitation TheoryDokument2 SeitenFacilitation TheoryYessamin Valerie PergisNoch keine Bewertungen

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDDokument9 SeitenA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDNoch keine Bewertungen

- CH Folk Media and HeatlhDokument6 SeitenCH Folk Media and HeatlhRaghavendr KoreNoch keine Bewertungen

- Dan 440 Dace Art Lesson PlanDokument4 SeitenDan 440 Dace Art Lesson Planapi-298381373Noch keine Bewertungen

- Directions: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankDokument2 SeitenDirections: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankRanulfo MayolNoch keine Bewertungen

- Talk 4Dokument35 SeitenTalk 4haryonoismanNoch keine Bewertungen

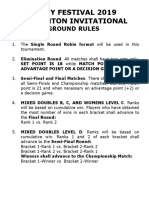

- Ground Rules 2019Dokument3 SeitenGround Rules 2019Jeremiah Miko LepasanaNoch keine Bewertungen

- Pediatric Autonomic DisorderDokument15 SeitenPediatric Autonomic DisorderaimanNoch keine Bewertungen

- Trigonometry Primer Problem Set Solns PDFDokument80 SeitenTrigonometry Primer Problem Set Solns PDFderenz30Noch keine Bewertungen

- Memoire On Edgar Allan PoeDokument16 SeitenMemoire On Edgar Allan PoeFarhaa AbdiNoch keine Bewertungen

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBDokument1 SeiteForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanNoch keine Bewertungen

- Sop 2Dokument43 SeitenSop 2naveengargnsNoch keine Bewertungen

- Biosphere Noo Sphere Infosphere Epistemo PDFDokument18 SeitenBiosphere Noo Sphere Infosphere Epistemo PDFGeorge PetreNoch keine Bewertungen

- How Is Extra-Musical Meaning Possible - Music As A Place and Space For Work - T. DeNora (1986)Dokument12 SeitenHow Is Extra-Musical Meaning Possible - Music As A Place and Space For Work - T. DeNora (1986)vladvaidean100% (1)

- Introduction To PTC Windchill PDM Essentials 11.1 For Light UsersDokument6 SeitenIntroduction To PTC Windchill PDM Essentials 11.1 For Light UsersJYNoch keine Bewertungen

- The Personal Law of The Mahommedans, According To All The Schools (1880) Ali, Syed Ameer, 1849-1928Dokument454 SeitenThe Personal Law of The Mahommedans, According To All The Schools (1880) Ali, Syed Ameer, 1849-1928David BaileyNoch keine Bewertungen

- Level 5 - LFH 6-10 SepDokument14 SeitenLevel 5 - LFH 6-10 SepJanna GunioNoch keine Bewertungen

- 111Dokument1 Seite111Rakesh KumarNoch keine Bewertungen

- The Handmaid's Tale - Chapter 2.2Dokument1 SeiteThe Handmaid's Tale - Chapter 2.2amber_straussNoch keine Bewertungen

- How To Create Partner Function in SAP ABAPDokument5 SeitenHow To Create Partner Function in SAP ABAPRommel SorengNoch keine Bewertungen

- BGL01 - 05Dokument58 SeitenBGL01 - 05udayagb9443Noch keine Bewertungen

- Isolated Flyback Switching Regulator W - 9V OutputDokument16 SeitenIsolated Flyback Switching Regulator W - 9V OutputCasey DialNoch keine Bewertungen

- Social Awareness CompetencyDokument30 SeitenSocial Awareness CompetencyudaykumarNoch keine Bewertungen

- Contract of PledgeDokument4 SeitenContract of Pledgeshreya patilNoch keine Bewertungen

- Approaches To Violence in IndiaDokument17 SeitenApproaches To Violence in IndiaDeepa BhatiaNoch keine Bewertungen

- Ib Physics SL - Unit 4 ReviewDokument46 SeitenIb Physics SL - Unit 4 ReviewMax HudgenesNoch keine Bewertungen

- University of Dar Es Salaam MT 261 Tutorial 1Dokument4 SeitenUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaNoch keine Bewertungen