Beruflich Dokumente

Kultur Dokumente

Accounting and Finance Management

Hochgeladen von

Venkatesh Gangadhar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten40 SeitenAccounting and Finance Management

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAccounting and Finance Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten40 SeitenAccounting and Finance Management

Hochgeladen von

Venkatesh GangadharAccounting and Finance Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 40

M.

S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Session 7

Accounting and Finance

Management

Vinay Basavaraj

1

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Session Objectives

At the end of this session, students will be able

to:

Elaborate the accounting rules and concepts

Explain the nuances of financial statements

Perform ratio analysis

Explain the uses of management accounting

Elaborate different business structures

2

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Session Objectives

At the end of this session, students will be able

to:

Calculate cash flows

Perform capital budgeting

Explain the dividend discount model and using the model,

calculate intrinsic value of common stock

3

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Contents

Accounting rules and concepts

Financial statements

Ratio analysis

Managerial Accounting

Business Structures

Cash Flow

Capital Budgeting

Dividend discount model

4

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Accounting rules and concepts

Accountancy, or accounting, is the production

of financial records about an organization

Many tedious accounting practices have been

simplified with the help of computer software

Today, accounting is called "the language of

business"

5

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Accounting rules and concepts

Key concepts

Accounting period

Accrual

Bookkeeping

Cash flow forecasting

Cost of goods sold

6

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Accounting rules and concepts

In India, Indian Accounting Standards (AS),

are a set of accounting standards notified by

theMinistry of Corporate Affairswhich are

converged with International Financial

Reporting Standards(IFRS)

These accounting standards are formulated by

Accounting Standards Board of Institute of

Chartered Accountants of India (ICAI)

7

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Financial statements

A financial statement (or financial report) is a

formal record of the financial activities of a

business, person, or other entity

Relevant financial information is presented in

a structured manner and in a form easy to

understand

8

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Financial statements

Statement of financial position: also referred to

as abalance sheet, reports on a

company'sassets, liabilities, andownership

equityat a given point in time

A profit and loss statement provides

information on the operation of the enterprise.

These include sales and the various expenses

incurred during the processing state

9

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Financial statements

Statement of comprehensive income: reports

on a company's income, expenses, and profits

over a period of time

Statement of cash flows: reports on a

company's cash flow activities, particularly its

operating, investing and financing activities

10

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Financial statements

Key concepts

Double-entry system

Mark-to-market accounting

FIFO and LIFO

GAAP / IFRS

Management Accounting Principles

Matching principle

Revenue recognition

11

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Ratio analysis

What is Financial statement analysis?

Financial statement analysis(or financial analysis)

the process of understanding the risk and

profitability of a firm (business, sub-business or

project)

12

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Ratio analysis

What is Financial statement analysis?

The analyst uses reported financial information

and different accounting tools and techniques

13

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Ratio analysis

Constituents of financial statement analysis

Reformulating reported

financial statements

Analysis and adjustments

of measurement errors

Financial ratio analysis

14

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Managerial Accounting

Management accountingor managerial

accountingis concerned with the provisions

and use of accountinginformation to managers

within organizations

It provides them with the basis to make

informed business decisions that will allow

them to be better equipped in their

management and control functions

15

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Managerial Accounting

In contrast tofinancial accountancy,

management accounting is:

primarily forward-looking

designed and intended for use by managers within

the organization

computed by reference to the needs of managers

16

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Managerial Accounting

Tools of management accounting

Activity-based costing (ABC)

Grenzplankostenrechnung(GPK)

Lean accounting

Resource consumption accounting (RCA)

Transfer pricing

Throughput accounting

17

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Business Structures

Of all the decisions one makes when starting a

business, probably the most important one

relating to taxes is the type of legal structure of

the company

18

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Business Structures

The most common forms of business are

Sole Proprietorship

Partnership

Corporation

A more recent development to these forms of

business is the limited liability company (LLC)

and the limited liability partnership (LLP)

19

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Cash Flow

Cash flowis the movement of moneyinto or

out of a business, project, or financial product

Measurement of cash flow can be used for

calculating other parameters that give

information on a company's value and

situation

20

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Cash Flow

Statement of cash flow

The (total) net cash flow of a company over a

period (typically a quarter, half year, or a full year)

is equal to the change in cash balance over this

period

21

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Cash Flow

Statement of cash flow

The total net cash flow is the sum of cash flows

that are classified in three areas:

Operational cash flows

Investment cash flows

Financing cash flows

22

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Capital budgeting(or investment appraisal) is

the planning process used to determine

whether an organization's long

terminvestmentssuch as new machinery,

replacement machinery, new plants, new

products, and research development projects

are worth the funding

23

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

It is the process of allocating resources for

major capital, or investment, expenditures

One of the primary goals of capital budgeting

investments is to increase the value of the firm

to the shareholders

24

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Many formal methods are used in capital

budgeting, including the techniques such as:

Accounting rate of return

Payback period

Net present value

Profitability index

Internal rate of return

Modified internal rate of return

Equivalent annuity

Real options valuation

25

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Among the methods of Capital Budgeting

mentioned, the most common are:

26

Net present

value (NPV)

Internal rate

of return

(IRR)

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

However, in case of conflict between NPV and

IRR, the former prevails

Conflict arises when the two methods choose

different investment projects

The NPV method is a more technically-sound

method of capital budgeting

27

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Funding Sources

Capital budgeting investments and projects must

be funded through excess cash provided through

the raising of debt capital, equity capital, or the use

of retained earnings

28

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Need For Capital Budgeting

As large sum of money is involved which

influences the profitability of the firm making

capital budgetingan important task

Long term investment once made can not be

reversed without significance loss of invested

capital

29

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Capital Budgeting

Need For Capital Budgeting

Investment decision are the base on which the

profit will be earned and probably measured

through the return on the capital

The implication of long term investment decisions

are more extensive than those of short run

decisions because of time factor involved

30

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Dividend discount model

Thedividend discount model (DDM) is a

method of valuing a company based on the

theory that astockis worth the discounted sum

of all of its future dividend payments

Also known as the Gordon model

31

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Dividend discount model

Derivation of equation

32

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Dividend discount model

Problems with the model

The presumption of a steady and perpetual growth

rate less than thecost of capital may not be

reasonable

If the stock does not currently pay a dividend, like

manygrowth stocks, more general versions of the

discounted dividend model must be used to value

the stock

33

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Dividend discount model

Problems with the model

The stock price resulting from the Gordon model is

hyper-sensitive to the growth rate chosen

34

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Accounting rules and concepts

Accountancy, or accounting, is the production of

financial records about an organization

Key concepts include accounting period,

Bookkeeping, Accrual etc.

Financial statements

A financial statement (or financial report) is a

formal record of the financial activities of a

business, person, or other entity

35

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Ratio analysis

Financial statement analysis(or financial analysis)

the process of understanding the risk and

profitability of a firm (business, sub-business or

project)

Managerial Accounting

Managerial accountingis concerned with the

provisions and use of accountinginformation to

managers within organizations

36

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Business Structures

Of all the decisions one makes when starting a

business, probably the most important one relating

to taxes is the type of legal structure of the

company

Cash Flow

Cash flowis the movement of moneyinto or out of

a business, project, or financial product

37

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Capital Budgeting

Capital budgeting(or investment appraisal) is the

planning process used to determine whether an

organization's long terminvestmentssuch as new

machinery, replacement machinery, new plants,

new products, and research development projects

are worth the funding

38

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Capital Budgeting

Among the methods of Capital Budgeting

mentioned, the most common are NPV and IRR

(the former prevails in case of any conflict)

39

M.S Ramaiah School of Advanced Studies - Bangalore

PEMP- GP-POM

Summary

Dividend discount model

Thedividend discount model (DDM) is a method

of valuing a company based on the theory that

astockis worth the discounted sum of all of its

future dividend payments

40

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- TeamcenterDokument481 SeitenTeamcenterVenkatesh GangadharNoch keine Bewertungen

- Recruitment AgreementDokument5 SeitenRecruitment AgreementTricia GrafiloNoch keine Bewertungen

- Electrical Contracting Book V2Dokument199 SeitenElectrical Contracting Book V2HandoyoGozali100% (1)

- Quality ControlDokument3 SeitenQuality ControlmageNoch keine Bewertungen

- Wind Turbine Blade MaterialsDokument64 SeitenWind Turbine Blade MaterialsMatthew Mullan100% (1)

- 9 - Accounting For Franchise Operations - FranchisorDokument7 Seiten9 - Accounting For Franchise Operations - FranchisorDarlene Faye Cabral RosalesNoch keine Bewertungen

- Final ExamDokument59 SeitenFinal ExamME ValleserNoch keine Bewertungen

- Critical Thinking and Problem Solving SkillsDokument20 SeitenCritical Thinking and Problem Solving SkillsVenkatesh GangadharNoch keine Bewertungen

- AP 300Q Quizzer On Audit of Liabilities ResaDokument13 SeitenAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNoch keine Bewertungen

- A Project Report On Market Strategey of Tommy HilfigerDokument49 SeitenA Project Report On Market Strategey of Tommy HilfigerKamal King54% (13)

- Six Sigma Book PDF FormDokument218 SeitenSix Sigma Book PDF Formbabudukku100% (24)

- Project Absenteeism of EmployeesDokument64 SeitenProject Absenteeism of Employeesruchikunal90% (50)

- ASTRO Full ReportDokument63 SeitenASTRO Full Reportsally100% (1)

- Chapter 3 Solutions PDFDokument50 SeitenChapter 3 Solutions PDFHayu AriantiNoch keine Bewertungen

- Singapore Visa - 2019120164649 PMDokument12 SeitenSingapore Visa - 2019120164649 PMVenkatesh GangadharNoch keine Bewertungen

- Internship & Placement BrochureDokument9 SeitenInternship & Placement BrochureVenkatesh GangadharNoch keine Bewertungen

- SQL Practice SolutionsDokument11 SeitenSQL Practice SolutionsVenkatesh GangadharNoch keine Bewertungen

- Oppe 2Dokument16 SeitenOppe 2Venkatesh GangadharNoch keine Bewertungen

- Butterfly ValvesDokument8 SeitenButterfly ValvesVenkatesh GangadharNoch keine Bewertungen

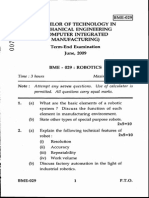

- Bachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing)Dokument2 SeitenBachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing)Venkatesh GangadharNoch keine Bewertungen

- ButhanDokument1 SeiteButhanVenkatesh GangadharNoch keine Bewertungen

- Design of Power Screws: Torque, Stress CalculationsDokument15 SeitenDesign of Power Screws: Torque, Stress CalculationsVenkatesh GangadharNoch keine Bewertungen

- Creating PDF Reports With Pandas, Jinja and WeasyPrint - Practical Business PythonDokument20 SeitenCreating PDF Reports With Pandas, Jinja and WeasyPrint - Practical Business PythonVenkatesh GangadharNoch keine Bewertungen

- 7 Design For Static LoadingDokument21 Seiten7 Design For Static LoadingPRASAD326100% (1)

- B.Tech. Mechanical Engineering (Computer Integrated Manufacturing) Term-End Examination June, 2014Dokument3 SeitenB.Tech. Mechanical Engineering (Computer Integrated Manufacturing) Term-End Examination June, 2014Venkatesh GangadharNoch keine Bewertungen

- AME2503Dokument59 SeitenAME2503Venkatesh GangadharNoch keine Bewertungen

- Life-Long Learning and Information Management-1 HRDokument15 SeitenLife-Long Learning and Information Management-1 HRVenkatesh GangadharNoch keine Bewertungen

- EMM2512 AssignmentDokument4 SeitenEMM2512 AssignmentVenkatesh GangadharNoch keine Bewertungen

- AME2503Dokument89 SeitenAME2503Venkatesh GangadharNoch keine Bewertungen

- IP RightsDokument80 SeitenIP RightsVenkatesh GangadharNoch keine Bewertungen

- Life-Long Learning and Information Management-1 HRDokument15 SeitenLife-Long Learning and Information Management-1 HRVenkatesh GangadharNoch keine Bewertungen

- Bme 023Dokument4 SeitenBme 023Venkatesh GangadharNoch keine Bewertungen

- MaterialsDokument25 SeitenMaterialsluffydmonNoch keine Bewertungen

- Statistics For ManagersDokument100 SeitenStatistics For ManagersVenkatesh GangadharNoch keine Bewertungen

- Jun 2011 Bme-030Dokument3 SeitenJun 2011 Bme-030Venkatesh GangadharNoch keine Bewertungen

- Bachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing)Dokument8 SeitenBachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing)Venkatesh GangadharNoch keine Bewertungen

- Bachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing) Term-End Examination) Une, 2009Dokument4 SeitenBachelor of Technology in Mechanical Engineering (Computer Integrated Manufacturing) Term-End Examination) Une, 2009Venkatesh GangadharNoch keine Bewertungen

- Tower Are The Supporting Structure For Wind Mill Which Carry Load Generated From TurbineDokument3 SeitenTower Are The Supporting Structure For Wind Mill Which Carry Load Generated From TurbineVenkatesh GangadharNoch keine Bewertungen

- NXXXXDokument29 SeitenNXXXXMusavir IqbalNoch keine Bewertungen

- Interim ReportDokument13 SeitenInterim ReportDeepanshi RawatNoch keine Bewertungen

- Opinnäytetyö Johansson 2019Dokument42 SeitenOpinnäytetyö Johansson 2019yolandamarchella07Noch keine Bewertungen

- Week 2 - Recruitment SourcesDokument47 SeitenWeek 2 - Recruitment Sourcesyousuf AhmedNoch keine Bewertungen

- Lesson 5 Strategic ImplementationDokument94 SeitenLesson 5 Strategic ImplementationMahlet AbrahaNoch keine Bewertungen

- SCOR Project and Key Risk Indicator On PT. Albisindo Timber CompanyDokument83 SeitenSCOR Project and Key Risk Indicator On PT. Albisindo Timber CompanyRafly Galih SaputraNoch keine Bewertungen

- July 2014 Amanah Saham Gemilang - Pendidikan: 3-Year Fund VolatilityDokument1 SeiteJuly 2014 Amanah Saham Gemilang - Pendidikan: 3-Year Fund VolatilitySwa Ming JianNoch keine Bewertungen

- Zeian Cover RevisedDokument13 SeitenZeian Cover Revisedcherry valeNoch keine Bewertungen

- Companies Act 2013 HighlightsDokument9 SeitenCompanies Act 2013 Highlightsashishbajaj007100% (2)

- Hermo MY E-Commerce Website AnalysisDokument13 SeitenHermo MY E-Commerce Website Analysisdearestfarah25% (4)

- Economics For Engineers (HMTS 3201) : Time Allotted: 3 Hrs Full Marks: 70Dokument4 SeitenEconomics For Engineers (HMTS 3201) : Time Allotted: 3 Hrs Full Marks: 70gaurav kumarNoch keine Bewertungen

- Hilton 11e Chap009PPTDokument52 SeitenHilton 11e Chap009PPTNgô Khánh HòaNoch keine Bewertungen

- Session 12: Topic Cover Bill of Materials ProductionDokument45 SeitenSession 12: Topic Cover Bill of Materials ProductionTanureema DebNoch keine Bewertungen

- Developing A Supply Chain Disruption Analysis Model - Application of Colored Petri-NetsDokument10 SeitenDeveloping A Supply Chain Disruption Analysis Model - Application of Colored Petri-Netsmario2008Noch keine Bewertungen

- Ek AkuntansiDokument74 SeitenEk AkuntansiEsa SulyNoch keine Bewertungen

- April 2019 Company ListDokument399 SeitenApril 2019 Company ListBharat YadavNoch keine Bewertungen

- EbayDokument10 SeitenEbayAhsan ShaniNoch keine Bewertungen

- Code of Conduct Living Our ValuesDokument35 SeitenCode of Conduct Living Our ValuesKim Na NaNoch keine Bewertungen

- RMT 531Dokument11 SeitenRMT 531Aaron Buii BuiiNoch keine Bewertungen

- Original Syllabus Sem 2Dokument21 SeitenOriginal Syllabus Sem 2Sharad RathoreNoch keine Bewertungen

- Imc FinalsDokument3 SeitenImc FinalsMaecaella LlorenteNoch keine Bewertungen